-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Nagel Stubborn In Fight Against Inflation

EXECUTIVE SUMMARY

- FIRST REPUBLIC'S FUTURE TO BE DISCUSSED AS MAJOR BANK CEOS MEET (RTRS SOURCES)

- FIRST REPUBLIC RESCUE MAY RELY ON US BACKING TO FACILITATE DEAL (BBG)

- FIRST REPUBLIC CONSIDERS DOWNSIZING IF CAPITAL RAISE FAILS (RTRS)

- BIDEN TEAM REVIEWS IMPACT OF SVB COLLAPSE ON CHINESE STARTUPS (BBG)

- BUNDESBANK CHIEF SAYS RATE-SETTERS MUST BE ‘MORE STUBBORN’ IN INFLATION FIGHT (FT)

- CHINA LIQUIDITY CONDITIONS EXPECTED TO STAY AMPLE (SEC DAILY)

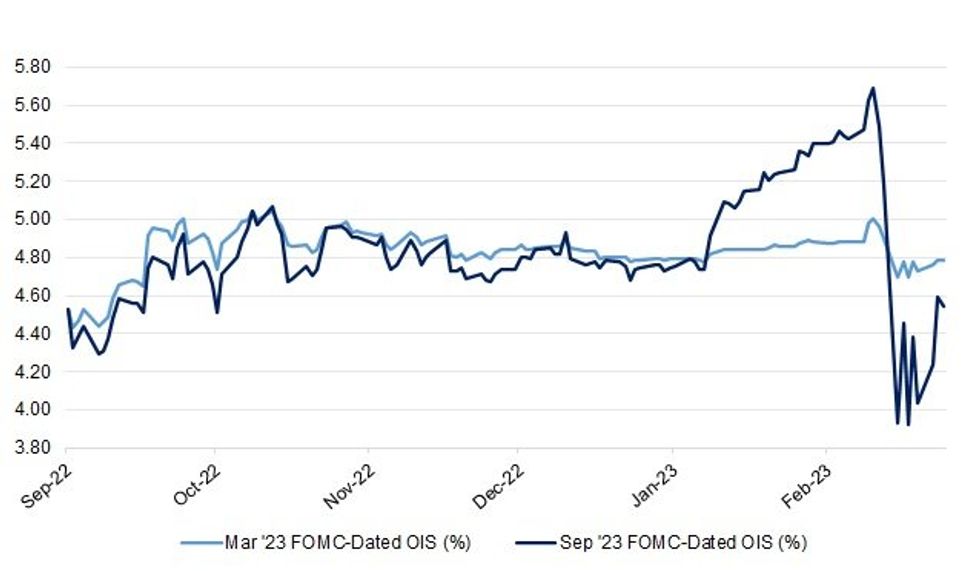

Fig. 1: Mar '23 & Sep '23 FOMC-Dated OIS (%)

Source: MNI - Market News/Bloomberg

UK

BOE: UK chancellor Jeremy Hunt has said that the Bank of England should remain focused on taming “dangerously high” inflation, despite the strain placed on the global banking sector by rising interest rates. (FT)

BREXIT: Rishi Sunak faces a Commons clash with Eurosceptic Tory backbenchers after they published a damning verdict of his Brexit deal. (Telegraph)

FISCAL/PENSIONS: Ministers have delayed plans to raise the state pension age to 68 amid falling life expectancy in the UK and warnings from Tory MPs that the move could provoke a backlash from middle-aged voters. (FT)

EUROPE

ECB: Germany’s central bank boss says eurozone rate-setters must be “stubborn” and continue raising borrowing costs to tackle inflation, discounting fears that recent financial turmoil could further affect Europe’s banks. (FT)

FISCAL: A backlash from Germany, and other “frugal” countries after the European Commission applied its preferences for a new set of fiscal rules to guidance for member states’ 2024 budgets could mean an already tight window for agreeing on reform has become even narrower, officials in Brussels told MNI. (MNI)

GREECE: Greece will hold general elections in May, Prime Minister Kyriakos Mitsotakis said in a television interview on Tuesday. (RTRS)

BANKS: UBS is set to enter talks with Michael Klein to unwind a deal that would have seen the Wall Street dealmaker take control of much of Credit Suisse’s investment bank, according to people with direct knowledge of the matter. (FT)

BANKS: The Swiss government said it’s temporarily suspending certain kinds of bonus pay for Credit Suisse Group AG staff following the state-brokered takeover of the bank by rival UBS Group AG. (BBG)

BANKS/BONDS: Some holders of Credit Suisse Group AG's so-called additional tier 1 (AT1) bonds have approached a law firm to assess whether they have a case against the Swiss authorities’ decision to wipe out their holdings as part of the UBS Group AG deal. (RTRS)

BANKS/BONDS: UBS Group AG announced on Wednesday an invitation for holders of its senior unsecured bail-in notes to tender their notes for cash. The notes in question, which were issued on March 17, 2023, include the EUR 1.5 billion 4.625% fixed rate notes due March 2028 and the EUR 1.25 billion 4.750% fixed rate notes due March 2032, the statement said. (RTRS)

MARKETS: The Securities and Exchange Commission scrapped plans to vote Wednesday on a rule that would have increased regulators’ visibility into financial risks at some hedge funds and private equity funds. (WSJ)

U.S.

FED: WSJ Fed reporter Timiraos tweeted the following on Tuesday: “A research paper looks at intraday trading data to conclude "market volatility is more than three times higher during press conferences given by current Fed Chair Jerome Powell than during press conferences by predecessors Janet Yellen and Ben Bernanke." (MNI)

BANKS: Major bank chief executives are gathering in Washington for a two-day scheduled meeting starting on Tuesday, with the future of First Republic Bank to be discussed, sources familiar with the matter said. (RTRS)

BANKS: Wall Street leaders and US officials discussing an intervention at First Republic Bank are exploring the possibility of government backing to encourage a deal that would shore up the lender, people with knowledge of the situation said. (BBG)

BANKS: First Republic Bank is beefing up its adviser ranks as the troubled lender seeks to stay afloat and plan for a postcrisis future amid a trans-Atlantic crisis of confidence in the banking system. (WSJ)

BANKS: First Republic Bank, the U.S. regional bank struggling to remain viable following a flight of deposits, is looking at ways it can downsize if its attempts to raise new capital fail, according to two people familiar with the matter. (RTRS)

BANKS: Goldman Sachs Group Inc President and Chief Operating Officer John Waldron said some smaller banks will need more capital and the sector should brace for stricter regulation of regional banks. (RTRS)

BANKS: Government officials discussed the idea of increasing deposit insurance without obtaining approval from Congress as they brainstormed various approaches to solving the turmoil in banking, two sources familiar with the talks said on Tuesday. (RTRS)

BANKS: Treasury, Fed and FDIC officials will brief members of the Senate Banking Committee by Zoom on Wednesday, Senator Kevin Cramer tells Bloomberg. Briefing to be on the response to recent bank failures. (BBG)

BANKS: The U.S. Senate Banking Committee will hold the "first of several hearings" on the collapse of Silicon Valley Bank and Signature Bank on March 28, Chairman Sherrod Brown said on Tuesday, with testimony from Federal Deposit Insurance Corporation Chair Martin Gruenberg, Federal Reserve official Michael Barr, and Nellie Liang, an under secretary at the U.S. Treasury Department. (RTRS)

BANKS: Senator Elizabeth Warren said Tuesday she doesn’t think multibillion-dollar banks should get an increase in federal insurance without tighter regulation. (BBG)

OTHER

GLOBAL TRADE: Chinese President Xi Jinping and Russian President Vladimir Putin pledged on Tuesday to “significantly increase” trade between their two countries by 2030, and Putin threw his weight behind wider globalisation of the yuan, a move aimed at weakening the power of the US dollar. (SCMP)

U.S./CHINA: The US is assessing whether Silicon Valley Bank’s collapse inflicted more pain on Chinese technology startups than the government in Beijing and Chinese companies have disclosed, according to officials familiar with the matter. (BBG)

U.S./CHINA/TAIWAN: Taiwan's defence ministry has contigency plans for any moves by China during Taiwan President Tsai Ing-wen's overseas visit, Deputy Defence Minister Po Horng-huei told reporters ahead of a parliament session on Wednesday. (RTRS)

GEOPOLITICS: Russia and China said in a joint statement on Tuesday that the close partnership between them did not constitute a "military-political alliance." (RTRS)

JAPAN: Japan is set to allocate more than 2 trillion yen ($15.1 billion) in additional aid to ease the impact from high inflation ahead of local elections next month. (BBG)

JAPAN: Japan's banking sector is sound but authorities must be vigilant to the fact credit concerns have spread globally at a very fast pace, Finance Minister Shunichi Suzuki said on Wednesday. (RTRS)

JAPAN/SOUTH KOREA: Japan will remove some export curbs on high-tech materials to South Korea next week, South Korea's Newsis news agency reported on Wednesday, citing the country's trade minister. (RTRS)

RBA: Reserve Bank officials tested the proposition that governor Philip Lowe could immediately step down following the release of Jim Chalmers’ report into the central bank, papers released under FOI laws reveal. (The Australian)

AUSTRALIA: Australia’s economic expansion in 2023 will be weaker than previously anticipated and inflation is poised to be stronger, a survey showed. (BBG)

SOUTH KOREA: Prosecutors indicted opposition leader Lee Jae-myung on Wednesday over development corruption and bribery charges arising from his term as mayor of Seongnam, south of Seoul, years ago. (Yonhap)

NORTH KOREA: South Korea and the United States plan to conduct their "largest-ever" combined live-fire drills in June as part of a program to celebrate the 70th anniversary of their alliance, Seoul's defense ministry said Wednesday. (Yonhap)

RUSSIA: The White House said there were no signs the summit between Chinese and Russian leaders Xi Jinping and Vladimir Putin would lead to peace in Ukraine. John Kirby, a spokesperson for the National Security Council, told reporters on Tuesday that the White House had not heard “anything” from the meeting that gave the US “hope” that the conflict would end soon. (FT)

RUSSIA: Ukraine's President Volodymyr Zelenskiy said on Tuesday that Kyiv had suggested to China that Beijing join a Ukrainian peace formula to end Russia's war in Ukraine, but that it was still waiting for an answer. (RTRS)

RUSSIA: Russian banks posted profits of 293 billion roubles ($3.85 billion) in February, up 14% on January levels, the central bank said on Tuesday. (RTRS)

ARGENTINA: The International Monetary Fund said on Tuesday Argentina informed the IMF it will merge two payments due this week into a single payment of about $2.7 billion on March 31. The fund said via a spokesperson that Argentina's decision does not require board approval and is consistent with IMF rules, so Argentina remains current in payments. (RTRS)

IMF: Ukraine won staff backing for a $15.6 billion loan from the International Monetary Fund, setting up the first loan to a nation at war in the institution’s 77-year history. (BBG)

GOLD: The former head of the JPMorgan Chase & Co. precious- metals business and his top gold trader should get multiyear prison terms after they were convicted of spoofing the market for years, the US government said in a court filing. (BBG)

OIL: The US shale patch may lose as much as 20% of its activity over the next year if energy prices hold at current levels, according to one of the biggest private equity players in the industry. (BBG)

CHINA

POLICY: China will quicken the development of strategic industries like information technology and artificial intelligence as it deepens the reforms of its state-owned enterprises, the Shanghai Securities News reported Wednesday, citing the State-owned Assets Supervision and Administration Commission. (BBG)

ECONOMY: Improving total factor productivity is the key to achieving high quality growth of around 5% over the next 10 years, according to economists speaking at the Peking University's Policy Analysis Conference. (MNI)

ECONOMY: The China Association of Automobile Manufacturers (CAAM) on Wednesday urged the auto industry and authorities to cool the 'price-cut hype' to ensure the healthy and stable development of the industry. "Local governments should use appropriate methods while promoting consumption and stabilising the economy," CAAM said. (RTRS)

PBOC: Liquidity in China’s financial system is expected to remain sufficient through the end of the month, although a recovery in borrowing demand and faster issuance of local government bonds are pushing up short-term interest rates, the Securities Daily reports. (BBG)

PROPERTY: The People's Bank of China (PBOC) move to lower the reserve requirement ratio (RRR) will support the real estate market by improving wider economic conditions and boosting house buyer sentiment, according to news outlet Cailian. (MNI)

MARKETS: Citadel Securities LLC is planning to bolster business in China while it hires across Asia, expanding in the region at a time when most financial firms are cutting costs. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY37 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) conducted CNY67 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY37 billion after offsetting the maturity of CNY104 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0104% at 09:44 am local time from the close of 2.2271% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 41 on Tuesday, compare with the close of 55 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8715 WEDS VS 6.8763 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8715 on Wednesday, compared with 6.8763 set on Tuesday.

OVERNIGHT DATA

JAPAN FEB, F MACHINE TOOL ORDERS -10.7% Y/Y; PRELIM -10.7%; JAN -9.7%

AUSTRALIA FEB WESTPAC LEADING INDEX -0.06% M/M; JAN -0.12%

The six-month annualised growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, lifted slightly to –0.94% in February from –1.04% in January. (Westpac)

NEW ZEALAND Q1 WESTPAC CONSUMER CONFIDENCE INDEX 77.7; Q4 75.6

The Westpac McDermott Miller Consumer Confidence Index rose 2.1 points to 77.7 in March. Even so, consumer confidence continues to languish at extremely low levels. Households across the country are continuing to grapple with skyrocketing living costs, higher mortgage rates and a deepening downturn in the housing market. (Westpac)

MARKETS

US TSYS: Marginally Richer In Asia, Fed In View

TYM3 deals at 114-09, +0-05, with a 0-08 range observed today on volume of ~91k.

- Cash tsys sit 1-4bps richer across the major benchmarks, the curve has steepened

- In early dealing, Asia-Pac participants faded yesterday's cheapening, perhaps using the opportunity to square short positions ahead of today's FOMC rate decision.

- The bid marginally extended on reports that US bank First Republic may need government support to encourage buyers for the troubled bank.

- Further support was seen as USD/JPY was offered after testing resistance level at ¥132.65, the high from 20 March, which spilled over into mild USD weakness. However there was little follow through in the move and tsys ticked away from session highs.

- FOMC dated OIS currently price a 20bps hike for today's meeting, with a terminal rate of ~4.95% seen in May. There are ~65bps of cuts priced for 2023.

- In Europe today UK CPI and ECB speak from Lagarde headlines. However the Fed rate decision and Powells post meeting press conference are today's highlights; our preview is here.

JGBS: Futures Lead Weakness After Tokyo Holiday, Swap Spread Widening Adds Further Pressure

The early Tokyo cheapening impetus held through Wednesday’s session after Japanese participants returned from Tuesday’s holiday and reacted to a moderation in systemic fears surrounding the global banking sphere.

- That leaves JGB futures the best part of 80 ticks lower into the close, with bears unable to force a test of early session lows despite various rounds of selling pressure becoming evident as the session wore on.

- Cash JGBs sit 1-8bp cheaper with 7s leading the weakness given the move in futures.

- Meanwhile, swap rates are 3-10bp higher as that curve steepens, with swap spreads wider across the term structure, meaning that payside swap flows exerted some pressure on JGBs at different stages of the day.

- Some light richening in U.S. Tsys and the proximity to the impending FOMC decision probably provided some light counter to the broader weakness in JGBS.

- Local news flow was dominated by the loose outlining of a Y2tn fiscal package (drawn up from reserve funds) that will aim to lessen the inflationary burden in Japan (handouts for low-income households and support for those using LNG as an energy source). This comes ahead of next month’s local elections.

- Looking ahead, global matters are set to continue to dominate on Thursday, with a liquidity enhancement auction for off-the-run 5- to 15.5-Year JGBs the only point of note on tomorrow’s local docket.

AUSSIE BONDS: Closes At Cheaps Ahead of FOMC

ACGBs closed at session cheaps (YM -18.0 & XM -17.5) as U.S. Tsys give back early Asia-Pac strength ahead of the FOMC decision tonight. ACGBs however underperformed U.S. Tsys highlighting a continuation of yesterday’s post-RBA Minutes selling. While the RBA Minutes for March confirmed that the Board was set to evaluate the case for a pause at the April meeting it failed to provide a fresh local impetus for ACGBs.

- Cash benchmark yields closed at their highs +17-18bp with the AU-US 10-year yield differential +6bp at -22bp.

- Swaps shunt 15-16bp cheaper with EFPs 2-3bp tighter.

- Bills strip closed 12-18bp cheaper with back-end whites leading.

- RBA dated OIS closed 16-24bp firmer for meetings beyond May. April meeting pricing remained at flat.

- On the local data front, Westpac's leading Index signalled below-trend growth with a -0.06% M/M print in February after -0.12% M/M in January.

- The local calendar is light until next week when February retail sales (Tue) and monthly CPI (Wed) are scheduled for release. These two releases were highlighted in the RBA Minutes as important inputs to the April policy decision.

- Attention now turns to tonight’s FOMC policy decision. BBG consensus expects a 25bp hike. The market is pricing an 82% chance of a 25bp hike.

AUSSIE BONDS: ACGB Nov-33 Auction Results

The Australian Office of Financial Management (AOFM) sells A$700mn of the 3.00% 21 November 2033 Bond, issue #TB166:

- Average Yield: 3.3491% (prev. 3.6854%)

- High Yield: 3.3525% (prev. 3.6875%)

- Bid/Cover: 3.8671x (prev. 3.5250x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 55.4% (prev. 66.1%)

- Bidders 41 (prev. 50), successful 7 (prev. 17), allocated in full 3 (prev. 10)

NZGBS: Off Bests Awaiting The FOMC Decision

NZGBs closed off best levels despite stronger U.S. Tsys in Asia-Pac trade. ACGB's underperformance versus U.S. Tsys likely assisted the move away from yield lows. At the close, the 2-year and 10-year benchmarks were respectively 11bp and 9bp higher in yield. NZGBs however outperformed ACGBs with the cash AU/NZ 10-year yield differential +4bp at -89bp. This differential hit a multi-decade low of around -100bp last week after the worse-than-expected Q4 current account deficit.

- Swaps closed at session cheaps with rates 11-14bp higher, implying wider swap spreads, with the 2s10s curve 3bp flatter.

- RBNZ dated OIS pricing closed 4-10bp firmer for meetings beyond April. April meeting pricing remained around 25bp of tightening. Terminal OCR expectations firmed 5bp to 5.22%.

- On the local data front, Q1 NZ Consumer Confidence showed a modest rise in sentiment to 77.7 from 75.6 but remained on the pessimistic side of the ledger.

- The local calendar is light for the remainder of the week with RBNZ Chief Economist Conway’s speech, “The path back to low inflation in NZ”, at the KangaNews DCM forum tomorrow the highlight.

- Attention now turns to tonight’s FOMC policy decision. BBG consensus expects a 25bp hike, although some analysts expect no move. The market is pricing an 82% chance of a 25bp hike.

EQUITIES: Rallying Ahead Of FOMC

Regional equity markets are all tracking higher ahead of the upcoming Fed decision. Gains have been led by HK and Japan markets, although all major bourses are firmer. US equity futures are a touch higher, with eminis remaining close to 2 week highs, last around ~4039. EU futures are modestly higher as well.

- Japan markets have played catch up after returning from yesterday's holiday. The Topix near a 2% gain, with the bank index up around 2.5% at this stage. Sell-side analysts have stated AT1 bond risks are low for the country's banks, which has aided sentiment at the margin.

- The HSI is also close to 2% higher. Gains have been broad based across the bank, property and tech spaces. The headline HSI index is getting close to erasing losses for March.

- China shares have lagged somewhat, the CSI 300 is +0.32% firmer at this stage. Some AI related companies have underperformed as shareholders stated they would offload shares given the recent rally. We have also seen modest northbound outflows in the session so far, after 7 straight sessions of inflows.

- The Kospi (+1%) and Taiex (+1.35%) are both tracking higher as well, although offshore investors in the Kospi have lagged the recent turnaround in the index.

- The ASX 200 is +0.90% higher, led by financial stocks. Higher oil prices have boosted energy related names, although lower iron ore prices has weighed on some part of the materials space.

GOLD: Bullion Stabilises Ahead Of Fed Decision

With the resurgence in risk appetite and reversal of flight-to-quality flows, gold prices have struggled. They fell 2% on Tuesday but have stabilised during APAC trading today and are down 0.1% to $1938.80/oz, close to the intraday low of $1937.98 and off the $1946.29 high earlier. The USD index is close to flat.

- Bullion faced resistance at $2000 and has moved down since reaching a high of $2009.73 on Monday, as markets have calmed following global moves to support the financial system and Treasury yields rose in response. It broke through $1959.70, which opened $1918.30, the March 17 low, as the next support level. Gold remains above key moving averages.

- The focus is on the Fed announcement later today. Economists expect a 25bp hike and the OIS market has about an 80% chance of 25bp priced in. Hawkish comments from the FOMC would be negative for gold prices. ECB President Lagarde speaks and UK CPI data for February prints.

OIL: Crude Down Ahead Of Expected Fed 25bp Hike

Oil prices have been range trading during the APAC session, ahead of the Fed’s decision today, after beginning to recover this week as risk appetite improved. WTI is down 0.6% today to $69.30/bbl, still below $70, after reaching a low of $68.97 and a high of $69.54 earlier. Brent is down 0.5% to $74.95, off the intraday low of $74.62. The USD index is flat.

- The oil market slumped as news of troubled banks hit the wires. But fundamentals seem more positive than recent price action would suggest with output likely to be reduced, possibly in Russia, and demand from China recovering. Uncertainty regarding the economic impact of recent bank problems may continue to cause volatility in the crude market. Price forecasts for H2 2023 are between $80 and $140, according to Bloomberg.

- The focus is on the Fed announcement later today. Economists expect a 25bp hike and the OIS market has just over an 80% chance of 25bp priced in. The EIA releases the official US inventory data today. ECB President Lagarde speaks and UK CPI data for February prints.

FOREX: AUD Outperforms, USD Moderately Pressured

The AUD is the strongest performer in the G-10 at the margins, benefiting from improved risk sentiment as regional equities firm and US Treasury Yields tick lower today. The USD is moderately pressured, BBDXY is down ~0.1%.

- AUD/USD prints at $0.6690/95 ~0.4% firmer in todays dealing. The aussie has looked through weakness in Iron Ore prices, futures in Singapore fell ~2.5% to $120/tonne as Chinese steel demand has not picked up despite peak construction season approaching.

- AUD/NZD printed its highest level since 10 March and sits a touch below the $1.08 handle.

- Kiwi is marginally firmer, NZD/USD was pressured after Westpac lowered its 2022-23 NZ milk price forecast to $8.4/kg. However the improving risk sentiment saw the pair firm off session lows to sit ~0.1% higher at $0.6200/05.

- USD/JPY was offered after testing resistance at ¥132.65 the high from 20 March. The pair fell ~0.4% from peak to trough before marginally paring losses to deal at ¥132.45/50.

- GBP is marginally firmer up ~0.1% benefiting from the moderate USD pressure. EUR is little changed and has observed narrow ranges in Asia.

- Cross asset wise, Hang Seng is ~2% firmer and e-minis are up ~0.1%. US Treasury Yields are softer, the 10 Year Yield is down ~2bps.

- In Europe today UK CPI provides the headline. However, the Fed rate decision and Powell's post meeting press conference are today's highlight, our preview is here.

FX OPTIONS: Expiries for Mar22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E916mln), $1.0620-25(E612mln), $1.0660-80(E1.4bln), $1.0715-35(E1.2bln), $1.0775(E646mln), $1.0810(E564mln)

- USD/JPY: Y132.00($519mln), Y132.45-55($826mln), Y134.00($712mln), Y134.22-25($511mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/03/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 22/03/2023 | 0700/0700 | *** |  | UK | Producer Prices |

| 22/03/2023 | 0845/0945 |  | EU | ECB Lagarde Address at ECB and its Watchers Conference | |

| 22/03/2023 | 0900/1000 | ** |  | EU | EZ Current Account |

| 22/03/2023 | 0930/0930 | * |  | UK | ONS House Price Index |

| 22/03/2023 | 0930/1030 |  | EU | ECB Lane in Debate at ECB and its Watchers Conference | |

| 22/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 22/03/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/03/2023 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/03/2023 | 1345/1445 |  | EU | ECB Panetta in Debate at ECB and its Watchers Conference | |

| 22/03/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/03/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting | |

| 22/03/2023 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.