-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Negative Covid Vaccine Flow Does The Rounds

By Krzysztof Kruk & Anthony Barton

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

- ECB POLICYMAKERS WARY OF FOLLOWING FED'S ROUTE ON INFLATION TARGET (RTRS SOURCES)

- J&J COVID-19 VACCINE STUDY PAUSED DUE TO UNEXPLAINED ILLNESS IN PARTICIPANT (STAT)

- TRUMP TESTS NEGATIVE FOR COVID

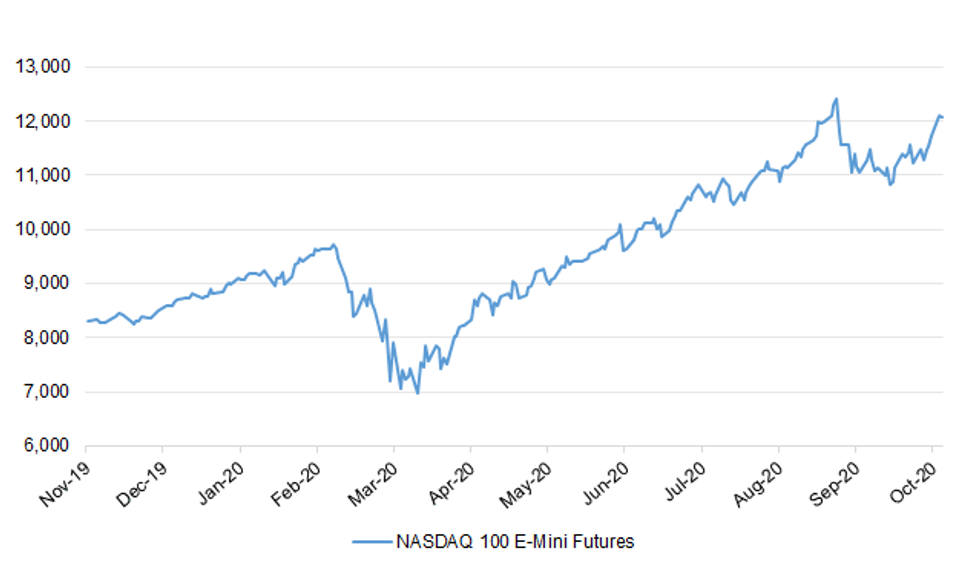

Fig. 1: NASDAQ 100 E-Mini Futures

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: U.K. Prime Minister Boris Johnson announced bars and pubs will be closed in the worst-hit parts of England from Wednesday to control a surge in coronavirus, but his top health adviser said it won't be enough. Chief Medical Officer Chris Whitty issued the warning after the premier set out his plan for a three-tier system of Covid alert levels, set at medium, high, and very high, to simplify the imposition of lockdown measures. In the areas rated very high under the plan, there will be tighter restrictions on social mixing, bars and pubs will be closed and travel discouraged, but Whitty said local authorities will need to take more action to get the virus under control. "It is the case we are going to have to do more," Whitty said. "Probably in some areas significantly more." (BBG)

CORONAVIRUS: Boris Johnson urged council leaders across the north last night to step up and agree draconian lockdown measures after Liverpool's regional mayor accepted tough restrictions. The city, and some of the surrounding area, will be on the highest coronavirus alert from tomorrow after the launch of a three-tier system intended to reboot the fight to contain the virus in England. (The Times)

CORONAVIRUS: Meanwhile, London Mayor Sadiq Khan said despite the capital being on the medium alert level, its status could "change very quickly - potentially even this week" and move into a higher level. (BBC)

CORONAVIRUS: A "circuit breaker" lockdown was recommended to the government by scientists three weeks ago, newly published documents have revealed. Minutes from a 21 September meeting of the Scientific Advisory Group for Emergencies (SAGE), published on the government website on Monday night, showed that a short period of lockdown was at the top of a list of measures to be considered for "immediate introduction". (Sky)

CORONAVIRUS: Boris Johnson overruled Government scientists who pressed for national lockdown measures such as stopping all household mixing and closing all pubs, it emerged on Monday night. (Telegraph)

BREXIT: The European Union's securities watchdog said it expects to make a statement soon on where shares listed in the bloc must be traded after Britain's full departure from the European Union in December. It was important for market participants to have clarity on where they can trade shares, Steven Maijoor, chair of the European Securities and Markets Authority (ESMA), told the European Parliament. (RTRS)

BOE: MNI BRIEF: BOE's Bailey-UK Banks Dampen Negative Rate Impact

- The UK banking system, with its relatively heavy reliance on retail deposits for funding, would dampen the effect of the central bank's setting a negative policy rate, Bank of England Governor Andrew Bailey said. Bailey said research showed that the structure of the banking system was central to how negative rates feed through to the economy with banks not imposing negative rates on deposits. "The more your banking system depends on retail deposits the less impact a negative rate will have … and we actually have quite a heavy share of retail deposits. So we do think the effect would be dampened," Bailey said in a public policy forum -

FISCAL: The government will head into the next election with a black hole in the public finances almost three times bigger than when Boris Johnson came to power, a leading thinktank has warned. The Institute for Fiscal Studies said the scale of the Covid recession and Britain's slow economic recovery would inflict lasting damage for the exchequer, leaving borrowing about £100bn higher by the time of the election in 2024 than forecast before the pandemic struck. (Guardian)

ECONOMY: British consumers ramped up their spending sharply last month as some households stockpiled and began their Christmas shopping early ahead of possible new coronavirus restrictions, according to surveys published on Tuesday. Credit card provider Barclaycard said spending rose at the fastest rate since the country was hit by the coronavirus lockdown. (RTRS)

EUROPE

ECB: There is reluctance among European Central Bank policymakers to follow the U.S. Federal Reserve's move to target an average inflation rate, fearing this could tie their hands, sources involved in a revamp of ECB policy told Reuters. The four central bank sources, including members of both the hawkish and dovish wings of the ECB's policymaking governing council, also expressed doubts about whether orthodox inflation theory still applied in economies where prices have long stagnated despite interest rates close to or below zero. (RTRS)

ECB: The euro zone economy is losing momentum and the European Central Bank will react accordingly, ECB Vice President Luis de Guindos said on Monday, citing December's macro-economic projections as a key guide for future policy moves. "High-frequency indicators point to (the economy) losing a certain momentum," de Guindos told a live interview with the Institute for International Finance. "Our policy reaction will be consistent with the evolution of the situation." "We will have new projections in December and will assess how adequate the package is according to new projections but we don't have a concrete date... and we're doing that continuously," de Guindos added. (RTRS)

PORTUGAL: The Portuguese government aims to narrow the budget deficit to 4.3% of GDP in 2021 from an estimated deficit of 7.3% this year, according to the 2021 budget proposal posted on parliament's website. Government debt is forecast to fall to 130.9% of GDP in 2021 from 134.8% in 2020. The economy is forecast to grow 5.4% in 2021 after contracting an estimated 8.5% this year. (BBG)

CZECH REPUBLIC: The Czech government tightened social distancing rules and closed down schools, restaurants and bars through early November. It also banned public alcohol consumption and limited outdoor gatherings to six people. The country of 10.7 million is suffering the most acute epidemic among EU states. New infections reached a record of 8,618 cases on Friday, leapfrogging Spain as the bloc's top hot spot based on the two-week cumulative number of cases per capita, according to the European Center for Disease Prevention and Control. (BBG)

US

FISCAL: U.S. President Trump tweeted the following on Monday: "Republicans should be strongly focused on completing a wonderful stimulus package for the American People!" (MNI)

FISCAL/CORONAVIRUS: The Covid-19 pandemic will exact a $16 trillion toll on the U.S. -- four times the cost of the Great Recession -- when adding the costs of lost lives and health to the direct economic impact, former U.S. Treasury Secretary Lawrence Summers and fellow Harvard University economist David Cutler wrote in an essay published in the Journal of the American Medical Association. About half of that amount is related to lost gross domestic product as a result of economic shutdowns and the ongoing spread of the virus, while the other half comes from health losses including premature death and mental and long-term health impairments, Cutler and Summers said. The $16 trillion amount is equal to about 90% of annual U.S. GDP; it's also more than twice as much as the U.S. has spent on wars since Sept. 11, 2001, according to the essay. (BBG)

CORONAVIRUS: The United States is "facing a whole lot of trouble" as coronavirus cases continue to surge across the country heading into the cold winter months, Dr. Anthony Fauci, the nation's top infectious disease expert, told CNBC on Monday. (CNBC)

CORONAVIRUS: A 25-year-old was infected twice with the coronavirus earlier this year, scientists in Nevada have confirmed. It is the first confirmed case of so-called reinfection with the virus in the U.S. and the fifth confirmed reinfection case worldwide. (NPR)

CORONAVIRUS/POLITICS: President Donald Trump has tested negative for the coronavirus "on consecutive days," White House physician Dr. Sean Conley said Monday. Conley, in a brief memo shared hours before Trump was scheduled to host a reelection campaign rally in Florida, said that the president's Covid-19 results came from an antigen test from Abbott Laboratories. But Conley's memo noted that a variety of laboratory data all show the virus is no longer active in the president's body. (CNBC)

POLITICS: Joe Biden has reached 270 electoral votes for the first time since POLITICO's Election Forecast debuted late last year. In addition to a double-digit national lead, Biden has built a stable advantage in the three Great Lakes States that put Donald Trump over the top in 2016: Michigan, Pennsylvania and Wisconsin. Our latest presidential-race ratings now have Biden favored in enough states — including Wisconsin, which we've moved from "toss-up" to "lean Democratic"— to clinch the presidency. To win reelection, Trump would now have to sweep all five toss-up states, plus pull back a "lean Democratic" state like Wisconsin or Pennsylvania. (POLITICO)

POLITICS: New polls show Biden is gaining in the Northern battlegrounds among white voters. Joseph R. Biden Jr. holds a significant lead in the pivotal states of Michigan and Wisconsin, with President Trump so far failing to retain the overwhelming advantage he enjoyed among white voters there in 2016, according to surveys from The New York Times and Siena College on Monday. Overall, Mr. Biden led Mr. Trump by eight percentage points in Michigan, 48 percent to 40 percent, among likely voters. His lead in Wisconsin was slightly larger, 51 percent to 41 percent. (New York Times)

POLITICS: The Trump campaign is launching a new "eight-figure" advertising campaign this week that focuses, in part, on recovering President Trump's standing among senior citizens, according to top officials. Senior citizens are the most reliable voting bloc and they formed the core of Trump's political base in 2016. But that's no longer the case. (Axios)

POLITICS: Joseph R. Biden Jr. gave his clearest answer in weeks regarding his position on expanding the Supreme Court, saying that he was "not a fan" of the concept. Joseph R. Biden Jr. on Monday gave his clearest answer in weeks regarding his position on expanding the Supreme Court, saying that he was "not a fan" of the concept but preferred to keep attention on Republican efforts to fill the seat of Justice Ruth Bader Ginsburg with their own nominee only weeks before Election Day. "I'm not a fan of court packing," Mr. Biden told WKRC-TV in Cincinnati as he campaigned there on Monday. "But I don't want to get off on that whole issue. I want to keep focused. The president would love nothing better than to fight about whether or not I would in fact pack the court or not pack the court." (BBG)

POLITICS: Judge Amy Coney Barrett's confirmation hearings are set to enter into their next phase on Tuesday, with the 48-year-old nominee due to answer questions from the Senate Judiciary Committee in person for the first time since her nomination last month. Barrett is expected to take questions about her past statements on abortion and the role of precedent, her views on an upcoming case over the Affordable Care Act and whether she will recuse herself from litigation stemming from the upcoming election between President Donald Trump and former Vice President Joe Biden. (CNBC)

OTHER

GLOBAL TRADE: A Wisconsin factory hailed by President Donald Trump as proof he was reviving U.S. manufacturing did not create enough jobs in 2019 to earn its owner Foxconn Technology Group tax credits, the state said on Monday, the second year it has missed its targets. (RTRS)

GLOBAL TRADE: TDK is seeking U.S. approval to ship its electronic parts used in 5G technology to Huawei, Nikkei reports, without attribution. The U.S. government hasn't granted the approval as of Monday. (Nikkei)

GLOBAL TRADE: Britain and Australia held "productive" talks in the second round of trade negotiations, laying the groundwork for an initial exchange of tariff offers, the UK trade ministry said on Monday. "Both sides shared draft chapter text or papers outlining their preferred approach, and the groundwork was laid for an initial exchange of tariff offers," it said in a statement on the negotiating round that ended on Oct. 2. (RTRS)

CORONAVIRUS: The study of Johnson & Johnson's Covid-19 vaccine has been paused due to an unexplained illness in a study participant. A document sent to outside researchers running the 60,000-patient clinical trial states that a "pausing rule" has been met, that the online system used to enroll patients in the study has been closed, and that the data and safety monitoring board — an independent committee that watches over the safety of patients in the clinical trial — would be convened. The document was obtained by STAT. Contacted by STAT, J&J confirmed the study pause, saying it was due to "an unexplained illness in a study participant." The company declined to provide further details. (STAT News)

CORONAVIRUS: China's joining of a global push to make coronavirus vaccines accessible for developing nations brings to 180 the number countries participating in the World Health Organization-backed initiative -- representing 90% of the global population, Soumya Swaminathan, the WHO's chief scientist, said Monday. While the U.S. hasn't joined the $18 billion effort, called Covax, the breadth of participants is encouraging, Swaminathan said. Meanwhile, WHO Director-General Tedros Adhanom Ghebreyesus urged countries not to pursue "herd immunity." The vast majority of people haven't yet been infected and questions remain about how long immunity lasts and what long-term effects Covid-19 creates, he said. (BBG)

CORONAVIRUS: Units of China National Pharmaceutical Group, known as Sinopharm, rose on a report that inoculation by its coronavirus vaccines is available through appointments in Beijing and Wuhan. The company will administer two vaccines being developed by subsidiary China National Biotec Group, local news outlet Jiemian reported, citing unidentified sources. Residents in Wuhan and Beijing can now make appointments to get a vaccine, Jiemian reported. Students who need to go abroad from November to January will be given priority, the report said. Calls to China National Biotec were not immediately answered. (BBG)

HONG KONG: Hong Kong's government will keep existing social distancing rules for another week, Cable TV reports, citing unidentified people. (BBG)

JAPAN: Approval rating of Japanese Prime Minister Yoshihide Suga's Cabinet dropped 7 percentage points to 55%, public broadcaster NHK reports, citing its poll taken from Oct. 9-11. Disapproval rating rose by the same percentage points to 20%. (BBG)

JAPAN/CHINA/SOUTH KOREA: A three-way meeting among the leaders of Japan, South Korea and China is unlikely to take place this year, NHK reports, without attribution. South Korea is assigned as host of this year's meeting, but no specific plans have been decided yet. The Japanese government sees the meeting as "difficult" unless South Korea takes "appropriate" steps toward a resolution of the forced labor issue between the two countries. (BBG)

AUSTRALIA/CHINA: The Federal Government is looking into reports that Chinese state-owned energy providers and steel mills have been told to stop importing Australian coal. Trade Minister Simon Birmingham said he had seen the reports, and that the Government had reached out to China for more information. "We don't have evidence to verify those reports," he said. "We have certainly been in touch with Australian industry and have been working to seek a response from Chinese authorities in relation to the accusations that have been made publicly." (ABC)

AUSTRALIA/CHINA: China's ban on Australian thermal and coking coal imports, which has left several Australian vessels stranded at Chinese ports, is likely to remain in place indefinitely amid deteriorating trade ties between the two nations, analysts said. Chinese authorities communicated the ban verbally, suggesting the informal approach was politically motivated, commodities analysts said, though it also aligned with tightening coal import quotas and Beijing's goal to reduce consumption and carbon emissions. Coal import quotas at some Chinese ports have now been exhausted for 2020. (SCMP)

NEW ZEALAND: The BNZ/SEEK employment report notes that "after being held back by the renewed lockdown in August, job ads rebounded a solid 14.7% in September, as restrictions eased. This left advertising levels down 21.7% on September 2019. This was a lesser fall than the 31.8% annual drop posted in August. The regional breakdown highlighted the relative impacts of the staggered COVID-19 restriction levels. With Auckland moving down to a Level "2.5" near the very end of August – having been on Level 3 for 18 days – its activity for September was given a shot in the arm. Auckland's job ads jumped a seasonally adjusted 19.7%, after dropping 8.3% in August. That said, most everywhere else also enjoyed a reasonable lift in advertising in September. This was aided by the country, (except Auckland) moving down to Level 1 on 21 September from Level 2, but also reflected underlying gains, judging by the trends." (MNI)

SOUTH KOREA: South Korea's new virus cases rebounded to over 100 on Tuesday, snapping five consecutive days of a two-digit rise, as sporadic cluster infections continued across the nation and imported cases rose amid an eased social distancing scheme that went into effect this week. The country added 102 COVID-19 cases, including 69 local infections, raising the total caseload to 24,805, according to the Korea Disease Control and Prevention Agency (KDCA). It marked a slight rise from 98 cases reported on Monday and a sharp rise from 58 cases from Sunday. The daily figure rebounded to 114 on Wednesday last week before falling back to 69 the following day. (Yonhap)

TAIWAN: The White House is moving forward with three sales of advanced weaponry to Taiwan, sending in recent days a notification of the deals to Congress for approval, three sources familiar with the situation said on Monday. (RTRS)

SOUTH AFRICA: South Africa won't be able to meet its finance ministry's debt targets and it may be undesirable for it to attempt to do so at a time when the economy is being battered by the fallout from the coronavirus, according to an advisory panel appointed by President Cyril Ramaphosa. In a more than 100-page document advising the government on an economic recovery program that Ramaphosa is due to unveil on Oct. 15, the President's Economic Advisory Council said spending cuts could hold back growth and have other adverse consequences. (BBG)

MARKETS: Hong Kong scrapped trading of stocks and bonds Tuesday after tropical storm Nangka prompted authorities to shutter businesses and close schools. (BBG)

OIL: U.S. Gulf of Mexico operators shut 1.3m b/d, or 69.4%, of oil production following Hurricane Delta, BSEE says in notice. (BBG)

OIL: The oil market will suffer a long-lasting blow from the coronavirus, with demand taking years to recover and peaking at a lower level, the International Energy Agency said. After an unprecedented 8% drop this year, global oil consumption will return to pre-crisis levels in 2023, provided Covid-19 is brought under control next year, the Paris-based agency said on Tuesday. Even in that case, which is the most optimistic scenario for oil considered by the IEA, the pandemic has an enduring impact. The IEA reinforced its view that global oil demand will plateau around 2030, topping out at lower levels than forecast last year. (BBG)

CHINA

CORONAVIRUS: China reported 13 coronavirus cases for Oct. 12, including 7 imported infections. The remaining six were from a new cluster disclosed yesterday in the eastern port city of Qingdao, when China ended a streak of more than two months without local transmission. Underscoring the country's continued recovery from its pandemic-induced economic slump, deliveries of sedans, SUVs, minivans and multipurpose vehicles rose 7.4% in September from a year earlier to 1.94 million units, according to the China Passenger Car Association. That's the third straight monthly rise and contrasts with weakness in the U.S. and Europe. (BBG)

YUAN: The yuan's long-term appreciation may be dampened after the PBOC this week removed forex risk reserves for banks, a measure which encouraged yuan transactions, the Securities Daily reported on Tuesday citing Lian Ping, an economist from Zhixin Fund. Both onshore and offshore yuan rates dropped on the first day after the announcement. The PBOC may consider cutting countercyclical factors if the yuan continues to gain in the near term, thus avoiding one-way expectations and negative impacts on the export sector, Lian said. He said the FX risk reserve cuts should help businesses to counter currency risks using forward forex trading. (MNI)

ECONOMY: China will continue with stable economic reform measures such as tax and fee cuts, boosts to consumption, and the opening-up of markets to ensure growth goals are met this year, Premier Li Keqiang told provincial governors on Monday, according to a press statement. Li stressed fiscal funds must be channeled to small businesses in difficulties, and any arbitrary charges and tax burdens should be forbidden. China should find new growth drivers in consumption and provide a suitable business environment to enhance market vitality, while ensuring the smooth operation of industrial chains to further support market opening and boost foreign trade and investments. (MNI)

MARKETS: China should encourage foreign investments in its securities markets to maintain the future balance of payments, China Securities Journal reported citing economist Zhang Anyuan. The current trade surplus alone cannot sustain the balance of payments, which could come under pressure once overseas travel resumes, said Zhang, an economist with China Securities. China should also contain leverage ratios, such as promoting equity financing, given the fact that these real economic channels have risen 21 percentage points in H1, Zhang said. (MNI)

BANKING: China's banking regulator is easing requirements on banks to report lower profits, delivering a reprieve for the $45 trillion sector that has been under pressure to sacrifice earnings to support the economy, according to people familiar with the matter. The China Banking and Insurance Regulatory Commission has given major lenders discretion to report earnings declines of about 10%, or less, below the more than 20% drop seen in the second quarter, said the people, who asked not to be identified as the matter is private. The relaxation of a June directive to rein in profits comes as lenders face ballooning bad debt and eroding capital levels. The instructions will alleviate a major concern for investors in Chinese banks, whose shares have been trading at record low valuations after they were enlisted to ease the financial hardship of millions of people and businesses hurt by the pandemic. Profit at China's banks plunged at the fastest pace since at least 2009 in the second quarter as bad debt hit a record and capital buffers eroded. The CBIRC declined to comment. (BBG)

EQUITIES: Chinese domestic equities are worth more than $10 trillion the first time since 2015, when a record crash erased half the market's value in months and saddled millions of investors with losses. (BBG)OVERNIGHT DATA

CHINA SEP TRADE BALANCE +$37.00BN; MEDIAN +$60.00BN; AUG +$58.93BN

CHINA SEP TRADE BALANCE +CNY257.68BN; MEDIAN +CNY419.50BN; AUG +416.59BN

CHINA SEP EXPORTS +9.9%; MEDIAN +10.0%; AUG +9.5%

CHINA SEP EXPORTS CNY +8.7% Y/Y; MEDIAN +10.5%; AUG +11.6%

CHINA SEP IMPORTS +13.2% Y/Y; MEDIAN +0.4%; AUG -2.1%

CHINA SEP IMPORTS CNY +11.6% Y/Y; MEDIAN +1.0%; AUG -0.5%

JAPAN SEP MONEY STOCK M2 +9.0% Y/Y; MEDIAN +9.0%; AUG +8.6%

JAPAN SEP MONEY STOCK M3 +7.4% Y/Y; MEDIAN +7.4%; AUG +7.1%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 97.7; PREV. 95.7

--------------------------------------------------------------------------------------------------------------------------

Consumers have given a thumbs up to the Budget, with sentiment rising 2.1% to its highest level since the last weekend of May. This is the second best postbudget gain in the last six years. There were healthy gains in 'future finances' and 'current' and 'future' economic conditions. Surprisingly, sentiment is weaker in New South Wales, including Sydney, than it is in Melbourne. Less surprisingly, confidence is strongest (and above neutral) in Perth. It is also above neutral in Tasmania and South Australia. (ANZ)

NEW ZEALAND SEP FOOD PRICE INDEX -1.0% M/M; AUG +0.7%

NEW ZEALAND SEP REINZ HOUSE SALES +37.1% Y/Y; +24.8%

NEW ZEALAND SEP CARD SPENDING RETAIL +5.4% M/M; AUG -7.9%

NEW ZEALAND SEP CARD SPENDING TOTAL +4.8% M/M; AUG -7.0%

SOUTH KOREA SEP BANK LENDING TO HOUSEHOLD TOTAL KRW957.9TN; AUG KRW948.2TN

UK SEP BRC SALES LIKE-FOR-LIKE +6.1% Y/Y; MEDIAN +3.5%; AUG +4.7%

CHINA MARKETS

PBOC NET DRAINS CNY100BN VIA OMOS

----------------------------------------------------------------------------------

- The People's Bank of China (PBOC) skipped open market operations on Tuesday. This resulted in a net drain of CNY100 billion given the maturity of CNY100 billion of reverse repos, according to Wind Information.

- The liquidity in the banking system is at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1880% at 09:31 am local time from the close of 1.9644% on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7296 TUES VS 6.7126

------------------------------------------------------------------------------------------------------------

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7296 on Tuesday, compared with 6.7126 set on Monday.

MARKETS

SNAPSHOT: Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 16.51 points at 23574.6

- ASX 200 up 76.836 points at 6208.8

- Shanghai Comp. down 9.561 points at 3348.904

- JGB 10-Yr future down 3 ticks at 151.93, yield down 0.1bp at 0.031%

- Aussie 10-Yr future up 1 tick at 99.160, yield down 0.7bp at 0.839%

- U.S. 10-Yr future unch. at 138-29, yield down 1.17bp at 0.762%

- WTI crude up $0.03 at $39.46, Gold down $11.77 at $1910.91

- USD/JPY up 10 pips at Y105.43

* ECB POLICYMAKERS WARY OF FOLLOWING FED'S ROUTE ON INFLATION TARGET (RTRS SOURCES)

* J&J COVID-19 VACCINE STUDY PAUSED DUE TO UNEXPLAINED ILLNESS IN PARTICIPANT (STAT)

* TRUMP TESTS NEGATIVE FOR COVID

BOND SUMMARY: Negative vaccine headline flow reintroduced itself in Asia-Pac trade, as STAT News noted that "the study of Johnson & Johnson's Covid-19 vaccine has been paused due to an unexplained illness in a study participant." This weighed on e-minis after Monday's rally (e-minis were already ticking lower as cash Tsys re-opened flatter), with yesterday's rally being a product of market pricing surrounding the odds of a blue wave in the November election, and the fiscal stimulus that such a result would entail. Still, T-Notes held to a narrow 0-03+ range, last +0-00+ at 138-29+, with cash Tsys trading 0.4-1.9bp richer across the curve amid bull flattening, albeit with the space back from richest levels.

- JGB futures failed to gain any traction above the 152.00 psychological level, even with broader defensive flows in play. The contract last trades +2, just shy of 152.00. Results from the latest liquidity enhancement auction for off the run 15.5-39 Year JGBs were firmer than the previous offering, as the tail and spreads narrowed, while the cover ratio nudged higher. Cash trade saw 5s outperform on the day, with swaps generally wider vs. JGBs across the curve. The long ends of both the JGB and swaps curves generally underperformed.

- There was little in the way of meaningful activity in the Aussie Bond space, with most of the focus going into assessments surrounding Sino-Aussie coal trade matters. Curve a touch flatter, with YM unchanged and XM +1.0.

JGBS AUCTION: The Japanese Ministry of Finance (MOF) sells Y498.4bn of 15.5-39 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.002% (prev. +0.009%)

- High Spread: 0.000% (prev. +0.014%)

- % Allotted At High Spread: 93.5747% (prev. 69.6113%)

- Bid/Cover: 2.330x (prev. 2.025x)

AUSSIE BONDS: The Australian Office of Financial Management (AOFM) sells A$150mn of the 0.75% 21 November 2027 I/L Bond, issue #CAIN414:

- Average Yield: -0.6312% (prev. -0.4371%)

- High Yield: -0.6250% (prev. -0.4325%)

- Bid/Cover: 5.6333x (prev. 4.3000x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 60% (prev. 40%)

- bidders 43 (prev. 33), successful 9 (prev. 6), allocated in full 8 (prev. 5)

EQUITIES: A bid for Tsys after the long weekend, in addition to a pause in J&J's COVID-19 vaccine study owing to test subject complications, weighed on most of the major risk assets during Asia-Pac hours.

- Weather conditions in Hong Kong saw the HKEX's morning session suspended.

- The ASX 200 was the exception to the broader rule, where utilities, tech and financials led the march higher, while the materials sector struggled as coal names languished on the back of the broader attention given to the reports surrounding Chinese restrictions imposed on Australian coal trade.

- E-minis traded lower after Monday's rally.

- Nikkei 225 -0.1%, Hang Seng suspended, CSI 300 -0.4%, ASX 200 +1.3%.

- S&P 500 futures -15, DJIA futures -105, NASDAQ 100 futures -48.

OIL: The major crude benchmarks were happy to stick to tight ranges in Asia-Pac hours, with WTI & Brent trading within a few cents of their respective settlement levels at typing.

- This comes after the supply side issues that we flagged yesterday weighed on crude during the first session of the week, with both WTI & Brent shedding a little over $1.00 at Monday's settlement.

- This week's API & DoE weekly inventory readings are delayed by ~24 hours vs. their usual times, owing to the Columbus Day holiday.

GOLD: Gold has edged back from levels registered 24 hours ago, after the close above psychological resistance on Friday, although the technical picture that we flagged yesterday remains intact. Spot last deals -$4/oz at $1,919/oz, with U.S. real yields and the USD remaining at the fore of traders' minds.

FOREX: G10 FX space switched into a defensive mode as U.S. Tsys re-opened after the elongated weekend, while STAT published a report noting that J&J paused their Covid-19 vaccine study owing to an unexplained illness in one participant. AUD was the worst G10 performer, as reports outlining fresh tensions in Sino-Australian relations did the rounds, with stories re: informal ban taking focus. It is worth noting that there is A$1.0bn worth of options with strikes at $0.7100 expiring at today's NY cut. The Kiwi held up well amid AUD/NZD sales. Safe haven currencies were bid on the back of the broader risk-off mood.

- USD/CNH rallied past yesterday's high as cash Tsys re-opened/STAT published its story, which put a bid into the greenback. The rate eased off after an in-line PBoC fix and continued to trade in positive territory, but comfortably shy of highs.

- IDR led losses in Asia, ahead of today's monetary policy decision from Bank Indonesia. KRW also faced some additional headwinds as South Korea's daily coronavirus case count returned above 100.

- German ZEW Survey, U.S., German & Swedish CPIs, UK labour market report take focus today. BoE's Bailey, ECB's de Cos, Fed's Barkin & Riksbank's Ingves are set to speak.

FOREX OPTIONS: Expiries for Oct13 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1700(E514mln), $1.1800(E2.7bln), $1.1845-50(E739mln), $1.1900(E748mln)

- USD/JPY: Y106.10-15($1.0bln)

- EUR/JPY: Y124.00(E730mln)

- GBP/USD: $1.2990-1.3000(Gbp553mln)

- AUD/USD: $0.7100(A$1.0bln), $0.7200(A$690mln), $0.7400(A$603mln)

- AUD/NZD: N$1.0880(A$1.6bln)

- EUR/AUD: A$1.6500(E592mln)

- USD/CNY: Cny6.9750($580mln)

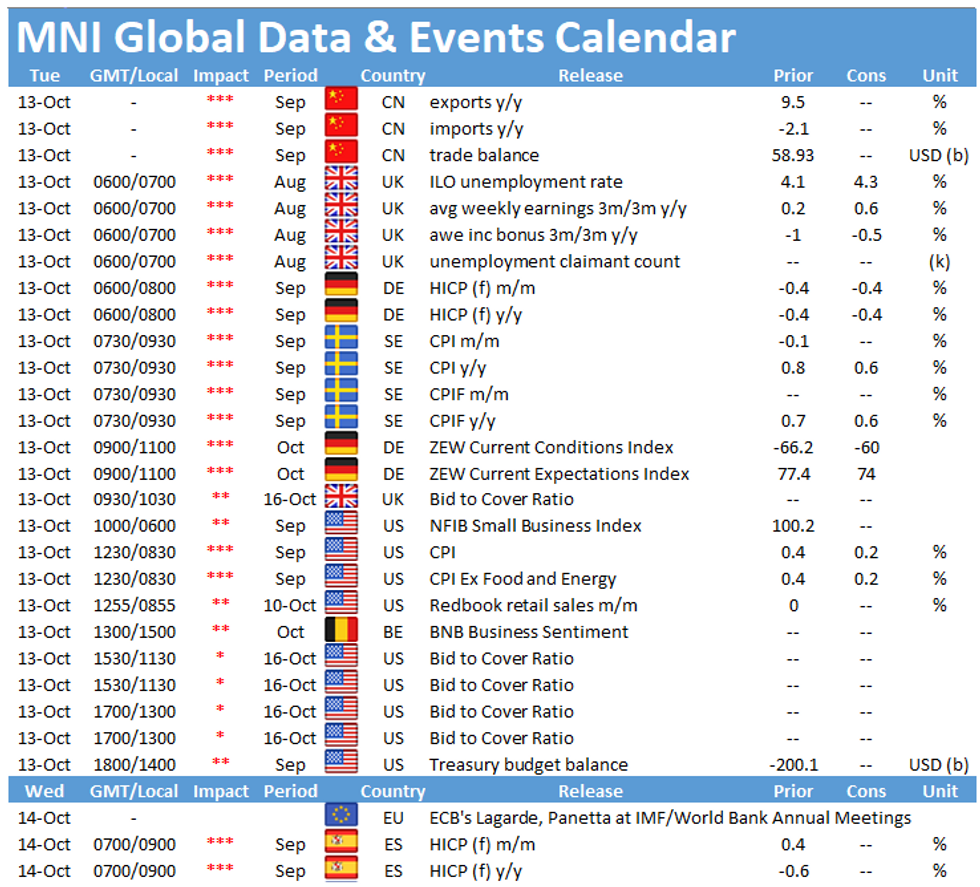

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.