-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: NFPs Round Off A Heavy Week Of Risk Events

EXECUTIVE SUMMARY

- SNB CAN’T EXCLUDE RATE HIKES AS INFLATION PERSISTS, JORDAN SAYS (BBG)

- SWISS CENTRAL BANK READY TO SELL ASSETS IF NEEDED, OFFICIALS SAY (BBG)

- BRAZIL'S LULA THREATENS CENTRAL BANK AUTONOMY AFTER HAWKISH WORDS (RTRS)

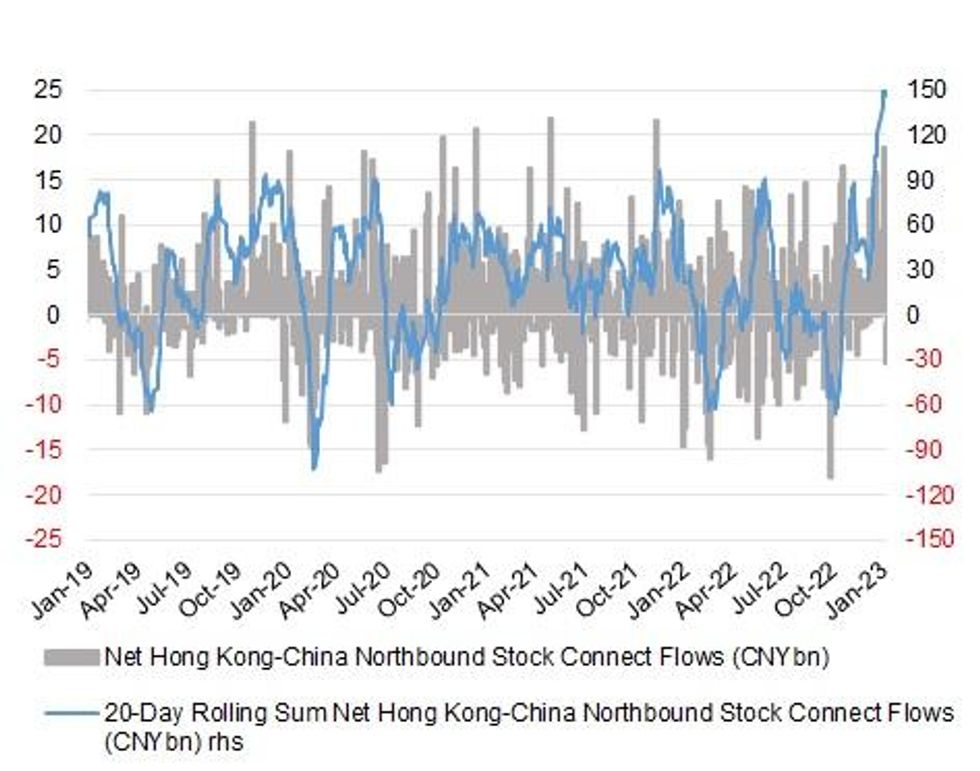

Fig. 1: Net Hong Kong-China Northbound Stock Connect Flows (CNYbn)

Source: MNI - Market News/Bloomberg

UK

BOE: Mr Bailey told ITV News Business and Economics Editor Joel Hills: "I see the signs that we are beginning to turn a corner". "Energy prices, which have obviously been one of the big forces pushing inflation up, have come off substantially and that is good, very good." (ITV)

BREXIT: Northern Ireland’s Democratic Unionist Party and a handful of Conservative Members of Parliament issued a warning to UK Prime Minister Rishi Sunak over Brexit, foreshadowing domestic obstacles ahead as his government seeks to end a dispute with the European Union. (BBG)

EUROPE

ECB Executive Board member Elderson tweeted the following on Thursday: “Our commitment to do our part in the fight against climate change is steadfast. Today’s @ecb decision on stronger tilting of our corporate bond holdings towards firms with a better climate performance supports the decarbonisation of our portfolio in line with the Paris agreement.” (Twitter)

FRANCE: Poll carried out by BVA for RTL shows 60% of participants oppose French pension reform, up 2 points. (BBG)

SNB: Underlying inflationary dynamics are stronger than what the Swiss National Bank is prepared to tolerate for price stability, President Thomas Jordan said. (BBG)

SNB: The Swiss National Bank is ready to reduce its balance sheet if monetary conditions require such a move, senior officials said. (BBG)

RATINGS: Sovereign rating reviews of note slated for after hours on Friday include:

- Fitch on Estonia (current rating: AA-; Outlook Negative) & Latvia (current rating: A-; Outlook Stable)

- S&P on the European Financial Stability Facility (current rating: AA; Outlook Negative) & the European Stability Mechanism (current rating: AAA; Outlook Stable)

- DBRS Morningstar on Belgium (current rating: AA, Stable Trend) & Sweden (current rating: AAA, Stable Trend)

U.S.

FED: The Federal Reserve is no longer behind the curve on inflation but persistent price pressures could force the central bank into further interest-rate hikes later this year after an expected pause, ex-Richmond Fed economist Peter Ireland told MNI. (MNI)

FED: Roberto Perli, the incoming head of the Federal Reserve’s market operations, recently laid out options for the central bank to safeguard financial markets in the event that Congress fails to raise the debt limit before the deadline later this year. (BBG)

POLITICS: President Biden on Thursday said he and House Speaker Kevin McCarthy (R-Calif.) would treat each other with respect, after both elected officials agreed yesterday to continue discussions about the debt ceiling. (Axios)

EQUITIES: Apple missed expectations for revenue, profit, and sales for many of its lines of business on Thursday, sending the stock lower in extended trading. Apple’s overall sales for the holiday quarter were about 5% lower than last year’s, the first year-over-year sales decline since 2019. (CNBC)

EQUITIES: Amazon on Thursday issued first-quarter guidance that came in light of estimates, overshadowing better-than-expected revenue for the fourth quarter. The stock slid after hours, erasing most its rally from the regular trading day. (CNBC)

EQUITIES: Alphabet missed on both top and bottom lines when it reported fourth quarter earnings after the bell Thursday. The company’s stock dropped nearly 4% after hours, erasing some of the 7.28% it gained in normal trading hours. (CNBC)

OTHER

U.S./CHINA: A suspected Chinese spy balloon has been flying over the United States for a couple of days, and senior U.S. officials have advised President Joe Biden against shooting it down for fear the debris could pose a safety threat. (RTRS)

U.S./CHINA/TAIWAN: U.S. Central Intelligence Agency Director William Burns said on Thursday that Chinese President Xi Jinping's ambitions toward Taiwan should not be underestimated, despite him likely being sobered by the performance of Russia's military in Ukraine. (RTRS)

CANADA/CHINA: High-altitude surveillance balloon was detected and its movements are being actively tracked by NORAD, Canada’s Department of National Defence said in a statement. (BBG)

BOJ: The three leading candidates to be the next Bank of Japan governor need to be sensitive to the importance of low interest rates embedded in the economic policies of the Kishida administration and be alert to the risks of derailing Japan's economic recovery from any tweaks to decade-long easy policy, MNI understands. (MNI)

BOJ: Bank of Japan (BOJ) Governor Haruhiko Kuroda said on Friday he expected wages to rise "quite significantly", boosted by improvements in the economy and a tightening job market. (RTRS)

BOJ: The Bank of Japan’s next governor hasn’t been decided yet, Finance Minister Shunichi Suzuki tells reporters. (BBG)

JAPAN/CHINA: Chinese Foreign Minister Qin Gang and his Japanese counterpart Yoshimasa Hayashi discussed disputed islands in the East China Sea on Thursday, with both expressing concerns and Qin hoping Japan could stop "right-wing" provocations. (RTRS)

RBA: The Reserve Bank of Australia will deliver a fourth successive quarter-point interest rate hike on Tuesday and is likely to follow up with a fifth in March as it grapples with an unexpected revival in inflation, a Reuters poll found. (RTRS)

SOUTH KOREA: South Korea's exports are anticipated to remain sluggish "at least" through the first six months of 2023, the finance minister said Friday, while inflation is expected to slow in the latter half. (Yonhap)

HONG KONG/CHINA: Mainland China will fully reopen its borders with Hong Kong and Macau from Monday with all Covid-19 restrictions dropped and no quotas imposed on arrivals from either side, Beijing’s top office overseeing city affairs has announced. (SCMP)

TURKEY: Turkish Capital Markets Board postpones deadline for funds to close reverse repo transactions for a second time, according to its weekly bulletin. (BBG)

MEXICO: Mexico’s Foreign Affairs Minister Marcelo Ebrard is confident in getting the nomination to fight for the country’s presidency next year, even as he faces a fierce battle within the ruling party to succeed Andres Manuel Lopez Obrador. (BBG)

BRAZIL: Brazilian President Luiz Inacio Lula da Silva on Thursday issued his latest threat to the autonomy of the country's central bank a day after it floated the possibility of keeping interest rates at a six-year high for a longer-than-expected period. (RTRS)

BRAZIL: Brazil President Luiz Inacio Lula da Silva defended the use of additional tools besides interest rates to rein in inflation, including a more active policy to reduce foreign exchange volatility and the regulation of fuel prices and food stocks. (BBG)

BRAZIL: President Luiz Inacio Lula da Silva said the collapse of retailer Americanas SA was a result of “fraud” committed by one of its biggest shareholders, Brazilian billionaire Jorge Paulo Lemann. (BBG)

RUSSIA: A new ground-launched, bomb-tipped rocket to be ordered from Boeing Co. will be part of the latest package of US arms for Ukraine that will be announced Friday by the White House and Pentagon, officials said. (BBG)

RUSSIA: European Union leaders will meet Ukrainian President Volodymyr Zelenskiy in Kyiv on Friday, bringing the promise of new sanctions against Russia but disappointing Ukraine's hope for swift membership to the EU. (RTRS)

SOUTH AFRICA: Eskom Holdings SOC Ltd. will reduce the intensity of rolling power cuts starting Friday, the state-owned utility said in a Twitter post. The company will cut 4,000 megawatts from the national grid starting at 5 a.m. on Friday, from 5,000 megawatts currently. The level will be further reduced to 3,000 megawatts from 5am on Saturday. (BBG)

MARKETS: The U.S. Commodity Futures Trading Commission said on Thursday that as a result of the ransomware attack on ION Trading UK the CFTC's weekly Commitments of Traders report will be delayed until all trades can be reported. (RTRS)

EQUITIES: Embattled billionaire Gautam Adani is in talks with creditors to prepay some loans backed by pledged shares as he seeks to restore confidence in his conglomerate’s financial health, a person with knowledge of the matter said. (BBG)

EQUITIES: Adani Enterprises, the flagship company of the Adani Group will be removed from the Dow Jones Sustainability Indices, prior to open on February 7, 2023, according to a note from S&P Dow Jones Indices. (CNBC 18)

OIL: China's independent refineries are ramping up imports of discounted fuel oil blended from Russian barrels to use as low-cost feedstock amid a shortage of government crude oil import quotas for some of them, according to trade sources and data. (RTRS)

OIL: U.S. oil refiners are dialing back operating runs this quarter after sky-high utilization rates last year, and aim to operate at between 85% and 89% of capacity, according to company outlooks and analysts' estimates. (RTRS)

CHINA

FISCAL: China’s local governments plan more fiscal spending this year with potential tax and fee relief measures to boost economic growth, China Securities Journal reports, citing local plans and analysts. (BBG)

PROPERTY: China Evergrande Group will be promoting and offering discounts for 458 projects, including residential flats, shops and parking spaces, The Paper reports, citing information from the firm. (BBG)

MARKETS: Chinese securities regulator pledged to enhance inclusiveness of stock and bond financing for tech companies and promote mergers and acquisitions, according to a meeting held by the China Securities Regulatory Commission (CSRC) to outline major works in 2023. (MNI)

YUAN/EQUITIES: Foreign capital inflows into China's A-share market are likely to sustain the rally in the yuan as market sentiment is boosted by the recovery of the economy, China Securities Journal reported. (MNI)

EQUITIES: Chinese banks are expected to accelerate initial public offerings (IPO) as strict controls on listings of financial institutions will be eased after the launch of a registration-based IPO system, 21st Century Business Herald reported Friday citing analysts. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY296 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) conducted CNY23 billion via 7-day reverse repos with the rates unchanged at 2.00% on Friday. The operation has led to a net drain of CNY296 billion after offsetting the maturity of CNY319 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9857% at 9:23 am local time from the close of 1.9107% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 45 on Thursday, compared with the close of 42 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7382 FRI VS 6.7130 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7382 on Friday, compared with 6.7130 set on Thursday.

OVERNIGHT DATA

CHINA JAN CAIXIN SERVICES PMI 52.9; MEDIAN 51.0; DEC 48.0

CHINA JAN CAIXIN COMPOSITE PMI 51.1; DEC 48.3

Optimism continued to grow in the sector in January. Businesses expressed greater confidence in an economic recovery following the easing of Covid controls, with the gauge for expectations for future activity growing nearly 6 points month-on-month, hitting the highest since February 2011. (Caixin)

JAPAN JAN, F JIBUN BANK SERVICES PMI 52.3; PRELIM 52.4; DEC 51.1

JAPAN JAN, F JIBUN BANK COMPOSITE PMI 50.7; PRELIM 50.8; DEC 49.7

AUSTRALIA DEC HOUSING FINANCE -4.3% M/M; MEDIAN -3.0%; NOV -4.2%

AUSTRALIA JAN, F JUDO BANK SERVICES PMI 48.6; PRELIM 48.3; DEC 47.3

AUSTRALIA JAN, F JUDO BANK COMPOSITE PMI 48.5; PRELIM 48.2; DEC 47.5

Australia’s service sector economy improved in January following a moderation of activity for much of 2022. This welcome slowdown of economic activity has translated into a modest easing of inflation pressures although, capacity constraints, particularly in the labour market, are still evident across the economy as we start 2023. (Judo Bank)

NEW ZEALAND JAN ANZ CONSUMER CONFIDENCE INDEX 83.4; DEC 73.8

The ANZ-Roy Morgan Consumer Confidence Index in January bounced 9 points off its record low to 83.4. Just like our Business Outlook survey, some of the post-RBNZ shock appears to have worn off. However, subdued card-spending data in December suggests consumers may indeed be “cooling their jets” as instructed. While confidence rose, it remains very low, and the softening labour market could see the long-running disconnect between consumers’ stated intentions and their actual spending decisions close. (ANZ)

SOUTH KOREA JAN FOREIGN RESERVES US$429.97BN; DEC US$423.16BN

MARKETS

US TSYS: Richer In Asia

TYH3 deals at 115-19, +0-01+, just off the top of its 0-07+ range on volume of ~79K.

- Cash Tsys sit 1-2bps richer across the major benchmarks.

- Tsys firmed vs. levels seen late in the NY session, after some cheapening into the NY close, with regional participants focused on yesterday's BoE & ECB meetings/guidance.

- The space looked through a firmer than forecast Caixin Services PMI print.

- There was little meaningful macro headline flow.

- Asia-Pac flow saw a block buyer of TY futures (+2.5K) and a block seller of WN futures (-750).

- In Europe today we have final Eurozone Services and Composite PMIs and PPI. Further out NFP headlines (our preview is here), with the ISM Services survey also due. SF President Daly is the first Fed speaker post blackout period.

JGBS: Firmer, Led By Futures

The early bid, as Tokyo reacted to Thursday’s major central bank meetings and seemingly elevated chances of BoJ Deputy Governor Amamiya succeeding current Governor Kuroda, has held, leaving futures 39 ticks better off into the close. Wider cash JGBs are flat to 3.5bp richer, with 7s leading on the curve owing to the bid in futures. Futures breached their overnight peak on the push higher.

- Swaps have generally lagged the move in JGBs, leading to wider swap spreads in the main. Local headline flow has been fairly subdued, with continued rhetoric re: Sino-Japan relations and BoJ Governor Kuroda outlining the current paper loss of the BoJ’s bond holdings providing the highlights.

- Elsewhere, Kuroda reiterated the need for maintaining ultra-easy policy settings to stimulate wage growth, with various other comments/themes reiterated in his latest address in front of parliament.

- Offer/cover ratios in the latest round of BoJ Rinban operations (covering 1- to 5- & 10- to 25+-Year JGBs) were subdued printing at 1.6-2.0x, this may have provided a slight bid in the Tokyo afternoon.

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y4.88092tn 3-Month Bills:

- Average Yield -0.1589% (prev. -0.1548%)

- Average Price 100.0427 (prev. 100.0416)

- High Yield: -0.1489% (prev. -0.1414%)

- Low Price 100.0400 (prev. 100.0380)

- % Allotted At High Yield: 16.2677% (prev. 57.4435%)

- Bid/Cover: 3.292x (prev. 2.914x)

AUSSIE BONDS: Holding Firm In Wake Of ECB & BoE

Bond futures finished a little shy of their Sydney session peaks, after reaction to Thursday’s key central bank meetings drove a bid in the early rounds of Friday trade (with a late pullback in the overnight session providing an opportunity for slightly better entry points).

- YM was +14.0, while XM finished +16.0, with both breaching overnight highs, although lacking meaningful momentum thereafter. The 10- to 12-Year zone outperformed on the wider ACGB curve, with the major benchmarks running 10-16bp richer on the day.

- Bills were 5-17bp richer through the reds, as the strip bull flattened. Meanwhile, RBA dated OIS continues to near-enough fully price in a 25bp hike for next week’s meeting, although terminal rate pricing has come in and is showing back below 3.65% after finishing just above 3.70% yesterday.

- There wasn’t anything in the way of meaningful reaction to firmer than expected Caixin services PMI data out of China.

- Participants are now looking ahead to the U.S. NFP print, which will cross in the overnight session.

- Further out, next week’s key domestic risk events include the RBA monetary policy decision mentioned above, the subsequent release of the RBA SoMP, Q4 retail sales volume, trade balance data and the Melbourne Institute inflation metrics.

- Note that next week’s AOFM issuance slate sees a continued A$1.5bn run rate for ACGB issuance, albeit over 2 auctions (ACGB May-28 & Nov-33), as opposed to this week’s 3.

AUSSIE BONDS: ACGB Apr-29 Auction Results

The Australian Office of Financial Management (AOFM) sells A$500mn of the 3.25% 21 April 2029 Bond, issue #TB138:

- Average Yield: 3.1922% (prev. 3.7426%)

- High Yield: 3.1975% (prev. 3.7450%)

- Bid/Cover: 3.7800x (prev. 2.8062x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 95.0% (prev. 84.1%)

- Bidders 42 (prev. 47), successful 10 (prev. 14), allocated in full 6 (prev. 8)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 8 February it plans to sell A$1.0bn of the 3.00% 21 November 2033 Bond.

- On Thursday 9 February it plans to sell A$500mn of the 12 May 2023 Note, A$1.0bn of the 9 June 2023 Note & A$500mn of the 7 July 2023 Note.

- On Friday 10 February it plans to sell A$500mn of the 2.25% 21 May 2028 Bond.

NZGBS: Early Richening Extends In Wake Of Major Central Bank Meetings

NZGBs firmed as Friday trade wore on, with core global FI markets remaining underpinned in Asia-Pac hours, as the region looked to Thursday’s key central bank meetings/guidance, which triggered some adjustments ahead of Friday’s NFP release.

- That left the major NZZGB benchmarks running 10-14bp richer, as the curve flattened. Meanwhile, swap rates were 6-13bp lower across the major benchmarks, leaving swap spreads a touch wider on the day.

- RBNZ dated OIS continued to indicate just over 50bp of tightening for next month’s meeting after the well-documented pullback observed YtD (with domestic labour market and CPI data, as well as the readthrough from the major global central banks, in the driving seat in recent weeks). Meanwhile, terminal OCR pricing is showing below 5.20%, as the global central bank impulse made itself felt.

- There wasn’t much in the way of meaningful domestic headlines to trade off of.

- Any follow through from the impending U.S. NFP release will dominate early Asia-Pac trade on Monday, although NZ markets are closed. Meanwhile, next week’s local docket sees card spending data, the manufacturing PMI & REINZ house price data.

EQUITIES: China/HK Weaken, Firmer Trends Elsewhere

China/HK equities remain a weak point, with sharper losses recorded so far for today's session. Sentiment hasn't been aided by a weaker US futures backdrop, Eminis down near -0.50% at this stage, while the Nasdaq is off by -1.4%. This came after disappointing Amazon/Apple earnings results post the close. It is only unwinding some of the impressive gains from Thursday's session in US trade (S&P500 +1.47%, Nasdaq +3.25%).

- For Hong Kong, the HSI is off by near 1.75% at this stage, leaving the market down nearly 5% for the week. However, this would be the first weekly loss since mid December last year.

- The CSI 300 is down 1.5% at this stage, with northbound stock connect outflows evident for the first session since the beginning of the year. The Caixin services PMI came in stronger than expected, 52.9, versus 48.0 prior and the 51.0 forecast.

- Trends are more positive elsewhere, the Nikkei 225 up 0.35%, while the ASX200 gained 0.6%. The Kospi is up 0.50%, but the Taiex is down 0.10% at this stage.

- Philippine equities continue the recent volatile patter, down 1% today, while Indian shares are slightly higher, despite further sharp falls for Adani.

GOLD: Tracking Lower For The Week, Although Payrolls Still To Come

Gold has consolidated today after Thursday's sharp near 2% pull back. After closing in NY just under $1913, we last tracked around $1915. At this stage we are tracking lower for the week (last Friday's close was $1928.04), despite the Fed outcome mid week.

- The near term technical set up is not great, with such a sharp reversal from Thursday's fresh cycle highs around $1960. Still, support should be evident around the $1900 level.

- Gold continues to track broader USD trends as well. So, we may see range trading ahead of the US non-farm payrolls report later.

- Gold ETF holdings remain close to recent lows.

OIL: Tracking 5.5% Lower For The Week

Brent crude is close to session lows, last near $82/bbl, while WTI sat around $75.60/bbl. For Brent we remain above Thursday session lows near $81/bbl, but we are still well down for the week, off by 5.5% at this stage. Oil, along with other commodities haven't enjoyed the same risk bounce that equities saw post the Fed.

- Brent is back below all key EMAs, with the 20 and 50 day sitting back between $84-$85/bbl respectively. A break below $80/bbl would leave the market targeting $77.77 (Jan 5 low).

- Some air has come out the China re-opening trade this week, while swelling US crude stockpiles also remains a cap on near term upside.

- Looking ahead, over the weekend the EU's ban on seaborne imports of diesel comes into effect on Sunday, while US Secretary of State Blinken visits China on the same day. Then next week we have the usual weekly US inventory reports.

FOREX: USD Firmer In Asia

The USD is trading on the front foot in the Asian session, BBDXY is up ~0.2%.

- JPY is marginally outperforming its G-10 peers, USD/JPY is down ~0.1%. Support was seen in the pair below ¥128.50.

- AUD/USD is down ~0.2%, AUD is the weakest performer in G-10 space at the margins. Aussie was pressured after a stronger than forecast Caixin Services PMI print, before paring losses after falling as much as 0.5% to last deal $0.7060/65.

- NZD/USD was also pressured post the Caixin Services PMI print, Kiwi pared losses as support came in ahead of $0.6460 and currently deals close to unchanged from NY closing levels.

- EUR/USD is down ~0.2% and is below the 1.09 handle. GBP/USD is ~0.1% softer.

- Cross asset wise; US Equities futures are lower, NASDAQ futures down ~1.5% after earnings from Apple, Amazon and Alphabet were below expectations. US Treasury yields are marginally lower, 10YY are down 2bps.

- In Europe today we have Eurozone Services and Composite PMIs and PPI. Further out January NFP headlines, also on the wires is ISM Services Survey and US Composite and Services PMIs.

FX OPTIONS: Expiries for Feb03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0770-75(E739mln), $1.0850-60(E1.4bln), $1.0950(E1.6bln), $1.0975-80(E640mln), $1.1000(E1.5bln)

- GBP/USD: $1.2325(Gbp1.5bln)

- EUR/GBP: Gbp0.8840(E673mln)

- USD/JPY: Y127.00($545mln), Y129.50-55($1.1bln), Y130.00($1.0bln)

- EUR/JPY: Y138.15(E500mln)

- USD/CAD: C$1.3300($960mln), C$1.3400-05($670mln), C$1.3500($3.0bln)

- USD/CNY: Cny6.8000($1.1bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/02/2023 | 0700/0800 | * |  | NO | Norway Unemployment Rate |

| 03/02/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 03/02/2023 | 0815/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 03/02/2023 | 0845/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 03/02/2023 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/02/2023 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/02/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/02/2023 | 0930/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 03/02/2023 | 1000/1100 | ** |  | EU | PPI |

| 03/02/2023 | 1215/1215 |  | UK | BOE Pill & Shortall MPR National Agency Briefing | |

| 03/02/2023 | 1300/1400 |  | EU | ECB Elderson Speech at Climate Outreach Event | |

| 03/02/2023 | 1330/0830 | *** |  | US | Employment Report |

| 03/02/2023 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/02/2023 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.