-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: No Fireworks At Yuan Fix, RBA Due

EXECUTIVE SUMMARY

- USD/CNY MID-POINT FIX ROUGHLY IN LINE WITH BROADER EXPECTATIONS

- CHINA MULLS NEW HOLDING COMPANY FOR HUARONG, BAD-DEBT MANAGERS (BBG)

- USD STRUGGLES IN ASIA

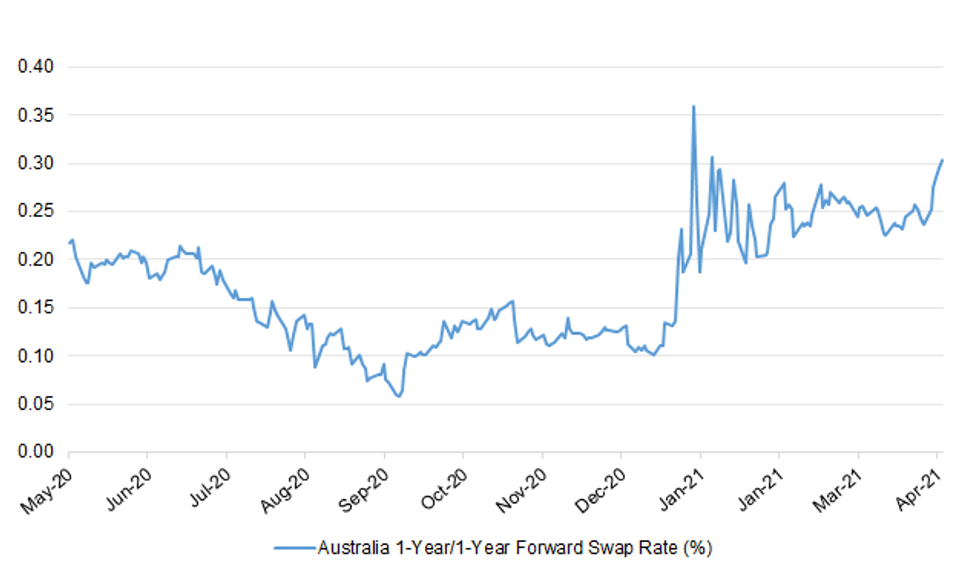

Fig. 1: Australia 1-Year/1-Year Forward Swap Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: here is a "significant chance" the government's target of lifting remaining lockdown restrictions from 21 June will change, a government adviser has told Sky News. Professor Adam Finn, a member of the Joint Committee on Vaccination and Immunisation (JCVI), cast doubt on whether Prime Minister Boris Johnson will be able to proceed with his timetable for easing COVID rules as planned. He told Sky News that "things are much more up in the air" than they were earlier this month, due to the spread of the Indian variant of coronavirus in the UK. Stage four of Mr Johnson's roadmap for lifting lockdown restrictions - when the prime minister aims to remove all legal limits on social contact - is scheduled to take place from 21 June. But Prof Finn said this was now "very much open to question" as he warned of England having to return to a full lockdown if the pace of reopening was later realised to have been too fast. (Sky)

CORONAVIRUS: More countries are set to be added to the red list amid concerns over high infection rates and the spread of Covid variants, an analysis shows. (Telegraph)

EUROPE

ECB: Whether the expected bout of inflation in the second half of 2021 will be temporary or permanent "will depend on what the reaction of wages will be," European Central Bank Governing Council member Klaas Knot says at web-streamed event. "There's still significant amount of slack in the euro-area labor market." "The likelihood of this temporary inflation translating into second- round effects and substantial wage demands -- at this moment I'm not seeing any signs of it." "Asset price inflation is of course a different story. We're seeing lots of asset-price inflation."

ECB: The results of a banking health check the European Central Bank will publish this summer will sound a wake-up call for lenders to take action even if they are unlikely to hold any surprises, ECB governing council member Ignazio Visco said. In an interview with Reuters on Monday, Visco said supervisors were engaged in a constant dialogue with the banks they oversee, and know their situation in detail. (RTRS)

GERMANY: Chancellor Angela Merkel is ready to allow Germany's controversial lockdown law to lapse, the latest sign that the pandemic is releasing its grip on Europe's largest economy. (BBG)

FRANCE/RATINGS: France's (Aa2 stable) credit profile reflects its wealthy and highly diversified economy, competent public institutions and affordable government debt, set against fiscal challenges that the pandemic has exacerbated, Moody's Investors Service said in an annual report today. The coronavirus crisis has widened fiscal deficits that were already high before the coronavirus crisis. Social discontent and the government's plans to support the economic recovery will limit the pace of fiscal consolidation over the coming years. "We expect that there will be fiscal consolidation from 2022 once the French government starts to roll back pandemic-related support measures," said Sarah Carlson, a Moody's Senior Vice President and author of the report. "However, the pace of deficit reduction will be gradual." Moody's forecasts that the budget deficit will decline to 5.4% of GDP in 2022, broadly in line with the authorities' plans. The public debt ratio is likely to remain around 115% to 120% of GDP, having increased from just below 100% in 2019, which is significantly higher than the debt ratios of most rating peers. France's high debt affordability mitigates its elevated debt burden. Upward pressures on the rating would emerge if France's fiscal and debt metrics were to improve materially on the back of more significant structural measures on the expenditure side once the pandemic shock abates. Conversely, the rating would come under downward pressure if the reforms implemented since 2017 were to be rolled back or diluted over the coming years, or if the unavoidable temporary increase in the budget deficit and debt ratio due to the pandemic were not corrected. (Moody's)

OTHER

CORONAVIRUS: The heads of the International Monetary Fund, the World Health Organization, the World Bank and the World Trade Organization called for a "stepped-up coordinated strategy, backed by new financing, to vaccinate the world," in an editorial published in the Washington Post. The call, issued before the G-7 meeting next week, aims to boost vaccinations in developing countries. (BBG)

JAPAN: Japan is preparing to hold next month's Olympics with some spectators present, even as experts warn it would be difficult to stage the games unless the pace of infections falls in the capital, according to media reports. Organizers are preparing to let domestic fans attend the games and spectators would be required to provide a negative virus test or a vaccination certificate, TV Asahi said Tuesday. Fans from overseas are not allowed to see the events in person. (BBG)

JAPAN: Some members of the Japanese government's coronavirus expert panel warned that it would be "difficult" to hold the Tokyo Olympics this summer if the capital's virus situation remains at the highest of four levels, the Asahi newspaper reported. Meanwhile, the first group of foreign athletes arrived in Japan on Tuesday for training ahead of the Games, Kyodo said. The Australian women's softball team flew in to Narita airport, and are fully vaccinated. (BBG)

AUSTRALIA: Victoria's Covid outbreak "may get worse before it gets better," the acting premier James Merlino said, as the number of active cases in the state climbed above 50 and extended into two aged care facilities, leading Merlino to warn an extended lockdown could not be ruled out. (Guardian)

RBNZ: Reserve Bank (RBNZ) Chief Economist Yuong Ha has clarified quantitative easing might be with us for some years. Speaking to interest.co.nz, he explained there might not be an abrupt end to the RBNZ's bond buying when its Large-Scale Asset Purchase (LSAP) programme ends in June 2022. If, after June 2022, the RBNZ decides it needs to keep monetary conditions stable, it could buy new bonds when the bonds it owns mature. This would see it keep its balance sheet the same size. If the RBNZ seeks to tighten monetary conditions/increase interest rates, it could sell some of the bonds it owns or not replace matured bonds with new ones. This would shrink the size of its balance sheet. And if the RBNZ decides it needs to loosen monetary conditions/lower interest rates, it could buy more bonds and thus increase the size of its balance sheet. (Interest NZ)

SOUTH KOREA: The growth rate of South Korea's consumer prices for May is estimated to have remained high due largely to last year's low base, a senior government official said Tuesday, amid concerns about growing inflationary pressure. First Vice Finance Minister Lee Eog-weon said the growth of consumer inflation is likely to surpass 2 percent in the second quarter, but annual inflation is not likely to top the central bank's target of 2 percent. He said the government will unveil a set of measures to help stabilize consumer prices this week. (Yonhap)

CANADA: MNI REALITY CHECK: Canada GDP Holding up on Commodity Demand

- Canadian industry leaders told MNI the economic rebound will continue through the pandemic's third wave on a housing boom, progress with vaccinations and strong demand for exported commodities. Homebuilding and exports are two main sectors driving first-quarter GDP growth during massive lockdowns in provinces like Ontario and Quebec. The MNI economist consensus is for annualized growth of 6.7% in a report due Tuesday at 8:30am EST, slightly above Statistics Canada's flash estimate. While slower than the fourth quarter's 9.6% pace, any growth still defies some predictions around the end of last year that the third Covid wave would cause output to shrink again - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

TURKEY: Restaurants and cafes in Turkey, which have been effectively closed for weeks except for takeaway and delivery, in a partial easing of lockdown measures will be allowed to open in June from 7 a.m. until 9 p.m., except for Sundays, President Recep Tayyip Erdogan said after a Cabinet meeting on Monday. Gyms and parks will also reopen in June. (BBG)

MEXICO: Finance Ministry models indicate Mexico will grow about 6.5% this year, Deputy Minister Gabriel Yorio says in a tweet on his remarks at an Organisation for Economic Co-operation and Development panel. Recovery of pre-pandemic levels will happen sooner than expected, Yorio said. Covid revealed costly social gaps, especially those related to gender, as women have been most affected in rejoining the labor market. Post Covid public policy should promote sustainable growth through projects that address social gaps, gender inequality and climate change challenges. (BBG)

MEXICO: Mexico's Finance Ministry is planning another sustainable bond issuance this year, with a term longer than seven years, Deputy Minister Gabriel Yorio said at an Organisation for Economic Co-operation and Development panel, Milenio reports. Mexico has sustainable public financing agenda, Yorio said. (BBG)

BRAZIL: Economy seems to be reacting better to the second wave of the pandemic in Brazil, Central Bank President Roberto Campos Neto said at Brazil Investment Forum 2021. Brazil is on a vaccination acceleration curve. Question for 2H is how service sector will recover. It is a myth to think that investments in Brazil will come from the public sphere; solutions are private. Credibility today is linked to the fiscal issue. Sustainable growth needs structural reforms to have long-term investments. Brazil is feeling pressure on inflation due to increased demand for commodities. (BBG)

BRAZIL: Pfizer wants to include teenagers ages 12 and older in its Covid-19 vaccine package leaflet, Brazil's health regulator known as Anvisa said in a statement. Currently, the vaccine is authorized in Brazil for those 16 and older. Studies will be needed to demonstrate a safety and efficacy relationship for the age group, Anvisa says. (BBG)

RUSSIA: German Chancellor Angela Merkel is sending a high-ranking negotiating team to Washington this week to discuss the controversial Nord Stream 2 pipeline project, Funke media group reported. The delegation, led by the chancellor's foreign policy adviser, Jan Hecker, and her chief economic adviser, Lars-Hendrik Roeller, will meet with U.S. National Security Adviser Jake Sullivan and Trade Representative Katherine Tai, according to the report. (BBG)

RUSSIA: Dominic Raab will on Tuesday present a "rap sheet" of Russia's bad behaviour to Nato allies, as Moscow said it would increase its military presence in the west of the country. (Telegraph)

IRAN: Iran produced a record volume of highly-enriched uranium that could quickly be turned into fuel for a nuclear weapon, underscoring the urgency with which diplomats are moving to restore an agreement that would rein in the Persian Gulf nation's program. International Atomic Energy Agency inspectors circulated a confidential assessment of Iran's atomic program on Monday as envoys hunkered down for an eighth week of negotiations in Vienna. Diplomats are trying to orchestrate a U.S. return and Iranian compliance with a landmark nuclear agreement that curtailed Tehran's production of nuclear fuel in exchange for sanctions relief. (BBG)

OIL: A year after shuttering unprecedented volumes of crude, the OPEC+ alliance is expecting world oil markets to get acutely tight. The coalition led by Saudi Arabia and Russia believes that the glut created during the pandemic has nearly gone, and that oil stockpiles will diminish rapidly in the second half of the year as lockdowns ease and travel gathers pace. That leaves the Organization of Petroleum Exporting Countries and its partners with a decision they will start pondering as soon as Tuesday: whether to pour more oil into the market in the second half when the outlook is still so mired in uncertainty. Holding output steady would support the market against the twin risks of renewed virus outbreaks and a potential export flood from fellow OPEC member Iran. But with Brent futures near $70 a barrel, it could also jeopardize the global economy and feed into the inflationary pressures fixating Wall Street. "There are many moving parts when it comes to factors affecting the global oil market, such as the pace of change during the pandemic," OPEC Secretary-General Mohammad Barkindo said after preliminary consultations on Monday. At their meeting on Tuesday, ministers are expected to press ahead with a gradual increase already penciled in for July, completing the return of 2 million barrels since May. In theory, according to a historic deal struck in the depths of the oil crisis last year, the group has committed to hold at that level until early 2022. But a tight market may call for the agreement to be revised. (BBG)

OIL: Kuwait's crown prince Sheikh Meshal al-Ahmad will lead a delegation, which includes the oil and foreign ministers, on an official visit to neighbouring Saudi Arabia on Tuesday, state media reported. (RTRS)

CHINA

YUAN: The PBOC's announcement on Monday raising financial institutions' FX reserve requirement ratios to 7% from 5% will tighten U.S. dollar supply in the domestic FX market by about USD20 billion, not a large amount considering the average daily trading volume was around USD41.1 billion last week, CICC said in a report. The move conveyed the PBOC's intention to maintain two-way fluctuations of the yuan. Previous similar moves to reduce the expectation for yuan's gain usually followed by the dollar gaining as much as 0.4% within a week, the report said. As of April, the balance of foreign exchange deposits in financial institutions is approximately US$1 trillion, the report added. (MNI)

ECONOMY: The Global Times tweeted the following on Tuesday: "#China's e-commerce platforms kick off 618 shopping festival on Tue with record sales, with the transaction volume of #Apple's iPhones on #JD exceeding $15.7 million in just 5 seconds." (MNI)

FISCAL: China should consider cutting taxes and lower high housing and education costs to encourage the younger generations to have more children, said the 21st Century Business Herald in an editorial after the government endorsed having three children. Family with two or more children should be taxed as a whole, not individually, and enjoy some tax reduction, which will encourage middle-income urban residents to have children, the newspaper said. China's declining fertility rate has a strong correlation with rising housing prices while having three children requires larger housing that is difficult to achieve in big cities, the newspaper said. (MNI)

ASSET MANAGERS: China's finance ministry is considering a proposal to transfer its shares in China Huarong Asset Management Co. and three other bad-debt managers to a new holding company modeled after the one that owns the government's stakes in state-run banks, according to a person familiar with the matter. Policy makers are re-examining the proposal, which was first tabled three years ago, as part of discussions on how to deal with the financial risks posed by Huarong, said the person, who asked not to be identified discussing private information. Some officials view the creation of a holding company as a step toward separating the government's roles as a regulator and shareholder, streamlining oversight and instilling a more professional management culture at Huarong and its peers, the person said.

CORONAVIRUS: The southern Chinese city neighboring Guangzhou requires negative nucleic acid tests within 3 days before departure for people leaving the city by plane, train or bus, CCTV reports, citing the local government. The authorities require same documents for those heading out of Guangdong province from the city by car. The new measure takes effect from 12 p.m. Wednesday. (BBG)

REITS: China's first batch of nine REIT products ranged from CNY2.3 to CNY13.38 per share, with expected dividend yields from 4% to 12%, said Quanshang Zhongguo, a WeChat blog run by Securities Times. They were sold out in half a day yesterday in a public offering, with some more than 40 times oversubscribed, the newspaper said. These REIT products focus on high-quality infrastructure projects in key areas, with five to be invested in industrial parks, warehouses, and logistics, the newspaper said. (MNI)

OVERNIGHT DATA

CHINA MAY CAIXIN MANUFACTURING PMI 52.0; MEDIAN 52.0; APR 51.9

To sum up, manufacturing expanded in May as the post-epidemic economic recovery kept its momentum. Both domestic and overseas demand were strong and supply recovered steadily. The job market remained stable. Manufacturers stayed confident about the business outlook as the gauge for future output expectations was higher than the long-term average. Inflation was still a crucial concern as prices continued rising. Policymakers mentioned rising commodity prices at the State Council executive meetings on May 12 and May 19 and issued instructions about stabilizing commodity supplies and prices. Inflationary pressure would limit the room for monetary policy maneuvers. The price transmission effect emerged as manufacturing output prices surged last month. Rapidly rising commodity prices began to disrupt the economy as some enterprises began to hoard goods, while some others suffered raw material shortages. Supply chains were also significantly affected. (Caixin)

JAPAN Q1 CAPITAL SPENDING -7.8% Y/Y; MEDIAN -6.8%; Q4 -4.8%

JAPAN Q1 CAPITAL SPENDING EX-SOFTWARE -9.9% Y/Y; MEDIAN -7.6%; Q4 -6.1%

JAPAN Q1 COMPANIES SALES -3.0% Y/Y; Q4 -4.5%

JAPAN Q1 COMPANIES PROFITS +26.0% Y/Y; Q4 -0.7%

JAPAN MAY, F JIBUN BANK MARKIT MANUFACTURING PMI 53.0; PRELIM 52.5; APR 53.6

May data marked a sustained improvement in the health of the Japanese manufacturing sector, as the latest Manufacturing PMI painted a different picture to 12 months ago. A continued recovery from pandemic-related disruption has now extended to four months. "Japanese firms recorded further increases in both output and new orders in May, as businesses reported improved demand, notably in external markets. New export orders rose at a solid pace in May, driven by sustained growth in key markets such as China. Sustained increases in production and total sales encouraged businesses to raise workforce numbers for the second successive month in the latest survey period. At the same time, firms noted an further intesification of price pressures, with input prices rising at the fastest pace for 31 months. Japanese goods producers remained optimistic in the year ahead outlook for activity. Firms were hopeful that the pandemic would subside and induce a broad recovery in demand across the sector. IHS Markit estimates that industrial production will rise by 8.8% in 2021. (IHS Markit)

AUSTRALIA Q1 CURRENT ACCOUNT BALANCE +A$18.3BN; MEDIAN +A$17.7BN; Q4 +A$16.0BN

AUSTRALIA Q1 NET EXPORTS -0.6% PTS FROM GDP; MEDIAN -1.2 PTS; Q4 -0.1 PTS

AUSTRALIA Q1 INVENTORIES +2.1% Q/Q; MEDIAN +0.2%; Q1 -0.1%

AUSTRALIA Q1 COMPANY PROFITS -0.3% Q/Q; MEDIAN +3.4%; Q1 -4.8%

AUSTRALIA APR BUILDING APPROVALS -8.6% M/M; MEDIAN -10.0%; MAR +18.9%

AUSTRALIA MAY CORELOGIC HOUSE PRICE INDEX +2.3% M/M; APR +1.8%

AUSTRALIA MAY, F IHS MARKIT MANUFACTURING PMI 60.4; PRELIM 59.9; APR 59.7

Australia's manufacturing sector continued to expand at a record pace in May with strong demand driving output growth. The sustained expansion of hiring activity at a record clip was also an encouraging sign for the Australian economy. "That said, supply constraints continued to feature strongly in the latest PMI survey. Alongside the pickup in demand for inputs across the manufacturing sector, delivery delays contributed to marked overall price inflation for both manufacturers and their end customers. "With no sign of a turning point in price inflation for Australia's manufacturing sector, based on forecasts both consumer and wholesale price inflation are expected to accelerate in 2021 compared to last year. (IHS Markit)

AUSTRALIA MAY AIG MANUFACTURING PMI 61.8; APR 61.7

Australia's manufacturing sector maintained its rapid pace of expansion in May fuelled by strong demand from the construction sector, a pick-up in business investment and healthy demand from households. Each of the six diverse manufacturing groups expanded at a more rapid rate in the month led by the machinery & equipment; building products; and chemicals sectors. Manufacturing production and employment accelerated and, while the pace of expansion eased from April's record high, sales also continued to rise. Manufacturers experienced further pressure on input costs and with wages also rising more rapidly, they are seeking to recover some of these extra costs from customers. With capacity utilisation running at high levels and new orders continuing to grow, manufacturers are finding it increasingly difficult to fill positions. While the new Victorian lockdown will dampen enthusiasm somewhat, these conditions are likely to be setting the stage for a lift in investment by manufacturers. (AiG)

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 111.4; PREV. 114.2

The announcement of a seven-day lockdown in Victoria in response to an outbreak of COVID-19 has impacted consumer confidence around the country. Confidence fell 3.8% in Melbourne, but was actually down more sharply in Brisbane (-4.7%) and Sydney (-4.5%). ANZ-Roy Morgan survey data show that short lock-downs don't have a lasting impact on consumer sentiment. Nor has Victoria's experience of lockdowns in 2020 driven a wedge between sentiment in that state and the rest of the country. This offers the prospect that even an extension of the current lockdown may not have too dramatic an impact on consumer sentiment. Of course, the absence of JobKeeper for this episode means we need to alert to worse results than the experience to date. (ANZ)

NEW ZEALAND APR HOME-BUILDING APPROVALS +4.8% M/M; MAR +19.2%

SOUTH KOREA MAY TRADE BALANCE +2.925B; MEDIAN +$3.751B; APR +$434MN

SOUTH KOREA MAY EXPORTS +45.6% Y/Y; MEDIAN +48.9%; APR +41.2%

SOUTH KOREA MAY IMPORTS +37.9% Y/Y; MEDIAN +38.0%; APR +33.9%

SOUTH KOREA MAY IHS MARKIT MANUFACTURING PMI 53.7; APR 54.6

South Korean manufacturers continued to report a sustained, yet softer improvement in the health of the sector, with the latest Manufacturing PMI easing to the softest level recorded for four months. This came as manufacturers reported an easing in rates of growth in both output and new orders in May. Moreover, firms also reported a significant slowdown in new business inflows from international clients, as export orders expanded at the softest pace since October 2020. That said, South Korean goods producers remained buoyed by increased demand, therefore raised staffing levels for the third month in succession. Ongoing supply chain disruption continued to plague the sector, which resulted in a further intensification of price pressures throughout May. Average cost burdens increased at the second-fastest pace on record, which contributed to a survey-record rise in output prices. As demand continued to evolve, firms remained confident that output would rise over the coming year. This is in line with IHS Markit estimates that industrial production will rise 6% in 2021. (IHS Markit)

CHINA MARKETS

PBOC INJECTS CNY10 BLN VIA OMOS TUES; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information. The operation aims to keep liquidity reasonable and ample, the PBOC said on its website. The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2750% at 09:26 am local time from the close of 2.5786% on Monday. The CFETS-NEX money-market sentiment index closed at 45 on Monday, flat from the close of Friday.

CHINA SETS YUAN CENTRAL PARITY AT 6.3572 TUES VS 6.3682 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3572 on Tuesday, compared with the 6.3682 set on Monday.

MARKETS

SNAPSHOT: No Fireworks At Yuan Fix, RBA Due

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 112.66 points at 28748.59

- ASX 200 down 16.229 points at 7145.4

- Shanghai Comp. down 4.144 points at 3611.333

- JGB 10-Yr future down 2 ticks at 151.44, JGB 10-Yr yield down 0.7bp at 0.08%

- Aussie 10-Yr future up 1.5 ticks at 98.365, Aussie 10-Yr yield down 1.3bp at 1.698%

- U.S. 10-Yr future down 0-06 at 131-24, US 10-Yr yield up 2.21bp at 1.6164%

- WTI crude up $1.27 at $67.59, Gold up $4.95 at $1911.82

- USD/JPY down 13 pips at Y109.45

- USD/CNY MID-POINT FIX ROUGHLY IN LINE WITH BROADER EXPECTATIONS

- CHINA MULLS NEW HOLDING COMPANY FOR HUARONG, BAD-DEBT MANAGERS (BBG)

- USD STRUGGLES IN ASIA

BOND SUMMARY: Core FI Mixed In Asia

10s led the way lower in U.S. cash Tsy trade after the elongated weekend, and last print ~2.5bp cheaper vs. Friday's closing levels, with pockets of selling in TYU1 observed overnight. T-Notes last -0-06 at 131-24, 0-02 off lows. Headline flow remains light, with no notable surprises in today's USD/CNY mid-point fixing. There was perhaps an element of the latest uptick in oil spilling over into Tsys, as Brent futures topped $70.00

- A sedate session for JGBs, with the pressure in the U.S. Tsy space seemingly applying some modest weight here, leaving cash JGBs little changed to ~0.5bp cheaper across the curve, while futures print 1 tick below yesterday's settlement level. There was little to note on the domestic front, outside of softer than expected Q1 CapEx data re: Japanese corporates & continued chatter surrounding the viability of the Tokyo Olympics.

- Aussie bonds were underpinned ahead of today's RBA decision, with local data generally on the firmer side of expectations, while there was another uptick in cases within the Melbourne COVID cluster. YM +0.5, XM +1.5, with 10s seeing some marginal outperformance on the cash ACGB curve. 3-Year EFPs are threatening to push above 16bp. There was also the potential for some trans-Tasman impetus, with RBNZ chief economist Ha telling Interest NZ that "there might not be an abrupt end to the RBNZ's bond buying when its Large-Scale Asset Purchase (LSAP) programme ends in June 2022." The last couple of days have seen various RBNZ policymakers look to re-assert the notion of optionality into the broader narrative after markets deemed last week's decision (and the OCR track within the MPS) to be hawkish. A reminder that there are no real expectations for anything in the way of the dissemination of fresh, meaningful information at today's RBA decision (see our full preview for more detail on that matter).

EQUITIES: Mixed As PMI's Slow

Another mixed session for equity markets in the Asia-Pac region. Markets in Japan are lower but off worst levels, liquidity was said to be thin which exacerbated the move lower. Markets in mainland China are also lower, the PBOC late yesterday raised RRR from 5% to 7% effective June 15, Caixin manufacturing PMI was in-line with last month at 52.0. The Hang Seng has managed to squeeze out some gains ahead of retail sales data later today. Manufacturing PMI figures in the region also negatively hit sentiment with many citing an uncertain outlook due to the latest wave of the pandemic. Markets in South Korea were boosted by another bumper set of exports in trade balance data. In the US future are marginally higher with liquidity still thin as participants are set to return from a long weekend.

OIL: Crude Futures Higher Ahead Of OPEC+ Meeting

Oil is higher again in Asia-Pac trade on Tuesday; WTI is up $1.34 from settlement at $67.66/bbl while Brent is up $0.92 at $70.24. Markets are focusing on comments from the OPEC+ group who see tighter conditions in the oil market according to its latest communication. The group meets later today and ahead of the meeting has said that the stockpile glut built up during the pandemic has almost been used up and expects inventories to reduce in the second half of the year. The group is expected to confirm the supply increase due for July which would complete the return of 2m bpd since May. Elsewhere, there were reports that Nigeria's NNPC are looking to purchase stakes in six private refineries to meet requirements in a government directive.

GOLD: Bulls In The Driving Seat

Fresh USD downside has supported bullion over the last 24 hours or so, with spot last dealing $5/oz or so higher on the day at $1,912/oz. The impulse from a softer USD has outweighed an uptick in U.S. Tsy yields during Asia-Pac dealing. Bulls now look to the Jan 8 high at $1,917.6/oz, with any sustained break there opening up the path to the Jan 7 high at $1,927.7/oz.

FOREX: Greenback Struggles

The greenback continued its move lower with liquidity still thinner than usual, UK and US participants are expected to return today after a long weekend.

- AUD is top of the G10 pile, AUD/USD up 31 pips at 0.7765. The RBA rate announcement is still to come. Final May manufacturing PMI came in at 60.4 from 59.9 previously, while ANZ Roy Morgan weekly consumer confidence printed 111.4 down from 114.2 last week. CoreLogic house prices rose 2.3% M/M in May from 1.8% in April

- NZD is up 14 pips at 0.7283, data showed New Zealand April home building approvals rose 4.8% M/M from a revised 19.2% rise in March.

- Yen is firmer, USD/JPY is down 14 pips having moved in a narrow range through the session. There are reports that organisers are preparing to hold the Olympics with spectators. Data showed Q1 capital spending fell more than expected at -7.8% Y/Y, consensus -6.8%, capital spending ex-software came in at -9.9% Y/Y against estimates of -7.6%. Companies sales print -3.0% Y/Y, profits rose 26.0% after falling 0.7% in Q4.

- Yuan is firmer, USD/CNH down 31 pips after the pair jumped on Monday following an increase in the RRR by the PBOC to 7% from 5% by the PBOC. The PBOC once again fixed USD/CNY above sell side estimates indicating a preference for a weaker yuan. Caixin manufacturing PMI at 52.0 in May was in-line with April.

- GBP/USD pushed higher, registering a fresh multi-year high in the process. Bulls now eye 1.4315 as the next resistance point, which represents the April 18 2018 high.

FOREX OPTIONS: Expiries for Jun01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2125-30(E775mln), $1.2150-51(E2.0bln-EUR puts), $1.2195-05(E587mln), $1.2225-40(E1.1bln-EUR puts), $1.2275(E1.7bln-EUR puts), $1.2300(E901mln)

- USD/CNY: Cny6.3900($501mln)

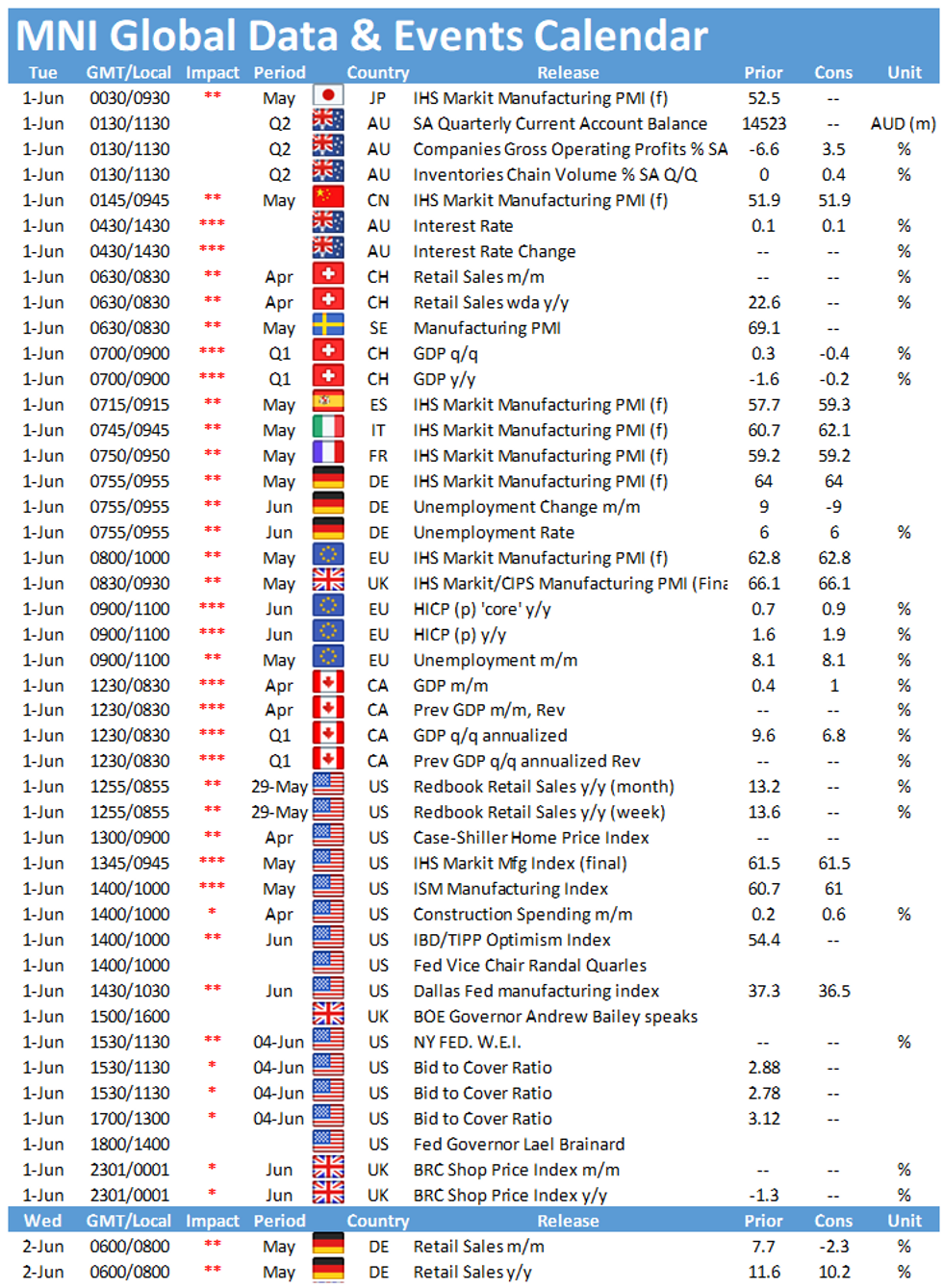

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.