-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: No Reprieve For Risk, MidEast Pipeline Outage Supports Crude

EXECUTIVE SUMMARY

- TORY REBELS CLAIM TO BE ON VERGE OF FORCING VOTE ON JOHNSON’S FUTURE (FT)

- KEY IRAQ-TURKEY PIPELINE KNOCKED OUT BY EXPLOSION (BBG)

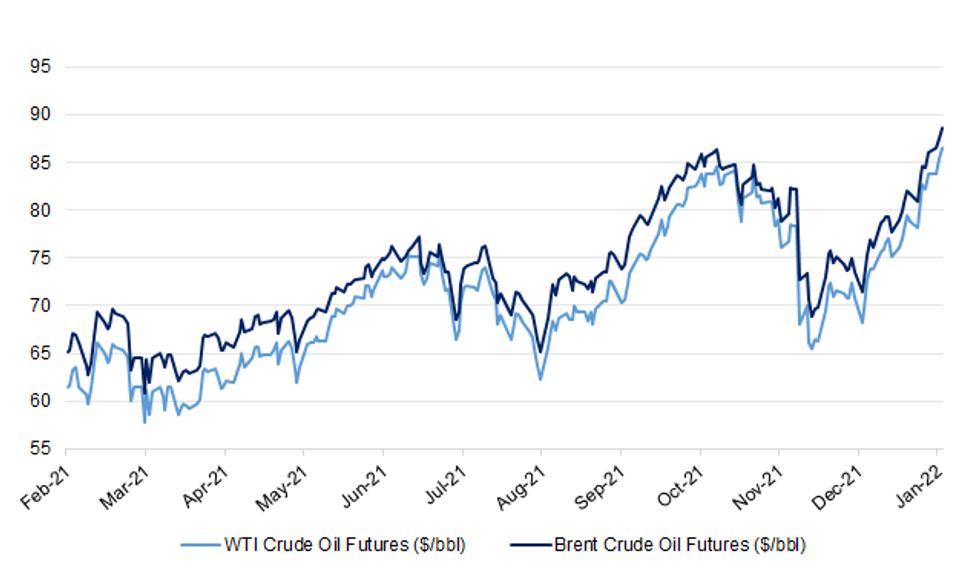

Fig. 1: WTI vs. Brent Crude Oil Futures ($/bbl)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Boris Johnson will on Wednesday embark on a fight for political survival, as Tory MPs claimed they were on the verge of triggering a no-confidence vote in the prime minister over alleged lockdown parties in Downing Street. Johnson will attempt to contain the rebellion by announcing a lifting of Covid-19 restrictions in England — a move popular with Tory MPs — but one ally said there was a “50-50 chance” he could soon face a confidence vote. The prime minister is confronting a new threat from Conservative MPs elected in 2019, many from so-called red wall seats in northern England who met on Tuesday to discuss the prime minister’s future following the “partygate” scandal. Downing Street is eyeing the prospect of a northern rebellion nervously, and some rebel Tory MPs claim they will soon have the necessary 54 letters required to trigger a confidence vote in Johnson. “It’s close,” said one. Party whips do not deny that Johnson’s future could soon be on the line, but one cabinet minister loyal to the PM insisted that the red wall rebels would not succeed, saying: “They are inexperienced. It won’t amount to much.” (FT)

POLITICS: There are claims that 20 "red wallers" are poised to submit letters to 1922 Committee chairman Sir Graham Brady after PMQs, taking the total to close to the 54 that would mean a no-confidence vote. "We're certainly nearly there," a Tory MP elected in 2019 told Sky News, blaming aggressive bullying tactics by government whips trying to protect the prime minister for stoking the rebellion. And a senior Conservative MP loyal to Mr Johnson told Sky News: "It's very worrying. Support for him is haemorrhaging away. Graham just smiled when I asked him how many letters he had." (Sky)

POLITICS: Boris Johnson's former top adviser Dominic Cummings will be interviewed by top civil servant Sue Gray during her investigation into the gatherings. A Cabinet Office source told Sky News: “If we reach the end of the investigation and the inquiry hasn’t spoken to Dominic Cummings, eyebrows would be raised.” Now, the man himself has confirmed to Sky News that he will indeed be talking to the investigation. (Sky)

POLITICS: Rishi Sunak, Britain’s chancellor, has led a cabinet pushback against calls from culture secretary Nadine Dorries for an end to the BBC licence fee from 2027. UK government insiders said that Sunak had told Dorries that there had not been proper cabinet discussion on whether the licence fee should ultimately be replaced, a view echoed by colleagues. (FT)

POLITICS: Boris Johnson’s promise to “level up” the nation by providing next-generation-speed broadband to most homes by 2025 is under threat as rural dwellers are left behind in the internet revolution, according to a report by parliament’s spending watchdog. (Guardian)

CORONAVIRUS: Boris Johnson will declare the end of coronavirus restrictions today as officials step up plans for post-pandemic Britain. Local Covid testing centres will start to be shut down from the spring as part of the long-term strategy for living with the virus. Working-from-home guidance and Covid passes are due to be scrapped from next week although people will still be told to wear facemasks. Whether this remains law or reverts to guidance is still being finalised. (Times)

CORONAVIRUS: British health officials are aiming to be ready to start charging Britons for COVID-19 tests that are currently free at the end of June, a document seen by Reuters shows, in what could be a risky gambit for the government. Britain has been increasingly dependent on rapid testing to try to tackle the more-transmissible Omicron variant, which has spread rapidly through the population but is less severe. The government has previously said it will end the universal free provision of easy-to-use lateral flow devices (LFDs) at a "later stage", with individuals and businesses bearing the cost. (RTRS)

CORONAVIRUS: Ministers have been issued with a stark warning over mandatory Covid vaccines for NHS workers in England, with a leaked document saying growing evidence on the Omicron variant casts doubts over the new law’s “rationality” and “proportionality”. Two jabs will become compulsory for frontline NHS staff from 1 April after MPs voted on the legislation last month. But the document, drawn up by Department of Health and Social Care (DHSC) officials and seen by the Guardian, said the evidence base on which MPs voted “has changed”, creating a higher chance of objections and judicial review. (Guardian)

EUROPE

EU: Three EU countries have thrown the bloc’s efforts to introduce a global minimum corporate tax rate of 15 percent within 12 months into disarray. Finance ministers from Estonia, Hungary and Poland protested on Tuesday the planned timetable, which G20 countries agreed to in October as part of a wider overhaul of corporate tax rules. The ministers also demanded the initiative be contingent on the rollout of a global levy on the world’s 100 biggest companies, due to be rubber-stamped in June and introduced in 2023. Their concern is that U.S. President Joe Biden will fail to find the Congressional support he needs to implement the same rules, leaving Europe at an economic disadvantage. (Politico)

EU: Access to a new EU fund meant to ensure a just green transition should be conditional on upholding the rule of law and a commitment to climate neutrality, according to a draft European Parliament report on the file seen by POLITICO. As part of plans to reduce greenhouse gas emissions by 55 percent this decade, the European Commission wants to slap a carbon price on fossil fuels used for transport and heating to incentivize a switch to cleaner alternatives. (Politico)

EU: The EU’s digital chief Margrethe Vestager wants the future operation of the so-called metaverse to face more scrutiny, saying that plans to create an all-encompassing virtual reality environment pose new challenges for antitrust regulators. The metaverse has become synonymous with the grand plans of Meta (formerly Facebook) to create shared virtual spaces, allowing for users to interact, work, play games and consume in an immersive digital environment that mirrors many of our real-world habits. “The metaverse will present new markets and a range of different businesses. There will be a marketplace where someone may have a dominant position,” Vestager told POLITICO in an exclusive interview. “Things are happening that we need to be able to follow.” (Politico)

EU: A top EU financial regulator has renewed calls for a bloc-wide “ban” on the main form of bitcoin mining and sounded the alarm over the rising proportion of renewable energy devoted to crypto mining. Erik Thedéen, vice-chair of the European Securities and Markets Authority, told the Financial Times that bitcoin mining had become a “national issue” for his native country Sweden and warned that cryptocurrencies posed a risk to meeting climate change goals in the Paris agreement. (FT)

GERMANY: German banks are becoming too complacent about the risk of borrowers defaulting and the potential for interest rates to rise, particularly in the country’s booming mortgage market, the deputy head of its central bank has warned. Claudia Buch, vice-president of the Bundesbank, told the Financial Times that banks had emerged relatively unscathed from the recession caused by the coronavirus pandemic but are overly optimistic about the future. “We think credit risks are underestimated,” said Buch. “The models that banks and market participants are using are based on historical data. These data might underestimate future macro risk, which is an implicit bias.” (FT)

GERMANY: Germany joined countries like the U.K., France and Italy in recording more than 100,000 new Covid-19 infections on one day, adding to evidence that the highly contagious omicron variant is spreading fast across Europe’s largest economy. (BBG)

ITALY: Silvio Berlusconi's campaign to become Italian president is making little progress and he would be wise to withdraw his candidacy, the right-hand man of the former prime minister said on Tuesday. Vittorio Sgarbi, a lower house deputy who has been trying to persuade undecided lawmakers to back the 85-year-old Berlusconi, said he had suspended his efforts because it was proving "a desperate task". (RTRS)

U.S.

CORONAVIRUS: The fast-moving omicron variant may cause less severe disease on average, but COVID-19 deaths in the U.S. are climbing and modelers forecast 50,000 to 300,000 more Americans could die by the time the wave subsides in mid-March. (AP)

ECONOMY/POLITICS: The White House is seeking to "reset" talks on its $1.75 trillion spending bill, aiming to salvage climate change measures but pare down or cut items like the child tax credit and paid family leave to appeal to U.S. Senator Joe Manchin and other Democrats as soon as this week, said two people working on the plan. Democratic President Joe Biden's administration is expected to pivot from a long-shot attempt to pass voting rights legislation through the Senate, which begins on Tuesday, to renew talks in earnest with lawmakers on a slimmed-down version of the Build Back Better bill, the sources said. White House climate czar Gina McCarthy and U.S. Treasury officials will head to Capitol Hill to meet with lawmakers and staff on the bill, the sources said, as part of the effort to preserve some of Biden's economic and environmental agenda. (RTRS)

POLITICS: Senate Majority Leader Charles Schumer (D-N.Y.) announced on Tuesday that Democrats will force a rules change vote once Republicans block a voting rights bill as soon as Wednesday. "If the Senate cannot protect the right to vote which is the cornerstone of our democracy, then the rules must be reformed. ...If the Republicans block cloture on the legislation before us, I will put forward a proposal to change the rules to allow for a talking filibuster on this legislation,” Schumer said. (Hill)

POLITICS: Sen. Bernie Sanders (I-Vt.) thinks there’s a “good chance” Sens. Joe Manchin (D-W.Va.) and Kyrsten Sinema (D-Ariz.) will face challenges in future Democratic primaries and says he would be open to supporting their opponents. Asked about the likelihood of Manchin and Sinema being challenged by other Democrats, Sanders indicated he thinks “there’s a very good chance” of that happening, though he observed “it’s up to the people of those states.” (Hill)

POLITICS: Rudy Giuliani and two other lawyers who helped former President Donald Trump advance baseless claims of fraud in the 2020 election have been subpoenaed by the House Committee investigating the Jan. 6 insurrection at the U.S. Capitol. Along with Giuliani, Sidney Powell and Jenna Ellis were part of a legal team that spearheaded an attempt to overturn the election results. Trump campaign adviser Boris Epshteyn also was summoned to testify by the committee. (BBG)

ENERGY: The Texas power grid and the natural gas drillers, wind farms and solar arrays that supply it are facing their second test in less than a month as sub-zero weather bears down on the Lone Star state. Temperatures in wide swaths of the second-largest U.S. state are forecast to plunge to well-below normal in coming days, according to the National Weather Service. The freeze will arrive little more than two weeks after the first arctic blast of the year crippled an as-yet undetermined number of gas wells, processing plants and other equipment vital to ensuring the steady flow of fuel to electricity generators. (BBG)

EQUITIES: Microsoft Corp is buying "Call of Duty" maker Activision Blizzard for $68.7 billion in the biggest gaming industry deal in history as global technology giants stake their claims to a virtual future. The deal announced by Microsoft on Tuesday, its biggest-ever and set to be the largest all-cash acquisition on record, will bolster its firepower in the booming videogaming market where it takes on leaders Tencent and Sony. (RTRS)

OTHER

CORONAVIRUS: There's no evidence that healthy children and adolescents need COVID-19 boosters shots, World Health Organization Chief Scientist Dr. Soumya Swaminathan said at a press briefing Tuesday. (Axios)

GEOPOLITICS: Germany signalled on Tuesday that it could halt the Nord Stream 2 pipeline from Russia if Moscow invades Ukraine, and Western nations rallied behind Kyiv over a Russian troop buildup that has stoked fears of war. Stepping up diplomacy after talks with Russia ended in stalemate last week, U.S. Secretary of State Antony Blinken will visit Kyiv on Wednesday before heading to Berlin to discuss "joint efforts to deter further Russian aggression against Ukraine" with German, British and French officials. As fears of conflict rose, Britain said this week it had begun supplying Ukraine with anti-tank weapons, Canada's foreign minister visited Ukraine and German Foreign Minister Annalena Baerbock held talks in Moscow and Kyiv to try to ease tensions. (RTRS)

GEOPOLITICS: U.S. President Joe Biden's top diplomat will seek to defuse a crisis with Moscow over Ukraine when he meets the Russian foreign minister in Geneva this week following visits with Ukrainian leaders in Kyiv and European officials in Berlin. "The United States does not want conflict. We want peace," a senior U.S. State Department official said on Tuesday. (RTRS)

GEOPOLITICS: Russia and Belarus will rehearse repelling an external attack when they hold joint military drills in Belarus next month, both sides said on Tuesday, at a time of acute tensions with the West over neighbouring Ukraine. (RTRS)

JAPAN: Japan on Wednesday will decide to place Tokyo and 12 other areas under a coronavirus quasi-state of emergency as the rapid spread of the Omicron variant lifts nationwide COVID-19 cases to new record highs and threatens to stretch the health care system. (Kyodo)

JAPAN: Japan's debt servicing costs would exceed 30 trillion yen ($261.55 billion) for the first time ever in fiscal 2025 if interest rates rise by 1% more than expected, a draft of the Ministry of Finance's (MOF) estimates, due later this month, showed. The MOF, in its annual estimates over a five-year period, projected debt servicing costs, worth 24.3 trillion yen for the next fiscal year, would hit 28.8 trillion yen in fiscal 2025, assuming interest rates at 1.3%. The estimated amount, to be presented at the lower house budget committee for debate on the state budget, would rise to 32.5 trillion yen in fiscal 2025 if interest rates rose to 2.3%. It would reach 36.3 trillion yen assuming interest rates at 3.3%, straining spending needed for policy-related areas such as education, defence and public works. (RTRS)

AUSTRALIA: Australia’s government will give visa rebates to students and backpackers who want to come to the country, in a bid to get them to fill a record number of job vacancies caused by the Covid-19 pandemic. Prime Minister Scott Morrison said visitors to Australia who enter on a student or a working holiday visa will get a rebate on their application fee. Morrison said he hoped the new arrivals would be able to help fill some of Australia’s “critical workforce shortages,” particularly in hospitality and agriculture. (BBG)

NEW ZEALAND: New Zealand is reviewing whether to begin a phased reopening of its border next month as it rushes to administer booster vaccination shots before the omicron variant of coronavirus takes hold in the community. “We want to give New Zealanders time to get their boosters,” Covid-19 Response Minister Chris Hipkins told reporters Wednesday in New Plymouth. “We will be moving to a self-isolation model, the question is exactly what the date is.” (BBG)

SOUTH KOREA: Housing prices are expected to further stabilize due largely to the central bank's rate hikes and the Federal Reserve's push for faster monetary tightening, Finance Minister Hong Nam-ki said Wednesday. Hong also voiced concerns that home prices in some regions could show signs of unstable movements due to presidential election candidates' campaign pledges on large-scale development. (Yonhap)

SOUTH KOREA: The top trade officials of South Korea and the United States on Wednesday agreed to strengthen their strategic partnership to actively respond to supply chain issues, new technologies and other major trade issues, Seoul's industry ministry said. South Korean Trade Minister Yeo Han-koo and U.S. Trade Representative (USTR) Katherine Tai held a teleconference earlier in the day ahead of Yeo's planned visit to the U.S. next week. (Yonhap)

MIDDLE EAST: Turkish President Recep Tayyip Erdogan revealed Tuesday that a potential visit by Israel's President Isaac Herzog is being discussed, in yet another sign of Turkish efforts to foster closer relations with Israel. “We're having conversations with President Herzog. Mr. Herzog could visit Turkey,” Erdogan told reporters during a visit to Albania, according to reports in the Turkish media. Israeli sources confirmed preliminary talks are underway, but said no date has been set, and the meeting's feasibility is also unclear. Herzog's spokesman refused to comment. (Haaretz)

TURKEY: Turkey's big state banks have set employee performance targets as they urge clients to convert foreign currencies into lira under a deposit-protection plan introduced last month to stem a currency crisis, according to people familiar with the effort. More than half a dozen bankers, customers and others familiar with the matter interviewed by Reuters describe a concerted push to boost the uptake of the scheme, which President Tayyip Erdogan unveiled when the lira tumbled to a record low in mid-December. (RTRS)

ISRAEL: Negotiations for a plea deal between former prime minister Benjamin Netanyahu and the state prosecution have stalled, according to Tuesday reports. Reports have swirled in recent days claiming Netanyahu was nearing a deal with Attorney General Avichai Mandelblit. Many of the reports have been unsourced and contradictory. There have been no formal confirmations of an emerging deal from either side and there are numerous obstacles that could slow or torpedo an agreement. So far, the main reported stumbling block to reaching a deal has been Mandelblit’s reported insistence on a “moral turpitude” clause, which would bar Netanyahu from political life for seven years. (Times of Israel)

OIL: A key pipeline running from Iraq to Turkey was knocked out by an explosion on Tuesday, adding to pressure on already tight oil markets. Pipeline operator Botas said the fire was brought under control and cooling operations were under way. It would reopen once the “necessary measures” had been taken. The cause of the explosion was unknown. It’s an important route bringing oil from northern Iraq to Europe via Turkey’s Mediterranean port at Ceyhan; the pipeline transported more than 450,000 barrels a day last year. While it’s not clear how quickly it can be brought back, the loss would compound a globally tight physical oil market that has already seen multiple disruptions in recent months. Oil futures settled on Tuesday at the highest since 2014. (BBG)

AIRLINES: Airlines across the world are adjusting their schedules and aircraft deployments for flights to the U.S. over fears that a 5G rollout by AT&T Inc. and Verizon Communications Inc. near American airports could interfere with key safety systems. Dubai’s Emirates Airline said it will suspend flights to several U.S. cities, including Chicago, Newark and San Francisco, while Japan Airlines Co. and ANA Holdings Inc. said Tuesday they will drop some routes and won’t fly their 777 jets to and from the U.S. mainland after a warning from Boeing Co. Korean Air Lines Co. said its 777 and 747-8 aircraft are affected by the 5G service, and is rearranging its fleet. Air India Ltd. also warned flights to the U.S. will be curtailed or revised from Jan. 19. (BBG)

CHINA

PBOC: The People’s Bank of China is likely to cut interest rates once or twice following a 10-bp cut to major policy rates this week, possibly in March or June, as it may need to further boost credit and help stabilize growth before the Federal Reserve begins rate hikes, wrote Ming Ming, deputy research head of CITIC Securities, in the 21st Century Business Herald. The PBOC is also expected to further lower the reserve requirement ratios and introduce more structural tools, said Ming. In the medium term, monetary policy tends to loosen, and the interest rate of China Government Bonds has room to fall further, Mind said. (MNI)

POLITICS: China should pay more attention to surpassing the United States in terms of improving people’s lives and contributing positively to the world, rather than pursuing the goal of becoming the world’s No 1 economy, said the country’s vice foreign minister on Tuesday. Le Yucheng made the comments a day after China published its 2021 gross domestic product (GDP) growth figure of 8.1 per cent, beating expectations and moving its economy closer to the size of that of the US. “Exceeding the US in GDP, we are not interested in it, and this is not what we are going after,” he told a forum held by the Chongyang Institute for Financial Studies at the Renmin University of China in Beijing. “To meet the people’s desire for a better life, this is what the Communist Party of China aims for.” (SCMP)

INFRASTRUCTURE: The Shanghai government seeks to expedite the issuances of bonds for infrastructure in the first half, so as to accelerate projects and stimulate growth, the China Securities Journal reported. Shanghai plans to complete more than CNY200 billion major projects including ports, railway, rail transit, water conservancy and underground pipeline, the newspaper said citing an official document. The government will also launch several major technology-enabled projects including smart hospitals, factories and transportation, guiding more private capital to invest in these areas by offering special loans with preferential interest rates, the newspaper said. (MNI)

OLYMPICS: China has agreed to grant visas to 46 US officials for next month’s Winter Olympics in Beijing, and reiterated its call for Washington to stop politicising the event, a source said. The South China Morning Post reported last month that the US government had submitted three-month applications for 18 people for the Games, just weeks after the White House confirmed it would carry out a diplomatic boycott of the event. A source familiar with the situation said that the list had expanded to 46 officials, most of whom worked for the Department of State. (SCMP)

OLYMPICS: A Beijing 2022 official said on Wednesday that any athlete behaviour that is against the Olympic spirit or Chinese rules or laws will be subject to "certain punishment", when asked about the possibility of athlete protests at next month's games. The official, speaking at a virtual briefing hosted by the Chinese Embassy in the United States, said that punshiments could include cancellation of athlete accreditation if their actions are deemed to be against the Olympic charter. (RTRS)

YUAN: The Chinese yuan is expected to remain strong against the U.S. dollar in the short term due to high domestic demand for FX settlement, despite that China-U.S. interest spread narrowed after the PBOC cut major policy rates this week, the 21st Century Business Herald reported citing analysts. However, the currency may weaken to 6.55 against the dollar by the end of 2022 as the room for further appreciation is limited should the Federal Reserve hikes rates and China’s current account surplus decreases, the newspaper said. Both the onshore and offshore yuan rose above 6.34 on Tuesday, the highest since May 2018. (MNI)

OVERNIGHT DATA

AUSTRALIA JAN WESTPAC CONSUMER CONFIDENCE 102.2; DEC 104.3

AUSTRALIA JAN WESTPAC CONSUMER CONFIDENCE -2.0% M/M; DEC -1.0%

This is a surprisingly solid result given the rapid spread of the omicron COVID variant over the last month. The 2% decline compares to the 5.2% drop seen in the first month of the delta outbreak in NSW, a 6.1% drop heading into Victoria’s ‘second wave’ outbreak in 2020 and the epic 17.7% collapse when the pandemic first hit in early 2020. Note that the headline Index and its components are all seasonally adjusted to remove a regular holiday-related January lift – the 2% decline in the headline index essentially means this regular lift failed to materialise in 2022. State and sub-group measures are not seasonally adjusted.While the January sentiment result was resilient overall, responses over the course of the survey week – from January 10 to January 14 – did show a deterioration suggesting some increased anxiety as the week progressed. (Westpac)

NEW ZEALAND DEC CREDIT CARD SPENDING RETAIL +0.4% M/M; +9.5% NOV

NEW ZEALAND DEC CREDIT CARD SPENDING TOTAL +1.9% M/M; +8.9% NOV

CHINA MARKETS

PBOC INJECTS NET CNY90BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rate unchanged at 2.1% on Wednesday. The operation has led to a net injection of CNY90 billion after offsetting the maturity of CNY10billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1230% at 09:30 am local time from the close of 2.0719% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 49 on Tuesday vs 44 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3624 WEDS VS 6.3521

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3624 on Wednesday, compared with 6.3521 set on Tuesday.

MARKETS

SNAPSHOT: No Reprieve For Risk, MidEast Pipeline Outage Supports Crude

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 793.59 points at 27463.66

- ASX 200 down 76.275 points at 7332.5

- Shanghai Comp. down 15.862 points at 3554.052

- JGB 10-Yr future up 16 ticks at 150.9, yield down 0.8bp at 0.135%

- Aussie 10-Yr future down 5 ticks at 97.975, yield up 5.1bp at 1.997%

- U.S. 10-Yr future -0-03+ at 127-08+, yield unch. at 1.874%

- WTI crude up $1.07 at $86.5, Gold down $0.54 at $1813.21

- USD/JPY down 32 pips at Y114.29

- TORY REBELS CLAIM TO BE ON VERGE OF FORCING VOTE ON JOHNSON’S FUTURE (FT)

- KEY IRAQ-TURKEY PIPELINE KNOCKED OUT BY EXPLOSION (BBG)

BOND SUMMARY: JGBs Regain Poise After Confirmation Of BoJ/Fed Divergence, Tsys & ACGBs Extend Losses

Asia-Pac headline flow failed to add much to the familiar narrative, leaving familiar market dynamics in play, with focus on the policy outlooks of major central banks.

- Selling pressure hit T-Notes from the off, pushing the contract to fresh cycle lows. TYH2 edged away from worst levels (127-03+) in the Tokyo afternoon and last changes hands -0-06 at 127-06. Eurodollar futures operate 0.5-4.5bp lower through the reds. Cash Tsy curve continued to bear flatten in Asia, with the 20-Years outperforming ahead of today's auction of that tenor. The yield on 30-Year Tsys crossed above the 2.2% mark for the first time since June amid fresh cycle highs for yields across the curve. The U.S. data docket is limited to housing starts & building permits, with the main focus set to fall on aforementioned debt supply.

- Aussie bonds clung onto the tailcoats of faltering U.S. Tsys in cash Sydney trade, with yields last seen 3.2-5.5bp higher, albeit the ACGB curve has steepened a tad. The yield on 10-Year ACGBs showed above 2.0% for the first time since Oct. Main futures contracts wavered, with YM last -4.0 & XM -6.0. Bills trade 2-4 ticks lower through the reds. Westpac Consumer Confidence Index posted a somewhat surprisingly modest downtick but the ACGB space showed a limited reaction, with an auction for A$500mn of 2.75% 21 Jun '35 Bonds also largely shrugged off.

- JGB futures clawed back their initial losses and crept higher, extending gains after the Tokyo lunch break. JBH2 trades at 150.85 at typing, 11 ticks above last settlement and 2 ticks below session highs. Cash JGB curve steepened a tad, with yields easing across the curve, save for the super-long end. The BoJ yesterday gave a clear indication that they are keen to stick to their ultra-loose policy stance, which sets them apart from U.S. colleagues. Japan auctioned 1-Year Bills and conducted a liquidity enhancement auction for off-the-run JGBs with 1-5 years until maturity.

JGBS AUCTION: Japanese MOF sells Y2.8479tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8479tn 1-Year Bills:

- Average Yield -0.0909% (prev. -0.1088%)

- Average Price 100.091 (prev. 100.109)

- High Yield: -0.0879% (prev. -0.1068%)

- Low Price 100.088 (prev. 100.107)

- % Allotted At High Yield: 5.5750% (prev. 31.6769%)

- Bid/Cover: 3.164x (prev. 3.682x)

JGBS AUCTION: Japanese MOF sells Y398.7bn of 1-5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y398.7bn of 1-5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.008% (prev. -0.007%)

- High Spread: -0.007% (prev. -0.007%)

- % Allotted At High Spread: 16.7522% (prev. 100.0000%)

- Bid/Cover: 4.429x (prev. 5.539x)

AUSSIE BONDS: The AOFM sells A$500mn of the 2.75% 21 Jun ‘35 Bond, issue #TB145:

The Australian Office of Financial Management (AOFM) sells A$500mn of the 2.75% 21 June 2035 Bond, issue #TB145:

- Average Yield: 2.1526% (prev. 1.2357%)

- High Yield: 2.1550% (prev. 1.2375%)

- Bid/Cover: 2.2480x (prev. 3.3100x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 27.8% (prev. 81.9%)

- Bidders 38 (prev. 43), successful 23 (prev. 16), allocated in full 12 (prev. 9)

FOREX: Yen Benefits From Risk Aversion, Kiwi Firms On Hawkish RBNZ Bets

The yen swung from losses to gains as market sentiment turned sour, with Asia-Pac equity benchmarks retreating amid lingering angst surrounding the looming withdrawal of stimulus by the Fed. Spot USD/JPY lost altitude after charting a Doji candlestick on Tuesday.

- The NZD caught a bid as participants added hawkish RBNZ bets, with money markets now pricing ~31bp worth of tightening come the end of the Feb MPC meeting. ANZ revised their RBNZ call, noting that they expect the OCR to peak at 3% in Apr '23 rather than at 2% in 2H2022 as inflation pressures remain. Rising milk prices may have lent some additional support to the kiwi after a strong GDT auction held on Tuesday.

- The U.S. dollar lost shine and fared worse than most of its major peers, with the DXY slipping from a one week-high printed Tuesday. This helped spot USD/CNH edge lower, even as the PBOC pledged to use more monetary policy tools.

- German, UK & Canadian inflation data, U.S. housing starts & building permits as well as comments from ECB's Holzmann & BoE officials take focus from here.

FOREX OPTIONS: Expiries for Jan19 NY cut 1000ET (Source DTCC)

- USD/JPY: Y114.50-55($585mln), Y115.00($512mln)

- AUD/USD: $0.7245-50(A$535mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/01/2022 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 19/01/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 19/01/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 19/01/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 19/01/2022 | 0900/1000 | ** |  | EU | EZ Current Acc |

| 19/01/2022 | 0930/0930 | * |  | UK | ONS House Price Index |

| 19/01/2022 | 1000/1100 | ** |  | EU | construction production |

| 19/01/2022 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 19/01/2022 | 1330/0830 | *** |  | CA | CPI |

| 19/01/2022 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 19/01/2022 | 1330/0830 | *** |  | US | Housing Starts |

| 19/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.