-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

MNI EUROPEAN OPEN: North Korean Alert

EXECUTIVE SUMMARY

- FOMC MINUTES: FOMC AGREED MODEST RATE HIKE PRUDENT (MNI)

- FED'S DALY: ECONOMY COULD KEEP SLOWING WITHOUT MORE HIKES (MNI)

- WHITE HOUSE WORKS TO SATISFY SENATE DEMOCRATS IN FED VICE CHAIR SEARCH (WSJ)

- ECB HAS COMPLETED MOST OF ITS RATE-HIKING JOURNEY, VILLEROY SAYS (BBG)

- BOE BAILEY SAYS CAN HALT QT IF MARKETS STRESSED (MNI)

- BOJ’S UEDA HIGHLIGHTS RISK OF INFLATION FALLING BELOW TARGET (BBG)

- NORTH KOREA FIRES BALLISTIC MISSILE TOWARD EAST SEA (YONHAP)

- US CONGRESSIONAL DELEGATION TO VISIT TAIWAN APRIL 13-15 (AIT)

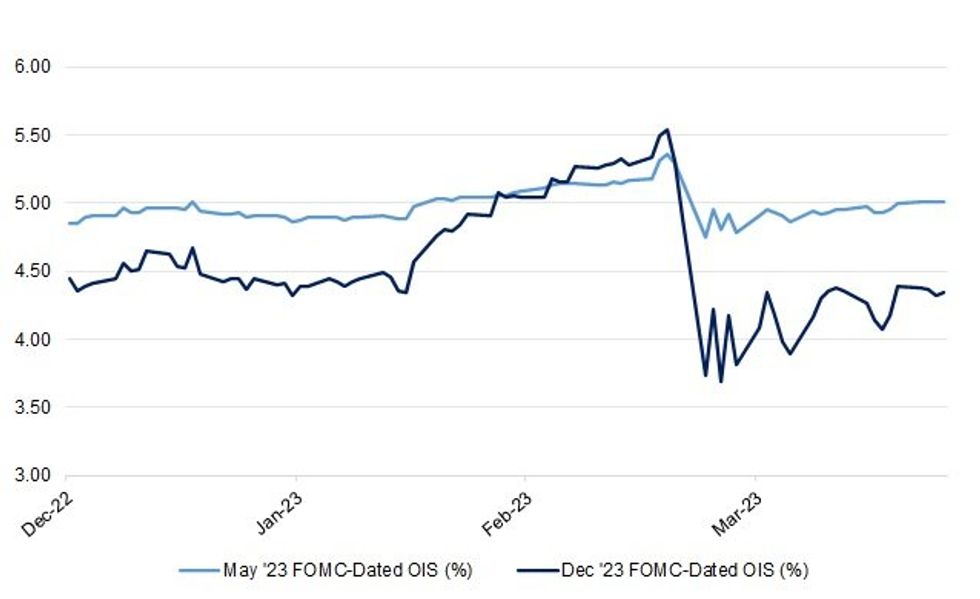

Fig. 1: May '23 & Dec '23 FOMC-Dated OIS (%)

Source: MNI - Market News/Bloomberg

UK

BOE: Bank of England Governor Andrew Bailey said Wednesday the end point for balance sheet reduction was unknown and that the Bank was ready to suspend quantitative tightening if markets conditions were to become stressed. (MNI)

BOE: Bank of England Governor Andrew Bailey said he did not see signs of a repeat of the 2007/8 global financial crisis, speaking at the International Monetary Fund Spring Meetings in Washington. "I do not see the evidence that we've got on our hands what I would call ... the makings of a 2007/8 financial crisis. I really don't see that," Bailey said when asked about recent instability in the banking sector. "The system is in a much more robust condition," he added. (RTRS)

ECONOMY/POLITICS: UK Chancellor of the Exchequer Jeremy Hunt signaled an election may be held as early as spring 2024 by which point he expects the economy to have “turned the corner.” (BBG)

EUROPE

ECB: The European Central Bank has already completed most of the interest-rate rises it needs to combat sticky underlying inflation, with the biggest impact of past increases yet to come, Governing Council member Francois Villeroy de Galhau said. (BBG)

ECB: European Central Bank Governing Council member Ignazio Visco said the turbulence in financial markets and collapse of lenders including Silicon Valley Bank increase uncertainty over the outlook for the world economy. (BBG)

ITALY: Italian Prime Minister Giorgia Meloni’s government proposed Flavio Cattaneo as the new chief executive officer of energy company Enel SpA, resolving a spat within her governing coalition. (BBG)

BANKS: The European Commission’s proposed banking reform package will allow authorities to tap deposit insurance funds to finance some bank resolutions. The bloc’s current approach “did not fully deliver with respect to key overarching objectives,” the EU’s executive arm says in draft documents seen by Bloomberg. “The reasons are mainly due to misaligned incentives” when national authorities need to choose which resolution tools to use when a bank fails, the commission said. (BBG)

BANKS: Brussels is set to unveil plans to better shield taxpayers from bank failure by strengthening its rules for struggling lenders. (FT)

U.S.

FED: Federal Reserve officials debated a temporary pause to interest rate hikes last month as a banking sector crisis raged but unanimously decided inflation pressures were still sufficiently worrisome to warrant a quarter point interest rate increase, according to minutes of the March meeting released Wednesday. (MNI)

FED: With credit tightening underway, the U.S. economy could slow enough to bring down inflation without the Federal Reserve lifting interest rates further, San Francisco Fed President Mary Daly said Wednesday. (MNI)

FED: The White House is working to secure the support of key Capitol Hill allies as officials deliberate over whom to nominate for the No. 2 job at the Federal Reserve, according to people familiar with the matter, with Democrats' slim majority in the Senate hanging over the search. (WSJ)

FISCAL: The U.S. government recorded a $378-billion budget deficit in March as outlays outpaced revenues, the Treasury Department said on Wednesday. (RTRS)

BANKS: White House economic adviser Lael Brainard said on Wednesday the U.S. banking system is "sound" and stable after two bank failures last month, but institutions that fail to show investors they are managing risks effectively may come under market pressure. (RTRS)

EQUITIES: Short interest on the Nasdaq rose 4.0% in the second half of March, the exchange said on Wednesday. (RTRS)

OTHER

U.S./CHINA: Most U.S. adults in a survey say they have little confidence that Chinese President Xi Jinping will “do the right thing regarding world affairs,” according to the poll by the Pew Research Center released Wednesday. Despite that pessimism, more than half of people in the U.S. said the two countries can work together on trade and economic policy, the survey found. (CNBC)

U.S./CHINA/TAIWAN: Republican Senator John Hoeven will visit Taiwan from April 13-15 as part of a trip to the Indo-Pacific region, according to a statement from American Institute in Taiwan, the US’s de facto embassy in Taipei. (BBG)

GEOPOLITICS: President Emmanuel Macron said France's position on Taiwan had not changed and that he favoured the current "status quo" in respect of the island. He made the comment at a news conference during a state visit to The Netherlands. In an interview with news outlet Politico and daily Les Echos, Macron had cautioned against being drawn into a crisis over Taiwan driven by an "American rhythm and a Chinese overreaction." (RTRS)

GEOPOLITICS: The US is an essential partner for protection but “Europe needs a powerful voice in geopolitics and there is a risk that we won’t accumulate sufficient amount of power,” Dutch Prime Minister Mark Rutte said at a joint press conference with French President Emmanuel Macron in Amsterdam. (BBG)

G7: G7 finance leaders pledged on Wednesday to take action to maintain the stability of the global financial system after recent banking turmoil and to give low- and middle-income countries a bigger role in diversifying supply chains to make them more resilient. (RTRS)

BOJ: New Bank of Japan Governor Kazuo Ueda struck a dovish tone once again by highlighting the risk of inflation slowing below the central bank’s target. Comparing the risk of inflation overshooting and falling below 2%, “it’s appropriate to conduct monetary policy by focusing on the latter risk” considering economic conditions, Ueda told reporters in Washington Wednesday. (BBG)

SOUTH KOREA: South Korean FX authorities and National Pension Service agree on a FX swap deal of up to $35b that will last until the end of 2023, Bank of Korea and finance ministry say in a statement. (BBG)

SOUTH KOREA: South Korea is likely to raise electricity and gas charges for 2Q and an announcement may come as early as next week, Maeil Business Newspaper says, without citing anyone. (BBG)

NORTH KOREA: North Korea fired an unspecified ballistic missile toward the East Sea on Thursday, South Korea's military said, following its continued refusal to answer what used to be daily cross-border calls. (Yonhap)

BOC: The Bank of Canada will likely keep interest rates at the current peak of 4.5% until around the end of this year, shunning the cut some investors are predicting to make sure inflation keeps moving back to target, former adviser Steve Ambler told MNI. (MNI)

TURKEY: Turkish President Recep Tayyip Erdogan expressed confidence that he will be reelected next month and his victory will amount to a message to the West, which he’s said oppose to him and support his rivals. (BBG)

BRAZIL: Brazil central bank chief Roberto Campos Neto told investors he was encouraged by this week’s inflation print but wants to see a downward trend before altering course, according to three people familiar with the conversations. (BBG)

RUSSIA: Russian President Vladimir Putin personally approved the arrest of a US reporter on espionage charges for the first time since the Cold War, according to people familiar with the situation. (BBG)

RUSSIA: Annual inflation in Russia dropped below the central bank's 4% target in March for the first time in a year, as the base effect of last year's double-digit price rises takes hold, data from the state statistics service Rosstat showed on Wednesday. (RTRS)

SOUTH AFRICA: South Africa’s central bank has the freedom to adjust monetary policy without having to follow the Federal Reserve’s interest-rate hikes because the effects of the US institution’s moves feed into the exchange rate and domestic inflation, which the Reserve Bank targets, its chief said. (BBG)

ARGENTINA: Argentina’s central bank board will keep its benchmark interest rate unchanged on Thursday at a weekly meeting despite expectations that inflation data coming Friday will show prices accelerated last month. (BBG)

WORLD BANK: The World Bank arm that provides help to the poorest countries plans more concessional loans and grants to nations facing higher risks of debt distress, a move that could unlock impasses hindering the restructure billions of dollars of debt held by low- income nations. (BBG)

EQUITIES: SoftBank has moved to sell almost all of its remaining shareholding in Alibaba, limiting its exposure to China and raising cash as the market downturn pummels the value of its technology investments. The Japanese group, led by billionaire founder Masayoshi Son, has sold about $7.2bn worth of Alibaba shares this year through prepaid forward contracts, after a record $29bn selldown last year. The forward sales, revealed through a Financial Times analysis of regulatory filings sent by post to the US Securities and Exchange Commission, will eventually cut SoftBank’s stake in the $262bn Chinese ecommerce group to just 3.8 per cent. (FT)

ENERGY: The crisis that sent natural gas prices skyrocketing in Europe over the past couple of years isn’t fully over as the region is still faced with constrained supplies and rising competition overseas for the heating and power-generation fuel, according to the boss of TotalEnergies SE. (BBG)

ENERGY: Birol added that Europe should be able to do without Russian liquefied natural gas. (RTRS)

OIL: The global oil market could see tightness in the second half of 2023, which would push oil prices higher, said Fatih Birol, executive director of the International Energy Agency. Birol added that global fossil fuel consumption could peak before the late-2020's. (RTRS)

OIL: US energy secretary Jennifer Granholm said on Wednesday that the federal government could begin buying oil to replenish an emergency stockpile later this year, “if it is advantageous to taxpayers”. (FT)

OIL: Russia’s war in Ukraine is the only thing that stopped the Biden administration from trying to shut down the US fossil-fuel industry, according to one of shale’s biggest producers. (BBG)

OIL: The U.S. Permian basin has not seen peak production, and increases in output from the region will help to offset production declines in other basins going forward, said Occidental Petroleum Chief Executive Vicki Hollub on Wednesday. (RTRS)

OIL: Oil and gas drillers in shale fields stretching from the Eagle Ford in Texas to the Duvernay in Canada say they’re finally seeing some relief from the rising costs that have restrained profits and production in recent years. (BBG)

CHINA

ECONOMY: Residents are continuing to save more in Q1 and will switch to consumption only after income levels recover, Yicai news agency said. Household deposits increased by CNY6.2 trillion in January, CNY792.6 billion in February, and CNY2.9 trillion in March, according to The People’s Bank of China data. Lower and middle income wages will increase this year as the economy recovers and this will drive consumer demand, an analyst said. (MNI)

ECONOMY: China’s growth model now depends more on service sector investment than real-estate, according to Liu Shijin, vice chairman of the Development Research Center of the State Council. (MNI)

FTZS: Authorities should relax operating rules for Free Trade Zones (FTZ) to leverage high-quality growth and further open the economy, according to a Yicai editorial. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY1 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) conducted CNY9 billion via 7-day reverse repos on Thursday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY1 billion after offsetting the maturity of CNY8 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 09:28 am local time from the close of 1.9881% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 41 on Wednesday, compared with the close of 45 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8658 THURS VS 6.8854 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8658 on Thursday, compared with 6.8854 set on Wednesday.

OVERNIGHT DATA

CHINA MAR US$ TRADE BALANCE +$88.19BN; MEDIAN +$40.00BN; FEB +$16.82BN

CHINA MAR US$ EXPORTS +14.8% Y/Y; MEDIAN -7.1%; FEB -1.3%

CHINA MAR US$ IMPORTS -1.4% Y/Y; MEDIAN -6.4%; FEB +4.2%

CHINA MAR CNY TRADE BALANCE +CNY601.01BN; FEB +CNY112.20BN

CHINA MAR CNY EXPORTS +23.4% Y/Y; FEB +5.2%

CHINA MAR CNY IMPORTS +6.1% Y/Y; FEB +11.1%

JAPAN MAR M2 MONEY STOCK +2.6% Y/Y; FEB +2.6%

JAPAN MAR M3 MONEY STOCK +2.1% Y/Y; FEB +2.2%

AUSTRALIA MAR EMPLOYMENT CHANGE +53.0K; MEDIAN +20.0K; FEB +63.6K

AUSTRALIA MAR FULL-TIME EMPLOYMENT CHANGE +72.2K; FEB 79.2K

AUSTRALIA MAR PART-TIME EMPLOYMENT CHANGE -19.2K; FEB -15.6K

AUSTRALIA MAR UNEMPLOYMENT RATE 3.5%; MEDIAN 3.6%; FEB 3.5%

AUSTRALIA MAR PARTICIPATION RATE 66.7%; MEDIAN 66.6%; FEB 66.7%

AUSTRALIA CONSUMER INFLATION EXPECTATIONS +4.6% Y/Y; MAR +5.0%

SOUTH KOREA MAR EXPORT PRICE INDEX -6.4% Y/Y; FEB -2.6%

SOUTH KOREA MAR EXPORT PRICE INDEX +2.0% M/M; FEB +0.8%

SOUTH KOREA MAR IMPORT PRICE INDEX -6.9% Y/Y; FEB -0.7%

SOUTH KOREA MAR IMPORT PRICE INDEX +0.8% M/M; FEB +1.9%

UK RICS HOUSE PRICE BALANCE -43%; MEDIAN -48%; FEB -47%

MARKETS

US TSYS: Marginally Cheaper In Asia As Regional Matters Dominate

TYM3 deals at 115-23, +0-00+, a 0-08+ range has been observed on volume of ~65k.

- Cash tsys sit 1-2bps cheaper across the major benchmarks, light bear flattening has been observed.

- Tsys were marginally richer to start as the latest North Korean missile test provided a level of support in early trade. The move however had little follow through and tsys pared gains to sit marginally cheaper.

- Pressure extended a touch as spillover from ACGBs in lieu of the Australian Unemployment rate holding steady weighed on tsys.

- Losses were marginally pared and tsys dealt in narrow ranges with little follow through on moves for the remainder of the Asian session.

- UK GDP and final German CPI provide the highlights in Europe. Further out we have PPI and Initial Jobless claims. We also have the latest 30-Year Supply.

JGBS: Curve Twist Flattens

Core global FI markets have generally ticked away from session lows, with a similar dynamic observed in JGB futures as we approach the bell. The contract is -3, after more than reversing the modest overnight session uptick. Cash JGBs are 1bp cheaper to 3bp richer as the curve twist flattens.

- Mixed internals at the latest liquidity enhancement auction for off-the-run 15.5- to 39-Year JGBs applied pressure in the early part of the Tokyo afternoon (spread dynamics were firm, but the cover ratio was soft, probably owing to the flatness of the JGB curve). A recovery from session lows in Asia-Pac equities pressured JGBs earlier in the day.

- Elsewhere, support from the previously outlined North Korean missile launch and dovish rhetoric from BoJ Governor Ueda gave way as the tension surrounding the missile launch peeled off from extremes, with the projectiles avoiding Hokkaido. An uptick from session lows in equities also applied some light pressure to the space.

- In terms of specifics, Ueda pointed to a need to exercise more caution re: inflation undershooting the Bank’s goal than overshooting it on a sustainable basis, flagging differences between inflation in Japan vs. its major global peers. As mentioned above, this once again places Ueda on the dovish side of the broader spectrum, at least for now.

- Looking ahead, the latest BoJ Rinban operations headline the domestic docket on Friday.

JGBS AUCTION: Liquidity Enhancement Auction For OTR 15.5- To 39-Year JGBs Results

The Japanese Ministry of Finance (MOF) sells Y499.5bn of 15.5- to 39-Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.013% (prev. -0.005%)

- High Spread: -0.011% (prev. -0.003%)

- % Allotted At High Spread: 96.0084% (prev. 13.9264%)

- Bid/Cover: 2.797x (prev. 3.004x)

AUSSIE BONDS: Yields Higher After Jobs Data

ACGBs sit just off session cheaps (YM -4.0 & XM -4.5) after stronger-than-expected employment data sparks a 9bp and 6bp sell-off in respectively 3-year and 10-year bond futures. The Employment Report for March printed a 53k increase and an unemployment rate of 3.5% versus expectations of +20k and 3.6%. Overall, today’s data presented a robust labour market with demand in line with trend supply (higher participation rate and more hours worked) growth.

- Cash ACGBs are 4bp weaker with the AU-US 10-year yield differential +5bp at -12bp.

- Swap rates are 5bp higher with EFPs slightly wider.

- Bills strip shunts 4-8bp cheaper after the data to be -4 to -7 on the day.

- RBA dated OIS firms 4-7bp for meetings beyond August after the data with year-end easing expectations reduced to 14bp. A 23% chance of a 25bp hike in May remains priced.

- Also on the data front, Melbourne Institute Inflation Expectations eased from 5.0% to 4.6%, their lowest in 14 months.

- With the local calendar light until next week, the local market will focus on US Tsys as it navigates US PPI and Initial Jobless Claims today ahead of US Retail Sales and Industrial Production for March on Friday.

NZGBS: At Cheaps, Higher ACGB and US Tsy Yields

NZGBs closed 1-4bp cheaper at session cheaps in sympathy with the post-employment data weakening in ACGBs. US Tsys are also 1-2bp cheaper in Asia-Pac trade. Like ACGBs, NZGBs have underperformed US Tsys with the 10-year yield differential +6bp at +64bp. The weekly NZGB auction held today displayed robust demand (cover ratio 3.0-4.0x range). However, with the shortest offering approximating a 5-year bond versus a 3-year bond last week, today’s auction failed to receive bids linked to RBNZ over-tightening risks and recessionary concerns.

- Swap rates are 3-4bp higher with the implied swap spread box flatter.

- RBNZ dated OIS closed little changed with 20bp of tightening priced for the May meeting and 42bp of easing priced for Feb-24 off a terminal OCR expectation of 5.48% (July).

- The local calendar is scheduled to release Manufacturing PMI (Mar) and Net Migration (Feb) tomorrow. The PMI has moved well off its recent low (47.4), but headwinds are mounting after the RBNZ’s aggressive tightening cycle. Net migration has recently returned to strong inflows with the border now open.

- Further afield, US PPI and Initial Jobless Claims will be the focus today ahead of US Retail Sales and Industrial Production for March on Friday.

EQUITIES: Firm Chinese Exports Help Turn Risk Mood, Hang Seng Tech Struggles

The early negative momentum in e-mini futures, as Asia-Pac participants reacted to Wednesday’s Wall St. downtick, as well as the negative feedthrough from the latest North Korean missile launch (which triggered a cautionary seek shelter warning in Japan’s Hokkaido region, although the warning was subsequently removed), has reversed, with the 3 major contracts running little changed to 0.2% firmer.

- The Hang Seng has bounced from early session lows after shedding ~2%, with the uptick in e-minis and much firmer than expected monthly export data out of China aiding that dynamic, although the index still runs 0.5% worse off on the day.

- To recap, the early weakness in the Hang Seng stemmed from pressure on tech giant Alibaba, which tumbled after the FT pointed to SoftBank offloading a significant chunk of its holdings in the company. Meanwhile, embattled Chinese property developer Sunac came under notable pressure as dealing in the company’s equity resumed after a year-long halt. Tech names kept the index heavy (HS Tech last -1.1%).

- The Nikkei 225 benefitted from the aforementioned turnaround in risk appetite, more than paring early losses, last printing 0.2% higher. The related move away from session lows in USD/JPY further aided the bid in the Nikkei 225. This comes after data from the Japanese MoF revealed the largest ever round of weekly net purchases of Japanese equities on the part of international investors (for the week ending 7 April).

GOLD: Bullion Supported By Lower US Inflation, Watch PPI Later

Gold prices are up another 0.2% to $2019.25/oz during the APAC session after finishing 0.6% higher on Wednesday at $2014.93. Gold spiked following the lower-than-expected US headline inflation data to a high of $2028.28, which pushed the greenback lower, but soon afterwards bullion tested the $2000 level. The USD is close to flat today.

- With core inflation in the US rising 0.1pp to 5.6%, as expected, analysts still expect the Fed to hike rates 25bp on May 3. The greater decline in the headline though has supported bullion as the market now expects monetary easing by year end.

- Later there is US PPI data for March, which is expected to post lower annual growth rates, and also jobless claims. There are no Fed speakers scheduled. There is also euro area and UK February output data.

OIL: Crude Lower Today But Market Generally More Positive

Oil prices are down during APAC trading today after rising around 2% on Wednesday on the back of a weaker dollar driven by the larger than expected drop in headline US inflation. WTI is currently 0.3% lower at $82.98/bbl and Brent is -0.4% to $87.00, both are around their intraday lows. The USD is close to flat so far today.

- Supply factors have also been supporting crude with OPEC announcing it will reduce output from May, flows from Iraqi Kurdistan still halted, signs that Russia is reducing production and lower US stocks at Cushing. Timespreads from futures contracts are also pointing to a tightening of the market. Moderating US inflation is boosting optimism that the Fed is close to a peak but core remains sticky. Analysts still expect another 25bp hike in May.

- China saw a sharp increase in energy imports in March to their highest since mid-2020. Also exports of refined products fell 12%, as fuel was kept for domestic use.

- The monthly OPEC report on market conditions is published today. On Wednesday, the IEA said that it expects demand to be stronger than supply in H2 2023.

- Later there is US PPI data for March, which is expected to post lower annual growth rates, and also jobless claims. There are no Fed speakers scheduled. There is euro area and UK February output data.

FOREX: AUD Firms As Labor Market Remains Tight

The AUD is the strongest performer in the G-10 space at the margins. The March employment report did not show any signs of the labour market easing, the unemployment rate held steady at 3.5% and the participation rate rose a touch to 66.7%. Elsewhere in G-10 ranges have been narrow with little follow through in a relatively muted Asian session.

- AUD/USD firmed in the aftermath of the print, post US-CPI highs remain intact for now as resistance was seen at $0.6720 and the pair marginally pared gains to sit ~0.3% higher.

- AUD/NZD briefly dealt above $1.08, the handle has emerged as a key level for bulls as they have been unable to sustain a break of this level in recent dealing.

- NZD/USD is a touch firmer, the pair last prints at $0.6215/20 ~0.1% higher today. A narrow $0.6200/20 range has been observed through the session as the NZD hasn't followed through on moves.

- Yen was firmer in early trade, USD/JPY dropped below the ¥133 handle as North Korea conducted their latest missile test. Support was seen below this level and the pair pared losses to sit a touch firmer.

- Cross asset wise; e-minis pared early losses to sit a touch firmer. BBDXY is little changed and US Treasury Yields are marginally higher across the curve.

- UK GDP and final German CPI provide the highlights in Europe. Further out we have US PPI and Initial Jobless claims.

FX OPTIONS: Expiries for Apr13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E3.4bln), $1.0850(E1.7bln), $1.0885-90(E1.1bln), $1.0900(E6.3bln), $1.0950(E1.5bln), $1.1000(E3.1bln)

- USD/JPY: Y131.25-30($800mln), Y132.00-05($1.3bln), Y132.20-25($663mln), Y133.00($1.2bln), Y134.00-05($1bln)

- GBP/USD: $1.2360-80(Gbp1.1bln)

- EUR/GBP: Gbp0.8795-10(E595mln)

- AUD/USD: $0.6625-30(A$1.7bln), $0.6645-50(A$1.7bln)

- USD/CAD: C$1.3525($1bln)

- USD/CNY: Cny6.8785-00($500mln), Cny6.9000($852mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/04/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 13/04/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/04/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/04/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 13/04/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/04/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/04/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 13/04/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank, G20 Finance Ministers' Meetings | |

| 13/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 13/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/04/2023 | 1230/0830 | *** |  | US | PPI |

| 13/04/2023 | 1300/0900 |  | CA | Governor Macklem speaks at IMF | |

| 13/04/2023 | 1300/1400 |  | UK | BOE Pill Speaker at MNI Connect | |

| 13/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/04/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.