-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Politics At The Fore Over The Weekend

EXECUTIVE SUMMARY

- FED'S CLARIDA, ECHOING POWELL, BACKS START OF TAPER THIS YEAR (DJ)

- FED'S WALLER: STRONG AUG JOBS REPORT WILL BE GREEN LIGHT FOR TAPER (YAHOO FINANCE)

- GERMAN SPD'S SCHOLZ WINS ELECTION DEBATE IN BLOW TO MERKEL HEIR (BBG)

- KUWAITI OIL MINISTER: OPEC+ COULD RECONSIDER OUTPUT INCREASE (RTRS)

- PBOC KEEPS DRIPPING IN LIQUIDITY VIA OMOS FOR MONTH-END NEEDS

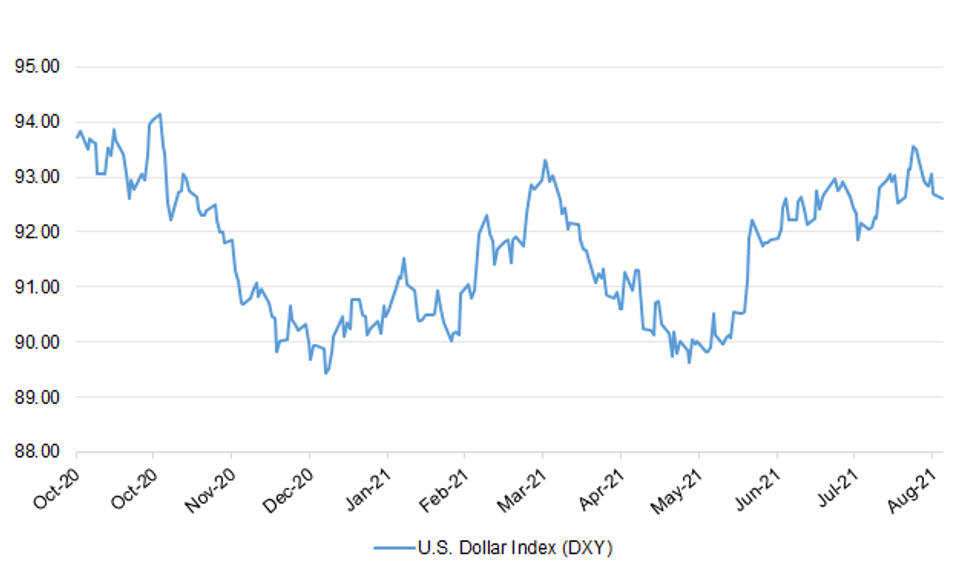

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Offering all teenagers a coronavirus jab will "solidify our wall of protection", the health secretary has said in his most bullish comments on child vaccination so far. Piling pressure on scientists to give the go-ahead, Sajid Javid promised that once they do there will be a rapid rollout, with schools and the NHS ready to give jabs with a "sense of urgency". Parents will be consulted but children will have the final say as they are deemed competent to consent to treatment, he suggested. Pupils could receive either the Pfizer or the Moderna vaccine, both of which have been approved in the UK for children aged 12 and above. (The Times)

CORONAVIRUS: The U.K. government's scientific advisers said Covid-19 cases are likely to rise exponentially among children when schools resume next month after the summer holidays. Most U.K. children haven't been vaccinated against coronavirus and it would be "sensible" for the government to plan for "high prevalence" in schools by the end of September, according to a document dated Aug. 11 that was released on Friday by the government's Scientific Advisory Group for Emergencies. (BBG)

CORONAVIRUS: Britain is lagging severely behind the rest of Europe when it comes to reopening international travel, raising fears that the country is missing out on a significant part of the economic rebound despite its early lead in vaccines. International flight levels are running at around one-third of their 2019 levels, according to analysis from Jefferies. By contrast eurozone flights are back to half of their pre-Covid numbers. Once domestic flights are included the UK is still down by around half while France and Italy are within one-third of their old flight numbers, according to Eurocontrol data. (Telegraph)

ECONOMY: The number of people dining out in London remains below pre-pandemic levels months after Covid restrictions were lifted, with a lack of tourists still hurting the capital's pubs and restaurants. (Telegraph)

ECONOMY: Business groups have been left "frustrated" after the business secretary rejected requests to loosen Brexit immigration rules to ease the supply chain crisis, telling companies to hire UK-based workers instead. Businesses across multiple sectors are struggling to meet customer demand as a consequence of labour shortages, particularly in haulage where there is a shortfall of an estimated 100,000 HGV drivers. The industry says this is a consequence of Brexit and the coronavirus pandemic. EU drivers now require a visa to work in the UK, but are not included on the government's shortage occupation list and do not qualify for their definition of skilled workers. (Sky)

BREXIT: Democratic Unionist Party (DUP) leader Sir Jeffrey Donaldson has accused the Irish government of "harming" Northern Ireland's relationship with the rest of the UK through its support for the Brexit deal. His comment came after he met Taoiseach (Irish Prime Minister) Micheál Martin. Their meeting in Dublin was their first since Sir Jeffrey became DUP leader. Mr Martin said he accepted unionists had "genuine concerns" over post-Brexit arrangements for Northern Ireland. But Sir Jeffrey warned that relations between Dublin and Stormont could become "untenable" if problems with the Northern Ireland Protocol could not be resolved. (BBC)

FISCAL: Rishi Sunak should drop the pensions triple lock in a painful spending review this autumn to save £4 billion a year, an influential think tank has argued. The chancellor's desire to break a Conservative manifesto commitment has been boosted by the support of the Institute for Government, which argues that it would be reasonable this year to avoid a "perverse" pensions increase of about 9 per cent. The institute warns that the government cannot meet all of its manifesto commitments in the wake of the pandemic and that a multi-year spending review due in the autumn would "crystallise difficult choices" for the chancellor. (The Times)

NORTHERN IRELAND: Two-thirds of voters in Northern Ireland believe there should be a vote over its place in the UK, but only 37% want it to take place within the next five years, according to a new poll for the Observer. Some 31% of voters said there should be a vote at some point about Northern Ireland's place in the UK but after 2026, the LucidTalk poll found. A further 29% said there should never be such a vote. There is currently a seven-point lead for Northern Ireland remaining part of the UK should any vote take place. Asked to state how they would vote, 49% said they would back remaining in the UK, while 42% backed being part of a united Ireland, with 9% saying they did not know. Other recent surveys have put support for a united Ireland much lower. The Northern Ireland Life and Times Survey, published in June, suggested that 30% backed a united Ireland. (Observer)

EQUITIES: Plans by blue-chip companies to increase dividend payments after the pandemic could be derailed by new rules forcing them to allocate spare cash to their pension schemes, an actuarial firm has warned. Companies are underestimating the impact of the new Pension Schemes Act 2021, which is designed to prevent debacles such as Carillion, LCP has warned. The construction group was allowed to pay dividends while its pension schemes were in serious deficit, only to go bust, leaving the pensions industry lifeboat to foot the bill. (The Times)

EUROPE

GERMANY: Finance Minister Olaf Scholz, the Social Democratic candidate for German chancellor, cemented his position as the front-runner to succeed Angela Merkel, giving a competent if wooden performance to see off attacks from rivals. Armin Laschet, the contender from Merkel's conservative camp, was the biggest loser in the first head-to-head clash among the three candidates. He failed to sustain a challenge that might lift his sputtering campaign, while the Greens' Annalena Baerbock gave a spirited performance, landing several blows, especially against Laschet. (BBG)

GERMANY: Germany's Social Democrats rose to an almost four-year high in a weekly poll, adding to evidence that they're pulling ahead of Chancellor Angela Merkel's bloc before a national election on Sept. 26. Insa's poll is the second within days to show Merkel's conservatives now lagging the Social Democrats, who may be set for a remarkable comeback after almost ending up as an opposition party four years ago. (BBG)

GERMANY: The German state of Baden-Wuerttemberg is considering banning unvaccinated people from restaurants and concerts as pressure grows on authorities to act, according to a report in the Bild am Sonntag newspaper. (BBG)

GERMANY: Thousands of protesters gathered in Berlin on Saturday to demonstrate against Germany's pandemic rules. Several dozen activists were detained, according to local media. German authorities have taken a harder line on anti-coronavirus rallies after demonstrators sought to storm the Reichtstag parliament building last year. (BBG)

FRANCE: Thousands of demonstrators gathered in French cities for a seventh consecutive weekend to protest against the government's health pass system, which makes access to restaurants, cafes and other venues conditional on proof of vaccination or a recent negative Covid-19 test. BFM TV reported that 200 protests were planned across the country. (BBG)

ITALY: Italy's government expanded the mask requirement for residents of Sicily to outdoor activities and limited restaurants to seating four people per table, with an exemption for families. (BBG)

AUSTRIA: Austria's conservative People's Party, or OVP, voted overwhelmingly Saturday to reelect Chancellor Sebastian Kurz as its leader at a party gathering. Kurz, 35, received the backing of 533 of 536 delegates, or 99.4%. He has led the party since 2017, and became the country's youngest-ever chancellor later that year. (AP)

SWITZERLAND: Zurich University Hospital will postpone surgeries for patients "not in direct danger to life and limb," as a spike in coronavirus cases fills up intensive care beds in Switzerland, newspaper Neue Zurcher Zeitung reported. (BBG)

SWITZERLAND: Switzerland's Federal Intelligence Service is warning of potential terrorist attacks on coronavirus vaccine infrastructure including vaccination centers, transport and manufacturing facilities, newspaper NZZ am Sonntag reported. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed Poland at A-; Outlook Stable

- DBRS Morningstar confirmed Portugal at BBB (high), Stable Trend

- DBRS Morningstar confirmed Slovakia at A (high), Stable Trend

- DBRS Morningstar confirmed Sweden at AAA, Stable Trend

U.S.

FED: The number two official at the Federal Reserve on Friday backed the start of a taper of bond purchases later this year, in comments that largely echoed Fed Chairman Jerome Powell's Jackson Hole speech. In an interview with CNBC, Fed Vice Chairman Richard Clarida said he expects the trend of "robust" job gains seen this summer to continue and "if that happens I would also support commencing reduction in the pace of our purchases later this year." The economy has added an average of over 800,000 per month over the last three months. Clarida said it wouldn't take the strong pace of 800,000 jobs per month for the Fed to reach its benchmark for tapering of "substantial" progress in the labor markets. "I don't think it takes 800,000 per month, but robust gains," Clarida said. (Dow Jones)

FED: Federal Reserve Governor Christopher Waller said Friday that if the August jobs report next week shows more than 850,000 payroll gains, he would advocate taking the first steps in pulling back the Fed's easy money policies. "I would like to go early this fall," Waller told Yahoo Finance in an exclusive interview on Friday. "I don't see any reason that we would need to wait until next year. That's my own view, unless something really bad comes out in the job market report next week, which I just don't expect to happen." (Yahoo Finance)

FED: The U.S. Federal Reserve has met its goal of "substantial further progress" on both employment gains and inflation and should begin to reduce its massive monthly bond buys this year, Cleveland Fed Bank President Loretta Mester said on Friday. "I am comfortable that we are basically there," Mester said in an interview with broadcaster CNBC. Mester added that she would support the central bank announcing a plan in September "and then we start tapering some time this year." "I would like to see those asset purchases taper down so that they're completed by the middle of next year," she said. (RTRS)

FED: Philadelphia Federal Reserve Bank President Patrick Harker said on Friday that the central bank probably would not raise interest rates before late 2022 or early 2023. "I would like to see the tapering process end, or basically end, before we think about any kind of Fed funds rate increase," Harker said during an interview with Yahoo Finance. "So given that, we're talking about probably late '22 to early '23 before we think about any kind of rate increase." He repeated his view that he would like the tapering process to start "sooner rather than later." (RTRS)

FED: St. Louis Federal Reserve President James Bullard cautioned that "aggressive" action could be taken against inflation if the Fed doesn't taper by the end of Q1 in 2022. "By the time we get over there and see the first half of next year, we're going to have a better view of whether inflation is really going to moderate in 2022 or not," Bullard told FOX Business, "And we need the optionality if it doesn't moderate." (FOX Business)

FED: The Trimmed Mean PCE inflation rate over the 12 months ending in July was 2.0 percent. According to the BEA, the overall PCE inflation rate was 4.2 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 3.6 percent on a 12-month basis. (Dallas Fed)

CORONAVIRUS: President Joe Biden said his administration is considering whether to start booster shots of the coronavirus vaccine as soon as 5 months after people receive a second dose. Soon after Biden made the comments, a White House official said there had been no change in the plan to administer boosters after eight months. Biden nonetheless said he talked with infectious disease expert Anthony Fauci about the possible timeline change earlier in the day, signaling his interest in studying the issue. (BBG)

CORONAVIRUS: Hospitals in the U.S. Southeast are running low on oxygen, with the worst-hit left only 12 to 24 hours worth, said Premier Inc., a hospital-supply purchasing group. This comes amid the region's struggle over the summer with high numbers of Covid-19 cases and hospitalizations. Now Hurricane Ida is set to hit the Gulf Coast in the coming days. (BBG)

CORONAVIRUS: A judge blocked Florida from enforcing Governor Ron DeSantis's ban on mask mandates in schools, clearing the way for educators to require face coverings in classrooms without the threat of retaliation by the state. (BBG)

CORONAVIRUS: U.S. regulators said Eli Lilly & Co.'s monoclonal antibody treatment can only be used in states where coronavirus variants are less prevalent. The move comes after the the U.S. government said earlier this year that Lilly would stop distributing its treatment, bamlanivimab and etesevimab, due to concerns about sustained increase in variants. (BBG)

PROPERTY: Treasury Secretary Janet Yellen and other top Biden administration officials urged governors and mayors across the country to hasten distribution of rental assistance after the Supreme Court struck down a federal coronavirus eviction moratorium benefiting most renters. "We are writing to request your urgent help preventing unnecessary evictions during the pandemic," they said in a letter Friday. "Our bottom line is this: No one should be evicted before they have the chance to apply for rental assistance, and no eviction should move forward until that application has been processed." (BBG)

EQUITIES: The US stock market regulator has asked the public to weigh in on the "gamification" of share trading, in response to concerns that some online apps are prodding investors to take risks they do not fully understand. The US Securities and Exchange Commission on Friday issued a request for comment on the digital practices used by online platforms such as Robinhood to keep customers trading. Gary Gensler, SEC chair, suggested some of these practices could count as stock market recommendations in themselves, leading to much stricter regulation for trading platforms. (FT)

OTHER

GLOBAL TRADE: U.S. officials have begun blocking the import of solar panels that they believe could be products of forced labor in China, implementing a recent ban that could slow construction of solar-energy projects throughout the country. Industry executives and analysts said solar panels from at least three Chinese companies have been targeted in recent weeks, and a Customs and Border Protection spokesman confirmed by email that the agency has "made a number of detentions" of products under the import ban. (Washington Post)

GLOBAL TRADE: The UK aims to wrap up negotiations to join the trans-Pacific trade group by the end of 2022 and hopes that the US can be persuaded to rejoin the bloc, according to the international trade secretary. In an interview with the Financial Times' Payne's Politics podcast, Liz Truss said that negotiations with the group of 11 countries was the immediate focus of the government's "Global Britain" post-Brexit trade agenda. (FT)

U.S./CHINA: A senior Pentagon official held talks with the Chinese military for the first time since President Joe Biden took office in January to focus on managing risk between the two countries, a U.S. official told Reuters on Friday. The United States has put countering China at the heart of its national security policy for years and Biden's administration has described rivalry with Beijing as "the biggest geopolitical test" of this century. (RTRS)

U.S./CHINA/TAIWAN: The Chinese People's Liberation Army (PLA) stayed on high alert and closely monitored two US warships as the latter sailed through the Taiwan Straits on Friday, with the PLA also holding multiple military exercises on both sides of the Straits on the same day. The PLA has full control of the situation in the region, and US' provocative military activities cannot change this, experts said on Saturday. (Global Times)

CORONAVIRUS: People who contract the delta variant of Covid-19 are more than twice as likely to be hospitalized as those infected with the alpha strain, according to a U.K. study, raising the prospect of a greater burden on health services this winter. (BBG)

CORONAVIRUS: President Joe Biden rebuked China for stonewalling a U.S. investigation into the origins of the coronavirus, as his administration reported it was unable to reach firm conclusions because of Beijing's unwillingness to cooperate. China denied that it had hindered the probe. "The world deserves answers, and I will not rest until we get them," Biden said in a statement on Friday shortly after the Office of the Director of National Intelligence released an unclassified summary of the report. "Responsible nations do not shirk these kinds of responsibilities to the rest of the world." The intelligence community determined the virus wasn't created as a biological weapon and said Chinese officials had no "foreknowledge" of the outbreak, but was divided on how it came to infect humans and spread across the globe. (BBG)

CORONAVIRUS: China has made serious protests to the United States over the COVID-19 origins tracing report submitted by the US intelligence community to US President Joe Biden, according to Vice-Foreign Minister Ma Zhaoxu. When delivering a statement issued on Saturday, the Chinese diplomat said the US has been obsessed in political manipulation and its intelligence-based origins tracing, and it disregards science and facts, he said. The motive is "to scapegoat China and spread political virus", he said, adding that mobilizing the intelligence agencies to work on tracing itself is another ironclad proof the US is politicizing the tracing issue. (China Daily)

CORONAVIRUS: A senior Chinese health official rejected a U.S. report blaming China for stonewalling an investigation into the origins of the coronavirus. China opposes the politicization of tracing the origins of the virus or using the subject as a tool to shift blame, according to Zeng Yixin, vice head of National Health Commission. The U.S. should treat origins tracing as a "scientific matter" and support scientists in various countries who are seeking answers on how the virus started, Zeng said in a statement posted on the commission's WeChat account. He reiterated that the Chinese government fully supports virus-tracing work based on open, transparent, scientific and cooperative principles. (BBG)

CORONAVIRUS: The European Union on Friday moved to reinstate COVID travel restrictions like quarantine and testing requirements for unvaccinated citizens of the United States and five other countries, two diplomats told Reuters. EU countries started a procedure to remove the United States from a list of countries whose citizens can travel to the 27-nation bloc without additional COVID restrictions. (RTRS)

CORONAVIRUS: Japan's health ministry is investigating the deaths of two men in their 30s after they received Moderna's Covid-19 vaccines that were among supplies that were later suspended due to risk of contamination. According to the ministry's statement over the weekend, the two individuals, who did not have any underlying conditions, died within three days of receiving their second Moderna shots earlier this month. There was no evidence that the deaths were caused by the vaccines but the ministry said it decided to disclose the cases to enhance transparency. (FT)

JAPAN: Mounting public criticism of Japan's handling of COVID-19 has kept Prime Minister Yoshihide Suga's approval rating languishing at an all-time low, a recent opinion poll shows. Disapproval of the government's handling of the coronavirus crisis rose 6 percentage points to 64%, according to the weekend Nikkei/TV Tokyo poll. The result comes within a hair of the 65% disapproval recorded in April, the highest since the question started being posed in February of last year. Approval of Suga's cabinet in August stood at 34% with disapproval at 56%. The level of support remains unchanged from July's survey, which represented the worst rating since Suga took office. (Nikkei)s

JAPAN: The verbal jabs are coming fast and furious in the race for the presidency of Japan's ruling party. Former policy chief Fumio Kishida -- who entered the fray to become the next leader of the Liberal Democratic Party -- proposed limiting the terms of party officials Thursday. Party officials other than the president should be limited to "one term of one year, [and only] up to three consecutive terms," Kishida said. He added that this would "prevent a concentration of power and people staying in position through habit." He also said he would replace LDP Secretary-General Toshihiro Nikai -- one of the party's most powerful lawmakers and who was the driving force behind Prime Minister Yoshihide Suga's ascendance -- who has held his post since August 2016. (Nikkei)

JAPAN: Japan could mix AstraZeneca Plc's Covid-19 shots with those developed by other companies in order to speed up its vaccination effort, according to the minister in charge of the country's rollout. The idea would be to combine the dose with one from Pfizer Inc. and BioNTech SE or Moderna Inc., Taro Kono said Sunday on a Fuji TV news program. Since AstraZeneca recommends eight weeks between its two shots, it's likely that time could be shortened if combined, Kono added. (BBG)

AUSTRALIA: Australia has notched a record number of Covid-19 case even with roughly half its population in lockdown. New South Wales recorded 1,290 new cases overnight, a day after hitting a previous high of 1,218 new cases, Premier Gladys Berejiklian told reporters Monday. Cases in Australia's most- populous state have topped 20,000 despite months of stay-at-home orders in Sydney, after the outbreak was triggered by an unvaccinated chauffeur infected while transporting airline crew in the city in June. Victoria state is poised to extend its monthlong lockdown beyond this week after recording 73 new cases. Authorities in the Australian Capital Territory are also discussing whether its lockdown will be extended after recording 12 new cases. (BBG)

RBNZ: The Reserve Bank of New Zealand (RBNZ) said on Monday that changes in its policy rate take around six months to have a significant impact on mortgages rates. A change of 1% in the official cash rate (OCR) moves average two-year mortgage rates by 0.34% within a month, but the big impact on mortgage rates takes place six months later where about 0.8% of the 1% change in the OCR is passed through, a RBNZ research note said. (RTRS)

SOUTH KOREA: South Korea said Monday it will begin providing emergency relief funds to people in the bottom 88 percent income bracket next week in the latest move to help them cope with the fallout from the pandemic. The government will begin to provide up to 250,000 won (US$215) per recipient on Sept. 6 as part of an 11 trillion-won cash handout program, according to the interior and finance ministries. The money must be spent by end-December. In July, the country drew up an extra budget of 34.9 trillion won, the second of its kind this year, to finance another round of relief funds to support pandemic-hit small merchants and most other people. (Yonhap)

SOUTH KOREA: South Korea will increase its spending on chips, bio-health and next-generation vehicles by 43 percent next year as the country seeks to nurture new industries, the country's finance minister said Monday. Finance Minister Hong Nam-ki said the government will earmark 6.3 trillion won (US$5.4 billion) to support the three key industries in its 2022 budget proposal. The country has set the non-memory chip, bio-health and next-generation vehicle sectors as the "BIG 3" industries where it seeks to create more jobs and foster innovation-driven growth. Hong said the government plans to build more than 3,300 repair shops for electric cars and 26 ones for hydrogen-powered vehicles by 2025. (Yonhap)

NORTH KOREA: North Korea appears to have resumed operation of its plutonium-producing reactor at Yongbyon in a move that could enable the reclusive country to expand its nuclear-weapons arsenal, the U.N. atomic agency said. The development, disclosed in the agency's annual report on North Korea's nuclear activities, adds a new challenge to President Biden's foreign policy agenda, alongside the dangerous U.S. withdrawal from Afghanistan and stalemated talks on restoring the 2015 deal on Iran's nuclear program. "Since early July, there have been indications, including the discharge of cooling water, consistent with the operation of the reactor," said the report by the International Atomic Energy Agency. (WSJ)

CANADA: Prime Minister Justin Trudeau said his government would require Canada's oil and gas sector to set benchmarks to reduce emissions if he is re-elected. In a platform published Sunday, the Liberals pledged to force oil and gas companies to set five-year targets to cut their emissions with the aim of reaching net zero emissions by 2050. The program would begin in 2025. Part of the plan includes a C$2 billion ($1.6 billion) fund to create green jobs in oil-producing regions. (BBG)

CANADA: Canada has approved the use of Moderna Inc.'s vaccine for people 12 and over. Previously only the Moderna vaccine was approved for adults in Canada. Pfizer Inc.'s vaccine is already approved for those 12 and over in country. (BBG)

TURKEY: Turkey cannot take the burden of a new migrant wave from Afghanistan, Foreign Minister Mevlut Cavusoglu said on Sunday after talks with his German counterpart. (Al Arabiya)

MEXICO: Mexico's new finance minister Rogelio Ramirez de la O said on Friday that the 2022 budget will not increase taxes, and that the government will instead focus on combating tax evasion. Speaking to lawmakers in Congress, Ramirez de la O said the budget would not include tax rate hikes, and would be balanced, responsible and realistic. (RTRS)

BRAZIL: Brazil President Jair Bolsonaro laid out three outcomes for the the presidential elections next year -- he will win the polls, get arrested or killed. Speaking to a group of evangelical leaders, the conservative leader said he will never be imprisoned as "no man on earth" scares him, and that he's "doing the right thing." The president has been ratcheting up his rhetoric and clashing with electoral authorities over unsubstantiated claims of voter fraud as his popularity falls to all-time lows. "When a president of a superior electoral court demonetizes the pages of government supporters, he opens a loophole for presidents of regional electoral courts to do the same to defend their respective governor," Bolsonaro said this Saturday. "This is not democracy." (BBG)

AFGHANISTAN: As many as five rockets were fired at Kabul's international airport but were intercepted by a missile defense system, a U.S. official told Reuters, as the United States' nears the complete withdrawal of its troops from the city. The official, speaking on the condition of anonymity, said the rockets were fired early Monday morning Kabul time, though it was unclear if all were brought down by the defense system. Initial reports did not indicate any U.S. casualties, but that information could change, the official said. (RTRS)

AFGHANISTAN: The Pentagon said Saturday that two high-profile ISIS-K targets were killed in a U.S. drone strike in Afghanistan. The development comes less than two days after a suicide bomber detonated an explosive near the gates of Kabul's airport, resulting in the deaths of 13 American service members. The Pentagon said the strike targeted two ISIS-K members believed to be involved in planning attacks against U.S. forces in Kabul. Army Maj. Gen. William Taylor said Saturday that there were no known civilian casualties following the strike. (CNBC)

AFGHANISTAN: The United States carried out a military strike on Sunday against an ISIS-K target in Kabul, a development that comes in the final days of an immense humanitarian evacuation mission. "U.S. military forces conducted a self-defense unmanned over-the-horizon airstrike today on a vehicle in Kabul, eliminating an imminent ISIS-K threat to Hamad Karzai International airport," U.S. Central Command spokesman Navy Capt. Bill Urban wrote in a statement. (CNBC)

AFGHANISTAN: National Security Adviser Jake Sullivan signaled that the U.S. will keep targeting Islamic State in Afghanistan, saying two members killed in an air strike on Friday had been planning additional attacks. President Joe Biden "will stop at nothing to make ISIS-K pay," Sullivan said on "Fox News Sunday." The group, an Islamic state offshoot, claimed responsibility for the suicide bombing on Thursday that killed at least 88 people, including 13 U.S. service members. (BBG)

AFGHANISTAN: President Joe Biden was warned Friday that another terror attack in Kabul is "likely," one day after a suicide bomber outside the city's airport killed at least 113 people, including 13 U.S. service members. The stark warning from the president's national security team came as the United States entered the final days of a monthslong military withdrawal from Afghanistan, on track to meet Biden's Aug. 31 deadline for a full withdrawal. (CNBC)

AFGHANISTAN: The United States is "not likely" to have an "on-the-ground diplomatic presence" in Afghanistan after Aug. 31, Secretary of State Antony Blinken said Sunday on "Meet the Press." "What is going to happen is that our commitment to continue to help people leave Afghanistan who want to leave and who are not out by September 1st, that endures," Blinken told host Chuck Todd. (Axios)

AFGHANISTAN: The United States, along with 97 other countries, announced Sunday that they had reached an agreement with the Taliban to allow them to continue to get Afghan allies out of the country after the Aug. 31 withdrawal deadline. (Axios)

AFGHANISTAN: The Taliban have taken over control of three gates at Kabul's airport from U.S. forces and will be in charge of the rest soon, an official from the group said. "The whole airport is slowly coming under the control of the Taliban," Enhamullah Samangani, a member of the group's Cultural Commission, said by telephone. The group is "looking forward to operating the airport after they all leave by Tuesday," he said. The U.S. Embassy in Afghanistan told citizens to leave the vicinity of the airport following a "specific, credible threat" of another terrorist attack. U.S. President Joe Biden warned on Saturday that a further attack there is "highly likely" based on an assessment by his military commanders. (BBG)

AFGHANISTAN: French President Emmanuel Macron called for the creation of a "safe zone" under United Nations control in Kabul to allow continued humanitarian operations and help outside countries maintain pressure on the Taliban. (BBG)

AFGHANISTAN: China's Foreign Minister Wang Yi spoke to US Secretary of State Antony Blinken on Sunday about Afghanistan, accusing Washington of using "double standards" in its efforts to eradicate terrorism in the country and urged Blinken to do more to stop the violence that has rocked Kabul. (SCMP)

IRAN: A top Iranian security official accused U.S. President Joe Biden on Saturday of illegally threatening Iran after he said he may consider other options if nuclear diplomacy with Tehran fails. "The emphasis on using 'other options' against (Iran) amounts to threatening another country illegally and establishes Iran's right to reciprocate ... against 'available options'," Ali Shamkhani, secretary of Iran's Supreme National Security Council, said on Twitter. Biden told Israeli Prime Minister Naftali Bennett in White House talks on Friday he was putting "diplomacy first" to try to rein in Iran's nuclear programme, but that if negotiations fail he would be prepared to turn to other unspecified options. (RTRS)

MIDDLE EAST: Senior officials from Saudi Arabia and Iran attended a regional summit together for the first time in more than five years on Saturday as efforts are stepped up to cool tensions in the Middle East. The foreign ministers from the two nations, which cut diplomatic ties at the beginning of 2016, gathered at the conference in Baghdad that was ostensibly intended to rally support for Iraq. But it was also viewed as an important barometer of efforts to de-escalate hostilities that soared during Donald Trump's presidency. Other leaders and officials attending the meeting included those from Turkey and the United Arab Emirates, which have endured a particularly bitter relationship in recent years, as well as the heads of state of Qatar and Egypt, two other governments that have been adversaries. (FT)

OIL: Power outages in Louisiana and beyond were spreading Aug. 29 after Category 4 Hurricane Ida made a Louisiana landfall, after roughly 95% of the US Gulf's oil and gas production was shut in and many Louisiana refineries and petrochemical plants were closed in advance of the major storm. (Platts)

OIL: Colonial Pipeline Co, the largest petroleum products pipeline in the United States, said on Sunday it would temporarily halt fuel deliveries from Houston to Greensboro, North Carolina, due to Hurricane Ida. The pipeline operator, which carries nearly half the fuel consumed along the U.S. East Coast, said supplies would continue to be available at its terminals throughout the Southeast. It expects to resume full service when it is safe to do so, it said in a note to shippers. (RTRS)

OIL: The increase in oil output agreed last month by OPEC+ nations could be reconsidered at its next meeting on Sept. 1, Kuwait's oil minister said on Sunday. The Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, collectively known as OPEC+, will meet on Wednesday to discuss the previously agreed increase of 400,000 barrels per day (bpd) for the next several months. "The markets are slowing. Since COVID-19 has begun its fourth wave in some areas, we must be careful and reconsider this increase. There may be a halt to the 400,000 (bpd) increase," Mohammad Abdulatif al-Fares told Reuters on the sildelines of a government-sponsored event in Kuwait City. (RTRS)

OIL: Abu Dhabi's state-owned Adnoc sees availability of its flagship light sour Murban crude rising to as high as 1.422mn b/d over the coming twelve months, the company said in its latest forecast, around 25pc above current levels. (Argus Media)

OIL: Abu Dhabi National Oil Company (ADNOC) plans to maintain its allocation cuts for all grades of crude it sells to term customers at 5% in November, four sources with knowledge of the matter said on Monday. (RTRS)

OIL: The head of Libya's National Oil Corp. was suspended pending an investigation into whether he violated policy, the OPEC nation's Oil Minister told Bloomberg. Mustafa Sanalla, who's served as the NOC's chairman for seven years, traveled abroad on a business trip without getting the necessary approval, according to a letter detailing the claims and seen by Bloomberg. That was a "violation" of ministry policy, the letter said. Oil Minister Mohamed Oun confirmed the contents of the letter in a phone call. NOC officials weren't immediately available for comment. Sanalla couldn't immediately be reached by phone. (BBG)

CHINA

PBOC: China is likely to stick to reform and revitalize the market rather than relying on more liquidity such as cutting interest rates, as the unbalanced recovery from impact of the pandemic has worsened the fundamental issues that the economy faces, Guan Tao, a former forex regulatory official and global chief economic of BOC Securities wrote in an article published on Yicai.com. Liquidity itself cannot force business expansion, more local government investments, or logistical breakdowns, Guan said. China should be on guard for risks of the yuan's sudden correction as other economies pursue easing, as well as surging commodity prices that fan inflation, Guan said. (MNI)

POLICY: China must persist in opening to the outside world despite rising global uncertainties, the official People's Daily said in a commentary. China should steadily expand the institutional opening of its rules and standards, deepen overseas partnerships via Belt and Road initiative, consolidate its supply chains, industrial chains as well as data and talent chains, the newspaper said. The growth of foreign trade reached 24.5% from January to July, registering a 10-year high, which has effectively ensured the balance of international payments and helped stabilized the economy, the newspaper said, though noting that the growth of orders may slow down as the pandemic gradually eases. (MNI)

POLICY: China kicked off a two-month campaign to crack down on commercial platforms and social media accounts that post finance-related information that's deemed harmful to its economy. (BBG)

POLICY: China's anti-corruption watchdog has hit out at the country's entertainment industry as Beijing tightens its grip on online celebrity culture and widens the scope of a crackdown on wealth and big business. A statement posted on the website of China's Central Commission for Discipline Inspection this weekend cited a wave of "negative news" and singled out several celebrities, including former Prada ambassador Zheng Shuang, who is accused of tax evasion, and Canadian-Chinese star Kris Wu, who was recently arrested on suspicion of rape. The watchdog's comments came after China's internet regulator on Friday set out a list of 10 measures to address issues in the sector, adding that it would "resolve the problem of chaos" in online fan culture that it said was having a negative impact on young people. The measures include banning online popularity rankings of celebrities and regulating companies that work with them. (FT)

LOCAL GOV'T BONDS: China will accelerate the issuance of local government special bonds moderately to ensure substantial work at the end of this year and early next year, the 21st Century Business Herald reported citing a report by the Ministry of Finance. Such bond sales may be about CNY500 billion for Sep, CNY700 billion for Dec, and a total of CNY600 billion in Oct and Nov, the newspaper said. Infrastructure investment may be boosted in the following months, though any growth could still be limited by the need of controlling local implicit debt, the newspaper said citing Wu Qiying, an analyst with GF Securities. (MNI)

EQUITIES: Leading Chinese social media platforms WeChat, Douyin, Kuaishou and Sina Weibo said on Saturday they will start rectification of irregular practices involving publishing financial information on their platforms, in response to Chinese cyberspace regulator's latest crackdown on violations of financial self-media accounts. (Global Times)

OVERNIGHT DATA

JAPAN JUL RETAIL SALES +1.1% M/M; MEDIAN +0.4%; JUN +3.1%

JAPAN JUL RETAIL SALES +2.4% Y/Y; MEDIAN +2.1%; JUN +0.1%

JAPAN JUL DEP'T STORE & SUPERMARKET SALES +1.3% Y/Y; MEDIAN +1.9%; JUN -2.3%

MNI DATA BRIEF: Japan July Retail Sales Post 5th Straight Rise

- Japan's retail sales rose 2.4% y/y in July, a fifth straight gain, preliminary data released Monday by the Ministry of Economy, Trade and Industry (METI) showed, but METI's assessment ahead remained that retail sales "are flattening" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIAN Q2 COMPANY OPERATING PROFITS +7.1% Q/Q; MEDIAN +2.5%; Q1 -0.6%

AUSTRALIAN Q2 INVENTORIES +0.2% Q/Q; MEDIAN +1.2%; Q1 +2.4%

CHINA MARKETS

PBOC NET INJECTS CNY40 BLN VIA OMOS MONDAY

The People's Bank of China (PBOC) conducted CNY50 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. The operation injected net CNY40 billion into the market as there is CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2764% at 09:40 am local time from the close of 2.3299% on Friday.

- The CFETS-NEX money-market sentiment index closed at 39 on Friday vs 42 on Thursday.

CHINA SETS YUAN CENTRAL PARITY AT 6.4677 MON VS 6.4863 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4677 on Monday, compared with the 6.4863 set on Friday, marking the biggest daily drop since Jul 30.

MARKETS

SNAPSHOT: Politics At The Fore Over The Weekend

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 116.98 points at 27758.37

- ASX 200 up 13.515 points at 7501.8

- Shanghai Comp. up 12.068 points at 3534.225

- JGB 10-Yr future up 9 ticks at 152.21, yield down 0.3bp at 0.024%

- Aussie 10-Yr future up 1.5 ticks at 98.840, yield down 1.5bp at 1.175%

- US 10-Yr future up 0-01 at 133-29+, yield down 0.16bp at 1.3054%

- WTI crude down $0.24 at $68.50, Gold down $1.70 at $1815.85

- USD/JPY down 10 pips at Y109.74

- FED'S CLARIDA, ECHOING POWELL, BACKS START OF TAPER THIS YEAR (DJ)

- FED'S WALLER: STRONG AUG JOBS REPORT WILL BE GREEN LIGHT FOR TAPER (YAHOO FINANCE)

- GERMAN SPD'S SCHOLZ WINS ELECTION DEBATE IN BLOW TO MERKEL HEIR (BBG)

- KUWAITI OIL MINISTER: OPEC+ COULD RECONSIDER OUTPUT INCREASE (RTRS)

- PBOC KEEPS DRIPPING IN LIQUIDITY VIA OMOS FOR MONTH-END NEEDS

BONDS: Core FI A Touch Better Bid In Asia

Much of the weekend's headline flow focused on goings on in Afghanistan, with the U.S. conducting a surgical strike against some of the plotters of the recent attack on Kabul airport, in addition to moving to foil another terror act in the city. Elsewhere, RTRS sources pointed to an intercepted missile attack, which fired on Kabul airport early on Monday morning.

- Incremental support has spilled over from Friday's post-Powell dealing into Asia-Pac trade, with T-Notes holding to a narrow 0-03 range thus far, last +0-01 at 133-29+ after a couple of tests of Friday's late NY high, but there was nothing in the way of a notable break, despite brief and shallow showings above. Cash Tsys trade little changed to ~0.5bp richer across the curve. There hasn't been much in the way of notable headlines/market flow observed thus far. As a reminder, TYU1 will see first notice on Tuesday.

- The cash JGB space has seen firming of 0.5-1.0bp across the curve, while futures initially showed higher before tapering off into the lunch break, last +8 on the day. The details of the latest round of BoJ Rinban ops revealed the following offer/cover ratios: 3- to 5-Year: 2.45x (prev. 3.02X), 5- to 10-Year: 2.93x (prev. 2.66X).

- There was no reaction from Aussie bonds to the latest round of Australian Q2 GDP partials, which saw a much slower than expected uptick in inventories during Q2, alongside a much larger than expected jump in corporate operating profits. YM +2.5, XM +1.5 at typing. Elsewhere, NSW lodged another record daily COVID case count (1,290), while there was a brisk start to the week for A$-denominated corporate issuance.

EQUITIES: Mostly Positive

Most equity markets in the Asia-Pac region saw gains on Monday, though moves were limited in a subdued session; markets continue to weigh comments from FOMC Chair Powell at the Jackson Hole Economic Symposium on Friday, US equity markets finished last week with gains after Powell was less hawkish than expected. Chinese tech stocks saw gains, building on an advance last week which constituted the biggest weekly gain since January. The Hang Seng was a beneficiary of the rally though early gains of up to 1.5% were eroded as the session wore on. Brokerages in China took a hit after reports in state media that regulators have told brokerages to step up oversight of non-compliant margin trading activities. Markets in Japan are higher, data earlier showed retail sales rose above estimates. US futures are slightly higher, indices seeing gains of less than 0.1% heading into the European open. Markets await US NFP data on Friday after Powell indicated the labour market has not reached the FOMC's threshold to taper just yet.

GOLD: Holding On To Powell-Inspired Gains

It has been a fairly limited round of Asia-Pac trade for bullion, with spot consolidating Friday's post-Powell gains to trade little changed after the Fed Chair walked back some of the hawkish commentary that various regional Fed Presidents put forth before his address. Fed Vice Chair Clarida also presented a relatively measured view on the taper discussion. A tapering announcement and the first actions re: such a move may be implemented by the end of the year, but Powell & Clarida didn't seem to be in any particular rush. Spot last deals little changed just shy of $1,820/oz, with the initial resistance/bull trigger located at the July 15 high ($1,834.1/oz).

OIL: Early Gains For WTI Eroded As Ida Moves Inland

Oil is mixed in Asia-Pac trade on Monday; WTI lower by around $0.10/bbl from settlement while Brent is up $0.26 from settlement levels. WTI was earlier in positive territory as markets braced for the impact of Hurricane Ida in the Gulf of Mexico, more than 95% of crude oil production in the region has been taken offline. However, the gains were eroded as the session wore on with reports that Hurricane Ida is moving inland.

FOREX: Hugging Post-Powell Ranges

Major pairs fluctuated inside tight ranges with moves limited in Asia on Monday, consolidating after the greenback declined in the wake of FOMC Chief Powell at Jackson Hole.

- JPY slightly firmer, data earlier in the session showed July retail sales rose 2.4% Y/Y, above estimates of a 2.1% increase.

- AUD and NZD both a handful of pips lower. The COVID situation remains in focus, in Australia NSW reported another record rise in cases while in New Zealand there were reports the government will review current lockdown restrictions today. AUD largely ignored data which showed company operation profit rose 7.1%, well above estimates of 2.5%.

- Little movement seen in commodity currencies, markets brace for the impact of Hurricane Ida in the Gulf of Mexico, more than 95% of crude oil production in the region has been taken offline. WTI firmed at the start of the session but gave up gains after reports that Ida had moved inland.

- German CPI data is on the docket for the European session. Further afield markets await the August US NFP print on Friday after Powell indicated the labour market has not reached the FOMC's threshold to taper just yet.

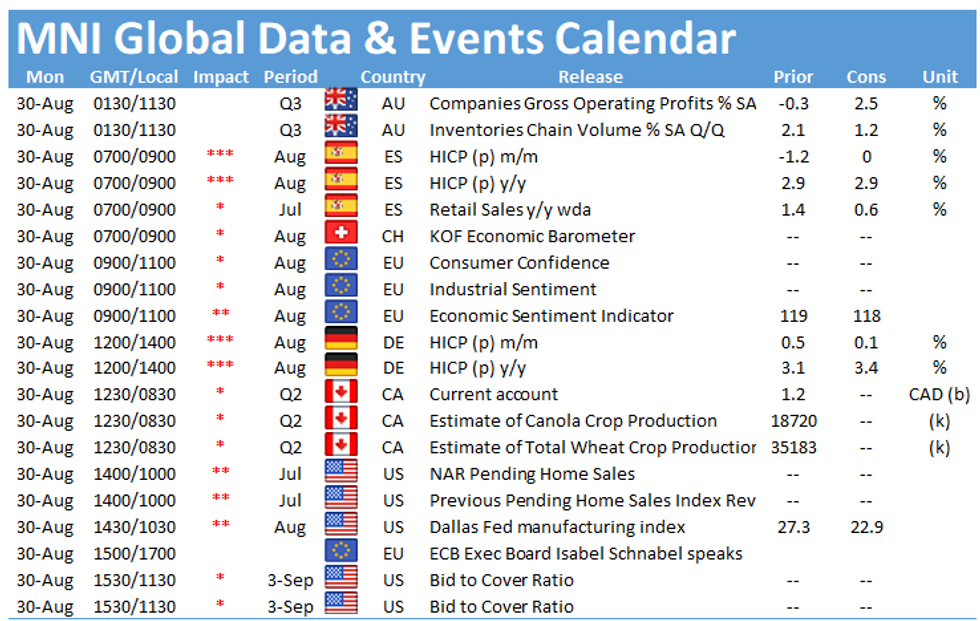

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.