-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI EUROPEAN OPEN: Powell Points To A Couple More Hikes, Focus Moves To ECB & BoE

EXECUTIVE SUMMARY

- CAUTIOUS POWELL SIGNALS 'COUPLE' MORE FED HIKES (MNI)

- WHITE HOUSE LIKELY TO TAP BRAINARD, BERNSTEIN AS TOP ECONOMIC ADVISORS, SOURCES SAY (CNBC)

- WHITE HOUSE: BIDEN, MCCARTHY HAD FRANK, STRAIGHTFORWARD TALK IN DEBT MEETING (RTRS)

- BOJ'S WAKATABE WARNS ON INFLATION TARGET AMBIGUITY (MNI)

- IEA'S BIROL DOES NOT SEE MAJOR DISRUPTION FROM RUSSIAN OIL PRODUCT PRICE CAP (RTRS)

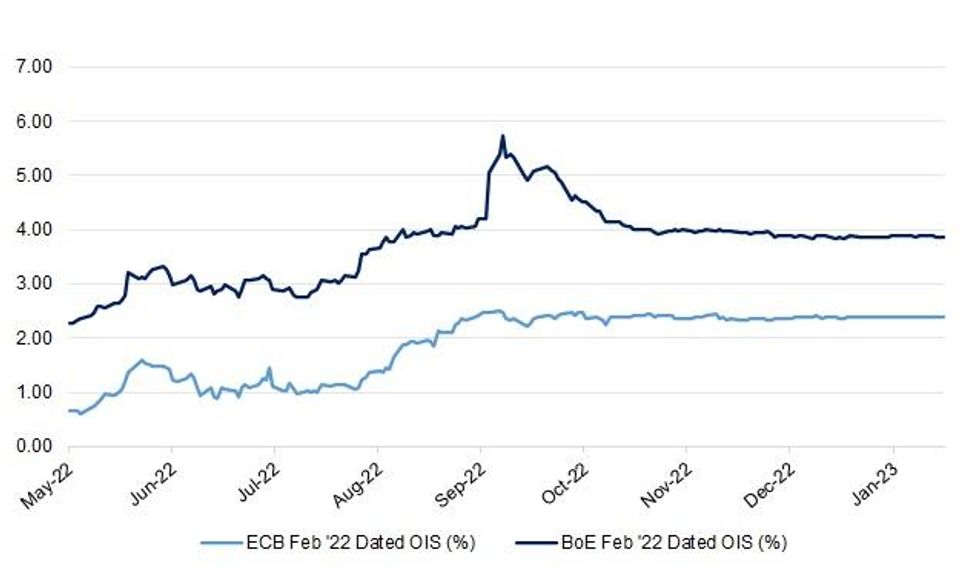

Fig. 1: ECB & BoE Feb ‘22 Dated OIS

Source: MNI - Market News/Bloomberg

UK

FISCAL/ECONOMY/POLITICS: Unions and the government appear as far apart as ever after widespread strike action closed or partly closed more than half of schools across England and Wales. (Guardian)

EUROPE

FRANCE: French opposition lawmakers are trying to prevent the sale of Electricite de France SA assets after the planned nationalization of the utility, fearing President Emmanuel Macron’s government could revive a plan under which more profitable parts of the business would be partially sold off. (BBG)

U.S.

FED: Federal Reserve Chair Jerome Powell on Wednesday signaled the FOMC sees interest rates moving above 5% this year but indicated the central bank is ever more data dependent as it approaches peak rates for the cycle and proceeds to hold them there at least through this year. (MNI)

FED: The Federal Reserve nudged up short-term interest rates by a quarter-percentage point and signaled it was on track to do so again at its meeting next month while officials consider whether and when to pause increases late this spring. (WSJ)

FED: WSJ Fed reporter Timiraos tweeted the following on Wednesday: “The Fed is finally getting more of the data they've wanted but wants to ensure disinflation isn't transitory. That's why their outlook for the labor market and the role they think it'll play in sustaining progress is and could continue to be a big focus.” (MNI)

FED: Democratic Senator Elizabeth Warren calls on Fed Chair Jerome Powell to pause interest rate hikes and “remember his dual Mandate.” (BBG)

ECONOMY: The White House will likely appoint Federal Reserve Vice Chair Lael Brainard to run the National Economic Council and Jared Bernstein to lead the Council of Economic Advisers, sources familiar with the matter tell CNBC. (CNBC)

FISCAL: U.S. President Joe Biden and Republican House of Representatives Speaker Kevin McCarthy had a "frank and straightforward dialogue" on raising U.S. government borrowing limits on Wednesday, and agreed to continue their talks, the White House said. "The President welcomes a separate discussion with congressional leaders about how to reduce the deficit and control the national debt while continuing to grow the economy," the White House said in a statement on Wednesday. (RTRS)

FISCAL: U.S. House of Representatives Speaker Kevin McCarthy said on Wednesday he believed he could reach an agreement with President Joe Biden on raising the nation's debt ceiling. "I think at the end of the day, we can find common ground," McCarthy told reporters after meeting with Biden. (RTRS)

EQUITIES: Meta shares popped in extended trading on Wednesday after the company reported fourth-quarter revenue that topped estimates and announced a $40 billion stock buyback. Here are the results. (CNBC)

OTHER

U.S./CHINA/TAIWAN: The speaker of Taiwan's parliament during a forum for international religious freedom in Washington on Wednesday stressed the importance of defending the island's democracy in the face of pressure from China. (RTRS)

U.S./CHINA/TAIWAN: U.S. House of Representatives Speaker Kevin McCarthy said on Wednesday that he does not think China can tell him where he can go when he was asked about a possible trip to Taiwan. (RTRS)

CHINA/TAIWAN: Taiwan’s Civil Aeronautics Administration confirmed on Wednesday that it is discussing a request from China to restore normal operations of direct cross-strait flights, Taipei-based United News Daily reports. (BBG)

GEOPOLITICS: The Philippines has granted the United States expanded access to its military bases, the countries said on Thursday, amid mounting concern over China's increasing assertiveness in the disputed South China Sea and tensions over self-ruled Taiwan. (RTRS)

BOJ: Bank of Japan Deputy Governor Masazumi Wakatabe said on Thursday that the BOJ’s commitment to continuing with monetary easing has not changed at all, despite the bank widening the range around its 10-year yield target in December. (MNI)

BOJ: Bank of Japan Deputy Governor Masazumi Wakatabe said on Thursday that ambiguity in inflation targeting would make the objective of monetary policy vague and could undermine the transparency of monetary policy and its effectiveness. (MNI)

BOK: Bank of Korea expects CPI to grow around 5% in February after 5.2% gain in Jan., according to emailed statement from the central bank. Uncertainty in future path of inflation is high on factors related to China re-opening and economic flows. (BBG)

SOUTH KOREA: South Korea's financial minister said Thursday the overnight rate-hike decision by the U.S. Federal Reserve has eased market uncertainties, although the government will continue to keep a watchful eye on potential volatility. (Yonhap)

NORTH KOREA: North Korea's Foreign Ministry said on Thursday that joint drills by the U.S. and its allies have pushed the situation to an "extreme red-line" and threaten to turn the peninsula into a "huge war arsenal and a more critical war zone." The statement, carried by state news agency KCNA, said Pyongyang was not interested in dialogue as long as Washington pursues hostile policies. (RTRS)

NORTH KOREA: The White House on Wednesday rejected North Korean accusations that joint military exercises in the region are a provocation and said the United States has no hostile intent toward Pyongyang. "We have made clear we have no hostile intent toward the DPRK (North Korea) and seek serious and sustained diplomacy to address the full range of issues of concern to both countries and the region," said a spokesperson for the White House National Security Council. (RTRS)

MEXICO: Mexico’s central bank is “very worried” about food price inflation, which is the country’s main inflation risk, Deputy Governor Jonathan Heath said Wednesday. (BBG)

BRAZIL: Brazil’s central bank on Wednesday said it was considering holding interest rates at a six-year high for longer than markets expect due to fiscal risks under recently inaugurated President Luiz Inacio Lula da Silva. (RTRS)

BRAZIL: Brazilian lawmakers on Wednesday voted to reelect the heads of both the Chamber of Deputies and the Senate, bolstering President Luiz Inácio Lula da Silva's prospects for passing legislation and governing in the polarized nation. (AP)

BRAZIL: The eldest son of former President Jair Bolsonaro said his father isn’t fleeing Brazilian justice by applying for a six-month US visa and that he would return home if called by authorities. (BBG)

TURKEY: Turkish President Recep Tayyip Erdogan pledged the nation will keep slashing its benchmark interest rates to shore up the economy ahead of a crucial reelection bid this year. (BBG)

TURKEY: January inflation will reflect the impact of higher minimum wages on consumer prices, but deceleration will gain momentum from February onwards, Turkey’s Treasury and Finance Minister Nureddin Nebati tells reporters in a press briefing on Wednesday. Below are highlights of his embargoed comments on inflation and budget. (BBG)

PERU: Peru's congress on Wednesday voted down another bid to advance elections from April 2024 to this year, a move sought by President Dina Boluarte to calm unrest that has left dozens dead in seven weeks of anti-government protests. (AFP)

ENERGY: The European Union needs to prolong measures to curb natural gas demand to ensure it can make it through next winter, especially in the event of a full cutoff of Russian supplies, according to the Bruegel think tank. (BBG)

METALS: U.S. officials met on Tuesday with gold industry companies and associations to urge broader due diligence standards and robust implementation of Russia-focused sanctions, the State Department said in a statement on Wednesday. (RTRS)

OIL: International Energy Agency (IEA) chief Fatih Birol said on Wednesday he does not expect major problems or disruptions from a European Commission proposal to set price caps on Russian oil products. (RTRS)

OIL: President Joe Biden’s administration on Wednesday recommended a scaled-down version of a major oil drilling project in the North Slope of Alaska, taking a step toward approving the $8 billion Willow plan that climate groups have long condemned. (CNBC)

CHINA

ECONOMY: Economic scarring inflicted by three years of Covid, coupled with weak balance sheets and lower productivity, risks undermining the government’s push to deliver growth of over 5% and its long-term ambition of high-quality development, policy advisers said. (MNI)

ECONOMY: Chinese President Xi Jinping called for enhanced efforts to boost demand while deepening supply-side reforms in order to promote a broader domestic economic cycle, according to a Xinhua News Agency report about a recent meeting chaired by the President. (MNI)

PBOC: The People’s Bank of China is likely to expand the lending quota of policy financial instrument to fund infrastructure projects and spur the economy, China Securities Journal reported citing analysts on Thursday. (MNI)

BANKS/CREDIT: China’s banks may ratchet up financing to support the country’s economic restructuring, targeting low-carbon development, technological innovation, farming, SMEs and elderly care services, in expectation of more monetary easing this year, the China Securities Journal reports, citing analysts. (BBG)

EQUITIES: China issued a draft rule to ease regulations for initial public offerings in a bid to liberalise the stock market to broaden access to capital, the China Securities Regulatory Commission (CSRC) said in a statement late Wednesday. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY401 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) conducted CNY66 billion via 7-day reverse repos with the rates unchanged at 2.00% on Thursday. The operation has led to a net drain of CNY401 billion after offsetting the maturity of CNY467 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0091% at 9:23 am local time from the close of 2.0370% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 42 on Wednesday, compared with the close of 45 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7130 THURS VS 6.7492 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7130 on Thursday, compared with 6.7492 set on Wednesday.

OVERNIGHT DATA

JAPAN JAN MONETARY BASE -3.8% Y/Y; DEC -6.1%

JAPAN JAN MONETARY BASE Y651.9TN; DEC Y632.4TN

AUSTRALIA DEC BUILDING APPROVALS +18.5 M/M; MEDIAN +1.0 M/M; NOV -8.8%

AUSTRALIA Q4 NAB BUSINESS CONFIDENCE -1; Q3 +9

Business confidence fell considerably in Q4 as concerns about global and domestic economic growth mounted. Still, business conditions remained strong, albeit easing from the highs seen in Q3. The easing in conditions was evident across industries and states, but all remained in positive territory. Leading indicators also remained fairly strong, including expectations for future business conditions and future employment – an outlook at odds with the low levels of confidence reported by firms. (NAB)

NEW ZEALAND DEC BUILDING PERMITS -7.2% M/M; NOV +6.7%

SOUTH KOREA JAN CPI +5.2% Y/Y; MEDIAN +5.0%; DEC +5.0%

SOUTH KOREA JAN CPI +0.8% M/M; MEDIAN +0.7%; DEC +0.2%

SOUTH KOREA JAN CORE CPI +5.0% Y/Y; DEC +4.8%

SOUTH KOREA DEC RETAIL SALES +6.7% Y/Y; NOV +8.4%

SOUTH KOREA DEC DEPARTMENT STORE SALES +10.3% Y/Y; NOV +3.7%

SOUTH KOREA DEC DISCOUNT STORE SALES +8.4% Y/Y; NOV +9.2%

MARKETS

US TSYS: Little Changed In Asia

TYH3 deals at 115-11, -0-04+, a touch off the base of its 0-06 range on volume of ~106K.

- Cash Tsys sit little changed across the major benchmarks.

- Tsys richened at the margins in early Asia trading as regional participants reacted to Fed Chair Powell's post-meeting comments re: the disinflation process beginning.

- The richening held until cross-market pressure, likely stemming from JGBs in lieu of a soft 10-year JGB auction, saw Tsys retreat from session highs.

- Asia-Pac flow was headlined by a 3K block buyer of TYH3, with some downside screen interest noted via the TYH3 115.00/114.50 put spread (+3K).

- In London hours we have the BoE & ECB monetary policy decision, as well as ECB President Lagarde's post-meeting press conference, which presents plenty of scope for cross-market-driven gyrations. Further out U.S. Factory Orders, Initial Jobless Claims and Durable Goods will cross.

JGBS: Futures Unwind Overnight Bid, 10-Year Auction Sloppy At Best

JGB futures have unwound the bulk of their overnight session bid, with the contract +7 into the close. Wider cash JGBs run flat to 6bp richer, with the super-long end outperforming all day. Swap spreads are generally flat to wider, excluding 10s, which are a touch tighter.

- Intermediates moved away from best levels in set up for this afternoon’s 10-Year JGB supply after latching onto the wider bid in core global FI markets post-FOMC.

- Further weakness was observed in the afternoon, after the 10-Year JGB auction saw the cover ratio continue to hover just below the 6-auction average, while the low price missed wider expectations, with the average price also printing below the expectations for the low price. The price tail was also wide. It would seem that uncertainty re: the BoJ kept some on the sidelines (as we suggested may be the case), while the structural richness promoted by the BoJ’s YCC settings probably acted as a further headwind for demand. This resulted in the need for further concession for supply to be absorbed.

- Comments from soon to be departing BoJ Deputy Governor Wakatabe reaffirmed the need for continued easing, while he also pushed back against the idea of a more ambiguous inflation target ahead of a potential tweak to the BoJ-government accord on inflation.

- Friday’s local docket is headlined by final services & composite PMI data as well as the latest round of BoJ Rinban operations.

JGBS AUCTION: 10-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.2582tn 10-Year JGBs:

- Average Yield: 0.485% (prev. 0.500%)

- Average Price: 100.14 (prev. 100.00)

- High Yield: 0.495% (prev. 0.500%)

- Low Price: 100.04 (prev. 100.00)

- % Allotted At High Yield: 58.5171% (prev. 28.1152%)

- Bid/Cover: 4.611x (prev. 4.764x)

AUSSIE BONDS: Off Best Levels Into The Close

Aussie bond futures finished off of best levels after respecting their overnight peaks, leaving YM +6.0 & XM +3.0. The major benchmarks were 6bp richer to flat, as the curve bull steepened.

- The overnight session/early Sydney richening was a product of spill over surrounding the latest FOMC decision.

- The pullback from best levels lacked much in the way of an overt explainer.

- EFPs narrowed on the day, suggesting that receiver-side flows in swaps aided the general bid in bonds, while the pull away from best levels was driven by bonds.

- Bills finished 3-10bp richer across the curve, as the strip flattened. RBA dated OIS continued to show just under 25bp of tightening for next week’s meeting, while terminal cash rate pricing oscillated either side of 3.70%, ticking lower on the day as the impulse from post-FOMC gyrations in the wider FI space was felt. Note that some sell-side names have flagged a non-trivial chance of a larger than 25bp step at next week’s meeting, in lieu of the firmer than expected Q4 CPI data received last week.

- Looking ahead, tomorrow will see the release of housing finance data and A$500mn of ACGB Apr-29 supply.

NZGBS: Early Fed-Inspired Bid Extends On Firm Demand At Auctions

Benchmark NZGB yields were 11bp lower across the curve on Thursday, with the space going out at richest levels of the day, as a parallel shift was observed.

- Feed through from the latest FOMC decision kickstarted the richening, with NZGBs then extending on their early FOMC-inspired bid in lieu of the latest round of NZGB supply, which came in the form of NZGB-28, -33 & -37. The auctions saw strong to very strong demand, with all 3 well covered, providing cover ratios of 2.5-4.6x, as the longest bond on offer generated the firmest cover.

- Swap rates were 9-14bp lower across the curve, with steepening apparent, leaving swap spreads mixed.

- RBNZ dated OIS continues to show just over 50bp of tightening for next month’s meeting, with terminal OCR pricing in a touch to 5.25%, adding to yesterday’s labour market-inspired downtick.

- Locally, building permits data provided a soft outcome, although markets looked through that release.

- Domestic headline flow has been fairly limited elsewhere.

- Looking ahead, Friday’s local docket is headlined by the latest ANZ consumer confidence survey reading.

EQUITIES: Regional Tech Leads The Way Post The Fed

Regional equities are mostly higher, following the positive US tone from Wednesday, with higher futures (S&P +0.25% & Nasdaq +0.85%) today also helping. The beta with respect to US moves remains a touch lower within the region, but the risk on tone is clearly evident. Tech plays have outperformed in the region today, as the market continues to digest Fed moves from the Wednesday session.

- The HSI is up around 0.4% at this stage, with the underlying tech index up a further 1.74% today.

- China shares also higher, albeit just, with the CSI 300 +0.06% in the first half of trade today. Brokerages weighed on the broader index despite eased IPO rules, which should make it easier for companies to list onshore. For Wednesday's session the Golden Dragon index rebounded 4.34% in US trade.

- The Kospi is up 0.77%, with offshore investors adding +$261.1mn to local shares. The lower pace of Fed hikes, coupled with Powell stating the disinflation process has begun, is seen as benefiting the tech space. The Taiex is slightly outperforming, up 1.00% at this stage.

- There are some laggards in the region, the ASX 200 is +0.20% at this stage, with some commodities not seeing as much risk-in flows post the Fed.

- Indian shares are struggling to gain traction, as the Adani saga continues, while Philippine shares can't sustain moves above the 7000 level.

GOLD: Bullion Holds Onto Its Gains Post The Fed

Gold prices bounced after the Fed announced a 25bp hike and Chairman Powell commented that disinflation had begun. They rose 1.2% to finish the NY session at $1950.52/oz, as the USD DXY index was 0.9% lower. They have traded sideways during the APAC session close and are up 0.1% to around $1952.15 after reaching a low of $1950.47 followed by a high of $1957.33. Gold is at its highest since mid-April 2022. DXY is down a further 0.3%.

- Gold prices have remained above the bull trigger of $1949.20, the January 26 high. The next level to watch is $1963, 76.4% retracement of the March – September 2022 bear leg. Bullion is trading well above its 50-day simple MA, which is itself now above both the 100- and 200-day MA.

- Later the ECB and Bank of England meet and both central banks are expected to hike rates 50bp. In the US, Challenger job cuts for January, jobless claims and Q4 preliminary unit labour cost data are scheduled.

OIL: Crude Recovers Today But Only Partially

Oil has started February on the back foot. Prices fell sharply on Wednesday down 2.8% as US data showed a further inventory build. Crude has only partly unwound those losses during the APAC session rising around 0.8%. DXY is down 0.3%.

- WTI is trading just above $77/bbl close to the intraday high and off the low of $76.69 earlier, but below its 50-day MA. Brent is around $83.45 after a low today of $83.15, and above the 50-day MA. Brent remains above its support of $82.06.

- OPEC+ “reaffirmed their commitment” to current output quotas after their meeting on Wednesday. It is monitoring the impact of China’s reopening on demand.

- Goldman Sachs remains optimistic on oil prices and they continue to forecast Brent at $105/bbl in Q4 supported by a better global growth backdrop. In the short-term, oil should find support from cold weather. It currently has boosted crude demand by 200kbd in recent days.

- On February 5, the EU will ban almost all seaborne imports of Russian refined products and there is talk that the G7 plus EU will include a price cap on Russian fuel with $100/bbl being discussed for diesel. (bbg)

- Later the ECB and Bank of England meet and both central banks are expected to hike rates 50bp. In the US, Challenger job cuts for January, jobless claims and Q4 preliminary unit labour cost data are scheduled.

FOREX: USD Bears Remain In Control

The USD has stayed on the back foot today, although we haven't seen much follow through from early session selling. The BBDXY sit close to 1211 currently, -0.25/0.30% versus NY closing levels, the DXY is slightly weaker, under 101.00, which is comfortably below late NY session lows. The dollar remains on the backfoot post the Fed.

- Cross asset signals have leaned against the USD from an equity market standpoint, with US futures continuing to push higher (as least for the S&P +0.36% & Nasdaq +1%), while regional equities have firmed, particularly for tech sensitive countries. US yields are mixed, slightly firmer at the front end, but with tight ranges overall.

- The better risk tone hasn't prevented slight JPY outperformance. USD/JPY sunk to 128.15/20 in early trade, but we now sit back at 128.50. The bear trigger is at 127.23, the Jan 16 low, from here bears can target 126.81 a Fibonacci projection.

- NZD/USD has also traded with a positive bias, with the pair hitting fresh cycle highs above 0.6535. We are just off these levels currently.

- AUD/USD lost some momentum, despite stronger housing data, last around 0.7145, just +0.10% up on NY closing levels.

- Looking ahead, we have the BOE rate decision before the ECB rate decision and President Lagarde's press conference. Also on the wires is U.S. Factory Orders, Initial Jobless Claims and Durable Goods.

FX OPTIONS: Expiries for Feb02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0580-00(E1.1bln), $1.0750(E669mln), $1.0855-60(E586mln), $1.0895-10(E1.1bln), $1.0925-50(E741mln), $1.1150(E744mln)

- USD/JPY: Y127.00($1.4bln), Y128.90-05($1.0bln), Y129.30-50($1.3bln), Y130.00($1.8bln), Y131.55-75($1.0bln)

- GBP/USD: $1.2315(Gbp560mln)

- USD/CNY: Cny6.9500($1.2bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/02/2023 | 0700/0800 | ** |  | DE | Trade Balance |

| 02/02/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 02/02/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 02/02/2023 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 02/02/2023 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 02/02/2023 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 02/02/2023 | 1330/0830 | * |  | CA | Building Permits |

| 02/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 02/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/02/2023 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 02/02/2023 | 1345/1445 |  | EU | ECB Press Conference following Rate Decision | |

| 02/02/2023 | 1500/1000 | ** |  | US | Factory New Orders |

| 02/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 02/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/02/2023 | 1830/1930 |  | EU | ECB Lagarde Speech at Franco-German Business Awards | |

| 03/02/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.