-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Powell Reverberates Around Asia

EXECUTIVE SUMMARY

- KNOT: EXPECT ECB TO KEEP RAISING RATES FOR SOME TIME AFTER MARCH (RTRS)

- SWISS NATIONAL BANK DOES NOT RULE OUT MORE INTEREST RATE HIKES (RTRS)

- BOJ WILL END YCC IN 2023 BUT TWEAK THIS WEEK UNLIKELY, ECONOMISTS SAY (RTRS POLL)

- RBA'S LOWE SAYS PAUSE IN APRIL DEPENDS ON DATA (MNI)

- OIL LOADINGS FROM RUSSIA WESTERN PORTS TO FALL (RTRS SOURCES)

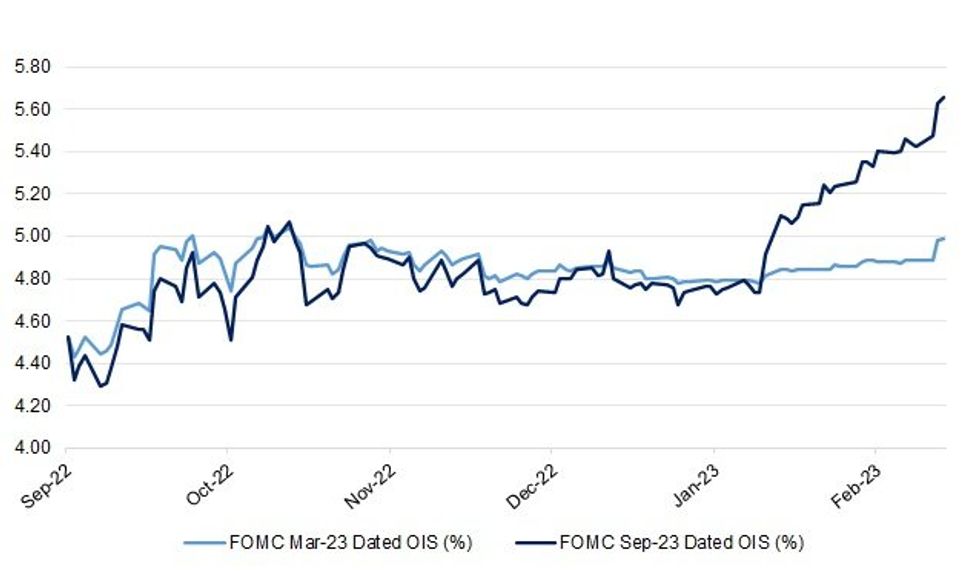

Fig. 1: FOMC Mar ‘23 & Sep ‘23-Dated OIS

Source: MNI - Market News/Bloomberg

UK

FISCAL: Chancellor of the Exchequer Jeremy Hunt is considering giving British firms extra tax relief on investment spending as he seeks measures to boost economic growth in his spring budget. (BBG)

FISCAL: As Jeremy Hunt prepares to present his first spring budget next week, the Treasury is coming under renewed pressure from business leaders to announce greater support to revive faltering investment and economic growth. (The Times)

EUROPE

ECB: The European Central Bank (ECB) should be expected to continue raising rates for some time to come following a new hike at its policy meeting this month, ECB governing council member Klaas Knot said on Tuesday. (RTRS)

FRANCE: French unions pledged to keep up their fight against President Emmanuel Macron’s plan to raise the minimum retirement age after turnout surged to its highest yet in a sixth day of protests on Tuesday. (BBG)

IRELAND: Irish inflation will likely end 2023 at a lower level that previously envisaged, the Central Bank of Ireland said Wednesday. (MNI)

SNB: The Swiss National Bank cannot rule out that it will have to raise interest rates again to fight inflation, Chairman Thomas Jordan said on Tuesday. (RTRS)

SWEDEN: Swedish home prices halted a slide that’s lasted for almost a year even as one of the world’s worst-hit housing markets still faces a further climb in borrowing costs. (BBG)

U.S.

FISCAL: U.S. President Joe Biden’s plan to raise the Medicare tax on high earners and other proposed spending measures “will not see the light of day,” U.S. Senate Republican leader Mitch McConnell said on Tuesday. (RTRS)

FISCAL: A Senate subcommittee on the Banking, Housing and Urban Affairs Committee heard from witnesses Tuesday about the consequences of not raising the $31.4 trillion debt limit amid a stalemate between Republican lawmakers and the White House over a bill that would allow the federal government to continue to pay its debt obligations. (CNBC)

BANKS: Treasury Secretary Janet Yellen on Tuesday warned that climate change is already taking a significant economic toll and could cause extensive losses to the U.S. financial system in the coming years. (CNBC)

OTHER

GLOBAL TRADE: Nvidia Corp, Advanced Micro Devices Inc (AMD.O) and other tech firms are scrambling to assess whether they must halt sales to units of China's Inspur Group Ltd after its addition to a U.S. export blacklist last week. (RTRS)

U.S./CHINA: The White House threw its support behind a new bipartisan Senate bill on Tuesday that would give the Biden administration the power to ban TikTok in the U.S. (CNBC)

U.S./CHINA: U.S. officials are set to relax coronavirus testing requirements on travelers from China as soon as Friday, a decision that comes as cases decline in that country, according to three officials who spoke on the condition of anonymity to describe the plan. (Washington Post)

US./CHINA/TAIWAN: The White House seeks no change in U.S.-China relations, including on Taiwan, spokesman John Kirby said on Tuesday in response to China's foreign minister's warning to Washington to change its "distorted" attitude or risk conflict. (RTRS)

GEOPOLITICS: South Korea will seek to accelerate its participation in the Quad working group, South Korea's Yonhap news agency reported on Wednesday, citing a senior administration official. (RTRS)

BOJ: The Bank of Japan will end its long-term yield control policy this year, the majority of economists said in a Reuters poll, anticipating academic Kazuo Ueda's new leadership to dismantle the complex easing scheme and restore bond market functionality. (RTRS)

BOJ: Bank of Japan officials are wary their forecast for a U.S.-led global economic recovery in mid-2023 could be threatened by higher-than-expected U.S. rates after Federal Reserve chairman Jerome Powell delivered a hawkish policy outlook, MNI understands. (MNI)

RBA: Reserve Bank of Australia Governor Philip Lowe underlined his willingness to pause at the April 4 meeting depending on the flow of economic data over the next few weeks. (MNI)

RUSSIA: Media reports on the Nord Stream pipelines attacks are a coordinated effort to divert attention and the Kremlin is perplexed how U.S. officials can assume anything about the attacks without investigation, the Kremlin said on Wednesday. (RTRS)

RUSSIA: Russia said on Tuesday that media reports about who might be behind last year's attacks on the Nord Stream pipelines underscored the need to answer Moscow's questions about what had happened. (RTRS)

RUSSIA: A senior aide to Ukrainian President Volodymyr Zelenskiy said on Tuesday that Kyiv was "absolutely not involved" in last year's attacks on the Nord Stream pipelines and has no information about what happened. (RTRS)

OIL: China's oil demand will grow 500,000 to 600,000 barrels per day in 2022, OPEC Secretary General Haitham Al Ghais said on Tuesday, as the world's top crude importer emerges from COVID-19 restrictions. "With China opening up, we are quite optimistic, cautiously," he told the CERAWeek energy conference in Houston. (RTRS)

OIL: Decisions on oil output taken by OPEC+ countries reflect consensus in the group and Saudi Arabia judges that its current output policy - that it won’t raise production this year - is correct, its foreign minister said on Tuesday. (Al Arabiya)

OIL: Russia plans to cut oil exports and transit from its western ports in March by 10% on daily basis from February, according to market sources and Reuters calculations. (RTRS)

OIL: U.S.-led international sanctions on Russia have begun to erode the dollar's decades-old dominance of international oil trade as most deals with India - Russia's top outlet for seaborne crude - have been settled in other currencies. (RTRS)

OIL: U.S. crude production and demand will rise in 2023 as Chinese travel drives consumption, the U.S. Energy Information Administration (EIA) said in its Short Term Energy Outlook (STEO) on Tuesday. (RTRS)

OIL: The Opec cartel is back in control of the world oil market as the shale revolution peters out, according to a number of industry executives who warned of higher prices for crude in the year ahead. (FT)

CHINA

ECONOMY: China needs to further prioritize quality over quantity when pursuing economic growth and further improve policy coordination to make it happen, Xinhua News Agency said in a commentary in explanation of President Xi Jinping’s calls for high-quality growth. (BBG)

PBOC: China has reinstated the People’s Bank of China provincial branch system to manage activities such as currency issuance, treasury management, maintaining financial stability and anti-money laundering. (MNI)

SWAPS: China will further open up its bond market by implementing a trading program to provide overseas investors an access to its onshore interest rate derivatives products, Securities Times reported, citing Huo Yinli, Party chief of the China Foreign Exchange Trade System, under the central bank. (BBG)

PROPERTY: Defusing risks in the real-estate industry should be done in a “slow release” manner, according to Ni Hong, Minister for Housing. (MNI)

REITS: China should consider amending its regulations to simplify the structure of REITs, the China Securities Journal reported, citing Sha Yan, president of the Shenzhen Stock Exchange. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY103 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) conducted CNY4 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY103 billion after offsetting the maturity of CNY107 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9284% at 09:26 am local time from the close of 1.8823% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 43 on Tuesday, compared with the close of 46 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9525 WEDS VS 6.9156 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9525 on Wednesday, compared with 6.9156 set on Tuesday.

OVERNIGHT DATA

JAPAN JAN, P LEADING INDEX 96.5; MEDIAN 96.9; DEC 96.9

JAPAN JAN, P COINCIDENT INDEX 96.1; MEDIAN 96.4; DEC 99.1

JAN FEB ECO WATCHERS SURVEY OUTLOOK 50.8; MEDIAN 49.7; JAN 49.3

JAN FEB ECO WATCHERS SURVEY CURRENT 52.0; MEDIAN 49.0; JAN 48.5

JAPAN JAN BOP CURRENT ACCOUNT -Y1.9766TN; MEDIAN -Y785.0BN; DEC +Y33.4BN

JAPAN JAN BOP ADJUSTED CURRENT ACCOUNT +Y216.3BN; MEDIAN +Y803.3BN; DEC +Y1.1839TN

JAPAN JAN BOP TRADE BALANCE -Y3.1818TN; MEDIAN -Y2.9238TN; DEC -Y1.2256TN

JAPAN FEB BANK LENDING INCLUDING TRUSTS +3.3% Y/Y; JAN +3.1%

JAPAN FEB BANK LENDING EXCLUDING TRUSTS +3.6% Y/Y; JAN +3.4%

MARKETS

US TSYS: Pressured In Asia, Powell Testimony Continues Today

TYM3 deals at 110-23, 0-07+, a touch off the base of the 0-11 range on elevated volume of ~185K.

- Cash Tsys sit 2-6bps cheaper across the major benchmarks, the curve has bear flattened.

- Asia-Pac participants added to yesterday's NY weakness in Tsys as they digested Fed Chair Powell's remarks at his Senate appearance.

- 2 Year-Yield breached yesterday's highs (highest since '07) and the 2s10s inversion printed a fresh cycle extreme.

- 10 Year Yield did briefly print above 4%, however, the lack of follow through above there and subsequent tick back below the round number stabilised the long end a little (much like NY trade on Tuesday)

- On the sell side Goldman Sachs raised their Fed terminal rate forecast by 25bps to 5.5-5.75%.

- Block sales in TU (3.7k lots), FV (2.25k lots) and TY (~2.8k lots) provided the highlight on the flow side.

- There was little meaningful macro headline flow through the Asian session.

- In Europe today we have final Eurozone GDP and ECB-speak from Lagarde. Further out MBA Mortgage Applications, ADP Employment , Trade Balance and JOLTS Job Openings will cross. Elsewhere, Fed Chair Powell’s Congressional testimony continues and we have the latest 10-Year Tsy supply.

JGBS: Long End Weakness Promotes Twist Steepening Post-Powell & Pre-BoJ

JGB futures have moved further away from their early Tokyo lows during afternoon trade, printing -3 ahead of the bell.

- The early steepening dynamic and leg lower in JGB futures was seemingly a product of follow through from Fed Chair Powell’s hawkish warnings. Super-long paper remained heavy throughout the day with U.S. Tsys operating on the backfoot in Asia.

- The twist steepening dynamic in JGBs thereafter was potentially a product of continued unwinds of hawkish flattener plays pre-BoJ and a subdued to average round of cover ratios in the latest round of BoJ Rinban operations (1- to 25-Year JGBs). Cash JGBs are 0.5bp richer to 3bp cheaper into the close, with only 30s and 40s sitting cheaper on the session.

- Local headline flow was subdued.

- There isn’t much to inspire on the local calendar on Thursday, with final Q4 GDP readings providing the pick of the bunch. We will also get the latest liquidity enhancement auction covering off-the-run 1- to 5-Year JGBs.

- Focus remains squarely on Friday’s BoJ decision. A clear consensus looks for no change in BoJ policy settings come the end of outgoing Governor Kuroda’s final policy meeting. However, the Bank’s recent propensity to shock (see the surprise widening of the YCC band back in December) means that this view is held with varying degrees of conviction. There will be more on that matter in our full preview of the event.

JGBS AUCTION: 6-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y3.66097tn 6-month Bills:

- Average Yield: -0.1596% (prev. -0.1330%)

- Average Price: 100.081 (prev. 100.066)

- High Yield: -0.1458% (prev. -0.1148%)

- Low Price: 100.074 (prev. 100.057)

- % Allotted At High Yield: 98.4326% (prev. 21.4375%)

- Bid/Cover: 3.357x (prev. 4.171x)

AUSSIE BONDS: Reverse Direction With Weaker U.S Tsys

After an initial spike higher with the release of RBA Governor Lowe’s speech this morning, ACGBs quickly reversed and then cheapened over the session to close near lows (YM -9.0 and XM -6.0). With Lowe clarifying yesterday’s dovish message, that a pause as soon as April is possible (offering little new), ACGBs turned to U.S Tsys for direction. Cash ACGBs weakened 5-8bp with the 3/10 cash curve 2bp flatter.

- The 3s10s swaps curve bear flattened with rates 4-6bp higher and EFPs 1-2bp tighter.

- Bills closed 2-7bp cheaper, steepening.

- After yesterday’s aggressive RBA-induced softening, RBA-dated OIS firmed +3-6bp for meetings beyond June with terminal rate pricing pushing back out to 4.07% versus yesterday’s of ~4%. The strip took the lead from Tuesday's repricing of FOMC expectations.

- Futures roll activity will pick up from the overnight session, with tick sizes shrinking ahead of next week's expiry.

- With the local calendar light for the remainder of the week, the market will be guided by developments abroad. Later today we hear from Fed Chair Powell when he testifies before the House. The BOC is also scheduled to deliver a policy decision. With the RBA now openly discussing a policy pause, the market will be keen to see if the BOC carries through with its no-change guidance today.

AUSSIE BONDS: ACGB Jun-35 Auction Results

The Australian Office of Financial Management (AOFM) sells A$500mn of the 2.75% 21 June 2035 Bond, issue #TB145:

- Average Yield: 3.8184% (prev. 2.3456%)

- High Yield: 3.8200% (prev. 2.3475%)

- Bid/Cover: 4.5200x (prev. 3.1600x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 58.8% (prev. 41.9%)

- Bidders 42 (prev. 48 ), successful 10 (prev. 15), allocated in full 5 (prev. 6)

- The time passed since the previous auction means that the statistics from the previous auction provide little comparable use.

NZGBS: Close On Cheaps As U.S Tsys Weaken

Today threatened to be a volatile session as the market caught up with developments in AU and U.S., and it didn't disappoint with the 2-year NZGB benchmark trading in a 10bp range (the 10-year traded in a more modest 4bp range). NZGB benchmarks close at session cheaps with Fed Chair Powell-induced U.S Tsy weakness the key driver. The 2/10 cash curve bear flattened with yields little changed to +7bp higher.

- On a relative basis, the NZGB benchmarks outperformed U.S. Tsys with the 10-year yield differential -4bp tighter and the 2-year yield differential -12bp lower. Not surprisingly after recent RBA developments, the NZ/AU 10-year yield differential closed +4bp wider.

- A similarly heavy session for swaps with rates 4-9bp higher, implying wider swap spreads, and the 2s10s curve 5bp flatter.

- With the strongly divergent messages from the RBA and the Fed since the local close yesterday RBNZ-dated OIS has taken its cue from U.S. developments. Pricing is 3-9bp firmer across meetings with August leading. April pricing firms to 45bp of tightening. Equally noteworthy, terminal rate expectations have pushed well above the RBNZ’s projected OCR peak of 5.50% to ~5.60%.

- The local calendar has card spending data for February scheduled on Thursday, while RBNZ Deputy Governor Hawkesby will appear at a private event, fleshing out the previous monetary policy decision (no new information will be divulged).

EQUITIES: Weakness Across The Board, Although Nikkei Outperforms

Regional equities are mostly in the red, with Japan the outlier. With the continued move higher in US yields, particularly in the short end, the tech sector has underperformed today. US futures did dip into negative territory but are now back close too flat.

- The HSI is off around 2.5% at this stage, with the tech sector off by close to 3.8%. Outside of the hawkish Fed developments, there has also been focus on China's plans for a bureau that will tighten data security. Oversight of the banking and insurance industries is also expected.

- Mainland stocks are weaker, with the CSI 300 off by 0.66% at this stage. Northbound outflows have been modest.

- The Kopis is off by 1.3%, while the Taeix is off by 0.50%. The Nikkei 225 is an outperformer, +0.40%, with the weaker yen (near 138.00) likely helping at the margins.

- Weakness is evident elsewhere, but losses are generally under 1%.

GOLD: Bullion Struggling Under Hawkish Fed Comments, Powell Speaks Again Later

Gold prices fell 1.8% m/m on Tuesday as Fed Chairman Powell not only said that rates are likely to peak at a higher rate than expected at the last meeting but another 50bp hike is possible. His comments were more hawkish than expected by markets and Treasury yields and the USD rose, and equities sold off. He speaks in front of the House later today and in anticipation gold is down another 0.2% during APAC trading. It is currently around $1810.55/oz, close to the intraday low of $1809.50 following a high of $1814.30 earlier.

- A close to 50bp hike is now priced in by markets for the March 22 meeting, which is negative for non-yielding gold. On the other hand, China increased its gold reserves for the fourth consecutive month in February. Asia has generally been increasing its holdings of bullion.

- Gold remains above the bear trigger of $1804.90, the February 28 low. But it is approaching its 100-day simple moving average.

- Later today Fed Chairman Powell appears before the House Financial Services Committee, Barkin speaks and the Beige Book is published. ECB President Lagarde also speaks. The Bank of Canada is expected to pause. Ahead of Friday’s US employment data, there is February ADP employment and also JOLTS vacancy data. US January trade data are also released.

OIL: Crude Stable Ahead Of Further Comments From The Fed’s Powell

Oil prices fell sharply on Tuesday following Fed Chairman Powell’s more hawkish comments implying a possible 50bp move. WTI was down 4% to $77.58/bbl and is currently trading around that level, which is close to today’s intraday high. Brent is currently up 0.2% to be trading around $83.45/bbl. The USD index is up 0.2%.

- Tuesday’s correction in crude reversed the recent bull cycle. WTI held above support of $75.83, the March 3 low, and has continued to do so today.

- US API data showed that crude stocks fell 3.8mn barrels last week after rising 6.2mn. Distillate rose 1.9mn and gasoline 1.8mn. This is an early indication that extensive refining maintenance may be coming to an end. The official EIA data is published later today.

- OPEC+ Secretary General Al-Ghais said that the market was concerned about reduced oil demand from Europe and the US, even as Asian consumption is “phenomenal”.

- China imported 10.4mbd of crude in February, which was down 11% on December and -3% y/y. This data may be reflecting the build up in stocks over the last two years. (bbg)

- Later today Fed Chairman Powell appears before the House Financial Services Committee, Barkin speaks and the Beige Book is published. ECB President Lagarde also speaks. The Bank of Canada is expected to pause. Ahead of Friday’s US employment data, there is February ADP employment and also JOLTS vacancy data. US January trade data are also released.

FOREX: Greenback Firms On Rising US Yields

The USD is on the front foot in Asia as rising US Treasury Yields boost the greenback. Yen is the weakest performer in G-10 space at the margins.

- USD/JPY prints at ¥137.80/90, approaching upside resistance is at ¥137.95 high from 2 March and bull trigger. Early in the session weaker than expected trade balance and current account figures weighed on the Yen. JPY was a relative outperformer on Tuesday so today's move may reflect a partial reversal of the trend.

- Kiwi is also softer, NZD/USD is down ~0.2%. The pair has been pressured and registered a fresh YTD low at $0.6085 before marginally paring losses to sit a touch below $0.6100.

- AUD is marginally outperforming, AUD/USD registered its lowest level since early November before paring losses to sit a touch firmer. The next downside target is $0.6547 61.8% retracement Oct - Feb bull cycle. RBA Gov Lowe noted that this morning the RBA is getting closer to a pause but that the peak in rates hasn't been reached however there was little follow through and the losses were pared.

- AUD/NZD is ~0.3% firmer, the cross has recovered above the $1.08 handle recouping some of yesterday's losses.

- EUR and GBP sit ~0.1% softer as the greenback strength marginally weighs.

- Cross asset wise, 2 Year US Treasury Yields are at a cycle high (5.07%). US Equity futures are little changed. BBDXY is ~0.2% firmer.

- In Europe today we have final Eurozone GDP. Further out MBA Mortgage Applications, ADP Employment , Trade Balance and JOLTS Job Openings will cross. Elsewhere, Fed Chair Powell’s appears before the House Finance Committee.

FX OPTIONS: Expiries for Mar08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-05(E797mln), $1.0560-65(E2.5bln), $1.0600(E902mln), $1.0645-60(E1.5bln), $1.0670-90(E2.3bln), $1.0715-35(E1.5bln), $1.0745-55(E1.5bln)

- USD/JPY: Y135.00($1.2bln), Y137.00($1.6bln)

- USD/CAD: C$1.3550-60($623mln)

- USD/CNY: Cny6.8650($1.1bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/03/2023 | 0700/0800 | ** |  | DE | Industrial Production |

| 08/03/2023 | 0700/0800 | ** |  | DE | Retail Sales |

| 08/03/2023 | 0900/1000 | * |  | IT | Retail Sales |

| 08/03/2023 | 0930/0930 |  | UK | BOE Dhingra at Resolution Foundation | |

| 08/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/03/2023 | 1000/1100 | *** |  | EU | GDP (final) |

| 08/03/2023 | 1000/1100 | * |  | EU | Employment |

| 08/03/2023 | 1000/1100 |  | EU | ECB Lagarde at Women's Day WTO Event | |

| 08/03/2023 | 1000/1100 |  | EU | ECB Panetta Intro at Euro Cyber Resilience Board | |

| 08/03/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 08/03/2023 | 1300/0800 |  | US | Richmond Fed's Tom Barkin | |

| 08/03/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 08/03/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 08/03/2023 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 08/03/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 08/03/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 08/03/2023 | 1500/1000 |  | US | Fed Chair Jerome Powell | |

| 08/03/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 08/03/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/03/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 08/03/2023 | 1900/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.