-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: NFPs & BoE Speak To End The Week

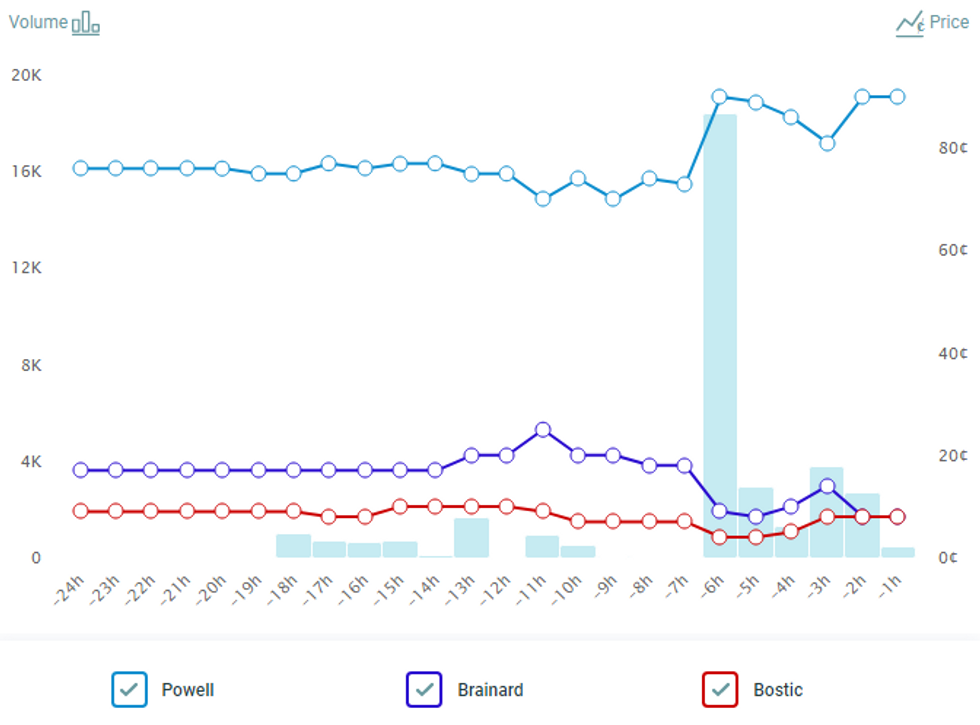

- Odds of a second term for Fed Chair Powell were boosted by press reports.

- The PBoC continues to fine tune liquidity conditions via OMOs.

- NFPs and BoE speak will headline the broader economic docket on Friday.

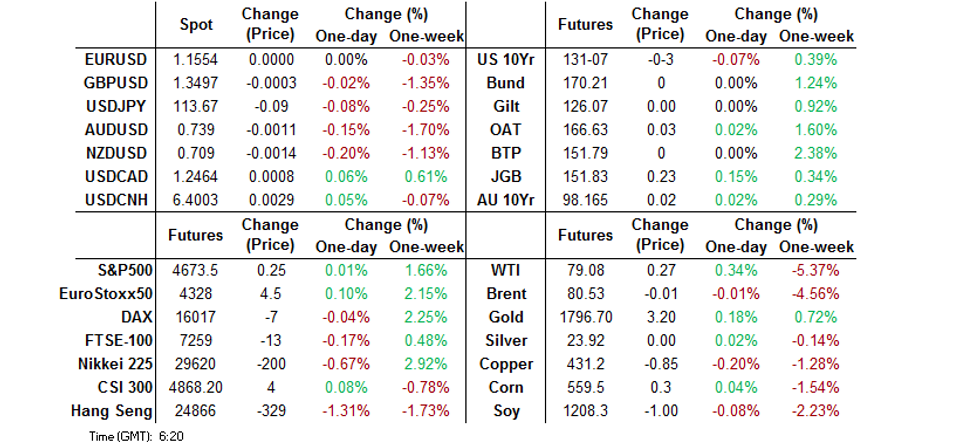

BOND SUMMARY: Mixed Trade for Core FI

With oil futures back from their early Asia highs and ACGBs bid post-SOMP, the U.S. Tsy space regained some ground after a soft start to Asia-Pac trade. Note that a tweak to the PBoC's daily OMOs also provided a helping hand. TYZ1 last -0-04 at 131-06, while cash Tsys run 0.5-1.0bp cheaper across the curve, as the belly provides some incremental underperformance. Odds of Fed Chair Powell being nominated to serve a second term rose after the WSJ reported that he was seen at the White House on Thursday, while Axios sources noted that "the White House is asking Democratic senators to meet with Federal Reserve chair Jerome Powell before Thanksgiving - leading some to believe President Biden will renominate him this month." NFPs headline the local docket on Friday, with Fedspeak from Geroge & Quarles also due. BoE speak is also set to provide some interest (and potential cross-market impact) in the wake of yesterday's inaction on Threadneedle Street.

- JGB extended their overnight gains as local participants reacted to the BoE-driven overnight bid, before paring back from best levels into the lunch break. A bid then came back in during the afternoon session, with a lack of meaningful fiscal upheaval clearly evident in the latest round of communique from both the Finance & Economy Minister. The major cash JGB benchmarks run little changed to 1.5bp richer, with bull steepening in pay as the long end lags. We also saw Japanese Finance Minister Suzuki confirm earlier speculation re: the government considering Y100K handouts for under 18s, while underlining the need for fiscal discipline.

- There was a sharp move lower in Aussie bond futures into the close, leaving YM +4.0 and XM +2.0 come the bell. The former broke its early Sydney low, while the latter tested its own Sydney low. There was no headline flow to account for the move, perhaps a case of locals undertaking some pre-NFP book squaring. The space had moved away from early Sydney lows on the back of the RBA SoMP, which saw a slightly harder lean towards the RBA maintaining '24 as the timing of the first cash rate hike as its base case vs. Tuesday's communique, although there is clearly some optionality embedded. PBoC OMO liquidity dynamics also provided some support. The cover ratio at the latest ACGB Apr-25 auction wasn't particularly firm, with the recent vol. and removal of micro curve interest likely resulting in a much less aggressive stance when it came to capital deployment. Still, the pricing on the auction was far more encouraging, with the weighted average yield printing 0.87bp through prevailing mids (per Yieldbroker). The well-documented supportive factors and hedgability of the line (flagged ahead of the auction) ultimately prevailed, providing smooth passage.

FED: Press Reports Boost Odds Of A Second Term For Powell

A quick recap of overnight news re: the race surrounding the Fed Chair role:

- The WSJ reported that "Federal Reserve Chairman Jerome Powell was seen visiting the White House on Thursday, according to people familiar with the matter."

- Axios sources suggested that "the White House is asking Democratic senators to meet with Federal Reserve chair Jerome Powell before Thanksgiving - leading some to believe President Biden will renominate him this month, people familiar with the matter tell Axios."

- As you can see from the chart below, these reports (particularly the WSJ story) boosted the odds of Fed Chair Powell being nominated to serve a second term.

Fig. 1: Odds On Whom Will The Senate Next Confirm As Chair Of The Federal Reserve?

Source: PredictIt

Source: PredictIt

JAPAN: Modest Weekly Net Security Flows

The latest round of weekly international security flow data out of Japan revealed relatively modest net flows across the 4 major metrics, with a second consecutive round of net weekly sales of foreign bonds on the part of Japanese investors witnessed (after a run of 7 consecutive weeks of net buying).

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -525.9 | -604.5 | 235.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -210.4 | 120.5 | 94.7 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -472.3 | -372.7 | -926.2 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 411.5 | 229.7 | 2615.1 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Yen Poised To Finish Week Atop G10 Pile

Defensive feel dominated in Asia, as Kaisa Group's troubles with liquidity reignited concerns about a deepening crisis in China's property sector. USD/CNH edged higher, even as the PBOC put an end to a multi-day streak of softer than expected yuan fixings.

- Risk-off flows were evident in G10 FX space, with the yen garnering most strength. A correction in global monetary policy outlook may have played a role, after the BoE's surprise decision to leave interest rates unchanged fuelled reassessment of tightening prospects. The yen had earlier underperformed on expectations of a growing policy divergence, as the BoJ have been expected to continue pumping stimulus maintain accommodative policy settings.

- Antipodean currencies brought up the rear. In their latest Statement on Monetary Policy, the RBA said that their central scenario "could be consistent with the first increase in the cash rate being in 2024."

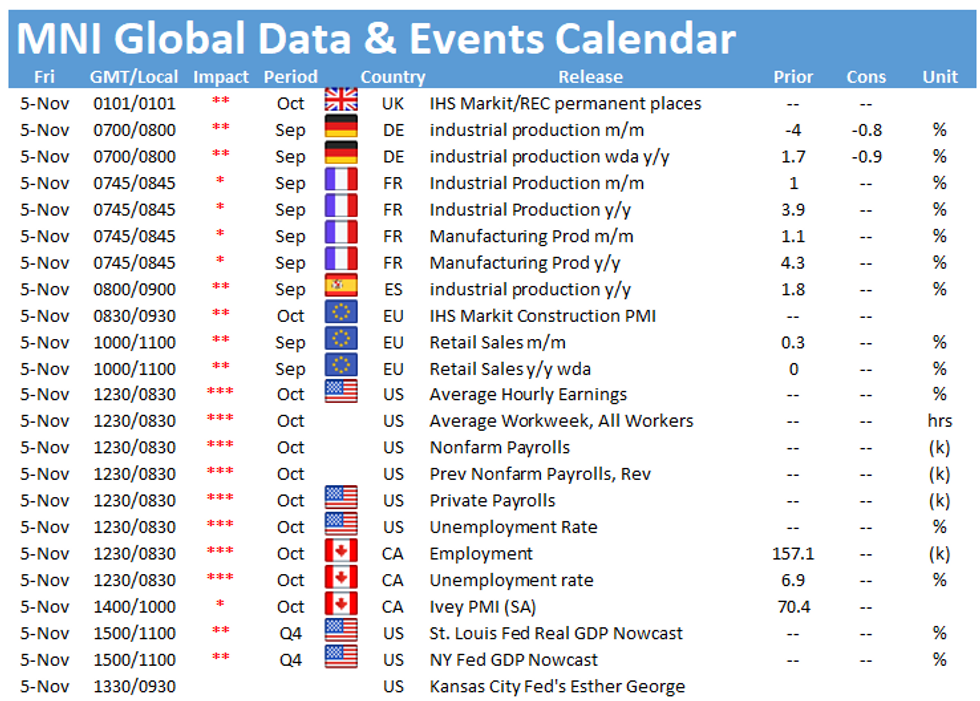

- U.S. NFPs headline the global data docket today. Also coming up are German industrial output & Canadian jobs data. In addition, we will hear from several ECB, BoE & Norges Bank policymakers.

ASIA FX: Dollar Prevails Over Most Asia EMFX, Peso Aided By Local CPI Data

Overnight greenback strength lent support to USD/Asia crosses, albeit the Philippine peso went bid as local CPI data missed expectations.

- CNH: Offshore yuan slipped against the greenback, even as the PBOC set their USD/CNY mid-point below sell-side estimate for the first time since Oct 19. Concerns about the ongoing crisis in China's property sector resurfaced after Kaisa Group flagged acute liquidity pressure.

- KRW: USD/KRW reopened on a firmer footing, before trimming some gains. Overnight greenback strength drove the move.

- PHP: The peso outperformed after Philippine inflation unexpectedly slowed in October, while Bangko Sentral ng Pilipinas pointed to the need to reassess the price environment ahead of their next monetary policy decision. Meanwhile, the decision to lower Covid Alert Level in Metro Manila by one notch likely provided further support to the local currency.

- IDR: USD/IDR extended gains to levels last seen in late August, as the rupiah cemented its position as the worst performer in the Asia EM basket this week. Bank Indonesia sought to soothe the nerves, their Exec Director said that the central bank sees rupiah depreciation as temporary. He rattled the triple intervention sabre, but also noted that Bank Indonesia guards rupiah stability rather than the level of rupiah.

- MYR: Malaysian markets reopened after a holiday. Spot USD/MYR crept higher, absorbing pent-up market impetus.

- THB: The baht firmed a tad, albeit spot USD/THB respected yesterday's extremes. Participants await Thailand's CPI data for the month of October.

EQUITIES: Equities Marginally Mixed In Asia

There was a lack of uniformity in equity trade during Asia-Pac hours, with the Nikkei 225 ticking lower after the JPY regained some poise over the last 24 hours on cross-market yield dynamics post-BoE. The Hang Seng also lost ground, with Chinese tech names under the microscope as we grind towards earnings reports from Tencent & Alibaba. Chinese property developers also continue to be scrutinised, with Kaisa Group suspending trade in Hong Kong after it missed payments on wealth management products. Another uptick in PBoC gross liquidity injections via OMOs allowed the CSI 300 to register incremental gains, although CNY780bn has been drained out of the market over the last 5 days, as the PBoC removed the bulk of its month-end liquidity provisions. Still, the major regional indices sit within 1.0% of Thursday's closing levels as we head towards the weekend. U.S. e-mini futures are virtually unchanged ahead of Friday's NFP print.

GOLD: NFPs In View

Spot gold has hugged a tight range during Asia-Pac hours, last dealing virtually unchanged, just above $1,790/oz. The BoE driven bid allowed gold to firm on Thursday, with the impetus from lower U.S. real yields outweighing the uptick in the DXY, although bulls were not able to force their way through $1,800/oz in spot trade, leaving the recently observed range (and technical overlay) well and truly intact. A softer than expected U.S. labour market report may be the catalyst to facilitate a test of key resistance at the Oct 22 high ($1,813.8/oz), while notable near-term support, located at the Oct 6 low ($1,746/oz) may prove a little too far out of reach on a stronger than expected labour market report.

OIL: A Touch Higher Overnight, But Comfortably Away From Recent Peak

WTI & Brent futures sit ~$0.20 above & ~$0.10 below their respective settlement levels, unwinding early gains. this comes after the contracts shed ~$2.00 & $1.50 respectively on Thursday. Yesterday's losses were spurred by news that Saudi crude production will soon top 10mn bpd (for the first time since it was impacted by the pandemic), while a firmer USD also applied pressure. In other news, the OPEC+ group stuck to its guns, deciding to boost its output by the previously outlined cumulative 400K bpd in December, ignoring the calls of oil consuming nations re: larger boosts of supply.

- This has resulted in the U.S. DoE noting that it is looking at "all tools," while the White House flagged the power to put more oil onto the market if required.

- Goldman Sachs noted that their "bullish view remains unchanged: the oil deficit remains unresolved, the current strength in oil demand remains a near-term tailwind and the increasingly structural nature of the deficits will require much higher long-dated oil prices. The now open disagreement between OPEC and the US administration, the threat of an SPR release and the potential resumption in negotiations with Iran will nonetheless increase the volatility in oil prices in coming weeks, especially as trading liquidity falls into year-end."

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.