-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: South Korea Deals With Martial Law Fallout

MNI: PBOC Net Drains CNY227 Bln via OMO Wednesday

MNI EUROPEAN OPEN: Pre-China NPC Musings And U.S. Yields Setting The Tone

EXECUTIVE SUMMARY

- FED CHAIR POWELL TO TESTIFY AT HOUSE FINANCIAL SERVICES COMMITTEE MARCH 8 (RTRS)

- GOOLSBEE’S WIFE WORKS AT FIRM THAT HELPED PICK HIM FOR FED JOB (BBG)

- BORIS JOHNSON WILL RAISE CONCERNS ABOUT RISHI SUNAK’S BREXIT DEAL IN HIS FIRST PUBLIC INTERVENTION SINCE IT WAS ANNOUNCED EARLIER THIS WEEK (THE TIMES)

- BOJ'S TAKATA SAYS EASY POLICY SHOULD BE MAINTAINED (MNI)

- CHINA’S NPC TO TARGET GROWTH ABOVE 5% WITH HELP FROM PBOC (MNI)

- CHINA’S ECONOMIC RECOVERY NEEDS MORE POLICY SUPPORT (SEC. TIMES)

- SAUDI ARAMCO SEES ‘VERY STRONG’ OIL DEMAND FROM CHINA (BBG)

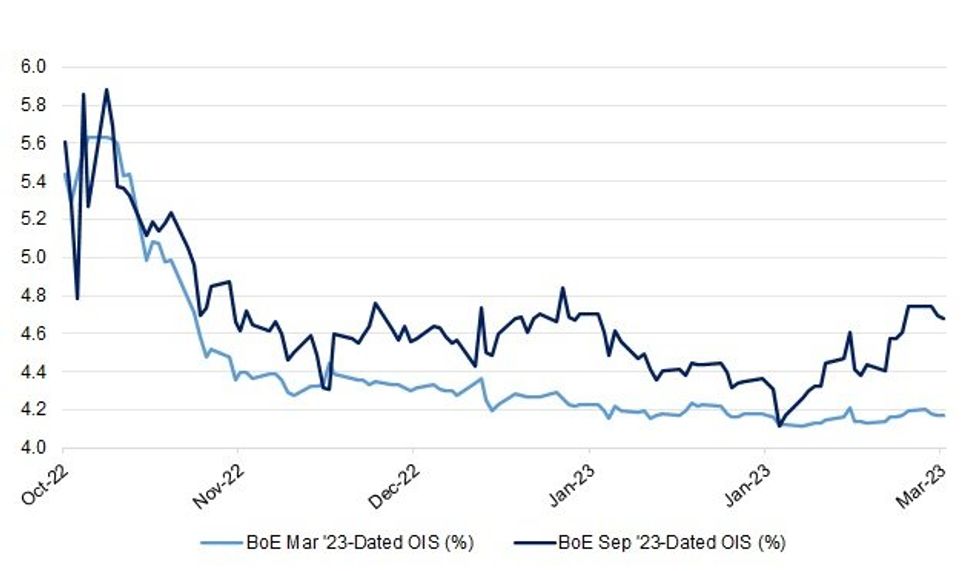

Fig. 1: BoE Mar & Sep ‘23-Dated OIS

Source: MNI - Market News/Bloomberg

UK

BREXIT: Boris Johnson will raise concerns about Rishi Sunak’s Brexit deal in his first public intervention since it was announced earlier this week. (The Times)

BREXIT: A new report from a unionist think tank has recommended that unionists do not support the Windsor Framework until certain amendments are made. (Belfast Telegraph)

FISCAL: UK Chancellor of the Exchequer Jeremy Hunt will offer voters a dollop of optimism alongside well-flagged spending restraint in his spring Budget as he tries to curb inflation, one of his junior ministers said. (BBG)

EUROPE

EUROZONE: Fitch Ratings Inc. sees Germany and Italy’s economies going into recession by the end of this year, though not the Eurozone as a whole. (BBG)

EU: The European Union is scrambling to salvage a plan to effectively ban new combustion-engine cars by 2035 after Germany and Italy threatened to block the agreement. (BBG)

U.S.

FED: Federal Reserve Chair Jerome Powell will testify on the U.S. central bank's semiannual monetary policy report to the House Financial Services Committee on March 8 at 10 a.m. ET, the panel said on Wednesday. Powell will testify at the Senate Banking Committee on the same topic on Tuesday. (RTRS)

FED: WSJ Fed reporter Timiraos tweeted the following on Wednesday: “KC Fed economists warn of a false dawn in easing rents: "A return to pre-pandemic rates of rent inflation could remain elusive" Tight labor markets suggest "rent inflation is likely to remain elevated even after the dust settles on pandemic-driven swings."” (MNI)

FED: The Fed must keep raising interest rates to put inflation on the path to its 2% target, according to Timothy Fiore of the Institute for Supply Management, whose factory price index has risen 12 percentage points over the last two months.(MNI)

FED: The search firm hired by the Federal Reserve Bank of Chicago to help find a new president includes among its executives the wife of Austan Goolsbee, the person ultimately picked for the role. (BBG)

POLITICS: The Senate on Wednesday voted to overturn a Labor Department rule that permits fiduciary retirement fund managers to consider climate change, good corporate governance and other factors when making investments on behalf of pension plan participants. (CNBC)

OTHER

GLOBAL TRADE: Ten European countries have written to the European Commission calling on the bloc to take measures to better compete with China and the United States in the long-term. (BBG)

GLOBAL TRADE: Huawei Technologies is in Spain pitching its cloud services and 5G technologies to global clients, emerging from three years of COVID restrictions and working around multiple U.S. trade sanctions that have hindered its expansion ambitions. (Nikkei)

U.S./CHINA: The United States is sounding out close allies about the possibility of imposing new sanctions on China if Beijing provides military support to Russia for its war in Ukraine, according to four U.S. officials and other sources. (RTRS)

G20: Indian Prime Minister Narendra Modi called on world leaders to find common ground on divisive issues on Thursday as he inaugurated a ministerial meeting of the Group of 20 bloc where Russia's year-long war in Ukraine is taking centre-stage. (RTRS)

BOJ: Bank of Japan board member Hajime Takata said on Thursday that the BOJ should patiently maintain easy policy, while paying attention to the impact of powerful easy policy on market functioning. (MNI)

BOJ: Former Bank of Japan governor Masaaki Shirakawa has highlighted the risks to Japan's inflation outlook from long-standing employment practices, as he called for global policymakers to give more consideration to supply-side factors in an article in the International Monetary Fund's latest Finance & Development Magazine. (MNI)

AUSTRALIA: Expectations for a 16% fall in Australian home prices from their peak have held steady despite growing expectations over the past few months the Reserve Bank will raise interest rates to a higher peak, a Reuters poll of analysts found. (RTRS)

NEW ZEALAND: The number of homes sold by Auckland's largest real estate agency plummeted in February. (Interest NZ)

SOUTH KOREA: South Korea's export slump will continue unless chip sales rebound, the finance minister said Thursday, amid the protracted downturn in outbound shipments of the mainstay product. (Yonhap)

BOK: South Korea faces an array of inflationary risks ranging from rising utility bills to wage increases and needs a “delicate policy response” to manage them, a Bank of Korea research report showed. (BBG)

MEXICO: The Bank of Mexico said on Wednesday that inflation is taking longer than initially anticipated to return to its target, in large part due to the persistence of core inflation. (RTRS)

MEXICO: Banco de Mexico’s Deputy Governor Irene Espinosa would prefer not to surprise the market with the following decisions of the central bank and instead wants to guide it in the “right direction,” she said in a quarterly report presentation on Wednesday.(BBG)

MEXICO: The United States will consider "all options," including a formal trade dispute panel, unless Mexico addresses Washington's concerns over Mexico's plan to limit imports of genetically modified corn, a senior U.S. trade official said on Wednesday. (RTRS)

BRAZIL: Brazil's state-run oil company Petrobras on Wednesday posted a better-than-expected 38% surge in fourth-quarter earnings but proposed to trim its usually robust dividend, under pressure from the new leftist government. (RTRS)

RUSSIA: The European Union is set to propose a three-track plan to provide Ukraine with much-needed ammunition in response to some member states’ calls to ramp up the continent’s production capacity, but the amount of funding remains unclear. (BBG)

RUSSIA: Chinese President Xi Jinping and Belarusian leader Alexander Lukashenko said they wanted to see peace in Ukraine, though they avoided providing details on how they’d bring the year-old war to an end. (BBG)

SOUTH AFRICA: South Africa’s only opposition-led province plans to facilitate the construction of almost 6 gigawatts of power generation capacity to counter nationwide electricity shortages and bolster the regional economy. (BBG)

MARKETS: Chinese brokerages offering overseas investing services to mainland clients have come under pressure from a regulatory push that seeks to seal off one of the few remaining loopholes in the country’s strict capital controls. (FT)

EQUITIES: Hong Kong Exchanges & Clearing is considering lowering market capitalization requirements in a revised system for cutting-edge tech companies to go public in the city, Hong Kong Economic Journal reports, in its bid to boost the city’s appeal as a listings hub and better align with China’s high-tech development focus. (BBG)

OIL: “The demand from China is very strong,” Saudi Aramco CEO Amin Nasser tells Bloomberg in Riyadh. In the US and Europe demand is “excellent”. (BBG)

OIL: Supplies of Russian flagship Urals crude oil to Turkey reached a four-month high in February after STAR refinery, owned by Azerbaijan's oil firm SOCAR, resumed purchases of the blend, data showed and four industry sources said on Wednesday. (RTRS)

CHINA

NPC/ECONOMY: China is becoming increasingly ambitious with its 2023 growth target, aiming potentially as high as 6%, in a bid to boost investor and consumer confidence and build on a promising post-pandemic recovery, sources involved in policy discussions said. (MNI)

ECONOMY/POLICY: More supportive macro policies are required to ensure China’s continuous and stable economic recovery, the Securities Times said in a commentary Thursday. (BBG)

ECONOMY: This year has been officially announced as the “Year of Consumption” by the Ministry of Commerce (MOFCOM). (MNI)

ECONOMY: China's job market was stable and better than expected in January and February, and the country's employment will continue to pick up and remain stable this year, Wang Xiaoping, the human resources minister, said on Thursday. However, there is still pressure on employment and the structural conflict between difficulty of recruitment and finding jobs remains outstanding, Wang said. (RTRS)

FISCAL: Subsidies available for the purchase of electric cars in 2023 will be clarified soon, according to Xin Guobin, deputy minister of the Ministry of Industry and Information Technology. (MNI)

POLICY: Beijing plans to promote State Owned Enterprises (SOE) listing on stock exchanges will speed up reforms and improve the corporate governance, according to Securities Daily. (MNI)

YUAN: Traders betting on a falling yuan are doing so at a time Beijing’s tolerance for currency weakness is at a minimum. (BBG)

PROPERTY: Major Chinese developers are warming up to land auctions, as evidenced by a slowing year-on-year decline in the amount of money they spent on land acquisitions in February, according to a report in the Securities Times Thursday. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY227 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) conducted CNY73 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY227 billion after offsetting the maturity of CNY300 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0000% at 09:25 am local time from the close of 2.0887% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Wednesday, the same as the index registered on the previous day.

PBOC SETS YUAN CENTRAL PARITY AT 6.8808 THURS VS 6.9400 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8808 on Thursday, compared with 6.9400 set on Wednesday.

OVERNIGHT DATA

JAPAN Q4 CAPEX +7.7% Y/Y; MEDIAN +7.1%; Q3 +9.8%

JAPAN Q4 CAPEX EX-SOFTWARE +6.3% Y/Y; MEDIAN +5.5%; Q3 +8.0%

JAPAN Q4 CORPORATE PROFITS -2.8% Y/Y; MEDIAN +8.4%; Q3 +18.3%

JAPAN Q4 CORPORATE REVENUES +6.1% Y/Y; MEDIAN +8.7%; Q3 +8.3%

JAPAN FEB MONETARY BASE Y651.8TN; JAN Y651.9TN

JAPAN FEB MONETARY BASE -1.6% Y/Y; JAN -3.8%

JAPAN FEB CONSUMER CONFIDENCE INDEX 31.1; MEDIAN 32.0; JAN 31.0

AUSTRALIA JAN BUILDING APPROVALS -27.6% M/M; MEDIAN -7.0%; DEC +15.3%

NEW ZEALAND Q4 TERMS OF TRADE +1.8% Q/Q; Q3 -3.9%

SOUTH KOREA JAN INDUSTRIAL PRODUCTION +2.9% M/M; MEDIAN -0.8%; DEC -3.1%

SOUTH KOREA JAN INDUSTRIAL PRODUCTION -12.7% Y/Y; MEDIAN -9.5%; DEC -10.5%

SOUTH KOREA JAN CYCLICAL LEADING INDEX CHANGE -0.3 M/M; DEC -0.5

SOUTH KOREA FEB S&P GLOBAL MANUFACTURING PMI 48.5; JAN 48.5

PMI survey data for February continued to depict subdued operating conditions in the South Korean manufacturing sector. Both output and new orders contracted further, although positively the rate of reduction in the latter eased to a three-month low. (S&P Global)

MARKETS

US TSYS: Cheaper In Asia, 10 Year Yield Holds Above 4%

TYM3 deals at 110-25, -0-07, a touch off the base of its 0-11 range on elevated volume of ~150k.

- Cash Tsys sit 1-4bp richer across the major benchmarks, the curve has bear flattened. 10-Year Tsy yields have pushed and held above 4.00%.

- Tsys were marginally pressured in early dealing, cross market pressure from JGBs spilled over.

- The early cheapening extended through the session, there was no overt headline driver for the move. Asia-Pac participants seemingly focused on firmer than expected prices paid component in the latest ISM manufacturing survey as well as Wednesday's comments from Minneapolis Fed President Kashkari (’23 voter), as he noted that he has an open mind on a 25 or 50bp hike in March.

- Downside interest via TY and US options headlined on the flow side, although was light.

- In Europe today Eurozone CPI and unemployment headline, further out we have initial jobless claims. Fedspeak from Gov Waller will also cross.

JGBS: Curve Steepens, Futures Bounce Aided By Stellar Demand At 10-Year Auction

Thursday saw mixed performance on the JGB curve, with futures off early Tokyo lows and the super-long end under some light pressure. The former is -6 at the close, while wider cash JGB benchmarks run 0.5bp richer to 3.0bp cheaper, with the curve pivoting around 7s, twist steepening. Swap rates are little changed to 2bp higher, resulting in wider swap spreads out to 10s, while super-long spreads are flat to narrower. 10-Year JGB yields are pressed up against the BoJ's YCC cap.

- Stellar demand at the latest 10-Year JGB auction was noted. It would seem that short covering needs, alongside diminished expectations for near-term monetary policy setting tweaks from the BoJ, yield levels testing the Bank’s YCC cap and short-term relative value appeal (generated from moves such as the recent cheapening on the 5-/10-/20-Year butterfly) were the dominant factors here. JGB futures ticked higher in the wake of the auction, pressing to fresh Tokyo session highs, before fading from best levels.

- The super-long end and swap rates seemed to be driven by the movement we have seen in core global FI markets since yesterday’s local close, while the early stabilisation in the belly is a little more up in the air when it comes to identifying a driver. The well-received 10-Year auction flagged above dd help the wider space away from session cheaps.

- Comments from BoJ board member Takata stuck with the central BoJ view.

- Tokyo CPI and labour market data headline the domestic docket on Friday.

JGBS AUCTION: 10-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.2462tn 10-Year JGBs:

- Average Yield: 0.500% (prev. 0.485%)

- Average Price: 100.00 (prev. 100.14)

- High Yield: 0.500% (prev. 0.495%)

- Low Price: 100.00 (prev. 100.04)

- % Allotted At High Yield: 30.8365% (prev. 58.5171%)

- Bid/Cover: 7.550x (prev. 4.611x)

AUSSIE BONDS: ACGB Bid Fades But Outperforms U.S Tsys

ACGBs pulled back from firmest levels of Sydney trade, leaving YM -6.0 & XM -7.5 at the close, as the trans-Tasman bid from well-received NZGB supply and impulse from AU/US tightener flows faded alongside an extension of U.S. Tsy weakness in Asia-Pac hours. Cash ACGBs close near session cheaps, 6-7bp weaker with the curve 1bp steeper. AU/U.S. 10-year yield differential still manages to narrow -3bp to -17bp, after printing as tight as ~-20bp.

- Swaps cheapen 6-8bp with the 3s10s swap curve 1bp steeper.

- Bills were 2-7bp weaker on the day through the reds, steeper, but off session extremes.

- Terminal rate pricing on the OIS strip shows back above 4.20% after yesterday's CPI-inspired pullback resulted in a close below that level.

- With the local calendar light tomorrow, only home loan data for January is slated, the Aussie looks destined to seek guidance from abroad ahead of the RBA Policy Decision next Tuesday.

- Given the prevailing weakness in the global rates market, all eyes will turn to Eurozone CPI ahead of NY trading when we see if U.S. Tsy weakness in Asian trading is sustained, added to, or reversed.

NZGBS: Weaker But Continued Outperformance Vs. U.S. Tsys

NZGBs weaken on the day but close off session extremes, partly defying carry-over weakness for U.S Tsys in early Asia-Pac trade that pushed 5- to 10-year Tsy yields above Wednesday's NY session highs. With Q4 Terms of Trade surprising on the upside (the only local release), Resilience in NZGBs appeared linked to ACGB’s relative strength. Strong demand at the weekly NZGB auctions also aided the bid, with cover ratios of 2.9-3.2x seen across the NZGB May-28, Apr-33 & May-51 offerings.

- Cash NZGBs close 8bp weaker across the curve with continued outperformance noted versus U.S Tsys. The NZ/U.S. cash yield differential narrowed 4bp for the 2-year and 3bp for the 10-year. So far this week the 10-year NZGB benchmark has outperformed its U.S. equivalent by 16bp.

- Swap rates close 6-8bp higher, implying a slight short- to mid-curve swap spread narrowing.

- Subdued trading in RBNZ dated OIS continued today with pricing flat to 1bp firmer across meetings with April meeting pricing at 40bp of tightening and terminal OCR pricing just shy of the RBNZ’s projected OCR peak of 5.50% at 5.47%.

- ANZ consumer confidence data and a keynote address from RBNZ Governor Orr on "Navigating Heavy Seas: Sustainable growth, productivity and wellbeing for a stronger New Zealand" headline locally on Friday.

EQUITIES: More Caution Amid Higher Yields

The tone in regional equities has been more cautious today. Cross-asset headwinds from firmer US yields and a stronger USD have weighed at the margins. US equity futures are tracking lower at this stage (-0.36% for Eminis and -0.48% for the Nasdaq).

- After strong gains yesterday, we have seen China and HK bourses consolidate today. The HSI is down by around 0.4% at this stage, with the underlying tech index down 1%. This only unwinds a part of yesterday's +6.64% gain. Mainland China stocks are modestly in positive territory. The proximity of the NPC may also be driving some caution in markets.

- Trends have been mixed elsewhere, the Nikkei 225 close to flat, likewise for the Taiex. The Kospi has outperformed up near 0.80%, although markets were closed yesterday, so this may reflect some catch up. Offshore investors have added $136.8mn to local shares.

- Indian shares are tracking lower in the first part of trade, the Nifty down by 0.50% at this stage. The index continues to battle the 200-day MA, which remains nearby (17397.50, versus current levels of 17362).

- The trend is more positive in SEA, with the Philippines the bourse the standout at +1%. Positive earnings results are fueling broad based gains for the index.

GOLD: Better Week For Gold As USD Comes Under Pressure

Gold prices rose on Wednesday consistent with USD weakness driven by solid PMIs in China. After rising 0.5% bullion is down 0.1% during APAC trading and moving in a narrow range. It is currently around $1834.40/oz after a high of $1838.21 and a low of $1831.18. The USD index is up 0.1%.

- Conditions remain bearish for gold, as the US Fed’s hawkish stance is likely to continue for now. Rate cuts are not generally expected until 2024.

- The Fed’s Waller and Kashkari are speaking later on the economic outlook and race, justice and the economy respectively. These are likely the most important upcoming events for gold. In terms of data, there are US jobless claims and final Q4 readings for unit labour costs/productivity. There is also euro area February CPI data and the ECB minutes.

OIL: Crude Trading Sideways After Rising On China PMI Data

Oil prices have been trading sideways during the APAC session after rising around a percent on Wednesday following positive PMI data from China. Brent is around $84.39/bbl, hovering around the 100-day moving average, and WTI is $77.72. The USD index is up 0.1%.

- Oil prices are holding above last week’s lows but moving average studies remain in bear mode. Key short-term support for WTI is at $73.80, the February 22 low.

- The EIA reported a lower-than-expected US crude inventory build of 1.165mn down from the previous week’s 7.648mn. US oil exports rose a very strong 22.4% on the week.

- The Fed’s Waller and Kashkari are speaking later on the economic outlook and race, justice and the economy respectively. In terms of data, there are US jobless claims and final Q4 readings for unit labour costs/productivity. There is also euro area February CPI data and ECB minutes.

FOREX: USD Firms In Asia As Treasury Yields Tick Higher

The greenback has gained in Asia, US Treasury yields have ticked higher through the session aiding the USD bid.

- Kiwi is the weakest performer in the G-10 space at the margins. NZD/USD prints at $0.6225/35 down ~0.4% today. Q4 Terms of Trade printed early in the session at 1.8%, rising from -3.4% prior.

- AUD/USD is ~0.2% softer, last printing at $0.6740/45. Weaker than expected Building Approval weighed at the margins, January measure printing at -27.6% vs -7.0% expected.

- Yen is softer, USD/JPY prints at ¥136.40/50 ~0.2% firmer today. Q4 Capital Spending rose 7.7% a touch above expectations, whilst Company Profits was below expectations printing -2.8% vs 8.4% exp.

- EUR and GBP are both down ~0.2% as the broad based USD bid weighs.

- As noted, US Treasury Yields have ticked higher in Asia. 10 Year Yields are holding above 4%. Regional equities and US Equity futures are softer. The Hang Seng is ~0.5% lower and e-minis are down ~0.4%. BBDXY is ~0.2% firmer.

- In Europe today Eurozone CPI and unemployment headline, further out we have US Initial Jobless Claims.

FX OPTIONS: Expiries for Mar02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0545(E583mln), $1.0595-10(E2.0bln), $1.0620-25(E1.8bln), $1.0660(E797mln), $1.0800(E847mln)

- USD/JPY: Y132.00($1.1bln), Y132.50-60($1.2bln), Y136.00($770mln), Y136.65($855mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/03/2023 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 02/03/2023 | 1000/1100 | *** |  | IT | HICP (p) |

| 02/03/2023 | 1000/1100 | *** |  | EU | HICP (p) |

| 02/03/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 02/03/2023 | 1230/1330 |  | EU | ECB Schnabel at MMCG Meeting | |

| 02/03/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 02/03/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/03/2023 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 02/03/2023 | 1500/1500 |  | UK | BOE Pill Speech at Wales Week | |

| 02/03/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 02/03/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/03/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/03/2023 | 2100/1600 |  | US | Fed Governor Christopher Waller | |

| 03/03/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 02/03/2023 | 2300/1800 |  | US | Minneapolis Fed's Neel Kashkari | |

| 03/03/2023 | 2350/0850 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.