-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Risk-Off Feel Dominates

- Caution takes hold in Asia as Macron's re-election fails to counter the impact of a familiar cocktail of risks.

- Core FI advance and the yen regains poise, with Antipodean financial markets shut for the ANZAC Day.

- Offshore yuan extends its retreat after the PBOC fix falls in line with expectations.

BOND SUMMARY: Risk Aversion Is Boon For Core FI, Antipodean Markets Closed

Broader aversion to risk lent support to core FI space, as looming global policy tightening, China's difficult Covid-19 situation, and Russia's ongoing invasion of Ukraine continued to undermine market sentiment. Emmanuel Macron's victory in the French presidential runoff failed to alter the otherwise gloomy risk backdrop, despite removing a key risk to political stability in Europe.

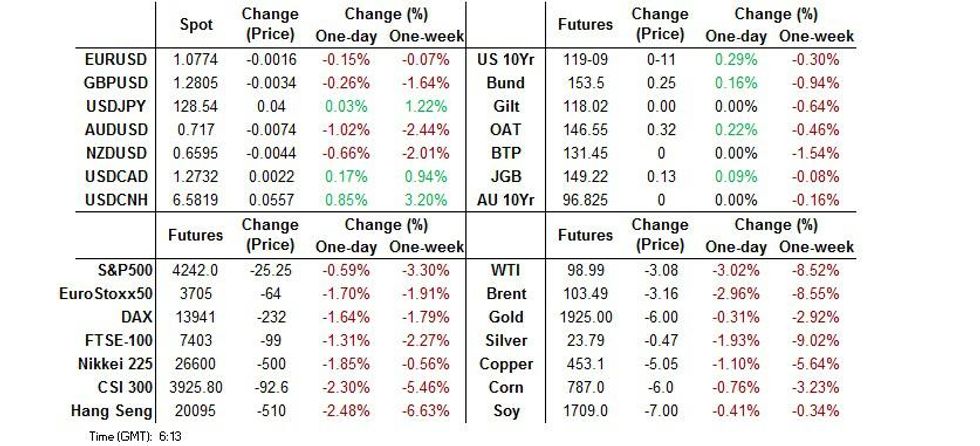

- T-Notes were in demand overnight, with TYM2 last seen +0-16 at 119-14, after topping out at 119-16. Eurodollar futures trade 5.5-11.5 ticks higher through the reds. U.S. Tsy yields sit 4.0-5.9bp lower across the curve, with its belly outperforming. The local economic docket lacks notable risk events.

- JGB futures pushed higher, extending gains after the Tokyo lunch break. JBM2 last changes hands at 149.29, up 20 ticks from the previous settlement. Cash JGB yield curve has flattened a tad. The BoJ conducted the pre-announced round of fixed-rate 10-Year JGB purchases in defence of the official cap on 10-Year yields.

- Antipodean financial markets were closed in observance of the ANZAC Day.

FOREX: G10 FX Space Sees No Desire To Take Risk, Yuan Tumbles After PBOC Fix

The spectre of an aggressive global tightening cycle mixed with China's worrying Covid-19 situation and Russia's ongoing invasion of Ukraine unleashed risk-off flows across G10 FX space at the start to the week. Activity was limited by market closures in Australia and New Zealand, with the countries observing the ANZAC Day holiday.

- Antipodean currencies led commodity-tied FX lower, with softer crude oil prices amplifying the impact of broader risk-off flows. Oil came under pressure as Libya said it would soon resume output in several shuttered fields.

- Risk aversion threw a lifeline to the embattled yen, making it the best G10 performer, even as Reuters cited a Japanese Finance Ministry official, who denied Friday's TBS report suggesting that Japan and the U.S. discussed the possibility of a coordinated currency intervention.

- Offshore yuan went offered as the PBOC set the the mid-point of permitted USD/CNY trading range virtually in line with expectations, reverting to a neutral stance after signalling appreciation bias (~50 pip deviation) on Friday. Spot USD/CNH pierced the CNH6.55 figure on its way to fresh one-year highs, while its implied volatilities soared to fresh cycle highs across the curve.

- The EUR caught a bid in early trade, but pared gains as the session progressed. The initial impulse was generated by the news that French President Macron defeated his right-wing rival Marine Le Pen and secured re-election.

- German Ifo Survey as well as comments from BoC's Macklem & ECB's Panetta take focus from here.

FOREX OPTIONS: Expiries for Apr25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E712mln), $1.0800-03(E521mln), $1.0825(E502mln), $1.0925(E503mln)

- AUD/USD: $0.7350(A$804mln)

ASIA FX: Risk Aversion Spoils Appetite For Asia EM FX

Asia EM currencies struggled for any topside momentum as China's worsening Covid-19 outbreak and the prospect of aggressive tightening action from the Fed came to the fore.

- CNH: Spot USD/CNH shot higher in the wake of the PBOC fix, lodging fresh one-year highs. The People's Bank set its central USD/CNY mid-point virtually in line with average sell-side estimate, reverting to neutrality after appreciation bias (~50 pip deviation) displayed in Friday's fixing. The pairs implied volatilities soared across the maturity curve.

- KRW: Spot USD/KRW climbed to levels not seen since the beginning of the Covid-19 pandemic, prompting local FX authorities to issue a warning on won depreciation. An official told reporters that South Korea is "closely monitoring" currency markets.

- IDR: Spot USD/IDR opened sharply higher in response to a temporary ban on crude palm oil exports announced by President Widodo after hours Friday. Note that Indonesia is the world's top producer of the edible oil.

- MYR: Spot USD/MYR extended its recent surge and peaked within touching distance from the MYR4.3500 mark. Last Friday saw BNM Gov signal patience on tightening policy, while over the weekend Malaysia's finance ministry noted that ringgit depreciation will be cushioned by the nation's strong external position and robust fundamentals.

- PHP: Philippine headline flow was thin, with broader regional trend driving spot USD/PHP towards key resistance from PHP52.500.

- THB: Spot USD/THB had a look above THB34.000 for the first time since 2017, as an ascending bull triangle pattern is materialising on the daily chart.

EQUITIES: Mostly Lower In Asia On Risk-Off Mood; US Mega-Cap Earnings Loom

Major Asia-Pac equity indices are between 1.5% to 2.7% worse off at typing, tracking a negative lead from Wall St.

- The CSI300 sold off, sitting 2.2% worse off at typing, trading at levels last witnessed in June ‘20. Losses were observed in virtually all sub-indices, with high-beta healthcare and consumer staples again leading losses. A note that some state-owned banks have announced the lowering of rates on certificates of deposit by 10bp earlier in the session, allowing banks to charge less for loans.

- The Hang Seng struggled, dealing 2.7% weaker at typing on underperformance in the financials sub-index and weakness in China-based tech stocks, with the Hang Seng Tech Index trading 2.9% softer at writing.

- Looking outside of Asia, several U.S. tech megacaps report earnings this week (noting that ~180 companies from the S&P500 making up approx. half of the index’s value will report earnings this week). Alphabet and Microsoft kick things off on Tuesday after the closing bell. Meta is up next on Wednesday after hours, while Amazon and Apple will report after the market closes as well. A note that weakness in mega-cap Netflix last week following dismal subscriber growth numbers inspired notably softer sentiment in tech stocks globally (particularly “stay-at-home”/pandemic winners) throughout the week.

- U.S. e-mini equity index futures are off worst levels, dealing 0.4% to 0.6% softer, led by losses in DJIA contracts.

- A note that Australian markets are closed for the ANZAC holiday today.

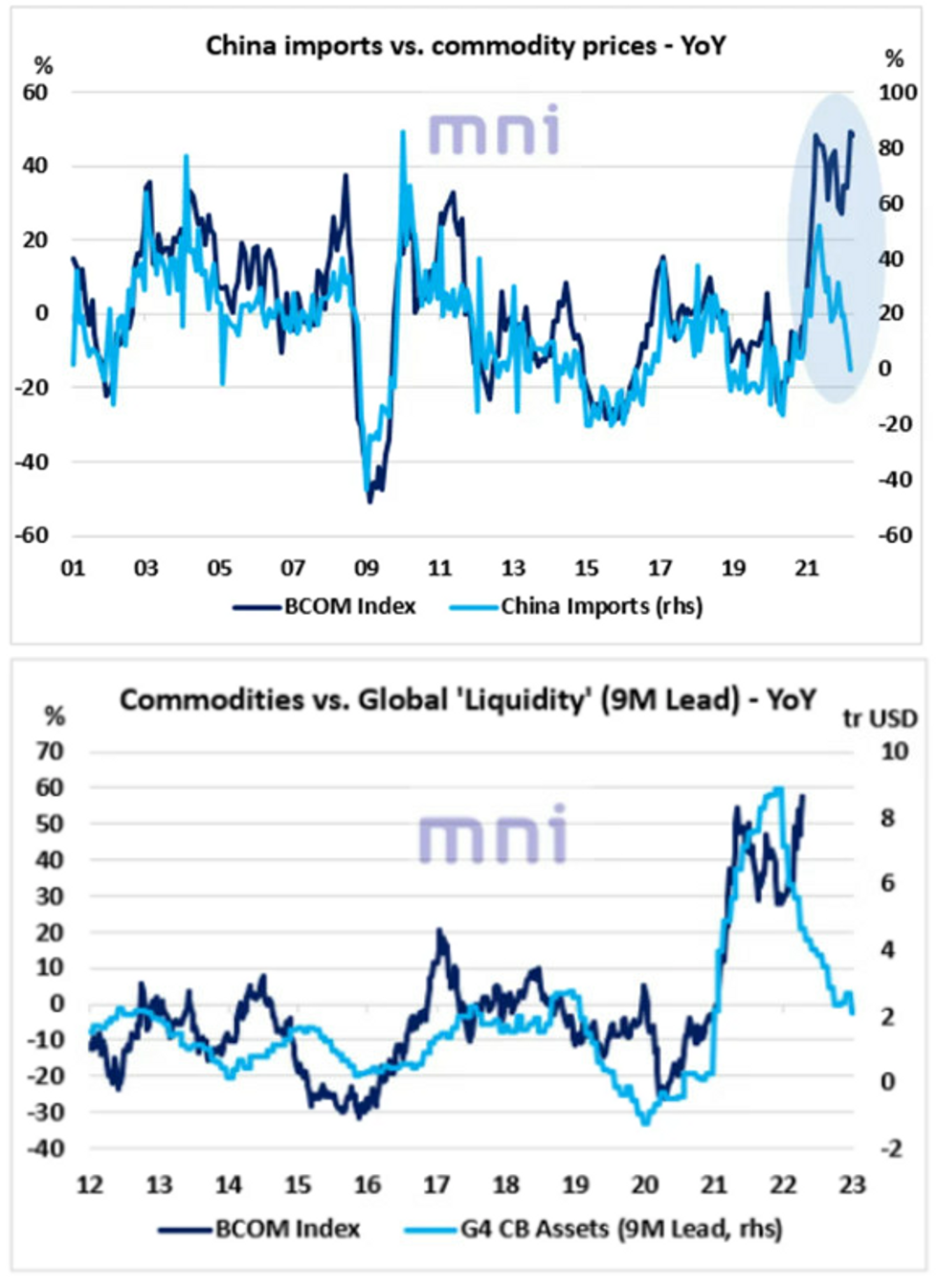

COMMODITIES: Is The ‘Bull’ Trend Sustainable in the MT?

- Investors have been questioning if the trend in commodity prices could persist in the medium term as global demand keeps weakening and a growing range of ‘fundamental’ indicators keep pricing in ‘cheaper’ commodities.

- The top chart shows that commodity prices have been constantly reaching new highs despite China imports plunging in recent months.

- As China represents over 50% of the total demand for some commodities (i.e. copper), the two times series have historically strongly co-moved together in the past 20 years.

- The bottom chart shows that the sharp decrease in the annual change in ‘liquidity’ (G4 CB assets) has been also pricing in ‘cheaper’ commodities in the coming months.

- Significant changes in central banks’ total assets have strongly led commodity prices in the past cycle (by 9 months).

- In the past few months, we also observe a significant divergence between the US Dollar, which has been constantly strengthening due to the elevated geopolitical uncertainty, and commodities.

Source: Bloomberg/MNI

GOLD: Lower As Fed’s Focus On Neutral Rates In View

Gold is $7/oz weaker, operating around session lows to print $1,924/oz at typing. The precious metal has hit its lowest levels in over two-weeks in Asia-Pac dealing, on track to close lower for a fourth session in five after coming to within a whisker of $2,000/oz on Apr 18 (at $1,998.4/oz).

- The move lower comes despite a broad downtick in nominal U.S. Tsy yields, with pressure from increasingly hawkish Fed expectations evident. On that front, May FOMC dated OIS point to ~55bp of tightening priced in for that meeting, suggesting a ~20% chance of a 75bp hike despite Cleveland Fed President Mester (‘24 voter) last Friday voicing opposition to such a move throughout calendar ‘22, emphasising the need for a “methodical approach” to hiking rates.

- To recap, Fed messaging leading up to the pre-FOMC blackout period has coalesced around a series of 50bp rate hikes to “neutral” levels (seen as around 2.5% by some Fed officials), led by remarks from Fed Chair Powell on Thursday indicating support for a 50bp hike in the May FOMC.

- From a technical perspective, gold has broken below its 50-Day EMA, exposing key support at $1,890.2/oz (Mar 29 low).

OIL: WTI Dips Below $100 As Events In China Eyed

WTI is ~-$2.90 and Brent is ~-$3.00 to print $99.20 and $103.70 respectively at typing, with focus centering around China’s ongoing COVID outbreak and its resulting impact on Chinese energy demand.

- To elaborate on certain developments, pandemic control measures have been enacted on the district of Chaoyang (pop. ~3.5mn) in Beijing, following the detection of at least ten cases over the weekend. Worry re: the possibility of a lockdown is evident (taking reference to limited reports of observed stockpiling activity amongst residents), although such a measure has not been announced yet. Looking to Shanghai, the city continues to record ~20k fresh cases daily, with deaths rising to a record of 51 for Sunday.

- Looking ahead, authorities have doubled-down on China’s “dynamic zero-COVID” strategy, with the head of the country’s COVID taskforce saying on Friday that the policy is necessary due to medical resource constraints and the low vaccination rate amongst the elderly population. BBG source reports on Friday estimated that Chinese crude consumption for April would decline by ~20%, representing a ~1.2mn bpd decrease.

- Elsewhere, a rising chorus of growth forecast downgrades continues to weigh on the outlook for energy demand worldwide, with RTRS source reports on Friday pointing to the German government trimming its GDP growth projections for ‘22 from +3.6% to +2.2%.

- Major oil benchmarks saw little reaction to a Times report that crossed early in the Asian session, citing the European Commission’s (EC) Dombrovskis as confirming the EC’s work on “some form” of embargo on Russian crude. A note that this comes after EC President von der Leyen had in the previous week touted work on “clever mechanisms” to ban Russian oil for the upcoming sixth round of EU sanctions on Russia.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/04/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/04/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/04/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 25/04/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/04/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/04/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/04/2022 | 1500/1100 |  | CA | BOC Gov Macklem testifies at parliamentary committee | |

| 25/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/04/2022 | 1700/1900 |  | EU | ECB Panetta Speech at Columbia University |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.