-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RESEND: Shock And Orr

EXECUTIVE SUMMARY

- MESTER: FED WEIGHS CREDIT CONDITIONS AS IT PONDERS HIKES (MNI)

- HOLZMANN: ECB AWARE OF QT RISKS (MNI)

- CENTENO: MORTGAGE DEFAULT RISK IN PORTUGAL IS LOW (RTRS)

- EUROPE'S BANKS RAMP UP BESPOKE LOAN TRADES TO REDUCE RISK (RTRS)

- RBA'S LOWE NOTES SUPPLY ISSUES, EXPECTS FURTHER HIKES (MNI)

- RBNZ SURPRISES WITH 50BP HIKE TO 5.25% (MNI)

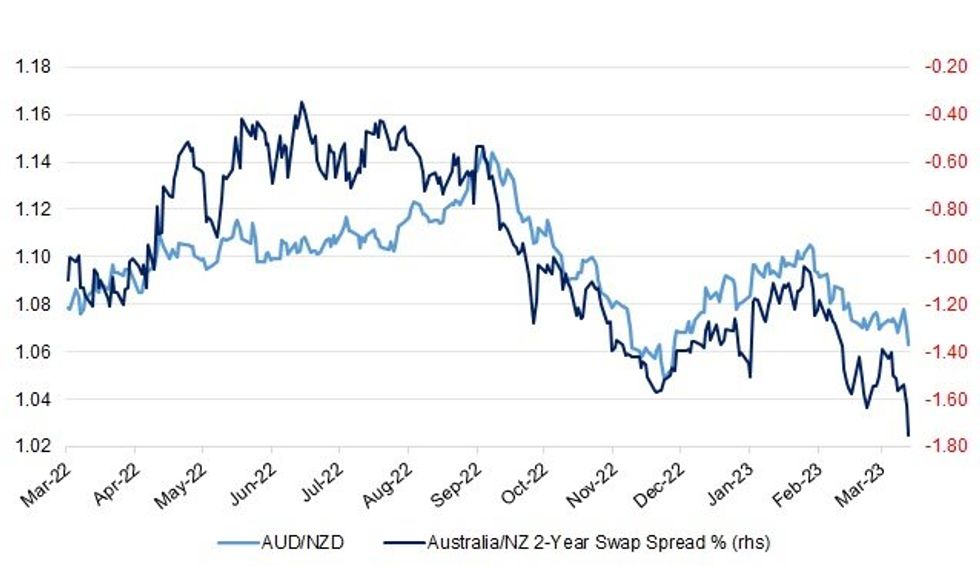

Fig. 1: AUD/NZD Vs. Australia/New Zealand 2-Year Swap Spread

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Business confidence in the UK crept up in the first quarter of the year, despite only a third of firms seeing an increase in sales, according to a survey. (BBG)

BANKS: The Bank of England has approved UBS Group AG's takeover of Credit Suisse Group AG in the United Kingdom, people familiar with the process told Reuters, a key market for the Swiss lenders racing to close the rescue deal. (RTRS)

EUROPE

ECB: The European Central Bank is conscious of the dangers of moving too fast in cutting reinvestments from its asset purchase programme, particularly after seeing last year’s UK gilt market volatility, National Bank of Austria Governor Robert Holzmann told MNI in an interview. (MNI)

FISCAL: The European Commission said in a statement on Tuesday it had approved a 3.5 billion euros ($3.8 billion) package of French state aid to small companies in the context of Russia's war against Ukraine. It also approved two billion euros in state aid by Austria for Wien Energie, for the same reason. (RTRS)

ITALY: Italy's regulated household gas prices fell 13.4% in March compared with the previous month, the country's energy authority ARERA said in a statement on Tuesday. (RTRS)

PORTUGAL: The risk of default on mortgages in Portugal is low despite the steep rise in interest rates by the European Central Bank (ECB) because there are so many people in work, ECB Governing Council member Mario Centeno said on Wednesday. In Portugal, around 90% of the stock of 1.4 million mortgages has variable rates indexed to three-month, six-month and 12-month Euribor rates. (RTRS)

IRELAND: Ireland is set to collect more than the 22.7 billion euros ($24.9 billion) of corporate tax forecast for this year, provided there are no shocks to the economy, the finance ministry's chief economist said on Wednesday. (RTRS)

SWITZERLAND/BANKS: The Swiss government should review what happened with Credit Suisse Group AG in order to glean lessons from its downfall, the International Monetary Fund said. (BBG)

BANKS: European banks are increasingly turning to bespoke deals with investors such as hedge funds to offload some of the risk on multi-billion euro loan portfolios and improve their financial strength, several sources involved told Reuters. Banks supervised by the European Central Bank (ECB), the biggest ones in the euro zone, completed a record 174 billion euros ($189 billion) of such deals last year, the regulator told Reuters. (RTRS)

EQUITIES: The head of Europe’s largest exchange operator has criticised the EU’s proposed creation of a central stock trading database, warning that retail investors risk falling victim to more sophisticated traders. (FT)

U.S.

FED: Further interest rate hikes from the Federal Reserve will depend on the magnitude and duration of tighter credit conditions stemming from recent tensions in the banking system and the extent of the drag on inflation and growth, Cleveland Fed President Loretta Mester said Tuesday. (MNI)

FISCAL: The Internal Revenue Service will unveil its long-awaited 10-year spending plan for $80 billion in new funding to beef up enforcement and taxpayer services, U.S. Treasury Secretary Janet Yellen said on Tuesday, promising major investments in new technology and services. (RTRS)

POLITICS: Former President Donald Trump pleaded not guilty in a historic moment for the United States on Tuesday to 34 felony counts of falsifying business records, as prosecutors accused him of paying two women to suppress their accounts of sexual encounters with him. (RTRS)

POLITICS: Former President Donald Trump said on Tuesday night, hours after his arraignment, that he was the victim of election interference and he lashed out at New York prosecutor Alvin Bragg for bringing criminal charges against him. (RTRS)

OTHER

EU/CHINA: Italy is studying ways to curtail the influence of China’s Sinochem on tire maker Pirelli SpA, in the latest sign of rising tension between China and Western countries over the control of key technologies. (BBG)

GEOPOLITICS: French President Emmanuel Macron and U.S. President Joe Biden discussed China on the phone on Tuesday and mentioned their willingness to engage Beijing to accelerate the end of the war in Ukraine, the Elysee Palace said on Wednesday. (RTRS)

GEOPOLITICS: U.S. Treasury Secretary Janet Yellen on Tuesday called for quicker action to resolve several outstanding sovereign debt restructuring cases, Treasury said in a statement. (RTRS)

JAPAN: Japan doesn’t plan to raise taxes or issue debt to pay for Prime Minister Fumio Kishida’s raft of measures to support childrearing households, broadcaster NTV quotes the ruling Liberal Democratic Party’s secretary general, Toshimitsu Motegi, as saying. (BBG)

BOJ: Bank of Japan officials are concerned slower global demand and tighter financial conditions could negatively impact large and small company capital investment, despite both sectors reporting strong plans this fiscal year. (MNI)

BOJ: A recent drop in global bond yields has created favorable conditions for the Bank of Japan to scrap its yield curve control program this month, according to a former BOJ executive director in charge of monetary policy.(BBG)

RBA: Reserve Bank of Australia Governor Philip Lowe has pointed to population and housing, electricity price growth and productivity as key supply-side issues that will inform how the board makes future decisions, adding he expects further tightening "may well be needed". (MNI)

AUSTRALIA: Earnings pressure for Australia’s four largest banking groups is likely to return mid-2023 as the interest rate cycle peaks, and funding costs rise, says Fitch Ratings in a new report. Cost management will remain a key focus but will be challenged by inflation. (Fitch)

RBNZ: The Reserve Bank of New Zealand hiked the official cash rate by 50bp to 5.25%, beating market expectations of a quarter point rise. The Reserve noted inflation was still persistently high and employment beyond its maximum sustainable level to return inflation to its 1-3% target. (MNI)

BOK: An economics professor and a former procurement agency chief have been recommended to replace two outgoing monetary policymakers of the Bank of Korea (BOK), the central bank said Wednesday. (Yonhap)

SOUTH KOREA: South Korea's financial regulator said on Wednesday it would ease local currency lending rules on foreign bank branches, which would free up at least 12.2 trillion won ($9.29 billion) for lending. The Financial Services Commission said in a statement it would exempt smaller players from a requirement to keep the loan-to-deposit ratio at or below 100% by raising the threshold for the requirement. (RTRS)

NORTH KOREA: US special representative for North Korea Sung Kim will travel to South Korea this week to meet with his Japanese and South Korean counterparts, State Department says in a statement. (BBG)

TURKEY: Turkish Treasury and Finance Minister Nureddin Nebati sees inflation continuing to slow down, with a decrease of as much as 5 percentage points expected next month. (BBG)

MEXICO: Mexico agreed to buy a fleet of natural gas plants and a wind farm for $6 billion from Spain’s biggest power company as part of President Andres Manuel Lopez Obrador’s push to nationalize energy production. (BBG)

BRAZIL: Brazil’s finance chief is considering a series of measures to boost credit in Latin America’s largest economy, saying capital markets have “stalled” under the weight of high interest rates. (BBG)

BRAZIL: The draft bill of Brazil‘s new fiscal framework will be ready this Wednesday and will be delivered to Congress by next Tuesday, or April 11, said the Minister of Planning, Simone Tebet, while participating in a public hearing in the House this Tuesday. (BBG)

BRAZIL: Brazil’s economic team has mapped out 300 billion reais ($59 billion) in revenue-boosting measures to help sustain its new plan to shore up public finances without raising taxes, according to Finance Minister Fernando Haddad. (BBG)

BRAZIL: Brazil's finance minister, Fernando Haddad, said on Tuesday that the dialogue with the central bank is ongoing in a "challenging scenario" due to the bank's formal autonomy. Speaking virtually at an event hosted by Bradesco BBI, he expressed confidence that President Luiz Inacio Lula da Silva's new government will manage to stabilize macroeconomic indicators, allowing for "monetary policy consistent with fiscal policy." (RTRS)

RUSSIA: The U.S. unveiled $2.6 billion worth of military assistance that includes air surveillance radars, anti-tank rockets and fuel trucks, the Pentagon announced on Tuesday, as Ukraine prepares to mount a spring offensive against Russia. (RTRS)

RUSSIA: NATO Secretary General Jens Stoltenberg said Tuesday he hoped to see Ukraine’s President Volodymyr Zelensky at a summit of the alliance’s leaders this summer. (AFP)

CHILE: Chile’s central bank held its benchmark interest rate steady for the third straight meeting and signaled that eventual borrowing cost reductions are further off as inflation takes longer to head to target. (BBG)

PERU: Peru's congress rejected a motion on Tuesday from leftist lawmakers to launch impeachment hearings against President Dina Boluarte on charges tied to the deaths of protesters, the latest chapter in the country's political volatility. (RTRS)

BANKS: Turns out, the biggest short in the banking industry anywhere in the world isn’t in Switzerland or Silicon Valley, but rather, in the relatively tame financial center of Canada. (BBG)

FOREX: The U.S. dollar will weaken against most major currencies this year as the interest rate gap with its peers stops widening, putting the currency on the defensive after a multi-year run, according to a Reuters poll of foreign exchange strategists.. (RTRS)

EMERGING MARKETS: Most emerging market currencies are forecast to drift higher over the coming year as investors fret less about financial stability and snap up riskier assets, according to a Reuters poll of analysts who largely upgraded forecasts from last month. While most of the currencies are seen gaining over the next 12 months, the March 31-April 4 poll of 60 foreign exchange analysts predicted volatility in the near term, and that only South Korea's won and the Thai baht would recoup 2022 losses. (RTRS)

OVERNIGHT DATA

JAPAN MAR, F JUDO BANK SERVICES PMI 55.0; PRELIM 54.2; FEB 54.0

JAPAN MAR, F JUDO BANK COMPOSITE PMI 52.9; PRELIM 51.9; FEB 51.1

The Japanese services economy signalled a sharp improvement in demand conditions at the end of the first quarter of 2023 as the dissipating impact of the COVID-19 pandemic and stronger customer confidence combined to boost output and orders. Latest PMI data indicated that business activity rose at the second-fastest pace on record, while new business inflows increased at a solid pace that was the strongest since February 2019. (S&P Global)

AUSTRALIA MAR, F JUDO BANK SERVICES PMI 48.6; PRELIM 48.2; FEB 50.7

AUSTRALIA MAR, F JUDO BANK COMPOSITE PMI 48.5; PRELIM 48.1; FEB 50.6

The Judo Bank Services PMI shows a dip back to cyclical lows for business activity in March. After slowing in 2022, services sector business activity has failed to build momentum as weaker manufacturing activity and rising interest rates act as a headwind. (Judo Bank)

SOUTH KOREA MAR FOREIGN RESERVES US$426.07BN; FEB US$425.29BN

MARKETS

US TSYS: Curve Flattens In Asia

TYM3 deals at 116-03, -0-05, with a narrow 0-05 range on volume of ~96k.

- Cash tsys sit 3 bps cheaper to 1bp richer across the major benchmarks, the curve has twist flattened pivoting on 20s.

- Tsys were marginally cheaper in early dealing, there was no overt headline driver, Asia-Pac participants perhaps using yesterday's richening as an opportunity to exit long positions.

- Pressure moderately extended as the RBNZ hiked rates 50bps raising the OCR to 5.25%. Markets had priced in a 25bp hike with only 1 economist of the 22 surveyed by Bloomberg looking for a 50bp hike. Screen flow added to the pressure, ~3.3k lots of TY given post RBNZ decision over a couple of clips.

- Ranges were tight with little follow through on moves for the remainder of the session.

- Fedspeak from Cleveland Fed President Mester crossed early in today's Asian. She noted that the Fed will weigh credit conditions as it ponders further hikes, also noting she sees the Fed Funds rate above 5% and holding there for some time.

- There is a slew of US data due today including ADP Employment, Trade Balance, Services PMI and ISM Services survey.

JGBS: Futures Pare Overnight Gains

JGB futures initially spiked through their overnight high as Tokyo reacted to the impulse derived from the softer than expected U.S. JOLTS data released Tuesday, before paring the bulk of those gains to sit +9 ahead of the close. Cash JGBs run 1.5bp richer to 0.5bp cheaper, with the 7- to 10-Year zone outperforming on the bid in futures. Swap rates are a touch lower on the day, fading from session extremes alongside JGBs.

- Subdued to average offer/cover ratios in today’s BoJ Rinban operations (covering 1- to 5- & 10- to 25-Year JGBs) and U.S. Tsys finding a bit of an intraday base (within tight ranges) helped stabilise JGBs in the Tokyo afternoon, with futures off worst levels. Note that today’s Rinban was the first round of purchases after the BoJ’s well-documented tweak to the Q2 purchase bands, with 10- to 25-Year paper receiving a Y50bn uptick in purchases today (after the reduction seen in purchase sizes covering that bucket during March)

- LDP Secretary General Motegi noted that Japan doesn’t intend to lift taxes or issue debt to facilitate PM Kishida’s measures aimed at supporting families.

- On the corporate issuance side Berkshire Hathaway has mandated banks for JPY issuance, with the deal reportedly set to follow in “the near future,” as Warren Buffett’s company returns to the JPY debt market.

- Weekly international security flow data from the MoF and 30-Year JGB supply headline tomorrow.

AUSSIE BONDS: Stronger, Off Bests After Gov. Lowe’s Speech

ACGBs are richer on the day (YM +2.0 & XM +2.0) but slightly weaker after RBA Governor Lowe’s speech and Q&A at the National Press Club in Sydney. Cash ACGBs are 2-3bp richer with the AU/US 10-year yield differential +6bp at -11bp.

- In his speech, Lowe stated that the decision to hold rates steady this month did not imply rate increases are over. Pausing to “assess how the various influences on the economy balance out” was consistent with practice in earlier interest rate cycles, according to Lowe. He also said the board will benefit from an updated set of forecasts at the May meeting.

- During the Q&A session, Governor Lowe emphasised that it's premature to discuss interest rate cuts since the balance of risks is currently tilted towards more rate hikes. However, he noted that any decision would depend on the data.

- Swaps are 6-7bp stronger on the day with EFPs 4bp tighter.

- RBA-dated OIS pricing is 1-3bp firmer for meetings to September and 4-5bp softer beyond. May meeting has a 21% chance of a 25bp hike priced. There is 32bp of easing priced by February 2024.

- Further afield, the global calendar is relatively light with the highlights being European PMIs and US ISM Services.

AUSSIE BONDS: ACGB Jun-35 Auction Results

The Australian Office of Financial Management (AOFM) sells A$800mn of the 2.75% 21 June 2035 bond, issue #TB145:

- Average Yield: 3.3432% (prev. 3.8184%)

- High Yield: 3.3475% (prev. 3.8200%)

- Bid/Cover: 2.2687x (prev. 4.5200x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 91.9% (prev. 58.8%)

- Bidders 45 (prev. 42), successful 20 (prev. 10), allocated in full 14 (prev. 5)

NZGBS: Weaker, Led by 2-Year As RBNZ Surprises

The NZGB cash curve had twist flattened 18bp by the close with the 2-year benchmark yield 12bp higher and the 10-year 6bp lower after the RBNZ surprised the market with a 50bp rate hike. The 10-year benchmark yield had spiked 12bp higher on the decision but quickly recouped those losses. At the close, the cash 2/10 curve was -69bp, the most inverted since 2009.

- The 2s10s swap curve closed 12bp flatter at -94bp, a new low for this cycle and the most inverted since 2008.

- RBNZ dated OIS shunted firmer with pricing +18-24bp across meetings with 20bp of tightening priced for May. Terminal OCR expectations increased 21bp to 5.49%.

- The market pricing and BBG consensus had been expecting a stepped-down 25bp increase today after the 50bp hike in February. The bank had considered both a 25bp and a 50bp hike at today’s meeting but believed that a larger tightening was needed to return inflation to its 1-3% target band.

- The RBNZ revised up its estimates of the inflationary impact of the cyclone rebuild and noted upside risks to the fiscal outlook.

- Further afield, the global calendar is relatively light today with the highlights being European PMIs and German Factory Orders ahead of US ISM Services.

EQUITIES: Japan Stocks Sink, South Korea Does Better In Holiday Affected Markets

Japan stocks are off sharply, the Topix down by nearly 1.9%, as global recession fears edge higher. Moves elsewhere have been more muted though, with South Korean stocks outperforming. Note also lighter liquidity with China and Hong Kong markets closed today for local holidays. US futures are close to flat presently.

- Japan stocks have been weighed by Toyota, which has contributed the most to lower index levels, while the electric appliances sector is also weaker. Such sectors are exposed to global demand, with softer US data outcomes raising recession fears in recent sessions. The firmer yen backdrop could also be weighing at the margins.

- In contrast such fears haven't weighed on South Korean shares, the Kospi is +0.55% higher, with the Kosdaq +1.35%. Samsung SDI has rallied strongly. The company will reportedly invest $3.1bn in advanced OLED panels, which has likely helped local sentiment. Offshore investors are still sellers of local equities (-$80.6mn so far today).

- Moves are more muted elsewhere. Indian shares are playing catch up after onshore markets were shut yesterday. The Nifty +0.50%. Philippines shares are higher, +0.55%, after the CPI miss gave hope the BSP can turn less hawkish.

- Australian shares are close to flat, while NZ shares are down 0.55%, as the RBNZ surprised with a +50bps hike.

GOLD: Bullion Supported By Lower USD And US Yields, Watch Wednesday’s US Data

Gold prices have held above $2000/oz during APAC trading and are up 0.2% following a 1.8% increase on Tuesday. It is currently trading around $2023.54. It reached an intraday high of $2025.37, which exceeded Tuesday’s high of $2025.04. Bullion has been supported by a lower dollar and US yields following weak US data. There is an increasing belief that Fed rates are close to peaking. The USD index has been flat on Wednesday.

- Gold broke through the bull trigger of $2009.70, the March 20 high, on Tuesday. It also rose past $2024.85, opening $2034 as a level to watch, but is now back below.

- There are no Fed officials scheduled to speak later today. But there is some important data with US ADP March employment forecast to rise 210k, and the trade deficit for February expected to widen slightly to $68.8bn. March ISM services is projected to ease to 54.4 from 55.1 and the prices paid component is likely to be watched closely, while the S&P Global services and composite PMIs are forecast to be stable at February levels.

OIL: Crude Continues Moving Higher, WTI Holds Above $81

Oil prices continued their march higher during APAC trading following Sunday’s OPEC+ output cut announcement. They are now about 7% higher than Friday’s close but are off this week’s highs. Brent is up 0.5% today to $85.36/bbl and WTI +0.4% to $81.06. Brent reached a high of $86.44 early on Monday and WTI of $81.81 on Tuesday. The USD index has been flat on Wednesday.

- Both Brent and WTI are now above their 200-day moving averages and up 17.3% and 21% from their March lows. The move was driven by a weaker dollar, stabilisation in the banking sector, supply measures and continued optimism on China demand. Watch resistance at $81.74 for WTI and $86.44 for Brent.

- The market has also been supported by the API reporting a crude drawdown of 4.3mn barrels in the latest week, according to Bloomberg citing people familiar with the data. A reduction in US stocks would be another factor weighing on supply. EIA data is published later.

- There are no Fed officials scheduled to speak today. But there is some important data with US ADP March employment forecast to rise 210k, and the trade deficit for February expected to widen slightly to $68.8bn. March ISM services is projected to ease to 54.4 from 55.1 and the prices paid component is likely to be watched closely, while the S&P Global services and composite PMIs are forecast to be stable at February levels.

FOREX: Kiwi Outperforms After RBNZ Raises OCR 50bps

NZD is the strongest performer in the G-10 space, bouncing after the RBNZ raised the OCR by 50bps to 5.25%. Markets had priced in a 25bp hike with only 1 economist of the 22 surveyed by Bloomberg looking for a 50bp hike.

- NZD/USD firmed to $0.6380 in the immediate aftermath of the decision being paring gains to sit ~0.5% higher at $0.6345/50. ANZ revised their terminal rate call up to 5.5% with a 25bp hike in May expected. Westpac also look for a 25bp hike in May noting that the RBNZ seems intent on getting the OCR to 5.5% the level they saw as sufficiently contractionary in February.

- AUD/USD dragged higher by the RBNZ and comments for RBA Gov Lowe noting that the tightening cycle isn't over, however the pair couldn't hold gains and now trades little changed.

- Yen has observed relatively narrow ranges, USD/JPY prints at ¥131.65/75. The final March print of Jibun Bank Services PMI printed this morning at 55.0 rising from 54.2. The Composite measure rose to 52.9 from 51.9 in March.

- Elsewhere in G-10 moves have had little follow through with ranges respected for the most part.

- Cross asset wise; 2 Year US Treasury Yields are ~+3bps and BBDXY is little changed as are E-minis.

- The final prints of EU, German and French Services PMI headline in Europe today. Further out there is a slew of US data including ADP Employment, Trade Balance, Services PMI and ISM Services survey.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/04/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 05/04/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 05/04/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/04/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/04/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/04/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/04/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/04/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/04/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/04/2023 | 0900/1100 | * |  | IT | Retail Sales |

| 05/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/04/2023 | 0915/1015 |  | UK | BOE Tenreyro Panellist at RES Conference | |

| 05/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 05/04/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 05/04/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 05/04/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/04/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/04/2023 | 1400/1600 |  | EU | ECB Lane Lecture at University of Cyprus | |

| 05/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.