-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Risk Remains Bid Overnight Amid Lack Of New Headline Themes

EXECUTIVE SUMMARY

- XI-BIDEN MEET MAY BE FURTHER DELAYED (SCMP)

- CHINA'S ECONOMY TO RECOVER IN H221 AFTER JULY SLOWDOWN (DAILY)

- SEC GIVES CHINESE COMPANIES NEW REQUIREMENTS FOR U.S. IPO DISCLOSURES (RTRS)

- RBNZ DEPUTY GOVERNOR BASCAND: COVID ONLY DELAYS TIGHTENING CYCLE (MNI)

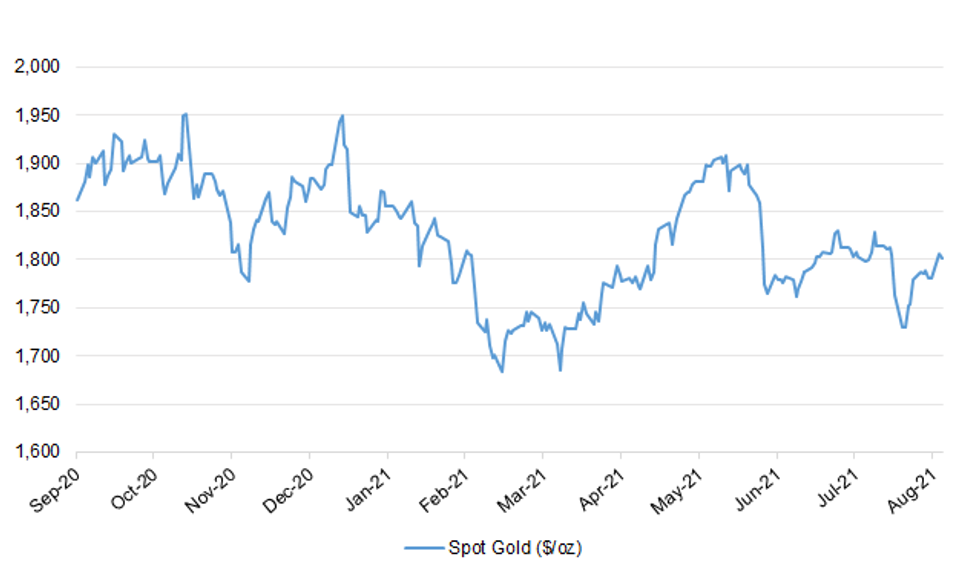

Fig. 1: Spot Gold ($/oz)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Booster jabs for the most vulnerable could start within two weeks but healthy over-70s may have to wait until more evidence amasses. The NHS aims to begin the booster campaign on September 6 and the Joint Committee on Vaccination and Immunisation (JCVI) is under pressure to issue firm advice so that planning can be finalised. However, the group wants to see more evidence from trials looking at the effectiveness of booster programmes after scientists were pleasantly surprised by how slowly immunity seems to be waning. Sources close to the committee said that the JCVI was likely to end up authorising a booster campaign in stages, mirroring the gradual approval of vaccination of teenagers. (The Times)

EUROPE

GERMANY: German Chancellor Angela Merkel said current measures in place to curb the virus remain sufficient, even as infection numbers tied to the spread of the delta are on the rise. Current rules requiring people to provide proof of vaccination or recovery from Covid -- and if not, a negative test -- are working, the German leader said. "Our goal is to achieve that, to go without any further measures," Merkel said at an event late Monday in Dusseldorf. "But we need to be vigilant." (BBG)

GERMANY: Chancellor Angela Merkel's Christian Democratic Union-led party bloc and the Social Democrats were tied at 23% in a survey of voters before the Sept. 26 general elections, according to an Insa poll for Bild TV. The CDU-led bloc lost two percentage points from the previous poll, while the Social Democrats gained three points. The pro-business Free Democrats rose 0.5 point to 13% and the Green party declined 0.5 point to 17%. (BBG)

FRANCE: France may hit its target of having injected 50 million people with at least one Covid vaccine dose in early September, French Health Minister Olivier Veran said on BFMTV. France will hit the goal either at the end of August or "during the first few days of September," Veran said France had previously set the end of August for the vaccination goal France may also begin offering as soon as early September 3rd doses for the elderly, Veran said. (BBG)

ITALY/BTPS: Italy to sell the following at auction on Aug 26:

- EUR2.75bn of 0.00% Jan-24 BTP

- EUR1.00bn of 0.65% May-26 BTPei linkers

SWEDEN: Swedish residential property prices fell 0.8% on the month in July, according to the Nasdaq OMX Valueguard-KTH Housing Index, HOX Sweden. HOX Sweden was unchanged in the 3 months through July and rose 13.6% y/y. Adjusted for seasonal effects, the index fell 0.2% m/m in July. (BBG)

U.S.

FISCAL: House Speaker Nancy Pelosi is maneuvering to resolve a showdown with a group of moderate Democrats that threatened to derail her strategy for shepherding President Joe Biden's economic agenda through Congress. Pelosi is attempting to use a procedural tactic to deem the Democrats $3.5 trillion budget blueprint adopted once the House votes for a rule governing floor debate for two other measures -- a $550 billion bipartisan infrastructure bill and voting rights legislation. If Pelosi's gambit succeeds it would kick off the reconciliation process in which committees write the details of the budget framework into legislation. The move avoids a direct separate vote on the budget resolution that was planned for Tuesday, while also letting Pelosi put off passage of the infrastructure legislation until at least next month. (BBG)

CORONAVIRUS: President Joe Biden on Monday once again urged more Americans to get vaccinated against Covid-19, saying the majority of deaths and hospitalizations in the U.S. due to the virus are among the unvaccinated. "Those who have been waiting for full approval should go get your shot now," Biden said during a White House press briefing hours after the Food and Drug Administration granted full approval to Pfizer and BioNTech's Covid vaccine for people 16 and up. He said the U.S. agency evaluated "mountains" of clinical trial data and concluded, "without question," that the Covid shot was safe and highly effective. "The overwhelming majority of people in the hospital with Covid-19 or almost all those dying from Covid-19 are not vaccinated, not vaccinated," he told reporters. "If you're fully vaccinated – both shots, plus two weeks– your risk of severe illness with Covid-19 is very, very low." "Please get vaccinated now," Biden added. (CNBC)

CORONAVIRUS: New Jersey is joining the growing list of states to require teachers to be vaccinated for COVID-19 this fall. The current mandate for health care workers is also expending to include all state employees. Amid renewed COVID concerns stoked by the delta variant, Gov. Phil Murphy announced earlier this month that school staff members, visitors and students from kindergarten to 12th grade are required to wear masks in New Jersey schools. The state has also mandated the vaccine for a variety of the state's front-line workers and now the requirement may be expanded to educators who will return Sept. 2. (NBC)

OTHER

GLOBAL TRADE: The number of Covid-19 infections is surging in Malaysia, threatening to aggravate shortages of semiconductors and other components that have hammered automakers for months. The Southeast Asian country hasn't historically had the kind of importance to technology supply chains that Taiwan, South Korea or Japan do. But in recent years, Malaysia emerged as a major center for chip testing and packaging, with Infineon Technologies AG, NXP Semiconductors NV and STMicroelectronics NVamong the key suppliers operating plants there. Now infections are soaring in the country, jeopardizing plans to lift lockdowns and restore full production capacity. The seven-day average for reported daily infections has pushed past 20,000, up from just over 5,000 in late June. (BBG)

U.S./CHINA: The prospect of Chinese President Xi Jinping holding a face-to-face meeting with his American counterpart Joe Biden on the sidelines of the Group of 20 Summit in Italy this autumn have dimmed, according to sources familiar with arrangements. While Beijing is yet to reach a final decision, the leadership leans towards China's president attending via a video link rather than flying to Rome for the summit on October 30-31. Virtual attendance would mean there would be no opportunity at the summit for the Chinese and US leaders to hold their first face-to-face meeting since Biden became US president on January 20. While any decision for Xi to not go to Rome for the summit would be partly because of safety concerns over the coronavirus pandemic, it also reflects the lack of progress made to restart the stalled China-US relationship. (SCMP)

U.S./CHINA: Vice President Kamala Harris warned that China poses a threat to countries in Asia, while reassuring nations in the region the U.S. won't force countries to choose between the world's biggest economies. In a speech in Singapore on Tuesday, Harris spoke about the U.S. vision for a region built on rules, human rights, freedom of the seas and unimpeded commerce. She also offered for the U.S. to host the 2023 summit of the 21-member Asia-Pacific Economic Cooperation forum, signifying the administration's commitment to multilateral engagement. (BBG)

U.S./CHINA: The U.S. Securities and Exchange Commission (SEC) has started to issue new disclosure requirements to Chinese companies seeking to list in New York as part of a push to boost investor awareness of the risks involved, according to a document reviewed by Reuters and people familiar with the matter. (RTRS)

GEOPOLITICS: Saudi Arabia and Russia have signed a joint military cooperation agreement aimed at developing joint military cooperation between the two countries, Prince Khalid bin Salman, Saudi Arabia's deputy defense minister said in a twitter post. (BBG)

CORONAVIRUS: The White House on Monday said it's likely that an unclassified version of the intelligence community's review of whether the coronavirus pandemic originated in a lab in China could be released as soon as next week. The deadline for the 90-day review to be completed is Tuesday. "I would say that it typically takes a couple of days, if not longer, to put together an unclassified version to present publicly, and obviously the president would be briefed first on any findings. So I don't have an exact date for you but I would expect it will be several days a couple to several days after tomorrow," White House press secretary Jen Psaki said. (New York Post)

HONG KONG: Hong Kong will allow domestic workers from the Philippines and Indonesia to return in phases as the city will recognize vaccination records from other countries, Chief Executive Carrie Lam says at a briefing. (BBG)

JAPAN: Japan's ruling party heavyweight Toshihiro Nikai said on Tuesday there was no change to his stance of supporting Prime Minister Yoshihide Suga's re-appointment as head of the party. Suga has said he would run in the Liberal Democratic Party's (LDP) leadership race to seek another term as head of the ruling party. Former Foreign Minister Fumio Kishida is also likely to run in the race, which is seen taking place next month, according to the Sankei newspaper. (RTRS)

JAPAN: Japan plans to add Hokkaido & 3 other prefectures to state of emergency. (Asahi)

AUSTRALIA: Prime Minister Scott Morrison is urging Australians to abandon Covid-19 precautions when vaccination rates hit thresholds later this year, even as academic modeling released Tuesday shows such a strategy could expose the nation to a wave of illness and death that it's so far avoided. Australia's delta-fueled surge is showing little sign of slowing after 753 cases were reported by New South Wales state on Tuesday, slightly down from its record of 830 infections Sunday. The virus is continuing to spread to other parts of Australia despite lockdown restrictions enforced on more than half the nation's 26 million people. New Zealand is also enforcing stay-at-home orders after the outbreak that started in Sydney reached there. (BBG)

AUSTRALIA: "Let us focus on the vaccine rates because that is what will determine how we can live moving forward," New South Wales (NSW) state Premier Gladys Berejiklian said. Berejiklian, who had promised more freedoms for the fully-vaccinated once total doses topped 6 million, said the state has crossed that milestone and changes will be announced later this week. Some 59% of people in NSW have had at least one dose, while 31% are fully vaccinated, slightly above the national numbers. (RTRS)

NEW ZEALAND: New Zealand is bracing for its biggest coronavirus outbreak yet as cases rise, the locations of interest balloon to more than 400 sites, and the number of close contacts swells to more than 15,700 people. On Tuesday, the country recorded 41 new positive cases, bringing the total number in its outbreak to 148 – the majority of whom are Samoan, and linked to a sub-cluster who assembled at the Assembly of God church in Mangere, Auckland before the lockdown. (Guardian)

NEW ZEALAND: Finance Minister Grant Robertson says an extended time at alert level 4 might trigger more support including residential or commercial rent relief or mortgage repayment holidays - but they weren't needed at this stage. Robertson is the first of a line-up of ministers expected to front to Opposition and other MPs in virtual select committees this week after the Prime Minister's decision to suspend the sitting of Parliament. Robertson told the Finance and Expenditure committee that the economy was well-positioned, with unemployment at 4 per cent and lower than expected net debt. (NZ Herald)

RBNZ: MNI INTERVIEW: RBNZ Deputy: Covid Only Delays Tightening Cycle

- The Reserve Bank of New Zealand expects only a short lockdown as a result of a new Covid-19 outbreak and is prepared to start tightening as early as October in the face of rising house price inflation, according to Deputy RBNZ Governor Geoff Bascand. In an interview on Tuesday with MNI, Bascand said the central bank was "watching and waiting" developments but he did not believe that a "six-week delay in a tightening cycle makes much difference in the long term" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

SOUTH KOREA: South Korea's 2022 budget may be slightly bigger than total budget of this year, Yonhap News reports, citing ruling party and government. South Korea's total budget including two extra budgets is 604.7t won. Finance ministry will announce 2022 budget plan on Aug. 31. (BBG)

NORTH KOREA: North Korea's main newspaper on Tuesday urged Japan to repent and make reparations for colonial-era brutality on the occasion of the 111th anniversary of Tokyo's annexation of the Korean Peninsula. The Rodong Sinmun, the official newspaper of the North's ruling party, pointed out that Japan forced Korea to sign the treaty in 1910, and called it a fabricated and illegitimate treaty. The paper challenged Japanese assertion that the annexation took effect legally with the approval of King Sunjong. The treaty was signed on Aug. 22, 1910, between pro-Japan Korean Prime Minister Lee Wan-yong and Japanese Governor General of Korea Terauchi Masatake. (Yonhap)

MEXICO: Mexico received 8.54b of the International Monetary Fund's special drawing rights, equivalent to $12.1b, according to a Banxico statement. Distribution part of IMF's $650b allocation to its members in proportion to each country's representation in the fund. Operation increases equally both liabilities and assets of central bank. (BBG)

BRAZIL: Congress may remove court-ordered payment rules known as "precatorios" from the spending cap, according to Brazil Economy Minister Paulo Guedes, who said the government would comply, in remarks made in a webcast. Govt presented a request for a constitutional amendment to change the law on precatorios and allow for payments in instalments, Guedes said. The country will maintain a commitment to fiscal discipline. Govt request of constitutional amendment on precatorios is not irresponsibility, Guedes said; states and municipalities already pay court orders in instalments. Central bank has autonomy and will combat inflation, Guedes said. (BBG)

BRAZIL: The most populous city in Latin America will begin requiring residents to have received at least one dose of a Covid-19 vaccine in order to enter restaurants, bars and public events. Sao Paulo's new "vaccine passport" rule announced by Mayor Ricardo Nunes mandates that some businesses must ensure the vaccination status of each patron in order to avoid fines, which Nunes said "won't be cheap," in a press conference Monday. Vaccination status can be proved by showing either the card given when the dose is administered or a QR code created via a web app that is expected to be launched Friday, the mayor said. (BBG)

AFGHANISTAN: The United States is in close coordination with the Taliban as it works to evacuate tens of thousands of people out of the Kabul airport before President Joe Biden's Aug. 31 deadline to withdraw U.S. troops, National Security Advisor Jake Sullivan said Monday. "We are engaging with the Taliban, consulting with the Taliban, on every aspect of what's happening in Kabul right now," Sullivan told reporters at the White House. "On what's happening at the airport, on how we need to ensure that there is facilitated passage to the airport for American citizens, SIVs and third country nationals. And we'll continue those conversations with them." Sullivan said the coordination was happening on a daily basis "through political and security channels," but he refused to elaborate. (CNBC)

AFGHANISTAN: U.S. President Joe Biden is expected to decide within 24 hours whether to extend the Aug. 31 Afghanistan withdrawal deadline in order to give the Pentagon time to prepare, an administration official said on Monday. Biden was still mulling how to proceed but some of his advisers were arguing against extending the withdrawal deadline for security reasons, the official said. Biden could signal his intentions at a virtual meeting of G7 nations on Tuesday, the official said. (RTRS)

AFGHANISTAN: U.S. House Intelligence Committee Chairman Adam Schiff, speaking to reporters on Monday after a briefing by intelligence officials, said he thinks it is very unlikely the evacuation of Afghanistan will be completed by a Aug. 31 deadline. (RTRS)

AFGHANISTAN: The UK has "hours now, not weeks" to evacuate people from Afghanistan, the defence secretary has said. Ben Wallace said troops would leave Kabul's airport when the US withdrew, which is due to happen on 31 August. (BBC)

AFGHANISTAN: British evacuations out of Afghanistan could not have happened without the US - and an extension depends on G7 talks with Joe Biden tomorrow, the armed forces minister has told Sky News. James Heappey said the mission to fly out thousands of British nationals and Afghans who worked for the British over the past 20 years could not have happened without the US Air Force. He told Sky News: "It is certainly the case that the mission in Kabul this week is fundamentally underpinned by a US presence, not just the number of troops at the airport but the role the US Air Force is playing in delivering air traffic control and all of the other airfield services." (Sky)

AFGHANISTAN: Joe Biden will come under pressure on Tuesday from western allies who want the US-led evacuation from Afghanistan extended beyond August 31, while facing the humiliating prospect that the Taliban may veto the idea. At an emergency G7 meeting the US president will hear calls from allies including Boris Johnson, UK prime minister, and Emmanuel Macron, French president, to negotiate with the Taliban for an extension. But the move exposes the fragility of the west's position in Afghanistan, as the world's leading democracies in effect plead with the Taliban to allow them to carry on with their evacuation for a few more days. (FT)

AFGHANISTAN: China's private companies are eager to invest in Afghanistan's economic reconstruction as the government's "successful diplomacy with the Taliban" laid the foundation for the safe operation of Chinese businesses there, the Global Times reported citing Chinese businesspeople in Afghanistan. However, Chinese state-owned companies are taking caution to be in line with the Chinese national strategy given Western governments' potential sanctions on the Taliban, the newspaper said. China can help Afghanistan generate self-dependent economic drive, even include the country, which sits along the Belt and Road Initiative route, into the China-Pakistan Economic Corridor, the newspaper said citing Liu Zongyi, the secretary-general of the Research Center for China-South Asia Cooperation at the Shanghai Institutes for International Studies. (MNI)

MIDDLE EAST: Iran resumed fuel exports to Afghanistan a few days ago following a request from the new Afghan government, which feels empowered by the U.S. withdrawal to buy the sanctioned nation's oil more openly, an Iranian official told Reuters. (RTRS)

OIL: A fire that struck an offshore oil platform operated by Mexico's state-run Pemex cut the company's production by 444,000 barrels per day (bpd) due to the lack of natural gas to re-inject into crude fields, a company document showed on Monday. (RTRS)

CHINA

PBOC: The PBOC is likely to withhold major monetary and credit easing measures until next year, judging by the statement from a Monday meeting chaired by Governor Yi Gang, which emphasized "coordinating macro policies this year and next year", the 21st Century Business Herald said. The PBOC is seen unlikely to continue with another RRR cut in Q3, but possibly in Q4 if economic slowdown accelerates and debt defaults surge, the newspaper said citing Zhang Jiqiang, deputy research head of Huatai Securities. New loans may hit a new high in Q1, 2022, as more investment projects to stabilize the growth start, which require loans to back up, the newspaper said. (MNI)

YUAN: The Chinese yuan will remain resilient supported by continued trade surplus in H2 and the higher-than-usual surplus in FX settlement and sales, which help overcome depreciation pressure from investors seeking refuge in the U.S. dollar, the Shanghai Securities News reported citing analysts. The yuan has performed stronger against other currencies under pressure from the U.S. Federal Reserve's possible slowing debt purchases, with the CFETS RMB Index up 0.32 from a week earlier, the highest since March 2016, the newspaper said. (MNI)

ECONOMY: China's economy is expected to see steady recovery in the second half despite a slowdown in July, according to a commentary published in the state-run Economic Daily. Separately, the People's Daily says in a commentary that China should adopt a more proactive macroeconomic policy to support the economy and maintain the sustainability and stability of its policies. Pessimism is growing over the economic outlook for the second half after a dismal performance in July, which was caused by high comparative base a year earlier as well as extreme weather and a new wave of Covid-19 outbreak last month. The economy in the second half is likely to be supported by recovery in consumption and manufacturing, and the launch of major projects under the 14th Five-Year Plan. In terms of macroeconomic policy, China is confident that it's capable of adjusting the economy through a "cross-cyclical" approach. (BBG)

CORONAVIRUS: China added only one confirmed local case in the central province of Henan, after zero new cases in the country a day earlier, containing one of the nation's worst outbreaks since the virus first emerged in 2019. A month of draconian measures appears to have ended the latest upsurge, but the question remains over how long the world's second-largest economy can steer clear of the virus given the spread of the infectious delta variant overseas. The eastern city of Yangzhou, which was most affected by the latest outbreak, as well as Jiangsu province, no longer have any critical cases, according to local government statements. (BBG)

EQUITIES: Chinese stocks may be able to shrug off regulatory concerns, like they have done in the past, and reach record highs, MSCI Inc. Chairman and CEO Henry Fernandez told Bloomberg Television's Haidi Lun and Shery Ahn in an interview. Regulatory compliance has weighed on Chinese markets every three to four years but they have been able to recover "very quickly" and reach new highs. (BBG)

EQUITIES: The Chinese taxi-hailing app Didi has suspended plans to launch in Britain and continental Europe amid concerns about how it handles sensitive passenger data, The Telegraph can reveal. (Telegraph)

OVERNIGHT DATA

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 101.6; PREV. 101.1

Consumer confidence rose 0.5% last week amidst rising cases and fresh lockdowns in Victoria and the ACT and an extension of the one in Sydney. The overall figure was due to rises of 8.0% in SA, 11.4% in WA and 1.7% in Brisbane. The news about the strength of the labour market in July with, unemployment rate dropping to 4.6%, might have added to the positive outlook. Confidence in Victoria and NSW remained at the lowest level among the states, falling 2.9% and 1.9% respectively. But even with this drop, sentiment in these two states remains well above the lows of last year. This supports our expectation that household spending will likely rebound sharply in lockdown areas when restrictions ease. (ANZ)

NEW ZEALAND Q2 RETAIL SALES EXCL.-INFLATION +3.3% Q/Q; MEDIAN +2.5%; Q1 +2.8%

SOUTH KOREA AUG CONSUMER CONFIDENCE 102.5; JUL 103.2

SOUTH KOREA Q2 HOUSEHOLD CREDIT KRW1,805.9TN; Q1 KRW1,764.6TN

CHINA MARKETS

PBOC INJECTS CNY10 BLN VIA OMOS TUES; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1955% at 09:25 am local time from the close of 2.1472% on Monday.

- The CFETS-NEX money-market sentiment index closed at 58 on Monday vs 48 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4805 TUES VS 6.4969 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4805 on Tuesday, compared with the 6.4969 set on Monday.

MARKETS

SNAPSHOT: Risk Remains Bid Overnight Amid Lack Of New Headline Themes

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 259.15 points at 27753.39

- ASX 200 up 25.174 points at 7515.1

- Shanghai Comp. up 34.84 points at 3511.972

- JGB 10-Yr future unch. at 152.28, yield down 0.6bp at 0.015%

- Aussie 10-Yr future down 3.0 ticks at 98.885, yield up 3.2bp at 1.128%

- U.S. 10-Yr future down 0-02+ at 134-04+, yield up 1.17bp at 1.2634%

- WTI crude up $0.09 at $65.73, Gold down $4.19 at $1801.26

- USD/JPY up 4 pips at Y109.74

- XI-BIDEN MEET MAY BE FURTHER DELAYED (SCMP)

- CHINA'S ECONOMY TO RECOVER IN H221 AFTER JULY SLOWDOWN (DAILY)

- SEC GIVES CHINESE COMPANIES NEW REQUIREMENTS FOR U.S. IPO DISCLOSURES (RTRS)

- RBNZ DEPUTY GOVERNOR BASCAND: COVID ONLY DELAYS TIGHTENING CYCLE (MNI)

BOND SUMMARY: Tight Ranges In Asia, Very Modest Pressure For Core FI

Cash Tsys sit 0.5-1.5bp cheaper across the curve, while T-Notes print -0-02+ at 134-04+, operating within a 0-03 range in Asia. Headline and market flow remain light, with a couple of pockets of TY futures sales witnessed since the re-open. The uptick in e-minis and the major Asia-Pac equity indices is applying some modest pressure to the space. Looking ahead to the NY docket, we will see the latest round of new home sales data, the Richmond Fed manufacturing index reading & 2-Year Tsy supply.

- JGB futures last +1, back from overnight session highs, with similar moves witnessed in the respective U.S. & Australian bond futures contracts. Cash JGB trade sees the major benchmarks running unchanged to ~0.5bp richer across the curve. News flow remains sparse, with the local COVID and political situations still dominating there. The latest round of 5-Year supply wasn't the firmest, with the pricing side disappointing. A lack of outright and relative value attraction at present likely hampered the auction. The average price seen at the auction only just met the broader expectations for the low price (as proxied by the BBG dealer poll), although the cover ratio nudged incrementally higher.

- Over in Australia YM & XM held to tight ranges albeit with a steepening bias, with the former -1.5 and the latter -3.0. Cash ACGB trade sees the longer end of the curve running ~4.0bp cheaper on the day at typing. The latest round of daily COVID case counts out of NSW & Victoria saw a slight moderation, but the numbers remain elevated (the NSW Premier has pointed to some form of additional freedom for those that are double vaccinated, with an announcement on the matter set to come towards the end of this week).

JGBS AUCTION: 5-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.0306tn 5-Year JGBs:

- Average Yield -0.120% (prev. -0.115%)

- Average Price 100.61 (prev. 100.60)

- High Yield: -0.116% (prev. -0.109%)

- Low Price 100.59 (prev. 100.57)

- % Allotted At High Yield: 3.0486% (prev. 54.6867%)

- Bid/Cover: 3.756x (prev. 3.533x)

JGBS AUCTION: 6-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.76585tn 6-Month Bills:

- Average Yield -0.1308% (prev. -0.1189%)

- Average Price 100.066 (prev. 100.060)

- High Yield: -0.1248% (prev. -0.1189%)

- Low Price 100.063 (prev. 100.060)

- % Allotted At High Yield: 51.5330% (prev. 67.4071%)

- Bid/Cover: 5.446x (prev. 4.377x)

AUSSIE BONDS: November 2032 Treasury Indexed Bond Syndication Results

The AOFM announces that "the issue by syndication of a new 0.25% 21 November 2032 Treasury Indexed Bond has been priced at a real yield to maturity of negative -0.675%. The issue size is A$3.25 billion in face value terms. There was a total of A$7.5 billion of bids at the final clearing price. Settlement of the issue will occur on Tuesday, 31 August 2021. National Australia Bank Limited; UBS AG, Australia Branch; and Westpac were Joint-Lead Managers for the issue. The AOFM will be mindful of the performance of the bond when considering the timing of future issuance."

- "In conjunction with the syndicated offer, the AOFM repurchased A$1,719.253 million (in face value terms) of the 1.25% 21 February 2022 Treasury Indexed Bond line at a real yield of -2.50%. Following settlement and cancellation of the bonds on Tuesday, 31 August 2021, the remaining volume on issue of the 1.25% 21 February 2022 Treasury Indexed Bond line will be A$5,120.853 million."

EQUITIES: Higher For A Second Day

Equity markets in the Asia-Pac region have posted gains on Tuesday, taking a positive lead from the US where major indices hit fresh record highs. Technology stocks were the drivers of gains in Asia which helped bourses in Hong Kong, Japan, China, South Korea and Taiwan higher. In China comments from the PBOC yesterday that the Central Bank would increase credit support to the economy and SME's in particular also helped engender a positive risk environment. In the US futures are higher, markets continue to assess full approval for the Pfizer-BioNTech vaccine while awaiting the Fed's annual Jackson Hole Economic Symposium, with commentary from FOMC Chair Powell on Friday headlining that (now virtual) event.

OIL: Crude Futures Continue Rally

Oil has continued to gain in Asia-Pac trade on Tuesday amid a positive risk environment, crude futures rose over 5% and have seen gains of ~0.5% so far today. Markets continue to digest yesterday's reports from the US Energy Department that it intends to sell up to 20 million barrels of crude oil from the nation's Strategic Petroleum Reserve. The next hurdle for WTI bulls is $67.53 the 20-day EMA while Brent bulls target $71.90 the high Aug 12 and a key resistance. Participants look ahead to US API inventory data later in the session.

FOREX: Risk Rally Extends

Another constructive session for risk assets and commodity currencies in the Asia-Pac session Tuesday, oil and equity markets built on Monday's gains. Major pairs observed narrow ranges amid a lack of catalysts; headline flow has been light while the economic docket had a distinct lack of major releases.

- Both AUD and NZD trade a handful of pips higher heading into Europe, AUD/USD breaking out of yesterday's range. The local COVID dynamic remains in focus, Both NSW and Victoria reported a lower case count than the previous day while New Zealand FinMin Robertson said that New Zealand was in a strong fiscal position to weather the lockdown. Elsewhere New Zealand retail sales excluding inflation rose 3.3% in Q2, above the 2.5% expected.

- USD/JPY is marginally higher on the session, the local COVID and political situation in Japan had little impact through the session.

- Offshore yuan has weakened slightly with USD/CNH creeping slightly higher, reversing some of Monday's decline. Markets digested comments from PBOC Governor Yang late on Monday, he said the Central Bank would increase credit support to the economy and SME's in particular. There were a few pieces doing the rounds from China dailies, including one from Minister of Commerce Wang that China could consider a smaller negative list to attract foreign capital.

- Looking ahead German GDP data is due later in the session while broader focus for the week remains on the Fed's annual Jackson Hole Economic Symposium, with commentary from FOMC Chair Powell on Friday headlining that (now virtual) event.

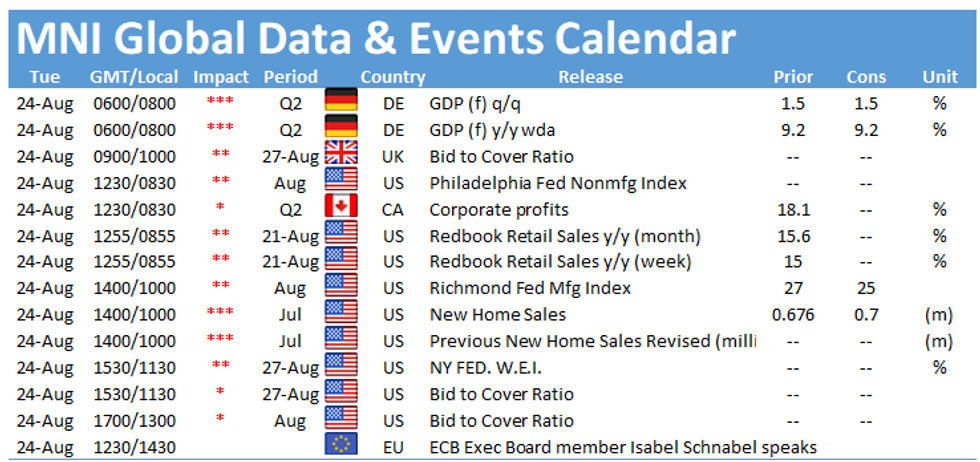

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.