-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Risk Sentiment Buoyed After PBOC Fix

EXECUTIVE SUMMARY

- INFLATION IN UK SHOPS DIPPED IN JUNE - BBG

- US TSY SEC YELLEN TO VISIT CHINA IN JULY- BBG

- RBA RISKS OVERTIGHTENING CASH RATE - MNI

- LI: "GLOBALIZTION REMAINS INTACT" - RTRS

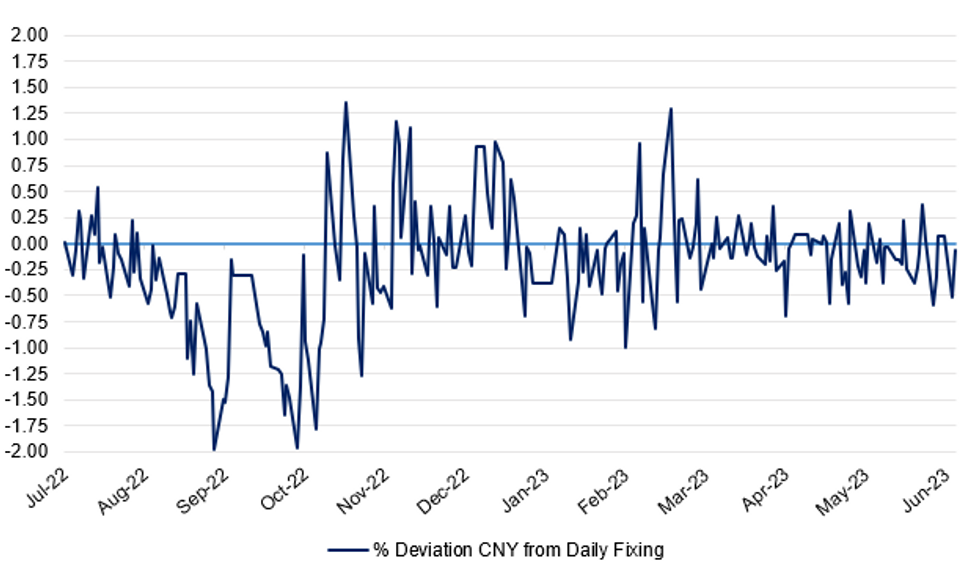

Fig. 1: % Deviation of CNY From Daily Fix

Source: MNI - Market News/Bloomberg

U.K.

INFLATION: Inflation in UK shops dipped this month, offering a glimmer of hope to ministers and central bankers struggling to contain the country’s cost-of-living crisis. Shop price inflation slowed to 8.4% in June, the British Retail Consortium said Tuesday, down from a peak of 9% in May. It was the sharpest decline since prices in shops started to rise at the end of 2021 following a period of deflation during the pandemic. (BBG)

HOUSING: Only 5% of privately rented properties in the UK are affordable to those on housing benefits, according to the Institute for Fiscal Studies. That’s a significant drop since the start of the pandemic, when 23% of new lets advertised on property website Zoopla could be rented solely using government housing support, the IFS said in a report published Tuesday. (BBG)

EUROPE

RUSSIA: President Vladimir Putin condemned leaders of the Wagner mercenary group as traitors to Russia in a late-night speech to the nation, his first public comments since the mutiny that posed the most serious threat to his nearly quarter-century rule. (BBG)

GREECE: Greece’s Prime Minister Kyriakos Mitsotakis appointed Kostis Hatzidakis as the country’s new finance minister following a landslide win in Sunday’s election. Hatzidakis, 58, who was labor minister shortly before the election, was also the minister of environment and energy in the early part of Mitsotakis’s first administration from 2019 to 2021. He then oversaw a rescue plan for Public Power Corp SA, Greece’s dominant power provider, after a report by auditors EY raised concerns over the company’s ability to continue as a going concern. He also served as development minister during the early years of Greece’s bailout programs from 2012 to 2014. (BBG)

U.S.

US/CHINA: US Treasury Secretary Janet Yellen plans to visit Beijing in early July for the first high-level economic talks with her new Chinese counterpart, people familiar with the scheduling said. Her trip was long anticipated but was put off until “the appropriate time,” Yellen said in April. The people discussed the timing and purpose of the trip on condition of anonymity, because the details haven’t been officially announced. (BBG)

TRUMP: CNN says it has obtained an audio recording of a 2021 meeting in New Jersey in which former President Donald Trump discusses the contents of secret documents. The recording, broadcast on CNN’s Anderson Cooper 360, includes a moment when Trump seems to indicate he was holding a document regarding possible military action against Iran, according to the report. (BBG)

ESG: This week’s arrival of the world’s first set of global ESG reporting standards may have major implications for firms in the US, where the acronym has become the target of political attacks that have stalled regulations and intimidated market participants. (BBG)

UKRAINE: The United States plans to announce as soon as Tuesday a new military aid package for Ukraine worth up to $500 million, keeping up U.S. resolve to help Ukraine against Russia as Moscow deals with a mutiny by some of its soldiers. (RTRS)

OTHER

RBA: The Reserve Bank of Australia risks overtightening if it hikes the cash rate above its current 4.1% in coming months, as the delayed impact of past increases begins to be felt, ex-board member Bob Gregory told MNI. (MNI)

AUSTRALIA: Anthony Albanese’s approval has fallen to its lowest level since the 2022 election and almost half of voters think Australia is heading in the wrong direction, the latest Guardian Essential poll suggests. More than two-thirds of voters (68%) think the Albanese government is not doing enough to ensure “affordable and secure rentals” while three-quarters (75%) said the same about the cost of living, the survey of 1,148 respondents found. (GUARDIAN)

RBNZ: New Zealand makes minor tweaks to RBNZ’s Monetary Policy Remit. The change will require the MPC to “achieve and maintain” rather than “keep” future annual inflation between 1% and 3% over the medium term. (BBG)

JAPAN: The balance of financial assets held by Japanese households stood at a record high of JPY2,043 trillion at the end of March, up 1.1% y/y and the 12th straight quarterly rise, preliminary fund circulation data released by the Bank of Japan on Tuesday showed. (MNI)

OIL: Oil edged higher on Tuesday after a choppy session following a short-lived armed uprising in Russia, a major OPEC+ producer. West Texas Intermediate futures climbed toward $70 a barrel after closing 0.3% higher on Monday. While the dramatic events in Russia over the weekend came to an abrupt end, they add further uncertainty to an oil market grappling with persistent concerns over the demand outlook, especially from China. (BBG)

OIL: Nascent oil producer Guyana is not interested in joining the Organization of the Petroleum Exporting Countries (OPEC), Guyanese Vice-President Bharrat Jagdeo said on Monday, as the South American country looks to rapidly boost production and attract new operators. (RTRS)

CHINA

ALIBABA: Alibaba Group Holding Ltd. ushered through a parade of high-profile stewards over its 24-year history, from the larger-than-life Jack Ma himself to a succession of C-suite executives who frequent conference and diplomatic circles. But the man who rose to the top in last week’s abrupt management reshuffle is an enigma even to some of the Chinese e-commerce juggernaut’s longer-serving employees. (BBG)

ELECTRIC VEHICLES: The world’s largest electric vehicle market is putting its crowded infancy stage behind it. The explosive industry in China — supercharged by government subsidies more than a decade ago — now spans about a hundred manufacturers churning out pure-electric and plug-in hybrid models. While that’s down from roughly 500 registered EV makers in 2019, the end now looks to be in sight for scores more. (BBG)

GLOBALIZATION: China's Premier Li Qiang told delegates that globalisation remains intact despite some setbacks at a World Economic Forum summit in Tianjin on Tuesday. The pandemic is unlikely to be the last public health crisis for the world, Li added. (RTRS)

FISCAL: The government will implement proactive fiscal support to bolster the economy in H2, according to Finance Minister Liu Kun. In a report delivered to the State Council, Liu said overall national finances remain in good health, with general expenditure and revenue remaining on track and within budget. For next steps, China will take measures to resolve local government debt risks and increase financial and accounting supervision. (MNI)

POWER SUPPLY: China’s overall power supply remains stable and under control but some small shortages are expected in some local areas, according to Xin Baoan, chairman at the State Grid Corporation of China. Speaking at the Davos forum in Tianjin, Xin said the population was demanding more electricity as the impacts of climate change became more severe. Authorities will be taking steps to optimise power usage across the grid over the next months. (MNI)

BONDS: China is expected to complete its 2023 special bond issuance by the end of Q3, as the government intensifies fiscal policy to help stabilise the recovery, according to Feng Lin, a senior analyst at the Research and Development Department of Dongfang Jincheng. According to Wind data, local governments have issued CNY2.1 billion of special bonds in the first five months of the year, accounting for 57% of the planned CNY3.8 trillion. Feng said issuance so far lagged behind the same period in 2022, but was faster than 2021. Authorities have used 50% of funds on infrastructure, he said. (MNI)

CHINA MARKETS

PBOC Injects Net CNY37 Bln Via OMOs Tuesday

The People's Bank of China (PBOC) conducted CNY219 billion via 7-day reverse repos on Tuesday, with the rates at 1.90%. The operation has led to a net injection of CNY37 billion after offsetting the maturity of CNY182 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8545% at 10:01 am local time from the close of 1.9107% on Monday.

- The CFETS-NEX money-market sentiment index closed at 45 on Monday, compared with the close of 44 on Sunday.

PBOC Yuan Parity Higher At 7.2098 Tuesday VS 7.2056 Monday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.2098 on Tuesday, compared with 7.2056 set on Monday.

OVERNIGHT DATA

UK June BRC Shop Price Index 8.4% Y/Y; PRIOR 9.0%

MARKETS

US TSYS: Narrow Ranges In Asia

TYU3 deals at 113-04+, -0-03, a touch off the base of the narrow 0-05 range on volume of ~49k.

- Cash tsys sit little changed across the major benchmarks.

- Tsys have been marginally pressured through the Asian session after the PBOC fixed the Yuan 100 pips stronger than forecast which weighed on the USD. However recent ranges have been respected thus far.

- Early in the session tsys were a touch firmer as Asia-Pac participants faded yesterday's issuance-induced retreat from session highs seen early in the NY session, perhaps using the opportunity to enter fresh long positions/close shorts.

- FOMC dated OIS price a terminal rate of 4.30% in November. There are ~70bps of cuts priced for 2024.

- There is a thin docket in Europe today. Further out we have a slew of US data including US new home sales, durable goods and Conference Board consumer confidence. We also have the latest 5-Year Supply.

JGBs: Futures Weaker After 20-Year Supply Sees Weaker Demand

In the Tokyo afternoon session, JGB futures are trading lower at 148.86, -13 from the settlement levels. The weaker demand observed at the auction of 20-year JGBs contributed to this downward trend. The auction price fell short of dealer expectations, and the cover ratio decreased compared to previous auctions. Furthermore, there was a notable increase in the auction tail compared to the May auction. The bid appears to have been influenced by the level of the outright 20-year yield and the richness of the 20-year on a 10/20/30-year butterfly.

- The leading economic indicator was revised at 96.8 in April, from 97.6 in the preliminary release, the Cabinet Office said. The Coincident indicator nuf=dged higher to 97.3 from 97.2.

- Cash JGBs remain mixed across the curve in afternoon trade break with the benchmark 10-year underperforming with its yield 1.1bp higher at 0.371%. The 40-year is the best performer with its yield 0.7bp lower at 1.354%.

- The 20-year zone sits 0.3bp higher at 0.959%, after being as low as 0.946%.

- The swap curve bear steepens with rates 0.5-2.6bp higher. Swap spreads are wider.

- The local calendar tomorrow is light tomorrow ahead of Retail Sales (May), International Investment Flows (June 23) and Consumer Confidence (June) on Thursday.

AUSSIE BONDS: Slightly Richer, At Cheaps, CPI Monthly Tomorrow

ACGBs sit slightly higher (YM +1.0 & XM +2.0). However, current levels are respectively 7bp and 5bp lower than the highs recorded during overnight trading. Given the lack of significant local news, it is likely that local market participants have been closely monitoring headlines and keeping an eye on the movements in US tsys during Asia-Pac trading. US tsy futures are 03+ cheaper at 113-03+, after reaching a high of 113-09 in early Asia-Pac trade.

- Cash ACGBs are 2bp richer with the AU-US 10-year yield differential unchanged at +20bp.

- Swap rates are 2-3bp lower with EFPs little changed.

- The bills strip bull flattens with pricing flat to +5.

- RBA-dated OIS pricing is 1-4bp softer across meetings. A 38% chance of a 25bp hike at the July meeting is priced.

- The local calendar heats up tomorrow with the release of May’s CPI Monthly, ahead of Thursday's release of Retail Sales for May. CPI monthly is expected to print at 6.1% y/y, after the unexpected jump to 6.8% in April. Meanwhile, retail sales are expected to provide further confirmation that the consumer slowdown is underway.

- The AOFM plans to sell tomorrow A$300mn of the 1.75% 21 June 2051 bond.

NZGBS: Gives Back Early Strength, Closes Flat, Review Leaves RBNZ’s Remit Unchanged

NZGBs closed on a low note with benchmark yields 1-2bp higher after trading 5bp lower earlier in the local session. In the absence of domestic catalysts, the local market appears to have been content to be steered by US tsys in Asia-Pac trade. Cash US tsys are 0.5-1bp cheaper, after giving up earlier gains.

- NZ Finance Minister Grant Robertson says the Reserve Bank’s Monetary Policy Committee remit and charter is largely unchanged following the first five-year review, with only minor changes to the monetary policy framework. Adding that the current monetary policy framework “remains fit for purpose”. (See link)

- Swap rates closed 1bp lower with implied swap spreads tighter.

- RBNZ dated OIS pricing closed flat to 2bp softer across meetings with terminal OCR expectations at 5.64%.

- The local calendar tomorrow is light again ahead of the latest ANZ Business Outlook survey on Thursday. On Friday, Consumer Sentiment is expected to continue to signal ongoing recessionary conditions, as households deal with the headwinds of high inflation and interest rates.

- Later today sees a slew of US data including US New Home Sales, Durable Goods and Conference Board Consumer Confidence. We also have the latest 5-Year Supply.

OIL: Crude Higher On Better Risk Appetite

Oil prices have made further modest gains of around 0.6% following Monday’s rise, as commodities have generally risen. WTI is at $69.82/bbl, just off the intraday high of $69.86 and approaching $70. Brent is around $74.76, close to the high of $74.81. The USD index is 0.2% lower.

- Oil fell in early APAC trading with WTI reaching a low of $69.29 and Brent $74.25. The recovery in crude was boosted by better risk sentiment driven by China’s CNY fixing being stronger than forecast.

- Bloomberg is reporting that China’s largest oil company and refiner have taken huge opposing positions in Middle East crude, which is unusual. This has resulted in volatile Dubai crude prices this month and has clouded the true situation in the Middle East market.

- US API inventory data is published today. US May durable goods orders, April house prices, May new home sales, June consumer confidence, June Richmond manufacturing & Dallas services print later. Canada’s May CPI is also released. ECB President Lagarde speaks.

GOLD: Extends Monday's Gain In Asia-Pac Trade

In the Asia-Pac session, gold has gained ground, reaching 1929.21 (+0.3%). This follows a slight increase (+0.1%) on Monday, as investors carefully evaluated escalating geopolitical uncertainty and signals pointing towards a potential recession.

- The price of bullion experienced a rise of up to 0.6% on Monday, primarily driven by the extraordinary mutiny led by Russian mercenary leader Yevgeny Prigozhin. However, the upside potential for this safe-haven asset was limited as Prigozhin abruptly halted his dramatic advance towards Moscow over the weekend.

- The price of the precious metal is primarily susceptible to the movements of real interest rates and the value of the dollar. Past trends indicate that rallies driven by geopolitical risks are typically short-lived in nature.

- According to MNI’s technicals team, the bear cycle in gold remains intact. Trendline support has been breached - the line is drawn from the Nov 3 2022 low and the break reinforces a bearish condition. Furthermore, the move lower confirms a resumption of the downtrend. The focus is on $1903.5, 61.8% of the Feb 28 - May 4 bull cycle. Key resistance is $1985.3, the May 24 high. Initial resistance is at $1948.8, the 20-day EMA.

FOREX: AUD Firms After PBOC Fixing Stronger Than Expected

The AUD is the strongest performer in the G-10 space at the margins firming after the PBOC fixed the Yuan 100 pips stronger than forecast which supported risk appetite and weighed on the USD.

- AUD/USD prints at $0.6710/15 and is up ~0.6%, after firming above the $0.67 handle resistance comes in at $0.6731 the 20-Day EMA. AUD/NZD is up ~0.4% and sits above the 200-Day EMA.

- Kiwi is ~0.2% firmer, NZD/USD prints at $0.6175/80. The Westpac Q2 Employment Confidence Index was on the wires this morning falling 3.9%.

- Yen is little changed, USD/JPY has observed a narrow range with little follow through on moves.

- Elsewhere in G-10, NOK and SEK are both ~0.4% firmer, however liquidity is generally poor in Asia.

- Cross asset wise; BBDXY is down ~0.2% and US Tsy Yields are little changed across the curve. WTI futures are ~0.5% higher.

- May CPI data from Canada headlines today's docket.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/06/2023 | 0600/0800 | ** |  | SE | PPI |

| 27/06/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/06/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/06/2023 | 0800/1000 |  | EU | ECB Lagarde Intro at ECB Forum | |

| 27/06/2023 | 0830/0930 |  | UK | BOE Tenreyro Panels ECB Forum | |

| 27/06/2023 | 0830/1030 |  | EU | ECB Panetta Panels ECB Forum | |

| 27/06/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/06/2023 | 0930/1130 |  | EU | ECB Elderson Panels ECB Forum | |

| 27/06/2023 | 1200/1400 |  | EU | ECB Schnabel Panels ECB Forum | |

| 27/06/2023 | 1230/0830 | *** |  | CA | CPI |

| 27/06/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 27/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/06/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/06/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/06/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 27/06/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/06/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 27/06/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 27/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.