-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Set For Fed Downshift

EXECUTIVE SUMMARY

- UK CHANCELLOR JEREMY HUNT TOLD TO CUT TAXES AFTER IMF WARNING (BBG)

- UK AND EU SET FOR NORTHERN IRELAND BREXIT DEAL (THE TIMES)

- BLINKEN TO DISCUSS RUSSIA'S WAR ON UKRAINE WITH CHINESE OFFICIALS (RTRS)

- BOJ BOUGHT RECORD SUM OF GOVT BONDS IN JAN TO DEFEND YIELD CAP (RTRS)

- PHILIPPINES OFFICIAL: AUSTIN'S MANILA VISIT TO BRING DEAL ON EXPANDED BASE ACCESS (RTRS)

- U.S. SAYS RUSSIA HAS VIOLATED NUCLEAR-ARMS TREATY BY BLOCKING INSPECTIONS (WSJ)

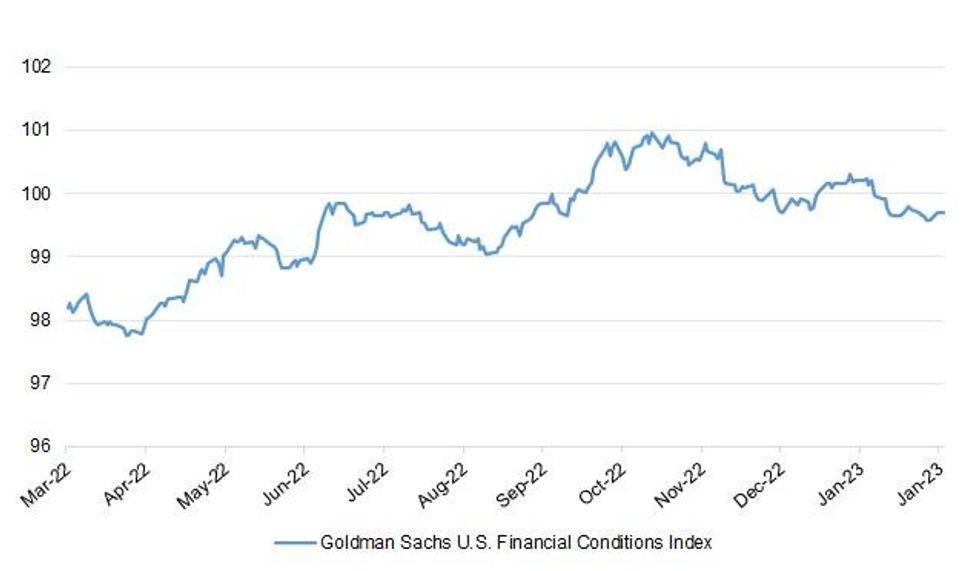

Fig. 1: Goldman Sachs U.S. Financial Conditions Index

Source: MNI - Market News/Bloomberg

UK

INFLATION: Shop prices have yet to reach their peak - despite record highs seen in January, it has been warned. (Sky)

FISCAL: UK Chancellor of the Exchequer Jeremy Hunt was told to cut taxes at a meeting with rank-and-file Conservative MPs on Tuesday, after the International Monetary Fund offered a bleak forecast of the UK’s economic outlook. (BBG)

FISCAL: Jeremy Hunt has opened the door to freezing fuel duty for another year as he was grilled on tax cuts by backbenchers. (Telegraph)

BOE: The Bank of England should raise interest rates by another 50 basis points this week, maintaining its tightening cycle despite a slowing economy, according to The Times shadow monetary policy committee. (The Times)

BOE: A stagnating UK workforce and a likely higher equilibrium rate of unemployment have raised the chances that the Bank of England will ratchet its already-low estimate for trend economic growth still lower when it produces its annual supply-side stock take in its February Monetary Policy Report. (MNI)

ECONOMY: More than half of UK company bosses are optimistic about their business prospects this year as concerns about inflation and political instability start to recede, according to the Institute of Directors. (BBG)

BREXIT: Britain and the European Union have struck a customs deal that could pave the way to ending years of post-Brexit wrangling over Northern Ireland. (The Times)

BREXIT: Rishi Sunak is facing a big test of his authority as he agonises over whether he can sell an outline deal on the Northern Ireland protocol to pro-UK unionist politicians in the region and Eurosceptic Tory MPs. After months of talks, negotiators have briefed Sunak a deal is taking shape to resolve the row over post-Brexit trading arrangements in Northern Ireland. “It’s getting close,” said one person briefed on the talks. (FT)

EUROPE

FISCAL: The European Union risks missing a March target to agree on a reform of its debt-limit rules in the face of resistance from countries including Germany, a prospect that may force member states into abrupt and potentially painful budgetary adjustments. (BBG)

FRANCE: French labor unions rallied more people to a second day of protests against government plans to raise the retirement age and announced two more days of action, turning up the pressure on President Emmanuel Macron to rethink his signature economic reform. (BBG)

SPAIN: Spain’s minimum wage will jump 8% after the government and the country’s main unions struck a deal on hiking it by more than the rate of inflation. (BBG)

U.S.

FED: The Fed interest rate policy path is pretty clear for the next few months of Federal Reserve FOMC meetings. A 25 basis point hike is coming this Wednesday, and likely one more at the following meeting, but after that, the disagreement between the market and the Fed begins. That’s according to the latest CNBC Fed Survey, which finds among top economists and investors a view of the Fed’s course that helps to explain why, in addition to recent data showing progress against inflation, stocks have been in rally mode to start the year. (CNBC)

FED: WSJ Fed Watcher Timiraos tweeted the following on Tuesday: “The ECI report is helpful for the Fed, which is on track to hike rates by 25 bps this week A slower pace of wage growth could ease worries that wage inflation will settle out at eye-wateringly high levels for a central bank that targets 2% inflation.” (MNI)

ECONOMY: Slowing wage growth amid continued employment gains suggests the U.S. job market is coming into better balance and the Federal Reserve could be nearing a soft landing as it works to conquer a bout of inflation that reached 40-year highs, Frank Fiorille, a vice president at the payroll firm Paychex, told MNI. (MNI)

ECONOMY/POLITICS: US lawmakers will hold a joint legislative hearing to discuss how to lower costs, strengthen supply chains, reduce emissions and solve energy issues, according to a statement from the Energy and Commerce Committee Chairwoman Cathy McMorris Rodgers. (BBG)

FISCAL: President Joe Biden will release his proposed budget on March 9, the White House said on Tuesday, setting a deadline before his meeting with the Republican House speaker on Wednesday to discuss the nation's spending. (RTRS)

POLITICS: Nikki Haley is moving closer to making her presidential campaign official. On Wednesday, supporters of the former South Carolina governor will get an email invitation to a Feb. 15 launch event in Charleston, at which she plans to announce her campaign, according to a person familiar with the plans but not authorized to speak publicly about them. (AP)

EQUITIES: EU industry chief Thierry Breton on Tuesday told Twitter owner Elon Musk to do more to fully comply with the bloc's online content rules. (RTRS)

OTHER

U.S./CHINA: U.S. Secretary of State Antony Blinken will try to revitalize some topics of discussion during an upcoming trip to China and will bring up the war in Ukraine, White House national security spokesman John Kirby said on Tuesday. (RTRS)

U.S./CHINA: China and the US must find common ground for the sake of the global economic recovery, the Communist Party’s flagship newspaper said, signaling Beijing’s continued desire to mend ties ahead of an expected visit by US Secretary of State Antony Blinken. (BBG)

GEOPOLITICS: U.S. Defense Secretary Lloyd Austin's visit to the Philippines this week is expected to bring an announcement of expanded U.S. access to military bases in the country, a senior Philippines official said on Tuesday. Washington is eager to extend its security options in the Philippines as part of efforts to deter any move by China against self-ruled Taiwan, while Manila wants to bolster defense of its territorial claims in the disputed South China Sea. (RTRS)

BOJ: The Bank of Japan bought a record 23.69 trillion yen ($182 billion) worth of government bonds in January, data showed on Wednesday, underscoring its resolve to defend its yield cap from attack by investors betting on a near-term interest rate hike. (RTRS)

BOJ: Bank of Japan Deputy Governor Masayoshi Amamiya’s lack of recent public speaking engagements offers support for economists’ view that he is the front-runner to helm the central bank from April. (BBG)

JAPAN: Japan’s government is planning to sell 20t yen in transition bonds over the next decade, Asahi reports without attribution. (BBG)

JAPAN/CHINA: Japan’s government is considering easing Covid-19 border controls on Chinese travelers in place since Dec., public broadcaster NHK reports without attribution. (BBG)

RBA: Reserve Bank of Australia Head of Economic Analysis Department Marion Kohler says inflation is expected to ease over the course of this year. She commented in an opening statement to the Senate Select Committee on the Cost of Living on Wednesday. (BBG)

RBA: There was enough nastiness in Australia’s recent fourth-quarter inflation report to lock in the prospect of several interest-rate increases over the coming months, with the data confirming that the country continues to lag well behind other major economies in the race to tame prices. (WSJ)

NEW ZEALAND: National Party finance spokesperson Nicola Willis says Chris Hipkins has “reheated” an old Jacinda Ardern policy by extending petrol tax and public transport subsidies. ”The new prime minister is bereft of any new ideas for addressing New Zealand's deepening cost of living crisis,” Willis said. Prime Minister Chris Hipkins confirmed on Wednesday the Government would extend its 25 cent petrol tax cut and half-price public transport until June 30, when the next Budget kicks in. Stuff first reported Hipkins’ plans to do so earlier in the day. (Stuff NZ)

SOUTH KOREA: South Korea on Wednesday posted a record monthly trade deficit for January due mainly to a far worse-than-expected drop in exports, drawing a pledge from government to employ all available resources to revive overseas sales. (RTRS)

HONG KONG/CHINA: China and Hong Kong plan to expand border reopening including resuming the operation of Lo Wu control point by Feb. 6, pro-Beijing newspaper Ta Kung Pao reports, citing unidentified people. (BBG)

USMCA: The United States on Tuesday said it was seeking a second trade dispute settlement panel over Canada's dairy import quotas, charging that Canada was still not meeting obligations to open its market to American producers. (RTRS)

BRAZIL: In a visit to the Brazilian Federation of Banks (Febraban) on Tuesday, Finance Minister Fernando Haddad asked for a vote of confidence from bankers on the conduct of economic policy and the fiscal issue. (Valor)

BRAZIL: Henrique Meirelles, who ran Brazil’s central bank for almost a decade, has a piece of advice for his former boss, President Luiz Inacio Lula da Silva: Stop talking about interest rates. (BBG)

BRAZIL: Debates on Brazil’s tax reform should be restarted as soon as possible, Lower House Speaker Arthur Lira told journalists this Tuesday. (BBG)

BRAZIL: Brazil authorities must investigate what happened in retailer Americanas, said the Minister of Labor Luiz Marinho in a press conference, when commenting on the accounting inconsistencies announced earlier this month by the retailer. (BBG)

BRAZIL: President Biden will welcome President Luiz Inácio Lula da Silva of Brazil to the White House on Feb. 10, the White House announced on Tuesday. (The Hill)

RUSSIA: Russia has violated the New START treaty cutting long-range nuclear arms by refusing to allow on-site inspections and rebuffing Washington’s requests to meet to discuss its compliance concerns, the U.S. State Department said in a report sent to Congress on Tuesday. The State Department’s finding that Moscow is in “noncompliance” with the accord marks the first time that the U.S. has accused Russia of violating the treaty, which entered into force in 2011. (WSJ)

RUSSIA: Russia will comply with START treaty on nuclear weapons limitations, but won’t let US inspectors in to check on them, Russian Ambassador to the US Anatoly Antonov says in Telegram post. (BBG)

RUSSIA: A U.S. weapons maker is offering to sell the Ukraine government two Reaper MQ-9 drones for a dollar to help the country defend itself as it prepares for an expected Russian offensive. The deal would require Kyiv to spend about $10 million to prepare and ship the aircraft to Ukraine, and about $8 million each year for maintenance and sustainment of the older model drones, which currently aren’t being used in Ukraine. (WSJ)

RUSSIA: The United States is readying a $2.2 billion package of military aid for Ukraine that is expected to include longer-range rockets for the first time, and other munitions and weapons, two U.S. officials briefed on the matter told Reuters on Tuesday. (RTRS)

RUSSIA: EU member states have warned Brussels against giving Ukraine an unrealistic expectation of rapidly joining the bloc, ahead of a summit in Kyiv where Volodymyr Zelenskyy is pressing for progress on accession and reconstruction. (FT)

COLOMBIA: Colombia central bank publishes minutes to Jan. policy meeting. All board members agreed that key interest rate is now nearing level needed to ensure that inflation slows to its 3% target. (BBG)

PERU/RATINGS: Moody's affirmed Peru at Baa1; Outlook changed to Negative

METALS: Brazil's Vale SA, one of the world's largest mining companies, on Tuesday reported a fourth-quarter 1% fall in iron ore production from a year earlier, while the sales volume of nickel soared. (RTRS)

ENERGY: Freeport LNG asked U.S. regulators for approval to add natural gas to one of the three idled units at its liquefied natural gas (LNG) export plant in Texas, a milestone in efforts to restore production after a seven-month outage, according to a federal filing made available on Tuesday. (RTRS)

OIL: Demand for U.S. crude and petroleum products rose 178,000 barrels per day (bpd) in November to 20.59 million bpd, the highest since August, the U.S. Energy Information Administration (EIA) said Tuesday in its Petroleum Supply Monthly (PSM) report. (RTRS)

OIL: Western oil tankers ramped up their shipments of Russian crude in January as prices for Moscow's flagship Urals grade held below an international price cap, according to market sources and Eikon data. (RTRS)

EQUITIES: The White House on Tuesday expressed outrage on Tuesday at Exxon Mobil Corp's record net profit in 2022 of $56 billion, a historical high not just for the company but for the entire Western oil industry. (RTRS)

CHINA

ECONOMY/YUAN: Chinese Premier Li Keqiang called for the ramping up of financial support for the expansion of domestic demand, and ensuring the yuan exchange rate remained stable at an adaptive and balanced level to keep the economy performing within a reasonable range, reported Xinhua News Agency. (MNI)

ECONOMY: China's economy is likely to see a stronger rebound than expected in the first quarter to about 4% as measures stimulating domestic demand take effect, China Business Network reported citing analysts. (MNI)

CREDIT: China's new loans are expected to reach a fresh record of over CNY4 trillion in January as supportive policies boost the infrastructure and manufacturing sectors, while lenders have also enhanced support to developers, analysts told Securities Daily on Wednesday. (MNI)

SWAPS: Hong Kong and mainland China regulators are set to launch Swap Connect early in the first quarter, allowing foreign access to the USD5 trillion onshore interest rate swaps market and providing investors with hedging tools at a time of heightened volatility in global bond markets, sources told MNI. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY292 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) conducted CNY155 billion via 7-day reverse repos with the rates unchanged at 2.00% on Wednesday. The operation has led to a net drain of CNY292 billion after offsetting the maturity of CNY447 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0233% at 9:23 am local time from the close of 2.1519% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday, compared with the close of 50 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7492 WEDS VS 6.7604 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7492 on Wednesday, compared with 6.7604 set on Tuesday.

OVERNIGHT DATA

CHINA JAN CAIXIN MANUFACTURING PMI 49.2; MEDIAN 49.8; DEC 49.0

After being hit by the latest wave of Covid infections, the primary focus of economic work should be on accelerating economic recovery and promoting normalized production and social orders. Improving expectations, restoring confidence, increasing income, expanding consumption, and stimulating domestic demand will be among the priorities. There is still uncertainty in how the pandemic will develop, so full preparation should be made to deal with the next wave of the virus. China will still need to effectively coordinate pandemic containment with economic and social development. (Caixin)

JAPAN JAN, F JIBUN BANK MANUFACTURING PMI 48.9; PRELIM 48.9; DEC 48.9

Subdued global economic conditions continued to hold back customer demand across the Japanese manufacturing sector in January, but there were a number of positive signals from the latest PMI survey. The rates of decline for output and new orders were the smallest since last October, whilst marginal employment growth was maintained as manufacturers sought to boost capacity in line with long-term investment plans. (S&P Global)

AUSTRALIA JAN, F JUDO BANK MANUFACTURING PMI 50.0; PRELIM 49.8; DEC 50.2

Australia’s manufacturing sector is on track for a soft landing in 2023, while the operating environment is quickly returning to normal following three years of pandemic induced disruption. (Judo Bank)

AUSTRALIA JAN CORELOGIC HOUSE PRICE INDEX -1.1% M/M; DEC -1.2%

The CoreLogic Home Value Index is part of the suite of housing market indices produced by CoreLogic. Since being launched in 2007, the Index has established a new benchmark for measuring value changes across the Australian housing market. (CoreLogic)

NEW ZEALAND Q4 UNEMPLOYMENT RATE 3.4%; MEDIAN 3.3%; Q3 3.3%

NEW ZEALAND Q4 EMPLOYMENT CHANGE +0.2% Q/Q; MEDIAN +0.3%; Q3 +1.3%

NEW ZEALAND Q4 EMPLOYMENT CHANGE +1.3% Y/Y; MEDIAN +1.5%; Q3 +1.2%

NEW ZEALAND Q4 PARTICIPATION RATE 71.7%; MEDIAN 71.7%; Q3 71.7%

NEW ZEALAND PRIVATE WAGES INCLUDING OVERTIME +1.1% Q/Q; MEDIAN +1.1%; Q3 +1.2%

NEW ZEALAND PRIVATE WAGES EXCLUDING OVERTIME +1.1% Q/Q; MEDIAN +1.2%; Q3 +1.1%

NEW ZEALAND AVERAGE HOURLY EARNINGS +0.9% Q/Q; Q3 +2.6%

NEW ZEALAND JAN CORELOGIC HOUSE PRICE INDEX -7.2% Y/Y; DEC -5.0%

Aotearoa New Zealand’s housing market downturn continues to roll on, with CoreLogic’s House Price Index (HPI) recording a 0.3% fall in January, the 10th consecutive month of decline. Residential property values are 7.2% lower than a year ago, the biggest 12-month decline since May 2009 (-7.9%), although still smaller than the ‘worst’ of the GFC when prices fell 9.7% in the year to March 2009. (CoreLogic)

SOUTH KOREA JAN TRADE BALANCE -US$12.690BN; MEDIAN -US$9.273BN; DEC -US$4.692BN

SOUTH KOREA JAN EXPORTS -16.6% Y/Y; MEDIAN -11.1%; DEC -9.6%

SOUTH KOREA JAN IMPORTS -2.6% Y/Y; MEDIAN -2.6%; DEC -2.5%

SOUTH KOREA JAN S&P GLOBAL MANUFACTURING PMI 48.5; DEC 48.2

The deterioration in South Korean manufacturing conditions was sustained into the new year, as output, orders and exports remained in contraction territory. Goods production slipped at the sharpest rate since last October, reflecting weaker demand and rising prices. (S&P Global)

MARKETS

US TSYS: Little Changed In Asia, Fed In View

TYH3 deals at 114-19+, +0-03, operating in a narrow 0-05 range on volume of ~68k.

- Cash Tsys sit little changed across the major benchmarks.

- After a muted start Tsys firmed off session lows in the wake of a softer than expected Caixin PMI print.

- With Asia-Pac participants seemingly content to stay sidelined ahead of this evening's Fed decision moves were limited and Tsys respected tight ranges.

- Macro headline flow was also light.

- Today in Europe we have Eurozone final manufacturing PMI and CPI, before a slew of U.S. data including the ISM manufacturing survey and JOLTs job openings. However, the headline risk event is the FOMC rate decision, with a 25bp hike all but priced into OIS markets participants will look to the guidance in Powell's press conference (our preview is here). We will also get the latest quarterly refunding announcement from the Tsy (see our preview of that event here).

JGBS: Flat To Richer, Futures Consolidate Overnight Gains

A sedate round of JGB trade, particularly by recent standards, was observed on Wednesday.

- JGB futures oscillated either side of late overnight levels during the Tokyo session, dealing +15 into the close, as bulls look to consolidate the bounce from Tuesday’s late Tokyo lows.

- Meanwhile, cash JGBs run flat to ~4bp richer as the curve flattens, while 10-Year JGB yields operate just below the upper limit of the BoJ’s YCC parameters. Be on the lookout for unscheduled Rinban purchases covering the 5- to 10-Year zone of the curve if a more meaningful test of the BoJ’s policy settings plays out in the coming days.

- The swap curve flattened, with benchmark rates there running flat to 3.5bp lower, albeit lagging the moves in JGBs, as swap spreads widened.

- Local headline flow was limited, which left participants to adjust to the broader market moves observed since yesterday’s Tokyo close.

- Looking ahead, Thursday’s local docket consists of 10-Year JGB supply and lower tier data, which will leave auction dynamics and post-FOMC adjustments at the fore.

AUSSIE BONDS: Finishing A Little Cheaper

Aussie bond futures went out just off session cheaps, with YM & XM both -2.0. When it comes to a potential catalyst we would point to a piece from WSJ RBA watcher Glynn, which noted that “there was enough nastiness in Australia’s recent fourth-quarter inflation report to lock in the prospect of several interest-rate increases over the coming months, with the data confirming that the country continues to lag well behind other major economies in the race to tame prices.” The space showed modest to no reaction to NZ labour market data & the Caixin m’fing PMI print out of China. Wider cash ACGBs were ~2bp cheaper across the curve.

- Bills were flat to 5bp cheaper through the reds, steepening. RBA terminal cash rate pricing hovers back around the 3.80% mark, initially pressured by NZ labour market data before edging higher, likely on the Glynn article.

- RBA’s Kohler, Head of Economic Analysis, appeared before the Senate Select Committee on the cost of living. It is worth noting that she was limited in her answers given that the RBA is currently reviewing its forecasts which will be published on February 10 in the Statement on Monetary Policy. She said that the central bank thinks that inflation peaked at the end of last year at around 8%. Kohler reiterated that higher rates were necessary to bring supply and demand into balance and inflation down.

- Building approvals data and the Q4 NAB business survey headline domestically tomorrow, with post-FOMC adjustments set to dominate.

AUSSIE BONDS: ACGB May-34 Auction Results

The Australian Office of Financial Management (AOFM) sells A$700mn of the 3.75% 21 May 2034 Bond, issue #TB167:

- Average Yield: 3.5911%

- High Yield: 3.5925%

- Bid/Cover: 5.1171x

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 47.2%

- Bidders 44, successful 7, allocated in full 1

- There are no prior comparable metrics as this was the first tap of the line since its initial syndication back in November 2022.

NZGBS: Curve Bull Steepens, RBNZ Terminal OCR Pricing Lower In Wake Of Labour Market Data

NZGBs worked away from richest levels as the session wore on, leaving the major benchmarks running flat to 7bp richer at the close, bull steepening. Swap rates were 2-9bp lower, also steepening on the curve, with swap spreads a touch tighter on the day.

- That came after the domestic Q4 labour market report triggered an early bid, with ASB and BNZ both switching their calls for next month’s RBNZ meeting to a 50bp hike (from 75bp previously), leaving all of the “Big 4” looking for a 50bp step.

- To recap, there was an unexpected 0.1ppt uptick in the unemployment rate as employment growth provided a marginal downside miss, the participation rate held steady, private wages printed largely in line with expectations and average hourly earnings slowed.

- This was the last round of meaningful data before next month’s RBNZ meeting. The downside surprise in the Q4 CPI reading (at least relative to Bank expectations) saw RBNZ dated OIS pricing come in, while today’s data has pushed pricing more towards a 50bp hike as opposed to another 75bp step. There is ~56p of tightening now priced for next month’s meeting, a handful of bp lower on the day. Meanwhile, terminal OCR pricing has also come in a touch, showing just below 5.30%.

- Looking ahead, building permits data and weekly NZGB supply, covering NZGB-28, -33 & -37, headline Thursday’s domestic docket, although adjustment to the impending U.S. Fed monetary policy decision will likely dominate.

EQUITIES: Modest Gains Ahead Of The Fed

Regional markets are mostly higher, although key bourses are struggling to make meaningful positive headway. US futures are in the red, albeit away from worst levels. Eminis are down -0.20%, Nasdaq futures off -0.28%. This is taking some of the shine off the better tone from Wall Street through Tuesday's session. Some cautiousness is also evident ahead of the upcoming Fed decision.

- The HSI is modestly higher, last +0.27%, after correcting lower for the first two sessions of the week. The tech sub index has rebounded 1.73% so far. The China-HK authorities plan to expand the border re-opening by Feb 6.

- The CSI 300 is close to flat. The Caixin manufacturing PMI, which is orientated towards smaller and export firms, disappointed coming in at 49.2, versus 49.8 expected.

- The Nikkei 225 is around flat as well, while the Kospi is enjoying a better session, up 0.45%, although this is down from earlier session highs. Trade figures were weaker than expected, while chip maker SK Hynix had a disappointing earnings result, but this hasn't impact sentiment. The Taiex is up around 0.45% as well.

- India shares are higher, last +0.60% for the Nifty, even with further Adani headwinds. The Indian budget is due later.

GOLD: Bullion Range Trading Ahead Of Fed Decision

Gold has been trading in a narrow range during the APAC session ahead of the Fed announcement later today. A 25bp rate hike is widely expected but the tone of the comments will be important and a hawkish note is likely to be detrimental to bullion. Gold prices are down 0.1% today to around $1926.40/oz after rising 0.3% on Tuesday following softer US data. DXY is flat on the session.

- Gold continues to trade between resistance at $1949.20, the January 26 high, and support at $1899.50, the 20-day EMA. But trend conditions remain bullish.

- The World Gold Council reported that demand for gold rose around 20% in 2022 to its highest since 2011 driven by precautionary flows due to rising inflation. Central bank purchases were their highest in over 50 years but jewellery demand was down slightly. The Council sees upside demand potential in 2023 because of recessionary and geopolitical fears and the recovery in China should drive increased demand for jewellery.

- Later the Fed meets and is expected to hike rates 25bp (see MNI Fed Preview). There are also manufacturing PMIs/ISM for January for the US and Europe and US JOLTS job openings for December.

OIL: Crude Extends Recovery Ahead Of Fed & OPEC Announcements Later

Oil prices have been zigzagging in a tight range during the APAC session ahead of the Fed and OPEC+ decisions later. A hawkish tone to Fed comments could put downward pressure on crude. WTI is currently up 0.5% to around $79.25/bbl and Brent +0.4% to $85.75. The USD is flat.

- WTI is still trading below $80 and initial resistance is at $80.49, the January 30 high. The sharp correction on Monday has put the uptrend in doubt and a further correction could see an extension towards $72.74, the January 5 low. WTI is ahead of its 50-day MA and Brent its 50- and 100-day MA.

- API reported another rise in US crude inventories of 6.3mn barrels and distillate was up 1.5mn and gasoline 2.7mn. The EIA stock data is out today.

- Later the Fed meets and is expected to hike rates 25bp (see MNI Fed Preview). OPEC+ also meets but reports before the meeting implied that there would be no change in their guidance. There are also manufacturing PMIs/ISM for January for the US and Europe and US JOLTS job openings for December.

FOREX: USD Tracks Recent Ranges

USD indices have traded tight ranges as the market awaits the outcome of the Fed decision later. The BBDXY was last close to 1223.50, little changed versus NY closing levels. Cross asset signals remain modest, with US cash Tsys yields mixed across the curve, the 2yr slightly higher, but weakness at the back end. US equity futures remain in the red, although are away from worst levels.

- USD/JPY is drifting higher this afternoon (last at 130.20/25), but this could be cross related, with AUD/JPY moving back above 92.00. USD/JPY has been running out steam above 130.50 in the past week, so this level could be eyed on the topside. Dips sub 130.00 remain supported for now.

- AUD/USD is back close to 0.7070, around +0.20% firmer for the session. Besides against the yen, AUD/NZD is also pushing higher post the NZ jobs report. The cross was last near 1.0980, with bulls eyeing a move through 1.1000. Commodity prices are mixed with copper off to 420.75%, -0.45%, while iron ore is around flat, last at $127.25/ton.

- NZD/USD sits at 0.6435, around 0.40% lower from pre-data levels this morning. Slowing jobs growth and the unemployment rate edging higher as seen local banks trim their expectations for the RBNZ meeting. Dips in the pair were supported below 0.06420.

- Besides the Fed later on we also have PMIs/ISMs for the EU and US.

FX OPTIONS: Expiries for Feb01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0765-70(E675mln), $1.0790-05(E996mln), $1.0850-55(E718mln), $1.0885-10(E3.0bln)

- USD/JPY: Y129.00($596mln), Y130.50($636mln)

- AUD/USD: $0.6920(A$527mln), $0.7000(A$572mln), $0.7140-50(A$683mln), $0.7185(A$1.1bln)

- USD/CNY: Cny6.82($1.1bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/02/2023 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/02/2023 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/02/2023 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/02/2023 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/02/2023 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/02/2023 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/02/2023 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/02/2023 | 1000/1100 | *** |  | EU | HICP (p) |

| 01/02/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 01/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 01/02/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/02/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 01/02/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/02/2023 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2023 | 1500/1000 | * |  | US | Construction Spending |

| 01/02/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 01/02/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 01/02/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 01/02/2023 | 1900/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.