-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Markets Tiptoe Towards Christmas Break

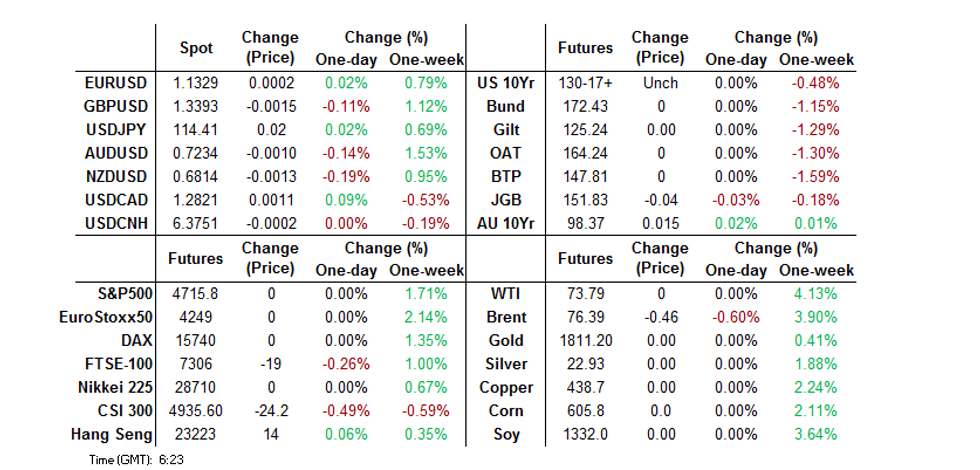

- Asia-Pac trade was subjected to low liquidity pre-Christmas conditions, with limited headline flow observed.

BONDS: Tight Asia Trade, Tsys Closed

U.S. Tsy futures and cash Tsy markets are closed.

- The modest overnight U.S. Tsy-driven weakness was unwound during today’s holiday-shortened Sydney session. This left YM +0.5 and & XM +1.5 at settlement, with nothing in the way of notable headline flow observed when it comes to sniffing out a driver for the move, which took place on low pre-Christmas volume.

- JGB futures lacked a clear sense of direction and closed -4, while cash trade saw most of the major benchmarks trade within -/+0.5bp of Thursday’s closing levels. The MoF confirmed its issuance plans for the next FY, which fell in line with suggestions that were made in source reports earlier this week. Meanwhile, the latest round of BoJ Rinban operations provided no real impetus for the space. Also note that the BoJ conducted its latest round of JGB repo operations, perhaps looking to remove worry re: any potential gyrations in the space between Christmas & the turn of the calendar year.

FOREX: Commodity Dollar Bloc Modestly Lower In Asia

Headline flow has been muted, with liquidity thin ahead of the Christmas break. FX trade has taken a very modest defensive tilt, allowing the JPY & CHF to move to the top of the G10 FX table. Note that USD/JPY threatened a break above Y114.50 early in Tokyo trade, before fading. Conversely, the commodity dollar bloc struggled (the moves are limited in the grander scheme of things), with low liquidity exacerbating the move in CAD at points. A raft of early market closures and a U.S. holiday will further crimp liquidity ahead of Christmas, with nothing in the way of tier 1 risk events on the docket.

EQUITIES: Mainland China Sees Modest Losses

The major regional equity indices were little changed in pre-Christmas Asia-Pac dealing, with e-minis closed for the holiday. There wasn’t much to go off in terms of headline flow, as you would expect. Chinese equities nudged lower (CSI 300 -0.4% at typing), with some pointing to liquidity worry, observed via an uptick in the 14-day repo rate, as a potential driver for the limited pressure.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.