-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Some Hope As SVB Finds A Buyer & More Support For U.S. Banking Sector Touted

EXECUTIVE SUMMARY

- FED’S KASHKARI SAYS BANK STRAINS BRING RISK OF RECESSION CLOSER (BBG)

- FED’S BARKIN SAYS ‘CLEAR’ CASE FOR RAISING RATES THIS WEEK (BBG)

- US MULLS MORE SUPPORT FOR BANKS AS IT GIVES FIRST REPUBLIC TIME (BBG)

- FIRST CITIZENS BANK TO BUY SVB'S DEPOSITS, LOANS FROM FDIC (RTRS)

- NEARLY $100 BILLION IN DEPOSITS PULLED FROM BANKS; OFFICIALS CALL SYSTEM 'SOUND AND RESILIENT' (CNBC)

- ECB'S DE GUINDOS: BANK TURMOIL MAY RESULT IN LOWER GROWTH AND INFLATION (RTRS)

- ECB’S SCHNABEL WARNS OF ‘STICKY’ INFLATION (IRISH TIMES)

- ECB'S CENTENO: DON’T SEE RATE HIKES EXTENDING BEYOND WHAT’S IN MARKET (BBG)

- PUTIN SAYS MOSCOW TO STATION NUCLEAR WEAPONS IN BELARUS FOR THE FIRST TIME SINCE THE 1990S (RTRS)

- CHINA's HOUSING MARKET SLUMP MAY DRAG ON, MAJOR DEVELOPER SAYS (BBG)G ON, MAJOR DEVELOPER SAYS (BBG)

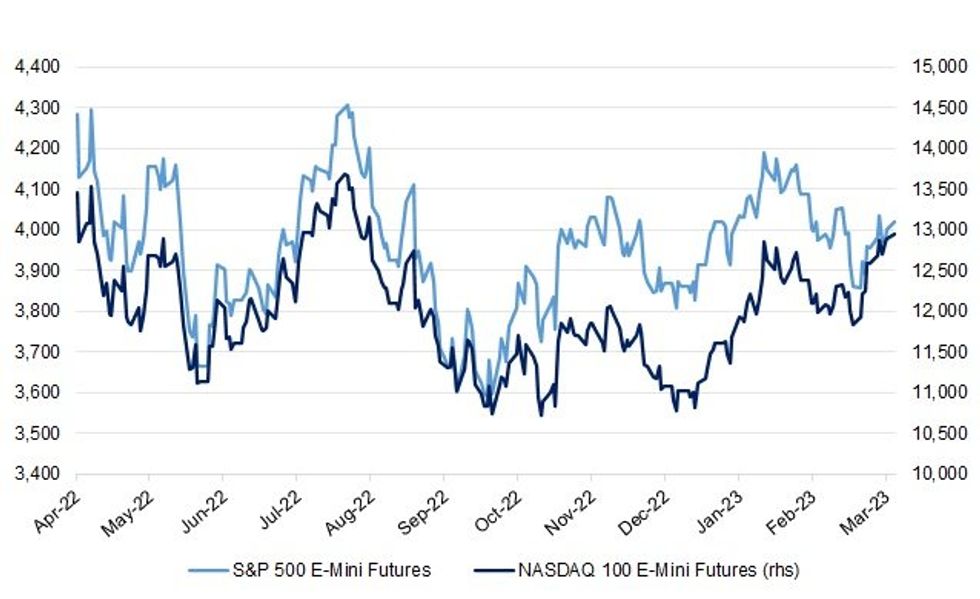

Fig. 1: S&P 500 & NASDAQ 100 E-Mini Contracts

Source: MNI - Market News/Bloomberg

UK

FISCAL: Delaying the rise in the UK state pension age until 2044-46 risks costing the government more than £60bn, according to research by a leading think-tank. (FT)

FISCAL: British oil and gas companies are next week expected to be offered the prospect of windfall tax relief, as prime minister Rishi Sunak looks to boost investment and improve the country’s energy security. (FT)

ECONOMY/BREXIT: Leaving the European Union had an impact on the UK economy equivalent to the coronavirus pandemic and likely reduced output by 4%, the chairman of the Office for Budget Responsibility told the BBC. (BBG)

SCOTLAND: The winner of the contest to succeed Nicola Sturgeon as SNP leader is to be announced later. (BBC)

EUROPE

ECB: The "impression" of the European Central Bank is that recent turmoil in the banking sector may result in lower growth and inflation rates, the European Central Bank's vice president Luis de Guindos said. "Our impression is that they will lead to an additional tightening of credit standards in the euro area. And perhaps this will feed through to the economy in terms of lower growth and lower inflation," he told Business Post in an interview posted on the ECB's website. (RTRS)

ECB: While inflation has started to fall across the euro area, underlying price growth is proving stickier than expected, European Central Bank (ECB) executive board member Isabel Schnabel has warned. Ms Schnabel, who has long said that inflation may be more persistent than estimated, noted that the recent fall in energy prices had been slow to improve medium-term prospects for inflation. (Irish Times)

ECB: European Central Bank Governing Council Member Mario Centeno said he doesn’t see the data available today justifying “an extension beyond what is in the markets” of the process of rising interest rates. (BBG)

ECB: Europe's banking system is not showing signs of the growing financial tensions seen outside the euro zone, although it is not completely isolated, ECB Governing Council member Mario Centeno said on Friday. (RTRS)

EU: Germany reached an agreement with the European Union on a landmark regulation that requires new cars to be carbon neutral by 2035, resolving a dispute that threatened to undermine the bloc’s ambitious blueprint to reduce greenhouse gas emissions. (BBG)

GERMANY: A top union boss in Germany justified a massive strike planned for Monday as a "matter of survival" for many thousands of people fighting for higher wages as inflation soars, according to an interview published in the Bild am Sonntag newspaper. (RTRS)

FRANCE: Marine Le Pen’s far-right party has been the biggest beneficiary of French discontent over President Emmanuel Macron’s decision to raise the minimum retirement age, according to a survey of voting intentions by pollster Ifop for Le Journal du Dimanche newspaper. (BBG)

SWEDEN: The Swedish central bank might have underestimated inflationary pressure and will likely have to stick to its forecasts of another interest rate hike in April, Riksbank Governor Erik Thedeen said on Sunday. (RTRS)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- Fitch affirmed Malta at A+; Outlook Stable

- S&P affirmed Germany at AAA; Outlook Stable

- DBRS Morningstar confirmed Finland at AA (high), Stable Trend

- DBRS Morningstar confirmed France at AA (high), Stable Trend

BANKS: Deutsche Bank AG shares fell and the cost of insuring its debt against default rose in sudden moves that some attributed to hedge funds seeking to profit from the broader turmoil roiling the financial industry. (BBG)

BANKS: The Swiss government was compelled to intervene to save Credit Suisse Group AG as the troubled bank wouldn’t have survived another day of trading amid a crisis of investor confidence, Finance Minister Karin Keller-Sutter said. (BBG)

BANKS: More than three-quarters of Swiss voters want the combined mega bank created by UBS’s emergency takeover of rival Credit Suisse to be split up by new legislation. (FT)

BANKS: The global regulatory regime for “too big to fail” banks set up after the 2008 crisis does not work, according to Switzerland’s finance minister. (FT)

BANKS: Credit Suisse Group AG faces the threat of a possible probe and disciplinary action over how top managers ran the bank in the lead-up to its collapse and takeover by UBS Group AG, Switzerland’s banking regulator told NZZ am Sonntag. (BBG)

BANKS/BONDS: The decision by Swiss authorities to fully write down Credit Suisse’s Additional Tier 1 (AT1) notes, without imposing full losses on the bank’s equity, does not imply that EU and UK authorities will treat insurers’ Restricted Tier 1 (RT1) instruments the same way, Fitch Ratings says. (Fitch Ratings)

U.S.

FED: Federal Reserve Bank of Minneapolis President Neel Kashkari said recent bank turmoil has increased the risk of a US recession but that it was too soon to judge what it means for the economy and monetary policy. (BBG)

FED: Federal Reserve Bank of Richmond President Thomas Barkin said the case for raising interest rates at the central bank’s meeting this week was “pretty clear,” emphasizing that inflation remains too high. (BBG)

FED: The Federal Reserve said on Friday that rising interest costs cut into the amount of money it handed back to the Treasury last year compared to what it handed back in 2021. (RTRS)

FED: The collapse of Silicon Valley Bank likely marks the start of a broader period of financial turmoil that could convince the Federal Reserve to cut rates before year end, former Kansas City Fed President Thomas Hoenig told MNI. (MNI)

FED: The Federal Reserve’s decision Wednesday shows the central bank is strongly considering a halt to monetary tightening including an end to balance-sheet runoffs because of what could prove a substantial drag on the economy and inflation from the recent banking crisis, Fed advisor Diane Swonk told MNI. (MNI)

BANKS: US authorities are considering expanding an emergency lending facility for banks in ways that would give First Republic Bank more time to shore up its balance sheet, according to people with knowledge of the situation. (BBG)

BANKS: The surge of deposits moving from smaller banks to big institutions including JPMorgan Chase and Wells Fargo amid fears over the stability of regional lenders has slowed to a trickle in recent days, CNBC has learned. (CNBC)

BANKS: Regulators again assured the public that the banking system is safe, as fresh data showed customers recently pulled nearly $100 billion in deposits. Treasury Secretary Janet Yellen, Federal Reserve Chairman Jerome Powell and more than a dozen other officials convened a special closed meeting of the Financial Stability Oversight Council on Friday. (CNBC)

BANKS: President Joe Biden said on Friday that federal deposit insurance could be tapped for deposits above $250,000 if other U.S. banks fail. Biden said U.S. banks are in "pretty" good shape and said he doesn't see an industry ready to explode. (RTRS)

BANKS: First Citizens Bank & Trust Co will buy all of Silicon Valley Bank'deposits and loans from the Federal Deposit Insurance Corporation (FDIC), the regulator said in a statement. (RTRS)

BANKS: Bill Isaac, former head of the Federal Deposit Insurance Corporation, told MNI the failures of regional lenders like Silicon Valley Bank and Signature Bank are unlikely to lead to bigger problems for the U.S. financial system because authorities acted with alacrity to stem concerns. (MNI)

OTHER

BANKS/MACRO: Some investors and analysts are calling for more coordinated interventions from central banks to restore financial stability, as they fear that tumult in the global banking sector will continue amid rising interest rates. (RTRS)

BANKS: ANZ Bank chief executive Shayne Elliott described the instability playing out in the global financial system as a modern version of the savings and loan crisis that swept through the US banking sector in the 1980s, as financial markets turn their attention to apparent contagion at Deutsche Bank. (AFR)

GLOBAL TRADE: Turkish President Tayyip Erdogan spoke by phone with Russia's Vladimir Putin and thanked him for his "positive attitude" in extending the Black Sea grain deal, the Turkish presidency said on Saturday. (RTRS)

GLOBAL TRADE: Decoupling from China will push global inflation higher and risks sparking a widespread recession, according to Yi Xiaozhun, former vice minister of the Ministry of Commerce and former deputy director general of the WTO. (MNI)

U.S./CHINA: US officials now expect that a phone call between President Joe Biden and China’s President Xi Jinping won’t happen as soon as they had hoped, as ties between the world’s two biggest economies continue to fray, according to people familiar with the matter. (BBG)

U.S./CHINA: U.S. House of Representatives Speaker Kevin McCarthy said on Sunday lawmakers will move forward with legislation to address national security worries about TikTok, alleging China's government had access to the short video app's user data. (RTRS)

U.S./CHINA: China's attitude towards developing a healthy, stable and constructive Sino-U.S. relationship remains unchanged, while it hopes the United States will stop using "unscrupulous means" to contain and suppress China, China's foreign minister Qin Gang said on Saturday. (RTRS)

CHINA/TAIWAN: China established diplomatic ties with Honduras on Sunday after the Central American country ended its decades-long relationship with Taiwan, while Taiwan's foreign minister accused Honduras of demanding exorbitant sums before being lured away by Beijing. (RTRS)

GEOPOLITICS: The United States and Canada must together build a North American market on everything from semiconductors to solar panel batteries, in the face of growing competition, including from an "increasingly assertive China," Prime Minister Justin Trudeau said on Friday. (RTRS)

GEOPOLITICS: Russia and China are not creating a military alliance, Russian President Vladimir Putin said in an televised interview broadcast on Sunday, stating that the two countries' military cooperation was transparent, news agencies reported. Putin also said Western powers were building a new "axis", bearing some resemblance to Germany and Japan's World War Two alliance. (RTRS)

JAPAN: The Japanese government's plan to soften the impact of inflation on households and businesses is expected to cost about 2.2 trillion yen ($16.83 billion), Kyodo news agency reported on Saturday citing the leader of a party in the ruling coalition. (RTRS)

RBA: The Reserve Bank of Australia review is poised to recommend shaking up the board and that the governor devolve powers to other RBA directors, who would formally take on more responsibilities beyond setting interest rates. The three reviewers are due to hand their report by this Friday to Treasurer Jim Chalmers, who will release the findings and an initial government response before the federal budget on May 9. (AFR)

AUSTRALIA: The Australian Labor Party in New South Wales state claimed power in an election on Saturday night, with voters backing the centre-left party’s pledges on anti-privatisation and cost of living relief. (RTRS)

AUSTRALIA: Within hours of Labor claiming victory over the NSW Coalition after 12 years in power, Unions NSW called the political change an opportunity “to restart how we do industrial relations and deliver public services” in the state as Labor prepares to scrap a public-sector wage cap of 3 per cent. The move is likely to embolden public sector workers in Victoria, where the Andrews Labor government has a 1.5 per cent wage cap. (AFR)

AUSTRALIA: Mortgage borrowers are starting to show the first signs of strain, as the effect of ten consecutive interest rate rises compounds growing cost of living pressures, forcing banks to proactively call customers who are at risk of getting into trouble on their repayments. (AFR)

AUSTRALIA/CHINA: Victorian Premier Daniel Andrews will travel to China this week for a trade mission, his first since the state’ss Belt and Road agreements were torn up. (ABC)

RBNZ: RBNZ has published an assessment of banks’ residential mortgage exposures to flooding risk, Deputy Governor Christian Hawkesby says in statement. (BBG)

SOUTH KOREA: South Korea extends eased financial rules, including loan-to-deposit regulations, to end of June as uncertainty in external and internal financial markets remains, Financial Services Commission says in an emailed statement. (BBG)

SOUTH KOREA: South Korea is likely to announce hikes in electricity and gas charges on March 31, Yonhap News says, citing unidentified sources. (BBG)

NORTH KOREA: North Korea fired two short-range ballistic missiles (SRBMs) toward the East Sea on Monday, Seoul's military said, as a U.S. nuclear-powered aircraft carrier plans to hold joint drills in waters near the peninsula. (Yonhap)

NORTH KOREA: Japanese Chief Cabinet Secretary Hirokazu Matsuno said North Korea may dial up its testing activity further with more missile launches or even conducting its first nuclear test since September 2017. (AP)

ASIA: China’s economy is on track to recover this year, S&P says in a statement. Maintain cautiously optimistic outlook for Asia-Pacific as China’s performance will dampen but not offset the hit of slower growth in the US and Europe, the fading impact of domestic re-opening post the pandemic, and higher interest rates. (BBG)

MEXICO: Mexico’s Supreme Court accepted a challenge from the country’s Electoral Institute INE against the electoral reform passed by President Andres Manuel Lopez Obrador’s supporters in congress, temporarily suspending its application while it assesses its constitutionality. (BBG)

BRAZIL: Brazilian President Luiz Inacio Lula da Silva has cancelled his trip to China, which was previously scheduled for March 27-31, due to medical reasons, according to his press secretary on Saturday. (RTRS)

RUSSIA: Russia will station tactical nuclear weapons in neighboring Belarus, President Vladimir Putin said on Saturday, marking the first time since the mid-1990s that Moscow will have based such arms outside the country. (RTRS)

RUSSIA: The U.S. Department of Defense said on Saturday that there are no indications that Russia is preparing to use nuclear weapons after Moscow's announcement to station tactical nuclear weapons in Belarus. (RTRS)

RUSSIA: A top security adviser to Ukrainian President Volodymyr Zelensky warned on Sunday that Russian plans to station tactical nuclear weapons in Belarus would destabilise that country. "The kremlin took Belarus as a nuclear hostage," Oleksiy Danilov, the head of Ukraine's National Security and Defence Council, wrote on Twitter. (RTRS)

RUSSIA: NATO on Sunday criticised Russia for its "dangerous and irresponsible" nuclear rhetoric, a day after Russian President Vladimir Putin said Russia would station tactical nuclear weapons in Belarus. (RTRS)

RUSSIA: EU foreign policy chief Josep Borrell on Sunday urged Belarus not to host Russian nuclear weapons, saying it could face further sanctions if it did. (RTRS)

RUSSIA: Russia's parliament speaker on Saturday proposed banning the activities of the International Criminal Court (ICC) after the court issued an arrest warrant for President Vladimir Putin, accusing him of the war crimes. (RTRS)

RUSSIA: A drone that hit the centre of a Russian town on Sunday, injuring two people, was a Ukrainian Tupolev Tu-141 Strizh and was packed with explosives, the TASS news agency quoted a law enforcement source as saying. (RTRS)

RUSSIA: Germany wants European Union nations to introduce end-user controls on technological and electronic goods that Russia could be using for military purposes in Ukraine, the country’s economy minister said. (BBG)

SOUTH AFRICA: South Africa’s state-owned utility Eskom Holdings SOC Ltd. resumed power outages Sunday after suspending rotational blackouts for most of the day. (BBG)

ISRAEL: Israeli Prime Minister Benjamin Netanyahu fired his defense minister on Sunday, as he attempts to rein in growing dissent within his own party over a judicial overhaul that has divided the country. (WSJ)

PERU: Peru’s central bank says it can tame inflation by the end of the year and bring it back to its target range, but only just barely. (BBG)

PERU: Peru's government expressed qualified interest in tapping the international bond market later this year in a bid to better manage liabilities, Economy Minister Alex Contreras said on Friday. (RTRS)

PER/IMF: The International Monetary Fund (IMF) on Friday commended Peruvian authorities for decisively addressing high inflation and advised continuing to implement monetary policy in a flexible and well-communicated manner. (RTRS)

ARGENTINA/RATINGS: Fitch downgraded Argentina to C

IMF: IMF managing director Kristalina Georgieva has warned of increased risks to financial stability and the need for vigilance following the recent banking sector turmoil in advanced economies. (FT)

MARKETS: The US Securities and Exchange Commission has raised concerns over Rokos Capital Management after the hedge fund was forced to hand over large amounts of cash to its banks as collateral when an outsized bet on US government bonds backfired earlier this month. (FT)

MARKETS: Chris Rokos has reduced risk in his macro hedge fund in response to double-digit losses this month, which could become his second-worst since the start of the money pool. (BBG)

EQUITIES: Banking turmoil and recession risks are spelling trouble for the global IPO market, keeping it mired in a slump even after investors started the year thinking that the worst of the stocks rout might be over. (BBG)

METALS: Trading in London Metal Exchange nickel contracts resumed Asian-hours trading on Monday, marking a crucial step in efforts to repair the market after last year’s unprecedented turmoil. (BBG)

OIL: Russia is very close to achieving its target of cutting crude oil output by 500,000 barrels per day (bpd) to around 9.5 million bpd, Deputy Prime Minister Alexander Novak said on Friday. (RTRS)

OIL: Iraq halted crude exports from the semi-autonomous Kurdistan region and northern Kirkuk fields on Saturday, an oil official told Reuters, after the country won a longstanding arbitration case against Turkey. (RTRS)

OIL: The head of Libya’s state oil company said he had the backing of both the government in Tripoli and the renegade general Khalifa Haftar who controls the east of the country, as he outlined plans to attract investment and boost production. (FT)

CHINA

ECONOMY: China can achieve its economic target of “around 5%” growth this year and monetary policy has room to maneuver as inflation remains mild, said Han Wenxiu, executive deputy director of the office of the Central Committee for Financial and Economic Affairs, at the China Development Forum 2023 on Saturday. (MNI)

ECONOMY: China’s economic rebound is weaker than expected as consumers emerge “stunned” from pandemic-led disruptions and a real estate meltdown last year, according to the head of AP Møller-Maersk. (FT)

ECONOMY: China will focus on key areas such as artificial intelligence (AI), biological manufacturing and smart vehicles, and cultivate new industrial chains and supply chains, a senior government official said on Monday. (RTRS)

FISCAL: China will intensify efforts to implement a strong fiscal policy and efficient taxation system this year to stabilise the economy, according to Liu Kun, China's Finance Minister. (MNI)

FISCAL: China’s growing debt will not severely hamper economic growth as the government's relatively healthy balance sheet helps offsets any issues, said Li Yang, chairman of National Institution for Finance and Development, told the China Development Forum 2023 on Saturday. (MNI)

FISCAL: China should expand and implement a full real estate taxation system as soon as the economy returns to normal, according to ex-finance minister Lou Jiwei. (MNI)

FISCAL: The most important task China faces is improving the social welfare system to address demand-side challenges as the population declines, Cai Fang, a member of monetary policy committee of People’s Bank of China, told MNI on the sideline of the China Development Forum 2023 on Saturday. (MNI)

PBOC: China still has further room to cut banks’ reserve requirement ratio this year, China Securities Journal reports, citing analysts. (BBG)

PBOC: China needs to relax restrictions on consumption of mid-and-high-end goods and services to boost domestic demand amid weak external demand, said Wang Yiming, a member of monetary policy committee of People’s Bank of China, at the China Development Forum 2023 on Saturday. (MNI)

PBOC: China should alleviate the shortage of basic public services to unleash potential demand, particularly equalising services for nearly 300 million migrant workers, Liu Shijin, a member of monetary policy committee of People’s Bank of China, told MNI on the sidelines of the China Development Forum 2023 on Saturday. (MNI)

ECONOMY/POLICY: China's economic development faces challenges and it is implementing effective solutions to solve them, the head of the state planner said on Sunday. China will strengthen coordination of fiscal, monetary, employment, industrial, consumption and other policies, Zheng Shanjie, head of the National Development and Reform Commission, said at a China Development Forum in Beijing. (RTRS)

POLICY: Chinese Vice Premier Ding Xuexiang used a speech to global executives to reassure participants that China would continue to open up as international companies increasingly complain of market-access challenges. (BBG)

FDI: China will hold a ceremony Tuesday to launch promotional events for its “Invest in China Year,” an initiative to attract foreign investment, according to a statement from the Ministry of Commerce. (BBG)

PROPERTY: A major Chinese developer expects the country’s housing market may slump again this year, suggesting the record property slowdown isn’t over yet. (BBG)

IMF: The head of the International Monetary Fund struck a positive note on China’s outlook, describing it as one of the “green shoots” in the world economy and urging authorities to rebalance the economy toward consumption. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY225 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) conducted CNY255 billion via 7-day reverse repos on Monday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY225 billion after offsetting the maturity of CNY300 billion reverse repos today, according to Wind Information.

- The Peoples' Bank of China cuts the reserve requirement ratio by 25 bps on Mar 27 while conducting CNY255 billion via 7-day reverse repos, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1081% at 09:45 am local time from the close of 1.6982% on Friday.

- The CFETS-NEX money-market sentiment index closed at 58 on Friday, compare with the close of 48 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8714 MON VS 6.8374 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8714 on Monday, compared with 6.8374 set on Friday.

OVERNIGHT DATA

CHINA FEB INDUSTRIAL PROFITS -22.9% YTD Y/Y; DEC -4.0%

JAPAN FEB SERVICES PPI +1.8% Y/Y; MEDIAN +1.7%; JAN +1.6%

MARKETS

US TSYS: Curve Flattens In Asia

TYM3 deals at 116-04+, +0-01, a touch off the top of the 0-10 range on volume of ~61k.

- Cash tsys sit 2bp cheaper to 2bp richer across the major benchmarks. The curve has twist flattened pivoting on 5s.

- Tsys were pressured in early dealing as local participants digested a Bloomberg source piece from Friday which suggested that US authorities are considering expanding an emergency lending facility for banks in ways that would give First Republic Bank more time to shore up its balance sheet. CNBC also noted at the weekend that deposits moving from smaller regional banks to big institutions have slowed to a trickle in recent days.

- There was little follow through on the early downtick lower, tsys recovered from session lows as a lack of immediate offering of policymaker support for the US banking sector on Monday added a layer of support.

- Tsys respected narrow ranges for the remainder of the Asian session with little follow through on moves.

- Minneapolis Fed President Kashkari noted yesterday recent bank turmoil has increased the risk of a US recession but it was too soon to judge what that means for monetary policy.

- In Europe today we have a thin data calendar, IFO Business Climate Index from Germany provides the highlight. Further out Dallas Fed Manf. Activity headlines an otherwise thin docket. The latest 2 Year supply is also due.

JGBS: Futures Unwind Overnight Gains, Curve Twist Steepens

Early Monday trade saw JGB futures extend on the late overnight session pull away from best levels as Tokyo participants reacted to some hope surrounding further support for the U.S. banking sector, although worry re: the European banking and Chinese property sectors limited the move in general, with most of the cash curve remaining bid on the day.

- JGB futures sit at unchanged levels as we enter the last hour of Tokyo trade, with a recovery in the Hang Seng and bid in e-minis the more prominent moves in Asia-Pac trade, while cash JGBs are 2.5bp richer to 1bp cheaper across the curve as 10s outperform and only 40s trade cheaper on the day.

- Spill over from swap flows will have applied some pressure to the space, with that curve steepening as rates ticked higher, meaning that swap spreads ran wider all day.

- Marginally firmer than expected domestic services PPI data will have also aided the direction of travel for JGB futures in early Tokyo trade.

- Elsewhere, domestic catalysts were light. The weekend saw the junior party in the ruling coalition affirm previous guidance re: the rough spending outline for the impending round of fiscal stimulus.

- Note that the 10-/40-Year JGB curve is on course to steepen for a third consecutive session, with the presence of tomorrow’s 40-Year JGB supply likely aiding that dynamic.

AUSSIE BONDS: 10-Year Hits Lowest Yield Since August

ACGBs sit richer ahead of the bell (YM +5.0 & XM +2.0) but well off session bests as hope surrounding further support for the U.S. banking sector pressured U.S. Tsys in Asia-Pac trade, offsetting gains sparked by weakness in Chinese property developer names. Cash ACGBs were 2-4bp richer on the day with the 3/10 curve 2bp steeper and the AU-US 10-year yield differential -2bp at -18bp. After hitting its lowest level since August (3.14%), the benchmark 10-year yield sits at 3.20%.

- Swaps curve bull steepened with rates flat to 3bp stronger and EFPs 2bp wider.

- Bills strip pricing is +2 to +4bp.

- RBA dated OIS sits 4-7bp softer for meetings beyond May with 37bp of easing priced by year-end. No change remained priced for April.

- After a light calendar today, things heat up tomorrow with the release of Retail Sales for February. After a volatile couple of months related to Black Friday sales (-4.0% M/M in December followed by +1.6% in January), the market will be keen to get a read on whether household spending weakness seen in Q4 GDP data has carried over into early 2023.

- With the global calendar relatively light until later in the week when Euro Area CPI (Mar) and US PCE deflator (Feb) are released, the market will likely find itself guided by banking headlines.

NZGBS: Closed At Bests, Outperforming $-Bloc

NZGBs closed at session bests with the 2-year and 10-year benchmarks 9bp richer on the day following the firmer lead from U.S. Tsys ahead of the weekend. U.S Tsys were little changed in Asia-Pac trade with the market eyeing e-minis and weakness in Chinese property developer names. NZGBs outperformed their $-bloc peers with the NZ/US 10-year yield differential 6bp narrower and the NZ/AU differential -4bp.

- Swaps closed 5-6bp stronger, implying wider swap spreads, with the 2s10s curve 1bp flatter.

- RBNZ dated OIS closed flat to 5bp softer across meetings with 22bp of tightening priced for April. Terminal OCR expectations were unchanged at 5.14%.

- With the NZ calendar light until ANZ Business Confidence and Building consents on Thursday, the market attention, other than banking headlines, will be on tomorrow’s release of Australian Retail Sales for February. After a volatile couple of months related to Black Friday sales (-4.0% M/M in December followed by +1.6% in January), the market will be keen to see if household spending weakness seen in Q4 GDP data has carried over into early 2023.

EQUITIES: China Stocks Underperform, HSI Pares Losses, US Futures Higher

China equities are trading on the back foot, amid a number of headwinds, although HK stocks have pared a good deal of early session losses. Sentiment is more positive elsewhere, aided by a firmer US futures backdrop (+0.50% for Eminis at this stage).

- US futures opened higher and have stayed in positive territory for the session, with reports from late last week of further Fed support for embattled bank First Republic likely helping at the margins. Surging deposits to large US banks had also slowed according to CNBC weekend reports. Still, we are off best levels for eminis.

- A headwind from China stocks has been evident, with the CSI 300 off 0.95% at this stage. Weaker industrial profits for Feb (-22.9% y/y ytd) didn't help, while Sinopec posted disappointing earnings. Housing related stocks were also under pressure after weekend reports from a major developer that the housing slump may drag on.

- Hong Kong shares were weaker, but the HSI pared losses of as much as 2% to be back near flat. So, this may help China stocks stabilize as the session continues.

- Sentiment has been less volatile elsewhere, Japan stocks +0.45% in terms of the Topix. The Kospi and Taiex sit slightly lower.

- Trends in SEA are mostly positive, led by Singapore stocks (+1%), but Indonesian and Philippine stocks have lagged.

GOLD: Stronger US Equities Holding Back Bullion, Market Watching Fed Closely

Gold broke through $2000 to a high of $2003.05/oz on Friday on continued banking concerns but it struggled to hold these gains once US equities began to rally. It ended the session down 0.75%. During today’s APAC trading bullion has been range trading and is down 0.1% to $1975.45 following a low of $1970.96, as the S&P e-mini is 0.5% higher. The USD index is down 0.1%.

- Increased recession risks in the wake of recent banking troubles and the implication that there will be less Fed tightening have driven increased positioning in gold. The outlook on these factors remains unclear and so any developments are likely to drive bullion going forward.

- On the weekend, the Minneapolis Fed’s Kashkari said that it was too early to gauge the impact of the banking crisis, while others have said that the Fed’s focus remains inflation, which could mean more tightening.

- The Fed’s Jefferson speaks later on monetary policy (2200 BST). ECB’s Elderson and BoE’s Bailey are also scheduled to speak. US Dallas Fed Index for March prints as well as the German IFO.

OIL: Prices Volatile As Waiting For Clarity

Oil prices have stabilised during the APAC session after falling over 1 percent on Friday. They are off highs reached earlier today but have been in a narrow range. WTI is 0.1% higher to $69.30/bbl, close to the intraday low of $69.13, while Brent is flat at $74.98, close to the $74.80 low. The USD index is down 0.1%. Positive US equity sentiment has failed to boost oil so far today.

- Crude markets are still concerned that central bank tightening and banking troubles will result in recession and reduced energy demand. Fed officials’ recent comments suggest that while it is too soon to gauge the fallout from banking events, for many members the focus remains on inflation and further hikes may be needed. There is still a lot of uncertainty around the growth/inflation and thus the Fed outlook and while that remains the case, oil markets are likely to remain volatile.

- JP Morgan is forecasting that Brent could fall below $60/bbl in the short-term.

- Due to strikes, Exxon Mobil has said that it will begin closing down its Gravenchon refinery in France, which accounts for 20% of the country’s refining capacity. The strikes have also impacted Nigeria, half of its April oil shipments are yet to be sold.

- The Fed’s Jefferson speaks later on monetary policy (2200 BST). ECB’s Elderson and BoE’s Bailey are also scheduled to speak. US Dallas Fed Index for March prints as well as the German IFO.

FOREX: USD Mildly Pressured In Asia

The greenback is mildly pressured in Asia today, the Hang Seng paring early losses and a bid in US Equity futures has weighed. BBDXY sits ~0.1% softer.

- AUD/USD is ~0.2% firmer, the AUD is the strongest performer in G-10 space at the margins today. The trend condition remains bearish, however the bull cycle that started Mar 10 remains in play for now. Resistance is at $0.6769, 50-Day EMA and support is seen at $0.6625 the low from Mar 24.

- Kiwi is also a touch firmer today. NZD/USD prints at $0.6205/10, the pair has observed a narrow range thus far with support seen below $0.62 and resistance about the 20-Day EMA ($0.6216).

- USD/JPY is ~0.1% softer, the pair was firmer in early dealing however resistance was seen at ¥131.00 and gains were pared. This morning Japan's Feb Services PPI printed at 1.8% rising from the Jan print of 1.6%.

- Elsewhere in G-10 the mild USD weakness we've seen is evident. EUR and GBP are ~0.1% higher.

- Cross asset wise; the Hang Seng erased losses of as much as 2% to sit little changed. E-minis are ~0.5% firmer. 10 Year US Treasury Yields are little changed.

- In Europe today we have a thin data calendar, IFO Business Climate Index from Germany provides the highlight. Further out Dallas Fed Manf. Activity headlines an otherwise thin docket.

FX OPTIONS: Expiries for Mar27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0785(E700mln), $1.0800(E1.0bln)

- USD/JPY: Y130.00-10($606mln), Y130.50-60($1.1bln)

- GBP/USD: $1.2300(Gbp636mln)

- USD/CAD: C$1.3660($500mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/03/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 27/03/2023 | 0800/1000 | ** |  | EU | M3 |

| 27/03/2023 | 0845/0945 |  | UK | BOE Treasury Select Committee Hearing on Silicon Valley Bank | |

| 27/03/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/03/2023 | 1340/1540 |  | EU | ECB Elderson Speech at Foreign Bankers' Association | |

| 27/03/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 27/03/2023 | 1500/1700 |  | EU | ECB Schnabel in Conversation at Columbia University | |

| 27/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 27/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 27/03/2023 | 1700/1800 |  | UK | BOE Bailey Speech at LSE | |

| 27/03/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 27/03/2023 | 2100/1700 |  | US | Fed Governor Philip Jefferson |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.