-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI EUROPEAN OPEN: Strong AU Jobs Report Keeps RBA Hike Risks Alive

EXECUTIVE SUMMARY

- FED’S BEIGE BOOK POINTS TO SLOWING U.S. ECONOMY - MNI

- BIDEN TESTS POSITIVE FOR COVID, WILL SELF-ISOLATE IN DELAWARE - RTRS

- JAPAN JUNE EXPORTS RISE DESPITE SLOW AUTO SHIPMENTS - MNI BRIEF

- AUSSIE EMPLOYMENT GROWS STRONGER THAN EXPECTED - MNI BRIEF

- XI TO MAP OUT VISION FOR CHINA ECONOMY AS KEY MEETING WRAPS - BBG

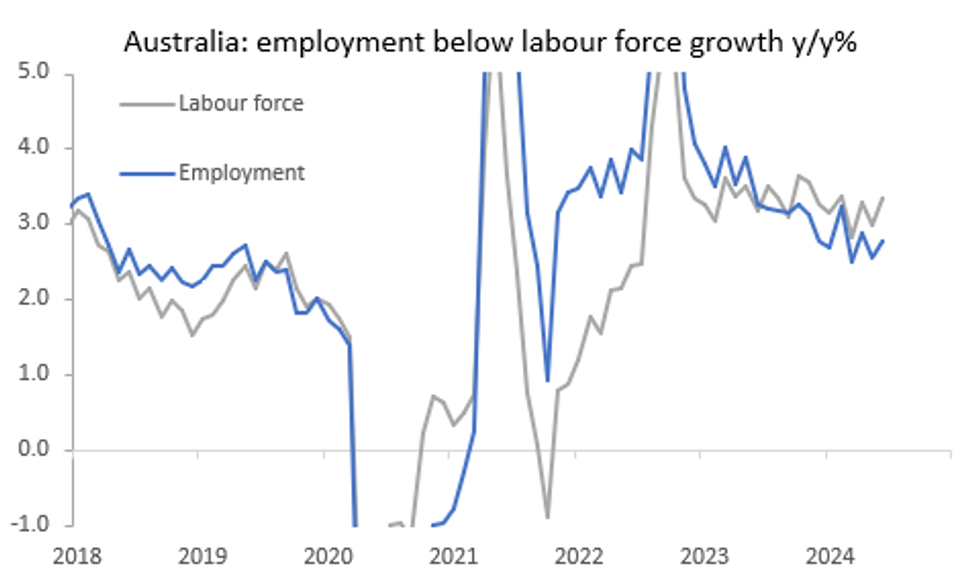

Fig. 1: Australian Jobs Growth Holds Up, Unemployment Rate Nudges Higher

Source: MNI - Market News/Bloomberg

UK

WAGES (BBG): “Plans for a big increase in the UK minimum wage threaten to make it harder for the Bank of England to cut interest rates and dampen longer-term growth, experts warned.”

EU (BBC): “Sir Keir Starmer will host around 45 European leaders on Thursday at a summit he hopes will begin to reset Britain’s relationship with the continent. The gathering of the European Political Community (EPC) will give leaders a chance to reaffirm support for Ukraine and discuss key shared concerns such as migration and energy.”

EUROPE

EU (BBC): “Members of the European Parliament (MEPs) decide on Thursday whether to hand Ursula von der Leyen a second term as European Commission president. Despite Ms von der Leyen’s recent efforts to shore up support, the outcome of the vote – due to take place at the European Parliament in Brussels at 13:00 (11:00 GMT) – is far from certain.”

UKRAINE (BBC): “Germany is planning to nearly halve military aid for Ukraine next year, from around €8bn (£6.7bn; $8.7bn) to around €4bn, according to a draft budget approved by the government. Finance Minister Christian Lindner said Ukraine's financing was "secure for the foreseeable future" due to a G7 group of rich nations scheme to raise $50bn from interest on frozen Russian assets.”

FRANCE (POLITICO): “The leftist New Popular Front agreed to put forward communist lawmaker André Chassaigne as a candidate for the new president of the lower house of parliament. The pressure is now on the other parties, who would need to form an agreement to defeat Chassaigne.”

US

ECONOMY (MNI): The economy slowed in a growing number of Federal Reserve districts in recent weeks, while prices rose modestly, the Fed's latest Beige Book report said Wednesday.

FED (MNI): Richmond Fed President Tom Barkin on Wednesday said he's happy to see less widespread inflation but is looking for further evidence that trend will continue, and the precise timing of interest-rate cuts is less important than the economic story behind such a move.

FED (MNI): The Federal Reserve is approaching the point where easing inflation and a softening labor market should allow it to begin cutting interest rates, Governor Christopher Waller said Wednesday, though he cautioned continued progress is not assured.

FED (BBG): “The Federal Reserve is likely to reduce interest rates in September in light of recent progress on inflation, but the move isn’t likely to mark the beginning of a full-fledged rate-cut cycle, according to the former president of the Fed’s Dallas branch.”

POLITICS (RTRS): “U.S. President Joe Biden, under pressure from fellow Democrats to drop his re-election campaign, tested positive for COVID-19 while visiting Las Vegas on Wednesday and is self-isolating after experiencing mild symptoms, the White House said.”

POLITICS (BBG): “President Joe Biden said he’s willing to relinquish power to Vice President Kamala Harris if he wins a second term but is unable to complete it for health reasons — while discounting the likelihood of that scenario.”

OTHER

JAPAN (MNI BRIEF): Japan's exports posted their seventh straight y/y rise in June, up 5.4%, driven by semiconductor manufacturing equipment orders and despite a slowdown of automobile shipments, data released by the Ministry of Finance showed on Thursday.

JAPAN (MNI BRIEF): Japanese corporate bank financing demand rose over the last three months following sales and capital investment increases and lower access to funding tools, according to the senior loan officer opinion survey on bank lending practices released by the Bank of Japan on Thursday.

AUSTRALIA (MNI BRIEF): The Australian unemployment rate held steady at 4.0% y/y in June, while employment gained 50,176, higher than the estimated 20,000 jobs, data from the Australian Bureau of Statistics showed. The seasonally adjusted rate printed at 4.1%, in line with expectations.

MIDEAST (BBG): “Vice Admiral Brad Cooper, Deputy Commander of the US Central Command, says the pier effort accomplished what was intended and the effort has “transitioned” to sending aid from Cyprus to the Israeli port of Ashdod.”

INDONESIA (BBG): " Indonesia will appoint Thomas Djiwandono, President-elect Prabowo Subianto’s nephew, as a deputy finance minister."

CHINA

PLENUM (BBG): “President Xi Jinping will unveil his long-term vision for China’s economy as he wraps up a twice-a-decade conclave on reform, days after unexpectedly weak growth figures piled pressure on Beijing to act urgently to reinvigorate domestic demand.”

POLICY (MNI PBOC WATCH): China's Loan Prime Rate is likely to remain unchanged in July as the central bank entertains an adjustment to its policy rates system, linking the reference lending rate to a short-term policy benchmark while downgrading the role of the medium-lending facility.

POLICY RATES (FINANCIAL NEWS): “Central bank moves to cut policy interest rates significantly might not solve China’s economic difficulty, the central bank-run newspaper Financial News reported, citing Zhou Qiong, senior researcher at the Shanghai Institution For Finance and Development. Recent market discussion on the PBOC cutting at least 70 basis points would risk stimulating investment and cause overcapacity, alongside hurting banks’ net interest margins, Zhou noted.”

GROWTH (21ST CENTURY HERALD): “Beijing municipality saw GDP growth of 5.4% in H1, as total retail sales of consumer goods remained flat y/y, and catering revenue reached CNY63.71 billion, down 3.5% y/y. Industry insiders said restaurant competition may intensify in H2 leading to lower profits, with more mid- to high-end eateries launching low cost options.”

CONSUMER SPEND (BBG): “Chinese consumers are cutting back on dining out, dealing a heavy blow to related shares as investors grow weary over the once-strong sector and its impact on the domestic economy.”

CHINA MARKETS

MNI: PBOC Net Injects CNY47 Bln Via OMO Thurs; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY49 billion via 7-day reverse repo on Thursday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY47 billion after offsetting the CNY2 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8741% at 09:51 am local time from the close of 1.8995% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Wednesday, compared with the close of 46 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1285 on Thursday, compared with 7.1318 set on Wednesday. The fixing was estimated at 7.2578 by Bloomberg survey today.

MARKET DATA

AUSTRALIA JUNE EMPLOYMENT +50.2k M/M; EST. +20.0K; PRIOR +39.5K

AUSTRALIA JUNE UNEMPLOYMENT RATE 4.1%; EST. 4.1%; PRIOR 4.0%

AUSTRALIA JUNE FULL-TIME EMPLOYMENT +43.3K M/M; PRIOR +41.3K

AUSTRALIA JUNE PART-TIME EMPLOYMENT +6.8K M/M; PRIOR -1.9K

AUSTRALIA JUNE PARTICIPATION RATE 66.9%; EST. 66.8%; PRIOR 66.8%

JAPAN JUNE TRADE BALANCE Y224.0B; EST. -Y185.7B; PRIOR –Y1220.1B

JAPAN JUNE EXPORTS +5.4% Y/Y; EST. 7.2%; PRIOR +13.5%

JAPAN JUNE IMPORTS +3.2% Y/Y; EST. +9.6%; PRIOR +9.5%

MARKETS

US TSYS: Tsys Edge Lower Ahead of Jobless Claims, Biden Tests Covid Positive

- Treasury futures have edged lower through the session after it was announced Biden has covid and had cancelled some upcoming appearances, we currently trade at session's worst levels with TUU4 is -0-01¾ at 102-18+ while TYU4 is currently -0-05+ at 111-08+

- Post NY close Former Fed Dallas President Kaplan said he anticipates the Fed may reduce interest rates in September and possibly again in December, but does not expect it to initiate a prolonged rate-cut cycle due to high fiscal deficits and energy prices.

- The cash treasury curve has bear-flattened today, the 2y yield is 1.9bps higher while the 10y is currently trading 1.5bps higher.

- Earlier, Biden was confirmed to have covid, this follows comments he made saying he would potentially drop out if diagnosed with a "medical condition". The betting markets have swung again post this news with Kamala jumping 28pts to 50%, while Biden has dropped 31pts to 38% chance of being the Democratic Party nominee.

- Projected rate cut pricing into year end slightly cooler vs. late Tuesday levels (*): July'24 at -6.5% w/ cumulative at -1.6bp at 5.313%, Sep'24 cumulative -25.7bp (-26.6bp), Nov'24 cumulative -41.1bp (-42.9bp), Dec'24 -63.6bp (-65.4bp).

- Focus turns Weekly Claims, 10Y TIPS Sale & TIC Flows.

JGBS: Cash Bonds Twist-Flatten, National CPI Tomorrow

JGB futures are weaker but well off session lows, -16 compared to the settlement levels.

- Outside of the previously outlined Trade Balance data, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys are 1-2bps cheaper in today’s Asia-Pac session, with a slight flattening bias.

- Earlier, Biden was confirmed to have COVID-19, this follows comments he made saying he would potentially drop out if diagnosed with a "medical condition". The betting markets have swung again after this news with Kamala jumping 25pts to 47%, while Biden has dropped 26pts to 44% chance of being the Democratic Party nominee.

- The cash JGB curve has twist-flattened, pivoting at the 20s, with yields 1.5bps higher to 1.5bps lower. The benchmark 10-year yield is 0.6bps higher at 1.047% versus the cycle high of 1.108%.

- The swaps curve has bear-steepened, with rates flat to 3bps higher. Swap spreads are wider.

- “Japan sold ¥349.60 billion of 5-year climate transition notes in line with expected cut-off yield with higher bid-to-cover ratio (4.04x) than the previous auction (3.39x), signalling solid investor demand.” (as per BBG)

- Tomorrow, the local calendar will see National CPI data.

AUSSIE BONDS: Holding Cheaper After Jobs Beat, Nov-27 Supply Tomorrow

ACGBs (YM -4.0 & XM -2.0) are holding 3-5bps cheaper than pre-Employment data levels.

- Australia's June employment increased by 50,176 month-over-month, exceeding the estimated 20,000. The June jobless rate remained steady at 4.1%, matching expectations. Full-time employment rose by 43,327, while part-time employment increased by 6,849. The participation rate in June was 66.9%, slightly above the estimated 66.8%.

- Given the stage in the cycle and restrictive monetary policy, this is a strong result. In addition, hours worked rose in Q2 driving underemployment down and the participation rate is close to highs. Strong Q2 increases the risk of an August hike if Q2 CPI prints at 1% or above.

- The cash ACGB curve has twist-flattened, with yields 2bp higher to 1bp lower. The AU-US 10-year yield differential is +7bps.

- Swap rates are flat to 3bps lower, with the 3s10s curve flatter and EFPs wider.

- The bills strip has bear-flattened, with pricing flat to -3.

- RBA-dated OIS is sitting flat to 3bps firmer across meetings. Terminal rate expectations have jumped to 4.43% from 4.39% before the data. For reference, the expected terminal rate saw a peak of 4.52% in late June.

- The local calendar is empty tomorrow.

- Tomorrow, the AOFM plans to sell A$700mn of the 2.75% Nov-27 bond.

NZGBS: Post-CPI Sell-Off Unwound, 65bps Of Easing Priced By Year-End

NZGBs closed at the session's best levels, with benchmark yields 4bps lower. Local participants seemed content to overlook the 1-2bp cheapening in US tsys during today’s Asia-Pac session and yesterday’s modest bear flattening.

- Today's move effectively unwound the sell-off triggered by yesterday’s Q2 CPI print. As a result, NZGB benchmark yields remain 28-35bps lower than pre-RBNZ decision levels, with the 2/10 curve 6bps steeper.

- The NZ-US 10-year yield differential has narrowed by 4bps to +18bps, its tightest level since late 2022. This differential has oscillated between +20 and +80bps since late 2022.

- Today’s weekly supply was well absorbed with cover ratios printing 2.5x to 3.3x.

- Swap rates closed 4-5bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed little changed on the day but remains 18-46bps softer than pre-RBNZ decision levels. The market is pricing a 39% chance of a cut in August, and a 79% chance of a cut by October. A cumulative 65bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty.

FOREX: USD/JPY Rebounds 100pips From Earlier Lows, A$ Outperforms As Jobs Data Stokes RBA Fears

Outside of AUD gains (post better than expected jobs data), the USD has ticked up against most of the majors. The BBDXY has edged back above 1248, against earlier lows of 1246.65. Yen volatility has been the other focus point.

- USD/JPY was biased lower in early trade, touching 155.38, which was a fresh lows back to early June. However, we now sit around 100pips higher, last around 156.40/45, slightly up in USD terms versus end NY closing levels from Wednesday.

- There didn't appear to be a fresh catalyst for the early morning move other than a continuation of USD/JPY's sharp reversal which kicked off late in Asia Pac trade on Wednesday. Futures volumes were firmer in early trade before subsiding somewhat. Note 154.55 was the June 4 low. The 50-day EMA is back near 157.90

- The A$ has outperformed on crosses, with AUD/JPY rebounding back to 105.4, against earlier lows of 104.53. This likely helped USD/JPY rebound. The June Australian jobs data showed a fairly resilient labour market for Q2, with jobs growth largely matching the pace of new entrants to the labour market. This is keeping the door ajar for a potential RBA rate hike in coming months.

- AUD/USD sits up at 0.6735, modestly firmer for the session. The AUD/NZD cross has regained ground back near 1.1100, pre data lows were just under 1.1060. NZD/USD is off to 0.6070, down 0.20%, but still above recent lows.

- Later, the ECB is seen on hold. We have Fed speak from Goolsbee, Logan and Daly. On the data front, US jobless claims and July Philly Fed, and UK labour market data are all due.

ASIA STOCKS: HK & China Equities Off Earlier Lows, Tech & Small Caps Lag

China & Hong Kong equities are mixed today. China equities are off earlier lows although concerns remain over regulatory tightening and economic recovery, AI stocks dropped after a report that the nation’s cyberspace regulator has asked for mandatory reviews of such models, while there are also concerns about the possibility of more severe US trade restrictions, particularly on the technology sector. These factors, combined with a lack of updates or headlines out of the Third Plenum have left investors cautious.

- Hong Kong equities are mixed with the HSTech Index is 0.65% lower while property is performing better with the Mainland Property Index is 0.60% higher, the HS Property Index is 0.20% higher while the HSI has pared already losses to trade 0.20% higher.

- China equity markets are also mixed today, small-cap indices are the worst performing with the CSI 1000 down 0.80%, the CSI 2000 down 1.50%, while the Beijing Stock Exchange Index is down 3.30% after a large rally on Wednesday while the large-cap CSI 300 is 0.12% higher.

- JD Vance, Donald Trump's running mate, has articulated a range of policy views, particularly critical of China. Vance has emphasized the need for the US to focus its military resources on China, arguing that the country poses a significant threat, especially regarding a potential invasion of Taiwan, which he believes would be catastrophic for the US economy due to Taiwan's crucial role in semiconductor manufacturing, per bbg.

- Xi Jinping is set to unveil his long-term economic vision, focusing on technology-driven "high-quality growth" and "Chinese-style modernization" at the conclusion of the Third Plenum. This meeting comes amid weak economic growth, a prolonged real estate crisis, and deflationary pressures. While specifics remain unclear, expected reforms include overhauling the consumption tax, reforming the hukou system, and boosting artificial intelligence. Measures to support the electric car and green energy sectors are also anticipated.

- Looking ahead, focus will again be on any headlines from the Third Plenum

ASIA PAC STOCKS: Asian Equities Head Lower As Tech Stocks Sell Off

Asian equities are lower today led by a sell-off in technology stocks extending the decline for second day amid concerns follows news that the Biden administration may impose stricter trade curbs on companies supplying advanced chip technology to China. Tokyo Electron led the losses, falling as much as 11%, significantly impacting the MSCI Asia Pacific Index, while shares in Samsung and TSMC also saw notable declines. Australia reported employment data earlier, showing a jump in jobs, while the unemployment rate held steady.

- Japanese equities have faced significant declines this morning, driven primarily by heightened concerns over potential tighter US restrictions on semiconductor sales to China. Tokyo Electron saw a sharp drop of nearly 11%, marking its worst two-day loss since 2008. These declines mirrored the selloff in US and European semiconductor stocks, particularly following news that the Biden administration may impose severe trade restrictions on companies like Tokyo Electron and ASML Holding NV if they continue providing advanced chip technology to China. Additionally, broader concerns over a stronger yen, which has reached its highest levels since early June further pressured Japanese exporters, the Topix is trading 1.15% lower while the Nikkei 225 2.11% lower.

- South Korean equities have experienced declines this morning, heavily influenced by fears over the potential imposition of stricter US semiconductor sales restrictions to China. Currently the Kospi is 1.40% lower, while the Kosdaq trades 1.37% lower.

- The Taiwanese equity market has gapped lower this morning also driven by heightened concerns over the potential for stricter U.S. semiconductor sales restrictions to China. Comments from Trump have added to the uncertainty, while investors remain cautious ahead of TSMC’s earnings report due out later today, which is expected to provide further insights into the sector's outlook amid the current geopolitical climate, currently TSMC is 3.10% lower while the Taiex is down 2.10%.

- Australian equities are slightly lower today, with the ASX 200 down 0.30%. Earlier, Australia's labor market showed resilience with the economy adding 50.2k jobs vs 20k expected, the participation rate rose to 66.9% from 66.8% while the unemployment rate came in at 4.051% (4.1% rounded) with estimates of 4.1%.

- Elsewhere, New Zealand equities are little changed, Singapore equities are 0.65% lower, Malaysian equities are 0.10% lower, Philippines equities are 0.10% lower while Indonesian equities are 1% higher and Thailand equities are 0.35% higher.

OIL: Crude Continues Climb Following US Stock Build Data

Oil prices continued to climb higher during APAC trading today after they rose sharply on Wednesday following EIA data showing the third straight US crude inventory drawdown. WTI is up 0.6% to $83.34/bbl off the intraday high of $83.53 to be up 2.2% this month. Brent is 0.4% higher at $85.42/bbl following a high of $85.63 but is only up 0.5% in July. The softer USD boosted oil yesterday and today the index is little changed.

- EIA reported US crude inventories fell 4.87mn last week. This is the third straight weekly drawdown worth 20.47mn barrels in total and bringing the level to its lowest since February and below the 5-year seasonal average.

- The Brent prompt spread has widened, signaling that the market remains tight, according to Bloomberg. Expectations for a Fed rate cut in September are improving the demand outlook.

- China’s Customs General Administration reported that June oil import volumes fell 10.7% y/y down from May’s -8.7% y/y. Product imports fell 32.4% y/y after -3.6% but export volumes rose 19% y/y up from 9.5% driven by diesel and kerosene. .

- Later the Fed’s Goolsbee, Logan and Daly appear and the ECB announces its decision (no change expected). There are US jobless claims and July Philly Fed, and UK labour market data.

GOLD: Hovering Just Below Fresh All-Time High

Gold is 0.4% higher in today’s Asia-Pac session, after closing 0.4% lower at $2458.79 on Wednesday.

- This came after bullion hit a fresh all-time high of $2,483.73/oz early in yesterday’s session.

- Gold is up nearly 20% since January, with much of this year’s gains fueled by large purchases from central banks, strong consumer appetite in China and demand for haven assets amid geopolitical tensions.

- Fed speak from Richmond Fed Barkin and Fed Gov Waller leaned dovish. “While I don’t believe we have reached our final destination, I do believe we are getting closer to the time when a cut in the policy rate is warranted,” Waller said.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, the trend condition in gold remains bullish and the breach of key resistance at $2450.1, the May 20 high, this week opens the $2500.00 handle next.

- Analysts note that with positioning and sentiment not at extreme levels, this level could be tested soon enough.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/07/2024 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 18/07/2024 | - |  | US | ECB Meeting | |

| 18/07/2024 | 0900/1100 | ** |  | EU | Construction Production |

| 18/07/2024 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 18/07/2024 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 18/07/2024 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 18/07/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 18/07/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 18/07/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 18/07/2024 | 1245/1445 |  | EU | ECB Monetary Policy Press Conference | |

| 18/07/2024 | 1415/1615 |  | EU | ECB's Lagarde presents MonPol decision on podcast | |

| 18/07/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 18/07/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 18/07/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 18/07/2024 | 1605/1205 |  | US | San Francisco Fed's Mary Daly | |

| 18/07/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 18/07/2024 | 1745/1345 |  | US | Dallas Fed's Lorie Logan | |

| 18/07/2024 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.