-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, December 13

MNI US OPEN - UK Economy Contracts for Second Straight Month

MNI EUROPEAN OPEN: Talk Of Yellen Supporting Second Term For Fed Chair Powell

EXECUTIVE SUMMARY

- FED JACKSON HOLE CONFERENCE TO TAKE PLACE VIRTUALLY (MNI)

- YELLEN BACKS POWELL REAPPOINTMENT, BOOSTING SECOND-TERM ODDS (BBG)

- FED'S KAPLAN SAYS DELTA COVID COULD PUSH BACK TAPER (MNI)

- NEW ZEALAND EXTENDS LOCKDOWN

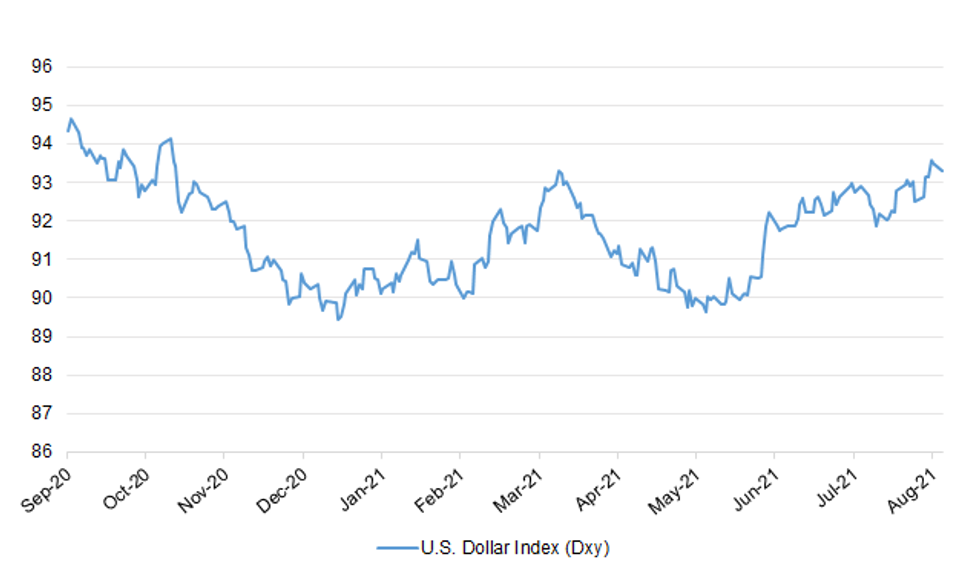

Fig. 1: U.S. Dollar Index (Dxy)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson has been accused of letting his vaccine passports plan descend into disarray as a leaked letter from government lawyers stated that "no final policy decision" had been taken on requiring the passes in nightclubs. (Telegraph)

BREXIT: Ministers have rejected industry calls to allow EU migrants to fill the large hole in the UK labour market for lorry drivers, but accept that more training courses are needed to boost the number of hauliers. The government on Sunday rebuffed a plea by logistics and retail trade bodies for it to grant temporary work visas to heavy goods vehicle drivers from the EU, although ministers are willing to look at increasing training of Britons wanting to be hauliers. It came as the meat industry said it was preparing to respond to labour shortages in its sector by making greater use of prisoners. (FT)

EUROPE

CORONAVIRUS: The European Union expects Novavax to submit data needed for the possible approval of its COVID-19 vaccine around October, an EU official told Reuters on Friday, in what could be another delay for the U.S. biotech firm. (RTRS)

FISCAL: MNI INTERVIEW: Germany's FDP To Push For Tough EU Debt Rules

- Germany's Free Democrats will ensure debt brake restrictions on public borrowing remain in place if they enter into government following September's general election, a senior party figure told MNI, while pushing for the retention of tough EU debt rules and strongly backing German judges in their dispute with Europe's top court over central bank asset purchases. With the FDP polling steady fourth ahead of the next month's vote, the most likely outcome is a so-called 'Jamaica' coalition in which party joins forces with the centre-right CDU/CSU and the Greens, Bundestag member Florian Toncar said in an interview, stressing though that much could change - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

GERMANY: Chancellor Angela Merkel's party bloc slumped to an all-time low in a weekly German voter poll, while the Social Democrats rose to an almost four-year high ahead of the country's Sept. 26 election. Underpinning the SPD's momentum is its candidate for chancellor, Finance Minister Olaf Scholz, who is more popular among voters than Armin Laschet, the contender for Merkel's Christian Democratic Union-led bloc. (BBG)

GERMANY: With just over a month to go until Germany's federal election, Chancellor Angela Merkel took to the campaign trail to support her party's flagging candidate, Armin Laschet. At a rally in Berlin, Merkel said: "It has always been important to him to place the individual and their inviolable dignity at the center of everything... I am deeply convinced that it is precisely with this attitude that (he) will serve the people of Germany as chancellor." Laschet is the leader of the Christian Democratic Union (CDU) and is leading the conservative challenge to potentially succeed Merkel when she bows out. (Deutsche Welle)

GERMANY: Economy Minister Peter Altmaier said he is convinced that there won't be another lockdown in Germany despite the rapidly increasing number of infections. "With everything we know today, we can avoid a new lockdown for those who have been vaccinated and those who have recovered," the CDU politician told Funke. "That also means that restaurants and shops can stay open during winter." (BBG)

FRANCE:France will begin a campaign to increase vaccination rates of students 12 years old and above from the start of the new school year in September, French education minister Jean-Michel Blanquer told Le Journal du Dimanche newspaper. (BBG)

BELGIUM: Belgian Prime Minister Alexander De Croo says the country wants to require health workers to be vaccinated and will weigh how to deal with people who refuse a vaccine, according to a Friday press conference. (BBG)

SWEDEN: Swedish Prime Minister Stefan Löfven will step down as party leader and prime minister in November. In a speech Sunday, Löfven said that he would resign as both head of the Social Democrats and as the country's leader at the party congress in November, explaining the decision had "matured for some time." "I have been party chairman for 10 years, prime minister for seven," he said according to local media. "But everything has an end. I want to give my successor the very best conditions." (POLITICO)

RATINGS: Sovereign rating reviews of note from Friday included:

- S&P affirmed Estonia at AA-; Outlook revised to Positive from Stable

U.S.

FED: MNI BRIEF: Fed Jackson Hole Conference To Take Place Virtually

- The Kansas City Federal Reserve announced Friday the annual Jackson Hole symposium will be held virtually, a reversal from prior plans that saw a modified, in-person program. "While we are disappointed that health conditions will prevent us from being able to gather in person at the Jackson Lake Lodge this year as we had planned, the safety of our guests and the Teton County community is our priority," said Kansas City Fed president Esther George, in a statement. The Kansas City Fed will release the program's full agenda Thursday, August 26 at 8 p.m. ET. Fed Chair Jerome Powell is scheduled to give livestreamed remarks on Friday at 10 a.m. ET - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: U.S. Treasury Secretary Janet Yellen has told senior White House advisers that she supports reappointing Jerome Powell as Federal Reserve chair, according to people familiar with the matter, a move that greatly increases his chance for a second term. President Joe Biden hasn't made a decision yet and is likely to make his choice around Labor Day, the people said. Keeping someone viewed by Wall Street as a trusted policy maker in charge of the world's most powerful central bank would send a signal of continuity as the economy recovers from the pandemic. With Powell's four-year term ending in February, the White House has been casting a wide net for possible candidates, according to people familiar with the deliberations. Advisers have been examining the public speeches and comments of potential contenders to consider, paying special attention to views on the labor market, they said. (BBG)

FED: MNI BRIEF: Fed's Kaplan Says Delta Covid Could Push Back Taper

- Dallas Federal Reserve President Robert Kaplan said on Friday he was watching carefully for any economic impact from the Delta variant of the coronavirus and might need to adjust his views on tapering should it slow economic growth. The "big caveat" is the Delta variant and if it turns out to be persistent enough or unfold differently as it has in some countries to affect demand, in which case it could impact the decision when to taper, he said. "I've got to take that into account, and will adjust my views accordingly. We've got a month between now and the next FOMC meeting, and it's a good thing we've got a month to see how this all unfolds because I don't know. I've got to be open minded and I will be" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: U.S. House of Representatives Speaker Nancy Pelosi on Saturday set an Oct. 1 target date for passing President Joe Biden's multitrillion-dollar infrastructure and social spending agenda. (RTRS)

CORONAVIRUS: Federal regulators are winding down the process of licensing Pfizer's two-dose coronavirus vaccine, setting up an approval possibly by Monday and potentially kicking off a wave of new mandates. The Food and Drug Administration is pushing to approve Pfizer-BioNTech's two-dose Covid-19 vaccine on Monday, further expediting an earlier timeline for licensing the shot, according to people familiar with the agency's planning. Regulators were working to finish the process by Friday but were still working through a substantial amount of paperwork and negotiation with the company. The people familiar with the planning, who were not authorized to speak publicly about it, cautioned that the approval might slide beyond Monday if some components of the review need more time. (New York Times)

CORONAVIRUS: The expected full approval by the U.S. Food and Drug Administration of Covid-19 vaccines could help businesses and institutions impose more vaccine requirements, Surgeon General Vivek Murthy said. (BBG)

CORONAVIRUS: Salt Lake City's mayor issued a mask mandate for all school students, defying a Utah state law that bans mandatory masking rules unless approved by local bodies. (BBG)

CORONAVIRUS: Boston issued a mask mandate for public places indoors, as 50,000 college students arrive in the city and another 50,000 public school students return to the classrooms. (BBG)

CORONAVIRUS: Signs of pressure are already starting to gather around a meeting of vaccine advisers to the Centers for Disease Control and Prevention that forms a key step in the Biden administration's plan to give booster shots to most U.S. adults. (BBG)

CORONAVIRUS: Florida is set to start withholding state funding from two school districts that have instituted mask-mandates for students in defiance of an executive order signed by Governor Ron DeSantis barring the requirement of facial coverings, according to a statement from the Florida Department of Education. (BBG)

CORONAVIRUS: The Centers for Disease Control and Prevention said Friday that travelers who are at high risk of severe complications from Covid-19 should avoid taking cruises, regardless of their vaccination status. The updated guidance also recommended that travelers who are not fully vaccinated avoid taking cruises. The new advice follows several coronavirus outbreaks that have been reported aboard cruise ships, according to the CDC. (CNBC)

POLITICS: President Joe Biden's job approval ratings have taken a dive as he's been criticized for his administration's handling of the withdrawal of U.S. troops from Afghanistan and while Covid-19 cases surge across the country. An NBC News poll released Sunday shows 49% of all adults surveyed say they strongly approve of the job Biden is doing as president while 48% disapprove. The 49% represents a drop of four percentage points compared to a previous NBC News survey done in April. The disapproval number is up by nine percentage points from that same prior poll. Among the registered voters surveyed, 50% say they approved of Biden's job performance while 48% noted they disapproved. (CNBC)

HOUSING: A U.S. appeals court rejected an emergency motion to halt the national ban on evictions, clearing the way for the case to go to the U.S. Supreme Court. A trio of judges denied a bid by the Alabama Association of Realtors to suspend an earlier court ruling that allowed the eviction moratorium to continue. The ruling comes one week after U.S. District Judge Dabney Friedrich rejected their plea to block the new eviction moratorium established by the Centers for Disease Control and Prevention, even as she voiced concerns over the legality of the policy. The ban was extended by the Biden administration until Oct. 3. (BBG)

OTHER

GLOBAL TRADE: U.S. Vice President Kamala Harris said issues stemming from a global chip shortage are "very real," as she heads to Asia on a trip aimed at building trade relationships with countries seen as crucial to the supply chain. Harris, who will visit Singapore and Vietnam where she will emphasize the U.S.'s role as a global leader, said Friday the country had both an economic and security interest related to the region, and how dependent it is on its supply chains. (BBG)

GLOBAL TRADE: Global supply and demand for auto chips should reach a "balance" by the fourth quarter of 2021, Taiwan's government said on Saturday, reiterating its commitment to doing its part to tackle a shortage that has closed production lines around the world. (RTRS)

GLOBAL TRADE: Most German companies expect widespread supply-chain problems to persist into next year, threatening to damp the economy's post-pandemic recovery. Only about a fifth of almost 3,000 firms polled by the Association of German Chambers of Industry and Commerce, or DIHK, said they expect the situation to improve this year, while a quarter isn't able to make a judgment on when things will get better, the group said on Thursday. (BBG)

GLOBAL TRADE: German exporters are facing increasing pressure in their home market from Chinese exports to the EU, according to a study by the Cologne Institute for Economic Research. (BBG)

GEOPOLITICS: The U.S. State Department was hit by a cyberattack and notifications of a potentially serious breach were made by the Department of Defense Cyber Command, a Fox News reporter said on Saturday. A knowledgeable source told Reuters the State Department has not experienced significant disruptions and has not had its operations impeded in any way. (CNBC)

GEOPOLITICS: President Joe Biden announced Friday his intent to nominate career diplomat and former U.S. ambassador to NATO Nicholas Burns as his ambassador to China. The president also announced that former two-term mayor of Chicago Rahm Emanuel will be nominated as his ambassador to Japan. (CNBC)

CORONAVIRUS: The World Health Organization is calling for as many as 25 experts from across medical, veterinary and biosafety fields to join a scientific advisory panel to study the origins of new pathogens, including SARS-CoV-2. Members must be free of conflicts of interest and serve in their individual capacity and not represent any governments, institutions or organizations, the WHO said in a statement Friday. In the context of Covid-19, participants will advise the WHO on the next series of studies and may join future WHO-international missions. (BBG)

HONG KONG: Hong Kong is "no longer in travel talks" with other places because of differences in approach to containing Covid-19, the city's health minister has revealed. Sophia Chan Siu-chee on Saturday said the government was still aiming to strike a balance between residents' expectation of "zero infections", while avoiding becoming "completely cut off" from the outside world. The long-awaited travel bubble with Singapore was ditched for good on Thursday, after the city state moved towards a policy of "living with the virus", in contrast to Hong Kong's stricter approach. (SCMP)

HONG KONG: Foreign investors who were concerned about the National Security Law last year have overcome their fears and are now focused on seizing opportunities in Hong Kong and mainland China, Hong Kong Monetary Authority Chief Executive Eddie Yue said in an interview with Xinhua. The investors are particularly interested in areas such as financial technology and green finance, he told the Chinese state media. "They actually consider putting more resources and expand business here," he said. (BBG)

JAPAN: Opposition-backed Takeharu Yamanaka won the Yokohama mayoral election on Sunday, defeating a ruling Liberal Democratic Party candidate in a blow to Japanese Prime Minister Yoshihide Suga. The loss by Hachiro Okonogi, a former chairman of the National Public Safety Commission, comes as Suga suffers from falling public support as he faces competition to remain LDP leader and a general election in the coming months. Yokohama is the capital of Kanagawa Prefecture, the second-most populous city in the country after Tokyo and home to the constituency of Suga's seat in the House of Representatives. (Kyodo News)

JAPAN: Japanese Prime Minister Yoshihide Suga is increasingly unlikely to call for an early snap election, with his ruling Liberal Democratic Party expected to vote on its next leader in September following Sunday's setback in the Yokohama mayoral race. (Nikkei)

JAPAN: Japanese Prime Minister Yoshihide Suga is weighing calling a general election in early Oct., Yomiuri reports, without saying where it obtained the information. While Suga can still call a snap vote before the ruling party's leadership contest in late Sept., the coronavirus outbreak hasn't shown signs of abating. LDP is seen pinning hopes on coronavirus vaccinations gathering pace in Oct. and hopes infections may ebb in addition to Suga getting a boost from a victory in the LDP election. Also see possibility pandemic will prevent Suga from dissolving the lower house before the chamber's term ends on Oct. 21. (BBG)

JAPAN: Liberal Democratic Party lawmaker Fumio Kishida plans to run in the election for leader of the ruling party, Sankei reports, citing unidentified people. Kishida will declare his candidacy as soon as Thursday. (BBG)

JAPAN: The approval rating of Japanese Prime Minister Yoshihide Suga's cabinet falls 3.8 ppts to record-low 25.8%, according to an ANN poll conducted on Aug. 21-22. Disapproval rating rises to 48.7%, the highest since Suga took office last Sept. 67% said Japan needs to overhaul laws to enforce a coronavirus lockdown. (BBG)

JAPAN: The Tokyo metropolitan government is considering converting some Olympic facilities into field hospitals to treat coronavirus infections as cases in the country hit record levels, the Sankei newspaper reported, citing unidentified people. (BBG)

AUSTRALIA: Australian Prime Minister Scott Morrison is doubling down on his strategy of looking to abandon Covid-Zero when full vaccination rates reach 70% of adults. Sydney's delta outbreak shows no signs of slowing, with 818 new cases detected in New South Wales on Monday. Even so, Morrison told reporters in Canberra that the surge was not a reason to delay reopening -- and that he wants all states and territories to abandon lockdowns when inoculation thresholds are met. "We should prepare for it," Morrison said of reopening. "We should not fear it. We should embrace it. And we should move forward together." (BBG)

AUSTRALIA: The entire state of Victoria has entered lockdown as authorities scramble to contain a rapidly growing cluster of Covid-19 centred on the regional city of Shepparton. The premier, Daniel Andrews, said all of regional Victoria was at risk and a statewide lockdown was the only option to head off a scenario like the one playing out in New South Wales. (Guardian)

NEW ZEALAND: New Zealand Prime Minister Jacinda Ardern says there are still a number of 'unanswered questions' in terms of where the Delta outbreak has spread, which is why she's made the decision to extend the nationwide lockdown. Auckland - the epicentre of the COVID-19 outbreak - will stay at alert level 4 lockdown for another week, until 11:59pm on Tuesday, August 31. For the rest of the country, the lockdown will be extended until 11:59pm on Friday August 27. (Sky)

NEW ZEALAND: The country reported nearly three dozen new infections, the Ministry of Health said, bringing the total number of cases in its community outbreak to 107. Of the 35 new cases reported Monday, 33 were in Auckland and two were in the capital, Wellington. "It's not unexpected to see a rise in daily case numbers at this stage," the ministry said in its statement. "At its peak last year, New Zealand had a daily total of 89 new cases." The cases come after a nationwide lockdown was extended through midnight on August 24 as New Zealand and other countries battle the highly-contagious delta strain of Covid. (BBG)

NEW ZEALAND: The delta variant of coronavirus is a big challenge for New Zealand's elimination strategy and could force the government to rethink the way it responds to an outbreak, Covid-19 Response Minister Chris Hipkins said. "With a virus that can be infectious within 24 hours of someone getting it, that does change the game a bit," Hipkins said in an interview on TVNZ's Q+A program. "With our Level Four lockdown, we are very well placed to be able to run it to ground, but we have to be prepared for the fact that we can't do that every time there is one of these." (BBG)

RBNZ: The Reserve Bank spared businesses and consumers from a rate rise on Wednesday but governor Adrian Orr makes clear it was only intended as a temporary reprieve to protect our collective fragile psyche. Interest rate changes take time to bite but Orr said the decision to hold for a few weeks was "literally down to the heightened uncertainty of the day". "In a few weeks are we going to be any wiser? Possibly not but by that stage people will understand what is going on. "We have not lost a lot. It is not like demand is going to get ahead of us in the next few weeks." (Stuff NZ)

RBNZ: The fresh outbreak of the coronavirus in New Zealand is not a "game changer" yet and there is no pressure to act on monetary policy, a senior central bank official said on Monday, as authorities struggle to contain the spread of the Delta variant. "At this stage we don't see it as a game-changer in the sense that our underlying economic analysis and views should be thrown out of the window and we should start again," the Reserve Bank of New Zealand's (RBNZ) Chief Economist Yuong Ha said in a phone interview with Reuters. "It's not like we were 12 months ago," he added. However, Ha said the outbreak of the highly transmissible Delta variant in New Zealand has raised some economic uncertainty. (RTRS)

SOUTH KOREA: South Korea expects half of its population to be fully vaccinated against Covid-19 by the end of September. The country has one of the lowest inoculation rates among major Asian economies, but the pace is picking up. "The progress is faster than expected," President Moon Jae-in wrote in a Facebook post on Saturday, noting that over 50% of South Korean have received at least their first dose. (BBG)

SOUTH KOREA: Moderna Inc. will supply 7 million doses of its vaccine to South Korea in the next two weeks, the country's premier said Sunday. The shipment plan, announced by Prime Minister Kim Boo-kyum in a televised meeting with health officials, bolsters South Korea's bid to have at least 70% of its population inoculated with the first shot by the end of September. (BBG)

SOUTH KOREA: South Korea's ruling party and government are considering more than 600t won of main budget for 2022 vs 558t won in 2021, DongA Ilbo newspaper reports, citing unidentified finance ministry officials. Details will be decided later this week after meetings between government and ruling Democratic Party; final plan to be submitted to parliament early next month. Government had planned 6-7% budget increase for 2022 but decides to expand spending amid resurgence of coronavirus. (BBG)

NORTH KOREA: South Korea and the United States on Monday discussed humanitarian aid to North Korea, the U.S. nuclear envoy said after talks with his counterpart in Seoul amid heightened tensions over Pyongyang's angry protest against military exercises between the South and the U.S. Amb. Sung Kim also said the U.S. does not have a hostile intent to the North, stressing that the ongoing South Korea-U.S. military exercise is "purely defensive" in nature and renewing his offer to "meet with my North Korean counterparts anywhere, at anytime." (BBG)

BRAZIL: Brazil's Economy Minister Paulo Guedes said on Friday that political conflict is contaminating the economy and overshadowing positive news on economic growth and the prospect of a much smaller primary budget deficit next year. Guedes spoke to investors as the country's political climate became even more tense after far-right President Jair Bolsonaro's request to the Senate Link on Friday to impeach a Supreme Court judge. Critics have accused Bolsonaro of sowing doubts about Brazil's voting system so he can question next year's election results if he loses. (RTRS)

BRAZIL: Brazilian govt should send budget proposal for 2022 forecasting a deficit of around 70b reais, Estado de Sao Paulo said without revealing how it got the information. Government's strategy is to first send the bill to Congress and later seek political conditions to reduce the deficit target to close to this amount, which will require an amendment to the Budget Guidelines Law, Estado reported. (BBG)

BRAZIL: The time for an income tax reform is now, Economy Minister Paulo Guedes said, citing that collection is much stronger now and companies are reporting record results. "My mission here is to do something that is doable," Guedes said at a debate in the Senate debate. (BBG)

BRAZIL: Brazilian President Jair Bolsonaro's chief of staff denied speculation of a crisis building between him and Roberto Campos Neto, the country's central bank chief, calling it an "imaginary bonfire." Bolsonaro expressed regret for signing a law that gave formal autonomy to the central bank, according to the Associated Press. The news agency reported it wasn't the first occasion that the president has expressed the desire to interfere in the country's monetary authority. "Let's not throw gasoline on the fire, especially gasoline that doesn't exist in an imaginary bonfire," Chief of Staff Ciro Nogueira said in a tweet, adding that the relationship between the government and central bank is "excellent." "The autonomy of the monetary authority is a historic and irreversible advance." (BBG)

BRAZIL: Brazil's Economy Minister Paulo Guedes said that when President Jair Bolsonaro's government began, his priority was to approve pension reform because the central bank's operating mechanism was known and the formal autonomy of the monetary institution was not a priority. (BBG)

RUSSIA: A controversial Russian gas pipeline is still a few miles away from being completed, with construction set to end within the next month. The Nord Stream 2 link to Germany is almost done, with just 15 kilometers (about 9 miles) of pipes still to be laid, Russian President Vladimir Putin said at a conference in Moscow. Depending on how many vessels are used, the build could take about 10 to 30 days, according to Bloomberg calculation. (BBG)

RUSSIA: The UK and the US issued joint sanctions on Friday against seven Russian nationals linked to the 2020 nerve agent attack on opposition activist Alexei Navalny. The UK's Foreign, Commonwealth and Development office and the US state department said they were freezing the assets of seven people linked to the Russian Federal Security Service (FSB), and would also subject them to travel bans. In a joint statement, the two governments said that the people were "directly responsible" for either planning or carrying out the poisoning of Navalny on August 20 last year. (FT)

RUSSIA: Chancellor Angela Merkel has sought to assuage Ukrainian concerns over the nearly completed Nord Stream 2 pipeline, saying Germany would not allow Russia to weaponise the gas corridor. The construction of NS2, which will pump Russian gas to western Europe across the Baltic Sea, is of particular concern to Kyiv, which stands to lose $2bn in transit revenues if Moscow cuts supplies through Ukraine. Opponents say the $11bn pipeline also increases Europe's dependence on Russian energy exports. "Gas cannot be used as a weapon," Merkel said on Sunday after meeting Volodymyr Zelensky, Ukrainian president, in Kyiv. "We are for new sanctions if Russia uses this gas pipeline as a weapon," she added without going into detail. (FT)

AFGHANISTAN: Boris Johnson, UK prime minister, will on Tuesday host crisis talks on Afghanistan with world leaders, as Britain presses the US to extend the evacuation timetable amid chaos and deaths at Kabul airport. Johnson, as chair of the G7, will hold talks that will include evacuation arrangements for western nationals and Afghan citizens, with Britain saying that seven Afghans died in a crush near Kabul airport on Saturday. Johnson also wants the G7 talks to focus on a longer-term approach to the Afghan crisis but accepts that following the US retreat that China and Russia are now key players in the region. (FT)

AFGHANISTAN: Boris Johnson will on Tuesday personally ask Joe Biden for a delay to the withdrawal of US forces from Afghanistan. (Telegraph)

AFGHANISTAN: President Joe Biden said the U.S. has expanded its evacuation efforts beyond the perimeter of the Kabul airport, warned of possible terror attacks and acknowledged that he may be forced to push back his deadline for leaving Afghanistan. Biden, speaking Sunday at the White House, declined to give details about "tactical changes we're making" given the developments, saying it was "still a dangerous operation." Biden, who has enlisted civilian aircraft in the effort, said about 7,800 people were evacuated over the weekend, bringing the total since Aug. 14 to more than 25,000. "We're working hard and as fast as we can to get people out," Biden said. (BBG)

AFGHANISTAN: The U.S. Embassy warned Americans not to go to the Kabul airport on Saturday "because of potential security threats." The guidance comes a day after President Biden reiterated his commitment to considering "every opportunity and every means" to get Americans and Afghan allies through Taliban checkpoints and into the airport. (Axios)

AFGHANISTAN: President Joe Biden told key allies in June that he would maintain enough of a security presence in Afghanistan to ensure they could continue to operate in the capital following the main U.S. withdrawal, a vow made before the Taliban's rapid final push across the country, according to a British diplomatic memo seen by Bloomberg. (BBG)

AFGHANISTAN: The main focus in Afghanistan now is to evacuate people from the country, NATO Secretary General Jens Stoltenberg said, as reports of violence and repression continue to emerge despite promises of peace from the Taliban. "We are working 24/7 to get as many people out as possible," he told CNBC's Hadley Gamble on Friday. (CNBC)

AFGHANISTAN: Turkey and Russia agreed to coordinate relations with the new government that will be formed in Afghanistan, according to the Turkish president's office. The agreement was reached during a phone call between Turkey's President Recep Tayyip Erdogan and Russian President Vladimir Putin on Saturday, Erdogan's office said. (BBG)

AFGHANISTAN: Commander Mullah Abdul Ghani Baradar, considered the Taliban's top political leader, is likely to delegate people to form a new government over the next few days, according to reports. (BBG)

AFGHANISTAN: The Taliban will be accountable for its actions and will investigate reports of reprisals and atrocities carried out by members, an official of the Islamist militant group told Reuters on Saturday. The official, who spoke on condition of anonymity, added that the group planned to ready a new model for governing Afghanistan within the next few weeks. (RTRS)

AFGHANISTAN: The Taliban are "intensifying the hunt-down" of individuals who worked with the Afghan government and its allied forces, conducting "targeted door-to-door visits" and arresting or threatening family members of "target individuals" unless they surrender, according to a confidential UN document obtained by Axios. (Axios)

AFGHANISTAN: The brother of slain Afghan warlord Ahmad Shah Massoud has called on the Taliban to form an inclusive government following their recapture of the country, and warned of resistance if they refused. Ahmad Wali Massoud, one of a band of leaders holding out against the Taliban from their base in the Panjshir valley, raised the prospect of a broad civil uprising if the militants did not agree to a deal. (FT)

IRAN: Iran's President Ebrahim Raisi called on Japan to release Iranian funds frozen in the country because of U.S. sanctions, Iranian state TV reported after the president met on Sunday with the visiting Japanese foreign minister. (RTRS)

ISRAEL: Israel's military bombed Palestinian militant weapons sites in the Gaza Strip early Sunday in response to a violent demonstration on the perimeter fence that left an Israeli police officer critically injured, the army said. (AP)

EURO: After a month of being whipsawed by external forces, euro traders are starting to turn their attention to risks closer to home. The euro's volatility curve shows they're putting emphasis on the European Central Bank's September gathering, when policy makers could give an indication of plans to pare back emergency bond purchases. Traders are betting the event will drive bigger swings than this month's annual Jackson Hole symposium for global central banks, which had delivered policy surprises in the past. That's in addition to wagers that volatility will remain elevated into the German elections -- another potential game changer for the common currency that could see the European Union's largest nation adopt looser fiscal policy. (BBG)

OIL: Iran has "a lot of possibilities" to keep selling oil, President Ebrahim Raisi said Aug. 21, as talks to end US sanctions on the country's energy industry have stalled. "There are a lot of possibilities and grounds for oil sales," Raisi said before a Parliament hearing on his proposed cabinet members including oil minister Javad Owji. (Platts)

CHINA

PBOC: The costs of business lending in China's economy have further room to fall despite that the PBOC kept the benchmark Loan Prime Rate unchanged for the 16th month on Aug. 20, the Economic Information Daily, owned by Xinhua News Agency, said in a report citing market participants. The rates on DR007, 10-y CGB and 1-y Interbank Deposit have all declined following the July RRR cut by the PBOC, so the Q3 corporate lending rates are also likely to drop as policies pushing for lower borrowing costs take effect, the newspaper said citing analyst Wang Qing of Golden Credit Ratings. The next-stage policies are likely to further fiscal policy measures and ensure ample liquidity on the basis of the so-called cross-cycle adjustment, the newspaper said. MNI notes that in an effort to stress structural reform and more sustainable measures, China has promoted the new expression in place of the previous countercyclical adjustment, seen as a more short-term boost. (MNI)

ECONOMY: China should focus on stabilizing the job market as a key to its cross-cycle macro policies and boosting domestic demand, wrote Guan Tao, the global chief economist of Bank of China International and a former forex official, on Yicai.com. Unemployment pressure remains high with the number of new urban jobs in the first seven months still 520,000 lower than the same-period average of 2018-2019, Guan said. The youth unemployment rate will rise significantly with the arrival of the graduation season, while the tougher regulations on the tutoring industry will lead to significant job reduction, Guan added. The two-year average rates of growth of disposable income and consumption of urban residents in the first seven months were 1.2 and 3.8 percentage points lower than that of the economic growth, according to Guan. (MNI)

CORONAVIRUS: China had zero locally transmitted cases and 21 imported coronavirus infections on Aug. 22, the National Health Commission said in a statement, as the country has worked to control a wave of delta variant cases. It also reported 16 imported asymptomatic infections. China's model shows what it takes to get Covid under control, and raises questions about whether other nations would be willing and able to follow the same draconian steps. (BBG)

CORONAVIRUS: Authorities in Shanghai have quarantined hundreds of people in an attempt to halt a fresh COVID-19 outbreak in the city after infections were detected in cargo workers at its airport, the municipal government said on Saturday. (RTRS)

EQUITIES: Ant Group Co., Ltd. has denied rumors of illicit purchase of stakes in the company ahead of its planned IPO last year, according to an overnight statement by the company. It is untrue that certain individuals, as mentioned in the rumors, had bought a stake in the company ahead of its IPO. It did not explain what people it was referring to Ant says it complies with the rules and law and the IPO process was transparent. (BBG)

EQUITIES: Chinese electric car maker BYD's plan to list its semiconductor arm has been suspended due to a regulatory probe into the law firm advising the company on the deal, in the latest sign of Chinese authorities tightening their scrutiny of local tech companies and capital markets. (Nikkei)

OVERNIGHT DATA

JAPAN AUG, P JIBUN BANK MANUFACTURING PMI 52.4; JUL 53.0

JAPAN AUG, P JIBUN BANK SERVICES PMI 43.5; JUL 47.4

JAPAN AUG, P JIBUN BANK COMPOSITE PMI 45.9; JUL 48.8

The Japanese private sector economy saw business conditions deteriorate further midway through the third quarter of the year, with flash PMI data signalling a quicker decline in business activity in August. The latest contraction was the quickest recorded since August 2020, while incoming business was reduced at the sharpest pace for seven months. Survey respondents commonly attributed weaker demand to ongoing COVID-19 restrictions, coupled with sustained supply chain pressures. The decline in overall private sector activity was led by the larger services sector, where business activity fell for the nineteenth consecutive month and at the quickest pace since May 2020. While manufacturers pointed to continued output growth, the rate of expansion softened from July. Japanese private sector businesses noted that the recent surge in COVID-19 cases related to the Delta variant had dampened prospects in the latest survey period, as firms indicated the softest degree of optimism regarding the year-ahead outlook for one year. That said, positive sentiment was solid overall as vaccination rates continued to increase markedly. (IHS Markit)

AUSTRALIA IHS MARKIT AUG, P MANUFACTURING PMI 51.7; JUL 56.9

AUSTRALIA IHS MARKIT AUG, P SERVICES PMI 43.3; JUL 44.2

AUSTRALIA IHS MARKIT AUG, P COMPOSITE PMI 43.5; JUL 45.2

Australia's private sector remained stuck in decline in August, according to the latest IHS Markit Flash Australia Composite PMI data, as activity remained heavily impacted by current mobility restrictions brought about by the spread of the COVID-19 Delta variant. Not only were demand and business activity hit, employment conditions also deteriorated, with private sector staffing levels falling for the first time since October 2020. The labour market situation had been made worse on both ends of supply and demand amid the latest COVID-19 disruptions. The one bright spot had been an improvement in the outlook amongst Australian private sector firms in August, with hopes of an improvement in the COVID-19 situation expected to spark an eventual rebound for the Australian economy. (IHS Markit)

SOUTH KOREA AUG 1-20 EXPORTS +40.9% Y/Y

SOUTH KOREA AUG 1-20 IMPORTS +52.1% Y/Y

CHINA MARKETS

PBOC INJECTS CNY10 BLN VIA OMOS MON; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:25 am local time from the close of 2.0857% on Friday.

- The CFETS-NEX money-market sentiment index closed at 48 on Friday vs 54 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4969 MON VS. 6.4984 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4969 on Monday, compared with the 6.4984 set on Friday.

MARKETS

SNAPSHOT: Talk Of Yellen Supporting Second Term For Fed Chair Powell

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 522.41 points at 27535.42

- ASX 200 up 23.73 points at 7484.6

- Shanghai Comp. up 34.393 points at 3461.727

- JGB 10-Yr future down 10 ticks at 152.29, yield up 0.4bp at 0.015%

- Aussie 10-Yr future down 1.5 ticks at 98.915, yield up 1.3bp at 1.092%

- U.S. 10-Yr future down -0-02+ at 134-01+, yield up 1.17bp at 1.2667%

- WTI crude up $1.08 at $63.22, Gold up $7.08 at $1788.18

- USD/JPY up 8 pips at Y109.86

- FED JACKSON HOLE CONFERENCE TO TAKE PLACE VIRTUALLY (MNI)

- YELLEN BACKS POWELL REAPPOINTMENT, BOOSTING SECOND-TERM ODDS (BBG)

- FED'S KAPLAN SAYS DELTA COVID COULD PUSH BACK TAPER (MNI)

- NEW ZEALAND EXTENDS LOCKDOWN

BOND SUMMARY: Core FI A Little Lower As Equities Tick Higher In Asia

Friday's uptick on Wall St. has resulted in a move higher in the Nikkei 225 early this week (+1.8%), while e-minis have also ticked higher. This has resulted in some modest pressure for U.S. Tsys & core FI, while the havens (JPY, USD & CHF) find themselves at the bottom of the G10 FX table.

- Headline flow has been limited during Asia-Pac hours, with much of the focus falling on the regional COVID situation and headwinds for global trade.

- T-Notes last print -0-03 at 134-01, sticking to the confines of a 0-06 range and operating on relatively limited volume. Cash Tsys run 0.5 to 1.5bp cheaper across the curve, with the belly leading the way lower ahead of this week's 2-, 5- & 7-Year supply schedule. Asia flow was headlined by a 10K screen seller of the TYU1 135.00 calls. European flash PMI data may set the tone ahead of NY trade. Monday's U.S. docket will see the release of flash PMI data, the latest Chicago Fed national activity index reading and existing home sales data.

- JGB futures last print -10 on the day, which represents a marginal extension of the overnight weakness as an uptick in domestic equities adds some light pressure to the space. The major cash JGB benchmarks run little changed to 1.0bp cheaper on the day with 7s leading the way lower, suggesting the move may be futures driven. Longer dated swap spreads are marginally wider on the day. There has been little in the way of idiosyncratic news flow to note for the space, outside of the previously identified political headlines.

- The Aussie bond space was also biased a touch lower, although the broader ranges once again remain contained. YM -1.5 & XM -1.0 at typing. There is plenty of discussion doing the rounds re: the potential for the first round of positive weekly RBA-purchase adjusted AOFM net supply in some time, given the previously flagged syndication of the new Nov '32 index linked line from the AOFM, which is set to price on Tuesday. Local COVID matters failed to impact the space.

EQUITIES: Rebound After Last Week's Sell Off

A positive day for equity markets in the Asia-Pac region, rebounding after last week's sell off. Markets in mainland China are up just shy of 2% heading into the European open, while bourses in Hong Kong, Japan and South Korea have seen similar gains. Bourses in Australia and New Zealand have seen more muted moves amid concern over the local COVID dynamic. In South Korea markets are higher after robust export data for the first 20 days of August. Risk assets rebounded with commodities also benefitting. Markets look ahead to European flash PMI today while broader focus for the week will fall on the Fed's annual Jackson Hole Economic Symposium, with commentary from FOMC Chair Powell on Friday headlining that (now virtual) event.

OIL: Crude Futures Rebound After Losing Streak

Oil gained in Asia on Monday, rebounding after its worst weekly loss since April 2020 and a seven session losing streak, both WTI and Brent are up over 1% after an ~8% drop last week. Risk sentiment has been broadly positive in Asia which has seen equities and commodity markets rise. WTI is dealing around $62.98 and has resistance at $65.00, the Aug 9 low, Brent sees resistance at $68.14/70.04 the low Aug 16 / high Aug 18. There were reports over the weekend that the Libyan Central Bank Governor has called for a boost in domestic oil output of around 40% of its current level in order to boost spending and facilitate the economic recovery.

GOLD: Familiar Territory As Participants Look To Jackson Hole

A softer DXY and little in the way of meaningful movement for U.S. yields is supporting gold during Asia-Pac dealing, with spot last +$5/oz just above $1,785/oz. Bullion continues to operate in well-trodden territory with the Fed's Jackson Hole Symposium presenting the major focal point for participants this week.

FOREX: Commodity Currencies Rebound

Risk sentiment was positive in the Asia-Pac session as Friday's theme's continued following a less hawkish tilt from Fed's Kaplan on Friday.

- AUD and NZD both started lower as local COVID dynamics caused some concern, but positive sentiment saw both lifted with AUD the winner on the day as worries in New Zealand abound that authorities have failed to contain the latest COVID-19 outbreak. The move in AUD accelerated after Australian PM Morrison said that individual states should stick to plans to reopen from lockdowns despite still elevated case counts in both NSW and Victoria. Commodity currencies were further supported by a rebound in oil prices with crude futures rising by over 1%.

- Offshore yuan strengthened, USD/CNH dipping back below the psychological 6.50 handle. On the coronavirus front China reported no new cases for the first time in over a month. China stepped up testing to isolate breakouts and utilized sweeping quarantines to isolate infections.

- Markets look ahead to European flash PMI readings coming up, while broader focus for the week will fall on the Fed's annual Jackson Hole Economic Symposium, with commentary from FOMC Chair Powell on Friday headlining that (now virtual) event.

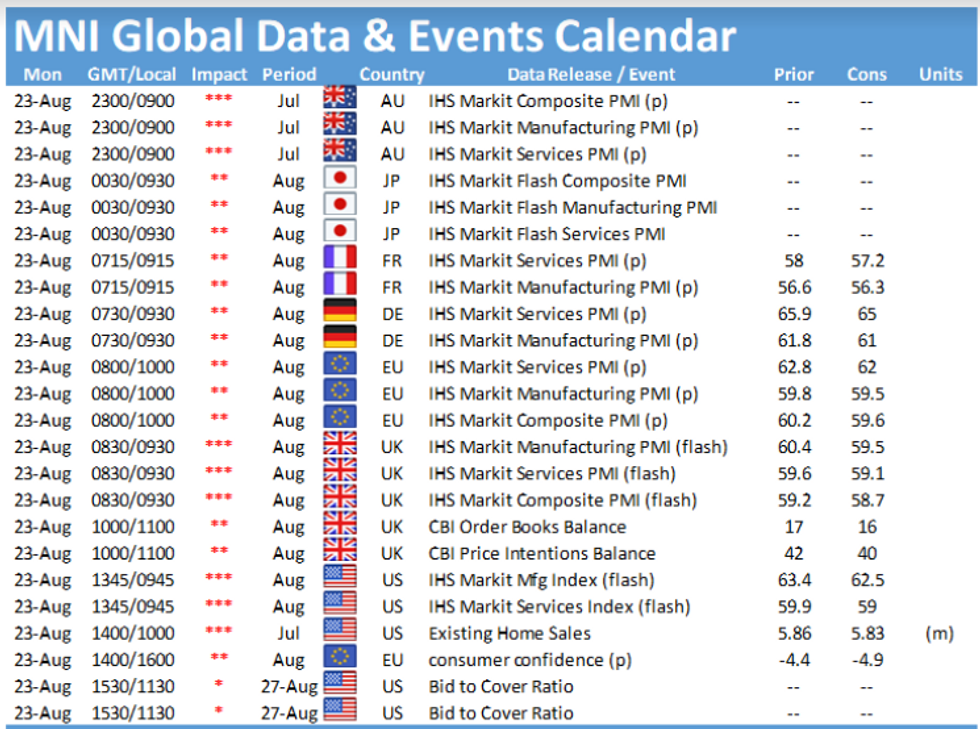

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.