-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Thursday's Events Dominate, Japanese Meeting On Banks Eyed

EXECUTIVE SUMMARY

- BANKS BORROW $164.8 BILLION FROM FED IN RUSH TO BACKSTOP LIQUIDITY (BBG)

- WALL STREET RIDES TO THE RESCUE AS 11 BANKS PLEDGE $30 BILLION TO FIRST REPUBLIC BANK (NBC)

- SWISS CABINET MET WITH CENTRAL BANK, REGULATOR TO DISCUSS CREDIT SUISSE (RTRS)

- CREDIT SUISSE TELLS STAFF SNB FACILITY DOES NOT TRIGGER A 'VIABILITY' EVENT (RTRS)

- UBS, CREDIT SUISSE OPPOSE IDEA OF FORCED COMBINATION, SOURCES SAY (BBG)

- ECB FEARED THAT DITCHING HALF-POINT HIKE MIGHT PANIC INVESTORS (BBG SOURCES)

- CREDIT SUISSE RESCUE GAVE ECB CONFIDENCE TO HIKE RATES (RTRS SOURCES)

- BOJ, MOF, FSA PLAN MEETING ON MARKETS AFTER SVB (NIKKEI)

- CHINA DOES U-TURN ON BOND FEEDS AFTER SUDDEN HALT ROILED MARKET (BBG)

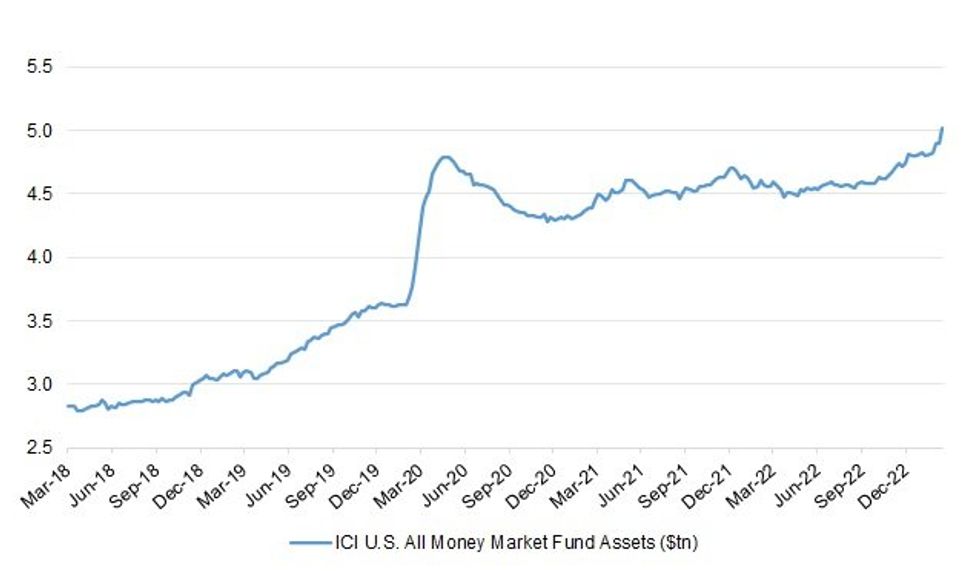

Fig. 1: ICI U.S. All Money Market Fund Assets

Source: MNI - Market News/Bloomberg

UK

FISCAL: Chancellor Jeremy Hunt has abandoned plans to make sovereign wealth funds pay corporation tax on property and commercial enterprises after cabinet warnings that the move would hit inward investment and depress growth. (FT)

FISCAL/POLITICS: NHS unions have reached a pay deal with the government in a major breakthrough that could herald the end of strikes by frontline staff in England. (Sky)

BREXIT: The DUP has said it still has concerns over EU law applying in Northern Ireland before a vote on Rishi Sunak’s Brexit deal on Wednesday. (Telegraph)

EUROPE

ECB: Fears that anything but a half-point hike would trigger panic among investors helped settle the European Central Bank’s interest-rate decision on Thursday, according to people familiar with the talks. (BBG)

ECB: European Central Bank policymakers only agreed another major increase in interest rates on Thursday after Credit Suisse secured a lifeline and markets calmed, four sources familiar with the matter told Reuters. (RTRS)

BANKS: The Swiss government met officials from the Swiss National Bank (SNB) and the financial market regulator FINMA on Thursday to discuss the Credit Suisse crisis. "This afternoon the Federal Council was briefed by FINMA and the SNB on the situation at Credit Suisse," a spokesperson told Reuters. No information would be provided on the content of the meeting, the spokesperson added. (RTRS)

BANKS: UBS Group AG and Credit Suisse Group AG are opposed to a forced combination, even as scenario planning for a government-orchestrated tie-up continues, according to people with knowledge of the matter. (BBG)

BANKS: Credit Suisse Group AG told staff on Thursday that the emergency backstop from the Swiss central bank does not trigger a "viability event," according to documents seen by Reuters. The bank also gave an update on how much money it had returned to investors in its supply chain finance funds, according to the document dated March 16. The document gave talking points to staff for client conversations. Credit Suisse declined to comment on the memo.(RTRS)

BANKS: U.S. shareholders of Credit Suisse Group AG sued the Swiss bank on Thursday, claiming that the bank defrauded them by concealing problems with its finances. (RTRS)

BANKS/RATINGS: DBRS Morningstar became the first global rating agency to cut Credit Suisse’s credit score on Thursday, less than a day after a major share price plunge saw Switzerland’s central bank provide emergency support to the lender. (RTRS)

GERMANY: German Chancellor Olaf Scholz sought to assuage fears that the collapse of Silicon Valley Bank and problems at Credit Suisse might trigger a new financial crisis, saying a more resilient banking system and stronger economy ensured savings were safe. (RTRS)

BUNDS: The market for German government securities is functioning well, although current market volatility could affect how banks participate at auctions, the German debt agency told Reuters on Thursday. (RTRS)

FRANCE: French unions plan another day of strikes and demonstrations against President Emmanuel Macron's pension reform, a union spokeswoman said on Thursday. (RTRS)

ITALY/BANKS/RATINGS: Italy’s five largest banks are firmly positioned to weather the effects of the economic slowdown, says Fitch Ratings in a new report, as domestic economic growth is likely to slow to 0.5% in 2023 from 3.7% in 2022. (Fitch Ratings)

RATINGS: Sovereign rating reviews of note slated for after hours on Friday include:

- Moody’s on Greece (current rating: Ba3; Outlook Stable) & Luxembourg (current rating: Aaa; Outlook Stable)

- S&P on Belgium (current rating: AA; Outlook Stable), Croatia (current rating: BBB+; Outlook Stable) & Spain (current rating: A; Outlook Stable)

- DBRS Morningstar on Latvia (current rating: A, Stable Trend) & the Netherlands (current rating: AAA, Stable Trend)

U.S.

FED: The Federal Reserve is most likely to take a break in its interest rate increases at its March meeting because of the turmoil in global financial markets that has resulted from troubles at U.S. regional banks and worries about Credit Suisse, William English, a former director of the Fed's division of monetary affairs, told MNI. (MNI)

FED: WSJ Fed reporter Timiraos tweeted the following on Thursday: “The "smoothed" version (unweighted series) of the Atlanta Fed wage growth tracker held steady at 6.1% in Feb for the third straight month. The huge gap between job switchers and stayers has been narrowing with the former coming down and the latter going up” (MNI)

FED/BANKS: Banks borrowed a combined $164.8 billion from two Federal Reserve backstop facilities in the most recent week, a sign of escalated funding strains in the aftermath of Silicon Valley Bank’s failure. (BBG)

BANKS: A group of financial institutions has agreed to deposit $30 billion in First Republic Bank in what’s meant to be a sign of confidence in the banking system, the banks announced Thursday afternoon. (NBC)

BANKS: Many of the institutions involved in the bailout of the beleaguered First Republic Bank are also said to be looking to make a possible purchase of the San-Francisco-based institution, Fox Business has learned. (Fox Business)

BANKS: Spreading the risk of financial contagion to achieve “a false sense of confidence” in First Republic Bank is “bad policy”, Pershing Square’s Bill Ackman said in a tweet. (BBG)

BANKS: Federal regulators and the Treasury Department on Thursday welcomed a decision by 11 larger banks to deposit $30 billion into regional bank First Republic Bank and said it showed the resilience of the U.S. banking system. The Fed also underscored its overall support for the banking sector, saying: "As always, the Federal Reserve stands ready to provide liquidity through the discount window to all eligible institutions." (RTRS)

BANKS: U.S. Treasury Secretary Janet Yellen and JP Morgan CEO Jamie Dimon first discussed using deposits from large banks to support First Republic Bank on Tuesday, and drummed up participation by other banks over the past two days, sources familiar with the rescue effort said on Thursday. (RTRS)

BANKS: “A more general problem that concerns us is the possibility that if banks are under stress, they might be reluctant to lend where they’re worried about shoring up liquidity and capital,” the Treasury chief said. “And we could see credit become more expensive and less available.” (BBG)

BANKS: The Credit Suisse crisis is not related to the current economic environment, the White House said on Thursday. "This is a distinct issue," White House spokesperson Karine Jean-Pierre told reporters at a briefing. (RTRS)

BANKS: The White House said on Thursday it would have more to say on regulatory changes regarding bank deposits in the coming days. (RTRS)

BANKS: Treasury Secretary Janet Yellen said on Thursday that stress tests are one tool to measure banks' health after the recent collapse of two large U.S. banks, but supervision of banks is critical. Yellen also told the Senate Finance Committee that stress tests focus on capital, not on liquidity - which was the underlying problem of the bank failures. She also supports tailoring bank supervision to the institution. (RTRS)

BANKS: Bipartisan group of senators ask the Federal Reserve to examine how how the central bank and other regulators missed warning signs in their oversight of Silicon Valley Bank before its collapse. (BBG)

BANKS: The effort to wind down Silicon Valley Bank was marred by an unmotivated seller, infighting between regulators and, ultimately, a failed auction. (BBG)

BANKS: Startups and investors say the newly created entity that took over from Silicon Valley Bank is offering some flexibility when it comes to deposit requirements for borrowers. (WSJ)

BANKS: With Credit Suisse Group AG having wobbled this week and a handful of regional US banks collapsing, company executives are getting more concerned about where they can safely keep their cash. (BBG)

BANKS: Federal government officials wanted a joint statement to include a reference to regulatory shortcomings that they believe helped lead to the bank’s demise. (New York Times)

FINANCIALS: Charles Schwab Corp. was hit with $8.8 billion in net outflows from its prime money market funds this week as investors scrutinized the brokerage’s resilience amid questions about the health of the wider financial industry. (BBG)

MARKETS: Money-market funds attracted their biggest weekly influx of cash since the early part of the Covid pandemic as depositors pulling their money away from more at-risk US banks sought a place to park their dollars. (BBG)

FISCAL: Treasury Secretary Janet Yellen said Thursday that China would be among the first in line to get paid under a Republican proposal to prioritize some U.S. debt obligations over others, calling it a “dangerous idea” that would technically cause the U.S. to default on its bonds. (CNBC)

ECONOMY: U.S. business creation and job growth will likely continue the boom that began following the pandemic even with a potential credit squeeze after the fall of Silicon Valley Bank, former Census Bureau chief economist John Haltiwanger told MNI. (MNI)

HOUSING: Some homebuyers are returning to the market as mortgage rates decline from the four-month high they reached last week, according to a new report from Redfin (redfin.com), the technology-powered real estate brokerage. (Business Wire)

RATINGS: S&P affirmed the U.S. at AA+; Outlook Stable

OTHER

GLOBAL TRADE: More than 50 U.S. agriculture and food groups on Thursday urged Congress and to approve new legislation that will clear the way for the United States to negotiate more free-trade agreements, arguing that without them American agriculture was falling behind global competitors. (RTRS)

U.S./CHINA: Even as TikTok’s Chinese owners publicly resist pressure from the Biden administration to sell the wildly popular video app, conversations between TikTok and potential buyers are heating up, sources told On The Money. (New York Post)

EU/CHINA: The French government is planning to ask cabinet ministers to avoid using TikTok and similar apps on their personal phones, according to two people with direct knowledge of the discussions. (BBG)

NATO: President Recep Tayyip Erdogan to meet Finnish President Sauli Niinisto at 2:30pm in Ankara, state-run Anadolu Agency Reports. (BBG)

JAPAN: The Bank of Japan, Finance Ministry and Financial Services Agency plan to meet Friday evening to discuss markets in the wake of the collapse of Silicon Valley Bank, Nikkei reports without attribution. (BBG)

JAPAN: Japan's government is closely coordinating with the Bank of Japan and financial authorities overseas to prevent fallout from the crisis of confidence engulfing banks in the West, Finance Minister Shunichi Suzuki said on Friday. (RTRS)

JAPAN: Japan’s main labor unions are set to win their biggest wage hikes in decades as employers acquiesce to government calls to lift pay amid rising inflation. (BBG)

JAPAN/SOUTH KOREA: Japan is looking to ease export curbs of key semiconductor materials to South Korea, but it has not yet decided whether to assign its neighbor ‘white nation’ status again, Japan’s trade minister says. (BBG)

RBNZ: Deputy Governor Christian Hawkesby says we are aware of the current issues with a small number of banks internationally. The Reserve Bank of New Zealand is monitoring the situation closely, and is in regular contact with other regional regulators and regulated entities. (RBNZ)

NEW ZEALAND/CHINA: New Zealand is following other nations in banning the TikTok app from parliament-issued devices, Radio New Zealand reports. (BBG)

NORTH KOREA: North Korea said that Thursday's launch was its largest Hwasong-17 intercontinental ballistic missile (ICBM), fired during a drill to demonstrate a "tough response posture" to ongoing U.S.-South Korea military drills, state media reported. (RTRS)

ASIA: Direct exposures to Silicon Valley Bank (SVB) and Signature Bank among Fitch Ratings’ portfolio of rated banks in APAC appear limited, says Fitch. (Fitch Ratings)

TURKEY/RATINGS: Sovereign rating reviews of note slated for after hours on Friday include:

- Fitch on Turkey (current rating: B; Outlook Negative)

MEXICO: Mexico’s financial system is safe from the problems with liquidity facing banks in other countries after the collapse of Silicon Valley Bank because its lenders have weathered crises before and have behaved in a cautious manner, the country’s finance minister said. (BBG)

MEXICO: Mexico Central Bank Governor Victoria Rodriguez Ceja, speaking at the Banking Convention in Merida, Yucatan, said the bank doesn’t expect recent US and global banking events to negatively impact the country’s banking system. (BBG)

MEXICO: Mexico’s banks are “well capitalized” and “well managed” and not at risk of contagion, Banxico’s Deputy Governor Irene Espinosa said to reporters at a banking conference in Merida, Yucatan. (BBG)

MEXICO: Mexico President Andres Manuel Lopez Obrador, speaking at the national banking convention, said he expects remittances from Mexicans living abroad to reach a new annual record by surpassing $60b this year. (BBG)

MEXICO: Mexico has launched of a new sustainable "M" bond, Deputy Finance Minister Gabriel Yorio said on Thursday while speaking at a banking conference in the southern city of Merida. (RTRS)

BRAZIL: Brazil President Luiz Inacio Lula da Silva’s plan to unveil a new fiscal outline that would limit government spending is unlikely to persuade the central bank to cut its benchmark interest rate any time soon, according to one of the bank’s former presidents. (BBG)

RUSSIA: Poland on Thursday pledged it would send four MiG-29 fighter jets to Ukraine, the first NATO member to do so, in a significant move in Kyiv’s battle to resist Russia’s onslaught. (CNN)

RUSSIA: The U.S. State Department has approved the potential sale of AGM-114R2 Hellfire missiles and related equipment for an estimated cost of $150 million, the Pentagon said on Thursday. (RTRS)

RUSSIA: The United States on Thursday released a de-classified video showing Russia's intercept of a U.S. military surveillance drone downed over the Black Sea two days ago, images that the White House said exposed how Moscow was lying about what happened. (RTRS)

COLOMBIA: Colombia’s monetary policy stance is tight enough to bring the fastest inflation in nearly a quarter century down to its target range by the end of 2024, according to a top central banker. (BBG)

PERU: Peru’s economy is accelerating and recovering from crippling anti-government protests, Finance Minister Alex Contreras said on Thursday in remarks broadcast on social media. (BBG)

ARGENTINA: Argentina's central bank board said it agreed to hike the country's benchmark interest rate by 300 basis points to 78% on Thursday after annual inflation hit 100% for the first time in over three decades. (RTRS)

ENERGY: Spanish energy firm Repsol SA has abandoned the idea of expanding a liquefied natural gas terminal on Canada’s east coast, saying the cost of shipping gas there is too high. (BBG)

OIL: The US is committed to replenishing the Strategic Petroleum Reserve but won’t rush to do so immediately despite the recent decline in oil prices, a top Biden administration official said. (BBG)

CHINA

ECONOMY/POLICY: China’s economic rebound isn’t yet solid and requires more fiscal support, monetary policy incentives and aid to industries, according to state-run China Securities Journal. (BBG)

ECONOMY/POLICY: China's economic recovery lacks stability as the external environment is more complex than last year and confidence among firms and consumers is down, according to Lian Ping, chairman of the China Chief Economist Forum. (MNI)

PBOC: China’s reference lending rate is expected to remain steady as the ongoing recovery keeps the central bank on the sideline with ample tools to boost growth if needed, while also monitoring any impact on the yuan or cross-border capital flows from the collapse of Silicon Valley Bank, economists and analysts said. (MNI)

FDI: The government is launching initiatives to boost foreign investment into the country, including a series of expos, tours and match-making events aimed at attracting overseas investors, according to the Ministry of Commerce (MOFCOM). (MNI)

FISCAL: China needs policies to support the estimated 147.39 million workers aged between 60-69 years old, which will help alleviate the pressures of ageing on society, according to Yicai. (MNI)

BONDS: Traders in China were able to access widely used bond price feeds again after an abrupt suspension of the data earlier in the week roiled the $21 trillion market. (BBG)

BONDS: It is unlikely that the overseas banking crisis creates waves in China’s financial system because of its healthier liability structure with lower exposure to bonds, the official Shanghai Securities News reported, citing analysts. (BBG)

PROPERTY: An investor that profited from the aftermath of China’s first dollar bond default by a developer nearly a decade ago is turning its back on the nation’s distressed property debt, after losing more than its peers in the past two years. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY165 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) conducted CNY180 billion via 7-day reverse repos on Friday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY165 billion after offsetting the maturity of CNY15 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0027% at 09:44 am local time from the close of 2.2066% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 47 on Thursday, compare with the close of 45 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9052 FRI VS 6.9149 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9052 on Friday, compared with 6.9149 set on Thursday.

OVERNIGHT DATA

JAPAN JAN TERTIARY INDUSTRY INDEX +0.9% M/M; MEDIAN +0.5%; DEC -0.4%

MARKETS

US TSYS: Curve Flatter In Asia

TYM3 deals at 114-11, +0-05, a touch off the top of the 0-10+ range on volume of ~115k.

- Cash tsys sit 1bps cheaper to 2 bps richer across the major benchmarks. The curve has twist flattened pivoting on 3s.

- Tsys were marginally cheaper at the open as Asia-Pac participants digested yesterday's cheapening driven by the $30bn rescue package from First Republic and the associated Fed rate pricing adjustments in OIS markets.

- Losses extended as FOMC dated OIS saw the terminal rate tick higher and rate cut expectations for 2023 moderate.

- Tsys firmed off session lows as firmer regional equities boosted risk appetite and weighed on the USD.

- The bid marginally extended as news of a meeting of Japan's MOF, FSA and the BOJ which will in part cover the collapse of SVB.

- Fed dated OIS pricing now sees a terminal rate in May of ~5%, with ~75bps of cuts in 2023.

- In Europe today the final read of Eurozone CPI headlines an otherwise thin docket. Further out Industrial Production and UofMich consumer sentiment will cross.

JGBS: Shunt Higher Into The Close On News Of Trilateral BoJ-MoF-FSA Meeting

A relatively sedate session for JGBs saw an uptick in activity in the last hour of trade on the back of wires running headlines covering a Nikkei piece which pointed to a trilateral (regular) meeting between the BoJ, MoF & FSA, which will in part cover the collapse of Silicon Valley Bank. Wires have suggested the meeting will take place at 16:45 Tokyo time (07:45 London), with chief financial diplomat Kanda set to brief the media afterwards. Finance Minister Suzuki continued to attempt to play down any local worry re: the headwinds for global banks, while affirming the need for vigilance and flagging ongoing communication with international regulatory bodies on those matters.

- Before then JGB futures had nudged away from their early Tokyo base alongside a similar move in U.S. Tsys, with Fed pricing in the STIR space front and centre.

- JGB futures shunted higher into the close, fully reversing overnight session losses (which came on the back of support efforts surrounding Credit Suisse & First Republic Bank, as well as the latest ECB decision) at one point, before closing -17. Cash JGBs are flat to 2.5bp richer as 10s outperform, printing at 0.29% into the close.

- Remarks from outgoing BoJ Governor re: the limits of NIRP not being reached failed to move the market.

- Swap rates are higher on the day, with that curve steepening, which limited the bid in JGBs until the last hour or so, at least to some degree, as swap spreads widened.

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y5.12519tn 3-Month Bills:

- Average Yield -0.2437% (prev. -0.1980%)

- Average Price 100.0655 (prev. 100.0532)

- High Yield: -0.2214% (prev. -0.1619%)

- Low Price 100.0595 (prev. 100.0435)

- % Allotted At High Yield: 23.3379% (prev. 78.1372%)

- Bid/Cover: 3.288x (prev. 2.673x)

AUSSIE BONDS: Weaker But Off Cheaps As U.S. Tsys Twist Flatten

ACGBs close weaker (YM -17.0 & XM -6.0) but off session cheaps as U.S. Tsys twist flatten in Asia-Pac trade. Cash ACGBs bear flatten with the 3-year and 10-year benchmarks respectivcely 16bp and 6bp weaker.

- The AU-US 10-year yield differential is unchanged on the day at -16bp, but as flagged earlier, too low versus developments at the short-end over the past week.

- Swaps close with the 3s10s curve 10bp flatter and rates 3-13bp higher. EFPs close 3-4bp tighter.

- Bills cheapen 12-25bp with the strip flattening.

- RBA dated OIS firms 27-30bp for meetings beyond May in sympathy with global STIR and a 50bp hike from the ECB yesterday. Nonetheless, April meeting pricing remains around flat with 14bp of easing priced by year-end.

- The local calendar is light next week with RBA Kent's speech at the KangaNews Summit and RBA Minutes the highlights. While RBA Governor Lowe provided further colour the day after the March policy meeting, the market will surely be looking for reasons why it makes sense to price in an end to the tightening cycle in the face of stronger economic data this week.

- Banking headline watching is the game plan ahead of Eurozone CPI, U.S. Industrial Production and University of Michigan Sentiment data tonight.

AUSSIE BONDS: ACGB May-34 Auction Results

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 3.75% 21 May 2034 Bond, issue #TB167:

- Average Yield: 3.4741% (prev. 3.9713%)

- High Yield: 3.4775% (prev. 3.9725%)

- Bid/Cover: 3.1000x (prev. 2.6278x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 62.6% (prev. 82.2%)

- Bidders 52 (prev. 47), successful 18 (prev. 20), allocated in full 11 (prev. 8 )

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 22 March it plans to sell A$700mn of the 3.00% 21 November 2033 Bond.

- On Thursday 23 March it plans to sell A$1.0bn of the 9 June 2023 Note, A$1.0bn of the 11 August 2023 Note & A$500mn of the 8 September 2023 Note.

- On Friday 24 March it plans to sell A$500mn of the 4.25% 21 April 2026 Bond.

NZGBS: Weaker With Firmer Tightening Expectations

NZGBs close 4-8bp weaker but well off session cheaps as U.S. Tsys twist flatten in Asia-Pac trade. The 2/10 curve was 3bp flatter with the NZ/US 10-year yield differential -4bp. NZ/AU 10-year yield differential was -2bp at +96bp, just below the multi-decade high set after the worse-than-expected Q4 current account deficit print earlier in the week.

- Swaps are 4-15bp weaker, implying a wider short-end swap spread, with the 2s10s curve 10bp flatter.

- RBNZ dated OIS pricing firms 12-13bp across meetings in sympathy with global STIR and the ECB’s 50bp hike yesterday. April pricing shows 27bp of tightening with terminal OCR expectations at 5.32%.

- The local calendar is light until February's Trade Balance data on Tuesday. After this week’s current account deficit print and the resultant comments from S&P about bond rating pressure, the release will likely be closely watched.

- RBNZ Chief Economist Conway is slated to give a keynote speech: “The path back to low inflation in NZ” at a capital markets forum on 23 March.

- Until then, the market will remain on banking headline watch ahead of Eurozone CPI (Feb) today, especially after ECB President Lagarde watered down tightening guidance. In the U.S., Industrial Production and University of Michigan Sentiment are the slated data highlights.

EQUITIES: HK/China Tech Plays Lead The Region Higher

All major regional indices are higher, with HK/China indices leading the way, although other major markets aren't too far behind. The combination of the dovish ECB 50bps hike and efforts to boost troubled US regional banks (First Republic), has been enough to drive positive sentiment heading into the weekend. Signals from other asset classes are supportive, with US yield edging down from session highs, commodities mostly higher and the USD softer. US equity futures are only up modestly though (~0.05/0.10% for Eminis).

- The HSI is up ~1.7% at this stage, with tech stocks leading the way. This sub index is up over 4.0%, with the China internet company Baidu surging amid positive analyst reviews for its AI chatbot.

- The CSI 300 is up ~1.2%, bouncing off support at the 100-day MA. Northbound stock connect flows have rebounded, +11.6bn yuan, slightly off session highs, but still the best inflow since the end of Jan this year.

- The Topix is around ~1.20% firmer at this point, although the underlying bank index is only up 0.4%, still comfortably down versus closing levels from last Friday. The Kospi is +0.75%, although the Taiex is outperforming at +1.4%.

- The ASX 200 is up a modest 0.42%, while bourses in SEA are higher, led by commodity sensitive plays Malaysia (~1.50%) and Indonesia (~1.40%).

GOLD: Third Straight Week Of Gains, ETF Holdings Trending Higher Again

Gold is closing in on previous resistance points, with the precious metals last near $1930. Moves above this level were not sustained through Wednesday and Thursday of this week (highs near $1937.50). Still, we are still up close to 0.50% for today's session, slightly outperforming the broad USD indices (BBDXY -0.30%). For the week, gold is up just over 3.2%, which is the third straight week of gains.

- Gold has run ahead of USD weakness in this latest surge higher. This is likely to reflect renewed safe haven demand for the metal given the jitters in global banking stocks this week.

- Note that gold ETF holdings are trending higher again after reaching a trough point last Friday.

- A clean break above the $1933/37 region will likely have bulls targeting earlier YTD highs above $1950. Note the simple 50-day MA sits back at $1877.

OIL: Stabilizes Further, But Still Tracking For Large Weekly Loss

Oil sentiment has continued to stabilize/improve through today's session. For Brent we are back around the $75.50/bbl level, which is +1% higher for the session. This builds on Thursday's +1.37% gain, although only unwinds a portion of losses from earlier in the week. Brent is still tracking nearly 9% weaker for the week. WTI is off by slightly more, last down by around 10% for the week, just above the $69/bbl level.

- In terms of Brent levels, support is clearly evident around the $72/bbl or a touch below this level, which we bottomed out on two occasions in recent sessions. On the topside though, the 20-day EMA is still some distance away at $81.25/bbl.

- Outside of broader risk sentiment shifts, which have turned more positive heading into the weekend, supply developments will also be eyed. Oil sentiment stabilized post reports of OPEC+ chiefs from Saudi Arabia and Russia meeting in Riyadh yesterday. Note that the next scheduled meeting for the OPEC+ group is April 3.

- Elsewhere, an advisor to US President Biden stated the US won't rush to refill the SPR.

- Next week outside of the usual weekly inventory numbers we have the FT Commodities Global summit (which runs from Mon-Wed), but most focus is likely to rest on the Fed's decision, out on Wed.

FOREX: Greenback Pressured, Antipodeans Outperform

The USD is pressured in Asia, AUD and NZD are the best performers in the G-10 space at the margins. Regional Equities are firmer boosting risk appetite weighing on the USD, BBDXY is down ~0.3%. US Treasury Yields have ticked away from session highs and now sit marginally lower.

- AUD/USD prints at $0.6705/15, up ~0.8%. The pair has broken through the $0.67 handle on the improving risk appetite, the next upside target is the 20-Day EMA at $0.6723. Stronger metals, Iron Ore futures are up 0.8% and Copper which is up ~1.5%, are aiding the bid in AUD at the margins.

- Kiwi is ~0.7% firmer, NZD/USD last prints at $0.6235/45. The 20-Day EMA ($0.6211) was breached in early dealing and the pair extended gains through the session.

- USD/JPY is ~0.5% softer, the pair prints at ¥133.05/155. The move away from session highs in US Yields have aided the strength in JPY. The bid extended on headlines that the BOJ and Japanese Govt will meet on markets after SVB.

- Elsewhere NOK and SEK are both firmer, both up ~0.7%.

- Cross asset wise; 10-Year US Treasury Yields are ~2bps lower. The Hang Seng is up ~2%, S&P500 e-minis are lagging the bid in Asian equities up ~0.1%.

- In Europe today the final read of Eurozone CPI headlines an otherwise thin docket. Further out US Industrial Production and UofMich consumer sentiment will cross.

FX OPTIONS: Expiries for Mar17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.2bln), $1.0660-80(E1.7bln), $1.0690-10(E5.1bln), $1.0775(E1.4bln)

- USD/JPY: Y130.00($3.3bln), Y130.92-00($937mln), Y132.00($1.7bln), Y133.00-10($2.0bln), Y133.60-68($698mln), Y134.00-20($1.2bln), Y134.90-00($1.5bln)

- EUR/JPY: Y131.00(E1.0bln)

- AUD/USD: $0.6580(A$831mln), $0.6650(A$1.1bln), $0.6700(A$611mln)

- USD/CNY: Cny6.8500($1.5bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/03/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 17/03/2023 | 0930/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 17/03/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 17/03/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/03/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/03/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 17/03/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.