-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: U.S. Banks & Fiscal Matters Still Dominate

EXECUTIVE SUMMARY

- BANK TURMOIL SEEN CRIMPING CREDIT AT DOUBLE POWELL’S ESTIMATE (BBG)

- FIRST REPUBLIC FACES POTENTIAL CURB ON BORROWING FROM FED (BBG)

- HOUSE GOP NARROWLY PASSES BILL TO RAISE DEBT LIMIT AND CUT SPENDING; WHITE HOUSE CALLED IT 'RANSOM' (ABC)

- EU REFORMS OF FISCAL RULES HIT RESISTANCE AMONG BIG CAPITALS (FT)

- CHINA BORROWING COSTS SEEN STAYING LOW IN 2Q (CSJ)

- IRAQ’S PAY DISPUTE WITH TURKEY KEEPS KURDISH OIL FROM FLOWING (BBG)

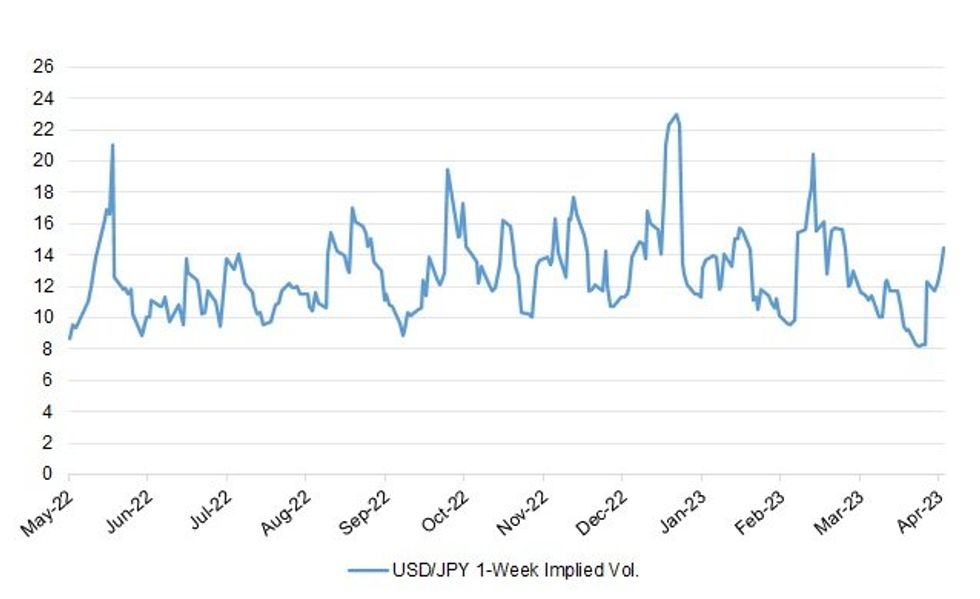

Fig. 1: USD/JPY 1-Week Implied Vol.

Source: MNI - Market News/Bloomberg

UK

POLITICS: This year's local elections, which take place on Thursday 4 May in most of England outside London, have long been billed as a tough first electoral test for Prime Minister Rishi Sunak. (BBC)

EUROPE

FISCAL: Brussels faced objections from the three biggest EU member states after proposing a sweeping overhaul of its debt and deficit rules on Wednesday, as capitals questioned its attempt to strike a balance between strengthening public finances and boosting investment. (FT)

FINLAND: Finland is closer to replacing a left-leaning cabinet with a coalition that would bring together parties from the fiscally conservative end of the political spectrum, including a far-right force, newspaper Helsingin Sanomat reported. (BBG)

U.S.

FED: US bank stress will tighten credit by twice as much as expected by Federal Reserve Chair Jerome Powell, said economists surveyed by Bloomberg, tipping the economy into recession. Almost all of the economists expect the Federal Open Market Committee to hike interest rates another quarter percentage point at its May 2-3 meeting, to a target range of 5% to 5.25%. (BBG)

FISCAL: House Republicans on Wednesday narrowly passed a bill to increase the nation's debt ceiling while cutting federal government spending -- and while the legislation has no prospect of becoming law, GOP leaders hope it will help force negotiations with Democrats. (ABC)

FISCAL: President Joe Biden said he’d be glad to sit down with House Speaker Kevin McCarthy to discuss raising the US debt ceiling — if McCarthy took default off the table. (BBG)

FISCAL: A U.S. default is highly unlikely, but negotiations around the debt ceiling are expected to be protracted, Daniel Ivascyn, chief investment officer at U.S. bond giant Pacific Investment Management Co (PIMCO), said on Wednesday. (RTRS)

BANKS: US bank regulators are weighing the prospect of downgrading their private assessments of First Republic Bank — a move that may curb the troubled firm’s access to Federal Reserve lending facilities. (BBG)

BANKS: The authors of a widely circulated study that found an additional 186 U.S. banks at risk of meeting the same fate as that of Silicon Valley Bank are urging regulators to require banks to promptly raise hundreds of billions of dollars in equity capital to soothe solvency concerns. (MNI)

US TSYS: BlackRock has been buying U.S. Treasuries in anticipation of an economic slowdown and a protracted fight between the U.S. government and Congress around the debt limit, BlackRock Chief Investment Officer of Global Fixed Income Rick Rieder said on Wednesday. (RTRS)

EQUITIES: Meta shares jumped 12% in extended trading on Wednesday after the company reported an unexpected increase in sales for the first quarter and issued better-than-expected guidance for the current period. (CNBC)

OTHER

GLOBAL TRADE: Biden welcomed Yoon's "bold steps" toward improving the South Korea-Japan relationship, according to the statement. The two leaders agreed to continue close consultations on the Inflation Reduction Act (IRA) and the CHIPS and Science Act to ensure they encourage mutually beneficial corporate investment in the U.S. amid concerns of South Korean businesses. (Yonhap)

U.S./CHINA: U.S. Commerce Secretary Gina Raimondo said on Wednesday that Chinese cloud computing companies like Huawei Cloud and Alibaba Cloud could pose a threat to U.S. security and vowed to review a request to add them to an export control list. (RTRS)

U.S./CHINA: Chinese police have visited the Shanghai offices of Bain & Company and questioned employees at the US management consulting firm, in the latest case of heightened scrutiny of foreign businesses in China as tensions between Beijing and Washington rise. (FT)

CHINA/TAIWAN: Multinational corporations are inserting clauses related to China-Taiwan tensions into commercial contracts as fears rise regarding possible Chinese action around the democratically ruled island. (Nikkei)

BOJ: Bank of Japan Governor Kazuo Ueda is expected to leave overall monetary stimulus unchanged at his first policy meeting Friday, with investors focused on what might be his opening changes after the BOJ’s first leadership transition in a decade. (BBG)

BOJ: Former Bank of Japan Deputy Governor Masazumi Wakatabe discusses the central bank’s monetary policy and says he’d be “very surprised if the BOJ changes the YCC.” (BBG)

NEW ZEALAND: New Zealand prime minister Chris Hipkins is shrinking ambitions and expectations ahead of the next budget, promising an “orthodox, no-frills budget” focused on cost of living and economic expansion. (Guardian)

SOUTH KOREA: U.S. President Joe Biden and South Korean President Yoon Suk Yeol upgraded their commitment to cooperate on maintaining stability in foreign exchange markets at a summit on Wednesday, a senior South Korean economic official said. (RTRS)

NORTH KOREA: The United States on Wednesday pledged to give South Korea more insight into its nuclear planning over any conflict with North Korea amid anxiety over Pyongyang's growing arsenal of missiles and bombs. (RTRS)

NORTH KOREA: The US, Japan and S. Korea are considering holding a 3-way summit meeting on May 21, the final day of the G-7 Hiroshima Summit, the Yomiuri newspaper reports, citing several unidentified Japanese officials. (BBG)

SINGAPORE: Singapore is raising property taxes in a bid to cool its red-hot housing market, amid mounting concern that an influx of wealth into the city-state is hurting affordability for locals and its competitiveness as a financial hub. (BBG)

ASIA: Asia’s developing economies have seen “very robust” growth but face risks from tightening global financial conditions due to rapid U.S. and European interest rate hikes, Asian Development Bank (ADB) President Masatsugu Asakawa said on Thursday. (RTRS)

BOC: Bank of Canada officials discussed raising interest rates before the April 12 decision to pause and concluded there wasn't enough evidence to justify further tightening, while arguing a rate cut that some investors predict for later this year is not the most likely policy outcome. (MNI)

TURKEY: Turkish President Tayyip Erdogan canceled his scheduled campaign rallies on Wednesday and Thursday for health reasons, weeks before May 14 presidential and parliamentary elections. (RTRS)

TURKEY: Turkey’s state-run energy importer Botas says it has been able to obtain the necessary FX for gas purchases via state lenders and authorized financial institutions within the scope of the protocol signed with the central bank and the Finance Ministry. (BBG)

MEXICO: Mexico President Andres Manuel Lopez Obrador said in a video that he’s fine and working amid his third positive Covid-19 diagnosis, in his first public appearance since Sunday. (BBG)

BRAZIL: A decision by Brazil’s Superior Court of Justice limiting the deduction of ICMS tax benefits of the Corporate Income Tax and Social Contribution on Net Income calculation base was exemplary, Finance minister Fernando Haddad told journalists this Wednesday. (BBG)

BRAZIL: Brazil's Supreme Court Justice Andre Mendonca on Wednesday determined the suspension of a judgment regarding tax benefits in the country's top appeals court that, according to the government, are costing the federal government around 88 billion reais ($17 billion) annually. (RTRS)

RUSSIA: Chinese President Xi Jinping spoke to Ukraine's Volodymyr Zelenskiy on Wednesday for the first time since Russia's invasion of Ukraine, fulfilling a longstanding goal of Kyiv which had publicly sought such talks for months. Zelenskiy, describing the hour-long phone call as "long and meaningful", signalled the importance of the chance to open closer relations with Russia's most powerful friend, naming a former cabinet minister as Ukraine's new ambassador to Beijing. (RTRS)

RUSSIA: Russia's weekly consumer prices rose at a faster pace in the week to April 24, data from state statistics service Rosstat showed on Wednesday, cementing expectations that the central bank will keep interest rates on hold on Friday. (RTRS)

RUSSIA: Russian industry unexpectedly rebounded for the first time in a year, as sectors associated with military production delivered strong performances amid rising spending on the invasion of Ukraine. (BBG)

RUSSIA/OIL: The Russian government is discussing changes to subsidies for oil refineries, Deputy Prime Minister Alexander Novak said on Wednesday. (RTRS)

COLOMBIA: Colombia’s finance minister José Antonio Ocampo was ousted by leftist president Gustavo Petro on Wednesday amid a reshuffle of ministers and the breakdown of his governing coalition in congress. (FT)

EQUITIES: South Korean electronics giant Samsung’s operating profit plunged in the first quarter as prices for its memory chips continued to fall and demand remained weak. (CNBC)

OIL: Iraq needs to resolve billions of dollars in financial claims with Turkey before resuming oil exports via a Mediterranean port, threatening more delays in bringing almost half a million barrels a day back to the market. (BBG)

FOREX: Argentina will start to pay for Chinese imports in yuan rather than dollars, the government announced Wednesday, a measure that aims to relieve the country's dwindling dollar reserves. (RTRS)

CHINA

PBOC/BANKS: Analysts expect the People’s Bank of China to guide down interest rates on loans further, targeting key and weak sectors through its structural monetary tools, with a cut to the reserve requirement ratio in Q3 or Q4 to lower lenders’ funding costs possible, China Securities Journal reported. (MNI)

ECONOMY: China's job market remains tough, and it is becoming especially hard for college graduates to find jobs, vice Human Resources minister Yu Jiadong said on Thursday. (RTRS)

ECONOMY: China plans to add one million jobs for young people in 2023 as its unemployment ratio jumped to a record high, China Business Network reported citing a circular issued by the State Council. (MNI)

ECONOMY: China’s electricity consumption is likely to jump 6% to 8% year-on-year in 2023, creating the possibility of power shortages, Shanghai Securities News reported, citing analysts. (BBG)

BANKS: China commercial banks' profits suffered in Q1 due to higher interest rates on loans, a surge in deposits and the slow recovery of financial markets, 21st Century Business Herald reported on Wednesday. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY59 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) conducted CNY93 billion via 7-day reverse repos on Thursday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY59 billion after offsetting the maturity of CNY34 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at month end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1032% at 09:30 am local time from the close of 2.0551% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Wednesday, the same as the close on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9207 THURS VS 6.9237 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9207 on Thursday, compared with 6.9237 set on Wednesday.

OVERNIGHT DATA

CHINA MAR INDUSTRIAL COMPANIES' PROFIT -19.2% Y/Y

CHINA MAR INDUSTRIAL COMPANIES' PROFIT -21.4% YTD Y/Y; FEB -22.9%

JAPAN FEB, F LEADING INDEX 98.0; PRELIM 97.7; JAN 96.7

JAPAN FEB, F COINCIDENT INDEX 98.6; PRELIM 99.2; JAN 96.1

AUSTRALIA Q1 EXPORT PRICES +1.6% Q/Q; MEDIAN -2.6%; Q4 -0.9%

AUSTRALIA Q1 IMPORT PRICES -4.2% Q/Q; MEDIAN +0.5%; Q4 +1.8%

NEW ZEALAND APR ANZ BUSINESS CONFIDENCE -43.8; MAR -43.4

NEW ZEALAND APR ANZ BUSINESS ACTIVITY OUTLOOK -7.6; MAR -8.5

April saw fairly flat activity indicators but falling inflation signals on the whole, consistent with the RBNZ gradually gaining traction. That said, it’s far from “job done” with the proportion of firms experiencing high costs and intending to raise prices still problematically high. The key themes of the April survey: Retail and agriculture respondents were generally more upbeat in April, while construction, manufacturing and services firms were more of a mixed bag. In levels terms, everyone’s downbeat. Headline inflation and pricing indicators eased further, with a clear turn downwards now evident in all three series, consistent with the RBNZ’s inflation forecast. That said, they all remain far too high. (ANZ)

SOUTH KOREA MAY MANUFACTURING CONFIDENCE 72; APR 69

SOUTH KOREA MAY NON-MANUFACTURING CONFIDENCE 76; APR 75

MARKETS

US TSYS: Curve Marginally Steepens In Asia

TYM3 deals at 115-15, -0-02+, with an observed 0-05 range on volume of ~53k

- Cash tsys sit 1.5bps richer to flat across the major benchmarks, light bull steepening has been observed.

- Tsys were richer in early dealing as Asia participants faded Wednesdays moderate cheapening perhaps using the opportunity to enter fresh long positions/close out shorts.

- A block trade in FV, 2k lots, added an additional level of support and tsys marginally extended gains.

- There was little follow through on the move higher and gains were marginally pared.

- Little meaningful macro news flow crossed through the session.

- There is a thin data calendar in Europe today, with the final read of Eurozone Consumer Confidence providing the highlight. Further out we have Advance US GDP and Initial Jobless Claims. We also have the latest 7 Year Supply.

JGBS: Futures Sitting Mid-Range, Push Off Overnight High

JGB futures are currently sitting in the middle of their range, -2 compared to settlement levels. This afternoon, JGB futures experienced some cheapening, likely due to the reversal of early Asia-Pacific strength in US Tsys.

- The JBM3 is currently trading at 148.02, which is higher than the range of 147.40-147.92 that it has been trading in since early April. Attention remains on 149.53, the March 22 high, according to MNI’s technical analyst.

- With few domestic drivers today, the local market has traded in a tight range ahead of the BoJ Decision tomorrow. The consensus view is that there will be no major policy changes due to Governor Ueda's recent appointment, existing BoJ forward guidance, the BoJ's view on inflation, and concerns about the US banking sector. There may be a small change to forward guidance by removing the reference to COVID-19.

- Cash JGBs twist steepen pivoting at the 7-year zone with yields -0.7bp lower to 0.5bp higher. The benchmark 10-year yield is flat at 0.465%, below the BoJ's YCC limit of 0.50%.

- Swap spreads are wider across the curve with the swaps curve bear steepening.

- The local data calendar sees the release of Tokyo CPI, Retail Sales and Industrial Production tomorrow, ahead of the BoJ Policy Decision.

AUSSIE BONDS: Weaker, At Cheaps, Tracking US Tsys

ACGBs sit weaker (YM -4.0 & XM -5.0) at or near session cheaps as US Tsys pare early Asia-Pac strength. Without any tier-one economic data or meaningful headlines, the local market appeared happy to track US Tsys.

- Cash ACGBs are 4-5bp cheaper with the AU-US 10-year yield differential unchanged at -10bp.

- Swap rates are 3bp higher with EFPs 1bp tighter.

- Bills pricing is -4 to -5 across the strip.

- RBA dated OIS pricing is flat to 3bp firmer across meetings with November leading.

- Trade data surprised on the upside with Export Prices +1.6% Q/Q and Import Prices -4.2% Q/Q versus expectations of -2.6% and +0.5% respectively.

- NSWTC priced today A$2.5bn of the new 4.25% 20 February 2036 benchmark bond via syndication after yesterday's launch. Joint lead managers for the transaction were Commonwealth Bank of Australia, UBS and Westpac.

- The local calendar is relatively light ahead of the RBA Decision Meetings on Tuesday with the release of Private Sector Credit and PPI data tomorrow as the highlights.

- Accordingly, the local market will likely seek guidance from US Tsys through the release of Q1 GDP later today and the March PCE Deflator tomorrow.

NZGBS: Weaker, Off Cheaps, Outperforms $-Bloc

NZGB benchmarks closed 2-3bp higher, off session cheaps, after weekly supply showed decent demand (cover ratios of 3.34-3.74). Yields were as much as 1.5bp lower post-auction. NZ/US and NZ/AU 10-year yield differentials both closed 2bp tighter.

- Swap rates closed 5-6bp higher with implied swap spreads wider.

- RBNZ dated OIS closed flat to 3bp firmer across meetings.

- Prime Minister Chris Hipkins, in a pre-Budget speech, has announced that the government will not impose a levy to pay for the recovery from recent natural disasters. The estimated costs of these disasters are between NZ$9-14.5bn, and the government will fund the recovery through a combination of operating and capital allowances, savings, reprioritizations, and some debt. The upcoming budget (May 18) will not introduce any major new taxes, such as a wealth tax or capital gains tax.

- ANZ business activity indicators remained stable in April while inflation signals decreased, indicating progress for the RBNZ. However, a significant percentage of firms continue to experience high costs and intend to raise prices, suggesting that the RBNZ has more work to do.

- With the Antipodean calendar light for the remainder of the week, the local market will likely be guided by US Tsys as they navigate Q1 GDP later today and the March PCE Deflator tomorrow.

EQUITIES: Mixed Trends In Asia Pac, Higher Nasdaq Futures Aid Tech Sensitive Plays

Asia Pac equities are mixed, with the major indices not showing definitive trends through the course of the session. HK/China shares are modestly higher. US futures are once again firmer, led once again by the tech side, with Nasdaq futures around +0.60% higher at this stage, buoyed by better earnings guidance from Meta late on Wednesday in the US.

- The CSI 300 is +0.11% at this stage, still comfortably below the 200-day MA, but showing some signs of stability. The index was weaker in earlier trading. Strength has been evident in the insurance sector on better earnings.

- The HSI is a touch higher, despite negative headwinds from the tech sub-index (last -0.84%).

- Singapore stocks are down 0.50%, weighed by the property sector, as the government announced it was increasing stamp duty for second home buyers and foreigners purchasing local property.

- The Kospi and Taiex are firmer by 0.25-0.35% respectively. Positive Nasdaq futures are helping, with Korean markets recovering from earlier losses after Samsung's Q1 earnings disappointed.

- The ASX 200 is down 0.50%, an underperformer as local banks struggled. The Topix is up 0.25% at this stage.

- In SEA Thai stocks are down over 1%, while Indonesia stocks are +0.80%, continuing yesterday's solid rebound. Hopes of positive earnings momentum the driver of the JCI.

GOLD: Bullion Higher As Fed Pause Expectations Grow Given Latest Banking Woes

Gold has continued to struggle to hold onto gains above $2000/oz. Today during APAC trading it has risen through that level but is currently trading just below. Gold is up 0.5% to $1999.182, close to the intraday high of $2000.96, after falling 0.4% on Wednesday despite the USD index also dropping 0.4%.

- Gold has benefited from flight to quality flows today as speculation grew that the Fed will have to pause given the most recent US banking troubles. Today and tomorrow’s data should be key in shaping the Fed outlook.

- First Republic’s earnings were significantly worse than expected and US regulators are now considering whether to impose borrowing restrictions on the troubled bank, according to Bloomberg.

- Later there is important US Q1 GDP data which is expected to rise 1.9% q/q saar. The price components are also likely to be watched closely and the core PCE price index is forecast to rise 4.7% q/q saar – more than Q4’s 4.4%. There are also jobless claims and pending home sales for March.

OIL: Crude Stabilises But Struggling With Global Uncertainties

Oil prices have stabilised during APAC trading today after slumping around 3.5% on Wednesday, supported by more positive equity sentiment as S&P e-minis increase 0.3%. WTI is flat at $74.40/bbl while Brent is 0.3% higher to $77.90. The USD index is down slightly.

- Prices are about 4.5% lower this week, as crude has struggled given renewed concerns around the US banking system and the possible impact it will have on US and global growth. The market has also become less worried about supply following shipping indicators pointing to robust Russian exports. Today and tomorrow’s US data are likely to influence oil prices given that they should be key in shaping the Fed outlook.

- Declining refining margins and uncertainty regarding the economic situation in China, the Fed outlook and output from Russia continue to dampen oil prices.

- Later there is important US Q1 GDP data which according to Bloomberg is expected to rise 1.9% q/q saar. The price components are also likely to be watched closely and the core PCE price index is forecast to rise 4.7% q/q saar – more than Q4’s 4.4%. There are also jobless claims and pending home sales for March and the European Commission survey for April.

FOREX: NZD Firmer In Asia, Moves Limited Elsewhere

Kiwi is the best performer in the G-10 space at the margins on Thursday. NZD/USD is ~0.3% firmer. Elsewhere in G-10 moves have been limited with little follow through.

- NZD/USD prints at $0.6130/35, the pair has firmed through today's Asian session after printing a 6 week low yesterday. NZ Treasury noted that recent floods and cyclone events will add 0.4% to Q1 and Q2 inflation.

- AUD/USD is ~0.1% firmer, the pair has consolidated in a narrow above $0.66 handle on Thursday. Q1 Export prices rose 1.6%, fall of 2.6% Q/Q had been expected and Import prices fell -1.2% Q/Q a rise of 0.3% had been expected.

- Yen is little changed from yesterday's closing levels. USD/JPY has dealt in a narrow 30 pip range for the most part, last printing at ¥133.65/75. Support comes in at ¥133.09 low from Apr 26, Resistance is at ¥134.47 high from Apr 25.

- Elsewhere in G-10 the greenback is a touch pressured, BBDXY is down ~0.1% however there has been little follow through on moves thus far.

- Cross asset wise; E-minis are ~0.2% firmer and US Treasury Yields are little changed across the curve.

- On the wires today we have Eurozone Consumer Confidence, Advance US GDP and Initial Jobless Claims.

FX OPTIONS: Expiries for Apr27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0750(E1.1bln), $1.0830(E635mln), $1.0900(E723mln), $1.0975(E585mln), $1.1000(E779mln), $1.1040(E1.1bln), $1.1125-26(E650mln)

- USD/JPY: Y135.00($1.2bln)

- GBP/USD: $1.2390-10(Gbp743mln), $1.2425-39(Gbp633mln)

- USD/CAD: C$1.3565-80($1.0bln)

- USD/CNY: Cny6.9500-20($770mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/04/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 27/04/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/04/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/04/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 27/04/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 27/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 27/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/04/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 27/04/2023 | 1230/0830 | *** |  | US | GDP |

| 27/04/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 27/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 27/04/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 27/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/04/2023 | 1615/1815 |  | EU | ECB Panetta at EACB Board Meeting | |

| 27/04/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 27/04/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.