-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: U.S. Fiscal Matters & Brexit Headline Ahead Of FOMC

EXECUTIVE SUMMARY

- UK DROPS PUSH FOR RENATIONALISING OF FISHING VESSELS IN BREXIT TALKS (GUARDIAN)

- MPS PUT ON STANDBY AS HOPES FOR BREXIT TRADE DEAL RISE (FT)

- MCCONNELL SAYS CONGRESS NOT LEAVING WITHOUT COVID RELIEF PACKAGE (BBG)

- MSCI TO DELETE CHINESE COS. IN TRUMP ORDER FROM GIMI INDEXES (BBG)

- CHINA REDUCES ITEMS ON THE NEGATIVE LIST FOR MARKET ACCESS (RTRS)

- AUSTRALIA REFERS CHINA TO WTO OVER BARLEY TARIFFS (ABC)

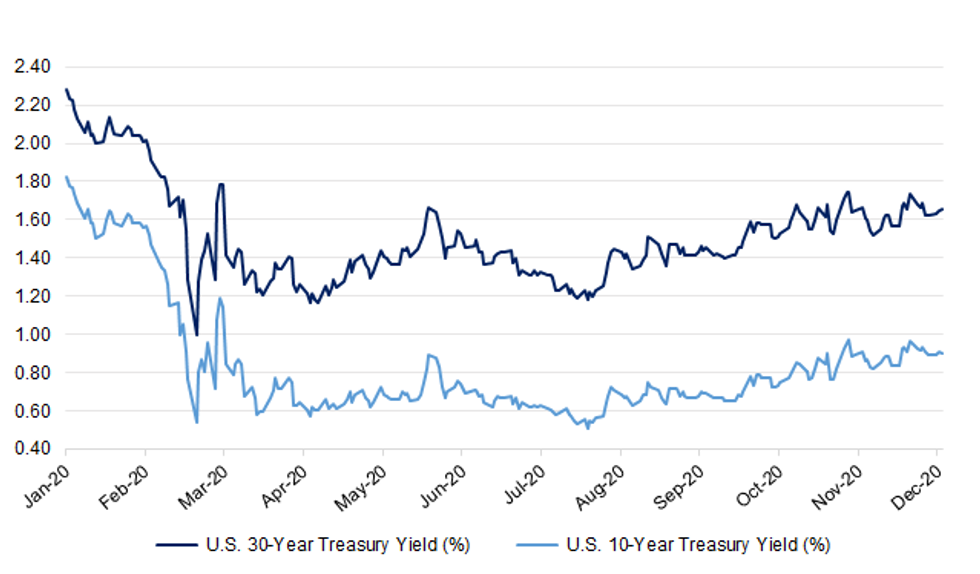

Fig. 1: U.S. 10- & 30-Year Treasury Yields

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Downing Street has watered down a key demand over post-Brexit fishing rights as part of a broader compromise, EU sources said as Germany's ambassador in Brussels said there was a chance of a deal by the weekend. The UK dropped a push for fishing vessels operating under the UK flag to be majority British-owned in the future, it was claimed. (Guardian)

BREXIT: The taoiseach has said he is increasingly hopeful that the EU and UK can reach an agreement to secure a trade deal. Micheál Martin said yesterday that both parties had engaged in talks in a "constructive way" in recent days. "My focus and view of that at the moment is that it's important that both get it right and that they concentrate on getting a deal," he told the Dáil. "Then subsequent to that, if they can get a deal over the line, it's a matter for member states to work out how we deal with that procedure." (The Times)

BREXIT: The prospects for having a Brexit trade accord between the U.K. and the European Union by the end of the year are "relatively positive" at the moment, Portuguese Foreign Affairs Minister Augusto Santos Silva said. "The points in which there is still divergence are well identified, and the two sides have demonstrated the will to continue negotiating until they are able to reach an agreement, or until they have to conclude that an agreement is impossible," Santos Silva said in an interview in Lisbon late Tuesday night. "We'll see." (BBG)

BREXIT: An ITV reporter tweeted the following on Tuesday: "Brussels source on flurry of speculation about a possible Brexit trade deal: "We are not there yet by any stretch of the imagination". Negotiations roll on..." (MNI)

BREXIT: British MPs have been put on standby for an extended House of Commons sitting next week, with hopes rising at Westminster that a post-Brexit trade deal with the EU could be ready for approval before Christmas. Downing Street and European diplomats insist negotiations are still stuck in key areas; one ally of Boris Johnson said there was "certainly no breakthrough" and that no-deal was still the most likely outcome. (FT)

BREXIT: MPs may not vote on any Brexit deal until next year, after it has come into force, Jacob Rees-Mogg has suggested. Parliament could be asked to "retrospectively correct" domestic law to recognise the agreement, with the New Year's Eve deadline fast approaching, the Commons Leader said. (Independent)

BREXIT: A stand-off between peers and the government over the future operation of the UK internal market post-Brexit has ended after ministers brought forward concessions. Following an extended tussle with the House of Lords, the executive has agreed changes to legislation, which will ensure future flexibility for the devolved administrations. The ending of parliamentary ping-pong with the Commons paves the way for the UK internal market bill to become law. (Guardian)

BREXIT: The UK is drawing up plans to turn London into a rival for Singapore as a hub for shipping companies to register their vessels following the end of the Brexit transition period, according to people briefed on the proposals. Industry bodies and unions have been canvassed over the reform of the shipping industry's so-called tonnage tax after January 1 2021, when the UK is no longer subject to the EU's state aid regime on subsidies. (FT)

CORONAVIRUS: Boris Johnson is resisting demands to "cancel Christmas", claiming it is too late to change plans to allow families to meet up during a five-day relaxation of COVID rules. He will face MPs in the Commons and later address Tory backbenchers and declare his opposition to dropping plans for three households to meet up from December 23 to 27. But the prime minister is expected to urge people to self-isolate before joining up with other households and the government is poised to issue tougher guidance for the festive period. (Sky)

FISCAL: Rishi Sunak could be forced to extend the taxpayer-funded furlough scheme beyond March after a record spike in redundancies, experts have warned. (Telegraph)

FISCAL: Taxpayers are facing a hit of up to £26 billion because the government failed to "strike the right balance" between rescuing companies and protecting the public purse with an emergency loan scheme, MPs have warned. The public accounts committee said that the bounce back loan scheme had been set up with "no business case", had distorted the small business lending market in favour of big banks and that debt recovery plans remained "woefully underdeveloped". (The Times)

FISCAL: The UK is pushing ahead with sweeping reforms of the way specialist vehicles used by private equity and infrastructure funds are taxed as the government seeks to bolster the country's appeal as an asset management hub at the end of the post-Brexit transition period. (FT)

HOUSING: Robert Jenrick will today abandon an algorithm that would have dramatically increased housebuilding in the Conservatives' southern heartlands. England's 20 biggest cities will instead take a larger share of new homes under revised plans drawn up by the housing secretary after a backlash from Conservative MPs including Theresa May. (The Times)

EUROPE

ECB: The European Central Bank decided on Tuesday to let banks pay out part of their cumulated 2019-2020 profits to shareholders if they have enough capital, easing a blanket ban on dividends and buybacks set during the first wave of the coronavirus crisis. The euro zone's top banking watchdog was still asking banks to be prudent so to preserve capital for a wave of unpaid loans that could reach 1.4 trillion euros ($1.70 trillion). But it is now making room for some small payouts from the healthiest banks, heeding calls from disgruntled bankers and investors as the economic outlook improves. (RTRS)

CORONAVIRUS: The European Commission is planning to exercise options to buy 180 million additional doses of coronavirus vaccine, German magazine Der Spiegel reported on Tuesday. The Commission is planning to buy 80 million additional doses from U.S. manufacturer Moderna and 100 million from German company BioNtech and its U.S. partner Pfizer, Spiegel reported. (RTRS)

GERMANY: Germany's health minister said on Tuesday he hopes that a COVID-19 vaccine will get European Union approval before Christmas and that first inoculations can start before the end of the year.Jens Spahn also confirmed the goal of a joint European Union approval. "We want a regular approval, not an emergency approval," he said at a press conference. (RTRS)

FRANCE: France's rolling seven-day average of new cases fell below 12,000 on Tuesday, marking a second day of pause after rising for most of last week. Hospitalizations fell for the first time in four days, health authorities reported. The seven-day average of deaths linked to the virus fell to the lowest since early November. (BBG)

ITALY: Italy may tighten restrictions over Christmas to limit the spread of COVID-19 infections, Prime Minister Giuseppe Conte said on Tuesday as he urged Italians to avoid "irresponsible" gatherings during the holiday period. (RTRS)

PORTUGAL: Portuguese airline TAP's restructuring plan includes losses for creditors, namely aircraft leasing companies, Infrastructure Minister Pedro Nuno Santos says in parliament. (BBG)

U.S.

FED: Fed Preview - December 2020: Reasons To Wait

- The FOMC is likely to adopt new guidance on asset purchases at the December FOMC, but will fall short of adjusting its purchase program in either scope or size, preferring to wait for further clarity over the outlook before taking such a step. While an increase in the weighted average maturity of the Fed's asset purchases is not the consensus outcome from this meeting, it is expected by some market participants – setting up the potential for a hawkish disappointment on Wednesday - on email now - for more details please contact sales@marketnews.com.

ECONOMY: MNI REALITY CHECK: US Nov Sales To Fall; First Since April

- U.S. retail sales likely fell in November for the first time since bottoming out in April, figures due Wednesday should show, as surging Covid-19 infections trigger renewed business restrictions and dampen consumer confidence, industry experts told MNI, although noting holiday spending may have helped dull the impact - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Congressional leaders closed in on an agreement to provide a new tranche of coronavirus relief on Tuesday, haggling deep into the night over how to spend hundreds of billions of dollars before adjourning for the year. "We're making significant progress and I'm optimistic that we are going to be able to complete an understanding some time soon," said Senate Majority Leader Mitch McConnell (R-Ky.) as he left the Capitol after a day of furious negotiating. "We're getting closer." (POLITICO)

FISCAL: The bipartisan group of senators working on an economic stimulus deal have received assurances from Senate GOP leadership that their $748 billion proposal will be used as the framework for a relief package that Congress hopes to pass by the end of the week, Sen. Joe Manchin (D-W.Va.) tells the Axios Re:Cap podcast. (Axios)

CORONAVIRUS: The number of Americans hospitalised with Covid-19 rose for a 10th day running, setting another record high as states reported more than 2,900 further deaths.Unlike earlier outbreaks in the US, the autumn resurgence of coronavirus has affected nearly every state in the country, pushing hospitalisations and other metrics to record levels. (FT)

CORONAVIRUS: Pfizer will distribute 4 million doses of its Covid-19 vaccine next week following the initial 2.9 million doses the company shipped out this week, White House press secretary Kayleigh McEnany told reporters during a briefing. (CNBC)

CORONAVIRUS: The Trump administration is discussing helping the drug maker get the raw materials it would need to produce tens of millions of extra doses of its Covid-19 vaccine in the spring. The Trump administration is negotiating a deal to use its power to free up supplies of raw materials to help Pfizer produce tens of millions of additional doses of its Covid-19 vaccine for Americans in the first half of next year, people familiar with the situation said. (New York Times)

CORONAVIRUS: A CNBC reporter tweeted the following on Tuesday: "Only 5-20% of available doses of #covid19 antibody drugs from Lilly and Regeneron are getting used each week, Operation Warp Speed's Moncef Slaoui just told me. They ship out about 65,000 doses a week." (MNI)

CORONAVIRUS: Health and Human Services Secretary Alex Azar told "The News with Shepard Smith" that most Americans can expect to get the coronavirus vaccine as soon as late February. "I believe by the end of February, the end of March, of course, depending on the decisions by our governors, but I believe we'll have enough supply out there to be reaching out to the general public for administration — at your CVS, Walgreens, Kroegers — by the end of February into March," Azar said. (CNBC)

CORONAVIRUS: The US Food and Drug administration on Tuesday authorised emergency use of the first over-the-counter self-testing Covid-19 antigen kit. (FT)

CORONAVIRUS: U.S. states and territories will get $140 million to prepare for Covid-19 vaccination campaigns and $87 million for tracking and testing, the U.S. Department of Health and Human Services said. The first Covid-19 shots are rolling out but the latest funding for distribution has been stalled with Congress unable to agree on a new stimulus package since the summer. State health officials have sought more than $8 billion to distribute hundreds of millions of doses of Covid-19 shots in the months ahead. (BBG)

CORONAVIRUS: The number of Americans taking road trips this Christmas is poised for a slump of as much as 25%, with most staying home amid soaring coronavirus cases, according to GasBuddy analyst Patrick DeHaan. (BBG)

CORONAVIRUS: Mayor Bill de Blasio suggested "right after Christmas" would be the best time to shutdown non essential business in New York City, which appears all but inevitable as coronavirus hospitalization rates continue to rise along with continued warnings from him and Governor Andrew Cuomo. (ABC)

POLITICS: Senate Majority Leader Mitch McConnell and his leadership team urged fellow Republicans on a conference call today not to participate in any efforts to object to certifying Joe Biden's presidential election win in the Jan. 6 joint session, two sources on the call tell Axios. (Axios)

POLITICS: A triumphant President-elect Joe Biden went down to Georgia on Tuesday, where he headlined a campaign rally for two Democratic Senate candidates in the state that handed him his biggest upset win of the 2020 presidential race. The drive-in rally in Atlanta was intended to benefit Democrats Jon Ossoff and Raphael Warnock, who are both facing incumbent Republican senators in runoff elections on Jan. 5. It was Biden's first campaign event as president-elect, coming just a day after the Electoral College certified his victory over President Donald Trump. (CNBC)

POLITICS: Facebook said Tuesday it will begin letting advertisers run ads targeting Georgia voters about the state's Jan. 5 runoff elections, starting Dec. 16 at 9am Pacific Time, even as its broader temporary political ad ban remains in place. (Axios)

POLITICS: A New York judge ruled on Tuesday that the Trump Organization must turn over documents to New York Attorney General Letitia James (D) as part of her office's probe into whether President Trump illegally inflated assets for financial gain. (The Hill)

POLITICS: President-elect Joe Biden is considering some well-known Republicans — think Meg Whitman types — for Commerce secretary as a way to signal to red-state Americans he understands their concerns and plans to address them. Biden's team is debating the political upside of an across-the-aisle pick, and it's still very possible the president-elect will settle on an all-Democratic Cabinet, according to people familiar with the matter. (Axios)

AIRLINES: Airlines would get $17 billion in U.S. government aid to recall furloughed workers and help cover payrolls through March under a bipartisan pandemic relief package unveiled in Congress on Monday that won immediate backing from an industry group. Airlines "enthusiastically support" the proposal, the trade group Airlines for America said in a press release. Carriers will attempt to bring back workers who have been laid off if it passes, "but that becomes increasingly challenging with each passing day," the group said. (BBG)

EQUITIES: A coalition of states is finishing an antitrust lawsuit against Google focused on its power in the online search market that could be filed as soon as Thursday, two people close to the probe said. The complaint — led by Colorado Attorney General Phil Weiser, a Democrat, and Nebraska Attorney General Doug Peterson, a Republican — is expected to allege that Google has altered the designs of its search engine to the disadvantage of rivals that offer specialized search results, two other people close to the investigation said. (POLITICO)

EQUITIES: Australia's competition regulator said on Wednesday it filed a court case against Facebook Inc for misleading consumers over the use of data collected by a now-discontinued mobile analytic app. The Australian Competition and Consumer Commission (ACCC) said the Onavo Protect mobile app, which Facebook ended in 2019, told customers it would keep their data private but it had instead been used by Facebook for research and identifying future acquisition targets. (RTRS)

OTHER

GLOBAL TRADE: China has further reduced the number of sectors and industries that are off-limits to both Chinese and foreign investors in its latest so-called negative list for market access. The 2020 list of industries that are either restricted or prohibited has been cut to 123, according to a document released by the National Development and Reform Commission on Wednesday, compared with 131 sectors on the 2019 list. Among the changes, foreign companies are now allowed to explore for, and produce, oil and gas in China. The restriction on foreign firms seeking to carry out carbon emission assessment in China was also lifted. Industries not on the list are open for investment to all and require no approval. (RTRS)

CORONAVIRUS: Clinical trials have started in the UK for a coronavirus vaccine being manufactured in West Lothian. The Valneva candidate vaccine will initially be tested on 150 volunteers at testing sites in Birmingham, Bristol, Newcastle and Southampton. It is being developed in Livingston and the UK government has pre-ordered 60 million doses. UK Business Secretary Alok Sharma said it was important to have a range of vaccines available. (BBC)

CORONAVIRUS: Pfizer rebutted comments by Florida Gov. Ron DeSantis that the company has had a "production issue" that's delaying deliveries of its vaccine to the state. "Pfizer hasn't had any production issues with our COVID-19 vaccine, and no shipments containing the vaccine are on hold or delayed," the company said. "We're continuing to dispatch our orders to the locations specified by the U.S. government." (BBG)

CORONAVIRUS: Fatigue, headaches and muscle pain are the most common side effects from Moderna's Covid-19 vaccine, along with some rare symptoms like intractable nausea or vomiting and facial swelling that are likely related to the shots, according to new data released Tuesday by the Food and Drug Administration. (CNBC)

HONG KONG: Hong Kong's government is planning to introduce HK$5b-HK$6b in relief measures for businesses hit hard by coronavirus-related social distancing measures, Sing Tao reports, citing unidentified people. The Legislative Council is expected to vote on the package next Monday. (BBG)

BOJ: In view of the situation regarding COVID-19, the Bank of Japan has decided to purchase around 6 billion U.S. dollar cash from the Ministry of Finance (Foreign Exchange Fund Special Account) in preparation for smoother execution of the Bank of Japan's operations, such as international financial cooperation and foreign currency supply to financial institutions. (BOJ)

JAPAN: Nishimura: Pausing `Go To' travel campaign over new year holidays to stem virus. (BBG)

JAPAN: Nishimura: nNow in phase of using fiscal policy to protect jobs. (BBG)

AUSTRALIA/CHINA: The Federal Government has confirmed it will appeal to the World Trade Organisation (WTO) over China's decision to impose huge tariffs on Australian barley earlier this year, threatening $2.5 billion of trade. It is the first time Australia has referred China to the independent umpire over an agricultural commodity. "This is the logical and appropriate next step for Australia to take," Trade Minister Simon Birmingham said. "We are highly confident that based on the evidence, data, and analysis that we have put together already, Australia has an incredibly strong case to mount in relation to defending the integrity and propriety of our grain growers and barley producers." (ABC)

NEW ZEALAND: New Zealand is expected to bounce back sooner from the impact of COVID-19 than previously thought, but large deficits and rising debt levels will have a lasting effect on the economy, the government said on Wednesday. The country's Treasury department predicted the budget deficit for the 2020/21 fiscal year to be NZ$21.58 billion, NZ$10.1 billion smaller than forecasts made in September. The GDP is expected to bounce back from its sharpest contraction on record in the second quarter to grow 10.5% in the September quarter, followed by further growth of 2.2% in the December quarter, according to the treasury's half-year economic and fiscal update. (RTRS)

SOUTH KOREA: South Korean authorities are reviewing the possibility of raising the social distancing to level 3 and are exchanging opinions with experts, health ministry official Yoon Tae-ho says in a briefing. The Asia nation reported a record 1,078 new coronavirus cases in 24 hours, up from 880 a day earlier, according to data from the Korea Disease Control and Prevention Agency's website. Total deaths rose by 12 to 616. (BBG)

CANADA: Canada will be receiving up to 200,000 more doses of the Pfizer-BioNTech vaccine next week and potentially up to 168,000 Moderna vaccine doses by the end of December. This means thousands more Canadians will be vaccinated before the end of the year. "Canada has secured our second agreement for early doses of COVID-19 vaccines," said Prime Minister Justin Trudeau on Tuesday, announcing that a second vaccine could be available for use in this country within days. (CTV)

BOC: MNI POLICY: BOC Says Q1 GDP May Fall, Blunts Vaccine Optimism

- Bank of Canada Governor Tiff Macklem on Tuesday said the economy could shrink again in the first quarter of next year as more people contract Covid-19, and cautioned against bringing forward too much optimism about vaccine breakthroughs. Gross domestic product may post either a small gain or a small decline between January and March, Macklem said at a press conference following a speech. Growth this quarter will likely surpass the 1% gain the BOC had projected in October based on momentum from recent data, he said - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

CANADA: Quebec Premier Francois Legault says closures of non-essential retailers from Dec. 25 to Jan. 11 will help break the second wave of Covid-19 infections and ease the burden on hospitals. Retailers that remain open won't be allowed to sell non-essential goods. (BBG)

MEXICO: Mexico's Finance Minister Arturo Herrera said on Tuesday the decision by lawmakers to delay debating a controversial new central bank law was a "correct measure". Herrera said on Twitter the delay offers a chance for a deeper and more technical debate about a law that Mexico's central bank and some lawmakers within the ruling National Regeneration Movement (MORENA) have strongly opposed. (RTRS)

MEXICO: Mexico's state-oil giant Petroleos Mexicanos (Pemex) said on Tuesday it carried out a debt operation that would allow it to cover short-term financial liabilities worth 96 billion pesos ($4.85 billion). The operation will give the ailing oil company some relief over the coming months, but it still needs to find billions of dollars more over the coming years to repay bond holders. "This financial operation is part of a set of steps Pemex took since the beginning of the COVID-19 crisis to mitigate the drop in income while not increasing public debt beyond the ceiling approved by the federal congress," it said in a statement. (RTRS)

BRAZIL: Congressmen Baleia Rossi and Aguinaldo Ribeiro are the most likely to be chosen as successor candidates by current Lower House speaker Rodrigo Maia, he told journalists in Brasilia. Maia said he was not concerned over the delay in picking a candidate to compete with Congressman Arthur Lira, an ally of President Jair Bolsonaro, in the February election for a new lower house speaker. The important thing is that the chosen name gets the broadest support among lawmakers, Maia said. Decision to be announced by the end of this week. Candidate chosen must guarantee lower house's independence from the government, defend a liberal agenda in the economy and respect minorities. (BBG)

MIDDLE EAST: The Saudi-led coalition fighting in Yemen said on Tuesday it intercepted and destroyed an explosive-laden drone launched by Iran-aligned Houthis towards the kingdom, Saudi state TV reported. (RTRS)

SAUDI ARABIA: The Kingdom of Saudi Arabia is on a hiring spree for lobbyists as President-elect Joe Biden, who has signaled that he will take a tougher stance with the nation, prepares to take office. With the potential for a more turbulent relationship with the U.S., Saudi Arabia has been hiring some lobbyists with ties to Republican congressional leaders. (CNBC)

OIL: Iran has circumvented U.S. sanctions and exported more oil to China and other countries in recent months, providing a lifeline for its struggling economy and undermining the Trump administration's so-called maximum pressure campaign against Tehran. The scale of Iran's petroleum sales is difficult to gauge, given their often covert nature. Several firms that monitor the global oil trade say shipments from Iran have roughly doubled from the low levels seen earlier this year, although estimates vary widely.On the high end, U.S.-based TankerTrackers.com, which uses satellite imagery to follow deliveries, estimated Iranian crude oil exports hit 1.2 million barrels a day over the fall, up from 481,000 barrels a day in February. (WSJ)

OVERNIGHT DATA

JAPAN NOV TRADE BALANCE +Y366.8BN; MEDIAN +Y522.5BN; OCT +Y871.7BN

JAPAN NOV EXPORTS -4.2% Y/Y; MEDIAN +0.4%; OCT -0.2%

JAPAN NOV IMPORTS -11.1% Y/Y; MEDIAN -9.5%; OCT -13.3%

JAPAN DEC, P JIBUN BANK MANUFACTURING PMI 49.7; NOV 49.0

JAPAN DEC, P JIBUN BANK SERVICES PMI 47.2; NOV 47.8

JAPAN DEC, P JIBUN BANK COMPOSITE PMI 48.0; NOV 48.1

The Japanese private sector continued to struggle in December, with flash PMI survey data signalling a further deterioration in business activity in the final month of the year. New orders also declined amid a further reduction in new export orders. "One positive note was private sector businesses in Japan recording the softest rate of job shedding in ten months, as overall employment levels only reduced fractionally. Manufacturing staffing levels even ticked higher. Despite the short-term disruption caused by a resurgence in coronavirus disease 2019 (COVID-19) cases, Japanese private sector businesses were optimistic that business conditions would improve in the year-ahead. Positive sentiment stemmed from the expectation that there would be an end to the pandemic which would fuel both domestic and international demand. Nevertheless, uncertainty surrounding the timing and pace of the economic recovery resulted in a softening of expectations. (IHS Markit)

AUSTRALIA NOV WESTPAC LEADING INDEX +0.46% M/M; OCT +0.30%

AUSTRALIA DEC, P IHS MARKIT MANUFACTURING PMI 56.0; NOV 55.8

AUSTRALIA DEC, P IHS MARKIT SERVICES PMI 57.4; NOV 55.1

AUSTRALIA DEC, P IHS MARKIT COMPOSITE PMI 57.0; NOV 54.9

Not only was the Australian economic recovery sustained in December, but growth also gathered momentum as the loosening of COVID-19 restrictions underpinned further improvements in demand for goods and services. As such, private sector output expanded at the quickest pace in five months. The preliminary PMI results also brought good news regarding employment. Both goods producers and service providers continued to hire extra staff, the former to the greatest extent in close to three years. News of vaccine development and hopes that COVID-19 worries will fade underpinned upbeat growth projections towards the year-ahead outlook for business activity. Private sector companies were at their most optimistic in over two years. One area that failed to improve was exports, with stricter lockdown measures in some nations, border controls and travel restrictions continuing to restrict external demand for Australian goods and services. The latest fall in international sales was the eleventh in successive months. (IHS Markit)

NEW ZEALAND Q3 BOP CURRENT ACCOUNT BALANCE -NZ$3.521BN; MEDIAN -NZ$3.860BN; Q2 +NZ$1.909BN

SOUTH KOREA NOV UNEMPLOYMENT RATE S/A 4.1%; MEDIAN 4.2%; OCT 4.2%

SOUTH KOREA NOV EXPORT PRICE INDEX -4.9% Y/Y; OCT -6.2%

SOUTH KOREA NOV EXPORT PRICE INDEX -0.8% M/M; OCT -2.4%

SOUTH KOREA NOV IMPORT PRICE INDEX -10.6% Y/Y; OCT -11.2%

SOUTH KOREA NOV IMPORT PRICE INDEX -0.3% M/M; OCT -2.2%

CHINA

CORONAVIRUS: A Chinese drugmaker has secured 100 million doses of the coronavirus vaccine co-developed by Pfizer Inc. and BioNTech SE, as the country seeks overseas shots in addition to home-made ones to ensure immunization for the world's most populous nation. (BBG)

POLICY: China may stabilize the macro leverage ratio to better resolve risks from shadow banking, real estate and fintech companies, the 21st Century Business Herald reported citing analysts. Next year's new credit and total social financing may be capped at around CNY19 trillion and CNY32 trillion, down CNY1 trillion and CNY3 trillion from this year, the newspaper said citing Li Chao, the chief economist of Zheshang Securities. Next year's quota of local government special bonds may be reduced to CNY3 trillion from CNY3.75 trillion, according to Xue Xiaoqian, deputy director of the Government Debt Research and Evaluation Center. China's total debt as a share of GDP rose to 270.1% at the end of Q3 from 245.4% as of Dec. 31, the Herald reported. (MNI)

SOES: State-owned financial firms should "resolutely" quit businesses that deviate from their main business and with few returns, according to a statement from the finance ministry. (BBG)

PBOC: The PBOC may be less likely to conduct wide RRR cuts in January after recent MLF operations eased a tightness following the defaults on several SOE-owned bonds and recent pressure on structured deposits, YiCai reported citing Wang Qing, an analyst with Golden Credit Rating. The central bank is unlikely to hike rates as doing so may raise financing costs and reduce investment and consumption, YiCai reported citing Yan Se, an economist from Founder Securities. (MNI)

POLICY: China should accelerate the implementation of legislation covering data ownership to prevent unfair competition in the use of data and technological advantage, the Economic Information Daily reported citing industry participants. China should consider digital taxes, especially on platforms with huge consumer traffic, the newspaper reported citing the former Deputy Minister of Finance Zhu Guangyao. China should also implement trading mechanisms and sharing platforms for financial data to break barriers and monopolies and strengthen the protection of personal information, the Daily reported citing Wang Zhaoxing, the former vice chairman of the China Banking and Insurance Regulatory Commission. (MNI)

EQUITIES: MSCI Inc. said it would delete the securities of the Chinese companies referenced in Donald Trump's Nov. 12 executive order barring American investments in Chinese firms owned or controlled by the military from its Global Investable Market Indexes (GIMI), citing global investment community concerns. MSCI cites feedback from more than 100 U.S. and non-U.S. market participants that suggested the order "may have a significant impact on the investment processes of global investors," including potential challenge to the "the investability of the impacted securities from the perspective of international institutional investors". (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY310 BILLION VIA OMOS WED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with rates unchanged at 2.2% on Wednesday. This resulted in a net drain of CNY310 billion given the maturity of CNY20 billion of reverse repos and CNY 300 billion of the medium-term lending facility (MLF) today, according to Wind Information.

PBOC SETS YUAN CENTRAL PARITY AT 6.5355 WEDS VS 6.5434 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5355 on Wednesday, compared with the 6.5434 set on Tuesday.

MARKETS

SNAPSHOT: U.S. Fiscal Matters & Brexit Headline Ahead Of FOMC

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 58.15 points at 26744.71

- ASX 200 up 47.855 points at 6679.2

- Shanghai Comp. up 3.377 points at 3369.945

- JGB 10-Yr future down 8 ticks at 152.08, yield up 0.6bp at 0.011%

- Aussie 10-Yr future up 0.2 ticks at 98.985, yield up 0.1bp at 0.964%

- US 10-Yr future up 0-04 at 137-31+, yield down 0.16bp at 0.9064%

- WTI crude down $0.09 at $47.53, Gold up $2.52 at $1856.16

- USD/JPY down 18 pips at 103.49

- UK DROPS PUSH FOR RENATIONALISING OF FISHING VESSELS IN BREXIT TALKS (GUARDIAN)

- MPS PUT ON STANDBY AS HOPES FOR BREXIT TRADE DEAL RISE (FT)

- MCCONNELL SAYS CONGRESS NOT LEAVING WITHOUT COVID RELIEF PACKAGE (BBG)

- MSCI TO DELETE CHINESE COS. IN TRUMP ORDER FROM GIMI INDEXES (BBG)

- CHINA REDUCES ITEMS ON THE NEGATIVE LIST FOR MARKET ACCESS (RTRS)

- AUSTRALIA REFERS CHINA TO WTO OVER BARLEY TARIFFS (ABC)

BOND SUMMARY: Low Conviction Ahead Of FOMC

Tsys showed nothing in the way of a meaningful reaction to the latest round of positive fiscal rhetoric out of DC, with T-Notes last +0-04+ at 138-00, while cash Tsys run +0.2bp to -0.5bp vs. closing levels (2s underperform), in what has been a limited pre-FOMC Asia-Pac session. 30K worth of TYF1 139.00 call block flow has provided the highlight thus far, with the trade looking like short cover.

- JGB futures softened in early afternoon trade, last -4, with the details of the BoJ's latest round of 1-10 Year Rinban ops revealing an uptick in the offer/cover ratios across the 3 buckets that cover that sector of the curve, while the purchase sizes were left unchanged. Yields have lacked any clear sense of direction during the session. Local headline flow has been light, with comments from Economy Minister Nishimura confirming the suspension of the Go To travel campaign over the new year period and offering little new re: broader fiscal matters. Local data had no impact on the space.

- In Australia, YM sits -0.4 with XM +0.2 at typing, as the latter ticked away from lows as we moved through the Sydney session. The slow uptick was perhaps linked to headlines which revealed that Australia will lodge a complaint with the WTO re: Chinese barley tariffs, reserving the right for further WTO actions against China in future. The move shouldn't really come as a surprise but does represent the latest escalation in Sino-Aussie tensions. Local data provided no real impetus for the space.

BOJ: 1-10 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.34tn of JGB's from the market, sizes unchanged from previous operations.

- Y500bn worth of JGBs with 1-3 Years until maturity

- Y420bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

JGBS AUCTION: 12-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.85098tn 12-Month Bills:

- Average Yield -0.1101% (prev. -0.1340%)

- Average Price 100.110 (prev. 100.135)

- High Yield: -0.1081% (prev. -0.1291%)

- Low Price 100.108 (prev. 100.130)

- % Allotted At High Yield: 48.2250% (prev. 47.2222%)

- Bid/Cover: 4.099x (prev. 3.507x)

EQUITIES: Mixed

The major e-mini contracts coiled during Asia-Pac hours, with the latest round of positive fiscal rhetoric out of DC ultimately failing to inspire a meaningful bid overnight, as the contracts consolidated the bulk of their Tuesday gains (which were themselves largely driven by hope surrounding support for a slimmed down fiscal support package in DC).

- The major regional equity indices clung to the coattails of Tuesday's Wall St. rally, however, the ratcheting up of Sino-Aussie tensions and MSCI's notice of removal from the relevant indices re: the securities of the Chinese cos referenced in U.S. President Trump's executive order barring U.S. investment applied some counter pressure.

- Nikkei 225 +0.2%, Hang Seng +0.8%, CSI 300 +0.2%, ASX 200 +0.8%.

- S&P 500 futures -4, DJIA futures -43, NASDAQ 100 futures +12.

GOLD: Better Bid Within Established Range

The latest round of USD weakness and softening of U.S. real yields has allowed bullion to push higher over the last 24 hours, although spot continues to operate in familiar territory, last printing around the $1,855/oz mark. Resistance is located at $1,875.4/oz, the Dec 8 high/bull trigger.

OIL: Very Narrow In Asia

WTI & Brent sit ~$0.10 below their respective settlement levels, holding to extremely narrow sub-$0.20 ranges thus far. This comes after the broader risk-positive tone supported the benchmarks on Tuesday.

- The latest round of weekly API inventory estimates hit after hours on Tuesday and was headlined by a surprise build in crude stocks, alongside a much larger than expected build for distillate stocks. We shall see if Wednesday's DoE inventories data point in a similar direction.

- Elsewhere, Tuesday saw WSJ sources suggest that "Iran has circumvented U.S. sanctions and exported more oil to China and other countries in recent months, providing a lifeline for its struggling economy and undermining the Trump administration's so-called maximum pressure campaign against Tehran."

- Tuesday also saw the release of the IEA's latest oil market report, in which the Agency cut its '20 & '21 global crude demand forecasts, following other industry bodies.

FOREX: US Dollar Main Driver Of Price Action; US Political Accord And FOMC Eyed

The main driver of price action in the Asia-Pac session was the US dollar which resumed its move lower as hopes for a stimulus package increased after Senate Majority Leader McConnell acknowledged Biden as the President-elect and said the Senate would not adjourn for the year without a relief package.

- There was limited price action in JPY pairs; the BoJ Rinban operations were in line with previous purchases while data earlier in the session showed that exports fell more than forecast at -4.2% against an expectation of +0.4%, imports also fell more than expected at -11.1% compared to -9.5% expected. The data was ignored despite the negative implications of weaker global economy (lower exports) and weak domestic demand (lower imports). USD/JPY last at session lows of 103.49, down 18 pips on the day.

- NZD/USD pushed back over the 0.71 handle, last up 20 pips at 0.7108, helped by the resumption of the downtrend in DXY. Earlier in the session the New Zealand Treasury released its half year economic fiscal update. The release initially had little effect on markets but seems to be supporting risk sentiment as the session wears on. The release outlined a slightly more positive case than the previous update. 2020/21 annual average GDP growth is forecast at 1.5% compared to the previous estimate of -0.5%, while the 2020/21 bond programme forecast has been cut to NZD 31.7bn. Forecasts for unemployment were downgraded to 6.9% from 7.8%.

- AUD/USD came off session lows, last flat on the session at 0.7559. Upside has been limited in the pair as tensions between Australia and China continue to simmer. Earlier Australian Trade Minister Birmingham said Australia will approach the WTO to challenge tariffs imposed by China on its barley exports. He added Australia reserve the right to invoke further WTO action against China.

- Bank of Canada Governor Macklem said recent CAD strength against the USD is material and is on their radar, however USD/CAD was unmoved on the news.

- Little by way of Brexit news flow, the FT reported the UK is compiling plans to turn London into a shipping hub that will rival Singapore. GBP/USD moving towards session highs at 1.3460 last.

- The PBOC fixed USD/CNY at 6.5355, 79 pips lower than the previous day and resuming the trend of a stronger yuan, after a weaker fix yesterday.

- Market focus will no doubt be on the FOMC meeting. The Fed are expected to keep rates on hold, some are expecting an increase in asset purchases or a version of operation twist where short term bonds are sold to buy longer term bonds.

FOREX OPTIONS: Expiries for Dec16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1950(E970mln-EUR calls), $1.2000(E1.2bln), $1.2070(E820mln-EUR calls), $1.2100(E1.1bln), $1.2150(E450mln), $1.2200-10(E496mln-EUR puts)

- USD/JPY: Y103.50-60($510mln), Y103.90-104.00($580mln)

- GBP/USD: $1.3190-1.3200(Gbp508mln), $1.3300(Gbp566mln)

- EUR/GBP: Gbp0.9000(E616mln)

- AUD/USD: $0.7450-60(A$1.2bln), $0.7500(A$1.2bln)

- AUD/JPY: Y78.30-35(A$664mln-AUD puts)

- USD/TRY: Try8.50($500mln-USD puts)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.