-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: U.S. Policymakers Deliver SVB Backstop

EXECUTIVE SUMMARY

- FEDERAL RESERVE ANNOUNCES EMERGENCY LENDING FACILITY TO SHORE UP US BANKS (FT)

- SILICON VALLEY BANK DEPOSITORS WILL HAVE ACCESS TO ‘ALL OF THEIR MONEY,’ REGULATORS SAY IN EFFORT TO STEM WIDER FALLOUT (NBC)

- SIGNATURE BANK CLOSURE DEALS ANOTHER BLOW TO CRYPTO INDUSTRY (BBG)

- FED’S BARKIN SIGNALS OPENNESS TO REVERTING TO HALF-POINT RATE RISE (FT)

- GOLDMAN SACHS REMOVE CALL FOR MAR HIKE, NOTES HEIGHTENED UNCERTAINTY FURTHER OUT

- CHINA CHOOSES CONTINUITY, RETAINING CENTRAL BANK CHIEF, FINANCE MINISTER (RTRS)

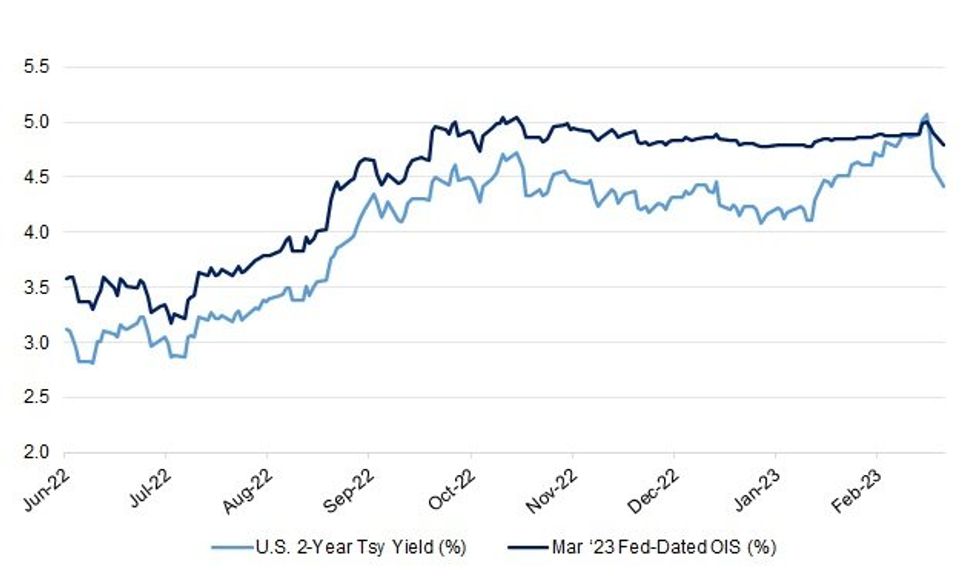

Fig. 1: U.S. 2-Year Tsy Yield Vs. Mar ‘23 Fed-Dated OIS

Source: MNI - Market News/Bloomberg

UK

ECONOMY: With expectations of future activity picking up sharply from a record low in October in the wake of the ill-fated Truss/Kwarteng administration and its much-criticised mini-budget, a survey by Accenture and S&P Global, the corporate advisers, has found that business confidence is at its highest level since the Russian invasion of Ukraine 12 months ago. (The Times)

FISCAL: Rishi Sunak and Jeremy Hunt have both argued now is not the time for tax cuts, indicating the pleas of Tory backbenchers will be rejected at next week’s Budget. (Telegraph)

FISCAL: Chancellor of the Exchequer Jeremy Hunt’s budget preparations have been upended by the rush to limit damage from the collapse of Silicon Valley Bank as Treasury officials race to finalize a support package for the UK’s tech sector. (BBG)

FISCAL: Chancellor of the Exchequer Jeremy Hunt will hand business a three-year tax break worth about £11 billion by replacing the UK’s most generous ever investment allowance with a temporary measure in next week’s budget, according a government official with knowledge of the matter. (BBG)

FISCAL: The chancellor is expected to deliver a multibillion-pound “cradle-to-grave giveaway”, using his budget on Wednesday to announce childcare and pension reforms. (The Times)

POLITICS: Rishi Sunak’s plan to tackle illegal migration may be an unworkable gamble, members of his government say. (BBG)

BANKS: Prime Minister Rishi Sunak suggested the UK will soon unveil its plan to contain the fallout from Silicon Valley Bank’s collapse, hours after US financial regulators stepped in to provide support to depositors and lenders. (BBG)

EUROPE

GERMANY: Deutsche Post AG secured a wage deal with the Verdi labor union covering 160,000 workers, raising salaries even as it expects profits to fall. (BBG)

FRANCE: The French Senate on Saturday adopted President Emmanuel Macron’s unpopular pension reform plan, with 195 votes for and 112 votes against, a bill whose key measure is raising the retirement age by two years to 64. (RTRS)

FRANCE: Fewer French people took to the streets for the seventh day of protests against the contentious pension reform of President Emmanuel Macron, even as a growing majority opposes the overhaul. (BBG)

SNB: The Swiss National Bank is pulling out all the stops to bring Swiss inflation under control, Chairman Thomas Jordan has told newspaper SonntagsBlick, hinting at further rate hikes ahead. (RTRS)

SWEDEN: Sweden is inviting international asset managers to help allocate 1 trillion kronor ($90 billion) of pension savings, but says it won’t accept applications from firms that don’t incorporate ESG into their strategies. (BBG)

RATINGS: Sovereign rating reviews of note from after hours on Friday include:

- Fitch affirmed Belgium at AA-; Outlook changed to Negative

- Fitch upgraded Cyprus to BBB; Outlook Stable

- S&P affirmed Portugal at BBB+; Outlook Stable

- DBRS Morningstar Confirms the Hellenic Republic at BB (high), Stable Trend

BANKS: Swiss financial regulator FINMA said on Friday it does not see sufficient grounds for proceedings against Credit Suisse, but has set expectations for future communication from the Swiss bank after investigating statements made by the chairman on outflows. (RTRS)

U.S.

FED/BANKS: US regulators unveiled emergency measures on Sunday to shore up the banking system and took control of another bank, as they moved to stem contagion from the implosion of Silicon Valley Bank. The Federal Reserve announced a new lending facility aimed at providing additional funding to eligible depository institutions to ensure that “banks have the ability to meet the needs of all their depositors”. In a statement, the US central bank added it was “prepared to address any liquidity pressures that may arise”. (FT)

BANKS: Federal regulators stepped in Sunday to back all Silicon Valley Bank deposits, resolving a key uncertainty surrounding the second-largest bank failure in U.S. history hours before global stock markets resume trading. (NBC)

BANKS: The U.S. government has not yet been able to find a buyer for Silicon Valley Bank, setting up a decision by the U.S. Treasury and Federal Reserve to backstop all uninsured deposits before branches open on Monday morning. (Axios)

BANKS: Silicon Valley Bank employees received their annual bonuses Friday just hours before regulators seized the failing bank, according to people with knowledge of the payments. (CNBC)

BANKS: The collapse of Silicon Valley Bank has had a ripping effect across the tech industry as many start-ups scramble to minimize the impact of its seizure by the federal government. (Axios)

BANKS: The closure of Signature Bank, a lender that counted a number of crypto companies as customers, marks another major setback for digital assets as the industry becomes ever more cut off from the banking system. (BBG)

BANKS: First Republic Bank says that total available, unused liquidity to fund operations is now more than $70 billion. (BBG)

BANKS: U.S. President Joe Biden said on Sunday he would address the banking crisis Monday morning. (RTRS)

BANKS: The collapse of Silicon Valley Bank is unlikely to create major waves of contagion or significantly disrupt the financial system as long as regulators manage the situation adequately, former FDIC Chair Sheila Bair told MNI on Sunday. (MNI)

FED: A top Federal Reserve official has said he is “open to any outcome” regarding the central bank’s conundrum over whether to revert to half-point interest rate rises in the face of unexpectedly strong economic data. (FT)

FED: Inflation is proving more stubborn than anticipated due to shifts in U.S. consumer spending patterns, a rosier European outlook and China's emergence from it zero-Covid policy, but there are scant signs that rising interest rates will cause a downturn this year, Federal Reserve Bank of St. Louis research director Carlos Garriga said in an interview Friday. (MNI)

FED: The Federal Reserve can meet its inflation target by keeping interest rates at a lower peak for longer, rather than by making more aggressive hikes, Chicago Fed researcher Leonardo Melosi told MNI. (MNI)

FED: U.S. inflation is likely to resume its downward drift in coming months despite bumps along the way, allowing the Federal Reserve to pause its rate increases after a few more hikes, former Philadelphia Fed economic advisor Luke Tilley told MNI. (MNI)

FED: The U.S. Federal Reserve said it will hold a closed-door meeting of its board of governors under expedited procedures on Monday. The meeting from 11:30 a.m. (0330 GMT) will primarily review and determine the advance and discount rates to be charged by the Federal Reserve banks, the Fed said in a statement. (RTRS)

ECONOMY: Shifts in U.S. employment over the past two years toward sectors with higher wages and productivity, and higher average hours worked, may drive further gains in labor productivity going forward, two top Treasury Department economists said on Friday. (RTRS)

ECONOMY/INFLATION: The US economy is “headed in the right direction” with slowing inflation, President Joe Biden said after a mixed jobs report eased bets that the Federal Reserve will accelerate its interest rate hikes. (BBG)

EQUITIES: Apple Inc. investors reelected its board, approved its compensation plan and rejected the shareholder proposals that the company opposed, giving the iPhone maker a clean sweep during its annual meeting. (BBG)

EQUITIES: Facebook parent Meta Platforms Inc. is planning additional layoffs to be announced in multiple rounds over the coming months that in total would be roughly the same magnitude as the 13% cut to its workforce last year, according to people familiar with the matter. (WSJ)

EQUITIES: The Federal Aviation Administration (FAA) on Friday approved Boeing to resume deliveries of its widebody 787 Dreamliner next week after the planemaker addressed recent concerns raised by the agency. (RTRS)

EQUITIES: Saudi Arabia’s Public Investment Fund is close to a deal for a large number of Boeing Co. commercial jets that will serve in the fleet of a new national airline, people familiar with the matter said. (WSJ)

OTHER

GLOBAL TRADE: The Ukrainian part of the grain deal is working effectively, while Russian agricultural exports continue to be blocked as a result of unilateral Western sanctions, Russian Foreign Ministry Spokeswoman Maria Zakharova said on Sunday, commenting on the potential extension of the grain deal. (TASS)

GLOBAL TRADE: The Biden administration is working to further tighten restrictions on the export of semiconductor manufacturing gear to China, escalating rules aimed at preventing the country from developing an advanced chip industry. (BBG)

GLOBAL TRADE: New Dutch curbs on the export of semiconductor technology to China are planning to block sales of three additional models of ASML Holding NV’s lithography machines, according to people familiar with the matter. (BBG)

GLOBAL TRADE: US and EU officials launched new talks on trade in critical minerals as Ursula von der Leyen visited the White House on Friday, in a move EU officials hope will boost its companies’ access to the US’s green subsidies. (FT)

JAPAN: Japanese authorities are carefully monitoring the actions of U.S. regulators and movements in financial markets, but they view the collapse of Silicon Valley Bank as caused by unique circumstances relating to the lender's balance sheet, MNI understands. (MNI)

NEW ZEALAND: The latest NZIER Consensus Forecasts show an upward revision to the near-term growth outlook for the New Zealand economy but a downward revision for the subsequent two years. (NZIER)

NEW ZEALAND: The New Zealand government is boosting financial support for around 1.4 million citizens as it tries to offset three-decade high inflation ahead of the country's election later this year. (RTRS)

SOUTH KOREA: South Korea's finance minister said on Sunday the country was closely monitoring any impact from the collapse of Silicon Valley Bank on South Korean markets. Top financial officials met on Sunday to discuss the collapse, the biggest bank failure since the 2008 financial crisis, the finance ministry said in a statement. (RTRS)

SOUTH KOREA: The Bank of Korea pledged steps to stabilize markets if needed as it sought to ease anxiety over the closures of Silicon Valley Bank and Signature Bank. (BBG)

NORTH KOREA: North Korea decided to take important, practical war deterrence measures at a meeting of the ruling party's military commission presided over by leader Kim Jong Un, state news agency KCNA said on Sunday. (RTRS)

NORTH KOREA: North Korea launched two missiles from a submarine in the waters of the Sea of Japan Sunday morning local time, according to the state-run news agency KCNA. (CNN)

CANADA: The federal government’s budget for 2023 will be released on March 28, Deputy Prime Minister and Finance Minister Chrystia Freeland announced Friday. (Global News)

TURKEY: Turkey’s central bank is forcing commercial lenders to lower the interest rates they charge for consumer loans as a part of its efforts to bring borrowing costs closer to the official benchmark rate. (BBG)

MEXICO: Mexico central bank Deputy Governor Jonathan Heath said in a tweet inflation in the second half of February was “more or less in line with its historical average, something that had not been observed in a long time.” (BBG)

BRAZIL: Brazilian Finance Minister Fernando Haddad said on Friday that the government's fiscal framework will include a new rule to monitor spending but that does not address public debt, in remarks on a package of eagerly awaited fiscal rules. (RTRS)

BRAZIL: President Lula already has received names suggested for roles in the Brazilian Central Bank, said the Finance minister Fernando Haddad in an interview with CNN Brasil. (BBG)

BRAZIL: The New Development Bank, the multilateral bank set up by the BRICS states, said on Friday it had agreed to elect a new Brazilian head at the request of the government of Brazil's new president, Luiz Inacio Lula da Silva. (RTRS)

BRAZIL: Brazil's Finance Minister, Fernando Haddad, announced on Friday that the federal government will provide compensation of 26.9 billion reais ($5.2 billion) to states for their losses due to the reduction of the state tax ICMS. (RTRS)

RUSSIA: The US and the European Union pledged to step up enforcement of sanctions on Russia and further choke off supplies and technology for its military. (BBG)

RUSSIA: The European Union hopes to agree new sanctions on Belarus by the end of March, which may include tougher restrictions on the potash sector. Proposals made by the EU in January would align sanctions on Belarus with those already imposed on Russia, its closest ally, but their adoption was delayed by differences between member states over food and agricultural exports, including potash and fertilizer. President Alexander Lukashenko allowed Vladimir Putin to use his country as a launchpad to invade Ukraine. (BBG)

RUSSIA: The head of Russia's Wagner mercenary force said in an interview published over the weekend that he had ambitions to turn his private military company into an "army with an ideology" that would fight for justice in Russia. (RTRS)

SOUTH AFRICA: South Africa’s presidency said it received a report from the graft ombudsman on its investigation into the theft of foreign-exchange from President Cyril Ramaphosa’s game farm, and reiterated he did nothing wrong. (BBG)

SOUTH AFRICA: Eskom announced on Sunday that Stage 4 power cuts will be in place until 4pm on Monday. (eNCA)

IRAN: Iran and the United States have reached an agreement to exchange prisoners, Iranian Foreign Minister Hossein Amirabdollahian told state TV on Sunday, but Washington denied it as a "false" claim by Tehran. (RTRS)

PERU: Peru’s central bank said on Friday it will evaluate inflation and related factors, including recent social unrest in the country, in its deliberations over possibly raising the country’s benchmark interest rate going forward. (RTRS)

CHILE: Chile's President Gabriel Boric, who has been struggling with low approval ratings since taking office a year ago, announced a major cabinet reshuffle on Friday, including the foreign minister. (RTRS)

MACRO/RATINGS: Global growth prospects for 2023 have improved significantly since December, says Fitch Ratings in its latest Global Economic Outlook (GEO) report, but the impacts of rate hikes on the real economy still lie ahead and are likely to push the US economy into recession later this year. (Fitch)

OIL: Higher Saudi supply helped keep Opec+ crude production steady in February, while Russian output held firm in the face of EU sanctions. (Argus Media)

OIL: Aramco's chief executive Amin Nasser said on Sunday the market would remain tightly balanced in the short to medium term, adding that he was cautiously optimistic. (RTRS)

OIL/EQUITIES: Saudi oil giant Aramco has announced a record profit of $161.1bn (£134bn) for 2022, helped by soaring energy prices and bigger volumes. (BBC)

OIL: Iran's oil exports have reached their highest level since the reimposition of U.S. sanctions in 2018, the country's Oil Minister Javad Owji said on Sunday, according to the semi-official Tasnim news agency. (RTRS)

OIL: The cost of the Canadian government-owned Trans Mountain oil pipeline expansion has jumped 44% from last year's estimate to C$30.9 billion ($22.35 billion), the federal corporation building the project said on Friday. Trans Mountain Corp (TMC) said it is in the process of securing external financing to fund the remaining cost of the project, which is now expected to start shipping oil in the first quarter of 2024. (RTRS)

OIL: President Joe Biden plans to announce limits on oil leasing in Arctic waters and sensitive areas of Alaska on Monday, taking steps to expand conservation as his administration prepares to approve a mammoth ConocoPhillips oil development in the region. (BBG)

CHINA

POLITICS: President Xi Jinping is completing his shake-up of China’s top personnel this weekend, a task that kicked off when the legislature voted to install a key ally and former aide as premier. Li Qiang, the former Communist Party boss of Shanghai, has been the front-runner for the job since he was named the party’s No. 2 in October. He officially took the position at the National People’s Congress on Saturday morning, winning by a vote of 2,936-3. Eight lawmakers abstained. (BBG)

POLICY: China unexpectedly kept its central bank governor and finance minister in their posts at the annual session of the rubber-stamp parliament on Sunday, prioritising continuity as economic challenges loom at home and abroad. (RTRS)

POLICY: China must redouble efforts to ensure stability and bolstering self-reliance, President Xi Jinping told lawmakers in a speech to mark the start of his precedent-breaking third term. He also vowed to oppose foreign interference on Taiwan, a veiled reference to increasing American support for the democratically elected government in Taipei. (BBG)

ECONOMY: Achieving the government's 5% GDP growth this year "will not be easy" as the external environment remains unpredictable and stabilising the economy is challenging, said China's new premier, Li Qiang, on Monday. (MNI)

ECONOMY: China’s growth target of around 5% this year is achievable given the longer term trend of development and the high frequency data since the start of this year, according to Kang Yi, director of the National Bureau of Statistics (NBS). Speaking on the sidelines of the National People’s Congress, Kang said he was confident in the overall improvement of economic activity so far this year. He cited growth in rail freight volume, power generation and loan expansion as evidence the economic rebound was on track, saying he was “really confident in the future”. (MNI)

ECONOMY: China must grow at a reasonable level that is conducive to high quality growth, while ensuring the rate is fast enough to support the expansion of employment and improvements to people’s livelihoods, according to Zhao Chenxin, deputy director of the National Development and Reform Commission (NDRC). (MNI)

PBOC: The re-election of Yi Gang as governor of the People's Bank of China will help maintain policy stability and ensure financial support for the real economy will remain strong, according to Yicai.com. (MNI)

PROPERTY: Chinese developer Logan Group Co. said it’s begun distributing draft restructuring proposals to offshore creditors and that looming winding-up hearings have agreed to be adjourned. (BBG)

PROPERTY: A senior advisor has called on policymakers to establish a state-backed fund of up to CNY100 billion to support the troubled property sector and provide better housing to people living in cities, while suggesting the central bank should cut rates to boost demand as inflation remains low. (MNI)

CHINA MARKETS

PBOC SETS YUAN CENTRAL PARITY AT 6.9375 MON VS 6.9655 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9375 on Monday, compared with 6.9655 set on Friday.

PBOC NET INJECTS CNY34 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) conducted CNY41 billion via 7-day reverse repos on Monday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY34 billion after offsetting the maturity of CNY7 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9603% at 10:00 am local time from the

- close of 2.0253% on Thursday. The CFETS-NEX money-market sentiment index closed at 44 on Friday, compared with the close of 59 on Thursday.

OVERNIGHT DATA

JAPAN Q1 BSI LARGE MANUFACTURING -10.5 Q/Q; Q4 -3.6

JAPAN Q1 BSI LARGE ALL COMPANIES -3.0 Q/Q; Q4 +0.7

NEW ZEALAND FEB BUSINESS NZ PSI 55.8; JAN 54.7

Expansion levels for New Zealand’s services sector lifted again during February, according to the BNZ – BusinessNZ Performance of Services Index (PSI). (BusinessNZ)

NEW ZEALAND FEB +1.5% M/M; JAN +1.7%

SOUTH KOREA MAR 1-10 EXPORTS -16.2% Y/Y

SOUTH KOREA MAR 1-10 IMPORTS +2.7% Y/Y

MARKETS

US TSYS: Curve Twist Steepens, Fed Rate Hike Expectations Pared

TYM3 deals at 113-07+, +0-03, with a 1-11 range observed on volume of ~412k. To recap early events in Asia, the Fed have created a new funding operation to stem the risk of a run on deposit taking institutions, while the Fed, US Treasury and FDIC noted in a joint statement that SVB depositors would be made whole.

- Cash tsys sit 14bps richer to 5bps cheaper across the major benchmarks, the curve has twist steepened pivoting on 20s.

- The rally in 2s adds to the largest 2 day gain lodged since the GFC.

- Tsys futures initially gapped higher at the re-open as Asia participants reacted to Friday's price action and the lack of immediate resolution re SVB.

- The initial move reversed on headlines that the Fed has announced a new emergency bank term funding scheme. Fed, US Treasury and FDIC noted in a joint statement that SVB depositors would be made whole, further adding further pressure.

- Tsys firmed off session lows as, on the sell side, Goldman Sachs updated their call for the March Fed meeting. They no longer look for a hike from the Fed later this month although they leave their 25bp hike calls for the May, June & July meetings pencilled in, albeit with considerable uncertainty cited.

- Fed-dated OIS has 23bps of tightening for next week’s meeting, after pricing ~43.5bp of tightening at one point last week. Pricing for the terminal rate is now at a touch below 5.1% now seen in June, trimming ~20bps today. There are ~43bps of cuts priced for H2 2023.

- There is a thin data calendar in Europe today, the session will be dominated by the evolving SVB situation. Tomorrow's February CPI, flagged by Fed Chair Powell as a key input into this month's FOMC decision, headlines the week's docket.

JGBS: Firmer & Flatter On Global Impulse

JGB futures were off best levels at the closing bell, although comfortably firmer, +57. Cash JGBs are flat to ~11bp richer, with the early flattening extending, aided by receiver side flows in swaps as swap spreads sit flat to tighter on the day. 10-Year JGB yields now sit at the lowest level observed since the BoJ’s surprise YCC tweak back in December (0.31%), nearly 20bp off the YCC cap.

- Global factors were at the fore today, with the moves from U.S. policymakers re: stemming the fallout from the failure of SVB front and centre. The introduction of a new Fed funding scheme for deposit taking institutions and the decision to make depositors at SVB (and another failed bank) whole provided the focal points.

- Locally, the junior ruling coalition partner, Komeito, indicated that it will be seeking several trillion JPY of stimulus spending, focused on supporting families with children and in a bid to reduce LNG prices.

- The latest quarterly BSI survey provided a deterioration in sentiment for large firms.

- Tomorrow’s domestic data slate is empty, although we will get the latest 5-Year JGB auction. That should leave the broader tone at the fore for most of Tuesday’s session.

AUSSIE BONDS: Focus On The SVB Situation Remains

ACGBs close firmer on the day (YM +12.4 & XM +6.3) but well off bests set before U.S. authorities made announcements about the Silicon Valley Bank (SVB) situation in early Asia-Pac trade. Cash ACGBs close 6-13bp lower with the 3/10 curve 6bp steeper.

- The 3s10s swaps curve bull steepens 5bp on the day with rates 2-8bp lower and EFPs 4-5bp wider.

- The bills strip richened 4-11bp on the day, led by late whites/early reds, but was well off session bests.

- RBA dated OIS pricing closed 7-12bp softer for meetings beyond April with pricing for the April meeting declining to a 27% chance of a 25bp hike.

- While light today, the local calendar delivers this week two releases explicitly cited by the RBA as important for April’s policy discussion, namely February NAB Business Survey tomorrow and the February Employment Report on Thursday. After two consecutive monthly declines the market is looking for a strong result (BBG consensus +50k) to defuse expectations of labour market stagnation.

- Until then, the market will likely continue to track the direction of U.S. Tsys as it wades through information regarding SVB and the U.S. authorities’ policy initiatives. The U.S. calendar also has the release of February CPI slated for Tuesday.

NZGBS: Tracking SVB Developments But Underperforming U.S. Tsys

In line with developments in global FI in Asia-Pac trade, NZGBs open stronger, reverse on policy announcements from U.S. authorities regarding Silicon Valley Bank (SVB) and then richen again to close 9-11bp stronger. The re-strengthening was linked to U.S. Tsy yields pushing below Friday session lows following news that Goldman Sachs no longer expected a hike from the Fed later this month.

- The 2/10 benchmark curve steepened by 2bp with the NZ/US 10-year differential +7bp.

- Swaps close 8-10bp richer, implying a wider 3-year swap spread.

- RBNZ dated OIS softened 7-19bp across meetings led by February-24. April meeting pricing softened to 36bp of tightening with terminal rate expectations falling below the RBNZ’s projected OCR peak of 5.50% to 5.44%.

- On the local data front, BusinessNZ PSI showed an upbeat 55.8 for February (54.5 in January) while February Food prices rose 1.5% M/M reflecting the impact of Cyclone Gabrielle.

- Tomorrow’s local calendar sees February REINZ house prices and Net Migration slated ahead of Q4 Current Account on Wednesday and Q4 GDP on Thursday.

- The market is however likely to remain almost entirely focused on developments in the SVB saga ahead of the release of US CPI for February on Tuesday.

EQUITIES: HK/China Equities Outperform, Higher US Futures Limit Losses Elsewhere

HK and China related equities have outperformed so far today. The HSI is up over 2%, the China Enterprise Index near a 3% gain. Elsewhere the focus has been on the rebound in US futures, with eminis and Nasdaq futures up +1.6%, as the US authorities seek to limit the fallout from the SVB collapse, with a number of backstops now in place ahead of Monday's US open. This has helped regional markets pare losses or climb into positive territory for today's session.

- China and HK shares have likely benefited from the NPC announcement over the weekend that current PBoC Governor Yi Gang would continue to serve in the post. It had been widely expected that he would retire. The Commerce and Finance Ministry positions also maintained the status quo. This should give the market some comfort of policy continuity.

- Mainland shares have lagged HK moves, but are still up near 0.90% for the CSI 300.

- Elsewhere, the picture is more mixed. Japan's Nikkei 225 is down around 1.5% at this stage, although away from lows for the session. Banking and finance related names have been a saw of weakness. The Kospi (+0.45%) and Taiex (0.10%) have fared better.

- The ASX 200 is down 0.50%, while Singapore and Malaysian markets are off by 0.7% and 0.9% respectively.

GOLD: Benefiting From Continued USD Pullback, But Some Resistance Ahead of $1890.

Gold continues to recover, up a further 0.80% so far today. We have gotten close to $1890 on a couple of occasions but there appears to be some resistance ahead of this level. We last tracked at $1882. The $1890 region represents highs from early February for the precious metal, so may be acting as a near term resistance point.

- Gold is back above all key EMA levels. Beyond $1890 lies the $1900, which we haven't been above since early February.

- Gold's move higher today is in line with USD weakness, with the BBDXY off by around 0.80% at this stage. Reduced risk aversion, evidenced in the equity space, is not diminishing gold demand from a reduced safe haven demand standpoint, although this may have helped limit gains beyond the $1890 level.

- The bigger driver is the weaker USD trend and yield pull back.

OIL: Underperforming Other Risk Assets

Brent crude is marginally firmer, +0.20% for the Monday session so far. This is underperforming broader risk appetite trends, where the USD is off by ~0.80%, while US equity futures are close to session highs. For Brent, we haven't been able to make much headway above the $83/bbl level, which is where we currently track. For WTI, we are just shy of the $77/bbl level.

- Brent is sub all the key EMA levels, with the 20-day, around $83.65/bbl, not too far away on the topside.

- China comments from new Premier Li Qiang that hitting the 5% growth target won't be easy may have weighed on oil sentiment at the margins. Still, other comments were encouraging from the perspective of opening up the China economy and support of the private sector.

- The skew of market positioning still remains placed for higher oil prices. ICE Brent futures data remain heavily skewed towards longs, as of Tuesday last week.

- Looking ahead, on Tuesday we get the OPEC monthly oil report, along with US CPI. While on Wednesday the IEA monthly report is out, as well as China monthly activity figures.

FOREX: USD Pressured, Fed Rate Hike Expectations Pared

The greenback is pressured in Asia as expectations for Fed rate hikes are pared. OIS prices ~23bps of tightening for next week’s meeting, after pricing ~43.5bp of tightening at one point last week. To recap early events in Asia, the Fed have created a new funding operation to stem the risk of a run on deposit taking institutions, while the Fed, US Treasury and FDIC noted in a joint statement that SVB depositors would be made whole.

- AUD is the strongest performer in the G-10 space at the margins. AUD/USD prints at $0.6660/65 ~1.3% firmer today. The next upside target for bulls is $0.6695, the low from 1 March.

- Kiwi is also firmer, benefiting from the improved risk appetite. NZD/USD prints at $0.6195/0.6200, the pair is ~1.1% firmer. Westpac also revised their RBNZ call for the next meeting down to 25bps.

- USD/JPY prints at ¥134.10/20, dealing a touch below the 50-Day EMA at ¥134.23. The pair has been supported on breaks below ¥134.

- Elsewhere in the G-10 space broad based USD weakness is evident. BBDXY is down ~0.8%, having broken its 20-day EMA in early dealing.

- Cross asset wise, US Equity futures are firmer. S&P500 E-minis are up ~1.7%. The US Treasury Curve has steepened.

- There is a thin data calendar in Europe today, the session will be dominated by the evolving SVB situation and continued re-pricing of Fed rate expectations.

FX OPTIONS: Expiries for Mar13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-10(E1.2bln), $1.0540-50(E1.0bln), $1.0600(E1.6bln), $1.0690-00(E2.1bln)

- USD/JPY: Y133.00($570mln), Y135.00($809mln), Y136.00($711mln), Y137.00($590mln)

- GBP/USD: $1.2075-00(Gbp577mln)

- USD/CNY: Cny6.8500($1.2bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/03/2023 | - |  | EU | ECB Panetta at Eurogroup Meeting | |

| 13/03/2023 | 1230/0830 | * |  | CA | Household debt-to-disposable income |

| 13/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 13/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 13/03/2023 | 1805/1805 |  | UK | BOE Dhingra Panellist at International Women’s Day event |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.