-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: US Curve Steepens, Oil Holds Gains In Asia

EXECUTIVE SUMMARY

- US, ISRAEL DISCUSSING POTENTIAL BIDEN VISIT TO ISRAEL, SOURCES SAY - RTRS

- LAGARDE: HEADLINE INFLATION IS EASING, CORE IS STILL HIGH” - BBG

- POLISH NATIONALISTS PiS ON BRINK OF LOSING POWER - EXIT POLL - RTRS

- US TACKLES LOOPHOLES IN CURBS ON AI CHIP EXPORTS TO CHINA - RTRS

- PBOC OFFERS MOST CASH SUPPORT SINCE 2020 AS DEBT SALES SURGE- BBG

- NEW ZEALAND PRIME MINISTER ELECT LUXON TO GET CRACKING ON BUILDING COALITION RELATIONSHIPS - RTRS

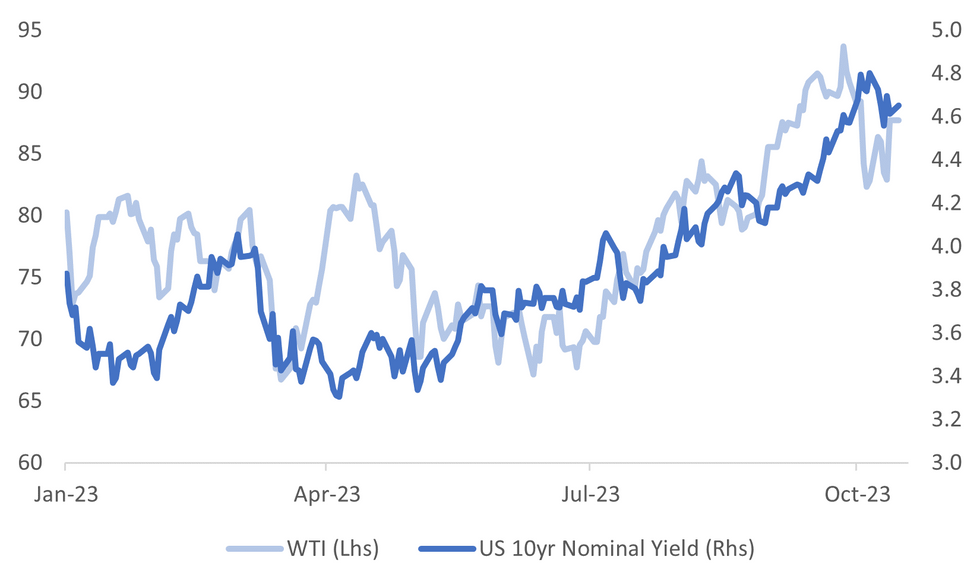

Fig. 1: US 10yr Nominal Tsy Yield & WTI Benchmark

Source: MNI - Market News/Bloomberg

U.K.

HOUSE PRICES: “UK home sellers increased their asking prices at the slowest pace for any October since 2008, as economists trimmed their growth forecasts for the wider economy, reports published Monday show.” (BBG)

MORTGAGES: “The bad news keeps coming for Britain’s lettings market, as a surge in mortgage payments pushes more landlords to the brink and threatens to pile extra misery on tenants.” (BBG)

SPENDING: “Almost a third of British consumers are planning to reduce spending on Christmas this year as the burden of lofty inflation weighs on shoppers.” (BBG)

EUROPE

ECB: “European Central Bank President Christine Lagarde said underlying inflation in the euro zone is still strong and wage growth is “historically high.” (BBG)

ECB: "A surge in global borrowing costs means eurozone rate-setters have probably done enough to tame inflation, the Financial Times reported, citing an interview with Spain Central Bank Governor Pablo Hernandez de Cos." (FT/BBG)

ECB: “The European Central Bank can’t declare that its fight against inflation is over just yet, according to Governing Council member Joachim Nagel.” (BBG)

ECB: “The European Central Bank may not even consider lowering interest rates for at least a year in order to vanquish inflation, according to Governing Council member Peter Kazimir.” (BBG)

ECB: “The euro zone’s buoyant consumers will save the economy from a hard landing, according to European Central Bank Governing Council member Edward Scicluna.” (BBG)

ITALY: "Italian Premier Giorgia Meloni’s deficit-laden budget is entering its final phase with the unveiling of tax cuts, measures for families, and also how to pay for them." (BBG)

POLAND: “Poland's incumbent Law and Justice (PiS) party was narrowly ahead in Sunday's general election, exit polls showed, but the liberal opposition appeared to secure a majority, raising the possibility of an end to eight years of nationalist rule.” (RTRS)

U.S.

US/ISRAEL: “ U.S. and Israelis officials are discussing the possibility of a visit to Israel soon by U.S. President Joe Biden at the invitation of Israeli Prime Minister Benjamin Netanyahu, a source familiar with the matter said on Sunday.” (RTRS)

US/CHINA: “The U.S. will take steps to prevent American chipmakers from selling products to China that circumvent government restrictions, a U.S. official said, as part of the Biden administration's upcoming actions to block more AI chip exports.” (RTRS)

OTHER

JAPAN: “The International Monetary Fund said that it sees no factors that would compel Japan to intervene in the foreign exchange market to support the yen.’ (BBG)

NEW ZEALAND: “New Zealand's prime minister-elect, Christopher Luxon, said on Monday while his party was waiting for special votes to be counted, they would also "get cracking" on building relationships with both ACT New Zealand and New Zealand First.” (RTRS)

CHINA

PBOC: The People’s Bank of China Governor Pan Gongsheng vowed to provide more substantial support to the economy amid recent improvements in economic indicators. Aggregate and structural monetary tools are expected to be better leveraged to expand domestic demand, boost confidence and provide stronger support for the real economy, Pan said at a two-day meeting of the International Monetary and Financial Committee through Saturday in Marrakech, Morocco. (PBOC)

ECONOMY: China’s economic policy should focus on high-quality development while maintaining reasonable GDP growth, according to Premier Li Qiang. Speaking at a recent symposium, Li said economic performance had continued to improve since Q3, but China remained in a critical period of recovery and industrial transformation with authorities needing to strengthen confidence with precise policies and calm responses. (YICAI)

GDP: China’s GDP likely grew 4.8% y/y in Q3 with high-frequency indicators in September showing a quicker pace of recovery, according to Wen Bin, chief economist at Minsheng Bank. Wen said the economy had shown weakness in July due to extreme weather, however, authorities implemented stronger countercyclical measures in August and September such as RRR and interest cuts which brought stability. Lu Ting, chief economist at Nomura China, said real estate remained weak in September which negatively impacted fixed-asset investment. (YICAI)

PBOC: “China’s central bank is making the biggest medium-term liquidity injection since 2020, stepping up efforts to support the nation’s economic recovery and debt sales.” (BBG)

POLICY: “China is likely to further cut interest rates and banks’ reserve requirement ratio this year to prop up the economy, according to a front-page report in Securities Daily, citing Wu Chaoming, deputy dean of Chasing International Economic Institute, and a research note by China Galaxy Securities.” (SECURITIES DAILY/BBG)

EQUITIES: “China’s effort to tighten rules for short selling and securities lending is positive in restraining improper arbitrage activity and rebalancing the interests of different investors, Shanghai Securities News reports, citing research from Citic Securities.” (SHANGHAI SECURITIES NEWS/BBG)

PROPERTY: “The good news for China's property developers is that a bottom is in sight. The bad news is that the sector will likely bump along this floor for years. S&P Global Ratings expects that the low number of construction starts, an inventory overhang in lower-tier cities, and ever-tightening escrow restrictions will keep property sales depressed.” (S&P/BBG)

CHINA MARKETS

MNI: PBOC Injects Net CNY155 Bln Via OMO Mon; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY789 billion via 1-year MLF and CNY106 billion via 7-day reverse repo on Monday, with the rate unchanged at 2.50% and 1.80%, respectively. The operation has led to a net injection of CNY155 billion after offsetting the maturity of CNY240 billion reverse repos today and CNY500 billion MLF Tuesday, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7746% at 09:50 am local time from the close of 1.8833% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 42 on Friday, the same as the close on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Higher At 7.1798 Monday Vs 7.1775 Friday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1798 on Monday, compared with 7.1775 set on Friday. The fixing was estimated at 7.3095 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND SEP PERFORMANCE SERVICES INDEX 50.7; PRIOR 47.7

CHINA 1-YR MLF RATE 2.50%; MEDIAN 2.50%; PRIOR 2.50%

CHINA 1-YR MLF VOLUME 789BN YUAN; MEDIAN 590BN YUAN; PRIOR 591BN YUAN

JAPAN AUG F INDUSTRIAL PRODUCTION M/M -0.7%; PRIOR 0.0%

JAPAN AUG F INDUSTRIAL PRODUCTION Y/Y -4.4%; PRIOR 0.0%

JAPAN AUG CAPACITY UTILIZATION 0.5%; PRIOR -2.2%

MARKETS

US TSYS: Curve Bear Steepens In Asia

TYZ3 deals at 107-17+, -0-05+, a 0-08+ range has been observed on volume of ~95k.

- Cash sit 1-4bps cheaper across the major benchmarks, the curve has bear steepened.

- In early dealing local participants have faded the bull flattening seen on Friday, the USD trimmed gains in early trade and US Equity futures were higher.

- The move lower didn't follow through and tsys dealt in narrow ranges for the remainder of the session. Little meaningful macro news flow crossed.

- There is a thin docket in Europe today, further out we have Empire Mfg and Fedspeak from Philadelphia Fed President Harker is due.

JGBS: Futures Holding In Positive Territory, 20Y Supply Tomorrow

JGB futures remain richer, +8 compared to the settlement levels, but well below the post-Tokyo high seen before the weekend.

- There hasn’t been much in the way of domestic drivers to flag. The local calendar has been empty so far today, with Industrial Production and Capacity Utilisation for August due later.

- Accordingly, local investors have likely monitored US tsys in today’s Asia-Pac session for guidance. Cash US tsys are holding 1-5bbps cheaper, with the curve steeper. Little meaningful macro news flow has crossed. TYZ3 deals at 107-18, -0-05 compared to NY closing levels.

- Cash JGBs are slightly mixed, with the range of yield movements bounded by -0.7bp (10-year) and +1.5bps (40-year). The benchmark 10-year yield is at 0.754%, above BOJ's YCC soft limit of 0.50% but below its hard limit of 1.0%. It is also lower than the cycle high of 0.814%.

- MT Newswire reports that the BOJ has purchased a total of 1,010 trillion yen in JGBs over the past decade, according to recent data from the central bank.

- Swap rates have slightly bear-steepened, with 0.1bp to 0.8bp higher. Swap spreads are generally wider out to the 20-year and tighter beyond.

- Tomorrow the local calendar is light, with the Tertiary Industry Index as the sole release.

- Tomorrow, the MOF plans to sell Y1.2tn of 20-year JGBs.

AUSSIE BONDS: Slightly Cheaper, RBA Minutes & NZ Q3 CPI Tomorrow

ACGBs (YM -1.0 & XM flat) are slightly cheaper, near session lows, after dealing in narrow ranges in the Sydney session.

- The local data calendar has been empty today, ahead of the RBA Minutes for the October meeting tomorrow.

- Hence, local participants have likely been on headlines and US tsys watch during today’s session after risk-off gripped the markets on Friday as investors fretted over an escalation of the Middle East conflict.

- US tsys are dealing 1-6bps cheaper in the Asia-Pac session, with the curve steeper.

- Cash ACGBs are flat, with the AU-US 10-year yield differential 1bp higher at -19bps.

- Swap rates are 1bp lower, with EFPs slightly tighter.

- The bills strip is weaker, with pricing flat to -1.

- RBA-dated OIS pricing is little changed across meetings.

- Tomorrow also sees the release of NZ Q3 CPI data. Australia’s Q3 CPI is released on October 25.

- On Friday, the AOFM announced that a new 21 June 2054 Treasury Bond is planned to be issued via syndication this week, subject to market conditions. Joint lead managers are: Barrenjoey Markets; Commonwealth Bank of Australia; J.P. Morgan Securities Australia; UBS Australia Branch and Westpac.

NZGBS: Closed Richer, Narrow Ranges, Q3 CPI Tomorrow

NZGBs closed 1-4bps richer after dealing in narrow ranges during the local session. The previously outlined Performance Services Index failed to be a market mover.

- The market also seemed to take in its stride the change of government following the weekend’s election. NZ Prime Minister-elect Christopher Luxon is in the position to negotiate with the ACT Party and the NZ First Party to form a stable government after his National Party secured the most seats in the election.

- The swaps curve closed with a twist-flattening.

- Tomorrow, the local calendar sees Q3 CPI. Bloomberg consensus expects +1.9% q/q and +5.9% y/y versus +1.1% and +6.0% in Q2. Q3 is expected to be boosted by higher accommodation and insurance prices plus increased government charges including public transport. The RBNZ is likely to look through the data if it’s in line with expectations as it forecasted a strong Q3 outcome of 2.1% q/q and 6% y/y in August, higher than the Bloomberg consensus. Also, at its October meeting, it said it was focused on the medium term.

- Nonetheless, easing inflation may spur investors to dial back their expectations for another rate hike. RBNZ dated OIS pricing is 1-2bps firmer today, with terminal OCR expectations at 5.72% (+22bps).

FOREX: Antipodeans Firm In Asia

The Antipodeans are firmer in Asia today, the Kiwi is the best performer in the G-10 space with the AUD also outperforming. US Equity Futures are higher and US Tsys have trimmed Fridays gains. BBDXY is ~0.1% lower

- Kiwi has held onto its early gains and is now consolidating above the $0.59 handle. The majority of Friday's losses have been erased. Bulls focus on the 20-Day EMA ($0.5952). The impending change of government in New Zealand has boosted sentiment today.

- AUD/USD is up ~0.4% and is consolidating above $0.63 after being supported ahead of $0.6287 2.00 projection of the Jun 16-Jun 29-Jul 13 price swing. Resistance in the pair comes in at $0.6445, high from Oct 11.

- Yen is a touch firmer, USD/JPY has observed narrow ranges with little follow through on moves. Technically the pair remains in an uptrend, resistance comes in at ¥15016, high from Oct 3 and bull trigger.

- Elsewhere in G-10 the Scandies are firmer however liquidity is generally poor in Asia.

- The data docket is thin on Monday in Europe.

EQUITIES: Asia Pac Markets Weaker, Potential Fresh US Tech Curbs Weigh

Regional Asia Pac equities are tracking lower across the board. Losses have been prominent for Japan and South Korea stocks. This follows a generally poor end for global equity market sentiment at the end of last week. This has carried over into early trade this week, although US futures have stayed in positive territory in the first part of Monday trade. Eminis were last near 4367, around 0.22% higher, while Nasdaq futures are nearly 0.30% higher.

- Broader focus remains on escalation risks around the Israel/Hamas conflict, with Bloomberg reporting that the US has been talking with other countries in the region in an attempt to prevent the conflict spreading.

- Japan's Topix is down 1.50%, the Topix off by -1.8%. Tech sensitive plays are underperforming. At the margin reports of further US restrictions on China access to semiconductors is likely weighing (see this BBG link).

- The Kospi is off over 1.3%, while the Taiex is down nearly 1.3%, with similar factors at play.

- The HSI is off 0.43% at the break, while the CSI 300 is down 0.69%. A larger than expected MLF liquidity boost has done little to aid sentiment. The 1yr MLF rate was held steady at 2.50%, as expected. Prospects of fresh tech curbs will be weighing.

- The ASX 200 is off 0.35%, while NZ's market is down by 1%.in NZ a change of government to the centre-right National Party has taken place after the weekend's general election.

- SEA markets are weaker, with Thailand markets playing catch up to the downside (-1.50%), after being out last Friday.

OIL: Prices Hold Friday’s Gains As Middle East Uncertainty Persists

Oil prices are off their intraday lows to be steady during the APAC session after rising almost 6% on Friday driven by heightened geopolitical risks. Brent is flat but broke above $91 earlier and is currently around $90.91/bbl following a low of $90.18 earlier. WTI is also flat at $87.70 after falling to $87.07. The USD index is down 0.1%.

- ANZ estimated that increased geopolitical tensions in the Middle East have added a $5-10/bbl risk premium to oil. Bloomberg is reporting that the US has been talking with other countries in the region in an attempt to prevent the conflict spreading. Such an outcome would drive oil prices higher but the move is only likely to be sustained if there is a disruption to supply. A trip by US President Biden to Israel is being explored.

- Brent timespreads are wider than a month ago signalling that the market remains tight, according to Bloomberg. Saudi Arabia will be watched closely if there are supply disruptions to see if it will increase its output again after announcing its cuts will continue to end 2023.

- Later the Fed’s Harker speaks on the economic outlook and the ECB’s Lagarde and Panetta attend the Eurogroup meeting and Enria and Tuominen speak. In terms of data, there is only US October Empire manufacturing.

GOLD: Friday’s Large Middle East Conflict-Induced Gain Pared Slightly

Gold is 0.7% lower in the Asia-Pac session, after closing 3.4% higher at $1,932.82 on Friday.

- Friday's surge marked the most significant increase in seven months, spurred by rising concerns about an escalation in the Israeli-Palestinian conflict, which drove a surge in demand for safe-haven assets.

- Today's market downturn may be attributed to reports of US President Joe Biden's potential visit to Israel in the coming days, coinciding with his administration's discussions with Iran through back channels aimed at containing the conflict.

- According to MNI's technical analysis team, a sustained breach above the $1,900 per ounce mark would expose a notable technical gap, with few significant resistance levels in sight until we reach the critical resistance point set at the September 1st high of $1,953.0 per ounce.

- It's worth noting that ongoing central bank purchases have continued to provide consistent support to the market, while holdings of gold in known ETFs recently rebounded from cyclical lows as the price of bullion rallied.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/10/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/10/2023 | 0830/0930 |  | UK | BOE's Pill Speech at the OMFIF BOE's Pill Speech at the OMFIF | |

| 16/10/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 16/10/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/10/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 16/10/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 16/10/2023 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 16/10/2023 | 1430/1030 |  | US | Philadelphia Fed's Pat Harker | |

| 16/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 16/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 16/10/2023 | 2030/1630 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.