-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: US House Passes Debt Ceiling Deal

EXECUTIVE SUMMARY

- US DEBT CEILING BILL PASSES HOUSE WITH BROAD BIPARTISAN SUPPORT - RTRS

- FED MODEL POINTS TO ‘VERY STRONG’ MAY EMPLOYMENT GAINS - MNI

- UK EXECUTIVES NOT YET CONVINCED WORK IS OVER, SURVEY FINDS - BBG

- JAPAN Q1 CAPEX UP Q/Q, GDP REVISED HIGHER - MIN BRIEF

- CHINA FACTORY ACTIVITY EXPANDS MODERATELY, CAIXIN SURVEY SHOWS - BBG

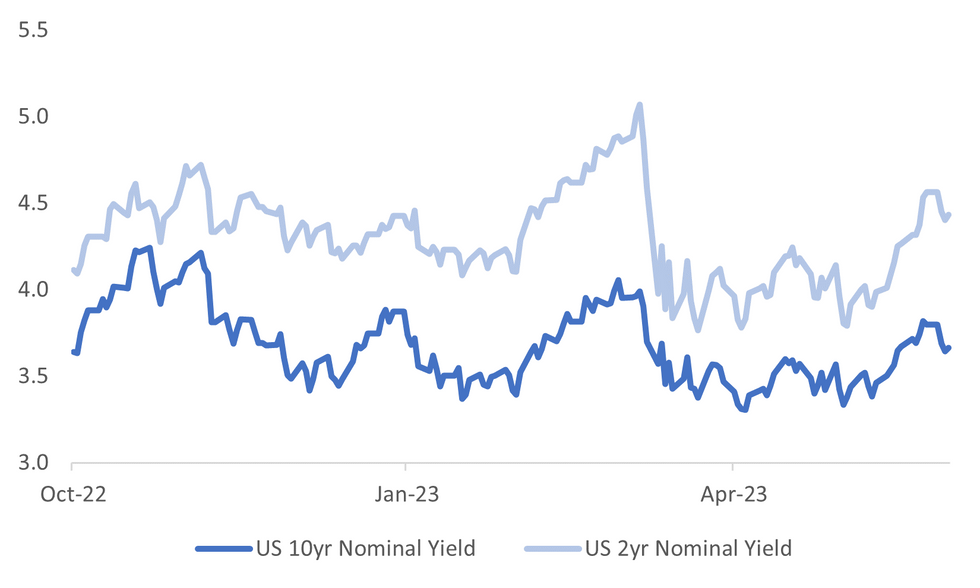

Fig. 1: US 2yr & 10yr Nominal Yields

Source: MNI - Market News/Bloomberg

U.K.

ECONOMY: British business confidence stabilized at “just below neutral” in May, with executives fearful that the shocks roiling the economy are far from over, a survey found. The Institute of Directors said its key gauge of sentiment edged down 1 point to -6, ending five months of increasing optimism. It leaves confidence at levels felt before Russia’s invasion of Ukraine last year. (BBG)

EUROPE

TECH: The European Union is trying to assemble the building blocks to produce electric cars, but subsidies are luring companies to the United States. European leaders complained for years that the United States was not doing enough to fight climate change. Now that the Biden administration has devoted hundreds of billions of dollars to that cause, many Europeans are complaining that the United States is going about it the wrong way. (NYT)

U.S

DEBT: A divided U.S. House of Representatives passed a bill to suspend the $31.4 trillion debt ceiling on Wednesday, with majority support from both Democrats and Republicans to overcome opposition led by hardline conservatives and avoid a catastrophic default. (RTRS)

POLITICS: Kevin McCarthy earned his stripes as Republican speaker of the U.S. House of Representatives on Wednesday, navigating fierce hardline opposition to pass a debt ceiling bill containing federal spending limits that President Joe Biden for months vowed to resist. (RTRS)

FED: (MNI) WASHINGTON - U.S. employment likely rose by 638,000 in May while wage growth continued to moderate, according to a real-time labor market index from the Federal Reserve Bank of St. Louis that "points to a still very strong labor market," economist Max Dvorkin told MNI. (MNI)

TECH: Apple Inc. is testing a pair of new high-end Macs and their accompanying processors ahead of its Worldwide Developers Conference next week, suggesting that it’s nearing the release of professional-focused desktop computers. (BBG)

OTHER

ASIA: Factories in Asia's largest economies stepped up a gear in May as supply chain problems eased, business surveys showed on Thursday, but sluggish global demand remained a major challenge for many of the region's big exporters. (RTRS)

JAPAN: (MNI) TOKYO - Combined capital investment by non-financial Japanese companies excluding software rose 2.7% q/q in Q1, accelerating from a 0.7% gain in Q4 2022, a quarterly revised survey released by the Ministry of Finance Thursday showed. (MNI)

TAIWAN: Taiwan and the United States will sign the first deal under a new trade talks framework on Thursday, both governments said, boosting ties between the two at a time of heightened tensions with China over the democratically-governed island. (RTRS)

AUSTRALIA: Australia’s house prices climbed for a third straight month in May, suggesting further interest-rate increases may be needed to cool resurgent demand that threatens to exacerbate inflationary pressures in the economy. (BBG

NZ: The annual pace of New Zealand house-price declines slowed further in May, coinciding with the central bank signaling it may have concluded its 18-month policy tightening cycle. (BBG)

CHINA

ECONOMY: China’s weak PMI data in May shows domestic demand remains insufficient which adds pressure to the fine tuning of macro policy, the 21st Century Herald said. Interviewing analysts and experts, the paper noted the economy’s overall recovery trend has not softened substantially, but has fallen short of analysts expectations at the start of the year. Policymakers must expand infrastructure construction and government investment to overcome weakness in the manufacturing, real estate and export sectors, the paper said. (21st Century Herald )

ECONOMY: China’s manufacturing activity expanded slightly in May, a private survey showed, a surprise improvement that contradicted official data showing a slump in factory output last month. (BBG)

HOUSING: The Government should embrace high-quality development and not restart the old speculative real-estate model, despite recent weak PMI and PPI data, according to an editorial from Yicai. The paper said the Government should resist calls from analysts and experts for excessive property sector stimulus, as this could restart speculative practices which would not deliver high-quality growth. Policymakers should take measures to ensure the property market remains healthy and ensure prices follow market fundamentals. Going forwards, authorities must reduce the economy’s operating costs and increase the marginal rate of return on investment. (Yicai)

JOBS: Applied maths graduate Liang Huaxiao tried to land a job with one of China's tech giants for two years. Then she tried customer service and sales. Then she applied for assistant roles in a bakery and in a beauty parlour. Like a rising number of her highly educated peers, Liang keeps trading down to try and find a source of income in China's worst youth job market on record. (RTRS)

INFRASTRUCTURE: China cut the sale of infrastructure bonds by almost half in May, a sign of slowing government investment at a time when the economy’s recovery is losing traction. (BBG)

CHINA MARKETS

PBOC Net Drains CNY5 Bln Via OMOs Thursday

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY5 billion after offsetting the maturity of CNY7 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9250% at 09:31 am local time from the close of 2.0845% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 47 on Wednesday, compared with the close of 46 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.0965 THURS VS 7.0821 WED

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.0965 on Thursday, compared with 7.0821 set on Wednesday.

OVERNIGHT DATA

AU MAY F JUDO BANK PMI Mfg 48.4; PRIOR 48.0

AU Q1 PRIVATE CAPEX 2.4%; MEDIAN 1.0%; PRIOR 3.0%

JAPAN Q1 CAPITAL SPENDING Y/Y 11.0%; MEDIAN 6.0%; PRIOR 7.7%

JAPAN Q1 CAPITAL SPENDING EX-SOFTWARE Y/Y 10.0%; MEDIAN 3.7%; PRIOR 6.3%

JAPAN Q1 COMPANY PROFITS Y/Y 4.3%; MEDIAN 0.9%; PRIOR -2.8%

JAPAN Q1 COMPANY SALES Y/Y 5.0%; MEDIAN 5.3%; PRIOR 6.1%

SOUTH KOREA MAY EXPORTS Y/Y -15.2%; MEDIAN -15.2%; PRIOR -14.3%

SOUTH KOREA MAY IMPORTS Y/Y -14.0%; MEDIAN -14.4%; PRIOR -13.3%

SOUTH KOREA MAY TRADE BALANCE -$2100mn; MEDIAN -$2530mn; PRIOR -$2654mn

SOUTH KOREA MAY PMI Mfg 48.4; Prior 48.1

CHINA MAY CAIXIN PMI Mfg 50.9; MEDIAN 49.5; PRIOR 49.5

MARKETS

US TSYS: Weaker After Debt Ceiling Passes The House, Heavy Calendar Ahead

TYU3 is currently trading at session lows at 114-04+, down 10+ from the closing levels in NY. While China's Caixin PMI comfortably exceeds the expansion/contraction threshold at 50.9, the main factor behind the move away from session highs was the news that the US House of Representatives voted in favour of raising the US debt ceiling by a margin of 314-117.

- The bill now awaits consideration in the Democrat-led Senate. President Biden has urged it to pass the agreement as soon as possible. However, several senators have indicated their intention to delay the legislation's progress, according to Bloomberg reports.

- Following the announcement, US tsys have weakened, reversing the earlier 1-3bp rally observed during the early Asia-Pacific session and turning into a 3-4bp cheapening across the yield curve, extending up to the 10-year maturity.

- Today’s agenda is also filled with important US data releases, including the ADP Employment report, ISM Manufacturing Index, final figures for Unit Labour Costs and Productivity in Q1, Challenger Job Cuts, and weekly Initial Jobless Claims. These releases will set the stage for Friday's highly anticipated Non-Farm Payrolls report.

JGBS: Richer After Solid Demand At 10-year Auction, US Tsys Pressure

JGB futures have strengthened in afternoon Tokyo trade, +12 compared to settlement levels. This positive movement can be attributed to the solid demand observed in the results of the 10-year JGB auction.

- However, the gains in JGB futures were countered to some extent by weaker US tsys in Asia-Pac trading. The reversal in US tsys occurred following the news of the US House of Representatives had voted to lift the US debt ceiling by a margin of 314-117. The bill now awaits consideration in the Democrat-led Senate. As a result, US tsys weakened, reversing the earlier 1-3bp rally seen during the early Asia-Pacific session and turning into a 3-4bp cheapening across the yield curve, extending out to the 10-year maturity.

- Cash JGBs are richer across the curve with yields 0.6-1.3bp lower. The 5-year zone is the outperformer, with the 4-year zone as the laggard.

- The benchmark 10-year yield is 1.0bp lower at 0.426%, after 10-year supply is well received with the low-price meeting wider expectations and the cover ratio rising to 3.689x from 3.60x at the previous auction.

- The swap curve shifts lower with rates 0.2-0.9bp lower. Swap spreads are wider across the curve.

- The local calendar tomorrow is light tomorrow with Monetary Base for May as the only release.

- Tomorrow will also see BoJ Rinban operations covering 1-5-year and 10-25-year JGBs.

- Ahead of that, the US calendar today sees the release of the ADP Employment report and ISM Manufacturing Index.

AUSSIE BONDS: Follows US Tsys Cheaper, Heavy US Calendar Today

ACGBs are weaker (YM -3.0 & XM -4.5) after US tsys reverse course after the debt ceiling bill passes the US House of Representatives. The bill now goes to the Democrat-led Senate and President Biden has urged it to pass the agreement as soon as possible. In terms of the Senate, Bloomberg is reporting that several senators have said that they won’t allow the legislation to pass quickly.

- Following the announcement, US tsys have weakened, reversing the earlier 1-3bp rally observed during the early Asia-Pacific session and turning into a 3-4bp cheapening across the yield curve, extending up to the 10-year maturity.

- Also potentially weighing on ACGBs was news that Q1 Capex printed higher than expected at +2.4% q/q versus expectations of +1.0%. The 2nd estimate of 2023-24 investment plans at A$137bn also printed above its estimate of A$136bn.

- Cash ACGBs are 3-4bp cheaper with the AU-US 10-year yield differential +2bp at -3bp.

- Swap rates are 4-5bp higher on the day with EFPs slightly wider.

- The bills strip sees pricing flat to -4 with late whites leading.

- RBA dated OIS is 2-5bp firmer for meetings beyond August with April’24 leading.

- The local calendar tomorrow sees Investor Loans data for April slated.

- The AOFM plans to sell A$500mn of the 4.25% 21 April 2026 bond tomorrow.

NZGBS: Weaker With US Tsys, Heavy US Calendar Today

NZGBs ended the session on a weak note, with yields climbing by 4bp across the benchmarks. The reversal in the local market can be attributed to a cheapening in US tsys, following the news of the US House of Representatives voting in favour of raising the US debt ceiling by a margin of 314-117.

- Additionally, the lacklustre demand observed at the auction of May-28 and May-34 bonds further contributed to the afternoon weakness. Notably, the cover ratios for these auctions declined to 2.64x and 2.75x from their previous levels of 3.40x and 4.13x, respectively. Although the cover ratio for the May-51 auction did experience a significant increase to 4.8x from 2.46x, the corresponding cash bond has traded 2.5bp cheaper following the auction, along with the other offerings.

- Swap rates closed -1bp lower to 1bp higher with the 2s10s 1bp flatter.

- RBNZ dated OIS closed flat to 1bp softer across meetings.

- The local calendar sees Q1 data for the Terms of Trade and Volume of All Buildings tomorrow.

- Ahead of that, the US calendar today sees the release of the ADP Employment report, ISM Manufacturing Index, final figures for Unit Labour Costs and Productivity in Q1, Challenger Job Cuts, and weekly Initial Jobless Claims. These releases will set the stage for Friday's highly anticipated Non-Farm Payrolls report.

EQUITIES: China Caixin PMI Beat Drives Relief Rally

Regional equities are mostly higher, with gains in China/HK in focus. Markets have been buoyed by the surprise Caixin manufacturing PMI beat in China. This goes against the recent run of softer data outcomes and yesterday's official PMIs. US equity futures spiked on the headlines the US House had passed the debt ceiling agreement, but this proved to be short-lived.

- Eminis were last close to 4193, just in positive territory. Earlier highs sat at 4202.50. Nasdaq futures are in the red, down -0.10% at this stage.

- The HSI is up 0.80% at the break, but was above +1% at one stage following the PMI beat. The tech sub-index is holding close to highs, last around +2%. The CSI 300 is near +0.70% at the break, with the index back above the 3700 level.

- Taiex (-0.40%) and the Kospi (-0.30%) are unperforming following tech losses in US trade on Wed.

- The ASX 200 is +0.30%, aided by higher metal prices post the China data. Indian shares are trying to go higher after yesterday's Q1 GDP beat, we aren't too far off recent highs, which may be limiting upside momentum.

FOREX: Firmer US Yields Halts Yen Rebound, AUD/NZD To Fresh Highs For May

The BBDXY has largely respected recent ranges. We last sat at 1245.40, against earlier highs near 1247. Some optimism emerged post the US House passing the debt ceiling agreement, but there wasn't much follow through. If anything, the USD index has slightly underperformed the firmer US yield backdrop. The 2yr sits just off session highs at 4.43%.

- The debt deal and the better Caixin China PMI have aided US yield moves. This has also helped USD/JPY move comfortably off fresh lows sub 139.00 (which printed early), with the pair back to 139.45/50. Better Q1 Capex data is likely to see Q1 GDP revised higher, but the data didn't have a meaningful impact on FX sentiment.

- AUD/USD was sub 0.6500 early, but now sits back closer to 0.6520. Higher commodity prices post the China data has helped, as has better than expected Q1 Capex figures locally. The AUD/NZD cross is trading at fresh highs for May, last near 1.0840.

- NZD/USD has lagged, last near the 0.6010/15 region, although we haven't moved back below 0.6000 so far today.

- Looking ahead, focus shifts to German retail sales on Thursday morning before the final manufacturing PMI reads for May. Attention will then be on the Eurozone Flash estimate of CPI which is expected to come in at 6.3% Y/y. This will be the final read before the June 15 ECB meeting. US ADP and the ISM Manufacturing PMI highlight the docket before Friday’s key employment report.

OIL: Crude Firmer On Debt-Deal & China Demand Optimism

Oil prices are higher during APAC trading driven by the passage of the US debt deal through the House of Reps and the Caixin PMI rising above 50. The USD index is flat.

- WTI is up 0.5% and has broken through $68 and is currently around $68.43/bbl, close to the intraday high of $68.64. Brent is 0.6% higher and is holding around $73.

- The dive in oil prices this week will not make for a happy OPEC meeting on the weekend. They will be looking at disappointing demand from China, while the group’s exports are declining and Russian output remains robust. The Saudi energy minister warned short-sellers earlier this month. It is possible that OPEC+ makes a small symbolic quota reduction to send a signal to the market. Most analysts expect no change.

- Bloomberg reported a 5.2mn crude stock build in the US according to API data. The official EIA numbers are released today.

- Later the Fed’s Harker speaks on the economic outlook. There are also US manufacturing PMI/ISM, Challenger job cuts, jobless claims and final Q1 productivity/ULC. In Europe, ECB President Lagarde speaks and PMIs, preliminary May CPI and unemployment rate are released.

GOLD: Supported By Lower Global Yields

Gold is slightly higher in the Asia-Pacific session, after closing at 1962.73 (+0.2%) on Wednesday.

- Bullion rose as bond yields declined following weaker economic data, softer equity markets, and Fedspeak (Jefferson/Harker) pushing back against a June hike.

- As far as FOMC dated OIS was concerned, Fedspeak weighed most heavily, especially for June OIS pricing with most of the day’s decline coming after Jefferson/Harker, to leave just +8bp priced, whilst it no longer fully prices a hike come July with +20bp.

- Gold experienced a decline of 1.4% in May, reversing the gains it made earlier in the month when it surged to nearly record levels due to concerns about a potential US default. However, these worries have subsided as President Joe Biden and Republican House Speaker Kevin McCarthy expressed optimism that legislation will be passed by lawmakers to prevent such a scenario.

- Fears of economic weakness have Wall Street strategists seeing a longer-term bull case for gold and the miners who dig up the precious metal even as the price of the bullion nears all-time highs. (link)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/06/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 01/06/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/06/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/06/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/06/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/06/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/06/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/06/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 01/06/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/06/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 01/06/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 01/06/2023 | 0930/1130 |  | EU | ECB Lagarde Speech at German Savings Banks Conference | |

| 01/06/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/06/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 01/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 01/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 01/06/2023 | 1230/0830 | ** |  | US | Non-Farm Productivity (f) |

| 01/06/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/06/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/06/2023 | 1400/1000 | * |  | US | Construction Spending |

| 01/06/2023 | 1400/1000 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 01/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 01/06/2023 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 01/06/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 01/06/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 01/06/2023 | 1700/1300 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.