-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: US Yields Drift Higher Ahead Of Key Inflation Data & Central Bank Meets

EXECUTIVE SUMMARY

- US ECONOMY REMAINS ‘VERY, VERY HOT’ LARRY SUMMERS SAYS - BBG

- EX-DEPUTY GOVERNOR SEES NO BOJ NORMALIZATION IN COMING MONTHS - BBG

- CHINA MAY CUT MLF RATE BY 5-10bps IN JUNE - SEC DAILY

- NZ ECONOMISTS EXPECT GROWTH TO SLOW SHARPLY IN 2023-24 - BBG

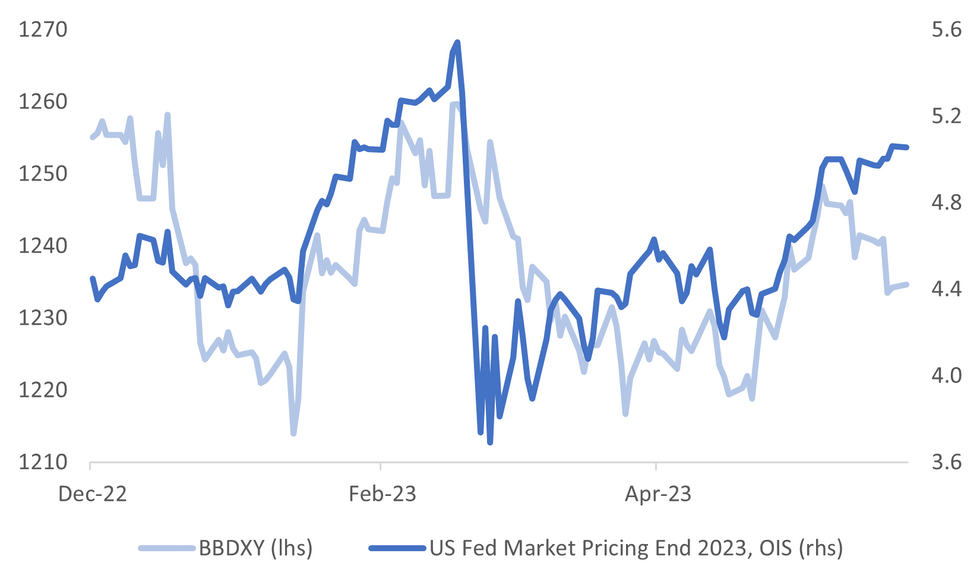

Fig. 1: Market End 2023 Fed Expectations (OIS) & BBDXY Trend

Source: MNI - Market News/Bloomberg

U.K.

POLITICS: Prime Minister Rishi Sunak faces a new electoral challenge after Boris Johnson’s surprise resignation from Parliament triggered at least three by-elections that could highlight softening support for the Conservative Party. (BBG)

POLITICS: Former Scottish First Minister Nicola Sturgeon was arrested as part of an investigation into the Scottish National Party’s finances, capping 48 hours of political drama in the UK. Sturgeon, who spearheaded the drive for Scottish independence, was released later on Sunday without charge. Police Scotland, who confirmed her arrest, said a 52-year-old woman was questioned by detectives for several hours before being released from custody at 5:24 p.m.(BBG)

REFORM: A Bank of England policy maker urged the UK government to move economic policy away from being an emergency response tool and onto a more sustainable footing. Catherine Mann, who sits on the nine-member panel setting interest rates, said fiscal and monetary policy makers need to “transition from a crisis-policy phase to a longer-term agenda that tackles underlying economic, social, and environmental challenges.” (BBG)

EUROPE

ECB: The European Central Bank will almost certainly deliver another interest rate hike on Thursday, pressing ahead with its fight against inflation even as the eurozone slides into a recession. Analysts predict that ECB policymakers will copy May's move and again raise borrowing costs by 25 basis points, taking the closely watched deposit rate to 3.50 percent. (AFP)

UKRAINE: Ukraine said on Sunday its troops had made territorial advances on three villages in its southeast, the first liberated settlements it has reported since launching a counter-offensive this past week. (RTRS)

U.S.

FED: Federal Reserve officials are ready to take a breather after more than a year of driving up interest rates, a move that’s likely to be accompanied by a strong signal that they’re prepared to keep hiking if needed. Policymakers are expected to leave rates in a range of 5% to 5.25% at their June 13-14 meeting, allowing them to take stock of the outlook following recent strains in the banking sector. But Chair Jerome Powell will also have to placate a number of officials who worry progress on inflation has stalled and say the Fed may need to do more to cool a surprisingly resilient economy. (BBG)

FED: The US economy remains “very, very hot,” though not as much as it was six to 12 months ago, said former Treasury Secretary Lawrence Summers. “The United States is, today, an underlying 4.5-5% inflation country,” Summers said, speaking via video link at the start of the two-day Caixin Asia New Vision Forum in Singapore. (BBG)

US/CHINA: The White House acknowledged the existence of Chinese spy facilities in Cuba, saying their presence dates back to the Trump administration and that Beijing continues to push to expand them. A senior administration official, in a statement issued Saturday on condition of anonymity because of the matter’s sensitivity, said US intelligence indicates that China has long maintained intelligence facilities in Cuba and that they were expanded in 2019. (BBG)

US/CHINA: The US expanded a ban on imports from China’s Xinjiang region, placing two more companies on its so-called entity list, the first additions since a law targeting forced labor in the area took effect a year ago. (BBG)

OTHER

JAPAN: The Bank of Japan is likely to stick with rock bottom interest rates in the near future including at this week’s policy meeting, according to a former deputy governor. “It’s still too early to call that this inflation has been sustainable and stable,” ex-deputy chief Masazumi Wakatabe said in an interview on Bloomberg TV Monday. “My guess is that at the June meeting there will be nothing.” (BBG)

JAPAN: The policy chief for Japan’s ruling Liberal Democratic Party said a no-confidence motion being considered by an opposition party may be a cause for dissolving parliament, leading to a general election. Koichi Hagiuda, head of the Policy Research Council at the LDP, made the remarks on a Sunday television news program amid ongoing speculation that Prime Minister Fumio Kishida may call an early election. (BBG)

INDIA: The Indian finance ministry officials will meet credit rating agency Moody's Investors Service on June 16 and pitch for a sovereign rating upgrade, two government sources told Reuters. The meeting will see participation from all government departments managing the economy, said the first source. (RTRS)

NZ: New Zealand Institute of Economic Research publishes quarterly consensus forecasts, in emailed statement. Economists see 2023-24 annual average GDP slowing to 0.6% from an estimated 2.8% in 2022-23. (BBG)

CHINA

POLICY: There is a higher chance for China to cut interest rates in the next few months and the earliest move could be lowering MLF rate by 5 to 10 basis points this month, Securities Daily reports, citing Ming Ming, chief economist of Citic Securities. (BBG)

PROPERTY: Goldman expects an “L-shaped” recovery in China’s real estate sector in coming years and the property weakness will likely be a multi-year growth drag for the world’s second largest economy, according to a research note by the US investment bank. Despite a transitory rebound in March thanks mainly to pent-up demand, many property indicators have shown renewed weakness since April, says the note dated June 11. (BBG)

CHINA MARKETS

PBOC Injects CNY2 Bln Via OMOs Mon; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Monday, with the rates unchanged at 2.00%. The operation kept the liquidity unchanged after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9593% at 09:33 am local time from the close of 1.8130% on Friday.

- The CFETS-NEX money-market sentiment index closed at 52 on Friday, compared with the close of 47 on Thursday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.1212 MON VS 7.1115 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1212 on Monday, compared with 7.1115 set on Friday.

OVERNIGHT DATA

NZ MAY CARD SPENDING RETAIL M/M -1.7%; PRIOR 0.4%

NZ MAY CARD SPENDING TOTAL M/M -1.9%; PRIOR 0.5%

JAPAN MAY PPI M/M -0.7%; MEDIAN -0.2%; PRIOR 0.3%

JAPAN MAY PPI Y/Y 5.1%; MEDIAN 5.6%; PRIOR 5.9%

MARKETS

US TSYS: Marginally Cheaper In Asia

TYU3 deals at 113-11, -0-01+, with a 0-06+ range observed on volume of ~38k.

- Cash tsys sit flat to 1bp cheaper across the major benchmarks, light bear flattening is apparent.

- Tsys have ticked away from session highs dealing in a narrow range for the Asian session, perhaps the proximity to tomorrow's CPI print and Wednesday's FOMC decision has kept local participants on the sidelines.

- At the open, despite the absence of any headline driver, TY gapped lower before finding support ahead of Friday's low and pared losses.

- FOMC dated OIS price ~8bp of hikes into Wednesday's meeting, a terminal of 5.30% is seen in July with ~25bps of cuts in 2023.

- There is a thin data calendar on Monday, we have the latest 3- and 10-Year Supply. Further out the weekend is headlined by the aforementioned CPI print tomorrow and Wednesday's FOMC rate decision.

JGBS: Outperform Tsy Futures Post PPI Miss & Ex BoJ Deputy Governor Comments

JGB futures are sitting towards the upper end of their range for the session so far. We are at 148.17 currently (+0.16), after a 148.00/26 range. This has outperformed the slightly softer US Tsys backdrop evident in the session to date (TYU3 -01 at 113-11).

- Japanese domestic news has likely aided this outperformance at the margins. PPI printed weaker than expected early doors (see this link), while ex-Deputy Governor Wakatabe stated he sees no change from the BoJ this Friday, nor at the July meeting (an upward revision to the inflation view is expected at the July meeting though).

- These latter comments are in line with Bloomberg's BoJ report from late on Friday, which suggested little need for YCC tweaks in the near term.

- In the cash JGB space we have seen a slight downtick in yields but very little follow, with a firmer US cash Tsy yield backdrop likely providing some offset. The 10yr yield was last close to 0.425%. In the swap space it been a similar story, the 10yr last just under 0.59%.

- Still to come is preliminary May machine tool orders. There is no market consensus, but the prior read was -14.4% y/y.

NZGBs: Marginally Cheaper On Monday

NZGBs have finished dealing 0.5-3.5bps cheaper across the major benchmarks, the curve has bear flattened.

- RBNZ dated OIS are little changed on Monday, pricing a terminal rate of 5.63% in October.

- Swap rates are a touch higher rising 2bp across 2s,5s and 10s.

- Retail Card Spending fell 1.9% M/M in May with the prior number revised lower to 0.5% M/M from 1.0% M/M. Retail Spending fell 1.7% M/M, the prior number was revised lower to 0.4% M/M from 0.7% M/M.

- NZIER's Quarterly Consensus notes that economists see 2023/24 GDP expanding at 0.6%. Westpac noted they see Fonterra 2023/24 milk price at $8.90/kg.

- Looking ahead, April Net Migration crosses tomorrow, before Q1 BoP and May Food Prices on Wednesday. Q1 GDP on Thursday headlines the week's docket, a fall of 0.1% Q/Q is expected.

FOREX: USD Marginally Firmer In Asia

The USD is a touch firmer in Asia Monday, however ranges have been narrow with little follow through on moves.

- Kiwi is marginally pressured, NZD/USD is down ~0.1% trimming some of Friday's gains. The pair has see-sawed around its 20-Day EMA with little follow through on moves. NZIER's Quarterly Consensus notes that economists see 2023/24 GDP expanding at 0.6%. Westpac noted they see Fonterra 2023/24 milk price at $8.90/kg.

- AUD/USD has observed a narrow range, last printing at $0.6740/45 little changed from opening levels. Resistance comes in at $0.6751 high from June 9 and support at $0.6623 the 20-day EMA.

- Yen is a touch firmer, USD/JPY sits marginally below opening levels however a ~25pip range has persisted in Asia today. Early in the session Japan's May PPI printed weaker than expected, coming in at -0.7% m/m (exp -0.2%), although Apr was revised slightly higher to 0.3%, versus 0.2% prior.

- Cross asset wise; US Treasury Yields are ~1bp firmer across the curve and BBDXY is up ~0.1%. E-minis are also ~0.1% firmer.

- The docket is thin on Monday, further out the highlights of the week are US CPI (Tuesday), FOMC rate decision (Wednesday) and BoJ monetary policy decision (Friday).

EQUITIES: Mixed Start To Busy Central Bank Week

Regional equities have gotten off to a mixed start this week. Japan stocks are modestly higher, while HK and mainland China are down slightly. SEA is mixed. US futures are positive but down from session highs. Eminis last around 4352.00, against a high of 4357.25. Nasdaq futures are slightly outperforming, last +0.15% at 14757.50, but also down from session highs.

- The Nikkei 225 is +0.25% at this stage, off from earlier highs. PPI data showed waning upstream price measures, while an ex-BoJ Governor didn't expect policy shifts from the central bank at the coming meeting this Friday.

- The HSI is down 0.57% at the break, while China stocks are slightly weaker. The CSI 300 remains above 3800 at this stage. Weakness in the HSI has been led by tech and banking sector names.

- There speculation the 1 yr MLF rate will be cut this Thursday, although recent commentary from the China authorities doesn't suggest we will see aggressive policy stimulus.

- The Kospi is tracking 0.50% lower, unwinding some of the recent outperformance, last around 2627 in index terms. The Taiex is tracking better, last around 0.50% firmer.

- In SEA Malaysia shares are the standout +1% higher. The government will extend existing subsidies and price controls for poultry and eggs beyond the original June 30 deadline. Also Malaysia named Shaik Rasheed Abdul Ghaffour as its new central bank governor, Malaysia's king approved Rasheed as the governor from July 1 for a period of 5 years.

OIL: Brent & WTI Close To Thursday Lows

Brent crude has continued to track lower. After opening closer to $74.90/bbl, we have mostly been on the backfoot, although some support has emerged sub $74/bbl (which is where we currently track). This isn't too far off Thursday lows, near $73.50/bbl, which came about post rumors of a US-Iran nuclear deal.

- At this stage, Brent is down a further 1.1%, having lost around 2.85% through Thurs/Fri last week. A fresh break of $73.50 will have the market targeting lows around $71.40/bbl from late May.

- WTI is back to just under $69.40/bbl, also close to Thursday session lows from last week (near $69/bbl).

- Goldman Sachs has cut its year-end Brent forecast to sub $90/bbl, the third downgrade it had made in 6 months.

- We did see investor positioning turn more constructive for oil in terms in the week ending June 6, but it remains to be seen if this is maintained following more bearish price action in recent sessions.

- Outside of the central bank meetings this week, also note that OPEC publishes its monthly Oil Market Report on Tuesday.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/06/2023 | - | *** |  | CN | Money Supply |

| 12/06/2023 | - | *** |  | CN | New Loans |

| 12/06/2023 | - | *** |  | CN | Social Financing |

| 12/06/2023 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 12/06/2023 | 1530/1130 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 12/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 12/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 12/06/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 13/06/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 13/06/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/06/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 13/06/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/06/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/06/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/06/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/06/2023 | 1230/0830 | *** |  | US | CPI |

| 13/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/06/2023 | 1400/1500 |  | UK | BOE Bailey Lords Economic Affairs Committee Hearing | |

| 13/06/2023 | 1400/1000 |  | US | Treasury Secretary Janet Yellen | |

| 13/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 13/06/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 13/06/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.