-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI DATA TABLE: MNI China Interbank Liquidity Index (Jun) - 3

MNI DATA TABLE: MNI China Interbank Liquidity Index (Jun) - 2

MNI EUROPEAN OPEN: USD Firms Ahead Of Jackson Hole, EUR/USD Tests Sub 200-day MA

EXECUTIVE SUMMARY

- POWELL, LAGARDE, UEDA, BROADBENT TO SPEAK AT JACKSON HOLE - MNI

- ECB’s NAGEL SAYS ‘MUCH TOO EARLY’ TO CONSIDER RATE HIKE PAUSE - BBG

- ECB'S VUJCIC SAYS MORE PRICE DATA NEEDED TO DETERMINE RATE PEAK -BBG

- CHINA ASKS BANKS TO LIMIT SOME CONNECT BOND OUTFLOWS - RTRS

- JAPAN AUG TOKYO CORE CPI RISES 2.8% Vs. JULY 3.0% - MNI BRIEF

- UK CONSUMER CONFIDENCE REBOUNDS AFTER SIGNS INFLATION IS COOLING - BBG

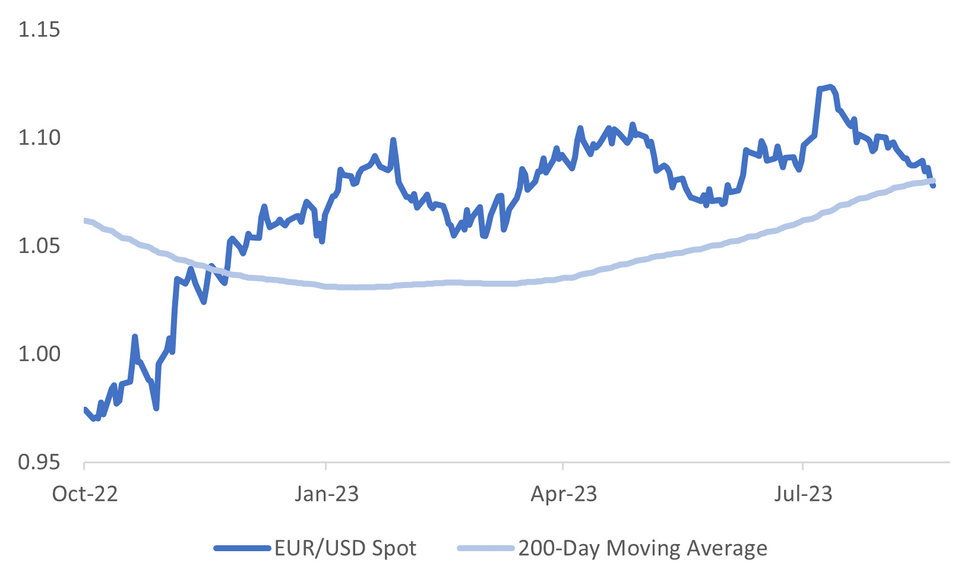

Fig. 1: EUR/USD Versus 200-day Moving Average

Source: MNI - Market News/Bloomberg

U.K.

CONSUMER: UK consumer confidence rebounded in August as inflation showed signs of cooling and strong wage growth buoyed household finances. The market research company GfK said its reading of sentiment rose 5 points to minus 25 this month, recouping almost all of the downturn in July. Consumers’ outlook for their own finances in the next year is now 28 points higher than a year ago. (BBG)

EUROPE

ECB: European Central Bank Governing Council member Joachim Nagel said that he’s not convinced inflation is under control enough for a halt in interest rate hikes, with his decision hinging on additional data in the coming weeks. (BBG)

ECB: European Central Bank Governing Council member Boris Vujcic said officials need more data about the trajectory of inflation to judge whether interest rates have risen far enough. “We are now certainly in the restrictive territory,” the head of Croatia’s central bank told Bloomberg TV in an interview on the sidelines of the Federal Reserve Bank of Kansas City’s annual symposium in Jackson Hole, Wyoming. (BBG)

RUSSIA: A group of Russian militants who fight on the Ukrainian side called on the Wagner Group of mercenaries to switch sides and join their ranks to revenge the deaths of Wagner founder Yevgeny Prigozhin and their commander Dmitry Utkin. Russian air authorities have said Prigozhin, Utkin and eight other people were on a private plane that crashed with no survivors north of Moscow on Wednesday. (RTRS)

U.S.

JACKSON HOLE: Global central bank leaders including Jerome Powell, Christine Lagarde, Kazuo Ueda and Ben Broadbent of the Federal Reserve, European Central Bank, Bank of Japan and Bank of England, respectively, are set to speak at the Kansas City Fed's annual economic symposium that runs from Thursday evening to Saturday afternoon. (MNI)

FED: An abstract interest-rate metric is dominating discussions across trading desks ahead of the Jackson Hole symposium, with investors wondering if Federal Reserve Chair Jerome Powell will weigh in, and bracing for further declines in US Treasuries if he does. Fidelity International, Jupiter Asset Management and hedge fund Blue Edge Advisors are among those pondering the implications of whether there has been an increase in the neutral rate, also known as R*. (BBG)

POLITICS: Donald Trump's mug shot was released on Thursday evening after he was booked at an Atlanta jail on more than a dozen felony charges as part of a wide-ranging criminal case stemming from the former U.S. president's attempts to overturn his 2020 election defeat in Georgia. (RTRS)

OTHER

JAPAN: The y/y rise in the Tokyo core inflation rate slowed to 2.8% in Aug from July's 3.0% due to lower energy prices, indicating that the nationwide August core CPI could fall from July's 3.1%, Ministry of Internal Affairs and Communications data showed Friday. (MNI BRIEF)

JAPAN: The Bank of Japan will start downscaling its massive monetary easing only in a year's time, the majority of economists said in a Reuters poll, as speculation for further policy shifts abated after a surprise yield control tweak last month. (RTRS)

JAPAN/CHINA: Japan’s release of treated radioactive wastewater into the sea has sparked outrage across China, triggering a ban on imports and pushing consumers to vent their anger. Some have even started hoarding salt. Tokyo’s move prompted swift retaliation from Chinese authorities, who banned all Japanese seafood imports starting Thursday. The announcement was met with broad support from the Chinese public, and also triggered anger among some over what’s seen as “selfish” behavior by the Japanese government. (BBG)

AUSTRALIA: Workers voted in favor of industrial action at two of Chevron Corp.’s liquefied natural gas facilities in Australia if talks don’t resolve a pay dispute. Unions could strike at Chevron’s Gorgon and Wheatstone Downstream plants should the company fail to provide an appropriate offer during negotiations, the Offshore Alliance said in an emailed statement. That would put at risk 24.5 million tons of annual supply, or about 5% of global liquefaction capacity. (BBG)

SOUTH KOREA: Hyundai Motor's unionised workers in South Korea on Friday vote on whether to hold a strike after two months of talks with the company over wage increase and extension of the retirement age stalled last week. (RTRS)

HONG KONG: Some perpetual dollar bonds sold by Hong Kong-based firms have been posting record weekly declines this month, a sign of contagion from China’s property sector struggles. (BBG)

ARGENTINA: Argentina’s currency interventions will be “limited and temporary” as part of the new framework of its $44 billion agreement with the International Monetary Fund, the multilateral lender said in a statement published Thursday citing Managing Director Kristalina Georgieva. (BBG)

CHINA

BOND CONNECT: China's central bank has asked some domestic banks to scale back their outward investments through the Bond Connect scheme, two sources with direct knowledge of the matter said. The window guidance from the People's Bank of China (PBOC)seems to be aimed at containing yuan outflows into Hong Kong, and thus ensuring less supply of yuan in offshore markets, the sources said. (RTRS)

YUAN: PBOC’s recent yuan-denominated bill sales in Hong Kong can help stabilize expectations of the Chinese currency by tightening liquidity in the offshore yuan market, Financial News, which is backed by the Chinese central bank, reports Friday, citing Sheng Songcheng, a former PBOC official. (BBG)

EQUITIES: Eleven brokerages announced plans Thursday to lower commission rate for stock trading after the country’s main onshore stock exchanges vowed to cut stock handling fees last week, Securities Times reports Friday. (BBG)

CAPITAL INFLOWS: China should make additional efforts to attract foreign capital, increase the vitality of businesses and expand institutional opening up, according to China’s Premier Li Qiang. On a recent tour of Guangdong province, Li said China faced a critical period of economic transformation which required authorities to promote scientific and technological innovation, and accelerate manufacturing's digital transformation. (Yicai)

TAXES: The Ministry of Finance has issued a notice calling for authorities to implement tax and fee reduction policies for SMEs to ensure they can effectively re-vitalise and develop accordingly. The notice said authorities should coordinate policies across government departments and work together to guide fiscal funds to increase innovation. (Securities Daily)

MARKETS: China Securities Regulatory Commission (CSRC) will strengthen policy coordination with other departments to provide more forceful support for medium- and long-term funds including pension, insurance and bank wealth management funds to participate in the capital market, the top securities watchdog said at a meeting with major institutional investors. (CSRC website)

CHINA MARKETS

MNI: PBOC Net Injects CNY123 Bln Friday via OMO

he People's Bank of China (PBOC) conducted CNY221 billion via 7-day reverse repos on Friday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY123 billion after offsetting the maturity of CNY98 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8000% at 09:23 am local time from the close of 1.7819% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 56 on Thursday, compared with 40 on Wednesday.

PBOC Yuan Parity Lower At 7.1883 Friday Vs 7.1886 Thursday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1883 on Friday, compared with 7.1886 set on Thursday. The fixing was estimated at 7.2826 by Bloomberg survey today.

MARKET DATA

UK AUGUST GFK CONSUMER CONFIDENCE -25; MEDIAN -29; PRIOR -30

JAPAN AUGUST TOKYO CPI Y/Y 2.9%; MEDIAN 3.0%; PRIOR 3.2%

JAPAN AUGUST TOKYO CPI EX FRESH FOOD Y/Y 2.8%; MEDIAN 2.9%; PRIOR 3.0%

JAPAN AUGUST TOKYO CPI EX-FRESH FOOD, ENERGY Y/Y 4.0%; MEDIAN 4.0%; PRIOR 4.0%

JAPAN JULY PPI SERVICES Y/Y 1.7%; MEDIAN 1.3%; PRIOR 1.4%

MARKETS

US TSYS: Narrow Ranges In Asia, Powell In View

TYU3 deals at 109-15, -0-04, a 0-05+ range has been observed on volume of ~120k.

- Cash tsys sit little changed across the major benchmarks.

- Tsys firmed in early dealing, there was no obvious headline driver, as perhaps local participants used Thursday's cheapening as an opportunity to close short positions ahead of Fed Chair Powell's Jackson Hole speech.

- There was little follow through on the moves higher and tsys pared gains to sit in a narrow range for the remainder of the session.

- FOMC Dated OIS price a terminal rate of ~5.45%, there are ~60bps of cuts priced to July 2024.

- There is a thin docket in Europe today, Further out the aforementioned speech from Fed Chair Powell headlines, US University of Michigan consumer sentiment also crosses.

JGBS: Futures Pare Losses In The Tokyo Afternoon, Eyeing US Tsys Ahead Of JH Speeches

In the Tokyo afternoon session, JGB futures slightly pared losses, -7 compared to settlement levels, after dealing in a relatively narrow range in the morning session.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Tokyo CPI for August, which was a touch below expectations in terms of the headline and ex-fresh fruit measures.

- Accordingly, local participants have likely been on headlines and US tsys watch ahead of the keenly anticipated address by Fed Chair Powell at the Jackon Hole Symposium.

- US tsys are sitting little changed in Asia-Pac trade. The ranges have been relatively narrow, with the proximity to Fed Chair Powell's speech today a limiting factor.

- Cash JGBs are mixed across the curve, with yield movements bounded by -1.2bp (20-year) and +0.2bp (the futures-linked 7-year). The benchmark 10-year yield is unchanged at 0.656%, above BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%.

- Swap rates are mixed across the curve, with the belly underperforming. Swap spreads are narrower, part from the 40-year.

- Early next week, the local calendar sees June Leading and Coincident Indices on Monday and July Jobless Rate data on Tuesday.

- On Tuesday, the MoF plans to sell Y2.9tn of 2-year JGBs.

AUSSIE BONDS: At Session Cheaps Ahead Of Fed Chair Powell’s JH Speech

ACGBs (YM -5.0 & XM -5.5) are weaker and near Sydney session lows. With the domestic data docket empty today, local participants have likely been on headlines and US tsys watch ahead of Fed Chair Powell's speech this evening (1505 BST / 0005 AEST) at the Jackson Hole Symposium.

- Aussie 10-year futures are trading above recent lows. Nonetheless, the break of support at 95.685, the Jul 10 low would reinforce a bearish theme, according to MNI’s technicals team.

- US tsys are sitting little changed in Asia-Pac trade. The ranges have been relatively narrow, with the proximity to Fed Chair Powell's speech today a limiting factor.

- Cash ACGBs are 4-5bp cheaper with the AU-US 10-year yield differential -1bp at -8bp.

- Swap rates are 5bp higher.

- The bills strip has bear-steepened, with pricing -1 to -8.

- RBA-dated OIS pricing is 2-6bp firmer for '24 meetings. A 6% chance of a 25bp hike is priced for September.

- Next week, the local calendar sees Retail Sales for July on Monday, ahead of RBA Governor Elect Bullock’s speech on Tuesday. On Wednesday, the CPI Monthly for July is on tap, with Construction Work Done (Q2), Building Approvals (Jul) and Private Sector Credit (Jul).

NZGBS: Closed On A Weak Note Ahead Of Jackson Hole Speeches

NZGBs closed at session cheaps, with benchmark yields 4-5bp higher. Without domestic drivers, local participants likely eyed headlines and US tsys ahead of the keenly anticipated address by Fed Chair Powell at the Jackon Hole Symposium.

- US tsys are sitting little changed in Asia-Pac trade. The ranges have been narrow, with the proximity to Fed Chair Powell's speech today a limiting factor.

- Swap rates are 3-5bp higher, with implied swap spreads little changed.

- RBNZ dated OIS pricing is 1-3bp firmer for meetings beyond October. Terminal OCR expectations sit at 5.65%.

- Bloomberg reports that ANZ Bank says China’s slowing economy could help curb NZ inflation, and may allow the RBNZ to avoid another interest rate hike, according to a weekly report. Nevertheless, ANZ maintains the view that a 25bp hike is needed in November. (See link)

- Next week the local calendar is empty until Building Permits on Wednesday and ANZ Business Confidence on Thursday.

- Next Thursday the NZ Treasury plans to sell NZ$225mn of the 0.25% May-28 bond, NZ$175mn of the 1.5% May-31 bond and NZ$100mn of the 1.75% May-41 bond.

FOREX: USD Firms In Asia, Powell In View

The greenback has firmed in the Asian session on Friday as Fed Chair Powell's speech this evening comes in to view. The greenback has moderately extended gains seen in Thursday's trading, lower regional equities are weighing on sentiment at the margins.

- EUR is pressured, EUR/USD is down ~0.3% and has broken several support levels. ECB's Nagel noted he is yet to make his mind up about the September ECB monetary policy decision. Support now comes in at €1.0767, bull channel base drawn from Mar 15 low, and €1.0733, low from Jun 12. Resistance is at €1.0933, the 20-Day EMA.

- Kiwi is down ~0.3% and sits a touch above YTD lows, bears look to break the low from 21 Aug ($0.5897).

- Yen is a touch pressured, USD/JPY is ~0.1% firmer and sits above the ¥146 handle. The pair has breached Thursday's highs although ranges remain narrow.

- AUD/USD is holding above the $0.64 handle, ranges have been narrow today.

- Elsewhere in the G-10 space GBP is down ~0.3%. The Scandies are also pressured however liquidity is generally poor in Asia.

- Cross asset wise; BBDXY is up ~0.2% and the Hang Seng is down ~1%. US Tsy Yields are little changed across the curve.

- The final read of German Q2 GDP is the highlight in Europe, further out the aforementioned Fedpeak from Powell headlines today's docket.

EQUITIES: Regional Equity Soften Ahead Of Jackson Hole

Regional Asia Pac equities are a sea of red following the negative lead from US and EU markets in Thursday trade. Losses are across the board, while US futures are mixed. Eminis sit a touch higher, last near 4388, while Nasdaq futures are down -0.15% to 14839.50. Markets may also be somewhat cautious ahead of Powell's speech at the Jackson Hole forum later in the US session.

- Hong Kong and China shares are lower to the break. The HSI down ~1%, with the tech index off around 2%. We saw a sharp pull back in US tech sentiment on Thursday.

- The CSI is down close to -0.50%. Brokerages have rallied on reports of lower commission rates for stock trading. This hasn't been enough to drive overall sentiment higher. Morgan Stanley also downgraded its China stock target for 2024 by 14%.

- In Japan, the Topix is down 0.80%, while the Nikkei has fallen ~1.85%. Tech names have weighed on the aggregate indices. The Kospi is off 0.70%, with offshore investors selling -$146.1mn of local shares today. The Taiex is down -1.40%, basically unwinding all of yesterday's gains.

- In SEA markets are weaker, but losses are less than 1%. The Philippines stock gauge down nearly 0.70% to sub 6200, with reports of lower bank lending weighing on the bank sector. The Singapore bourse is one of the few bright spots, last tracking close to flat.

OIL: Tracking Lower For the 2nd Straight Week

Brent crude is modestly higher in the first part of Friday trade. We were last near $83.65/bbl, down slightly from session highs ($83.78/bbl) and after opening at $83.26/bbl. This puts us +0.35% higher for the session to date, building on Thursday's modest 0.2% gain. WTI is near $79.35/bbl, following a similar trajectory to Brent. These trends are outperforming broader risk themes today, with the BBDXY up a further 0.20%, while regional equities are mostly in the red.

- Still, we are tracking lower for the second straight week, Brent off by 1.35% versus closing levels from the end of last week. WTI down 2.3% over the same period.

- Losses this week have been driven by a firmer USD/elevated yield backdrop ahead of the Jackson Hole symposium. Demand concerns out of China haven't helped, while there have also been some signs of greater oil supply from some OPEC members (albeit not core members).

- For Brent, support has been evident in recent sessions around $82/bbl level, which also coincides with the 50-day EMA. The 100-day EMA sits further south near $81/bbl. On the topside the 20-day EMA is around $84/bbl, while the 21 August high sits around $85.85/bbl.

- Outside of the upcoming Jackson Hole symposium (Fri-Sat), next week doesn't deliver many fresh oil specific risk events. Note we get US Q2 GDP on Wednesday and official PMIs from China on Thursday.

GOLD: Treaded Water Ahead Of Fed Chair Powell’s Speech At Jackson Hole

Gold is slightly weaker in the Asia-Pac session, after closing +0.1% at $1916.91 on Thursday. The resilience of bullion was surprising considering the renewed push higher in the USD index and higher US tsy yields.

- Possibly supporting the precious metal was news that the Polish central bank made its largest gold purchase in four years in July, boosting its share to more than a tenth of reserves.

- As a result, gold is on track for its first weekly gain in five ahead of a key speech by Federal Reserve Chair Jerome Powell at the Jackson Hole symposium in Wyoming, where he’s expected to offer clues on the interest-rate outlook.

- Prior to the Jackson Hole symposium, Fedspeak on Thursday conveyed a blend of perspectives. Taking a more hawkish stance, Boston Fed's Collins emphasised the prudence of maintaining elevated rates for an extended duration, underlining the potential necessity for further adjustments. Collins stated, "A preset path may not be conducive; additional increments might be necessary, and we could be on the cusp of a prolonged period of stability."

- Conversely, Philly Fed's Harker indicated to MNI that he leans towards endorsing the maintenance of prevailing interest rates until the conclusion of the year and potentially even beyond.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/08/2023 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/08/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 25/08/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/08/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/08/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index Direction |

| 25/08/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/08/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 25/08/2023 | 1405/1005 |  | US | Fed Chair Powell on economic outlook | |

| 25/08/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 25/08/2023 | 1900/2100 |  | EU | ECB's Lagarde speaks at Jackson Hole |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.