-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD Index Still Threatening Test Lower

EXECUTIVE SUMMARY

- BIDEN SIGNS $1.7 TRILLION US GOVERNMENT SPENDING BILL (AFP)

- PUTIN & XI TO SPEAK BY VIDEO LINK ON FRIDAY (RTRS)

- RUSSIA MAY RAISE YAN SHARE IN WELLBEING FUND TO 80% (BBG)

- CHINA’S ECONOMIC ACTIVITY REBOUNDS IN CITIES WHERE COVID PEAKED (BBG)

- BOJ SEEKS TO FEND OFF BOND BEARS WITH MORE BOND BUYING (BBG)

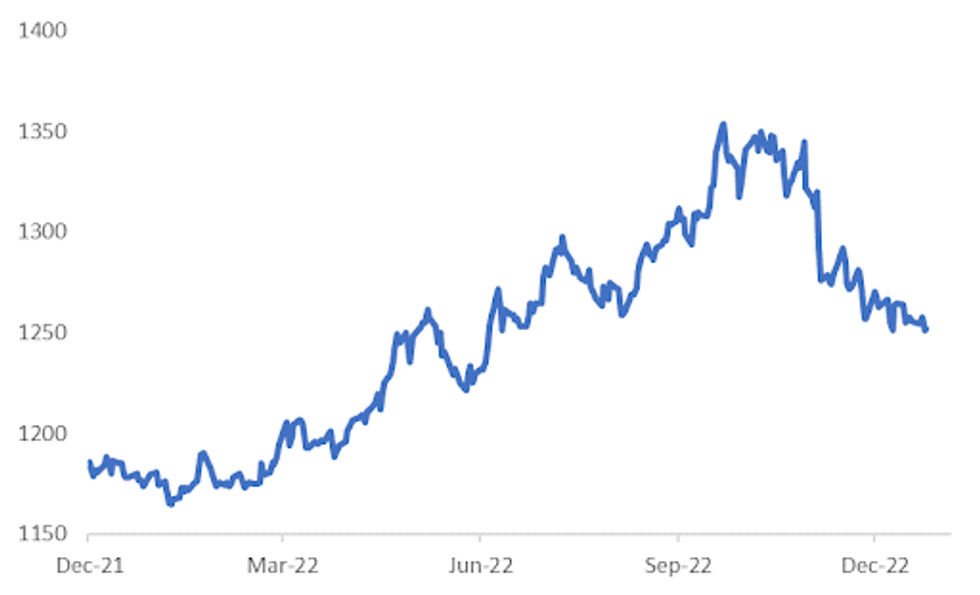

Fig. 1: BBDXY Index

Source: MNI - Market News/Bloomberg

UK

ECONOMY: UK ministers won’t be held to ransom by striking workers calling for more pay, Defence Secretary Ben Wallace said, as the government grapples with a wave of industrial action hitting hospitals, the railways and airports. (BBG)

EUROPE

RUSSIA/CHINA: Russian President Vladimir Putin will speak with Chinese President Xi Jinping via video link on Friday to discuss a host of bilateral and regional issues.(RTRS)

RUSSIA: Russian Finance Ministry defined a new structure of the National Wellbeing Fund, increasing the potential share of Chinese yuan up to 80%, Vedomosti reports late Thursday. Ministry excludes euro, yen and pound sterling from the wealth fund, Vedomosti cites a person close to the government and an unidentified person with knowledge of the text of ministry’s order (BBG)

U.S.

CORONAVIRUS: The US Centers for Disease Control is considering sampling international airplane wastewater to track any emerging Covid variants, Reuters reports, citing the agency.(BBG)

ECONOMY: Mortgage rates in the US rose for the first time since mid-November. The average for a 30-year, fixed loan was 6.42%, the highest since early this month and up from 6.27% last week, Freddie Mac said in a statement Thursday. (BBG)

FISCAL: President Joe Biden on Thursday signed off on a $1.7 trillion spending bill that will keep the US government funded through the next fiscal year -- notably including another big package for Ukraine's war effort.(AFP)

POLITICS: Former president Donald Trump has approvingly shared an article on his Truth Social account which argues that he should mount a third-party bid for the presidency if Republicans fail to award him the GOP nomination in the upcoming 2024 election. (Independent)

OTHER

JAPAN: The Bank of Japan announced a third day of unscheduled bond purchases as it fights back against speculation it’s moving toward ending its super-accommodative monetary policy. (BBG)

JAPAN: Banking units of Japan’s Mizuho Financial Group and Sumitomo Mitsui Financial Group increased headline mortgage interest rates for Jan. contracts. Mizuho Bank raises 10-year fixed loan rate to 3.5% from 3.2%. SMBC raises 10-year fixed loan rate to 3.79% from 3.53%. (BBG)

AUSTRALIA: Australians spent a record-breaking A$74.5 billion ($50.4 billion) in the run-up to Christmas, a sign that rising prices and soaring interest rates have yet to weaken consumer demand. (BBG)

SOUTH KOREA: South Korea’s inflation stayed elevated in December, paving the way for more policy tightening by the central bank in the new year. Consumer prices advanced 5% from a year earlier, matching November’s pace, the statistics office reported Friday. Economists had expected inflation to strengthen to 5.1%.(BBG)

SOUTH KOREA: South Korea will require coronavirus tests before and arrival for travelers from China by end-Feb. as Covid situation in the neighboring country worsens, Prime Minister Han Duk-soo says in meeting.(BBG)

CHINA

CORONAVIRUS: Nearly 50% of the patients taken in by the emergency room of a top military hospital in Beijing were in critical condition as Covid infections surged in the Chinese capital, according to a Thursday report on a health news app run by the People’s Daily. (BBG)

CORONAVIRUS: Local authorities across China must waste no time in preparing for Covid response measures in the countryside before the mass migration of people during the Lunar New Year holiday, the Securities Times said Friday. (Security Times)

ECONOMY: Economic activity is rebounding in several Chinese cities where Covid infections likely already peaked, although many parts of the country are still grappling with soaring cases and mobility is still far below levels reached a few months ago. (BBG)

ECONOMY: More government policy support could help consumption be a core pillar of economic growth in China next year, according to analysts interviewed by the Securities Times. Proposed consumption boosting measures include extending tax exemptions for green energy vehicles, further use of consumption vouchers, increasing fiscal transfers from governments to households, optimising epidemic controls to support the food & catering sector, and increasing confidence in the real estate sector. Following Covid disruptions, improved policy coordination is needed in social security, consumer finance, rural revitalisation, and income distribution, analysts interviewed by the Securities Times said. (Securities Times)

ECONOMY: The central government should show it is determined to develop and expand the private economy, and combat arguments that may weigh on market expectations such as “common prosperity means robbing the rich to aid the poor”, 21st Century Business Herald reported citing Yang Weimin, deputy director of Committee for Economic Affairs of the National Committee of the Chinese People’s Political Consultative Conference. It is necessary to abolish measures that are unfair to the private economy and remove hidden barriers, and officials at all levels should solve problems and do practical things for private enterprises, Yang was cited as saying. The 20th National Party Congress proposed “promoting the development and expansion of the private economy” for the first time, Yang added (Herald)

ECONOMY: China's unemployment level will remain under significant pressure in the short term, as sectors affected by the pandemic will take time to recover, and exporting employers face a downturn next year, according to Yu Jiadong, Vice Minister of the Ministry of Human Resources and Social Security. In addition, structural challenges such as quickening industrial transformation are leading to a shortage of skilled labour. China should implement monetary and fiscal policy conducive to expanding employment, and promote programmes such as college graduates entrepreneurship scheme. Yu’s comments were reported in an article from Caixin. (Caixin)

GEOPOLITICS: Qin Gang, China’s ambassador to the US, is set to be named as the country’s next foreign minister, Semafor reports, citing two people familiar with the matter it didn’t identify. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY181 BILLION VIA OMOs FRIDAY

The People's Bank of China (PBOC) on Friday injected CNY183 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY181 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep year-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1157% at 9:26 am local time from the close of 2.4230% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 48 on Thursday vs 45 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9681 THURS VS 6.9546 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9646 on Friday, compared with 6.9793 set on Thursday.

OVERNIGHT DATA

SOUTH KOREA DEC CPI +0.2% M/M; MEDIAN 0.2%; NOV -0.1%

SOUTH KOREA DEC CPI +5.0% Y/Y; MEDIAN 5.1%; NOV 5.0%

SOUTH KOREA DEC CORE CPI +4.8% Y/Y; MEDIAN 4.6%; NOV 4.8%

MARKETS

US TSY: Early Cheapening Marginally Extends

TYH3 deals at 112-14+,0-00+, a touch off the base of its narrow 0-03 range on light volume of ~22k.

- Cash tsys deal 1 to 2 bps cheaper across the major benchmarks today with the long end of the curve leading the move.

- The early cheapening marginally extended in the Asian afternoon, with no headline drivers, local participants have faded the move higher in tsys seen yesterday in the European and NY sessions.

- Cross asset flows show a mild risk-off tone developing, with the JPY and USD both firmer and US Equities futures softer. WTI is ~0.3% firmer.

- In Europe today we have a thin docket, further out MNI Chicago PMI provides the main point of interest on the last trading day of the year.

OIL: Down For December, But Dips Remain Supported

Brent crude is not too far off Thursday session highs, last tracking near $83.80/bbl. We currently sit little changed for the week, but down a little over 2% for the month. Dips towards $82/bbl were supported yesterday, but we remain comfortably below earlier weekly highs around $86/bbl. WTI sits close to $78.70/bbl currently.

- Looking ahead, official China PMI data prints tomorrow, but the market is likely to look through any downside surprises as optimism is still positive around the 2023 outlook on the shift away from CZS.

- Next week on Tuesday Bloomberg will publish its OPEC production survey. On Wednesday US API inventories are due, followed by EIA US inventories on Thursday.

- This weekly report, released yesterday saw a decent rise in US oil inventories, but as outlined above, dips in crude were supported through the session.

GOLD: Positive Momentum Maintained Into Year End

Gold has remained on a positive footing for the final trading session of the year. We last close to $1816.50, slightly down from session highs just above $1819. Gold is slightly outperforming a resilient USD backdrop this afternoon. For the week gold is up 1% at this stage.

- The precious metal continues to benefit from a softer USD backdrop, although major USD indices are yet to break down through recent support levels.

- The technical picture still appears encouraging for gold, with key MAs mostly trending higher. Through much of December we have found support ahead of the 20-day EMA (currently at $1794.26). Bulls will target a break of recent highs above $1833.

EQUITIES: A Positive End To The Year

(MNI Australia) Asia Pac equities are tracking higher, following the lead from US/EU markets through Thursday's session. Gains are more modest though, with major indices up less than 1% at this stage. US equity futures have stayed in negative territory for most of the session but are away from worst levels, last around -0.10% for the major indices. This may have trimmed risk appetite to some degree within the region.

- China/HK bourses are slightly outperforming the regional trend. The HSI up 0.80%, while the CSI 300 is +0.70% firmer at this stage.

- The domestic covid situation remains grim in China but case numbers looked to have peaked in some cities, including Beijing, which is seeing higher frequency indicators of economic activity recover.

- Elsewhere Thai equities are +0.70% higher as well. Optimism around the consumption backdrop likely aiding sentiment. Offshore investors were strong buyers of local equities yesterday, +$244.1mn.

FOREX: Yen Demand Persists, USD Index Still Threatening Test Lower

Yen demand has persisted as we approach the EU/London cross over. USD/JPY is back to 132.45/50, slightly above session lows near 132.40. Yen is the only G10 currency to move meaningfully higher against the USD, with some support emerging for the dollar ahead of key index levels. The BBDXY index last sits just above 1251, with dips towards the 1250 region supported over the past month.

- A modest risk-off tone has likely aided the USD at the margins, with US equity futures down slightly, while US cash Tsy yields are a touch higher as well, but overall moves are muted.

- AUD/USD was lower early, but dips have been supported, last at 0.6780, little change for the session (earlier lows came in at 0.6754). NZD/USD has underperformed, last down 0.30% to 0.6325/30. This has enabled the AUD/NZD to regain the 1.0700 handle.

- Other pairs have remained close to flat for the session.

- Looking ahead, we have a thin docket, with the MNI Chicago PMI providing the main point of interest on the last trading day of the year.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/12/2022 | 0800/0900 | *** |  | ES | HICP (p) |

| 30/12/2022 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 30/12/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/12/2022 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 30/12/2022 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 31/12/2022 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/12/2022 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.