-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

MNI EUROPEAN OPEN: Weaker China Exports & Imports Adds To Growth Headwinds

EXECUTIVE SUMMARY

- CHINA’S JULY EXPORTS, IMPORTS FALL MUCH FASTER THAN EXPECTED - RTRS

- MOODY’S CUTS US BANKS ON MOUNTING FUNDING COSTS, OFFICE EXPOSURE - BBG

- JAPAN JUNE REAL WAGE HITS 15th STRAIGHT Y/Y DROP - MNI BRIEF

- AUSTRALIAN BUSINESS CONDITIONS HOLD UP AS CONSUMER MOOD DIMS - BBG

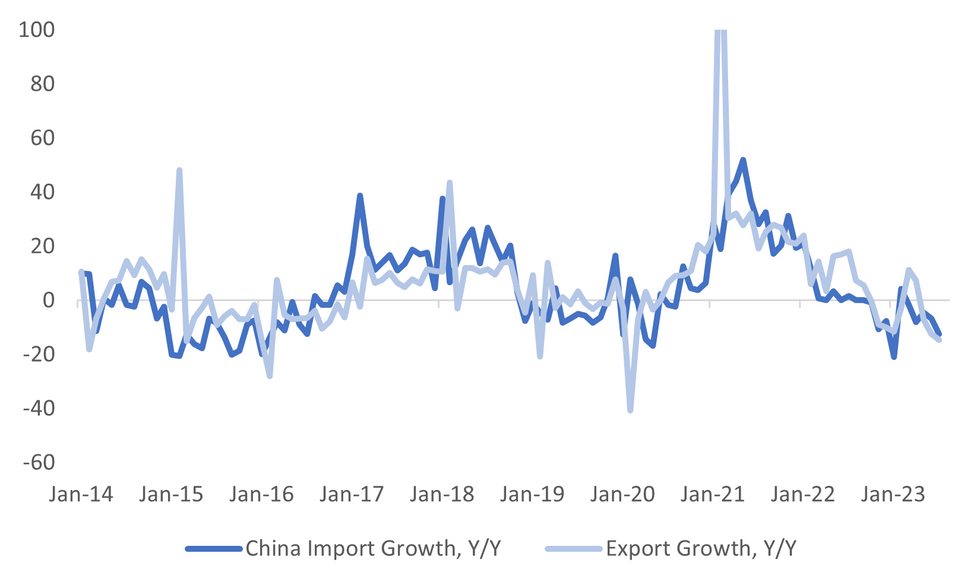

Fig. 1: China Export & Import Growth Continued To Slow In July

Source: MNI - Market News/Bloomberg

U.K.

RETAIL SALES: The British Retail Consortium, KPMG in London publish the July retail sales monitor showing total retail sales +1.5% y/y vs June +4.9% y/y. (BBG)

EUROPE.

ITALY: Italian Prime Minister Giorgia Meloni’s cabinet approved a surprise tax on the “extra profits” of banks this year. The levy was slipped into a huge package of measures that ranged from taxi licenses to foreign investment. The tax could bring over €2 billion ($2.2 billion) into state coffers, according to Ansa newswire. (BBG)

GERMANY: The German government expects Taiwan Semiconductor Manufacturing Co. to give the go-ahead for the construction of a €10 billion ($11 billion) facility in the eastern city of Dresden on Tuesday after a board meeting, according to people familiar with the matter. Chancellor Olaf Scholz’s ruling coalition will provide as much as €5 billion in subsidies for the plant, which will specialize in making chips for the automotive sector, Bloomberg has reported. (BBG)

U.S.

RATINGS: Moody’s Investors Service lowered credit ratings for 10 small and midsize US banks and said it may downgrade major lenders including U.S. Bancorp, Bank of New York Mellon Corp., State Street Corp., and Truist Financial Corp. as part of a sweeping look at mounting pressures on the industry. Higher funding costs, potential regulatory capital weaknesses and rising risks tied to commercial real estate loans amid weakening demand for office space are among strains prompting the review, Moody’s said in a spree of notes late Monday. (BBG)

DEBT: Bulging sales of US Treasuries are about to deliver a major test of investor demand and determine whether a selloff has room to run as the market braces for the biggest round of refunding auctions since last year. Yields have surged since late July, and climbed again Monday, amid evidence of a resilient US economy, and after the Treasury shocked traders last week when it signaled greater borrowing needs. A rising US budget deficit and a poor fiscal outlook at a time of near full employment contributed to the move by Fitch Ratings to strip the US of its top rating last week. (BBG)

TECH: Apple Inc. has begun testing its highest-end next-generation laptop processor, setting the stage for the release of its most powerful MacBook Pro ever next year. (BBG)

OTHER

COMMODITIES: Wheat dipped after advancing the most in two weeks on Monday as traders assessed the threat to grain exports from the Black Sea following Ukraine’s attack on another Russian vessel over the weekend. Futures in Chicago slipped to trade below $6.53 a bushel in Asian trading after closing almost 4% higher on Monday. Russia is the world’s biggest exporter of wheat and any disruption to its shipments could reverberate through global markets. The nation transports most of its grain through the waterway. (BBG)

JAPAN: The year-on-year drop of inflation-adjusted real wages, a barometer of households' purchasing power, widened to 1.6% in June from a 0.9% fall in May as the consumer price index rise accelerated, data released by the Ministry of Internal Affairs and Communications on Tuesday showed. Real wages stayed in negative territory for the 15th straight month in June, illustrating how household income has not kept pace with price rises and has impeded low-income household and elder spending. (MNI)

HONG KONG: Some recent secondary home transactions in Hong Kong saw 7%-11% price-cut by home-sellers from their initial offers as a new residential project from CK Asset is being sold at a low price, Ming Pao reports. (BBG)

PHILIPPINES: The latest spat between China and the Philippines in the South China Sea has an unlikely object at its center: a World War II-era ship that’s now rusty after being stranded in contested waters for more than two decades. (BBG)

NEW ZEALAND: Treasury Dept. comments in Fortnightly Economic Update, published Tuesday in Wellington. Says downturn in housing market is nearing an end. Numbers of residential dwelling approvals appears to be stabilizing as a surge in net migration helps stem the fall in both consents and house prices, and helps lift rents for new tenancies. (BBG)

NEW ZEALAND: New Zealand’s government has partnered with US investment firm BlackRock Inc to supercharge its efforts to become one of the first countries in the world to reach 100% renewable electricity. The government and BlackRock have announced a NZ$2 billion ($1.2 billion) fund that will provide access to greater pools of capital for New Zealand businesses to accelerate investment in green energy such as solar, wind, green hydrogen and battery storage. (BBG)

AUSTRALIA: Australian business conditions again proved solid in July with sales, profits and employment all above average, while a spike in labour costs and prices suggested inflationary pressures had yet to abate. A survey from National Australia Bank Ltd (NAB) released on Tuesday showed its index of business conditions dipped to +10 in July, from an upwardly revised +11 in June. Its volatile measure of confidence bounced three points to +2. (RTRS)

AUSTRALIA: Australian business conditions showed ongoing resilience to higher interest rates, defying expectations of a sharp economic slowdown, even as consumer sentiment remains “deeply pessimistic.” Business conditions, which measure sales, employment and profitability, eased a tad to 10 points in July while holding above the average since the start of the year, a National Australia Bank Ltd. survey showed Tuesday. Confidence advanced to 2 points, implying optimists outnumber pessimists. (BBG)

CHINA

TRADE: China's exports fell 14.5% in July year-on-year, while imports contracted 12.4%, customs data showed on Tuesday, in the biggest decline in outbound shipments from the world's second-largest economy since February 2020. A Reuters poll of economists had forecast a 12.5% fall in exports and a 5.0% drop in imports. China's economy grew at a sluggish pace in the second quarter as demand weakened at home and abroad, prompting top leaders to promise further policy support at a meeting of the Politburo last month. (RTRS)

YUAN: The yuan will take time to strengthen as markets wait for new stimulus policies to take effect and external factors remain uncertain, according to Huang Wentao, chief economist at China Securities Construction. In an interview with 21st Century Herald, Huang said although the government will not implement strong stimulus in H2, the yuan will strengthen later in the year as the domestic economy stabilises with inventories, incomes and exports recovering naturally. In the short term, CNY will fluctuate around CNY7.1-7.2 against the U.S. dollar, he added. (MNI)

GROWTH: China can increase its total factor productivity (TFP) growth rate to 2.5% and above to better meet its 2035 target to double its GDP from 2020, according to Professor Liu Qiao, dean at Guanghua School of Management, Peking University. Liu said policymakers can increase productivity via industrial transformation and new infrastructure which focuses on 5G/6G, big data and artificial intelligence among others. (Yicai)

PROPERTY: Country Garden, once China’s biggest developer by sales, has denied claims that a working group led by the vice mayor of Foshan City have been stationed at the company after its share prices slumped by 7.69% on Monday with several domestic bonds leading the decline. Rumors that the developer may default on its debts have circulated for some time, as multiple debts due in the short term have pressured the company’s cash flow. The firm has the ability to cover short-term debt maturity barring accidents, as it has CNY147.55 billion cash on its balance sheet, of which CNY128.28 billion is unrestricted cash as of end-2022, while the corresponding short-term debt due within one year is about CNY93.71 billion. (Yicai)

TECH: China's cyberspace regulator said on Tuesday it has issued draft rules to oversee the security management of facial recognition technology in the country, following concerns raised in public about overuse of the technology. The Cyberspace Administration of China (CAC) said facial recognition technology can only be used to process facial information when there is a specific purpose and sufficient necessity, and with strict protective measures. (RTRS)

CHINA MARKETS

PBOC Net Drains CNY2 Bln Via OMOs Tuesday

The People's Bank of China (PBOC) conducted CNY6 billion via 7-day reverse repos on Tuesday with the rate unchanged at 1.90%. The operation has led to a net drain of CNY2 billion after offsetting the maturity of CNY8 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8417% at 09:38 am local time from the close of 1.7130% on Monday.

- The CFETS-NEX money-market sentiment index closed at 45 on Monday, compared with the close of 54 on Friday.

PBOC Yuan Parity At 7.1565 Tuesday Vs 7.1380 Monday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1565 on Tuesday, compared with 7.1380 set on Monday. The fixing was estimated at 7.1859 by BBG survey today.

MARKET DATA

SOUTH KOREA JUNE BOP GOODS BALANCE $3984.6bn, PRIOR $1815bn

SOUTH KOREA JUNE BOP CURRENT ACCOUNT BALANCE $5873.7bn; PRIOR $1927.2bn

UK JULY BRC SALES LIKE-FOR-LIKE Y/Y 1.8%; PRIOR 4.2%

JAPAN JUNE HOUSEHOLD SPENDING Y/Y -4.2%; MEDIAN -3.8%; PRIOR -4.0%

JAPAN JUNE LABOR CASH EARNINGS Y/Y 2.3%; MEDIAN 3.0%; PRIOR 2.9%

JAPAN JUNE REAL CASH EARNINGS Y/Y -1.6%; MEDIAN -0.9%; PRIOR -0.9%

JAPAN JUNE BOP CURRENT ACCOUNT ADJUSTED ¥2345.9bn; MEDIAN ¥2243.1bn; PRIOR ¥1702.7bn

JAPAN JUNE TRADE BALANCE BOP BASIS ¥328.7bn; MEDIAN ¥192.7bn; PRIOR -¥1186.7bn

JAPAN JULY BANKING LENDING INCL TRUSTS Y/Y 2.9%; PRIOR 3.1%

JAPAN JULY BANKING LENDING EX TRUSTS Y/Y 3.3%; PRIOR 3.4%

JAPAN JULY ECO WATCHERS SURVEY CURRENT SA 54.4; MEDIAN 53.9; PRIOR 53.6

JAPAN JULY ECO WATCHERS SURVEY OUTLOOK SA 54.1; MEDIAN 52.7; PRIOR 52.8

AUSTRALIA AUGUST WESTPAC CONSUMER SENTIMENT M/M -0.4%; PRIOR 2.7%

AUSTRALIA AUGUST WESTPAC CONSUMER SENTIMENT INDEX 81; PRIOR 81.3

AUSTRALIA JULY NAB BUSINESS CONFIDENCE 2; PRIOR 0

AUSTRALIA JULY NAB BUSINESS CONDITIONS 10; PRIOR 11

CHINA JULY EXPORTS Y/Y -14.5%; MEDIAN -13.2%; PRIOR -12.4%

CHINA JULY IMPORTS Y/Y -12.4%; MEDIAN -5.6%; PRIOR -6.8%

CHINA JULY TRADE BALANCE $80.60bn; MEDIAN $70bn; PRIOR $70.62bn

MARKETS

US TSYS: Curve Flattens In Asia

TYU3 deals at 111-08+, +0-04+, a touch off the top of the 0-10+ range on volume of ~83k.

- Cash tsys sit 1-5bps richer across the major benchmarks, the curve has bull flattened.

- Tsys were marginally firmer in early dealing as Asia-Pac participants faded yesterday's cheapening, perhaps using the opportunity to enter fresh long positions/close out shorts.

- The long end of the tsy curve has extended gains though the Asian session, perhaps today's slated 3-Year issuance weighed on the short end in Asia. The move came alongside an uptick in the USD and weakness in US Equity Futures and Regional Equities.

- Ranges remained narrow for the most part, and little meaningful macro news flow crossed.

- The final print of German CPI headlines in Europe, further out we have trade balance as well as wholesale inventories and trade. Fedspeak from Philadelphia Fed President Harker and Richmond Fed President Barkin is due. We also have the latest 3-Year Supply.

JGBS: Futures Richer After 30Y Auction, US Tsys Are Also Stronger

In Tokyo's afternoon trading, JGB futures have gained strength, +9 compared to settlement levels, following robust demand witnessed in today's 30-year auction. The auction's lower price surpassed dealer expectations, while the cover ratio reached its highest point seen in a 30-year auction since January 2022. Additionally, the auction tail was notably shorter, marking its briefest length since February 2022.

- There hasn't been a presence of domestic catalysts to highlight, apart from the previously outlined real and nominal labour cash earnings, as well as household spending, all printing lower than estimates.

- US tsys sit 1-5bps richer across the major benchmarks in Asia-Pac trade, the curve has bull flattened.

- The cash JGB curve has bull flattened in afternoon trade with yields 0.3-5.0bp lower. The benchmark 10-year yield is 1.3bp lower at 0.617%, above BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%.

- The 30-year JGB is 4.2bp richer on the day after today’s 30-year supply.

- The swaps curve has also bull flattened after twist steepening at lunch. Swap spreads are generally wider across the curve.

- Tomorrow the local calendar sees July M2 & M3 Money Stock along with July Machine Tool Orders data.

- Tomorrow will also see BoJ Rinban operations covering 1- to 25-Year JGBs.

AUSSIE BONDS: Cheaper, Narrow Range, Confidence Data Fails To Move Market

ACGBs (YM +1.0 & XM +1.0) are slightly stronger after trading in a narrow range during the Sydney session. The latest consumer and business confidence data failed to move the market.

- Nonetheless, it is noteworthy that the price and cost measures in the NAB business survey all rose in July which given higher wages, power and fuel prices since July 1 is unsurprising. What they do in the months ahead will be important. It remains unclear whether demand is strong enough for costs to be passed onto consumers fully, partially or not at all.

- Cash ACGBs are 11-14bp richer after being closed yesterday for the NSW bank holiday. The AU-US 10-year yield differential is at +1bp.

- Swap rates are flat to 2bp higher with the 3s10s curve flatter.

- The bills strip is slightly richer with pricing +1 to +2.

- RBA-dated OIS pricing is flat to 2bp softer.

- (AFR) Goldman Sachs is tipping the decline in iron ore prices will extend into the back end of this year as the physical market tips into an imminent surplus, and concerns intensify that China will ramp up cuts to its steel output. (See link)

- Tomorrow the local calendar sees no data releases.

- The AOFM does however plan to sell A$700mn of the 2.75% 21 June 2035 bond.

NZGBS: Closed On A Soft Note, NZ-US 10Y Differential Widens

NZGBs closed 4bp cheaper at session cheaps ahead of tomorrow’s important data drop. Tomorrow the local calendar sees July Retail Sales Spending data along with the RBNZ’s Survey of Inflation Expectations. A lift in hospitality spending is expected to offset weakness elsewhere, according to Westpac, while inflation expectations look set to ease now that headline inflation is well past its peak.

- NZGBs have underperformed US tsys today with the NZ-US 10-year differential yield differential 5bp wider at +73bp.

- The long end of the tsy curve has extended gains through the Asia-Pac session. Today's slated 3-year issuance is possibly weighing on the short end. Ranges do remain narrow with little follow through, little meaningful macro news flow has crossed. This leaves cash tsys 1-6bp richer, the curve has bull flattened.

- Swap rates closed 2-3bp higher.

- RBNZ dated OIS closed little changed.

- Bloomberg reports that the NZ Treasury says the downturn in the housing market is nearing an end. Numbers of residential dwelling approvals appear to be stabilising as a surge in net migration helps stem the fall in both consents and house prices and helps lift rents for new tenancies. (See link)

FOREX: Yen Pressured In Asia

The Yen is the weakest performer in the G-10 space at the margins, softer than forecast Labour Cash Earnings pressured the Yen in early dealing. Losses extended after the PBOC Yuan fixing was corrected to 7.1565 from 7.1365 as broad based USD buying was seen.

- USD/JPY prints at ¥134.30/35, the pair is ~0.6% firmer on Tuesday. We remain well below resistance at ¥144.20, the high from July 7. Labour Cash Earnings were softer than expected in June printing at 2.3% Y/Y vs 3.0% exp, Real Cash Earnings fell -1.6% Y/Y.

- AUD/USD is down ~0.4%, last printing at $0.6545/50 sitting at its lowest level since 3 August. Support comes in at $0.6514 (low from Aug 3) and $0.6485 (low from Jun 1).

- Kiwi is also pressured, NZD/USD is down ~0.4% and has breached the $0.61 handle. The pair last prints at $0.6075/80.

- Elsewhere in the G-10 space GBP and EUR are both ~0.2% softer. The scandies are pressured, SEK and NOK are down ~0.3%, however liquidity is generally poor in Asia.

- Cross asset wise; e-minis are down ~0.2% and the Hang Seng is down ~1.3%. BBDXY is up ~0.3% and 10 Year US Tsy Yields are down ~3bps.

- In Europe the final read of German national CPI for July provides the highlight, further out we have US Trade Balance and Wholesale Inventories.

EQUITIES: China Shares Recoup Early Losses, But Generally Weaker Trends Elsewhere

Regional equities are once again mixed. China and HK markets started off weaker, but China onshore sentiment rebounded ahead of the lunch break. US equity futures are lower, with Eminis off by ~0.20%, last near 4529, while Nasdaq futures are down ~0.30% at this stage. These moves have helped offset some of the positive lead from the Monday US session.

- China's CSI 300 is a touch firmer at the lunch time break. We were -0.70% weaker at one stage. In index terms support has been evident around the 3960 level so far in August (latest levels ~3993). Health care stocks have recovered some ground, but the real estate sub index is off a further 0.55%, after dipping -3.36% yesterday. Funding/liquidity concerns at developer Country Garden remain a concern. July trade figures also point to weaker economic conditions for China.

- The HSI is off 1.37% at the break, although we are away from session lows. The HS China Enterprises Index is down 1.65%. The HSI has unwound the late July bounce, but remains comfortably above earlier July lows.

- Japan stocks are edging higher, but without strong conviction. The Topix up ~0.30%, likewise for the Nikkei 225. Yen is tracking weaker, down 0.60% against the USD, but earlier data showed weaker than expected wages and household spending data.

- The Kospi couldn't hold early positive momentum, the index sitting sub 2600, last down -0.10%. The Taiex is off by 0.70% at this stage, despite a bounce in the SOX in US trade on Monday.

- SEA markets are mixed, but mostly lower. Malaysia shares the main outperformers +0.40%.

OIL: Crude Rally Pauses, Market Reports Published This Week

Oil prices are off their lows but have been trading in a narrow range during the APAC session. They are currently around 0.1% higher with WTI at $82.00 and Brent $85.34. The stronger greenback with the USD index up 0.3%, weaker US equity futures and softer Chinese import data have put pressure on crude. Concerns re tensions in the Black Sea have taken a back seat.

- WTI broke through $82 earlier in the session and troughed at $81.90. The level is being tested again. Brent has held above $85 with a low of $85.22.

- The last week of July showed a record decline in US inventories, which was due to some volatility. The API data is released later today. Also, the US’ EIA publishes its monthly “Short-term Energy Outlook”. On the global stage, OPEC+ and the IEA release their reports this week too.

- The Fed’s Harker and Barkin speak later on the economy. On the data front there is US June trade, inventories, July small business optimism and German July CPI. The focus of the week will be US July CPI on Thursday.

GOLD: Slightly Lower In Asia-Pac After Closing Lower On Monday

Gold is slightly lower in the Asia-Pac session, after closing 0.3% lower on Monday. Bullion was weaker after long end US tsys were heavy with yields higher again after short covering on Friday pushed them lower.

- Anticipation of August supply has left US tsys heavy over recent days, especially in the wake of the debt warnings from the Fitch downgrade.

- Overnight, the market's anticipations of the Federal Reserve concluding its tightening measures were challenged by hawkish statements from Fed Governor Bowman. Additionally, Fed Williams maintained the potential for additional rate hikes. Fedspeak from Philadelphia Fed President Harker and Richmond Fed President Barkin is due later today.

- US CPI figures out later this week will be closely monitored.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/08/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 08/08/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 08/08/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 08/08/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 08/08/2023 | 1215/0815 |  | US | Philadelphia Fed's Pat Harker | |

| 08/08/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 08/08/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 08/08/2023 | 1230/0830 |  | US | Richmond Fed's Tom Barkin | |

| 08/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/08/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/08/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/08/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 08/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 08/08/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.