-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Yen Underperforms As BoJ Delivers No Surprises

EXECUTIVE SUMMARY

- BOJ KEEPS YCC; POLICY RATES FORWARD GUIDANCE - MNI BRIEF

- BOJ KEEPS ECONOMIC RECOVERY, INFLATION VIEW- MNI BRIEF

- ECB’S LANE SAYS RATES WILL BE RESTRICTIVE AS LONG AS NECESSARY - BBG

- JAPAN AUG CORE CPI RISES 3.1%, FLAT AGAINST JULY - MNI BRIEF

- CHEVRON AND UNIONS AGREE TO END AUSTRALIA LNG STRIKES - BBG

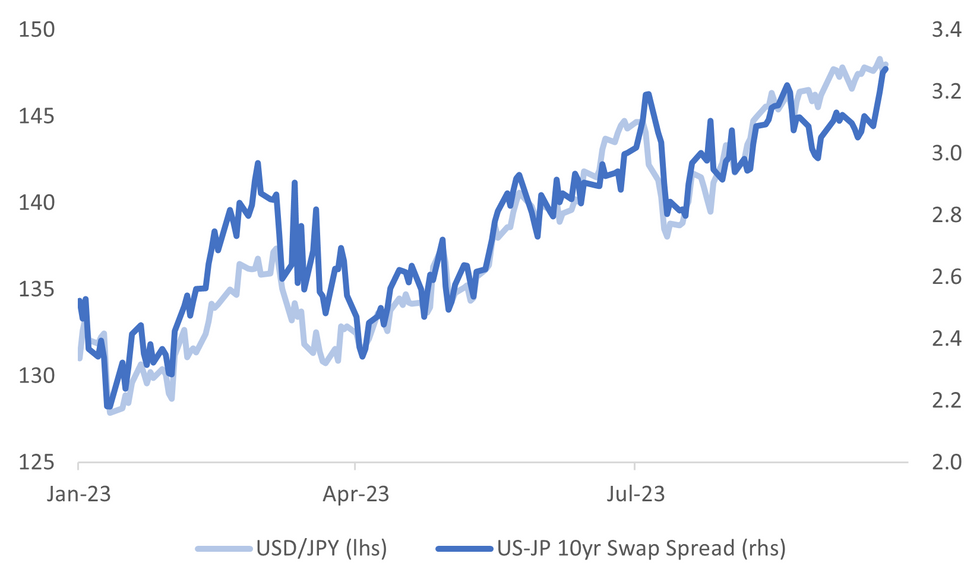

Fig. 1: USD/JPY Versus US-Japan 10-year Swap Rate Differential

Source: MNI - Market News/Bloomberg

U.K.

CONSUMER CONFIDENCE: UK consumer confidence rose to its highest level in almost two years as wage growth started to outstrip inflation, easing a cost-of-living crunch on household finances. GfK Ltd. said its index of consumer sentiment increased 4 points to minus 21 in September. That was the strongest level since January 2022 just before the Russian invasion of Ukraine sent energy bills soaring. Economists had expected a small drop in confidence. (BBG)

AI: UK Chancellor of the Exchequer Jeremy Hunt said the West must engage in talks with China over how best to regulate the growth of artificial intelligence, after Britain invited the country to its global AI summit later this year. “They won’t come to all the discussions, but you need to have a dialogue with countries like China, they’re not going away,” Hunt said in a Bloomberg interview on Thursday. “We have to be realistic and we have to have those discussions with our eyes open.” (BBG)

EUROPE

ECB: European Central Bank Chief Economist Philip Lane said interest rates have reached a level that could help inflation return to target if held for a sufficient amount of time, but stressed officials will be data dependent when assessing the restrictiveness of policy. “Our future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary,” Lane said in a speech in New York. “The high level of two-sided uncertainty around the baseline means that we will remain data dependent in determining the appropriate level and duration of restrictiveness in our monetary stance.” (BBG)

EU/CHINA: Europe's trade chief will push Beijing for fewer restrictions on European businesses on a four-day visit to China, when he can expect tough conversations over a planned EU investigation into electric car imports. Trade Commissioner Valdis Dombrovskis will take part in a joint economic and trade dialogue, meet Chinese officials and European companies active in China and deliver two speeches during his Sept. 23-26 trip to Shanghai and Beijing. (RTRS)

UKRAINE: U.S. President Joe Biden assured Ukrainian President Volodymyr Zelenskiy on Thursday that strong U.S. support for his war to repel Russian invaders will be maintained despite opposition from some Republican lawmakers to sending billions more in aid. Biden and Zelenskiy held a war council in the White House East Room as part of a blizzard of appearances the Ukraine leader made looking to bolster U.S. support for a war that began in February 2022 and has no end in sight. (RTRS)

U.S.

YIELDS: Treasury 10-year yields topped 4.5% for the first time since 2007, as a more hawkish Federal Reserve stance adds to concerns that the bonds face a toxic mix of large US fiscal deficits and persistent inflation. US government debt are heading for a third year of losses as bets on a rapid Fed pivot from aggressive hikes evaporate again after the central bank on Wednesday raised its projections for future borrowing costs. (BBG)

GEOPOLITICS: President Joe Biden vowed continued support for Ukraine as he met with President Volodymyr Zelenskiy at the White House amid concern that the country’s slow counteroffensive and opposition among conservative Republicans could threaten additional military assistance. “I’m counting on the good judgment of the United States Congress. There’s no alternative,” Biden said when asked if he was confident lawmakers would back more assistance for Kyiv. (BBG)

FISCAL: U.S. House Speaker Kevin McCarthy's attempt to restart his stalled spending agenda failed on Thursday when Republicans for a third time blocked a procedural vote on defense spending, raising the risk of a government shutdown in just 10 days. The House of Representatives voted 216-212 against beginning debate on an $886 billion defense appropriations bill, with five hardline conservative Republicans joining Democrats to oppose the measure. (RTRS)

OTHER

JAPAN: The Bank of Japan board on Friday decided unanimously to maintain yield curve control and pledged to continue patiently with monetary easing amid high uncertainties on economies and financial markets. The BOJ also decided to keep a cap of the 10-year interest rate at 1.0% and kept the forward guidance for the policy rates, committing to conduct additional easing measures if necessary. (MNI BRIEF)

JAPAN: The Bank of Japan board on Friday held its overall economic assessment steady, noting Japan’s economy "had recovered moderately.” The BOJ also maintained the near-term economic recovery scenario despite downward pressure stemming from a slowdown in the pace of the recovery in overseas economies. (MNI BRIEF)

JAPAN: Japan's annual core consumer inflation rate rose 3.1% y/y in August, unchanged from July’s 3.1%, but above the Bank of Japan’s 2% target for the 17th consecutive month, data released by the Ministry of Internal Affairs and Communications showed on Friday. (MNI BRIEF)

JAPAN: Prime Minister Fumio Kishida said Japan would maintain high vigilance and take necessary action against excessive currency moves, without excluding any option. Kishida was responding to questions following a speech in New York. (BBG)

COMMODITIES: Chevron Corp. and labor unions reached an agreement to end strikes at key liquefied natural gas facilities in Australia that have roiled the global market for the fuel. Workers accepted a proposed settlement on pay and conditions put forward by the country’s labor regulator and will suspend industrial action, the Offshore Alliance, a grouping of two major unions, confirmed Friday in a statement. (BBG)

AUSTRALIA: Australian Treasurer Jim Chalmers said he’s still interviewing candidates for the Reserve Bank’s deputy governor role after Michele Bullock started on the top job this week, adding that he’ll make a decision “before long.” “It’s a high quality field and we’ll end up with a very good deputy governor of the Reserve Bank, but we haven’t made a decision yet,” Chalmers told Australian Broadcasting Corp. radio Friday. “I think I’ve interviewed a small number, three of those, so far.” (BBG)

AUSTRALIA: Australia has recorded its first budget surplus since the eve of the 2008 global financial crisis as an ultra-tight labor market and elevated commodity prices swelled the nation’s fiscal coffers. (BBG)

NEW ZEALAND: New Zealand export receipts fell to their lowest in 19 months in August as prices for milk and meat come under pressure. The value of exports fell to NZ$4.99 billion ($3 billion) in the month, Statistics New Zealand said Friday in Wellington. That’s the lowest reading since January 2022. (BBG)

CHINA

PROPERTY: China’s property market is showing signs of stabilization as home transaction volume in big cities like Beijing has been rising fast after easing of home purchase rules, Shanghai Securities News reports. Existing home sales volume in Shenzhen, Beijing and Guangzhou rose 32.5%, 19.8%, 28.6%, respectively, in Sept. 11-15 from a week earlier, report cites China Index Academy (BBG)

PROPERTY: Moody’s Investors Service has put two of China’s few investment-grade developers on review for possible downgrade, the latest sign that fallout from the real estate industry’s debt crisis is spreading. China Jinmao Holdings Group Ltd. and China Vanke Co. are facing possible cuts, part of a number of ratings actions announced by Moody’s Thursday following last week’s cut of its sector view. (BBG)

ECONOMY: China’s economy still faces strong challenges and needs further policy support to restore confidence despite improvement in August, according to Guan Qingyou, president at the Institute of Financial Studies. In an article published by Yicai, Guan said households still show relative weakness in demand for medium and long-term loans which demonstrates low confidence. (Yicai)

ECONOMY: China’s economic recovery is well supported as its employment, inflation and international balance of payments are generally stable, Sheng Laiyun, deputy head of the National Bureau of Statistics, says in an article in Economic Daily. (BBG)

ECONOMY: Chinese Premier Li Qiang said China’s economy is at a critical juncture and called for keeping a strategic focus on economic transformation to boost development, state broadcaster China Central Television reports citing his remarks during a visit to high-tech enterprises in Beijing on Thursday. (BBG)

BONDS: The issuance of panda bonds reached CNY115.7 billion as of Sept 21 this year, a rise of over 60% y/y, according to Wind Information. Interest-rate cuts and loose liquidity provided by the People’s Bank of China amid the U.S. rate hike cycle has helped lower bond financing costs, while improved management of panda bond funds to facilitate domestic financing for overseas institutions has also made the asset class more attractive, said Li Xifeng, a researcher at CSI Pengyuan. (21st Century Business Herald)

CHINA MARKETS

PBOC Injects Net 141 Bln Via OMO Fri; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY202 billion via 14-day repo on Friday, with the rate unchanged at 1.95%. The operation has led to a net injection of CNY97 billion after offsetting the maturity of CNY105 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9583% at 09:37am local time from the close of 2.0151% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 47 on Thursday, compared with the close of 45 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1729 Friday Vs 7.1730 Thursday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1729 on Friday, compared with 7.1730 set on Thursday. The fixing was estimated at 7.3028 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND 3Q WESTPAC CONSUMER CONFIDENCE 80.2; PRIOR 83.1

NEW ZEALAND AUGUST EXPORTS NZD 4.99BN; PRIOR 5.38BN

NEW ZEALAND AUGUST IMPORTS NZD 7.28BN; PRIOR 6.55BN

NEW ZEALAND AUGUST TRADE BALANCE NZD -2291MN; PRIOR -1177MN

NEW ZEALAND AUGUST TRADE BALANCE 12 MTH YTD NZD -15537MNBN; PRIOR -15880MN

AUSTRALIA SEPTEMBER P JUDO BANK PMI MFG 48.2; PRIOR 49.6

AUSTRALIA SEPTEMBER P JUDO BANK PMI SERVICES 50.5; PRIOR 47.8

AUSTRALIA SEPTEMBER P JUDO BANK PMI COMPOSITE 50.2; PRIOR 48.0

UK SEP GFK CONSUMER CONFIDENCE -21; MEDIAN -26; PRIOR -25

JAPAN AUGUST NATL CPI Y/Y 3.2%; MEDIAN 3.0%; PRIOR 3.3%

JAPAN AUGUST NATL CPI EX FRESH FOOD Y/Y 3.1%; MEDIAN 3.0%; PRIOR 3.1%

JAPAN AUGUST NATL CPI EX FRESH FOOD, ENERGY Y/Y 4.3%; MEDIAN 4.3%; PRIOR 4.3%

JAPAN SEPTEMBER P JIBUN BANK PMI MFG 48.6; PRIOR 49.6

JAPAN SEPTEMBER P JIBUN BANK PMI SERVICES 53.3; PRIOR 54.3

JAPAN SEPTEMBER P JIBUN BANK PMI COMPOSITE 51.8; PRIOR 52.6

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 108-11+, -0-02, a 0-04+ range has been observed on volume of ~105k.

- Cash tsys sit little changed across the major benchmarks.

- Tsys have observed narrow ranges with little follow through on moves through a muted session in Asia today.

- There was a brief move lower however support came in ahead of yesterday's lows and losses were pared.

- The space looked through the latest BOJ monetary policy decision.

- Retail Sales from the UK provides the highlight in Europe today. Further out we have flash S&P Global PMIs, as well as Fedspeak from Gov Cook, SF Fed President Daly and Minneapolis Fed President Kashkari.

JGBS: Post-BOJ Decision Spike In Futures Unwound

JGB futures spiked to a fresh Tokyo session high in the early rounds of the afternoon session after the arguably dovish hold by the BOJ. However, those gains were unwound. JBZ3 is currently holding an uptick, +2 compared to settlement levels.

- The BOJ kept all the policy parameters unchanged. The policy rate stays at -0.1%, 10yr yield target around 0%, with a -/+0.50% band on this and a firm cap at 1.0%, which was introduced at the last policy meeting in July. Forward guidance was also unchanged, with the central bank maintaining its easing stance until the 2% inflation target is achieved in a stable manner. It will also not hesitate to take additional easing measures if necessary.

- Focus now shifts to Governor Ueda's press conference, (1530 Tokyo time, 0730 BST), particularly in light of his recent media interview, which came across as hawkish, but the ruling party pushed back on this notion (see this link for more details).

- The cash JGB curve has unwound the twist flattening seen early in the afternoon session to be slightly cheaper across the curve. The benchmark 10-year yield is 0.2bp higher at 0.745% versus the fresh post-YCC tweak high of 0.756% seen earlier in the session.

- Swap rates are lower out to the 30-year, with pricing 0.2bp to 1.5bps lower. Swap spreads are tighter across maturities.

- Next week the local calendar sees Dept Sales on Monday and PPI Services on Tuesday. BOJ Minutes for the July Meeting, Leading and Coincident Indices and Machine Orders are on Wednesday. The MOF plans to sell Y700bn of 40-year JGBS on Tuesday.

AUSSIE BONDS: Cheaper, Narrow Ranges, Tracking JGBS & US Tsys, CPI Monthly Next Wednesday

ACGBs (YM -1.0 & XM -5.5) are cheaper after dealing in a relatively narrow range during the Sydney session. With the domestic calendar light (Judo Bank preliminary PMIs only data), local participants have been on headlines, JGBs and US tsys watch.

- JGBs pared US tsy-linked morning weakness into the BOJ policy decision. The arguably dovish hold by the BOJ saw JGB futures spike higher in the early rounds of the Tokyo afternoon session. However, those gains have been unwound. The market now awaits BOJ Governor Ueda’s press conference at 3:30pm Tokyo time, 07:30 BST.

- After pushing to multiyear highs on Thursday, long-dated US tsys are dealing little changed in Asia-Pac trade.

- Cash ACGBs are 1-5bps cheaper, with the AU-US 10-year yield differential 1bp lower at -14bps.

- The 3s10s swap curve has twist-steepened, with rates 2bp lower to 4bps higher. EFPs are tighter.

- The bills strip is richer, with pricing +1 to +2

- Next week the local calendar is light until the release of the CPI Monthly for August on Wednesday.

- Monday sees panel participation by RBA Assistant Governor Jones at a Conference on Financial Technology, Climate Change, and Challenges.

- Next Wednesday the AOFM plans to sell A$800mn of the 2.25% May-28 bond.

NZGBS: Closed With A Twist Flattening Of the Curve

NZGBs closed with a twist-flattening of the 2/10 curve. Benchmark yields closed 1bp lower to 2bps higher. NZGBs opened on a weaker note, influenced by the negative performance of US tsys during the NY session. However, they rebounded from their session cheaps as JGBs rallied in anticipation of the BOJ’s policy decision.

- However, the local market couldn't sustain its best levels either, primarily due to a paring of JGB gains after the BOJ decision.

- US tsys have probed their NY session lows in Asia-Pac trade, although ranges have been narrow.

- Nevertheless, it's worth noting that NZGBs outperformed their counterparts in the $-bloc, with the NZ-US and NZ-AU 10-year yield differential 3-4bps lower.

- The swaps curve has twist-flattened at the close, with rates 3bps lower to 2bps higher.

- RBNZ dated OIS pricing closed little changed.

- NZ's trade deficit widened to NZ$2.291bn in August from a revised NZ$1.177bn in July. Exports to China declined 5.8% m/m (-18% y/y), while exports to Australia rose 1.3% m/m (-9% y/y).

- Next week the local calendar is empty until ANZ Business Confidence on Thursday.

- Next Thursday the NZ Treasury plans to sell NZ$225mn of the 3.0% Apr-29 bond, NZ$200mn of the 4.25% May-34 bond and NZ$75mn of the 2.75% May-51 bond.

FOREX: Yen Pressured In Asia

The Yen is the weakest performer in the G-10 space at the margins. The BOJ left policy unchanged and left its forward guidance unchanged, arguably delivering a dovish hold.

- USD/JPY prints at ¥148.15/20, the pair is ~0.4% firmer today. Technically the uptrend remains intact, resistance comes in at ¥148.60, 2.236 projection of the Jul 14-21-28 price swing.

- AUD/USD is a touch firmer, the pair was supported ahead of $0.64 in early trade and last prints at $0.6425/30. The trend condition is unchanged and remains bearish. Support comes in at $0.6357, low from Sep 6 and bear trigger.

- Kiwi is marginally firmer however narrow ranges have persisted for much of todays session. NZD/USD last prints at $0.5935/40.

- Elsewhere in G-10; EUR and GBP are a touch lower. NOK is the strongest performer in the G-10 space however liquidity is generally poor in Asia.

- Retail Sales from the UK provides the highlight in Europe today.

EQUITIES: HSI Bounces Off August Support Levels, Japan Equities Off Lows As BoJ Holds Steady

Asia Pac equities are mixed so far in Friday trade. This comes despite negative leads from US and EU markets through Thursday trade. US futures have recovered some ground, but are only modestly higher at this stage. Eminis were last near 4380, around +0.17% higher, while Nasdaq futures were +0.23% firmer. Eminis are only a touch above fresh lows going back to early June this year.

- Positive sentiment has been evident in terms of both Hong Kong and China equities. HK markets opened weaker, but at the break the HSI sits +1.20% firmer, with the tech sub-index +2.39% higher at this stage, tracking for its first gain this week.

- The HSI appeared to find some support around the 17570/80 region, which was also close to August lows.

- The CSI is also firmer, +1.0% higher to the break, with the index back above 3700. Further efforts to boost private economy development have been highlighted by the regulator, which was also something the Premier spoke about yesterday. Another focus point has been efforts in Beijing and Shanghai to allow the free-flow of foreign investor funds (see this link for more details).

- Japan stocks are down, last off -0.20% in terms of the Topix, but we are above session lows. The yen is weaker post the on hold BoJ outcome, which is aiding exporter related stocks.

- Other markets aren't showing strong trends. The Taiex is around flat, the Kospi modestly higher. In SEA Indonesian and Philippine bourses are both in the green at this stage.

OIL: Weekly Losses Pared

Brent crude is firmer in the first part of Friday dealing, last near $93.90/bbl. This is a ~0.60% gain, and puts us close to unchanged on levels at the end of last week. WTI is back to $90.35/bbl, a +0.80% gain, although this is still modestly down on last Friday closing levels ($90.77/bbl).

- Risk appetite has stabilized somewhat in the equity space, with US futures ticking higher and HK/China markets firmer. This has likely helped oil at the margins.

- The other focus point has been Russia's diesel and gasoline export ban. This threatens an already tight supply backdrop. However, some supply side analysts, including those from J.P. Morgan, expect the ban to be short lived.

- The US is also pressing Iraq to re-open the Iraq-Turkey crude pipeline as soon as possible.

- For Brent, the 20-day EMA sits back near $90.74/bbl, while recent highs rest near $96/bbl.

GOLD: Back-To-Back Declines For Bullion As Long-Dated Yields Push Higher

Gold is +0.3% in the Asia-Pac session, after closing -0.5% at $1920.02 on Thursday. Bullion came under pressure from a sizeable twist steepening of the US Treasury curve with longer-dated yields up strongly. The 30-year bond’s yield rose 13bps to 4.57%, its highest level since 2011. The 10-year approached 4.5%, last seen in 2007.

- While the Bank of England followed the US Fed with a hawkish hold, stronger labour markets and persistent inflation raise the prospect of rates remaining higher for the foreseeable future.

- Bloomberg reports that Oanda analyst Edward Moya said the peak in US Treasury yields is almost here, but until recession risks become the base case for the US, the precious metal might struggle to stabilise.

- From a technical standpoint, Thursday’s close was a significant retracement off yesterday’s pre-FOMC high of $1947.5, although the low of $1913.98 didn’t test support at $1901.1 (Sep 14 low).

- With climate-related disruptions accelerating, the metal will almost certainly remain a safe haven during rough times, according to analysts at HSBC Global Research. (See link)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/09/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 22/09/2023 | 0700/0900 | *** |  | ES | GDP (f) |

| 22/09/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 22/09/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 22/09/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 22/09/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 22/09/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 22/09/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 22/09/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 22/09/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 22/09/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 22/09/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 22/09/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 22/09/2023 | 1100/1300 |  | EU | ECB's de Guindos Speaks at Event | |

| 22/09/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/09/2023 | 1250/0850 |  | US | Fed Governor Lisa Cook | |

| 22/09/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/09/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 22/09/2023 | 1400/1000 |  | US | Boston Fed's Susan Collins | |

| 22/09/2023 | 1700/1300 |  | US | San Francisco Fed's Mary Daly | |

| 22/09/2023 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.