-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: Fed’s Bostic - Soft Inflation Could Bring Cuts Before Q3

Atlanta Federal Reserve President Raphael Bostic Thursday repeated he expects policymakers to begin cutting interest rates in the third quarter, but added if there is a further accumulation of soft inflation data then cuts could begin sooner.

"Because I’m data dependent, I have incorporated the unexpected progress on inflation and economic activity into my outlook, and thus moved up my projected time to begin normalizing the federal funds rate to the third quarter of this year from the fourth quarter," said Bostic in prepared remarks. "The rub is that if we keep policy too restrictive for too long, we risk doing unnecessary damage to the labor market and the macroeconomy."

Bostic emphasized he is remaining vigilant and should conditions evolve differently from his expectations then his view of policy will adjust. "Should underlying economic momentum prove stronger than expected and spark inflationary pressure, the Committee may need to maintain the restrictive policy stance longer than I foresee," said Bostic, a voting member of the FOMC this year. "Relatedly, premature rate cuts could unleash a surge in demand that could initiate upward pressure on prices."

"That said, if we continue to see a further accumulation of downside surprises in the data, it’s possible for me to get comfortable enough to advocate normalization sooner than the third quarter. But the evidence would need to be convincing," he said. After incorporating recent inflation data, Bostic's baseline forecast for full-year core PCE inflation is 2.4%. (See: MNI INTERVIEW: Fed Might Not Cut At All In '24-Ex-Fed Economist)

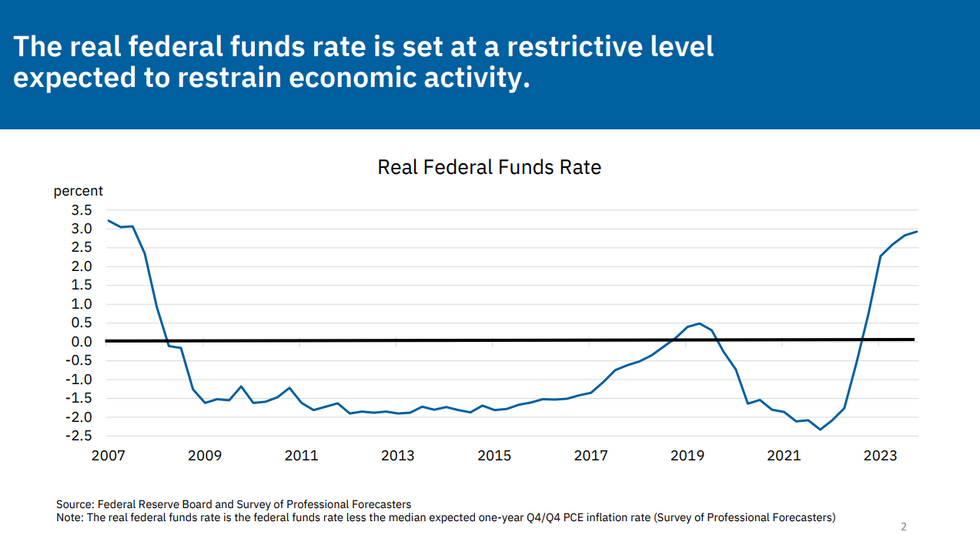

The Atlanta Fed president said "the real federal funds rate—that is, our interest rate adjusted for inflation—is at its highest level in over a decade" and the labor market remains broadly healthy. In assessing the appropriate path for policy in coming months, Bostic said he will be keeping an eye on shorter-term inflation measures, labor market pressures impacting inflation, and job growth and job losses.

"We must seek a delicate balance, and the time to seriously ponder how we arrive at that balance will quite likely soon be at hand if it is not already."

Source: Atlanta Fed

Source: Atlanta Fed

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.