-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: Bank Of Canada Decision Eyed

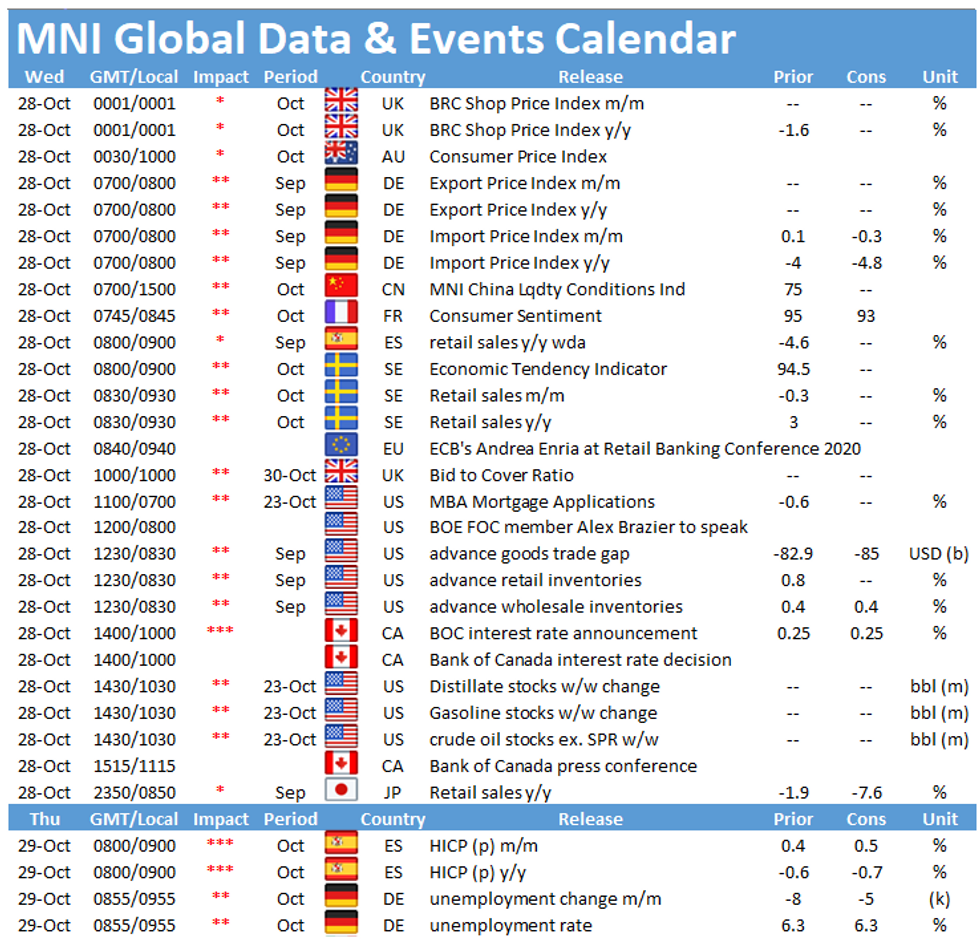

Wednesday morning kicks off with the release of French consumer sentiment at 0745GMT, followed by Spanish retail sales at 0800GMT. In the North Americas, the Bank of Canada's policy decision will be the highlight of the day.

French consumer sentiment seen falling

Consumer confidence is forecast to ease slightly to 93 in October, down from September's reading of 95. The indicator remains well below the long-term average and below February's pre-crisis level. The rising Covid-19 cases and stricter social distancing measures provide a challenging environment for consumers. The fear of unemployment remains at an elevated level since the start the of the pandemic, as did consumer's savings intentions. If the pandemic intensifies and further restrictions were to be imposed, confidence is likely to ease further going forward.

Spanish retail sales expected to fall amid rise in cases

Monthly retail sales started recovering from May onwards after plunging in March and April. In August, sales grew 1.8% after ticking up 1.2% in July. However, the current increase in Covid-19 cases and the strengthening of restrictions could put a lid on the recent recovery. Annual sales are expected to deteriorate after four consecutive improvements with markets looking for a drop to -3.4% following August's reading of -2.4%. Survey evidence suggests that the recovery hast lost momentum with the renewed increase in infection numbers. September's services PMI shifted further into contraction and the flash estimate for consumer confidence in the Eurozone eased again in October.

BOC expected to leave interest rates unchanged

The Bank of Canada will likely affirm that interest rates will stay near zero for years and press ahead with QE, as the economy's transition to what policymakers had called a long recuperation is threatened by a second wave of Covid-19.

Governor Tiff Macklem has pledged to keep up federal bond purchases of at least CAD5 billion a week until the economic recovery is well underway, and downside risks are rising with a second wave of the virus in Toronto, Montreal and Ottawa. Every economist in an MNI survey sees the official policy rate remaining at 0.25% in a decision due at 10am EST, and most see the pace of QE remaining unchanged.

Besides the press conference following the BOC's interest rate announcement, ECB's Andrea Enria speaking at the Retail Banking Conference 2020 of the European Savings and Retail Banking Group (ESBG) is of note.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.