-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI Global Morning Briefing

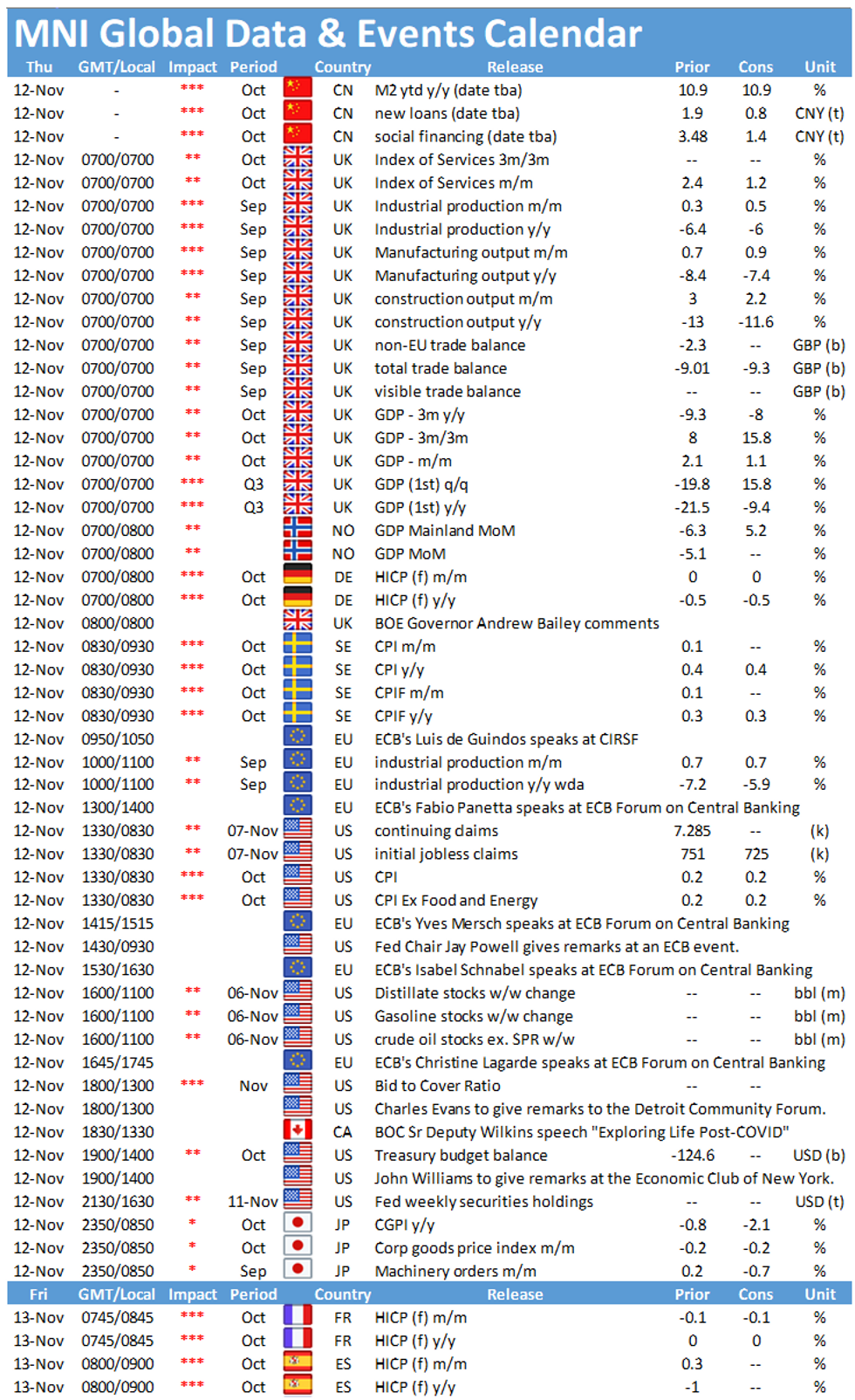

Thursday kicks off with the publication of the first estimate of UK Q3 GDP at 0700GMT, along with the short-term monthly indicators. At 1000GMT the release of industrial production figures for the Eurozone will be closely watched, while in the US the release of the consumer price index at 1330GMT is the highlight.

UK GDP set to rebound in Q3

Quarterly GDP is expected to rebound sharply in Q3 to +15.7% after falling 19.8% in Q2 as a result of the pandemic. The annual rate is seen at -9.5% in Q3 after the record 21.5% drop seen in Q2. A sharp increase in GDP is unsurprising as the UK economy gradually reopened in Q3 following an almost three-month lockdown. However, the outlook for Q4 is subdued as the second wave of Covid-19 has hit the country in early autumn. The rising infection rates led to a second lockdown which will weigh heavily on economic activity, likely leading to another decline of GDP, although the downturn is likely to be less severe now compared to spring as schools and several working places are allowed to remain open.

Monthly GDP is forecast to rise by 1.0% in September after ticking up 2.1% in August. The indicator has recovered since May, but the growth rate has decelerated since July and growth is still 9.2% below February's level. Meanwhile, industrial production, services and construction are all forecast to show a small monthly uptick in September by 0.9%, 1.1% and 2.1%, respectively. Nevertheless, all three indicators remain below February's level and the second lockdown poses a downside risk in the coming months. Especially the service sector is likely to see another sharp drop in November.

Survey evidence suggests that the recovery is slowing. The manufacturing and services PMI both eased in October but remain in expansion territory. Both surveys indicate another drop in employment and mention concerns regarding the impact of the new restrictions. The BRC shop sales monitor showed an increase in sales in October but noted that the second lockdown shortly before Christmas will weigh heavily on retail sales. According to the BRC footfall already declined ahead of the lockdown as consumers changed their behaviour amid rising infection numbers.

EZ industrial production expected to rise modestly

EZ Industrial output is seen rising by 0.7% m/m in September, matching August's growth rate. The industrial sector started its rebound in May, but the recovery is slowing ever since. The stricter measures to contain the spread of Covid-19 also weigh on the industrial sector. However, as companies in the industrial sector are allowed to remain open, the industry is not as heavily affected as the service sector and steep declines which were recorded in March and April are unlikely this time. State-level data is in line with market forecasts. German industrial output grew by 1.6% m/m and French production rose 1.4%, while the Italian industrial sector ticked down 5.6%.

US inflation remains muted

Inflation likely held steady in October, with markets expecting CPI to increase 0.2% in October. That will mostly be driven by gasoline prices, which dropped only slightly through the month despite falling oil prices. Core CPI should also rise 0.2% following a 0.2% gain in September.

The main event to look out for on Thursday is the ECB Forum on Central Banking, which is usually held in Sintra (Portugal) but is organised as an online event this year. Speakers include ECB's Christine Lagarde, Yves Mersch, Fabio Panetta and Isabel Schnabel as well as BOE's Andrew Bailey and Fed's Jay Powell.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.