-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing

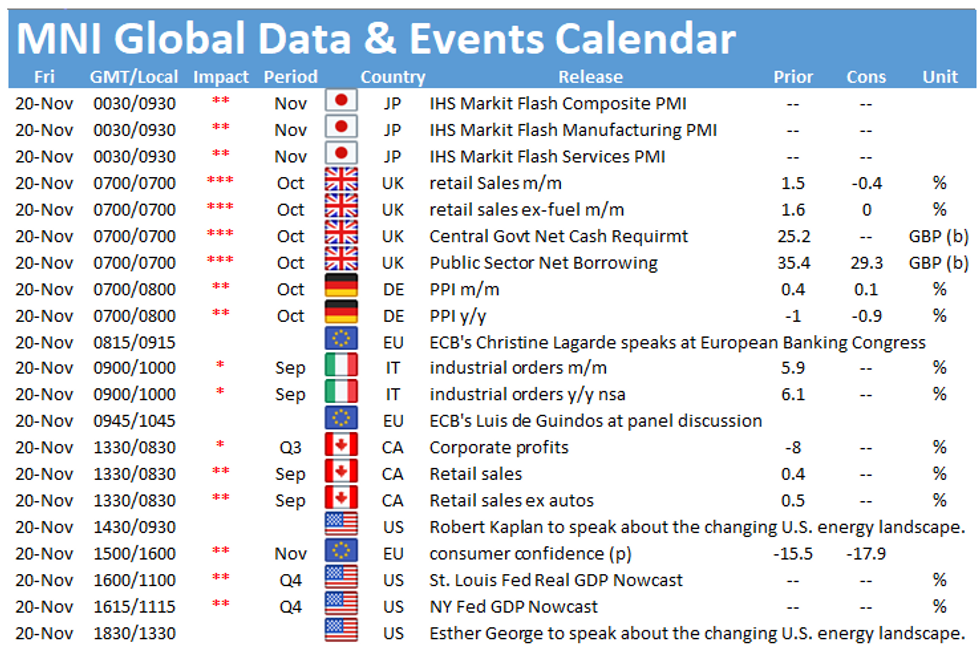

The week ends with several data releases of note, starting with the UK retail sales figures and public sector finances, both at 0700GMT. Later today, the publication of Canadian retail trade at 1330GMT and EZ flash consumer confidence at 1500GMT will be closely watched.

UK retail sales expected to drop

Retail sales are forecast to ease in October by 0.4% following a 1.5% uptick in September which was a fifth consecutive gain. Excluding fuel, sales are seen flat in October after September's uptick of 1.6%. The ONS noted that September sales were 5.5% higher than in February before the crisis. However, infection rates started to rise in early autumn and continued to worsen during October, which likely led consumers to stay at home and postpone spending. The lockdown which came into place in November will further weigh on spending going forward. Consumer confidence fell sharply in October even before the new lockdown was introduced and dropped further in November with consumer's opinion about their personal finances deteriorating.

UK debt to GDP already at highest since 1960

Public Sector net borrowing (excluding banking groups) registered at GBP 36.1bn in September and markets expect the indicator to register at GBP 32.0bn. September's reading marked the third highest level on record which began in 1993 but it was below the OBR's forecast of GBP39.2bn. Year-to-date borrowing rose to GBP 208.5bn in September, GBP 174.5bn higher than in the same period a year ago. The report further noted that public debt increased to 103.5% of GDP which is the highest ratio since the financial year ending 1960. Rising infection rates led to a second lockdown in November and stricter measures had been introduced in several parts of the country even before the new lockdown. Moreover, the government's furlough scheme has been extended until March. All new measures to mitigate the spread of the virus are likely to lead to additional funding needs and a higher deficit.

EZ consumer sentiment seen dropping amid second wave

Consumer confidence is forecast to deteriorate in November as the second wave hit most of the European countries and strict containment measures had been renewed. Sentiment is projected to drop to -17.9 after falling to -15.5 in October. Consumer confidence improved until September but started to deteriorate when Covid-19 cases started rising again. Subdued consumer confidence will weigh heavily on household spending in Q4.

Canadian retail sales forecast to slow

Retail trade rose 0.4% in August on a monthly basis, showing the fourth successive increase since the record drop at the beginning of the pandemic. In September, markets are looking for another uptick, although at a slower pace of 0.2%. Similarly, sales excluding autos are expected to decelerate to 0.1%, down from 0.4% registered in the previous month. Statcan noted that sales shifted above the pre-pandemic level in seven provinces, while they remained below in three.

Friday's events calendar throws up several interesting speeches including speakers such as ECB's Christine Lagarde, Fed's Tom Barking and Raphael Bostic as well as Dallas Fed's Robert Kaplan and Kansas City Fed's Esther George.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.