-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing

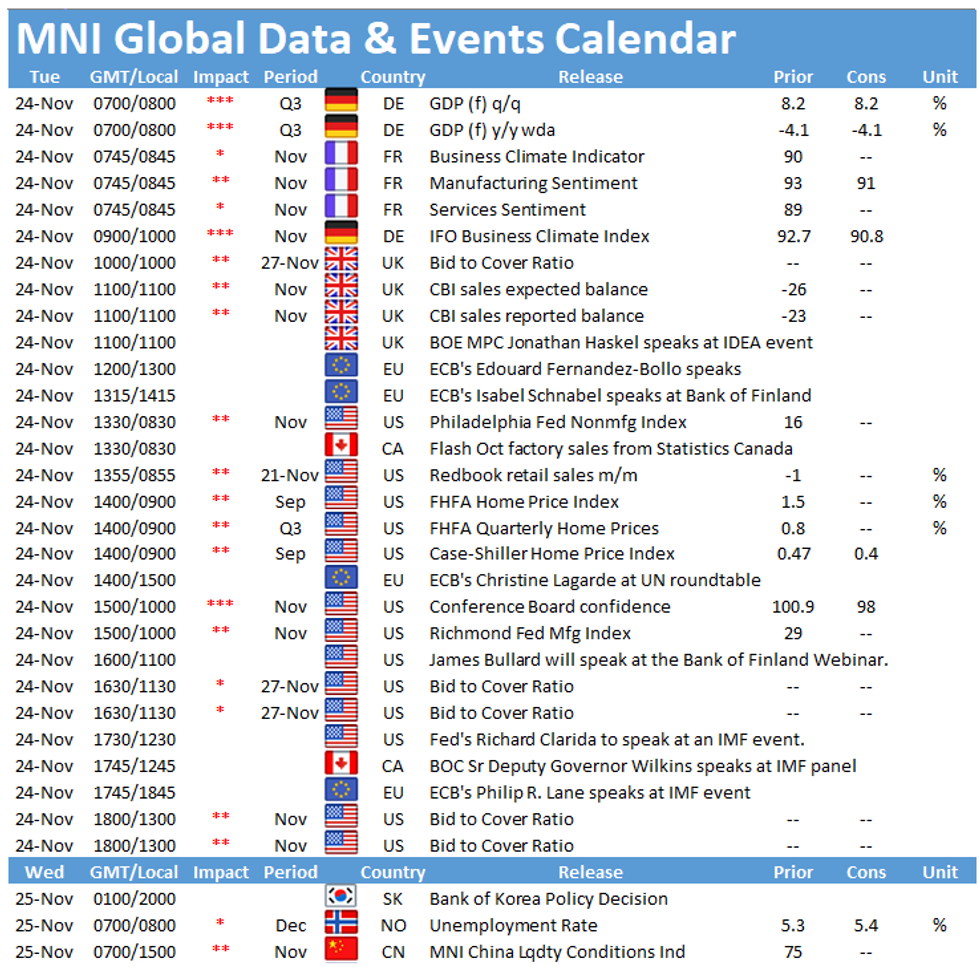

The main data events to look out for on Tuesday include the release of the French business climate indicator at 0745GMT, followed by the German Ifo business climate indictor at 0900GMT. In the US, the publication of consumer confidence at 1500GMT will be watched closely.

French business sentiment seen lower amid rising infection rates

The business climate indicator declined to 90 in October and markets expect business sentiment to fall further in November to 84 which would be the lowest level since July. October's decline was the first drop after five months of consecutive growth. However, despite the recent increases, the index still remains below the pre-pandemic level. Rising Covid-19 cases and the second lockdown are likely to weigh heavily on business sentiment towards the end of the year. Similarly, manufacturing sentiment is forecast to ease in November to 91, down from 93 recorded in October. This would mark the second successive decrease. However, service sentiment is likely to take the biggest hit in November due to the renewed tight restrictions which affects the service sector to a greater extent.

The recently released flash PMI showed a sharp drop in service sector business activity with the services PMI plunging to a six-month low of 38, while the manufacturing PMI shifted back into contraction.

German Ifo business climate expected to decrease

The Ifo business climate indicator is expected to tick down in November to 90.2 which would be the lowest level since June. The index recovered until September following a sharp drop in April, but it started to ease again already in October. Infection rates started to increase in early autumn as well which dampened the outlook for the coming months. Current conditions as well as Expectations are forecast to decrease slightly in November. The current situation index is seen lower at 87.6, while expectations are projected to drop to 93.5.

The new lockdown which was introduced in Germany in November is likely to weigh on business climate, although the positive news regarding a vaccine might offset some that effect. The flash services PMI fell to a six-month low of 46.2 in November, while the manufacturing PMI still signalled strong growth despite a small downtick.

US consumer sentiment seen deteriorating

Consumer confidence in the US eased slightly in October to 100.9 and markets look for another decline in November to 97.9. While the present situations index rose in October, expectations declined which was mainly driven by a softening in the outlook for jobs. Consumers were less optimistic about the short-term outlook and rising Covid-19 cases across the country bode ill with sentiment going forward. The preliminary Michigan consumer sentiment index showed downtick in November, mainly led by a less optimistic outlook.

The events calendar throws up a busy schedule on Tuesday including the following speakers: BOE's Jonathan Haskel, ECB's Edouard Fernandez-Bollo, Isabel Schnabel, Christine Lagarde and Philip Lane as well as St. Louis Fed's James Bullard and Fed's John Williams and Richard Clarida.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.