-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing

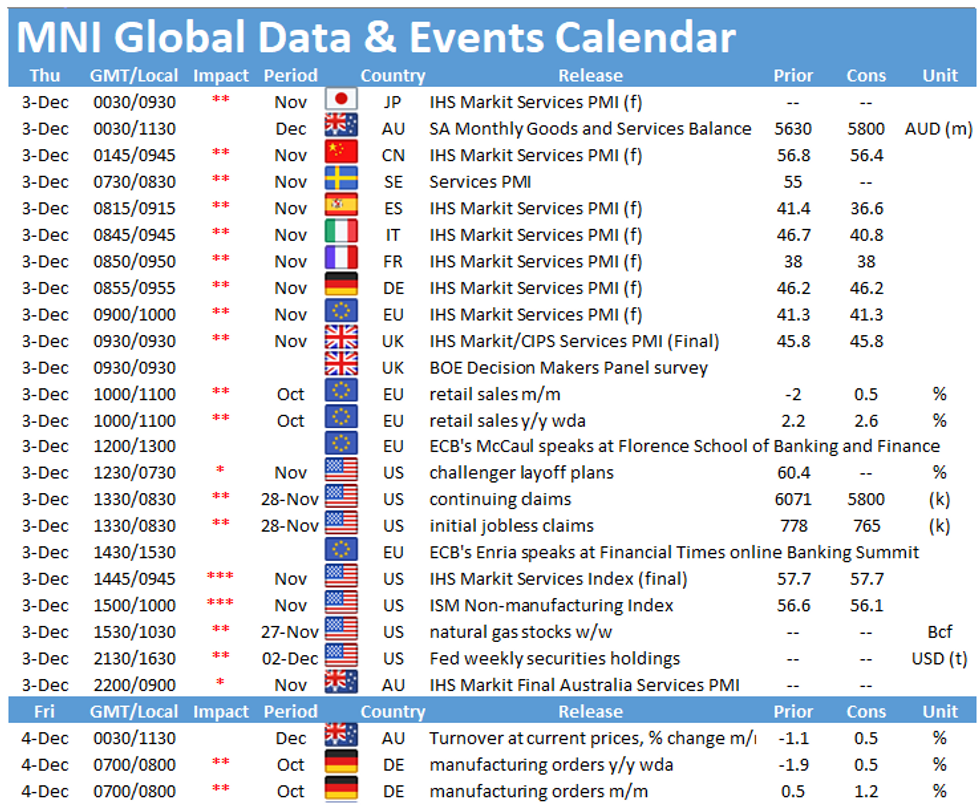

Thursday's data calendar sees several data releases of note, including final services PMIs for Spain (0815GMT), Italy (0845GMT), France (0850GMT), Germany (0855GMT), the EZ (0900GMT) and the UK (0930GMT). At 1000GMT the publication of EZ retail sales figures will be closely watched, as will US initial jobless claims at 1330GMT.

Europe's services dropped in November

Spain's and Italy's services PMI, for which no flash results are published, are both expected to fall further in November. Spain's index is seen 4.8 points lower at 36.6, while the Italian PMI is expected to decline by 5.9 points to 40.8. For both indicators this would mark the lowest level since May. France's, Germany's, the EZ's and the UK's services PMIs are expected to register at the flash results showing significant declines. All four indices dropped to a six-month low in November. The French index fell to 38.0, while the German services PMI slipped to 46.2 according to the flash estimate. The overall EZ services PMI decreased to 41.3 in Nov, while the UK's index fell to 45.8 in November. Service sector activity fell sharply due to the new lockdowns across Europe, especially as the consumer-facing part of the service sector was heavily affected by the new restrictions.

EZ retail sales expected to edge higher

Sales are forecast to increase by 0.5% in October after falling by 2.0% in the previous month. Sales rebounded sharply after the first lockdown, but the recovery slowed in recent months. The newly introduced tight measures in November in many European countries are likely to weigh on sales going forward, however, increased spending ahead of Christmas is likely to provide a boost to sales.

US jobless claims forecast to slow

Initial jobless claims filed through November 28 should dip to 765,000 after climbing to 778,000 in the week ending November 21. Claims for benefits under the Pandemic Unemployment Assistance (PUA) and Pandemic Emergency Unemployment Compensation (PEUC) continue to rise. Analysts say this indicates many job losses have become longer in duration and unemployed workers are exhausting regular state benefits.

The main events to look out for on Thursday include speeches by ECB's Elizabeth McCaul and Andrea Enria.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.