-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI Global Morning Briefing

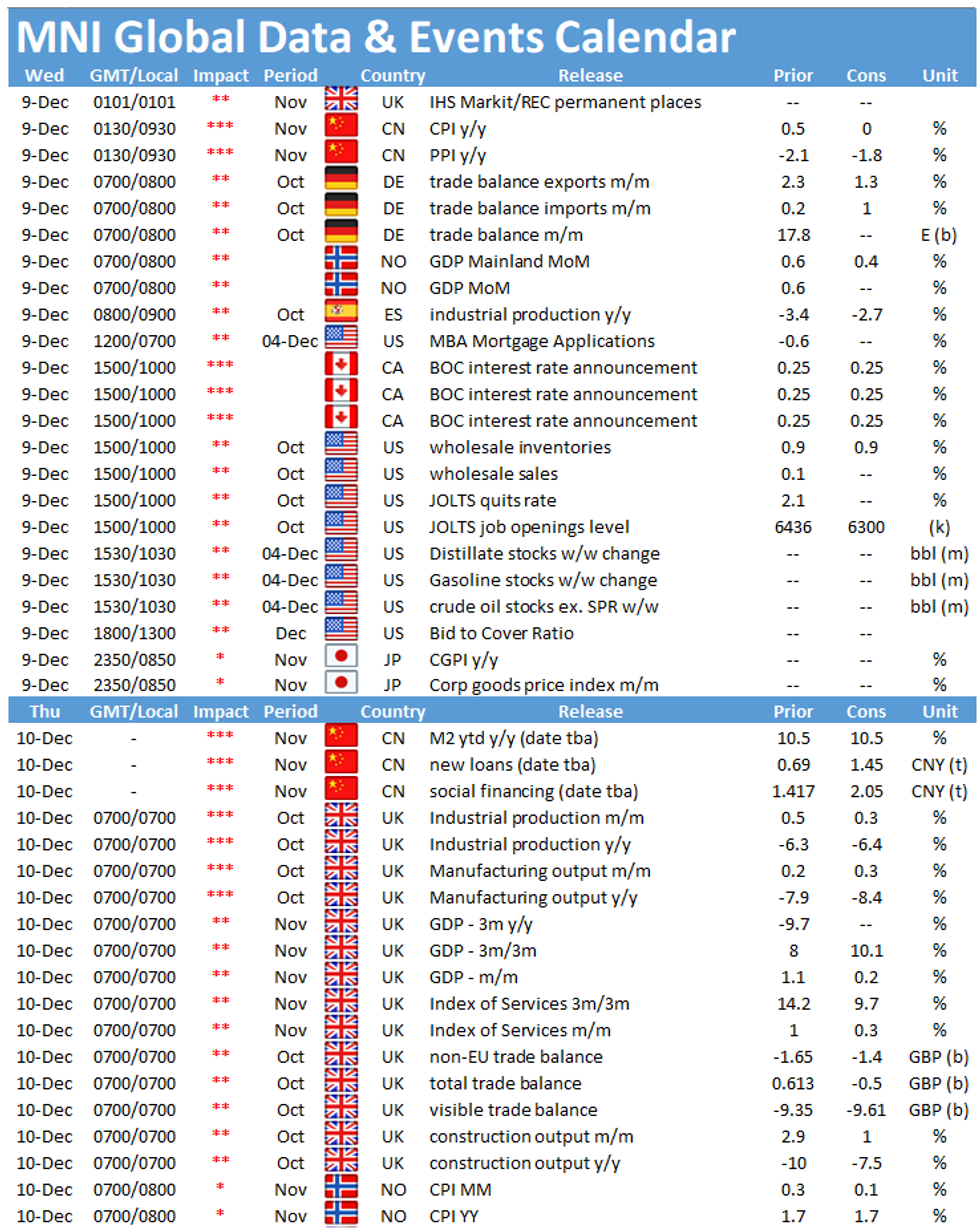

Wednesday sees a quiet session in terms of data releases with the highlights being the publication of the German trade balance at 0700GMT, followed by Spanish industrial production at 0800GMT. In the North Americas, the main event to follow is the interest rate announcement by the Bank of Canada at 1500GMT.

German trade balance forecast to shrink

The unadjusted trade balance is expected to narrow to EUR18.5bn in October after recording EUR20.8bn in the previous month. The seasonally adjusted trade surplus expanded marginally in September to EUR17.8bn as exports ticked up 2.3%, while imports declined by 0.1%. In October, markets look for exports to rise further, although at a slower pace of 1.3%. Imports are projected to increase by 1.0% on a monthly basis. Compared to February, September imports were 5.7% lower, while exports were 7.7% below the pre-crisis level. Survey evidence is mixed. November's manufacturing PMI noted an increase in export sales. On the other hand, the Ifo export expectations index shifted back into negative territory in November due to the intense second covid-wave.

Spanish industrial production growth likely to slow

Spanish industrial output is seen flat in October after growing marginally in September by 0.8%. Output rebound sharply after the initial fall in March in April but stagnated in August and September as the resurgence of covid-19 cases weighed on production. Annual production continues to decline. However, the year-on-year rate is expected to fall at a slower pace of -2.7% compared to September's 3.4% drop. Forward-looking survey evidence suggests a downside risk. The manufacturing PMI shifted to contraction territory in November due to a downturn in market demand.

BOC expected to leave bank rate unchanged

The Bank of Canada is almost universally expected to hold its benchmark lending rate at 0.25%, leaving more attention on whether policy makers outline any further move to "calibrate" its CAD4 billion a week of asset purchases. The BOC scaled back from the CAD5 billion pace at the last meeting in October, and the recent second wave of Covid suggests it would be hard to make another move now.

The events calendar remains quiet on Wednesday with no speeches scheduled for the day.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.