-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing

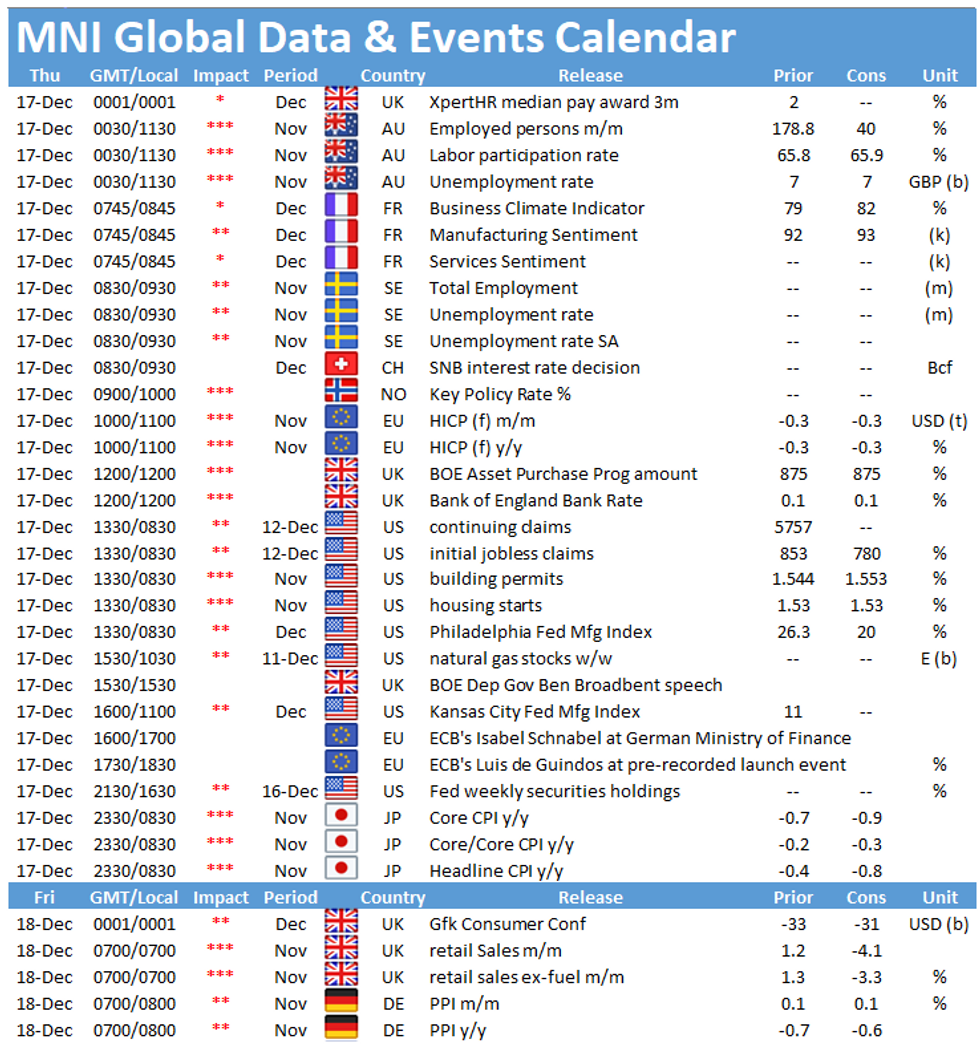

The main data and policy events to look out for on Wednesday include the final EZ inflation figures for November at 1000GMT, followed by the BOE's interest rate decision at 1200GMT. In the US the release of initial jobless claims at 1330GMT will be closely watched.

Final EZ inflation seen at flash estimate

The final EZ inflation print will likely be unchanged from the flash result, also unchanged on the reading from October. The headline HICP has come in at -0.3% since September, showing negative readings for four consecutive months. Energy prices remain the largest drag on headline inflation, but also the German VAT cut keeps EZ inflation muted. The ECB expects inflation to remain in negative territory until early 2021 and weak demand is likely to keep inflation subdued in the near-term.

BOE likely to stay on hold

The Bank of England meets Dec 17, the last meeting of the year that has seen policymakers slash interest rates to a record low 0.1%, consider a move to negative rates and extend its stock of bond buying to a potential GBP845 billion.

The December meeting falls just a fortnight ahead of the year-end, when we could still find the UK ending its transition out of the European Union without a future trade deal. Although the BOE is likely to stand pat on both rates and QE this month, Governor Andrew Bailey has said policymakers have enough in the armory to act if needed.

US jobless claims forecast to slow

Initial jobless claims filed through December 12 are expected to slow to 780,000 after increasing to 853,000 in the week ending December 5. Continuing claims increased to 5,757,000 during the week ending November 28, signalling that the labour market faces more and more stress. Rising infection rates and renewed containment measures are likely to keep jobless claims elevated in the coming weeks.

The main events to follow on Thursday include ECB's Isabel Schnabel speaking at the German Ministry of Finance and ECB's Luis de Guindos participating in a book launch.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.