-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: UK Wage Growth To Soar

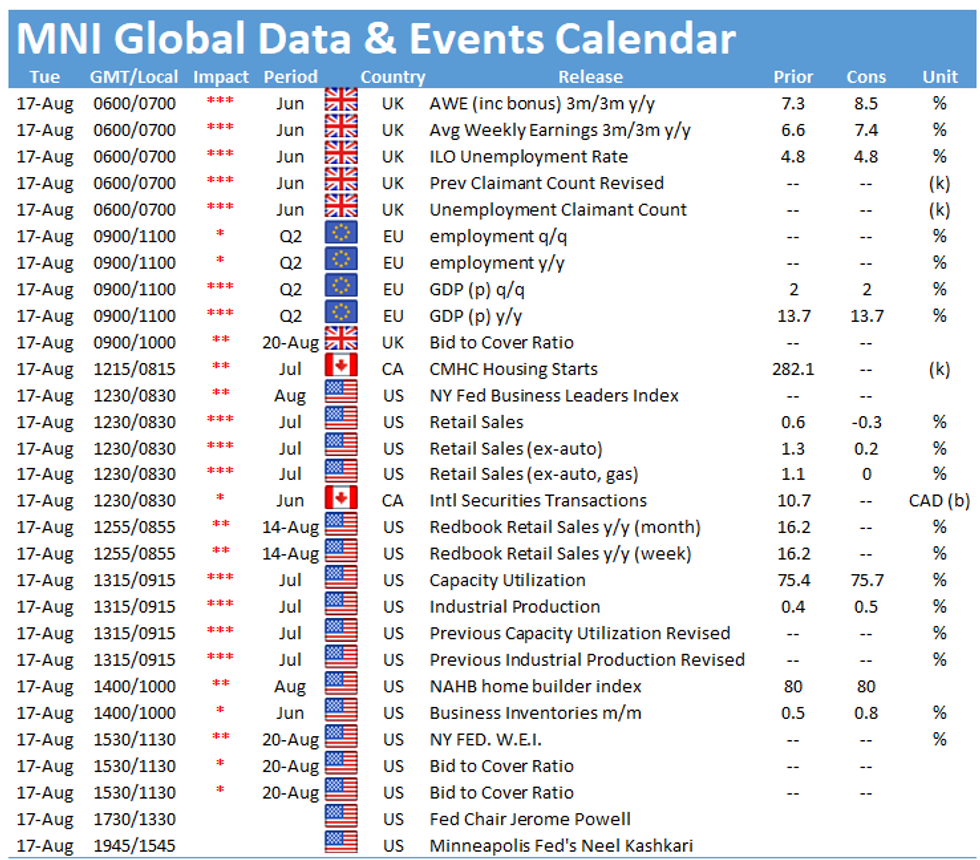

UK labour data and the euro area Q2 GDP data are the early highlights Tuesday, with the US retail sales to feature in the afternoon.

UK Wage growth to soar (0700BST)

The UK unemployment rate likely steadied at 4.8% in the second quarter, even after a record-high 356,000 jump in RTI employment in June, although wages growth is set to soar. That series is derived from PAYE data and covers only those in salaried employment. LFS employment likely increased by 73,000 after a 25,000 rise in the March-May period. Economists may keep an eye on the inactivity rate (21.3% in March-May), which has fallen more slowly than expected, according to Bank of England officials.

The jobless data are likely to be overshadowed by a sharp acceleration in earnings, with total pay forecast to hit 8.6%, above the peak of "around 8.5%" in Q2 forecast by the Bank of England, up from record-high growth of 7.3% in the three months to May. Regular earnings are forecast to rise by an annual pace of 7.4%, up from 6.6% previously.

Various Bank of England officials have noted that wage acceleration presents the biggest risk to inflation forecasts, but some believe that the MPC understands distortions in the data and will focus on underlying data. After adjusting for depressed wage growth a year ago and the concentration of lower-paid workers amongst those left jobless by the pandemic, the Office for National Statistics estimated underlying total wage growth at between 3.9% and 5.1% in the three months to May.

EZ Q2 GDP confirmed higher (1000 BST)

Eurozone flash GDP is due Tuesday and will likely confirm the 'preliminary flash' release, showing the economy grew by 2.0% quarter-on-quarter and by 13.7% year-on-year.

US Retail Sales May Slow (1330 BST)

US sales decelerated through July as spending shifted away from goods towards services, with Bloomberg forecasting a decline of 0.3% after June's 0.6% increase. A decline in vehicle sales likely offset most of the expected gains in restaurant and gas station sales, analysts say.

Excluding vehicle sales, sales should increase 0.2% after rising 1.3% in June, according to Bloomberg. Excluding vehicles and gas stations, sales should remain unchanged, while control group sales are expected to fall 0.3%, as highlighted in the latest MNI Reality Check.

The main speakers slated for Tuesday include Fed chair Jay Powell and Minneapolis Fed President Neel Kashkari.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.