-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

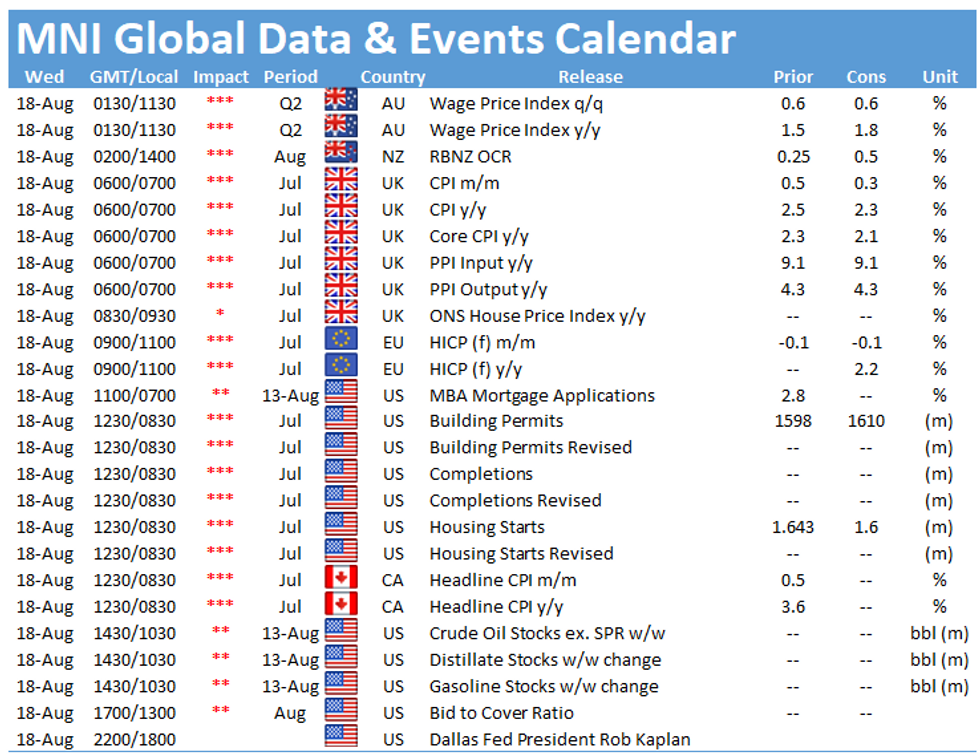

Free AccessMNI Global Morning Briefing: Inflation Data In Focus

Inflation data will be the main focus for financial markets Wednesday, with data due in the UK, eurozone and Canada.

UK Prices May Slow Before Late-Year Rise (0700BST)

UK Consumer price inflation likely declined to an annual pace of 2.3% in July falling, from a near-two-year high of 2.5% in June, as base comparisons that saw re-openings a year ago likely weren't matched this July. That, analysts note, means a lower annual rate of inflation, now, although a rise to between 3.5% and 4.0% is seen later this year. The MPC expects inflation to hit 4% by year end, a sharp increase from the previously-forecast peak of 2.5%.

Clothing prices could dampen inflation in July, as they declined in line with historical norms last month, in contrast with July of 2020 when sales patterns were distorted by the reopening of non-essential shops. A surge in used-car costs could counter some of that downward pressure; prices rose by an annual rate of 14.1%, according to Auto Trader, up from a 11.1% jump in June, when used-car prices added 0.08 percentage points to the change in CPI.

Producer prices likely steadied at elevated rates, according to City economists, but likely remained below May's peak. Output inflation is forecast at +9.1% y/y, while output prices are set to rise 4.3%, both unchanged from June.

Source: ONS

EZ Inflation At Near 2-Year High (1000 BST)

Eurozone HICP likely hit an annual rate of 2.2% in July, according to analysts, confirming the initial estimate released late last month. That represents the quickest pace of inflation since October 2018. However, benchmark effects, particularly in the energy sector (which rose by 14.1% y/y in the flash estimate) are likely to recede in coming months, and the European Central Bank has taken a relaxed attitude toward the rise in HICP above its new target of 2.0%.

The central bank expects inflation to recede to an annual rate of just 1.4% by 2023, although Bundesbank officials have hinted at concern with German inflation, which rose to 3.1% in July from 2.1% in June. Core inflation -- excluding food and energy -- fell to an annual rate of 0.7% in the July flash estimate, down from 0.9% a month earlier. Updated HICP data are scheduled for release at 1000 BST on Wednesday.

Canadian Inflation Seen Higher In July (1330 BST)

Canana Inflation likely quickened to 3.4% in July from 3.1% in June according to market consensus, keeping it above the top of the central bank's 1%-3% target band for a fourth month. Base effects on energy and rising service costs as the economy re-opened are expected to push prices up.

The BOC last month raised inflation forecasts while affirming price gains are largely transitory. Inflation was 3.6% in May, the highest in a decade. The BOC predicts CPI of 3.4% in Q2, 3.9% in Q3, 3.5% in Q4.

The only policymaker scheduled to talk Wednesday is Dallas Fed President Rob Kaplan, who speaks after the U.S. markets close.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.