-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

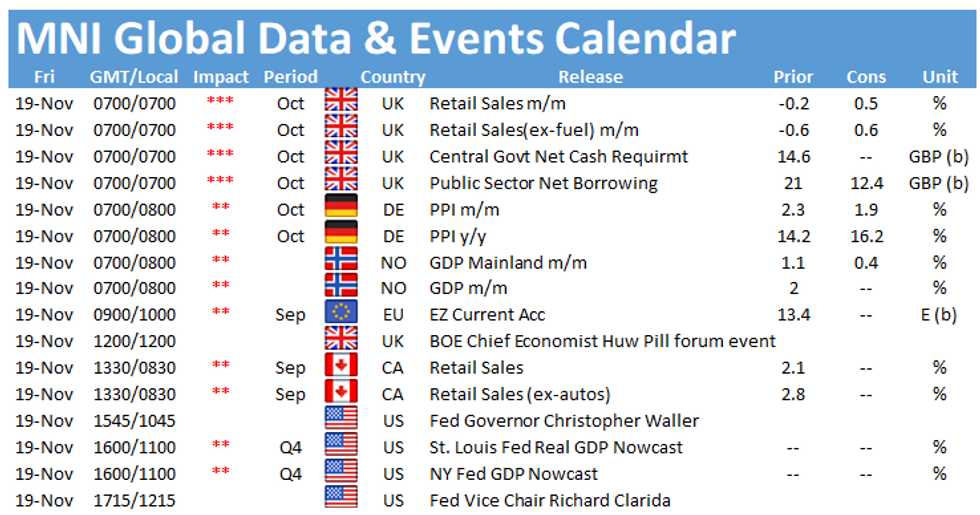

Free AccessMNI GLOBAL MORNING BRIEFING: November 19

UK Oct Borrowing Set To Fall With End of Furlough Scheme (0700GMT)

Government borrowing likely fell sharply in October, as the government outlays on the furlough scheme ceased at the end of September. Borrowing declined to GBP14.0 billion last month, say forecasters, down from GBP21.8 billion in September, which accounted for 95.5% of gross domestic product. The government disbursed GBP1.3 billion on job retention and assistance for the self-employed in September, the last month of the scheme, according to a National Statistics official when presenting borrowing figures in October.

However, interest payments are set to skyrocket, after retail price index rose by a full percentage point to an annual rate of 4.8% between July and August, the reference period for October disbursements. That suggests an outlay in the region of GBP7.5 billion in October, falling between a payout of GBP8.7 billion in June (based on a 1.4pp rise in RPI) and GBP6.3 billion in August (based on a 0.6pp increase in PPI). Interest payments totalled GBP4.8 billion in September.

Borrowing totalled GBP108.1 billion through the end of September, down 48.3% over the same period of 2020. That leaves borrowing on track to meet the latest OBR 2021/22 target of GBP183.0 billion, a 43% decline over the previous financial year.

UK Retail sales seen higher (0700GMT)

UK retail sales rose by 0.5% in October, according to City forecasters, which would break a five-month losing streak, the longest since the series began in 1996. But weakness over the spring and summer provide for easy monthly comparatives, raising the possibility of a significant statistical rebound in October. Sales have fallen by 5.2% after touching a multi-year peak in April.

Food sales rose modestly, largely boosted by festivals, with consumers stocking up on Halloween treats and forward-looking shoppers beginning to think about Christmas. However, higher prices may have kept sales volumes in check.

German PPI to rise further (0700GMT)

Monthly vs yearly German PPI inflation expectations are expected to diverge in today's data release. This data comes following last week's October HICP inflation rate jumping to 4.5% Y/Y for 2021.

Germany's monthly headline PPI rate is predicted to come in at 1.9% for October, slowing modestly from September's reading of 2.3%, although market analysts have tended to overestimate downside risks in German factory gate inflation this year. Germany's industrial manufacturing sector continues to be stunted by supply bottlenecks, particularly in the automobile industry, where semiconductor chips shortages have hampered production capacities.

This is reflected in the yearly PPI inflation, with forecasts for a two-percentage point increase to 16.2% in October 2021, compared to 14.2% last month, driven by high energy prices and prevailing supply shortages spilling over into heightened automobile prices.

The ECB remains insistent on current inflation being transitory, a view echoed in recent days by President Christine Lagarde and Executive Board member Isabel Schnabel.

Amongst the policymakers speaking on Friday are Bank of England Chief Economist Huw Pill, Fed Governor Chris Waller and Fed Vice Chair Richard Clarida.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.