-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: Central Banks Dominate

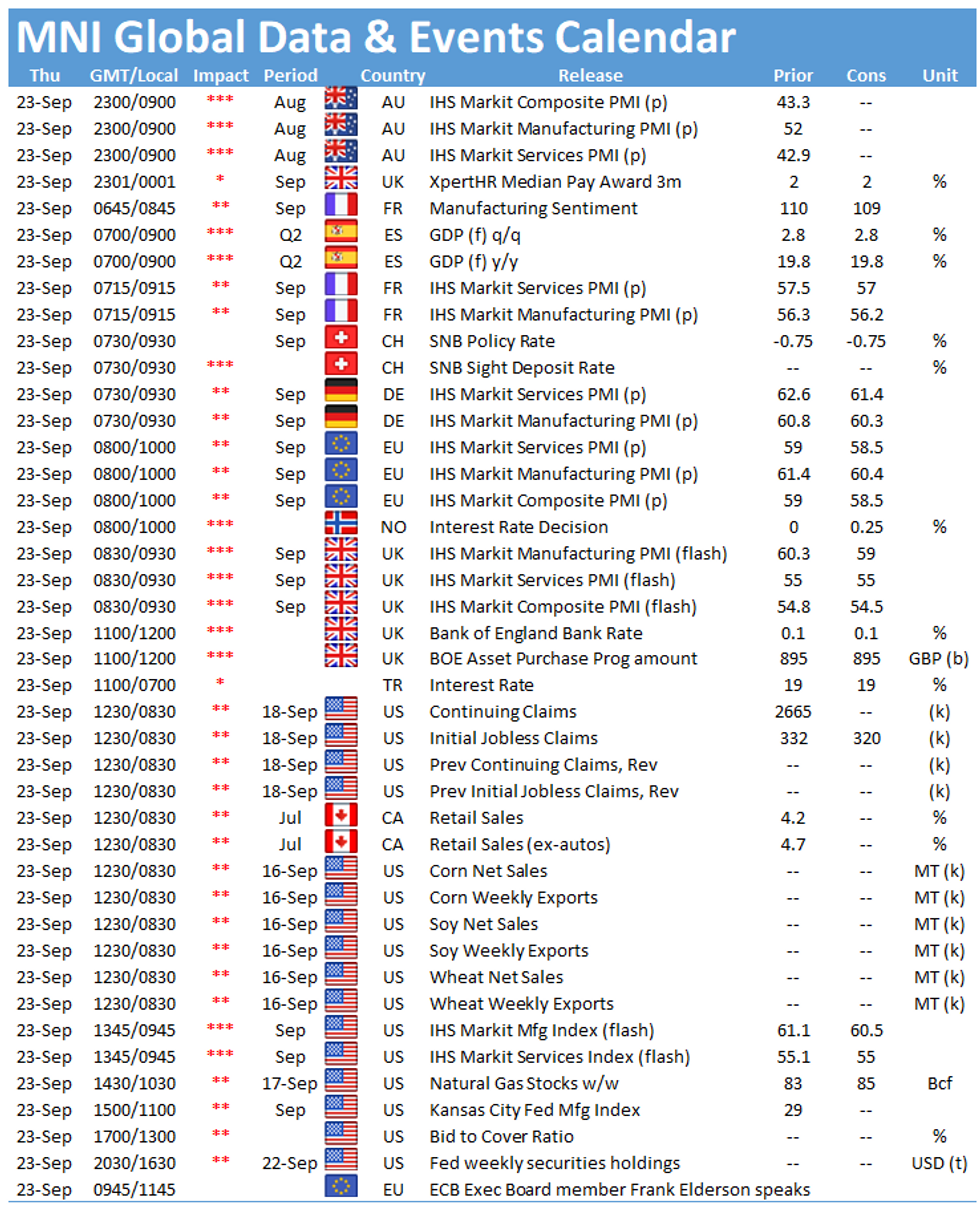

Thursday's data includes the release of the European flash PMIs, along with French manufacturing sentiment, final Spain Q2 GDP and US Initial jobless claims.

No change for SNB (0830BST)

The Swiss National Bank is expected to leave its policy rate at -0.75% when it meets Thursday, and to repeat its commitment to step into the foreign exchange market as necessary for so long as CHF continues to be "highly valued", MNI writes in its latest Reality Check.

Chairman Thomas Jordan may be absent as he continues to recover from undergoing heart surgery in August, leaving Fritz Zurbruegg and Andréa Maechler to present the latest round of growth and inflation projections.

Norges Bank set to hike (0900BST)

Norges Bank is set to raise interest rates for the first time in the cycle on Thursday, according to MNI's Reality Check, but it will weigh concerns over the global economy and capacity constraints before deciding to further consolidate its place among the first developed country central banks to tighten policy since the Covid crisis by steepening its projected rate path.

While Norway's central bank has clearly flagged the increase in its policy rate from zero to 0.25%, its Monetary Policy and Financial Stability Committee must also consider world supply chain constraints and signs of stalling growth in export markets, at a time of continued uncertainty about how long the pandemic will persist.

Bank of England on hold (1200BST)

The Bank of England, faced with a lingering Covid pandemic and with its monetary policy committee split down the middle over whether a key hurdle for tightening has been met, looks set to leave policy untouched at its September meeting which concludes with an announcement Thursday, according to MNI's latest Reality Check.

With all bar one MPC member voting in August to carry on with the current GBP150 billion asset purchase round, which will take until December to complete, there seems little prospect of a majority voting to halt it this month and running the risk that the market could interpret that as tightening. Instead the Committee will judge that its continuation provides some insurance against higher market interest rates. Bank Rate too will almost inevitably be left at 0.1%.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.