-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Japan Q3 GDP To Be Slightly Revised Down

MNI Global Morning Briefing: EZ ESI Seen Higher

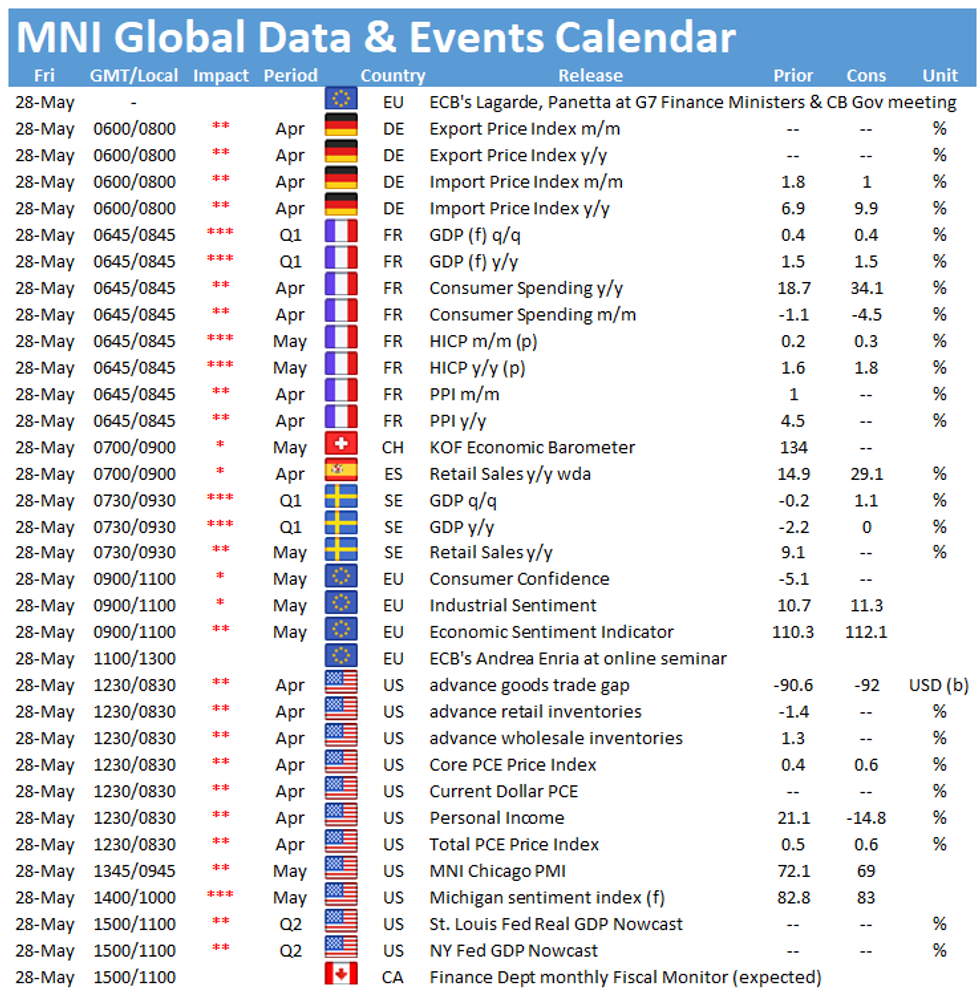

The week ends with a busy data schedule, including the release of the final French GDP figures and French flash inflation, both released at 0745BST. At 1000BST the European Commission's Economic Sentiment Indicator will be released before the focus turns to US personal income and consumption data at 1330BST.

French GDP seen at flash estimate

Final French GDP is expected to register at the flash result showing a quarterly uptick of 0.4% in Q1, following a 1.4% decline in Q4 2020. Nevertheless, GDP is still 4.4% below the level seen in Q4 2019, the last quarter before the pandemic. While household and government consumption ticked up in Q1, exports and imports and declined, with exports falling more than imports.

Restrictions have been eased in mid-May which is likely to boost to economic activity in Q2. Hence, the second quarter is likely to see a consumption driven increase of economic growth.

French inflation expected to rise further

Flash inflation is forecast to accelerate to 1.8% in May, up from 1.6% seen in April. April's uptick was driven by a sharp increase in energy prices, mainly due to base effects. Prices for petroleum products rose markedly by 13.9% in April. Energy prices are likely to be the main driver again of CPI growth in May.

Survey evidence is line with market forecasts. The flash composite PMI recorded the fastest increase in output prices since 2011 as firms pass on the higher input costs.

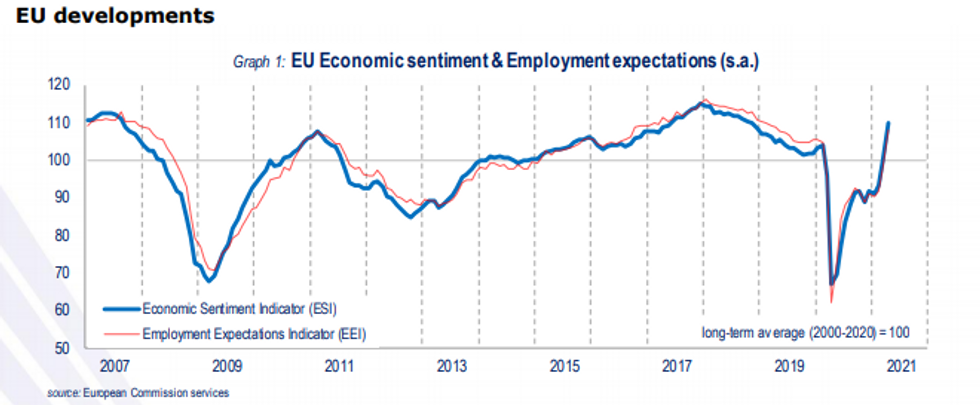

EZ Economic Sentiment Indicator forecast to post further gain

The EZ ESI is forecast to rise further in May to 112.1, up from 110.3 recorded in April. This would mark the highest level since June 2018 and the fourth consecutive gain. Last month's increase was broad-based with every category showing monthly gains. Industrial sentiment recorded a record high in April and service confidence posted the first positive reading since the start of the pandemic.

As many countries eased restrictions in May and vaccinations are progressing, further improvements are likely to be seen across the board. The flash EZ composite PMI rose by more than markets expected and jumped to 39-month high in May as new orders surged to an almost 15-year high.

Source: European Commission

US personal income seen falling

U.S. personal income is set to have fallen sharply in April, with markets expecting a decline of 14.8% following March's strong 21.1% gain, according to Bloomberg, mostly reflecting the fading effect of stimulus checks.

Meanwhile, personal spending in April should continue to improve. Spending on goods stumbled in April, evidenced by last week's retail sales numbers, but services spending is seen improving as businesses continue to reopen and widely available vaccines make in-person activities safer.

The highlights from Friday's events calendar include ECB's Christine Lagarde and Fabio Panetta participating at the G7 Finance Ministers and Central Bank Governors' meeting, while ECB's Andrea Enria speaks at an online seminar.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.