-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Eurozone Inflation Preview - November 2024

MNI POLITICAL RISK - Trump Initiates Tariff Negotiations

MNI US MARKETS ANALYSIS - CAD Slips as Trump Looks to Tariffs

MNI Global Morning Briefing: EZ Retail Sales Seen Recovering

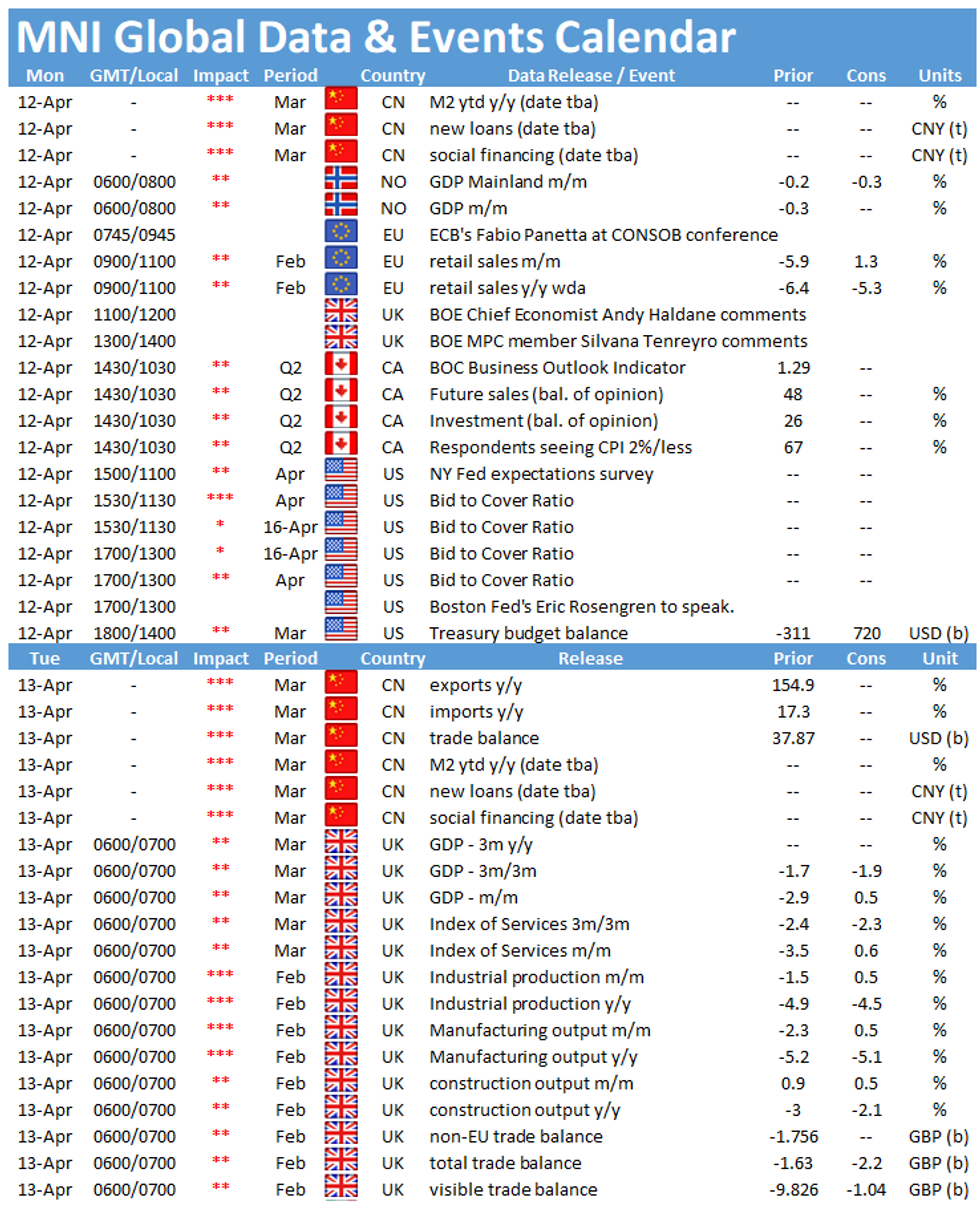

Monday kicks off with the publication of the Norwegian GDP at 0700BST, followed by EZ retail trade figures at 1000BST. The release of the Canadian Business Outlook and Consumer Survey at 1530BST is the highlight of the day in the North Americas.

Norwegian mainland GDP seen declining

Monthly GDP fell by 0.3% in January, while the monthly mainland GDP eased by 0.2% as infection rates rose at the beginning of the year and restrictions got tightened. Statistics Norway noted that the main reason for the decline was a drop in value added in the wholesale and retail trade, the first decrease registered since April 2020. January's report also noted the tightened restrictions are likely to result in a negative carry-over into February as restrictions remained widely in place. For February, markets are looking for another decline for the mainland GDP by 0.3%.

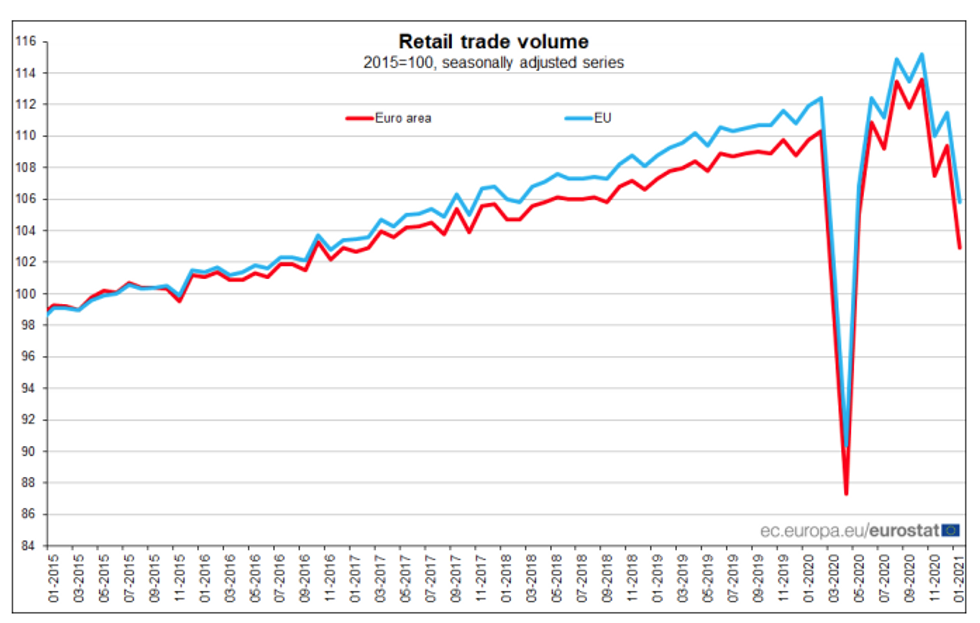

EZ retail sales expected to rise

Rising infection rates, a tightening of restrictions and a slow vaccination program weighed heavily on the EZ economy in January, leading to sharp decline in monthly retail sales by 5.9%, while annual sales were down 6.4%. While food sales eased in January, although they remained in positive territory, non-food product sales plunged by 12.0%. Restrictions have eased slightly in several countries in February and markets forecast retail sales are to tick up to 1.3%, while yearly sales are projected to decrease by 5.3%

Already available state-level data is in line with market forecasts looking for an uptick in February. Germany's retail sales rose by 1.2% in February, while Italian sales surged by 6.6% and Spanish sales were up 4.2%.

Source: Eurostat

Canadian Business outlook survey improved at the end of 2020

The business outlook survey indicator recovered further in Q4 2020 and shifted back to positive territory at 1.29 after recording extremely low levels in Q2 2020. This indicates that business sentiment is improving. The winter survey report noted that employment and investment intentions saw the biggest gains since the Q3 survey. The winter survey showed an uptick of the future sales indicator to 48, marking the second successive positive reading after Q2's sharp decline.

Monday's events calendar holds several interesting speakers in the cards, including ECB's Fabio Panetta, BOE's Andy Haldane and Silvana Tenreyro as well as Boston Fed's Eric Rosengren.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.