-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI Global Morning Briefing: Focus on EZ Inflation

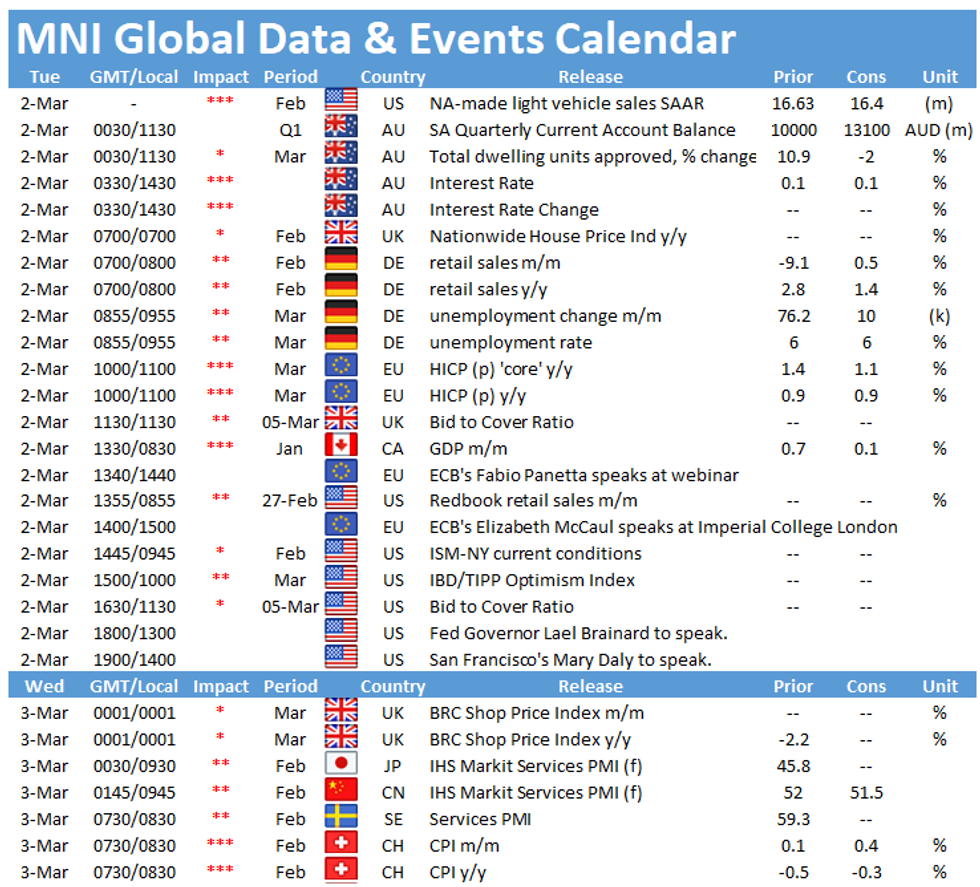

Tuesday kicks of with the release of German retail sales at 0700GMT followed by EZ flash inflation at 1000GMT. In the North Americas, the release of Canadian GDP figures will be closely watched at 1330GMT.

German retail sales seen rising slightly

Retail sales are expected to increase by 0.5% in January after plunging by 9.6% in December. The renewed lockdown in Germany resulted in the closure of shops from December 16onwards and hence to the partial loss of Christmas sales. While food stores posted a monthly increase in December, non-food stores, especially clothing and footwear retailers saw a sharp drop in sales. Online sales surged to over 30% in December. As tight restrictions remained in place in January as well as February, retail sales are likely to remain subdued going forward.

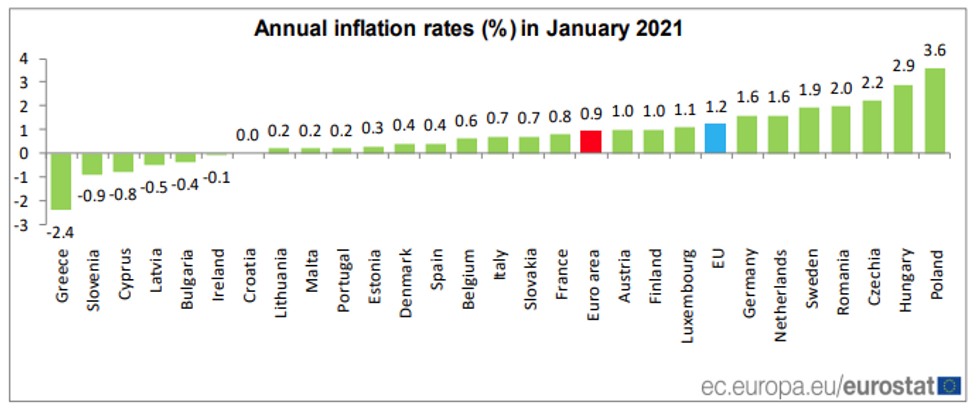

EZ inflation expected to accelerate

EZ inflation is seen unchanged at January's level of 0.9% in February. Inflation rose sharply in January and the increase was mainly led by a sharp rebound of German inflation due to the end of the VAT cut. But also Spain and Italy saw upticks of one percentage point. Energy price base effects will boost inflation in the coming months, although underlying price pressures are likely to remain subdued.

Source: Eurostat

Canadian GDP expected to grow in Q4

Markets are looking for a 7.2% annualized increase in Canadian GDP in Q4, following an annualized growth rate of 40.5% in Q3. GDP rebounded sharply in the third quarter as the economy reopened. However, the monthly growth rate slowed during Q3 before it recorded the lowest since April in October. Monthly GDP increased by 0.7% in November and markets are looking for a deceleration to 0.1% in December. Rising infection rates led tighter restrictions in many areas with several cities announcing a new lockdown, which weighs on business activity, especially in the service sector.

The main events to look out for on Tuesday include ECB's Fabio Panetta and Elizabeth McCaul as well as Fed's Lael Brainard and San Francisco Fed's Mary Daly.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.