-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: Focus on UK Labour Report

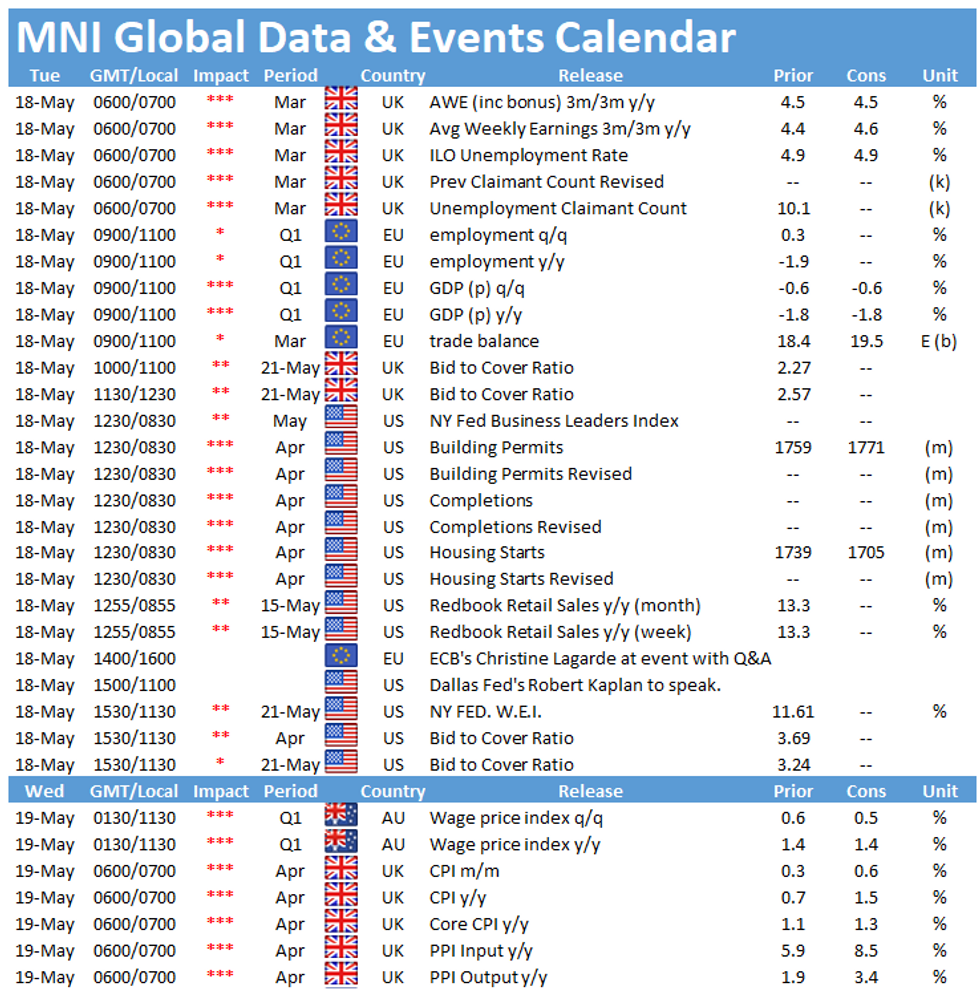

Tuesday kicks off with the publication of the UK's labour report at 0700BST, followed by the flash estimate (follows from the preliminary flash release) of EZ GDP at 1000BST. In the US, the release of data on housing starts and building permits at 1330BST is the highlight of the day.

UK unemployment rate seen unchanged

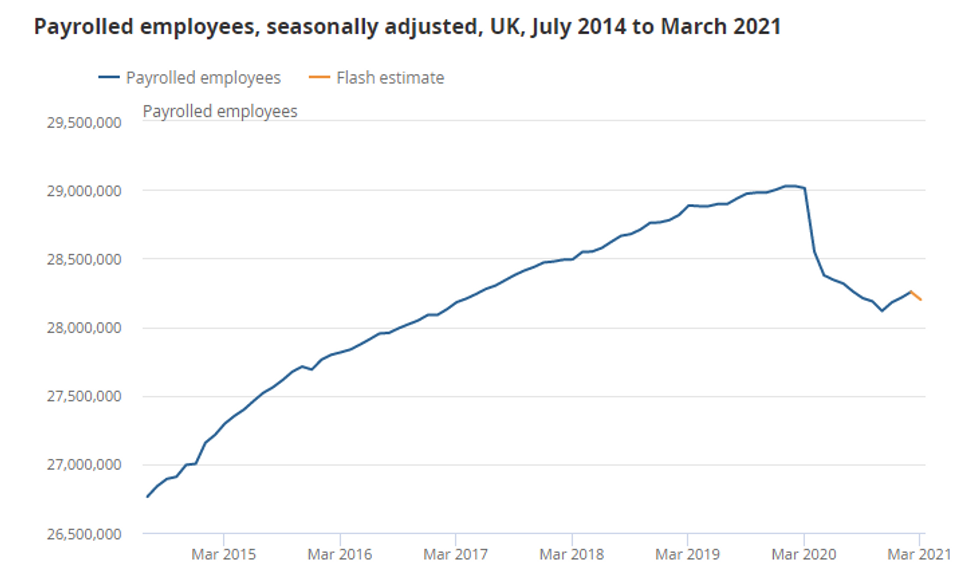

The UK jobless rate is seen stable at February's 4.9% in March. February's data was slightly stronger than expected with unemployment declining in contrast to an expected uptick, but it is still distorted by the furlough program. While the employment rate eased slightly, the inactivity rate ticked up in February. Moreover, March's PAYE data showed a decrease of the number of payrolled employees, after several months of increases. Compared to March 2020 there were 813,000 less people in payrolled employment in March 2021 with more than 50% being below the age of 25.

The main focus going forward will be how much of a boost the easing of restrictions provides for the labour market in the next few months. Survey evidence suggests an uptick in the demand for staff as the economy is gradually reopening. The KPMG/REC jobs report saw a rebound of recruitment activity in both March an April with permanent placements rising at the sharpest rate since 1997 in April.

Source: HM Revenue and Customs – Pay As You Earn Real Time Information; Office for National Statistics

EZ flash GDP forecast to register at preliminary estimate

The preliminary flash result showed a quarterly contraction of 0.6% for the Eurozone, while annual growth declined by 1.8% in the first quarter of 2021. The flash estimate of GDP is expected to register in line with preliminary flash result, which is based on 17 member states and covers approximately 93% of euro area GDP. Among the member states for which data is available, Portugal (-3.3%), Latvia (-2.6%) and Germany (-1.7%) saw the largest quarterly declines, while Lithuania (+1.8%), Belgium (+0.6%) and France (+0.4%) saw the biggest gains.

Looking ahead, second quarter growth is likely to gain momentum as economies are opening-up gradually. Especially the annual rate is set to rise significantly due to the sharp decline seen in the second quarter of 2020. The third quarter is likely to see another sharp increase, especially on a quarterly basis as most of the population should be vaccinated and more restrictions will be eased.

US Housing starts expected to slow

US privately-owned housing starts rose by 19.4% in March to an annual rate of 1,739,000, while annual housing starts jumped by 37.0%. Markets are looking for a 2.0% drop of the monthly rate to 1,705,000. On the other hand, building permits are projected to increase in April, although at a slower pace of 0.7% to 1,771,000, up from 1,766,000 seen in March. Housing completions rose by 16.6% on a monthly basis, while annual completions were 23.4% higher in March 2021 than a year ago.

Events to follow on Tuesday include speeches by ECB's Christine Lagarde and Dallas Fed's Rob Kaplan.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.