-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: Ifo Index Seen At 2-yr High

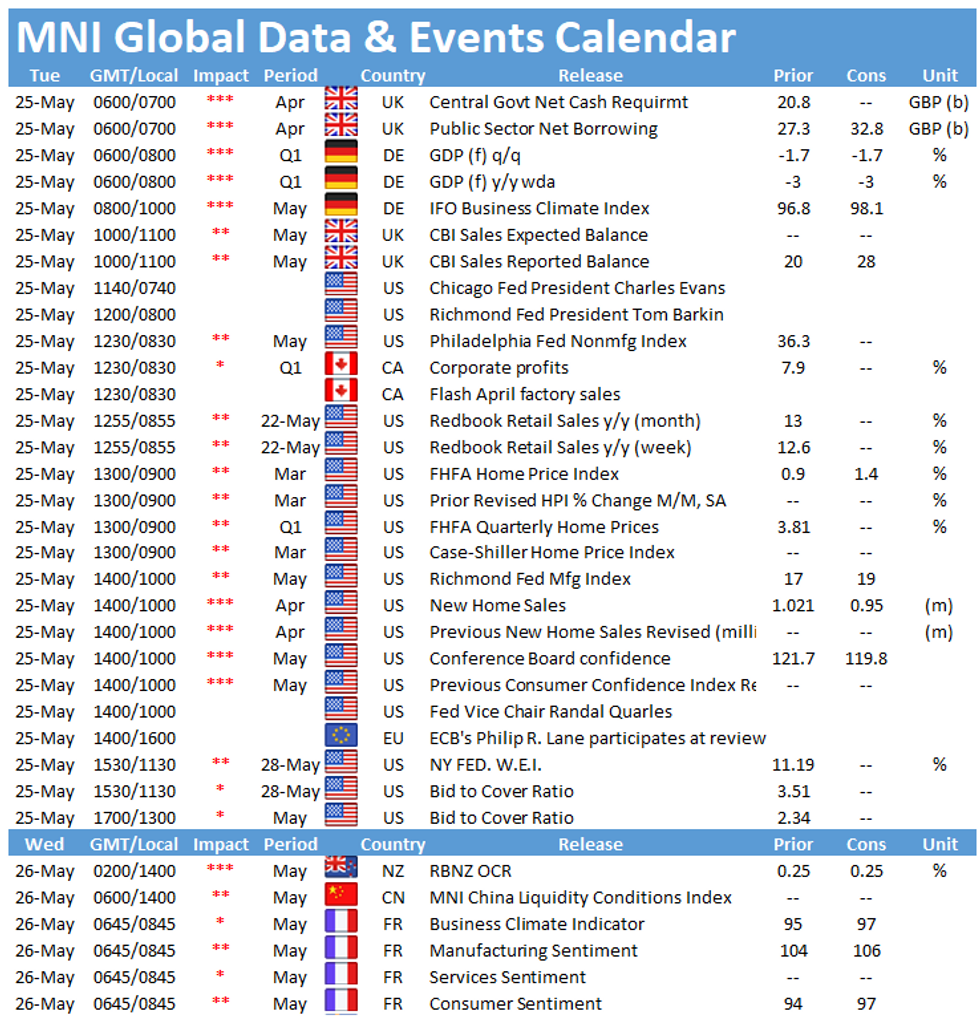

Tuesday kicks off with the publication of UK public sector finances at 0700BST, followed by the German Ifo business climate indicator at 0900BST. In the US the release of the consumer confidence index at 1500BST will be closely watched.

UK borrowing seen higher in April

April's public sector finances release will be the first of the new financial year 2021/22. In the past financial year, borrowing was GBP 24.3bn less than the OBR expected, as the impact of the winter lockdowns was smaller than anticipated. Nevertheless, year-to-date borrowing was still the highest borrowing since records began in 1947. In April, borrowing (excluding banking groups) is expected to register at GBP 32.0bn, after recording GBP 28.0bn in March.

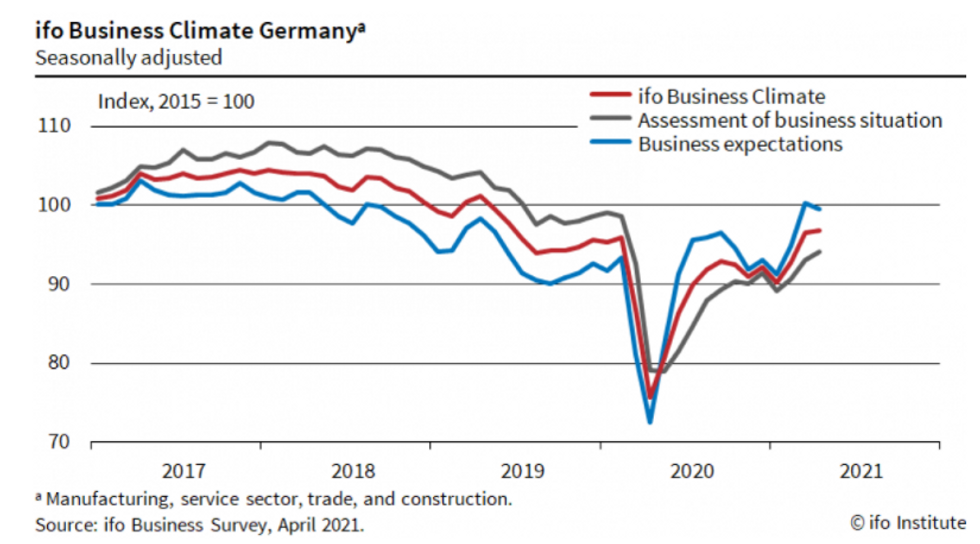

German Ifo business climate seen at 2-year high

The Ifo business climate indicator is expected to rise to a two-year high of 98.1 in May, which would mark the fourth consecutive increase. Company's assessment of the current situation is expected to improve further to 95.5, hitting the highest level since the start of the pandemic. Expectations eased slightly in April due to concerns over a third wave of infections and bottlenecks in intermediate products. In May, markets are looking for a renewed uptick to 101.0.

Vaccinations are gaining momentum with around 38% of the population having been vaccinated at least once. However, surveys suggest that supply chain issues persist, which is likely to weigh on the outlook.

Source: Ifo Institute

US consumer confidence expected to ease

Consumer sentiment rose sharply in April to 121.7, up from 109.0 seen in March and hitting the highest level since February 2020. April's increase was driven by the present situations index, which surged by 29.5 points to 139.6, while expectations ticked up 1.5 points to 109.8. The survey noted that consumers were more upbeat about their income prospects, likely because of the improving job market. In May, markets expect consumer confidence to ease slightly to 119.8.

Other survey evidence shows a similar picture. The flash Michigan consumer sentiment index dropped to 82.8 in May, due to higher inflation expectations. The survey saw annual expected inflation rising to the highest level in a decade.

The highlights of the events calendar include speeches by Chicago Fed's Charles Evans, Richmond Fed's Tom Barkin, ECB's Philip Lane and Fed's Randal Quarles.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.