-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI Global Morning Briefing: Italian Consumers More Opmistic

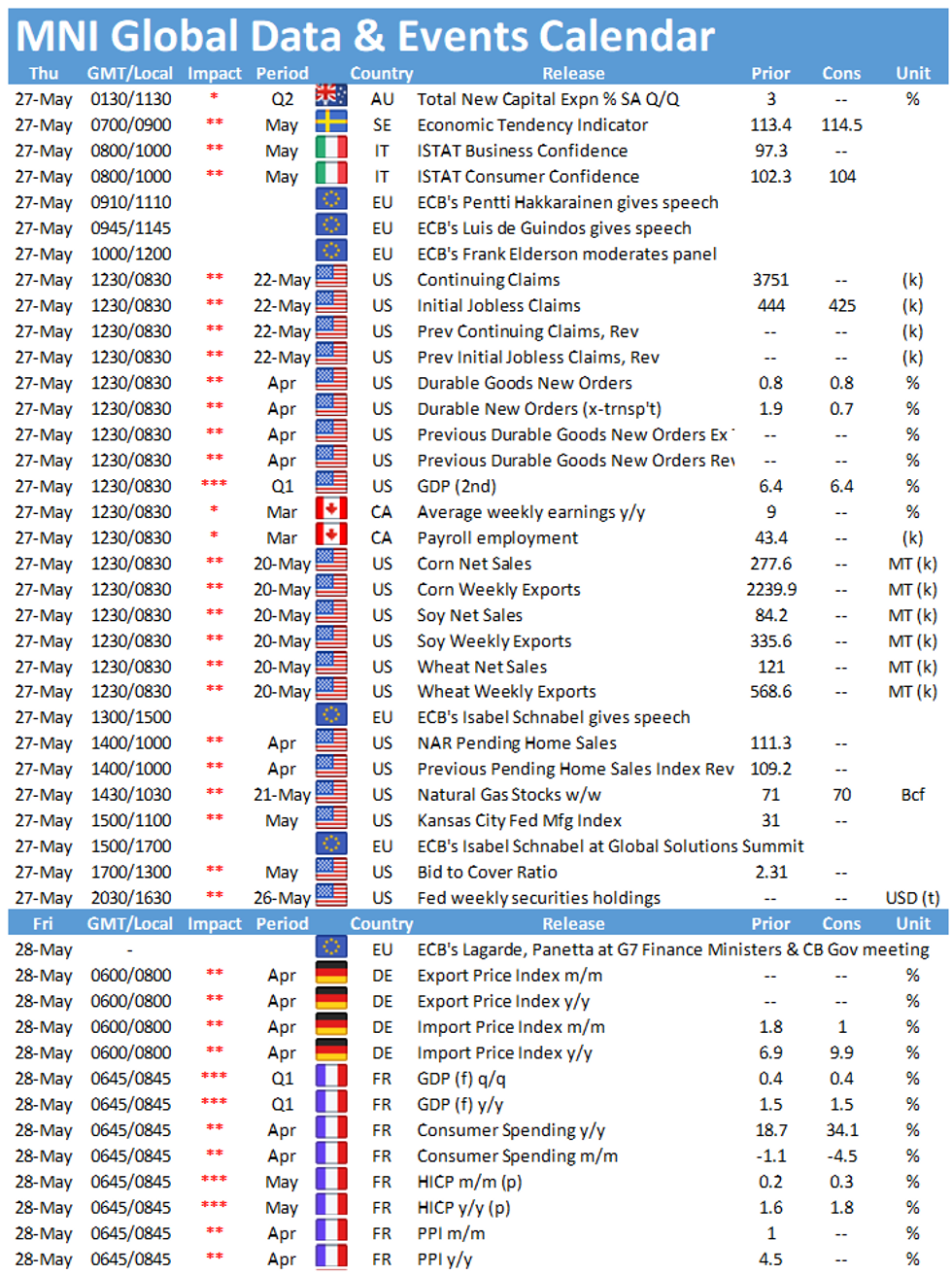

The main data events in Europe Thursday include Italian consumer and business confidence indicators at 0900BST. In the US, the release of Initial jobless claims at 1330BST will again be closely watched.

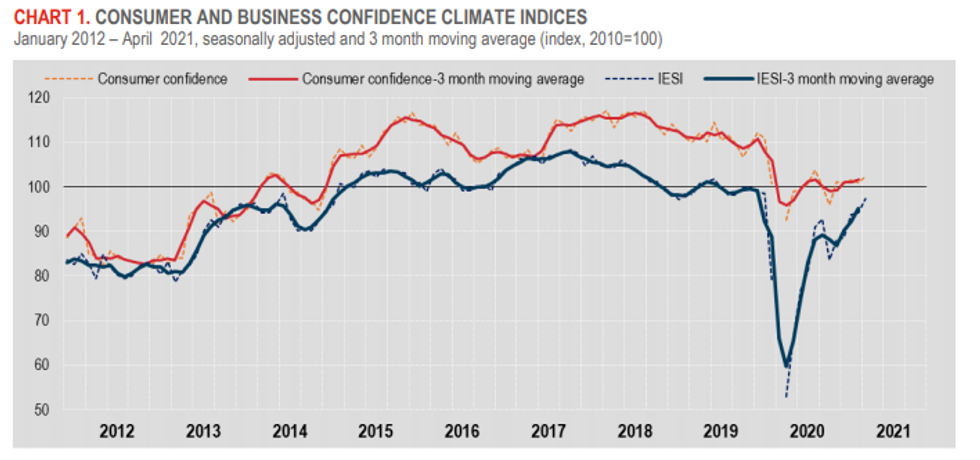

Italian consumers and business more optimistic

Italian consumer sentiment is expected to tick up to 104.0 in May, which would mark the highest reading since the start of the pandemic. The index rose to 102.3 in April with consumer's assessment of the economic situation and their financial one both improving. Meanwhile, business sentiment edged higher as well in April to 97.3 as did the manufacturing confidence index. April's report showed that firm's opinion on both current and expected new orders improved. Manufacturing sentiment is forecast to post another gain in May with markets looking for an uptick to 106, up from 105.4.

Restrictions have been loosened in Italy in mid-May with rules on international travel being eased as well, which bodes well for both consumer and business confidence. Other survey evidence is in line with market forecasts. The flash EZ consumer sentiment also gained 3 points in May, pushing the indicator slightly above the pre-crisis level. Moreover, the flash EZ composite PMI noted that business activity rose markedly in the euro area overall.

Source: Istat

U.S. Jobless Claims forecast to slow

U.S. jobless claims filed through May 22 are set to dip to 425,000 from 444,000 through May 15, a new pandemic low, according to the Bloomberg consensus. Initial claims should continue to trend downward as the economy opens through the summer and hiring improves.

Analysts say both initial and continuing claims could see a sharp decline in mid-June, when many states plan to opt out of enhanced federal UI benefits.

The main speakers to follow on Thursday include ECB's Pentti Hakkarainen, Luis de Guindos, Frank Elderson and Isabel Schnabel.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.