-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI GLOBAL MORNING BRIEFING: Ifo In Focus

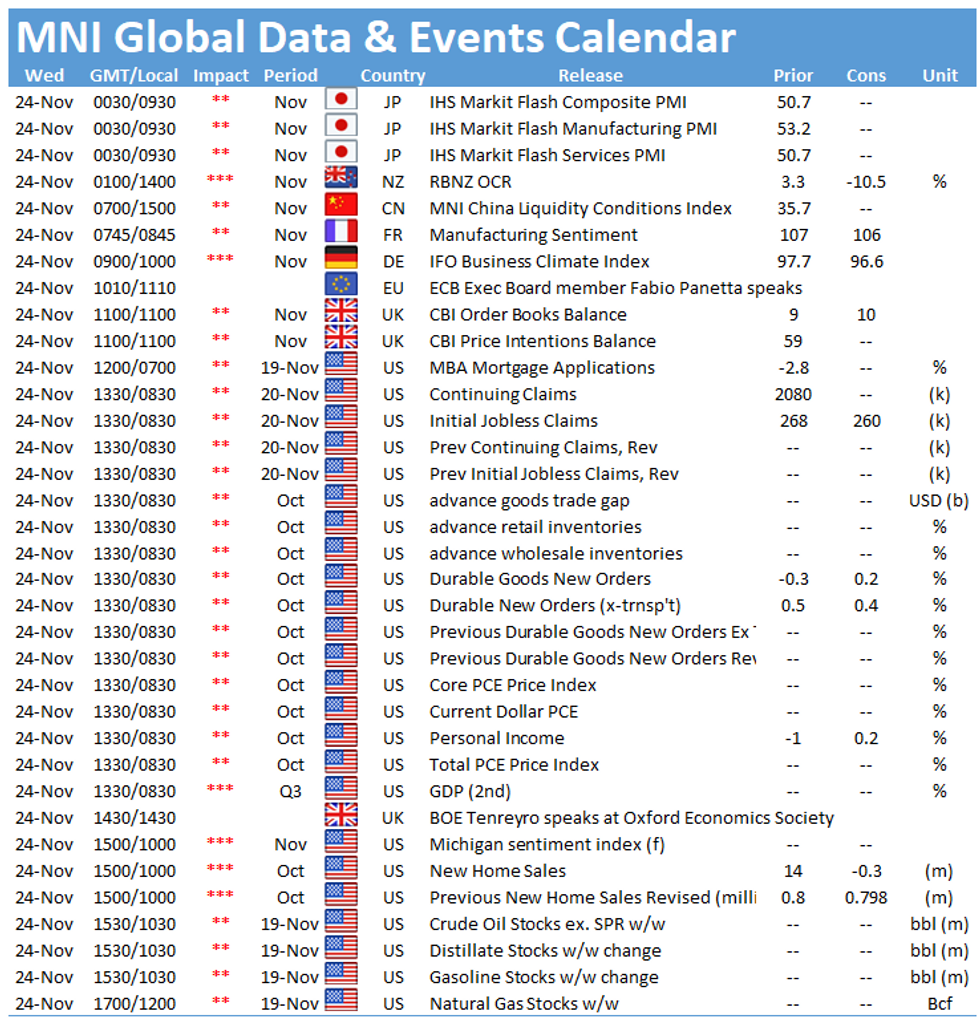

There is a busy data session on Wednesday, particularly in the US, as markets gear up for the Thanksgiving Day holiday.

French manufacturing sentiment slips further (0745 GMT)

The French manufacturing sentiment index is predicted to dip again, coming in at 106 for October, down one point from September's 107, as assessments of past and future orders remains pessimistic.

Yesterday's flash PMI for French manufacturing showed growth was surprisingly stronger than expected, reaching 54.6, up one point from last month despite persistent supply bottlenecks.

German business outlook seen pessimistic (0900 GMT)

Germany's ifo business survey is expected to dampen to 96.6 for November, compared to October's reading of 97.7.

This reflects harmful supply shortages alongside inflated input prices which continue to hamper the German manufacturing sector. Moreover, the recent surge in COVID-19 cases in the region is additionally hindering the outlook for services.

UK CBI order books likely edge lower (1100 GMT)

The UK CBI order books balance is forecast to slip down to +8 points in November, down from +9 points in October following a big drop from September's record high of +22 driven by perishable consumer goods. The UK manufacturing sector continues to experience both labour shortages and persistently high input prices. The index has only been above the zero mark since May, after two years in the negative.

US Initial claims seen at fresh post-pandemic low (1330)

US initial claims are expected to dip again in the latest week, falling to a fresh post-pandemic low of 268,000 from the upward surprise 268,000 seen in the previous period.

Continuing claims are also set to drop further, expected to slide to 2.03 million from 2.08 million previously.

Among the speakers expected Wednesday are ECB Executive Board member Fabio Panetta and BOE MPC member Silvana Tenreyro.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.